|

Balance Sheet |

| << Income Statement |

| Cash Flow Statement >> |

Financial

Statement Analysis-FIN621

VU

Lesson-11

FINANCIAL

STATEMENTS

(Continued)

Balance

Sheet

The

balance sheet lists the

amounts of the company's assets,

liabilities, and owner's

equity at the end of

accounting

period. The balances of the

assets and liability accounts

are taken directly from the

adjusted

trial

balance. Cash is listed first among the

assets. It is often followed by

such asset as

marketable

securities,

short-term notes receivable, accounts

receivable, inventories, and supplies.

These are the

most

common examples of current assets.

The term "current assets"

includes cash and those

assets that

will

be quickly converted to cash or

used up in operations

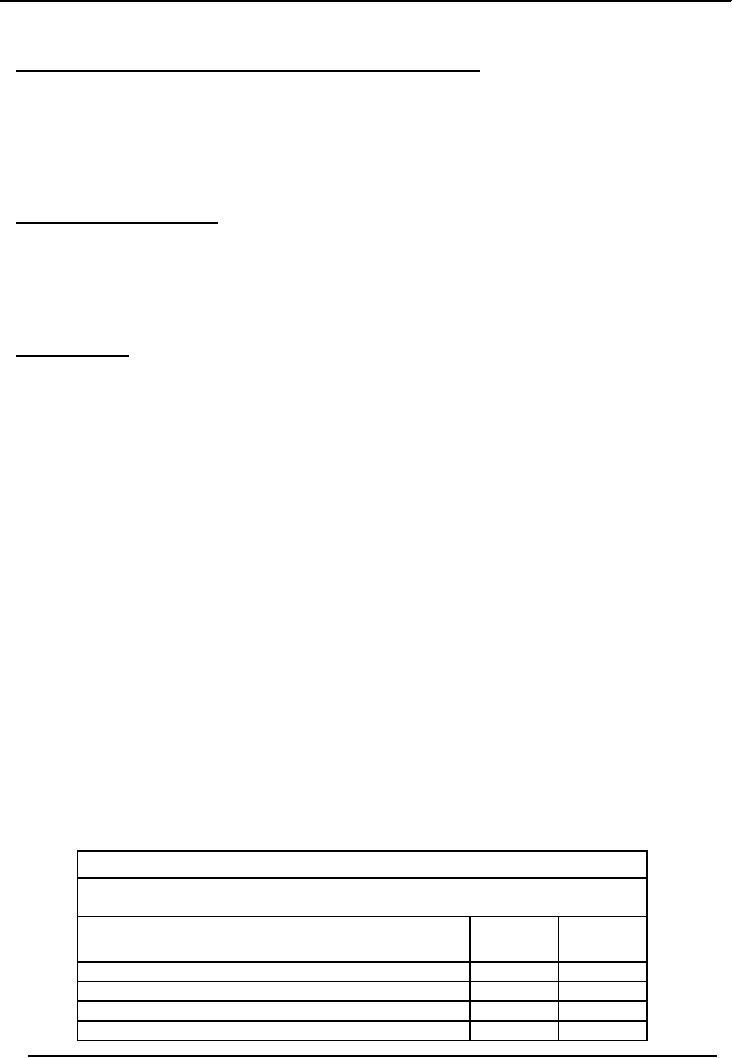

BALANCE

SHEET

MOOSA

& CO LTD.,

AS ON

JUNE 30, 2006

I)

Account form

Rs.

in _________

ASSETS

LIABILITIES+SHARE

HOLDERS'

FUNDS/OWNERS'

EQUITY

Current

Assets

-

cash & cash

equivalents

15

Current

liabilities

-

Marketable securities

3

-

pre-paid expense

2

-

Bank borrowings

15

-

Accounts Receivables

10

-

Accounts payable

5

(trade

debtors/customers)

(trade

creditors)

-

Inventory

20

-Provision

for tax

5

______

Total

current liabilities

25

Long-term

interest bearing loan

Total

current Assets

50

(fixed

liabilities)

50

Fixed

Assets

150

Owner's equity/shareholders funds

125

Total

Assets

200

Total

Liabilities and owners' equity

200

=========

====

Note:

The above list is not

exhaustive. It may include

many other items. Cash

equivalent are cash

substitutes

not immediately required

i.e. short-term high liquid

investment, usually for three

months.

