|

Financial

Accounting (Mgt-101)

VU

Lesson-9

Learning

Objective

�

After

studying this chapter, you should be able

to:

o Explain

what are Assets and

Liabilities: and

o Draw

up simple Balance Sheet from

given information in trial

balance.

Assets

are

economic resources that are

owned by a business and are

expected to benefit future

operations.

In

most cases, the benefit to

future operations comes in the form of

positive future cash flows.

The positive

future

cash flows may come directly

as the asset is converted into

cash(collection of a receivable)or

indirectly

as the

asset is used in operating the business

to create other assets that

result in positive future

cash

flows(building

& land used to

Manufacture

a product for sale). Assets

may have definite physical

form such as building,

machinery or

stock.

On the other hand, some

assets exist not in physical

or tangible form, but in the form of

valuable legal

claims

or right; examples are

accounts receivables, investment in govt.

bonds, and patent rights.

Liabilities

are

debts. The person or organization to

which the debt is owed is

called creditors. All

businesses

have

liabilities; even the most

successful companies purchase

stocks, supplies, and

services on credit. The

liabilities

arising from such purchases

are called accounts

payable.

Rule

of Debit and Credit

Assets

(increase in assets is debit

and decrease in asset is

credit)

Liabilities

(Increase in liability is credit and

decrease in liability is

debit)

Classification

of Assets

�

Fixed

Assets Are

the assets of permanent nature

that a business acquires,

such as plant,

machinery,

building,

furniture, vehicles etc.

Fixed assets are subject to

depreciation.

�

Long

Term Assets These

are the assets of the business

that are receivable after twelve months

of the

balance

sheet date. For example, if

business has invested some

money for two years in

any saving

scheme

or has purchased saving

certificates for more than

one year, it is a long term

asset.

�

Current

Assets Are

the receivables that are

expected to be received within

one year of the

balance

sheet

date. Debtors, closing stock &

all accrued incomes are the

examples of Current Assets

because

these

are expected to be received

within one accounting period

from the balance sheet

date.

� The

year, in which long term

asset is expected to be received, long

term asset is transferred

to

current

assets in that

year.

Classification

of Liabilities

�

Capital

is the funds

invested by the owners of the business.

Business has a liability to

return these

funds to the

owner.

We

know that for the purpose of

accounting, business is treated

separately from its owners.

This is

known

as Separate Entity Concept

i.e. Business is a separate

entity. Therefore, if the owner

gives

something

(can be in form of Cash or

Some other Asset) to the

business then the business,

not only has

to

return the amount to the owner but it

also has to give some return

on that money. That is why

we

treat Capital

(Owners Funds) as a

Liability.

�

Profit and

Loss Account The

net balance of the profit and

loss account i.e. either

profit or loss also

belongs

to the owners.

32

Financial

Accounting (Mgt-101)

VU

While

explaining capital we said

that the business has to give

return to the owners. Now if the

business

is

managed successfully, then this

return would be a Favorable figure

(Profit). This return will,

therefore,

be

added to the Owners' investment.

�

On the

other hand, if the business is

managed un-successfully then this

return would be an

un-favorable

figure

(Loss). It will, therefore, be deducted

from the Owners'

Investment.

�

Long

Term Liabilities These

are the liabilities that

will become payable after a

period of more than

one

year of the balance sheet

date. For example, if

business has taken a loan

from bank or any

third

person

and it is payable after three

years, it is a long term liability of the

business.

�

Current

Liabilities These

are the obligations of the business that

are payable within twelve months

of

the

balance sheet date. Creditors

and all accrued expenses

are the examples of current liabilities

of the

business

because business is expected to

pay these back within

one accounting

period.

�

The

year in which long term

liability is to be paid back, long

term liability is transferred

to

current

liability in that year.

BALANCE

SHEET

� It is a

position statement that

shows the standing of the organization in

Monetary Terms at a

Specific

Time.

� Unlike

Profit and Loss that

shows the performance of the entity

over a period of time, the Balance

Sheet

shows

the Financial State of Affairs of the

entity at a given date.

