|

ACCOUNTING & ACCOUNTING PRINCIPLES |

| Dual Aspect of Transactions >> |

Financial

Statement Analysis-FIN621

VU

Lesson-1

ACCOUNTING

& ACCOUNTING PRINCIPLES

Accounting

Almost

every organization and individual

maintains accounts and deals

with

accounting.

In simple terms, it can be

described as a record of Income and

expenditure of a business

organization,

or budget vs. utilization, in the

case of a government non-commercial

organization. In the

case

of the business entity, accounting

would deal with measuring,

recording and communicating

the

results

of business activities. That is

why; Accounting is often

called "Language of Business".

Purpose

of Accounting

Accounting

provides decision-makers with sufficient,

relevant information to make

prudent

and intelligent business decisions. This

information is provided through

accounting reports

called

financial statements. The

whole process is called

"financial reporting"

�

The

purpose of accounting is to organize the

financial details of

business.

�

To

identify the financial

transactions.

�

To

organize the financial data

into useful

information

�

To

measure the value of these

information in terms of

money

�

To analyze,

interpret, and communicate the

information to persons or groups,

both

inside

or outside the business.

Financial

Statements Generated by a

Business

A

business generates four

financial statements at the end of its

accounting period:-

i)

Income

statement: shows

operational results of business

during/over the accounting

period.

ii)

Statement of owners'

equity: showing

changes in owner's equity

through

profit/additional

investment or through losses/drawl by

owner.

iii)

Balance

sheet showing

financial position at the end of the

accounting period i.e.

a

picture

of what the business owns and

what it owes.

iv)

Statement of

cash flows giving

a picture of cash inflows (receipts) and

cash outflows

(payments)

over/during the accounting period. It is

prepared from the two

major

financial

statements viz Income

Statement and Balance

Sheet.

Notes

to Financial Statements:

In

addition to above, notes

containing additional information

(financial & non-

financial)

about the business are also

attached to financial

statements.

Accounting

Period

Accounting

period is the period of time covered by

an Income Statement. It is usually

one

year.

It can either be calendar year

(Jan to Dec) or financial year

(July to June). Financial Statements

are

prepared at the

end of accounting period and are the

end product of accounting

process/cycle.

1

Financial

Statement Analysis-FIN621

VU

Different

Types of Business

Organizations

1. Sole

Proprietorship

According

to D.W.T. Stafford, "It is the simplest

form of business organization,

which is owned and

controlled

by one man"

Sole

proprietorship is the oldest form of

business organization which is

owned and controlled by one

person.

In this business, one man

invests his capital himself. He is

all in all in doing his

business. He

enjoys

the whole of the profit. The

features of sole proprietorship

are:

�

Easy

Formation

�

Unlimited

Liability

�

Ownership

�

Profit

�

Management

�

Easy

Dissolution

2.

Partnership

According

to Partnership Act, 1932, "Partnership is

the relation between persons who have

agreed to

share

the profits of a business carried on by

all or any of them acting

for all."

Partnership

means a lawful business

owned by two or more persons.

The profit of the business

shared

by the

partners in agreed ratio.

The liability of each

partner is unlimited. Small and

medium size

business

activities are performed

under this organization. It

has the following features:

�

Legal

Entity

�

Profit

and Loss Distribution

�

Unlimited

Liability

�

Transfer

of Rights

�

Management

�

Number

of Partners

3.

Joint Stock

Company

According

to S. E. Thomas, "A company is an incorporated

association of persons formed usually

for

the

pursuit of some commercial

purposes"

A

joint stock company is a voluntary association of

persons created by law. It

has a separate legal

entity

apart

from its members. It can

sue and be sued in its

name. In the joint stock

company, the work of

organization

begins before its incorporation by

promoters and it continues after incorporation.

The joint

stock company

has the following

feature:

�

Creation

of Law

�

Separate

Legal Entity

�

Limited

Liability

�

Transferability

of shares

�

Number

of Members

�

Common

Seal

2

Financial

Statement Analysis-FIN621

VU

Generally

Accepted Accounting Principles

(GAAP)

These

are `Ground rules' i.e.

