|

Financial

Accounting (Mgt-101)

VU

Lesson-7

Areas

Covered in this lecture

�

Cash

book and bank book.

�

Accounting

Period.

�

Trial

Balance and its

limitations.

Flow

of Transaction

In Financial

Accounting, any business

transaction flows as

follows:

�

The

business transaction is recorded in a

voucher. The voucher is the first document

prepared in the

financial

accounting.

�

All

credit transactions are then

posted in the journal.

�

In

these days, voucher is directly

fed in the books of accounts by means of

computers.

�

From

the books of accounts, trial balance is

prepared, which shows the arithmetic

accuracy of the

accounting

system.

�

Finally,

financial statements. i.e., Profit &

Loss Account and Balance

Sheet is prepared from

trial

balance.

Cash

Book & Bank Book

�

Cash

book and bank book are

part of general

ledger.

�

All

entries including payables

and receivables are recorded

in the general ledger. Expenses,

income,

assets

and liabilities are recorded

in different head of accounts to

analyze the expenses incurred in

different

head of accounts.

�

Due to

large volume of transactions, entries

related to cash and bank are

recorded in the separate

books.

Cash

Book

�

All

cash transactions (receipts

and payments) are recorded

in the cash book.

�

Cash

book balance shows the amount of

cash in hand at a particular time.

�

Format of

cash book is here

under:

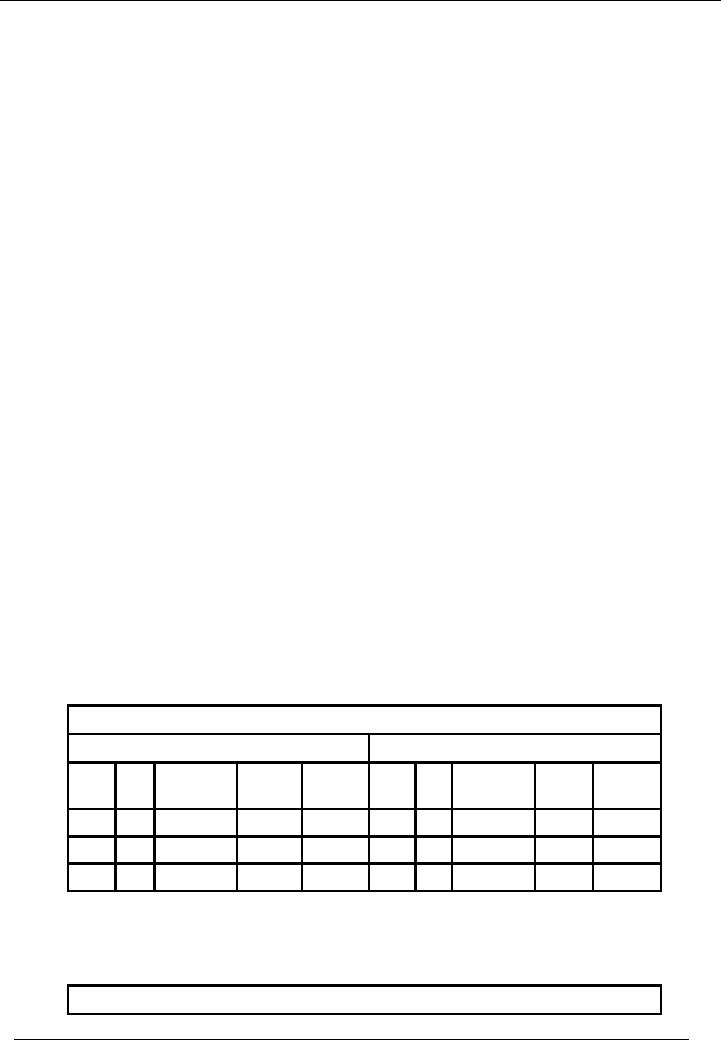

Cash

Book

Account

Code 01

Receipt

Side

Payment

Side

Date

No. Narration /

Ledger

Receipt

Date No. Narration / Ledger

Payment

Particulars

Code

Amount

Particulars

Code Amount

OR

Cash

Book

Account

Code 01

23

Financial

Accounting (Mgt-101)

VU

Date

Voucher

Narration

/

Ledger

Receipt

Payment

Balance

Number

Particulars

Code

Amount

Amount

Dr/(Cr)

�

Two

formats of cash book are

shown above. In the first

format, receipt side and

payment side are

shown

separately. In the second format,

two columns are shown

for receipt and payment

with an

extra

column of balance. The balance column

shows the net balance of cash

available for use.