� Balance

sheet is the summarized analysis in a

`T' form of all assets

and liabilities of the entity,

with

liabilities

listed on left hand side and

assets on right hand

side.

� Asset

is any owned physical object (tangible

asset) or a right (intangible

asset) having economic value

to

the

owner.

� Liability

is an obligation of the business to

deliver goods or to provide a

benefit in future.

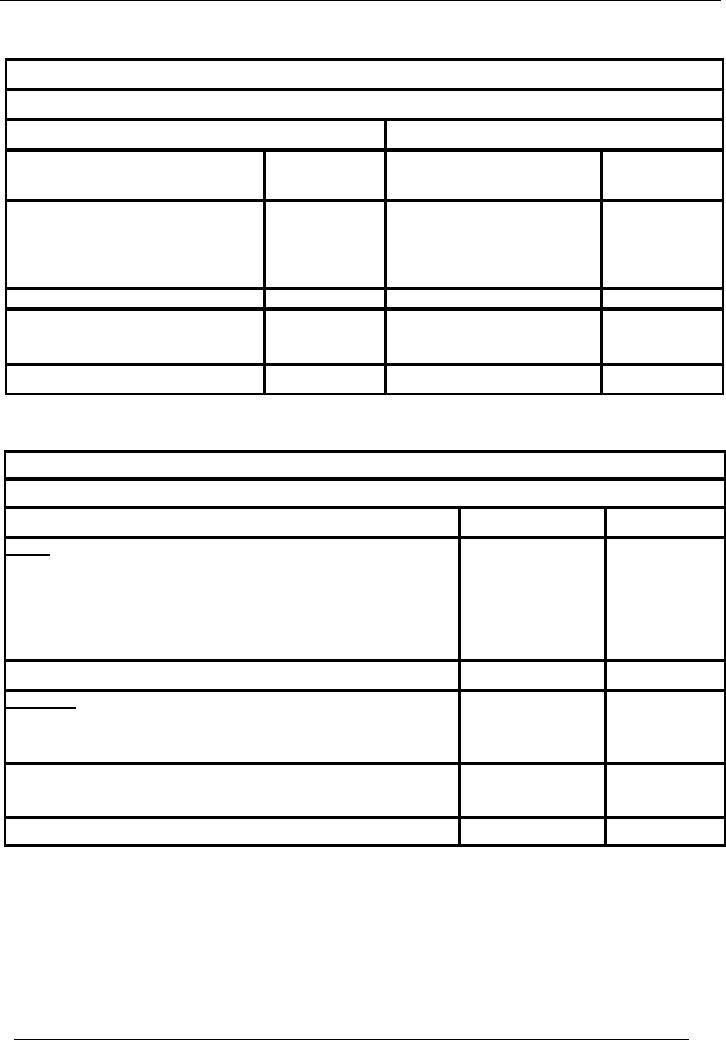

Format

of Balance Sheet (Account

Form)

