|

Financial

Accounting (Mgt-101)

VU

Lesson-6

Learning

Objective

�

This

lecture will cover following

areas:

o An

overview of the flow of

transactions.

o An

introduction to the basic books of

accounts.

o The

General Ledger, and

o The

ledger balance

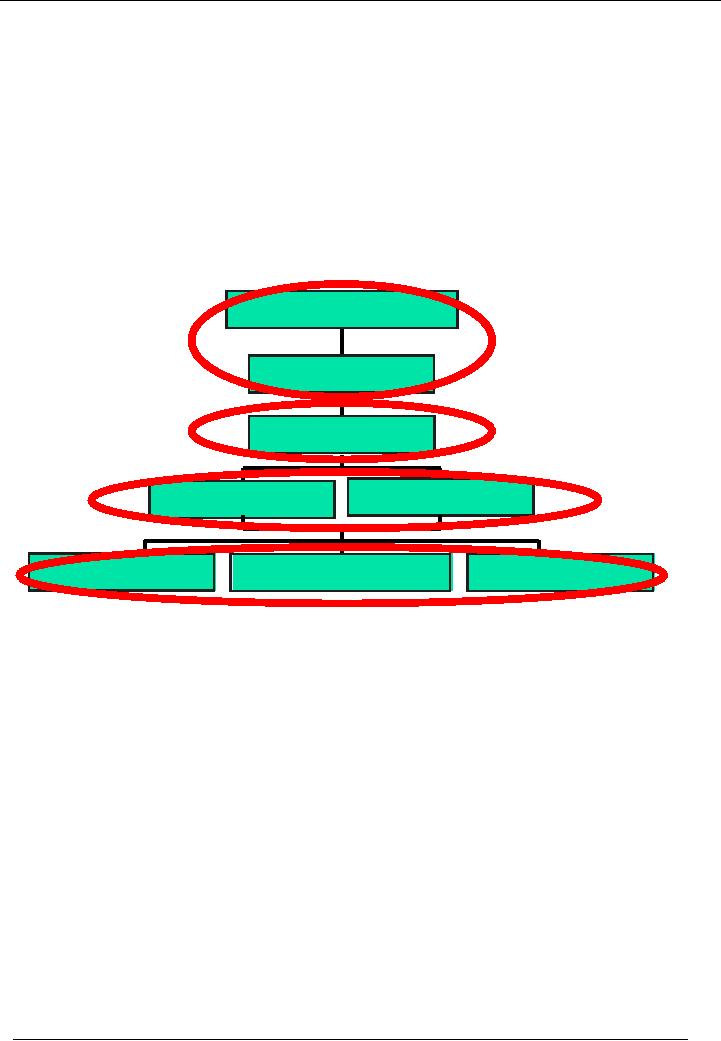

The

Flow of Transactions

Occurrence

of an Event

The

Voucher

General

Journal

Cash/Bank

Book

General

Ledger

Trial

Balance

Profit

& Loss Account

Balance

Sheet

Event

Event

is the happening of any thing but in

accounting we discuss monetary

events

Monetary

Events

If the

financial position of a business is

change due to the happening of event that

Event is called

Monetary

Event

The

Voucher

�

Voucher

is a document in a specific format that

records the details of a

transaction.

�

It is

accompanied by the evidence of

transaction.

18

Financial

Accounting (Mgt-101)

VU

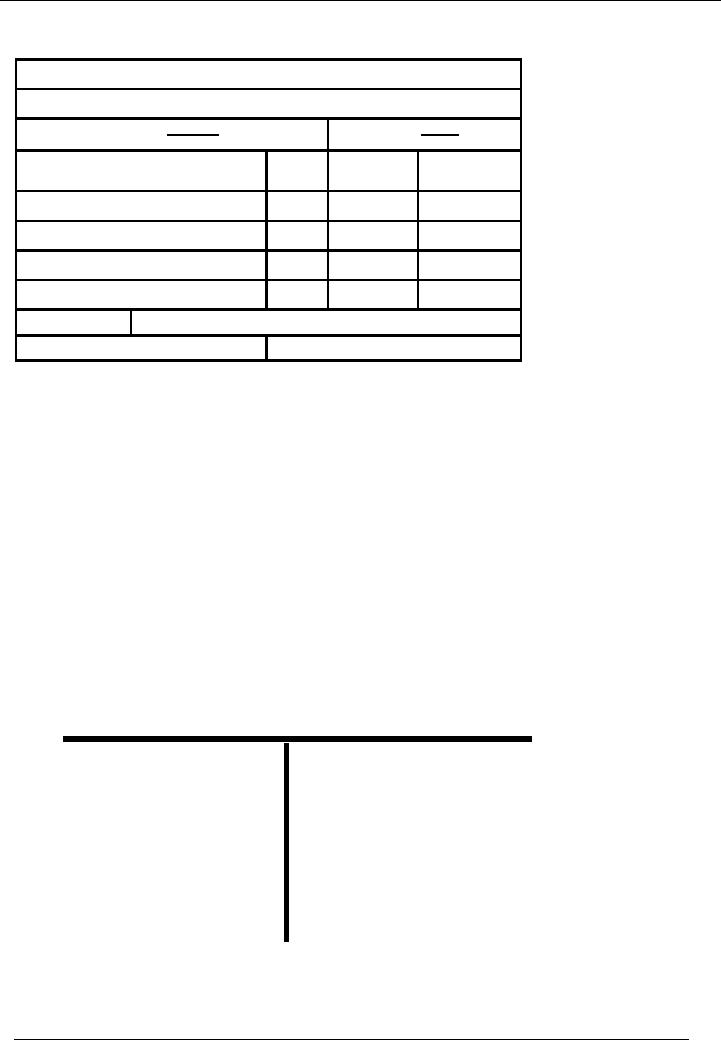

A

Sample Voucher

Name

Of Company

Type

Of Voucher

Date:

