|

Financial

Accounting (Mgt-101)

VU

Lesson-8

LEARNING

OBJECTIVE

�

After

studying this chapter, you will be

able to:

o Draw

up Profit & Loss account

from the information given in trial

balance.

o Differentiate

the term, Receipt & Payment,

Income & Expenditure and

Profit & Loss

account.

FINANCIAL

STATEMENTS

� Different

reports generated from the books of

accounts to provide information to the

relevant

persons.

� Every

business is carried out to

make profit. If it is not

run successfully, it will

sustain loss. The

calculation of

such profit & loss is

probably the most important objective of

the accounting function.

Such

information is acquired from

"Financial Statements".

� Financial

Statements are the end

product of the whole accounting

process. These show us

the

profitability

of the business concern and the financial

position of the entity at a specified

date.

� The

most commonly used Financial Statements

are `profit & loss

account' `balance sheet' &

`cash

flow

statement'.

Income

and Expenditure Vs Profit and Loss

�

Income

and Expenditure Account is

used for Non-Profit Organizations

like Trusts, NGOs.

�

Profit

and Loss Account is

used for Commercial

organizations like limited

companies.

PROFIT

& LOSS ACCOUNT

�

Profit

& Loss account is an account

that summarizes the profitability of the

organization for a

specific

accounting period.

�

Profit

& Loss account has two

parts:

o In the

first part, Gross Profit is

calculated.

o Gross

profit is the excess of sales

over cost of goods sold in

an accounting period.

o In

trading concern, cost of

goods sold is the cost of

goods consumed plus any

other charge

paid in

bringing the goods in salable

condition. For example, if

business purchased

certain

items

for resale purpose and

any expense is paid in respect of

carriage or bringing the

goods

in

store (transportation charges).

These will also be grouped under the

heading of `cost of

goods

sold' and will become part

of its price.

o In

manufacturing concern, cost of goods

sold comprises of purchase of

raw material plus

wages

paid to staff employed for converting this

raw material into finished

goods plus any

other

expense in this connection.

o In the

2nd part, Net Profit

is calculated.

o Net

Profit is what is left of the gross

profit after deducting all other

expenses of the

organization in a

specific time period.

How

to prepare Profit & Loss

account

� One

way is to write down all the

Debit and Credit entries of

Income and Expense accounts

in the

Profit

and Loss Account. But it is

not sensible to do

so.

� The

other way is that we

calculate the net balance or we can

say Closing Balance of each

income and

expense

account. Then we note all

the credit balances on the credit side

and all the debit balances

on

the

debit of profit and loss

account.

� If the net

balance of profit and loss

is Credit (credit side is greater

than debit side) it is

Profit and if

the net

balance is Debit (Debit side

is greater than credit side) it is a

loss.

28

Financial

Accounting (Mgt-101)

VU

Income,

expenditure, profit and loss

�

Income

is

the value of goods and

services earned from the

operation of the business. It

includes

both

cash & credit. For example, if a

business entity deals in

garments. What it earns from

the sale of

garments,

is its income. If somebody is rendering

services, what he earned from rendering

services is

his

income.

�

Expenses

are

the resources and the efforts

made to earn the income,

translated in monetary

terms.

It

includes both expenses,

i.e., paid and to be paid (payable).

Consider the above mentioned

example,

if any

sum is spent in running the

garments business effectively or in

provision of services, is

termed

as

expense.

�

Profit

is

the excess of income over

expenses in a specified accounting

period.

Profit=

Income-expenses

In the

above mentioned example, if the business

or the services provider earn

Rs. 100,000 &

their

expenses

are Rs. 75,000. Their

profit will be Rs. 25,000

(100,000-75,000).

�

Loss

is the excess of expenses over

income in a specified period of time. In

the above example, if

their

expenses are Rs. 100,000

& their income is Rs.

75,000. Their loss will be

Rs. 25,000.

RULES

OF DEBIT & CREDIT

�

Increase

in expense is Debit

(Dr.)

�

Decrease

in expense is credit (Cr.)

�

Increase

in income is credit (Cr.)

�

Decrease

in income is Debit

(Dr.)

Classification

of expenses

�

It has

already been mentioned that a

separate account is opened

for each type of expense.

Therefore,

in

large business concerns,

there may be a large number of

accounts in organization's books.

�

As

profit & loss account is a

summarized record of the profitability of

the organization. So, similar

accounts

should be grouped for reporting

purposes.