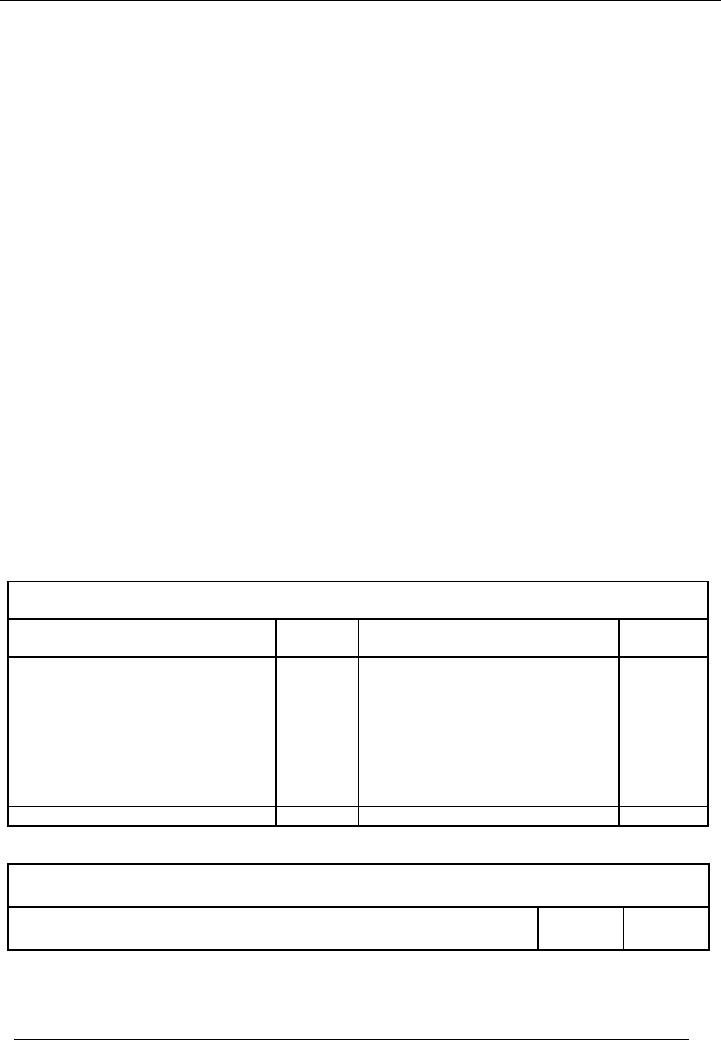

Name

of the Entity

Balance

Sheet As At-------

Liabilities

Amount

Assets

Amount

Rs.

Rs.

Capital

100000

Fixes

Assets

75000

Profit

and loss Account +

15000

115000

Long

Term Assets

20000

Long

Term Liabilities

50000

Current

assets

80000

Current

liabilities

10000

Total

175000

Total

175000

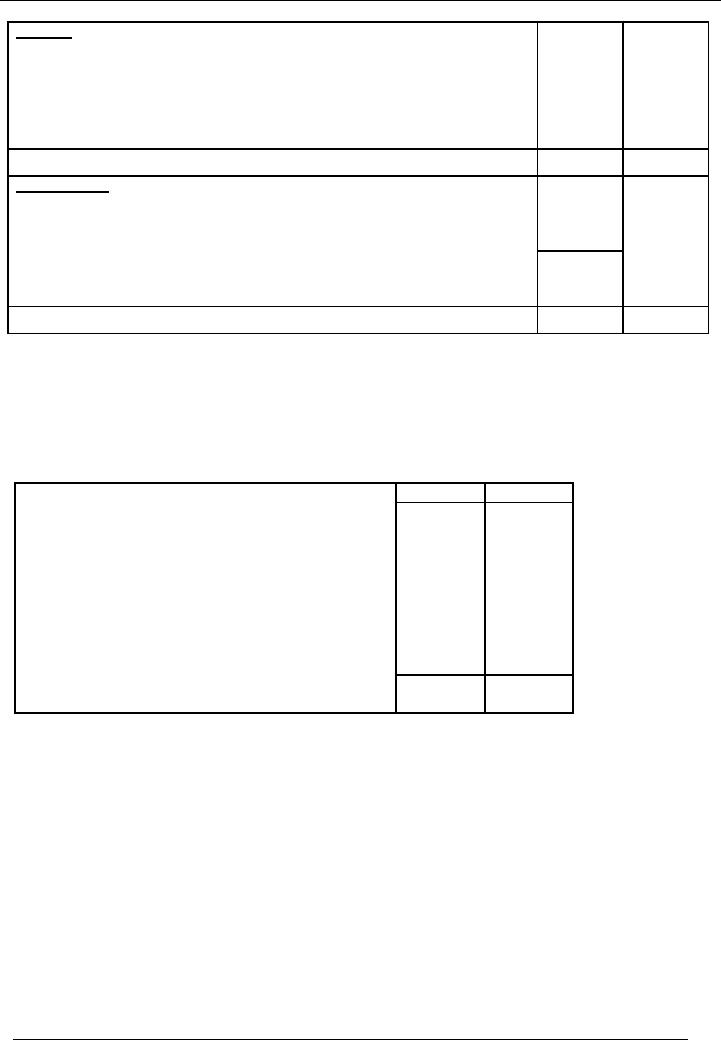

Format

of Balance Sheet (Report

Form)

Name

of the Entity

Balance

Sheet As At-------

PARTICULARS

Amount

Amount

Rs.

