|

Income Statement |

| << Closing entries in Accounting Cycle |

| Balance Sheet >> |

Financial

Statement Analysis-FIN621

VU

Lesson-10

FINANCIAL

STATEMENTS

Income

Statement

A

typical and Standard Income Statement

and Balance Sheet of a manufacturing

concern

would

be as follows:-

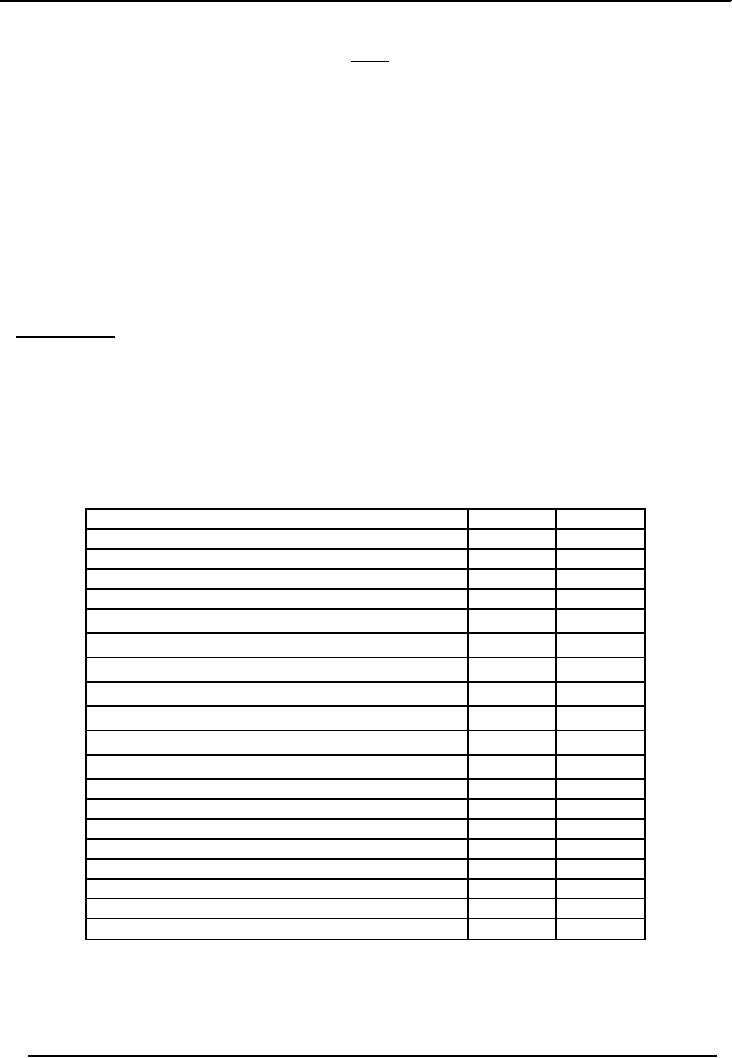

INCOME

STATEMENT/PROFIT & LOSS

ACCOUNT

MOOSA

& CO. LTD

FOR/DURING

THE PERIOD 2005-06

Rs.

in _______

Net

Sales *

100

Cost

of Goods Sold *

Raw

material

30

Salaries

& wages (direct

Labour)

10

Stores

& spares

5

Utilities

5

Depreciation

5

Others

5

____

_____

Total

60

Gross

Profit (loss)

40

_______________________________________________________________________

* Net

Sales = Gross Sales

Sales returns Sales

allowances/discounts.

*

Cost of Goods sold = Cost of

production of goods actually

sold; also called "cost of

sales": largest

expense

item.

Operating

expenses

Selling

& admin

5

Advertising

5

Depreciation

& others

5

Total

15

____

Operating

Profit (EBIT)

25

______________________________________________________________________

EBIT:

Earning before Interest and

Taxes.