�

The

ledger code shows the code

of that head of account

which contains the second effect of

the

cash

transactions because debits

and credits are always

equal in financial accounting.

�

Both of

these formats are correct. A

business can use any

format considering its

policies and

requirements.

Bank

Book

�

All

bank transactions are recorded in the

bank book.

�

The

balance of bank book reflects the

cash available at bank at a particular

time.

�

Format of bank

book is hereunder:

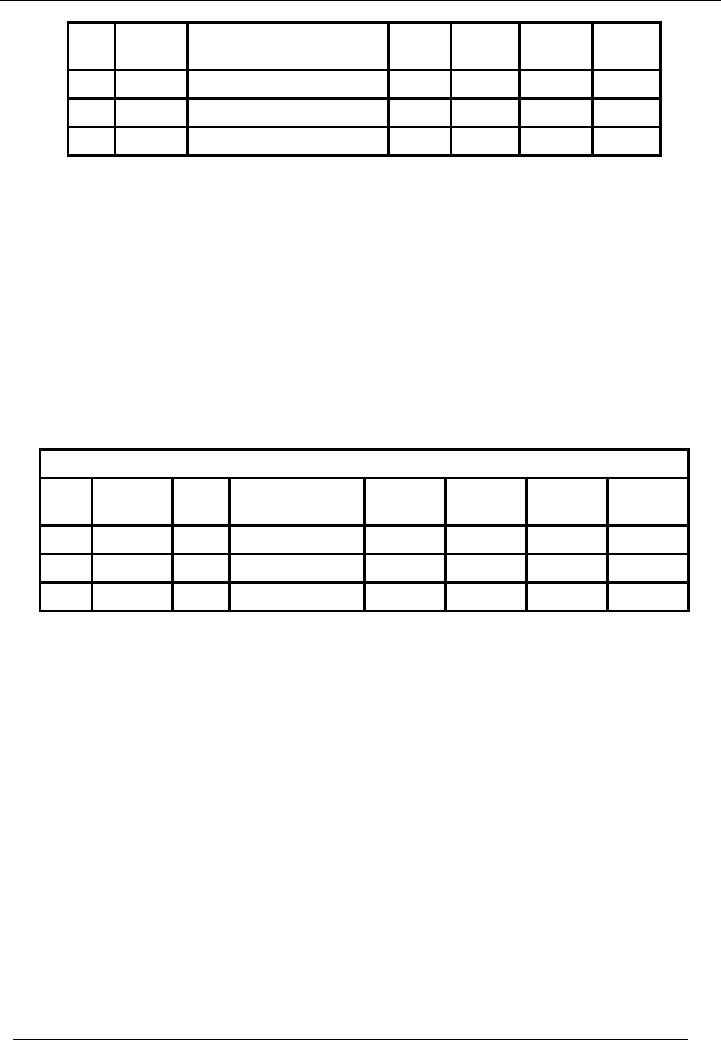

Bank

Book (Bank Account

Number)

Account

Code 02

Date

Voucher

Chq.

Narration

/

Ledger

Receipt

Payment

Balance

Number

No.

Particulars

Code

Amount

Amount

Dr/(Cr)

�

The

format of bank book is same as

that of cash book except the

column of cheque no.

�

This

column is added in the format because

all payments made by cheque

and the number of

cheque

is written in that column to keep the

accounting record

updated.

Accounting

Period

�

Accounting

period is any period for

which a profit and loss

account is prepared.

�

The

length of the accounting period

can be anything between one

day to one year

�

The

legal or statutory definition is a

maximum of one year.

�

The

only exception in this case is the

formation of a new company

which is formed before the

start

of accounting period.

24

Financial

Accounting (Mgt-101)

VU

Financial

year ("a period of 12 month

duration")

�

In

Pakistan, financial year starts

from 1st

of July

and ends on 30th of

June.

�

Exceptions

are:

o Specialized

business. e.g., Textile,

banks, Sugar mills

etc.

�

Financial reports

can be made for a week or a

month, depending upon the requirements of

the

company.

Debit

& Credit Balances

�

It has

already been mentioned that

both sides i.e. Debit

and credit side of a ledger

must be equal.

�

If

debit side of a ledger is

greater that credit side.