Principles for preparing

financial statements. These

are

constantly

evolving. These embody

accounting concepts, measurement

techniques and standards of

presentation of

financial statements. These

Accounting Principles enable

comparability between various

enterprises

and of the operational performance of the

same enterprise over many

years. These give

reliability

to Financial Statements.

Following

are some of the Generally

Accepted Accounting

Principles:

i)

Entity

principle:

specific

business entity separate

from personal affairs of the

owner(s).

ii)

Cost

principle:

valuation and recording of assets at

cost.

iii)

Going-concern

assumption: connected

with cost principle, assets

acquired for use

and

not

for resale.

iv)

Objectivity

principle:

definite, factual basis for

assets valuation; measuring

transactions

objectively.

v)

Stable

currency principle. The

currency remains more or

less

stable and rate of

inflation

is almost zero.

vi)

Adequate

disclosure concept: facts

necessary for proper

interpretation of statements;

"subsequent

events", lawsuits against the

business, assets

pledged as

securities/collaterals,

contingent liabilities etc; reflected in

Notes.

ACCOUNTING

EQUATION

ASSETS

= LIABILITIES + OWNER'S

EQUITY

Balance

Sheet is based on Accounting

Equation. It is in fact, a detailed

statement of the

Equation.

The Equation in a way shows,

utilization of Funds and Sources of

Funds. In other words, it

shows

what a business OWNS and

what it OWES. Alternately, the Accounting

Equation or Balance

Sheet

is a description of Total Assets of a

business against the claimants of these

Assets. Therefore,

this

Equation

shows financial position on a

specific date. The three titles in the

Equation are Elements of

Balance

Sheet. Similarly Elements of

Income Statement would be

Revenues & Expenses and their

net

affects

Owner's equity.

Within

the Elements, there would be sub-elements,

for example, the Element or

Account

"Assets"

would consist of cash,

Accounts Receivable, Land, and

Building etc. Each

financial

transaction

affects two or more elements or

sub-elements of the Accounting Equation.

Therefore, we

can

say that each financial

transaction affects Balance Sheet i.e.

financial position of the business.

This

would

be clear from the following

illustration.

Khizr

property dealer:

The

proprietor starts business

with deposit of Rs.180, 000. On

July 1, 2006

3

Financial

Statement Analysis-FIN621

VU

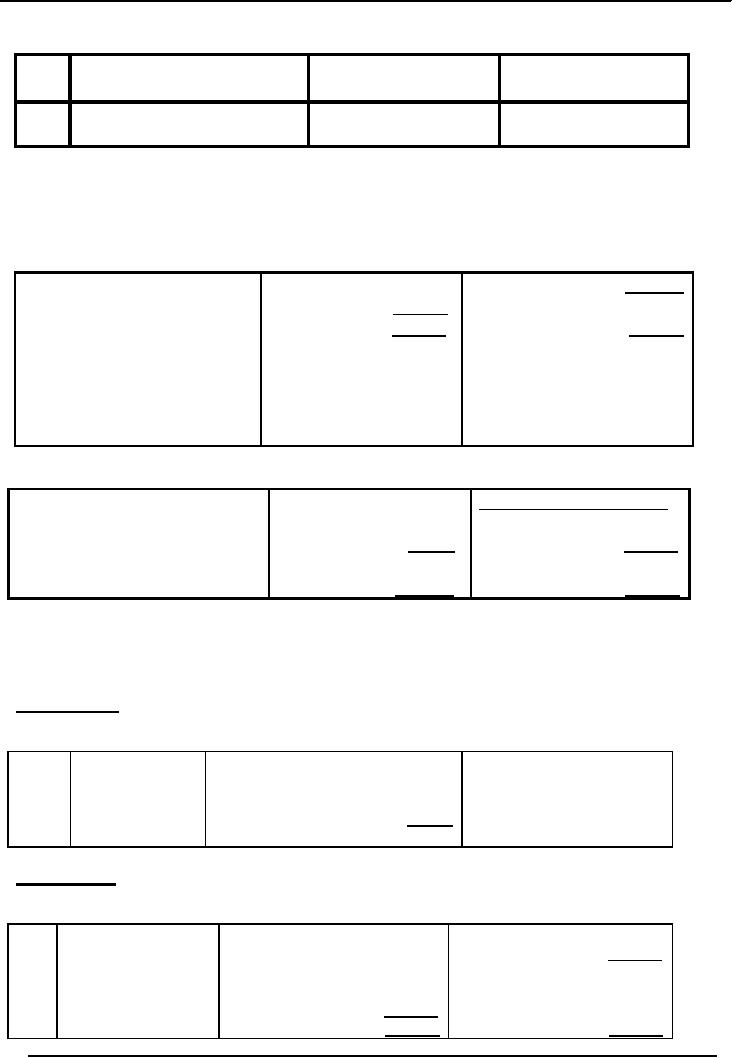

Financial

Position as on July 1,

2006

Assets

(Rs)