Examples

are Treasury bills, certificates,

prize bonds etc. Marketable

securities are investments in

govt.

bonds

and stocks and bonds of other

companies. Fixed Assets are

acquired for long-term use

e.g. Land,

Building,

Plant & Machinery, Vehicles,

Furniture`s & Fixtures etc.

Long-term loans are usually

secured

against

inventory and fixed assets.

Tax is shown both on Balance Sheet as

current liability i.e.

tax

payable

and on Income Statement, as

Interest expense for the

accounting period.

ii)

Report

form

Balance

sheet (As on end of accounting

period)

Rs.

in______

Assets

i)

Current

Assets

50

↓

↑

ii)

Fixed

Assets

150

Total:

200

42

Financial

Statement Analysis-FIN621

VU

LIABILITIES

& OWNERS' EQUITY/SHARE HOLDERS'

FUNDS.

STOCK

↑↓

Current

liabilities

25

Fixed/long

f term liabilities

50

Owners'

equity/shareholders funds.

125

____

Total:

200

Recording in

Balance Sheet: The

guiding rule for an accountant is to be

conservative and choose

lower

values. For example marketable securities

are recorded at cost, but

current market rate is

also

mentioned.

Inventory is recorded at cost or market

value, whichever is lower.

Land is recorded at

historical

cost. Other fixed assets

(i.e. Building, Plant &

Machinery, etc) are recorded at

original cost

less

accumulated depreciation called "Book

value. The accountant must

also make provisions

for

doubtful

debts and inventory

losses.

Current

Assets:

These are assets capable of

being converted into cash

within one year or

operating

cycle,

whichever is longer. Operating

cycle is the time required to

purchase or manufacture inventory,

sell

the product and collect cash

i.e.

Cash/assets

-----------→ Inventory--------→Receivables

---------→ cash

Processing

sales

collection

Length

of operating cycle = inventory

sale days + Receivable

Collection days.

Current

assets

are recorded in order of liquidity

i.e. ease of conversion into

cash. Within current Assets,

some

assets

are more liquid than others.

These are Quick Assets=

Total current Assets

Inventory Pre

paid

expenses.

The accountant must make allowances

for "doubtful accounts" i.e.

"unrealizable". It may

also

be noted that proportion of

current and fixed assets to

total assets is determined by the nature

of

business.

Some

additional items on Balance Sheet: Other

Assets: These are

Incorporation cost

i.e.

start-up

costs in connection with

setting up new business,

property held for sale

etc. Other additional

items

may be, Intangible Assets

like Goodwill, patents, trademarks

etc. Goodwill arises when

one

business

acquires another for a price in

excess of its fair market

value. This is shown on "fixed

Assets

side

of B/Sheet. It has no physical substance

or existence as such. Common meaning of

"Good Will" in

non-accounting

terms is the benefits derived

from a favorable reputation of the

business.