Other

expenses *

Financial

charges i.e. interest

5

Loss

on sale of assets

1

Purchase

of goodwill

1

Total

7___

Profit

before tax (EBT)

18

Provision

for tax

5

Profit

after tax

13

37

Financial

Statement Analysis-FIN621

VU

Other

income *

Investment

gains

7

Net

Profit

20

=====

(bottom line)

Dividend

paid

5

Retained

earnings

15

(Added

in shareholder's equity and carried

forward to Balance Sheet)

________________________________________________________________

*

Other expenses: also called

non-operating expenses.

*

Other income: Dividend revenue,

Interest revenue, Gain on Assets

Sales etc.

The

above is called Multiple Step

Income Statement.

Special

items: These

are one-time items that will

not recur in the future, and

are disclosed separately on

Income

Statement. Examples are: discontinued operations (firm

selling a major portion of

its business),

extra

ordinary transactions (unusual in

nature), and cumulative

effect of changes in accounting

methods

of

Inventory and Depreciation.

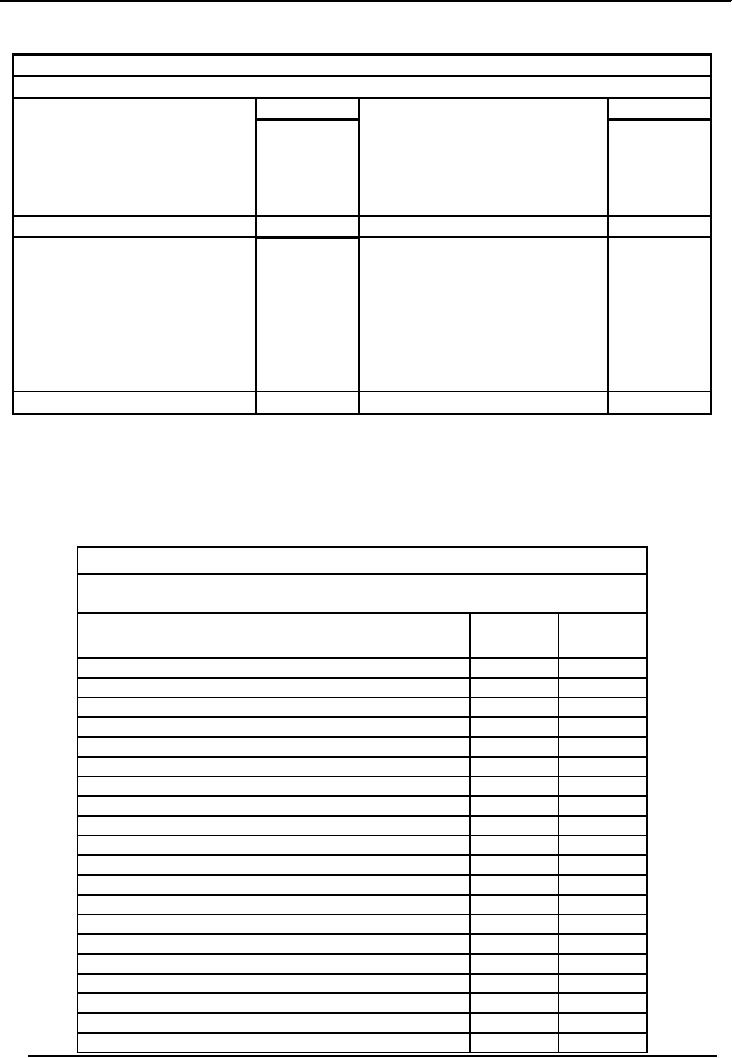

Illustration

# 1

The

following Trial Balance has

been extracted from the books of ABC

Company. on 30-06-2002.

From

this, prepare an Income Statement and

Balance Sheet for the year

ended 30-06-2002.

Particulars

Dr.

Cr.