The balance will be written

on the credit side and

it

will be called Debit

Balance. The reason being,

the balance is written on the credit side

because of

excessive

debit balance. Therefore, it is called

Debit Balance. For

example:

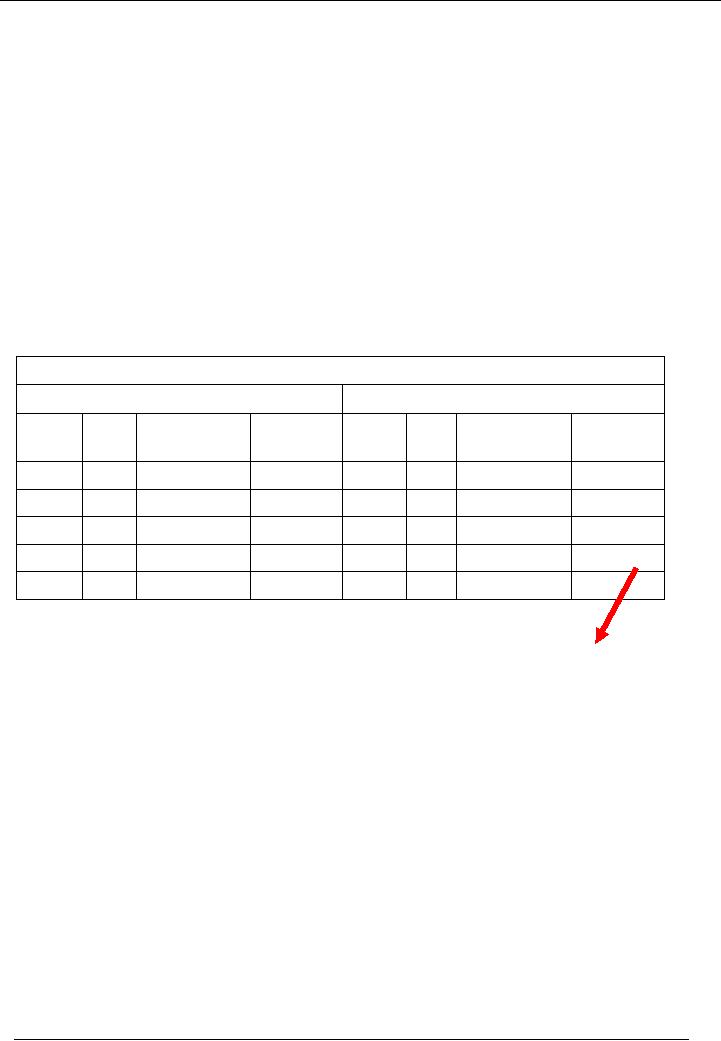

Title of

Account

Account

Code 01

Debit

Side

Credit

Side

Narration

/

Receipt

Narration

/

Payment

Date

No.

Date

No.

Particulars

Amount

Particulars

Amount

1

100,000

3

80,000

2

20,000

4

30,000

120,000

110,000

Balance

10,000

A Debit

Balance

�

Similarly, if

credit side is greater than

debit side, the balance will

be written on the debit side.

This

balance

is called. Credit Balance.

For Example:

25

Financial

Accounting (Mgt-101)

VU

Title of

Account

Account

Code 01

Debit

Side

Credit

Side

Narration

/

Receipt

Narration

/

No.

Date

Date

No.

Payment

Particulars

Amount

Particulars

Amount

1

80,000

3

100,000

2

30,000

4

20,000

110,000

120,000

Balance

10,000

A

Credit Balance

Trial

Balance

�

At the

end of accounting period, a

list of all ledger balances

is prepared. This list is

called trial

Balance.

�

Both

sides of trial balance i.e.

Debit side and credit side

must be equal. If both sides

are not equal,

there

are errors in the books of

accounts.

�

Trial

balance shows the mathematical

accuracy of the books of accounts.

Limitations

of Trial Balance

�

Trial

balance only shows the

mathematical accuracy of the

accounts.

�

If

both sides of trial balance

are equal, books of accounts

are considered to be correct.

But this

might

not be true in all the

cases.

�

If any

transaction is not recorded at all,

trial balance can not

detect the omitted

transaction.

�

If any

transaction is recorded in the wrong

head e.g. if an expense is debited to an

assets account.

Trial

balance will not be able to

detect that mistake

too.

26

Financial

Accounting (Mgt-101)