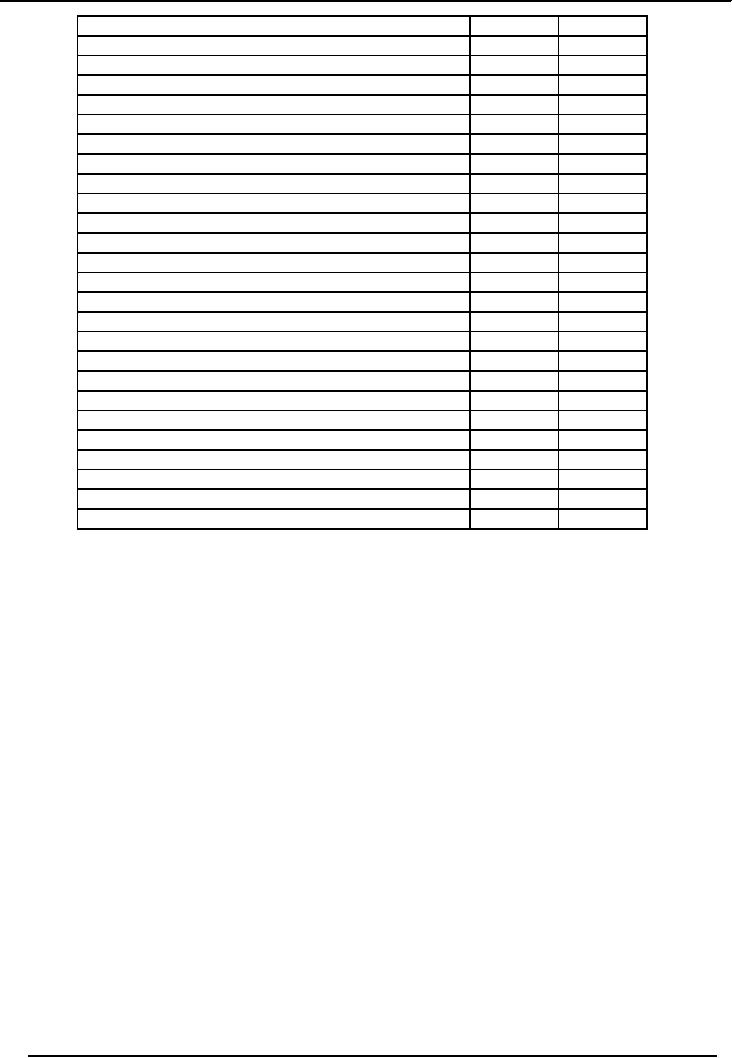

ILLUSTRATION

#2

Following

trial balance has been

extracted from the books of Hassan

Manufacturing Concern on June

30,

2002.

Hassan

Manufacturing Concern

Trial

balance

As on

June 30, 2002

Particulars

Amount

Amount

Dr.

(Rs.)

Cr.

(Rs.)

Raw

Material stock Jul. 01,

2001

35,500

Work

in process Jul. 01,

2001

42,000

Finished

goods stock Jul. 01,

2001

85,000

Raw

material purchased

250,000

43

Financial

Statement Analysis-FIN621

VU

Wages

180,000

Freight

inward

12,000

Plant

and machinery

400,000

Office

equipment

45,000

Vehicles

200,000

Acc.

depreciation Plant

195,200

Acc.

depreciation Office

equipment

12,195

Acc.

depreciation Vehicles

97,600

Factory

overheads

125,000

Electricity

80,000

Salaries

140,000

Salesman

commission

120,000

Rent

200,000

Insurance

150,000

General

Expense

60,000

Bank

Charges

8,500

Discounts

Allowed

20,000

Carriage

outward

35,000

Sales

1,500,000

Trade

Debtors

250,000

Trade

Creditors

220,000

Bank

165,000

Cash

110,000

Drawings

175,000

Capital

July 01, 2001

863,005

Total

2,888,000

2,888,000

Notes:

� Stock

on June 30, 2002.

o Raw

Material

42,000

o Work

in Process

56,500

o Finished

Goods

60,000

� 50%

of electricity, insurance and

salaries are charged to

factory and balance to

office.

� Depreciation

to be charged on Plant & Machinery at

20%, Office Equipment at 10%

and

Vehicles

at 20%on WDV.

� Write

off bad debts Rs.

30,000.