Owner's

equity (Rs)

i)

Deposit

in business by proprietor/ Cash

180,000

Khizr,

Capital 180,000

owner.

Jul 3,

06

Land

Valuing Rs. 141, 000 is

purchased for cash on July

3.

Financial

Position on that date would

be

II)

Purchase of land for

cash

Cash

39,000

Khizr,

Capital

180,

000

(Rs.141,000)

Land

141,000

Total

assets

180,000

Total

owner's equity

180,000

(Cash

is reduced by

Rs.141,

000, but

correspondingly

a new

asset

land has come

up)

Jul 5,

06

III)

Purchase of building

for

Cash

24,000

Liabilities

& Owner's equity

(Rs.36,000)

partly on cash

Land

141,000

Accounts/Notespayable21,000

Rs.15,000) and

partly on credit

Building

36,000

Owner's

equity

180,000

(Rs.21,000)

Total

assets

2,01,000

Total

201,000

Rs.15,

000 is paid in cash for the

building which further

reduces cash from Rs.39,

000 to Rs.24, 000.

For

remaining amount of Rs.21, 000, a

liability in the form of accounts or

notes payable involve

interest, where as

accounts payable are without

interest.

July

10, 2006: A

part of land valuing Rs.11,

000 was sold on credit. A

new asset "Accounts

Receivable"

has been introduced. The

new financial position as a

result of this transaction would

be:

24,000

Accounts Payable

21,000

iv)

Sale

of part of Cash

11,000

Owner's equity

180,000

land

on credit for Accounts

Receivable

Rs.11,000

Land

130,000

_______

Building

36,000

201,000

Total

201,000

July

14, 2006: Office

equipment for Rs.5400/- was

purchased on credit. A new

liability of Rs.5400 has

accrued,

raising Accounts Payable from

Rs.21, 000 to Rs.26,

400.