Sales

200,000

Purchases

180,000

purchase

return

2,500

Office

salaries

3,500

Furniture

& Fixture

16,000

Office

Equipment

11,000

Rent

5,000

Accounts

Payable(creditors)

28,000

Sales

Salaries

3,000

Freight

& custom duty on

purchases

6000

Repair

of office equipment

2,000

Accounts

Receivable(debtors)

52,000

Freight

on sales

1,000

Capital

41,500

Cash

in hand

37,000

Loan

from bank(for three

years)

50,000

Bank

charges

500

Interest

on loan

5,000

Grand

Total

322,000

322,000

38

Financial

Statement Analysis-FIN621

VU

Solution

BC

Company.

ofit

& Loss Account for the

year ended June 30,

2002.

Rs.

Rs.

Sales

200,000

Purchases

180,000

Purchase

return

2,500

Freight,

custom

duty

on

purchases

6,000

Gross

Profit

16,500

202,500

202,500

Salaries

3,500

Gross

Profit

16,500

Rent

5,000

Repair

of office equipment

2,000

Sales

salaries

3,000

Freight

on sales

1,000

Interest

on loan

5,000

Bank

charges

500

Net

loss

3,500

Total

20,000

20,000

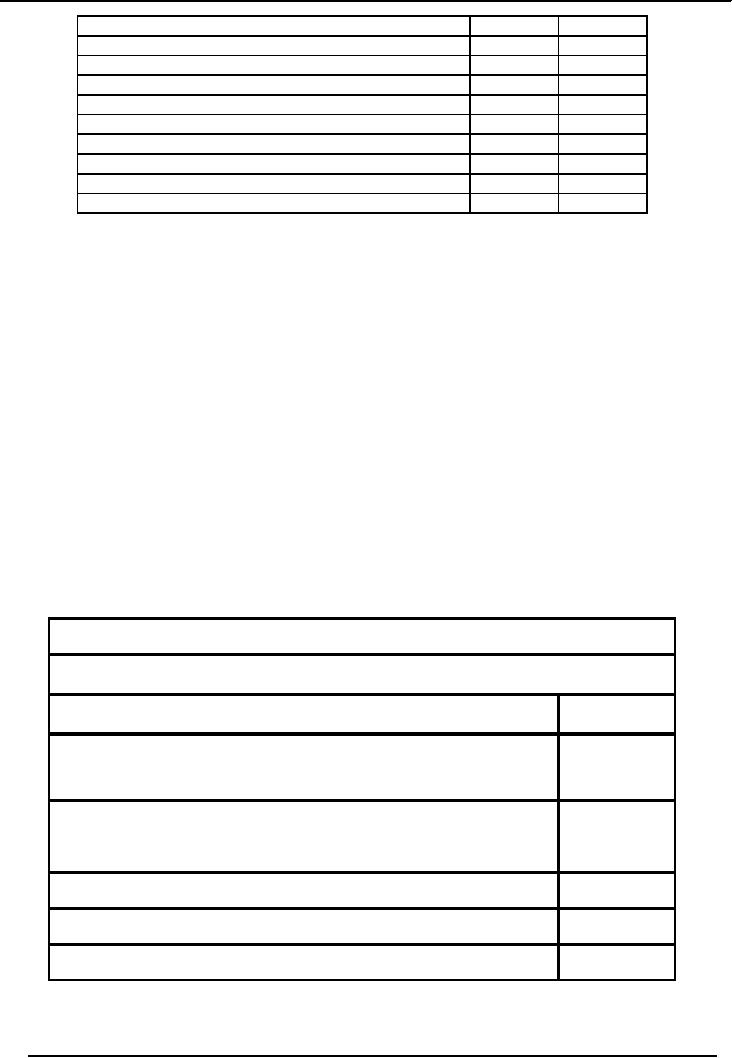

ILLUSTRATION

#2

Following

trial balance has been

extracted from the books of Hassan

Manufacturing Concern on June

30,

2002.

Hassan

Manufacturing Concern

Trial

balance

As on

June 30, 2002

Particulars

Amount

Amount

Dr.

(Rs.)

Cr.

(Rs.)