All the

wages are direct

44

Financial

Statement Analysis-FIN621

VU

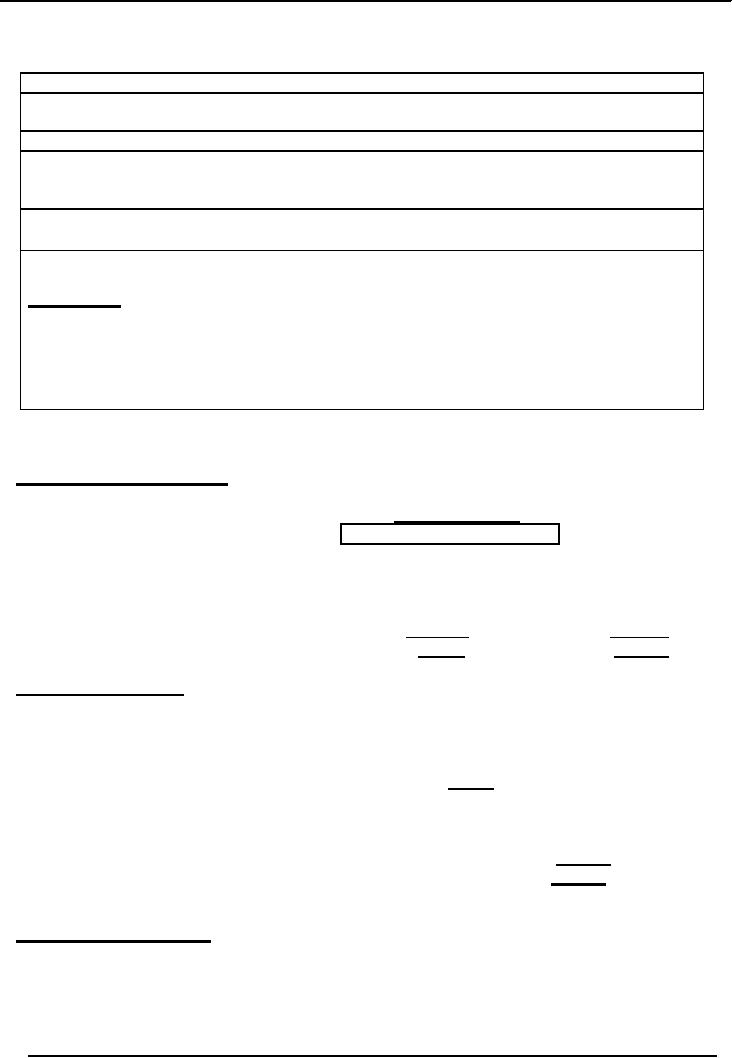

Balance

Sheet

Hassan

Manufacturer Concern

Profit

and Loss Account

For

the Year Ending June

30, 2002

Particulars

Note

Amount

Rs.

Fixed

Assets at WDV

4

275,284

Current

Assets

5

653,500

Current

Liabilities

6

(220,000)

Working

Capital

433,500

Total

Assets Employed

708,784

Financed

by:

Capital

863,005

Add:

Profit for the year

20,779

Less:

Drawings

(175,000)

Total

Liabilities

708,784

Note #

4 Fixed Assets at WDV

Acc.

Depreciation

WDV

Cost

Rate

Opening

For the year

closing

Plant

& Mach.

400,000

20%

195,200

40,960

236,160

163,840

Vehicles

200,000

20%

97,600

20,480

118,080

81,920

Office

Equip.

45,000

10%

12,195

3,281

15,476

29,524

275,284

64,721

Note #

5 Current Assets

Stock

Raw

Material

42,000

Work

in Process

56,500

Finished

Goods

60,000

158,500

Debtors

250,000

Less:

Bad Debts

(30,000)

Bank

165,000

Cash

110,000

Current

Assets

653,500

Note #

6 Current Liabilities

Trade

Creditors

220,000

45

Table of Contents:

- ACCOUNTING & ACCOUNTING PRINCIPLES

- Dual Aspect of Transactions

- Rules of Debit and Credit

- Steps in Accounting Cycle

- Preparing Balance Sheet from Trial Balance

- Business transactions

- Adjusting Entry to record Expenses on Fixed Assets

- Preparing Financial Statements

- Closing entries in Accounting Cycle

- Income Statement

- Balance Sheet

- Cash Flow Statement

- Preparing Cash Flows

- Additional Information (AI)

- Cash flow from Operating Activities

- Operating Activities’ portion of cash flow statement

- Cash flow from financing Activities

- Notes to Financial Statements

- Charging Costs of Inventory to Income Statement

- First-in-First - out (FIFO), Last-in-First-Out (LIFO)

- Depreciation Accounting Policies

- Accelerated-Depreciation method

- Auditor’s Report, Opinion, Certificate

- Management Discussion & Analyses (MD&A)

- TYPES OF BUSINESS ORGANIZATIONS

- Incorporation of business

- Authorized Share Capital, Issued Share Capital

- Book Values of equity, share

- SUMMARY

- SUMMARY

- Analysis of income statement and balance sheet:

- COMMON –SIZE AND INDEX ANALYSIS

- ANALYSIS BY RATIOS

- ACTIVITY RATIOS

- Liquidity of Receivables

- LEVERAGE, DEBT RATIOS

- PROFITABILITY RATIOS

- Analysis by Preferred Stockholders

- Efficiency of operating cycle, process

- STOCKHOLDERS’ EQUITY SECTION OF THE BALANCE SHEET 1

- STOCKHOLDERS’ EQUITY SECTION OF THE BALANCE SHEET 2

- BALANCE SHEET AND INCOME STATEMENT RATIOS

- Financial Consultation Case Study

- ANALYSIS OF BALANCE SHEET & INCOME STATEMENT

- SUMMARY OF FINDGINS