Rs.

33

Financial

Accounting (Mgt-101)

VU

ASSETS

Fixes

Assets

75000

Long

Term Assets

20000

Current

Assets

80000

Total

175000

LIABILITIES

Capital

100000

Profit

15000

115000

Long

Term Liabilities

50000

Current

Liabilities

10000

Total

175000

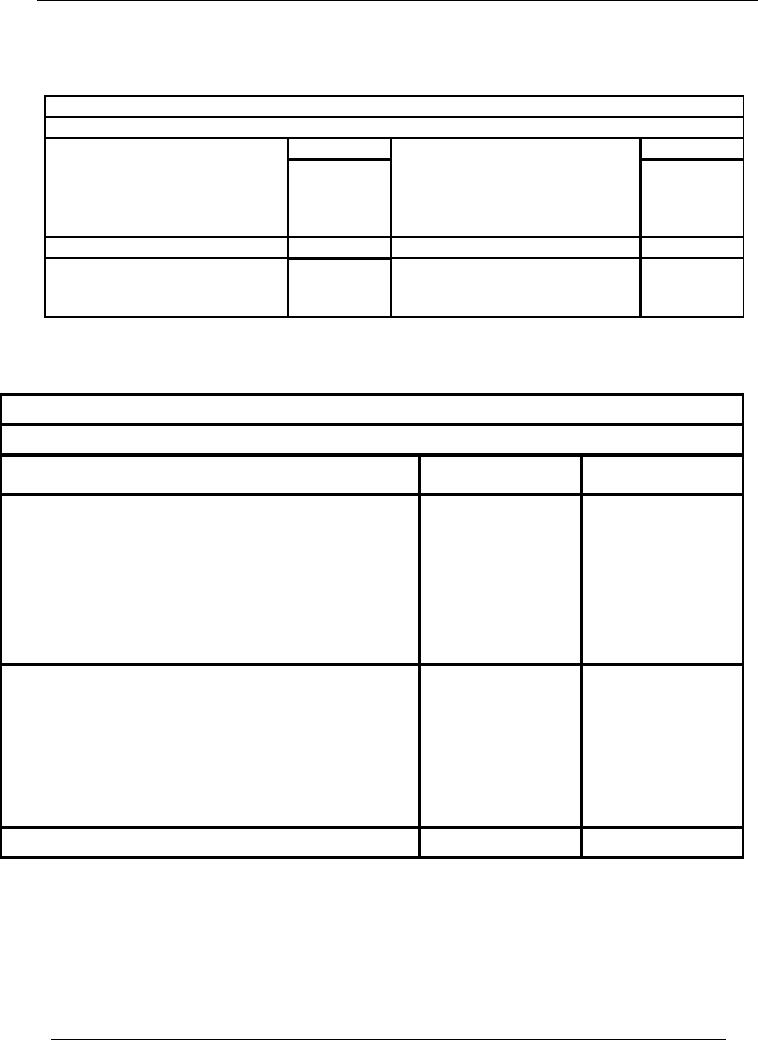

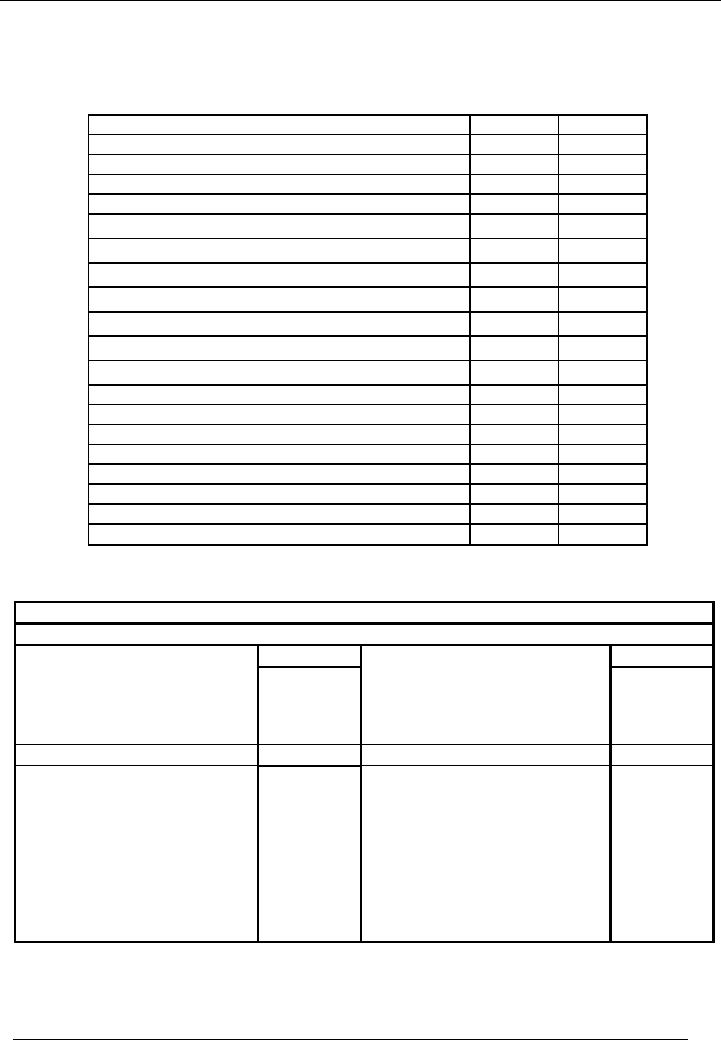

SOLVED

EXAMPLES

ILLUSTRATION

# 1

The

following is the trial

balance extracted from the

books of Naeem & Sons as on

30/06/2002.

Prepare

a profit & loss account & balance

sheet for the year

ended June 30,

2002.

Particulars

Dr.

Cr.

Sales

100,000

Purchases

45,000

purchase

return

3,000

Salaries

12,000

Rent

5,000

Debtors

25,000

Creditors

16,000

Capital

368,000

Plant &

machinery

400,000

487,000

487,000

Grand

Total

34

Financial

Accounting (Mgt-101)

VU

SOLUTION

Naeem

& Sons

Profit &

Loss Account for the

year ended June 30,

2002.

Rs.

Rs.

Sales

100,000

cost

of goods sold:

Purchases

45,000

Purchase return

3,000

Gross

Profit

58,000

103,000

103,000

Salaries

12,000

Gross Profit

58,000

Rent

5,000

Net

Profit

41,000

�

This

is a presentation of profit & loss

account in `T' account form.

Now same illustration is

presented in

statement

form.

Naeem

& sons

Profit &