�

The

most commonly used groupings of expenses

are:

o COST

OF GOODS SOLD

o ADMINISTRATION

EXPENSES

o SELLING

EXPENSES

o FINANCIAL

EXPENSES

�

Cost

of goods sold is the

cost incurred in purchasing or manufacturing the

product, which an

organization is

selling plus any other

expense incurred in bringing the product

in salable condition.

Cost

of goods sold contain the following

heads of accounts:

o Purchase

of raw material/goods

o Wages

paid to employees for manufacturing of

goods

o Any

tax/freight is paid on purchases

o Any

expense incurred on carriage/transportation of

purchased items.

�

Administrative

expenses are

the expenses incurred in running a

business effectively. Main

components

of this group are:

o Payment

of utility bills

o Payment

of rent

o Salaries

of employees

o General

office expenses

o Repair

& maintenance of office equipment &

vehicles.

29

Financial

Accounting (Mgt-101)

VU

�

Selling

expenses are

the expenses incurred directly in connection with the

sale of goods. This

head

contains:

o Transportation/carriage

of goods sold

o Tax/freight

paid on sale

�

If the

expense head `salaries'

includes salaries of sales staff. It

will be excluded from

salaries & appear

under the

heading of `selling

expenses'.

�

Financial

expenses are

the interest paid on bank loan & charges

deducted by bank on entity's bank

accounts.

It includes:

o Mark

up on loan

o Bank

charges

Receipt

& Payment Account

�

A

receipt & payment account is the

summarized record of actual

cash receipts and actual

cash

payment

of the organization for a given period of time. This

is a report that provides cash

movement

during

the reported period. In other words, it

can be defined as the summarized

record of the cash

book

for a specific

period.

Receipt

& Payment vs. Profit & Loss

Account

�

Receipt

& payment account is the summarized

record of actual cash

receipts and actual cash

payment

during

the period while profit &

loss account also includes

Receivable and

Payable.

�

Income

& expenditure Vs. Profit & Loss

Account

�

These

are two similar terms.

Only difference between these

two terms is that income

& expenditure

account

is prepared for non profit

oriented organizations, e.g.

Trusts, N.G.O's, whereas

profit & loss

account

is prepared in profit oriented

organizations, e.g. Limited

companies, Partnership firms

etc.

�

In

case of Income and

Expenditure Surplus/Deficit is to be find

and in case of Profit and

loss

account

profit or loss is to be

find.

30

Financial

Accounting (Mgt-101)