Raw

Material stock Jul. 01,

2001

35,500

Work

in process Jul. 01,

2001

42,000

Finished

goods stock Jul. 01,

2001

85,000

Raw

material purchased

250,000

Wages

180,000

Freight

inward

12,000

Plant

and machinery

400,000

Office

equipment

45,000

Vehicles

200,000

Acc.

depreciation Plant

195,200

Acc.

depreciation Office

equipment

12,195

Acc.

depreciation Vehicles

97,600

Factory

overheads

125,000

Electricity

80,000

Salaries

140,000

Salesman

commission

120,000

Rent

200,000

Insurance

150,000

General

Expense

60,000

Bank

Charges

8,500

39

Financial

Statement Analysis-FIN621

VU

Discounts

Allowed

20,000

Carriage

outward

35,000

Sales

1,500,000

Trade

Debtors

250,000

Trade

Creditors

220,000

Bank

165,000

Cash

110,000

Drawings

175,000

Capital

July 01, 2001

863,005

Total

2,888,000

2,888,000

Notes:

� Stock

on June 30, 2002.

o Raw

Material

42,000

o Work

in Process

56,500

o Finished

Goods

60,000

� 50%

of electricity, insurance and

salaries are charged to

factory and balance to

office.

� Depreciation

to be charged on Plant & Machinery at

20%, Office Equipment at 10%

and

Vehicles

at 20%on WDV.

� Write

off bad debts Rs.

30,000.

� All the

wages are direct.

Required:

You

are required to prepare profit and

loss account for the year

and balance sheet as on june30,

2002.

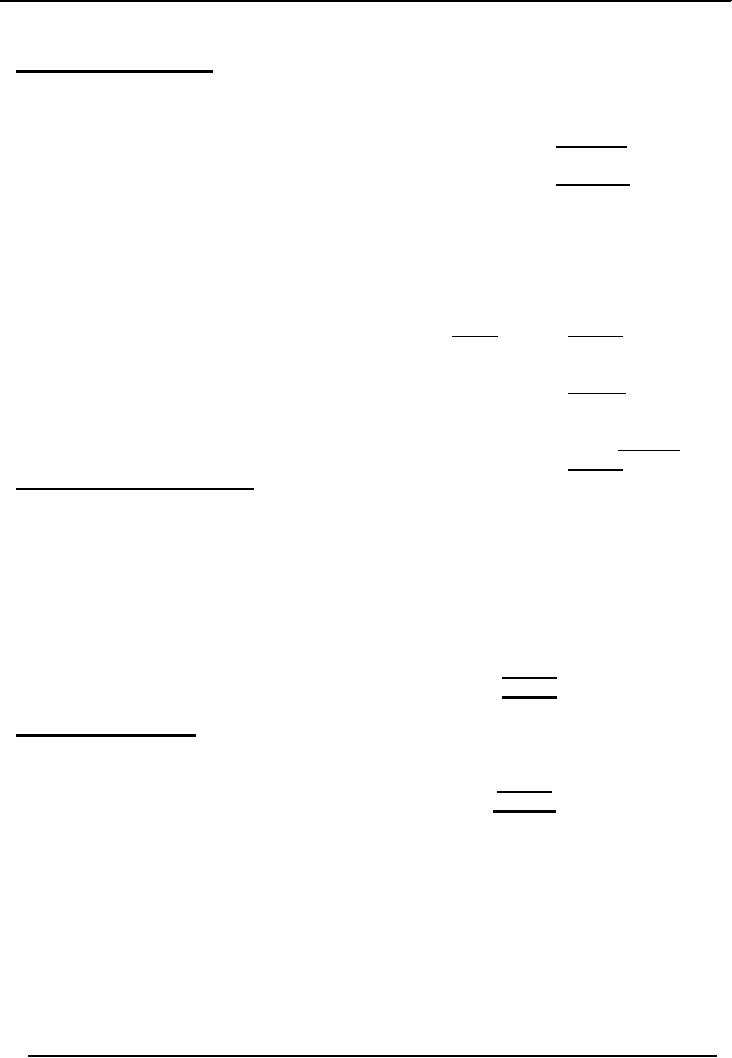

SOLUTION

Profit

& Loss Account

Hassan

Manufacturer Concern

Profit

and Loss Account

For

the Year Ending June

30, 2002

Particulars

Note

Amount

Rs.