Loss Account for the

year ended June 30,

2002

Particulars

Amount

Amount

Rs.

Rs.

100,000

Income

/ Sales / Revenue

Less:

Cost of Goods

Sold

Purchases

45,000

Less:

Purchase Return

(3,000)

(42,000)

58,000

Gross

Profit

Less:

Administrative expenses

Salaries

(12,000)

Rent

(5,000)

(17,000)

Net

Profit

41,000

This is

not a correct way to present

profit & loss account in

statement form. In actual

practice only main

heads

of

expenses are presented in

profit & loss account along

with foot note number.

Detail of that head

of

expense

is given in the note. Correct presentation of profit

& loss account is

hereunder:

35

Financial

Accounting (Mgt-101)

VU

Naeem

& sons

Profit &

Loss Account for the

year ended June 30,

2002

Particulars

Amount

Amount

Rs.

Rs.

100,000

Income

/ Sales / Revenue

Less:

Cost of Goods

Sold

(42,000)

(See

Note # 1)

58,000

Gross

Profit

Less:

Administrative expenses

(17,000)

(See

Note # 2)

Net

Profit

41,000

Note

# 1

Cost

of goods sold

Purchases

45,000

Less:

Purchase Return

(3,000)

Net

Purchases

42,000

Note

# 2

Administrative

expenses

Salaries

12,000

Rent

5,000

Total

Administrative expenses

17,000

It is

recommended that Profit &

loss account should be prepared in

above mentioned format.