VU

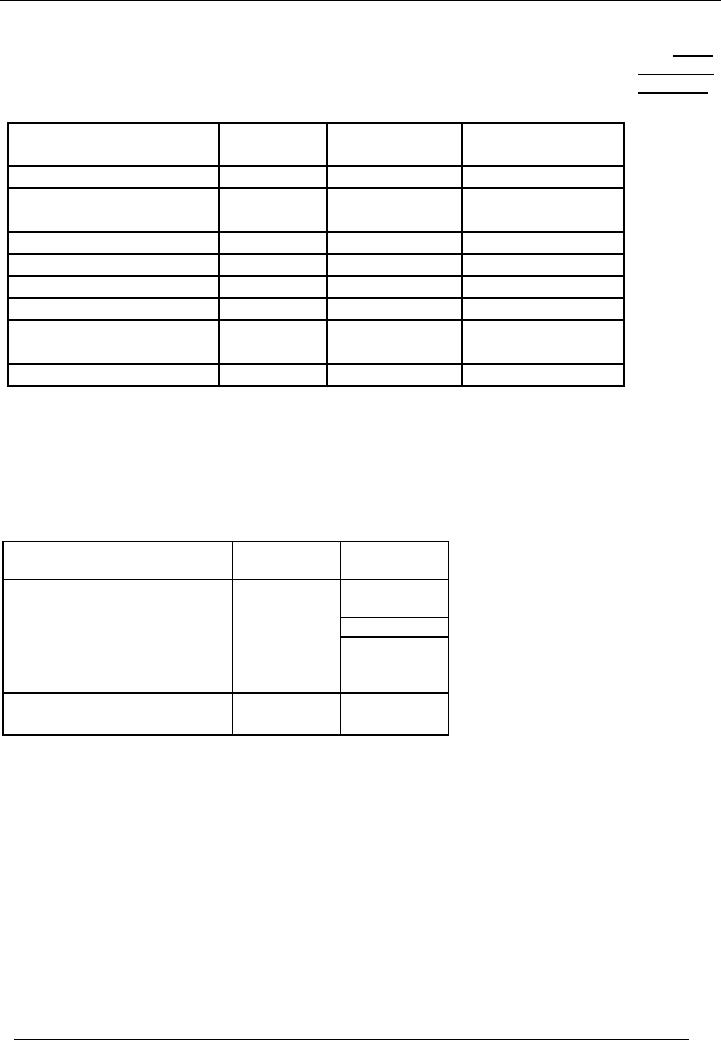

A sample of

Profit and Loss Account

Gross

Name

of the Entity

profit

and

Profit and

Loss Account

Net

profit

for

the period Ending

----

DEBIT

CREDIT

Gross

PARTICULARS

AMOUNT

PARTICULARS

AMOUNT

profit

=

Rs.

Rs.

Income

Cost

of sale

60000

income

100000

cost

of

Gross

profit c/d

40000

sales

(Income

cost of sales)

=

100000-

Total

100000

Total

100000

60000

Admin

expenses

15000

Gross

profit b/d

40000

Selling

expenses

5000

=

Rs.40000

Financial

expenses

5000

Net

profit

=

Gross

Net

profit (Gross profit

profit

expenses)

Expenses

Total

40000

Total

40000

=

40000 15000 5000 -

5000

=Rs.15000

A sample of

Income Statement

Name

of the Entity

Income

statement

For

the period Ending

----

PARTICULARS

AMOUNT

AMOUNT

Rs.

Rs

Income/Sales/Revenue

100000

Less:

Cost of sales

(60000)

Gross

profit

40000

Less:

Administration expenses

15000

Selling

expenses

5000

Financial

expenses

5000

(25000)

Net

profit

15000

Recognizing

Income and Expenditure

�

Income

should be recognized / recorded at the time

when goods are sold or

services are

rendered.

�

Expenses

should be recognized / recorded

when benefit relating to that

expense has been

drawn.

31

Table of Contents:

- Introduction to Financial Accounting

- Basic Concepts of Business: capital, profit, budget

- Cash Accounting and Accrual Accounting

- Business entity, Single and double entry book-keeping, Debit and Credit

- Rules of Debit and Credit for Assets, Liabilities, Income and Expenses

- flow of transactions, books of accounts, General Ledger balance

- Cash book and bank book, Accounting Period, Trial Balance and its limitations

- Profit & Loss account from trial balance, Receipt & Payment, Income & Expenditure and Profit & Loss account

- Assets and Liabilities, Balance Sheet from trial balance

- Sample Transactions of a Company

- Sample Accounts of a Company

- THE ACCOUNTING EQUATION

- types of vouchers, Carrying forward the balance of an account

- ILLUSTRATIONS: Ccarrying Forward of Balances

- Opening Stock, Closing Stock

- COST OF GOODS SOLD STATEMENT

- DEPRECIATION

- GROUPINGS OF FIXED ASSETS

- CAPITAL WORK IN PROGRESS 1

- CAPITAL WORK IN PROGRESS 2

- REVALUATION OF FIXED ASSETS

- Banking transactions, Bank reconciliation statements

- RECAP

- Accounting Examples with Solutions

- RECORDING OF PROVISION FOR BAD DEBTS

- SUBSIDIARY BOOKS

- A PERSON IS BOTH DEBTOR AND CREDITOR

- RECTIFICATION OF ERROR

- STANDARD FORMAT OF PROFIT & LOSS ACCOUNT

- STANDARD FORMAT OF BALANCE SHEET

- DIFFERENT BUSINESS ENTITIES: Commercial, Non-commercial organizations

- SOLE PROPRIETORSHIP

- Financial Statements Of Manufacturing Concern

- Financial Statements of Partnership firms

- INTEREST ON CAPITAL AND DRAWINGS

- DISADVANTAGES OF A PARTNERSHIP FIRM

- SHARE CAPITAL

- STATEMENT OF CHANGES IN EQUITY

- Financial Statements of Limited Companies

- Financial Statements of Limited Companies

- CASH FLOW STATEMENT 1

- CASH FLOW STATEMENT 2

- FINANCIAL STATEMENTS OF LISTED, QUOTED COMPANIES

- FINANCIAL STATEMENTS OF LISTED COMPANIES

- FINANCIAL STATEMENTS OF LISTED COMPANIES