VU

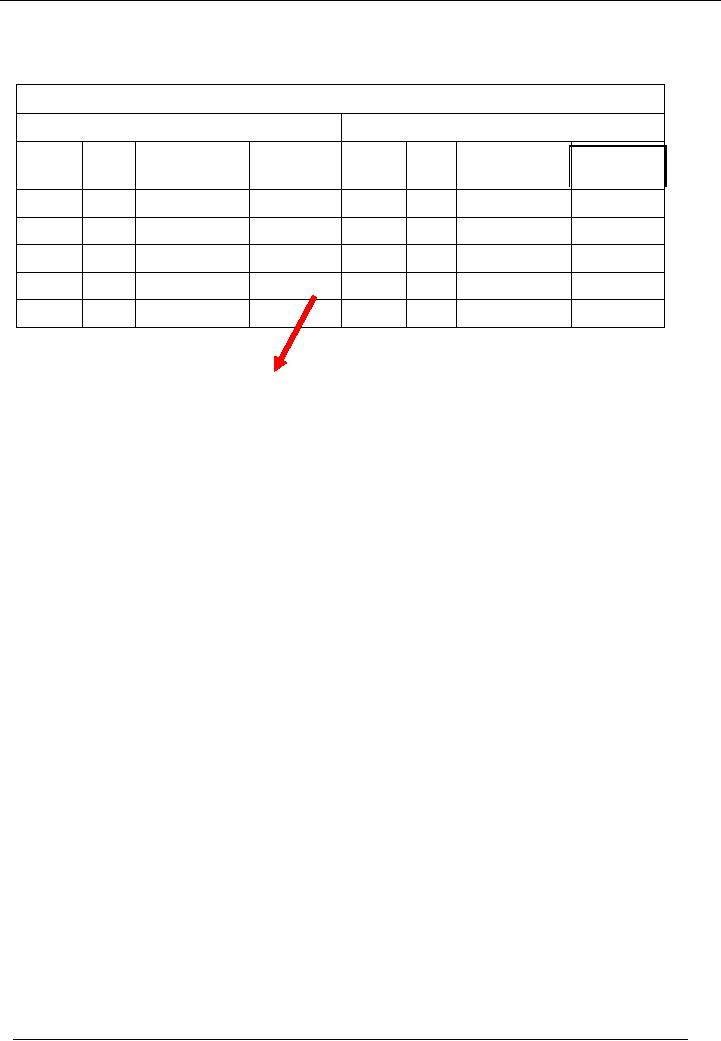

A

Sample Trial

Balance

Name Of

The Organization

Trial

Balance As On (Date on Which Trial

Balance is Drawn)

Title

of Account

Account

Debit

Credit

Code

Amount

Amount

Cash

in Hand

01

xy

Cash

at bank

02

xy

Capital

03

xy

Assets

04

xy

xy

Liabilities

05

Income

06

xy

Expenses

07

xy

Total

xyz

xyz

27

Table of Contents:

- Introduction to Financial Accounting

- Basic Concepts of Business: capital, profit, budget

- Cash Accounting and Accrual Accounting

- Business entity, Single and double entry book-keeping, Debit and Credit

- Rules of Debit and Credit for Assets, Liabilities, Income and Expenses

- flow of transactions, books of accounts, General Ledger balance

- Cash book and bank book, Accounting Period, Trial Balance and its limitations

- Profit & Loss account from trial balance, Receipt & Payment, Income & Expenditure and Profit & Loss account

- Assets and Liabilities, Balance Sheet from trial balance

- Sample Transactions of a Company

- Sample Accounts of a Company

- THE ACCOUNTING EQUATION

- types of vouchers, Carrying forward the balance of an account

- ILLUSTRATIONS: Ccarrying Forward of Balances

- Opening Stock, Closing Stock

- COST OF GOODS SOLD STATEMENT

- DEPRECIATION

- GROUPINGS OF FIXED ASSETS

- CAPITAL WORK IN PROGRESS 1

- CAPITAL WORK IN PROGRESS 2

- REVALUATION OF FIXED ASSETS

- Banking transactions, Bank reconciliation statements

- RECAP

- Accounting Examples with Solutions

- RECORDING OF PROVISION FOR BAD DEBTS

- SUBSIDIARY BOOKS

- A PERSON IS BOTH DEBTOR AND CREDITOR

- RECTIFICATION OF ERROR

- STANDARD FORMAT OF PROFIT & LOSS ACCOUNT

- STANDARD FORMAT OF BALANCE SHEET

- DIFFERENT BUSINESS ENTITIES: Commercial, Non-commercial organizations

- SOLE PROPRIETORSHIP

- Financial Statements Of Manufacturing Concern

- Financial Statements of Partnership firms

- INTEREST ON CAPITAL AND DRAWINGS

- DISADVANTAGES OF A PARTNERSHIP FIRM

- SHARE CAPITAL

- STATEMENT OF CHANGES IN EQUITY

- Financial Statements of Limited Companies

- Financial Statements of Limited Companies

- CASH FLOW STATEMENT 1

- CASH FLOW STATEMENT 2

- FINANCIAL STATEMENTS OF LISTED, QUOTED COMPANIES

- FINANCIAL STATEMENTS OF LISTED COMPANIES

- FINANCIAL STATEMENTS OF LISTED COMPANIES