36

Financial

Accounting (Mgt-101)

VU

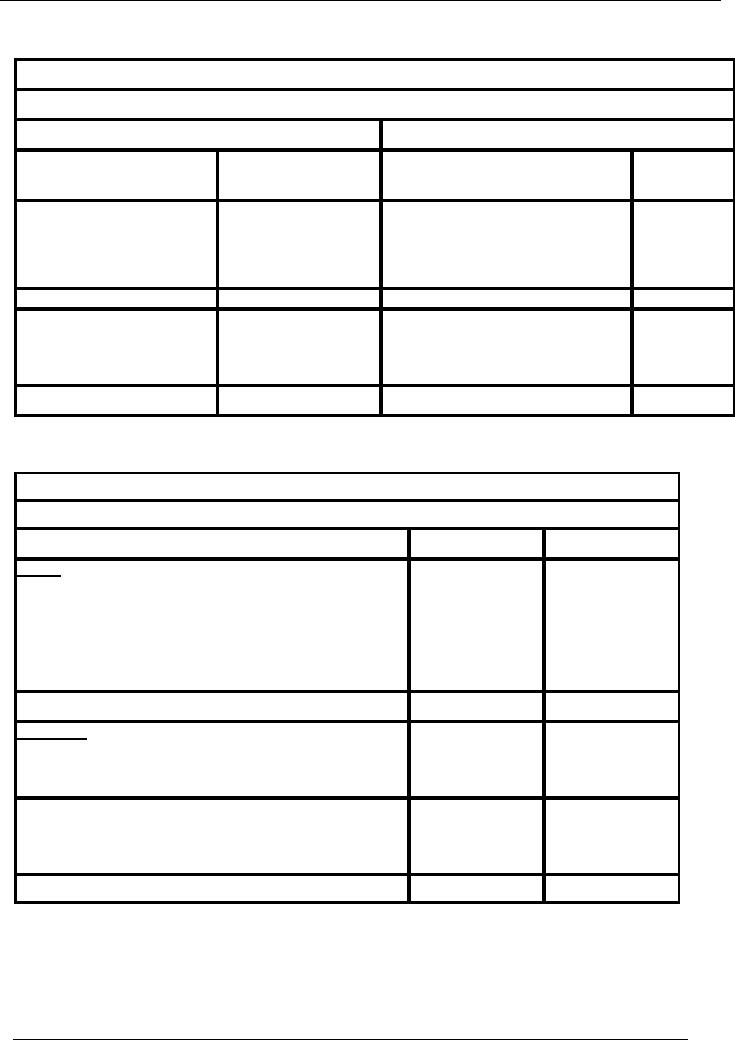

BALANCE

SHEET

Naeem

& Sons

Balance

Sheet As At June 30,

2002

Liabilities

Assets

Particulars

Amount

Particulars

Amount

Rs.

Rs.

Capital

368,000

Fixed Assets

Profit and

Loss Account

41,000

Plant &

Machinery

400,000

409,000

Current

Liabilities

Current

Assets

Creditors

16,000

Debtors

25,000

Total

425,000

Total

425,000

Balance

sheet in statement form is

presented hereunder:

Naeem

& Sons

Balance

Sheet As At June 30,

2002

Particulars

Amount

Rs.

Amount

Rs.

Assets

Fixed

Assets

Plant &

machinery

400,000

Current

Assets

Debtors

25,000

Total

425,000

Liabilities

Capital

368,000

Profit

41,000

409,000

Current

Liabilities

Creditors

25,000

Total

425,000

425,000

37

Financial

Accounting (Mgt-101)