Sales

1,500,000

Less:

Cost of Goods Sold

1

796,960

Gross

Profit

703,040

Less:

Administrative Expenses

2

518,761

Less:

Selling Expenses

3

155,000

Operating

Profit

29,279

Less:

Bank Charges

8,500

Net

Profit Before Tax

20,779

40

Financial

Statement Analysis-FIN621

VU

NOTES

TO THE ACCOUNTS

Note #

1 Cost of Goods

Sold

Stock

of Raw Material Jul 01,

2001

35,500

Add.

Purchases

250,000

Add.

Freight Inward

12,000

297,500

Less:

Closing Stock of Raw

Material

(42,000)

Raw

Material Consumed

255,500

Direct

labour

180,000

Factory

Overheads

Factory

Overheads

125,000

Electricity

(50% of 80,000)

40,000

Salaries

(50% of 140,000)

70,000

Insurance

(50% of 150,000)

75,000

Plant

Depreciation (Note 5)

40,960

350,960

Total

Factory Cost

786,460

Add:

Work in Process Jul 01,

2001

42,000

Less:

Work in Process Jun 30,

2002

(56,500)

Cost of

Goods Manufactured

771,960

Add:

Finished Goods Stock Jul 01,

2001

85,000

Less:

Finished Goods Stock Jun 30,

2002

(60,000)

Cost of

Goods Sold

796,960

Note #

2 Administrative Expenses

Salaries

(50% of 140,000)

70,000

General

Expenses

60,000

Rent

200,000

Insurance

(50% of 150,000)

75,000

Discount

Allowed

20,000

Bad

Debts

30,000

Office

Electricity (50% of

80,000)

40,000

Depreciation

Vehicles (Note 5)

20,480

Depreciation

Office Equip. (Note5)

3,281

Administrative

Expenses

518,761

Note #

3 Selling Expenses

Salesman

Commission

120,000

Carriage

Outward

35,000

Selling

Expenses

155,000

41

Table of Contents:

- ACCOUNTING & ACCOUNTING PRINCIPLES

- Dual Aspect of Transactions

- Rules of Debit and Credit

- Steps in Accounting Cycle

- Preparing Balance Sheet from Trial Balance

- Business transactions

- Adjusting Entry to record Expenses on Fixed Assets

- Preparing Financial Statements

- Closing entries in Accounting Cycle

- Income Statement

- Balance Sheet

- Cash Flow Statement

- Preparing Cash Flows

- Additional Information (AI)

- Cash flow from Operating Activities

- Operating Activities’ portion of cash flow statement

- Cash flow from financing Activities

- Notes to Financial Statements

- Charging Costs of Inventory to Income Statement

- First-in-First - out (FIFO), Last-in-First-Out (LIFO)

- Depreciation Accounting Policies

- Accelerated-Depreciation method

- Auditor’s Report, Opinion, Certificate

- Management Discussion & Analyses (MD&A)

- TYPES OF BUSINESS ORGANIZATIONS

- Incorporation of business

- Authorized Share Capital, Issued Share Capital

- Book Values of equity, share

- SUMMARY

- SUMMARY

- Analysis of income statement and balance sheet:

- COMMON –SIZE AND INDEX ANALYSIS

- ANALYSIS BY RATIOS

- ACTIVITY RATIOS

- Liquidity of Receivables

- LEVERAGE, DEBT RATIOS

- PROFITABILITY RATIOS

- Analysis by Preferred Stockholders

- Efficiency of operating cycle, process

- STOCKHOLDERS’ EQUITY SECTION OF THE BALANCE SHEET 1

- STOCKHOLDERS’ EQUITY SECTION OF THE BALANCE SHEET 2

- BALANCE SHEET AND INCOME STATEMENT RATIOS

- Financial Consultation Case Study

- ANALYSIS OF BALANCE SHEET & INCOME STATEMENT

- SUMMARY OF FINDGINS