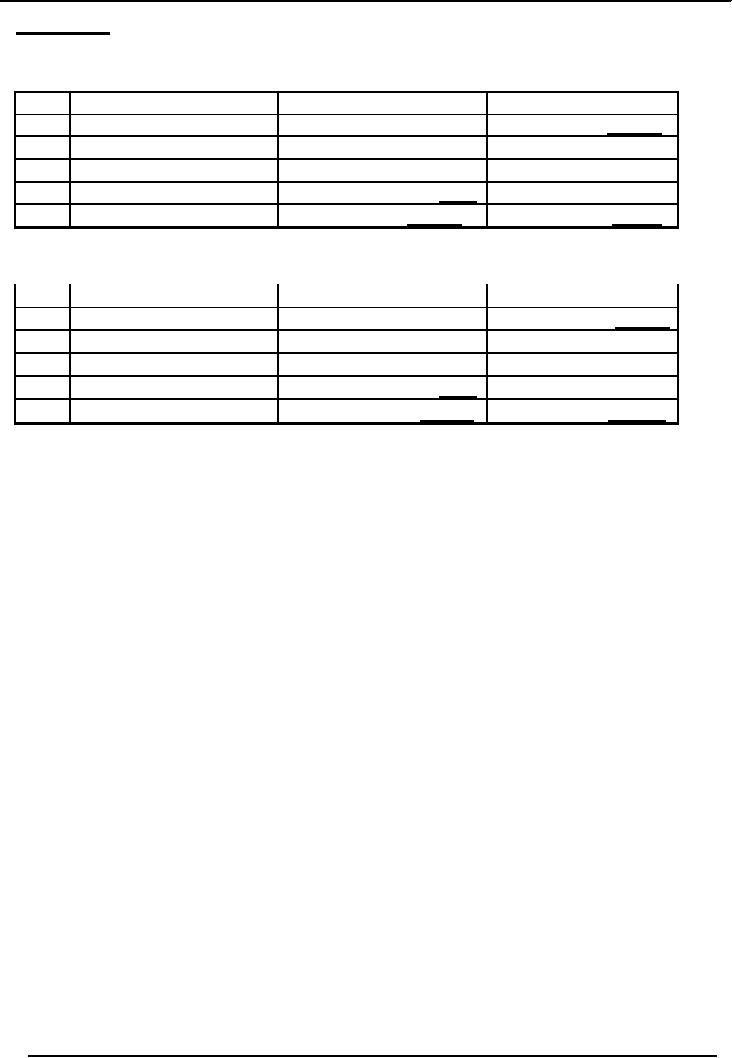

v)

Purchase

of Office Cash

24,000

A/C

Payable

26,400

Equipment

for

A/Cs Receivable

11,000

Owner's

equity

180,000

Rs.5400 on

credit.

Land

130,000

Building

36,000

Office

equipment

5,400

206,400

Total

206,400

4

Financial

Statement Analysis-FIN621

VU

July

20, 2006.

Accounts receivable which were

Rs.11, 000 on July 14, have

been converted into cash

to

the

extent of Rs.1, 500. Cash

has therefore increased from

Rs.24, 000 to Rs.25, 500 and

accounts

receivable

have correspondingly decreased to Rs.9,

500

(VI)

Partial

collection of

Cash

25,500

A/Cs

payable

26,400

Accounts

(Rs.15,00)

A/C

receivable

9,500

owner's

equity

180,000

Land

130,000

Building

36,000

Office

equipment

5,400

Total

206,400

Total

206400

July

31, 2006

(VII)

Payment of

liability

Cash

22,500

A/Cs

payable

23,400

(A/C

payable) Rs.3,000

A/C

receivable

9,500

owner's

equity

180,000

Land

130,000

Building

36,000

Office

equipment

5,400

Total

203,400

Total

2,03,400

It is

thus clear from the above

illustration that each

financial transaction affects

financial

position,

(which in effect is the balance

sheet). Accounting period in the

example was one month.

It

must

also be noted no business

activity (commissions/ fees/ Revenues

& Expenses) was involved

in

above

example. Only setting up of

business was involved and

therefore owner's equity

remains the

same.

5

Table of Contents:

- ACCOUNTING & ACCOUNTING PRINCIPLES

- Dual Aspect of Transactions

- Rules of Debit and Credit

- Steps in Accounting Cycle

- Preparing Balance Sheet from Trial Balance

- Business transactions

- Adjusting Entry to record Expenses on Fixed Assets

- Preparing Financial Statements

- Closing entries in Accounting Cycle

- Income Statement

- Balance Sheet

- Cash Flow Statement

- Preparing Cash Flows

- Additional Information (AI)

- Cash flow from Operating Activities

- Operating Activities’ portion of cash flow statement

- Cash flow from financing Activities

- Notes to Financial Statements

- Charging Costs of Inventory to Income Statement

- First-in-First - out (FIFO), Last-in-First-Out (LIFO)

- Depreciation Accounting Policies

- Accelerated-Depreciation method

- Auditor’s Report, Opinion, Certificate

- Management Discussion & Analyses (MD&A)

- TYPES OF BUSINESS ORGANIZATIONS

- Incorporation of business

- Authorized Share Capital, Issued Share Capital

- Book Values of equity, share

- SUMMARY

- SUMMARY

- Analysis of income statement and balance sheet:

- COMMON –SIZE AND INDEX ANALYSIS

- ANALYSIS BY RATIOS

- ACTIVITY RATIOS

- Liquidity of Receivables

- LEVERAGE, DEBT RATIOS

- PROFITABILITY RATIOS

- Analysis by Preferred Stockholders

- Efficiency of operating cycle, process

- STOCKHOLDERS’ EQUITY SECTION OF THE BALANCE SHEET 1

- STOCKHOLDERS’ EQUITY SECTION OF THE BALANCE SHEET 2

- BALANCE SHEET AND INCOME STATEMENT RATIOS

- Financial Consultation Case Study

- ANALYSIS OF BALANCE SHEET & INCOME STATEMENT

- SUMMARY OF FINDGINS