VU

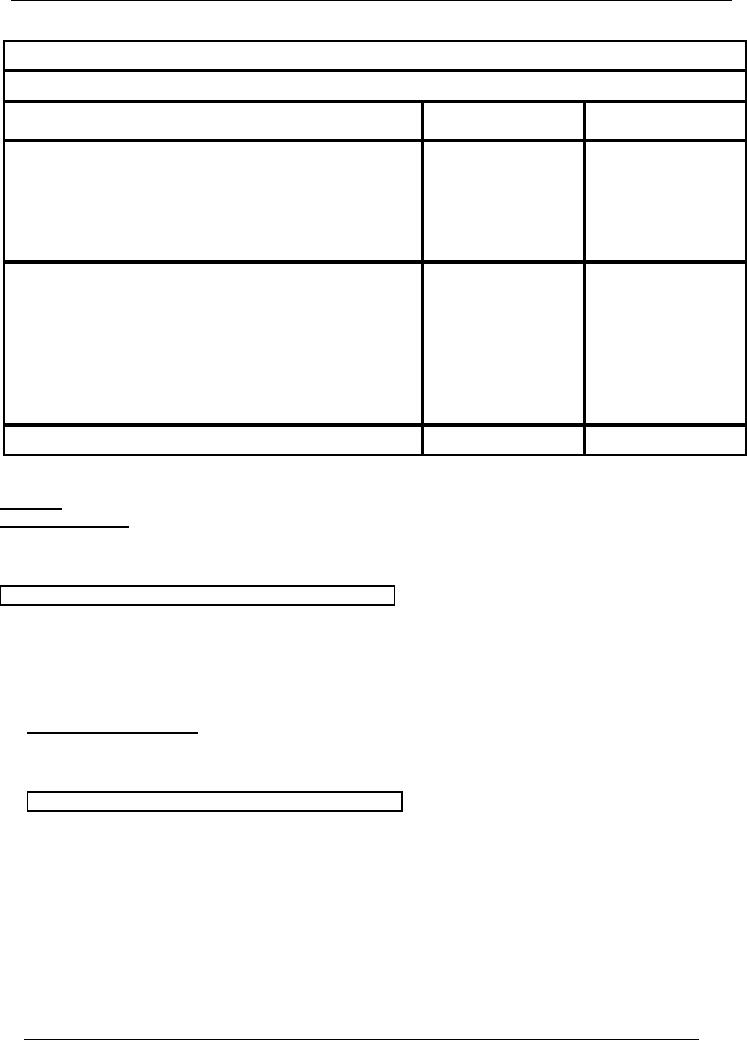

Illustration

# 2

The

following trial balance has

been extracted from the books of

Saeed & co. on 30-06-2002.

From this,

prepare

an income statement and

balance sheet for the year

ended 30-06-2002.

Dr.

Cr.

Sales

200,000

Purchases

180,000

purchase

return

2,500

Office

salaries

3,500

Furniture

& Fixture

16,000

Office

Equipment

11,000

Rent

5,000

Accounts

Payable(creditors)

28,000

Sales

Salaries

3,000

Freight

& custom duty on

purchases

6000

Repair

of office equipment

2,000

Accounts

Receivable(debtors)

52,000

Freight

on sales

1,000

Capital

41,500

Cash

in hand

37,000

Loan

from bank(for three

years)

50,000

Bank

charges

500

Interest

on loan

5,000

Grand

Total

322,000

322,000

SOLUTION

Saeed &

Co.

Profit &

Loss Account for the

year ended June 30,

2002.

Rs.

Rs.

Sales

200,000

Purchases

180,000

Purchase return

2,500

Freight,

custom duty on

purchases

6,000

Gross

Profit

16,500

202,500

202,500

Salaries

3,500

Gross Profit

16,500

Rent

5,000

Repair

of office equipment

2,000

Sales

salaries

3,000

Freight

on sales

1,000

Interest

on loan

5,000

Bank

charges

500

Net

loss

3,500

Total

20,000

20,000

Profit &

loss account in statement

form:

38

Financial

Accounting (Mgt-101)

VU

Naeem

& sons

Profit &

Loss Account for the

year ended June 30,

2002

Particulars

Amount

Amount

Rs.

Rs.

200,000

Income

/ Sales / Revenue

Less:

Cost of Goods

Sold

(183,500)

(See

Note # 1)

Gross

Profit

16,500

Less:

Administrative expenses

(10,500)

(See

Note # 2)

Less:

Selling expenses

(4,000)

(See

Note # 3)

Less:

Financial Expenses

(5,500)

(See

Note # 4)

Net

Profit/(Loss)

(3,500)

NOTE #

1

COST

OF GOODS SOLD

Purchases

180,000

Less:

purchase return

(2,500)

Add:

Freight, custom duty on

purchases

(6,000)

TOTAL

183,500

NOTE #

2

Administrative

expenses

Salaries

3,500

Rent

5,000

Repair

of office equipment

2,000

TOTAL

10,500

NOTE #

3

Selling

expenses

Sales

salaries

3,000

Freight

on sales

1,000

TOTAL

4,000

NOTE #

4

Financial

expenses

Interest

on loan

5,000

Bank

charges

500

TOTAL

5,500

39

Financial

Accounting (Mgt-101)

VU

BALANCE

SHEET

Saeed

& co.

Balance

Sheet As At June 30,

2002

Liabilities

Assets

Particulars

Amount

Particulars

Amount

Rs.

Rs.

Capital

41,500

Fixed Assets

Profit and

Loss Account

(3,500)

Furniture

& Fixture

16,000

38,000

Long

Term Liabilities

Current

Assets

Loan

from bank

50,000

Debtors

52,000

Current

Liabilities

Office

equipment

11,000

Creditors

28,000

Cash

37,000

Total

116,000

Total

116,000

Balance

sheet in statement

form

Saeed

& Co.

Balance

Sheet As At June 30,

2002

Particulars

Amount

Rs.

Amount

Rs.

Assets

Fixed

Assets

Furniture

& Fixture

16,000

Current

Assets

Debtors

52,000

11,000

Office

Equipment

Cash

37,000

Total

116,000

Liabilities

Capital

41,500

Profit/(Loss)

(3,500)

38,,000

Long

Term Liabilities

Loan

from bank

50,000

Current

Liabilities

Creditors

28,000

Total

116,000

40

Table of Contents:

- Introduction to Financial Accounting

- Basic Concepts of Business: capital, profit, budget

- Cash Accounting and Accrual Accounting

- Business entity, Single and double entry book-keeping, Debit and Credit

- Rules of Debit and Credit for Assets, Liabilities, Income and Expenses

- flow of transactions, books of accounts, General Ledger balance

- Cash book and bank book, Accounting Period, Trial Balance and its limitations

- Profit & Loss account from trial balance, Receipt & Payment, Income & Expenditure and Profit & Loss account

- Assets and Liabilities, Balance Sheet from trial balance

- Sample Transactions of a Company

- Sample Accounts of a Company

- THE ACCOUNTING EQUATION

- types of vouchers, Carrying forward the balance of an account

- ILLUSTRATIONS: Ccarrying Forward of Balances

- Opening Stock, Closing Stock

- COST OF GOODS SOLD STATEMENT

- DEPRECIATION

- GROUPINGS OF FIXED ASSETS

- CAPITAL WORK IN PROGRESS 1

- CAPITAL WORK IN PROGRESS 2

- REVALUATION OF FIXED ASSETS

- Banking transactions, Bank reconciliation statements

- RECAP

- Accounting Examples with Solutions

- RECORDING OF PROVISION FOR BAD DEBTS

- SUBSIDIARY BOOKS

- A PERSON IS BOTH DEBTOR AND CREDITOR

- RECTIFICATION OF ERROR

- STANDARD FORMAT OF PROFIT & LOSS ACCOUNT

- STANDARD FORMAT OF BALANCE SHEET

- DIFFERENT BUSINESS ENTITIES: Commercial, Non-commercial organizations

- SOLE PROPRIETORSHIP

- Financial Statements Of Manufacturing Concern

- Financial Statements of Partnership firms

- INTEREST ON CAPITAL AND DRAWINGS

- DISADVANTAGES OF A PARTNERSHIP FIRM

- SHARE CAPITAL

- STATEMENT OF CHANGES IN EQUITY

- Financial Statements of Limited Companies

- Financial Statements of Limited Companies

- CASH FLOW STATEMENT 1

- CASH FLOW STATEMENT 2

- FINANCIAL STATEMENTS OF LISTED, QUOTED COMPANIES

- FINANCIAL STATEMENTS OF LISTED COMPANIES

- FINANCIAL STATEMENTS OF LISTED COMPANIES