1-1-20--

No:

01

Description

Code

Debit

Credit

#

Amount

Amount

Cash

01

100,000

Capital

02

100,000

Total:

100,000

100,000

Narration:

Capital

Introduced in Cash by Owner

Prepared

By:

Checked

by:

The

General Journal

�

The

Journal used to be a chronological (day-to-day)

record of business transactions.

All vouchers

were

first recorded in books.

�

It was

also called the Book of

Original Entry or Day

Book.

�

But in

present day accounting and

especially with the introduction of

computers for accounting,

this

book

is not in use any

more.

�

We

will, therefore, not study the

use of Journal in detail but we should

know that it is a book

that

keeps

day-to-day record of transactions.

General

Ledger The `T'

Account

�

Ledger

is a book that keeps

separate record for each

account (Book of Accounts).

�

We

know that Account or Head of

Account is systematic record of

transactions of one

type.

�

An

account in its simplest form

is a T-shape and looks like

this:

Title of

Account

Left

hand side.

Right

hand side.

The

Debit side.

The

Credit side.

19

Financial

Accounting (Mgt-101)

VU

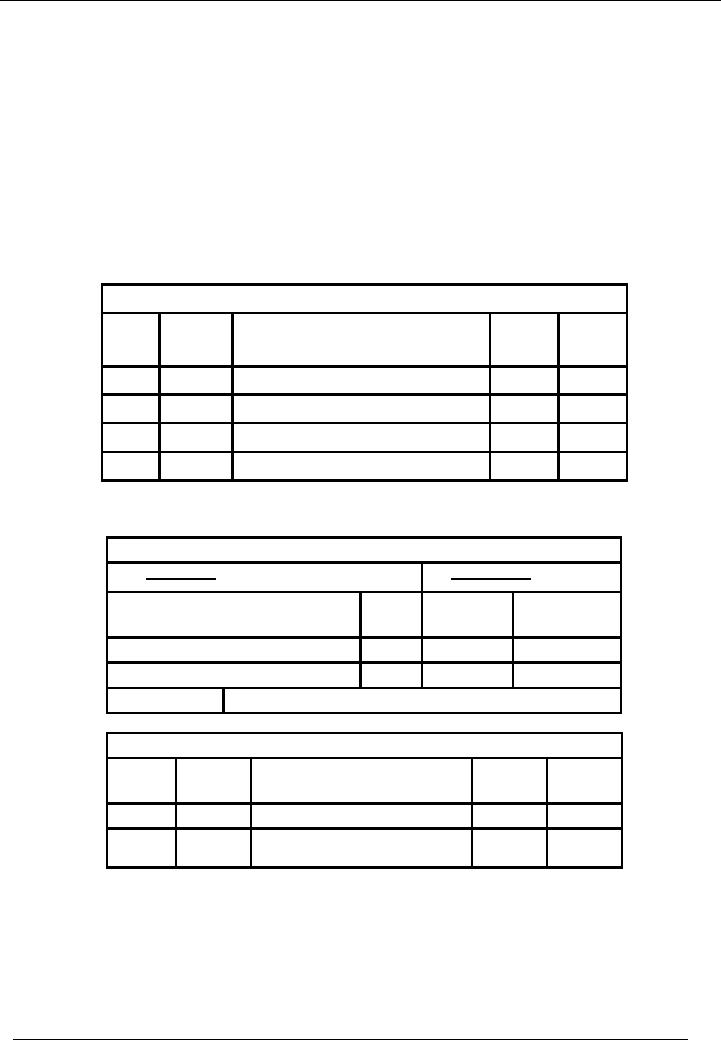

A

Standard General

Ledger

�

Since

the ledger keeps record of

transactions that affect one

head of account, therefore, it

should

provide

all the information that a

user may need.

�

Usually the

ledger is required to provide following

information:

o Title

of account

o Ledger

page number, called Ledger

Folio / Account Code

o Date of

transaction

o Voucher

number

o Narration

/ particulars of transition

o Amount

of transaction

A

Standard General

Ledger

Capital

Account (Title of

Account)

Account

Code 02

Date

Voucher

Particulars

/

Debit

Credit

Number

Narration

Amount

Amount

20--

Jan

01

01

Capital

Introduced in cash by

Owner

100,000

Recording

From Voucher To General

Ledger

Voucher

Date:

1-1-20--

No:

01

Description

Code

Debit

Credit

#

Amount

Amount

Cash

01

100,000

Capital

02

100,000

Narration:

Capital

Introduced in Cash by

Owner

Capital

Account (Title of

Account)

Account

code 02

Date

Voucher

Particulars

/

Debit

Credit

Number

Narration

Amount

Amount

20--

Jan

01

01

Capital

Introduced in cash by

100,000

Owner

20

Financial

Accounting (Mgt-101)

VU

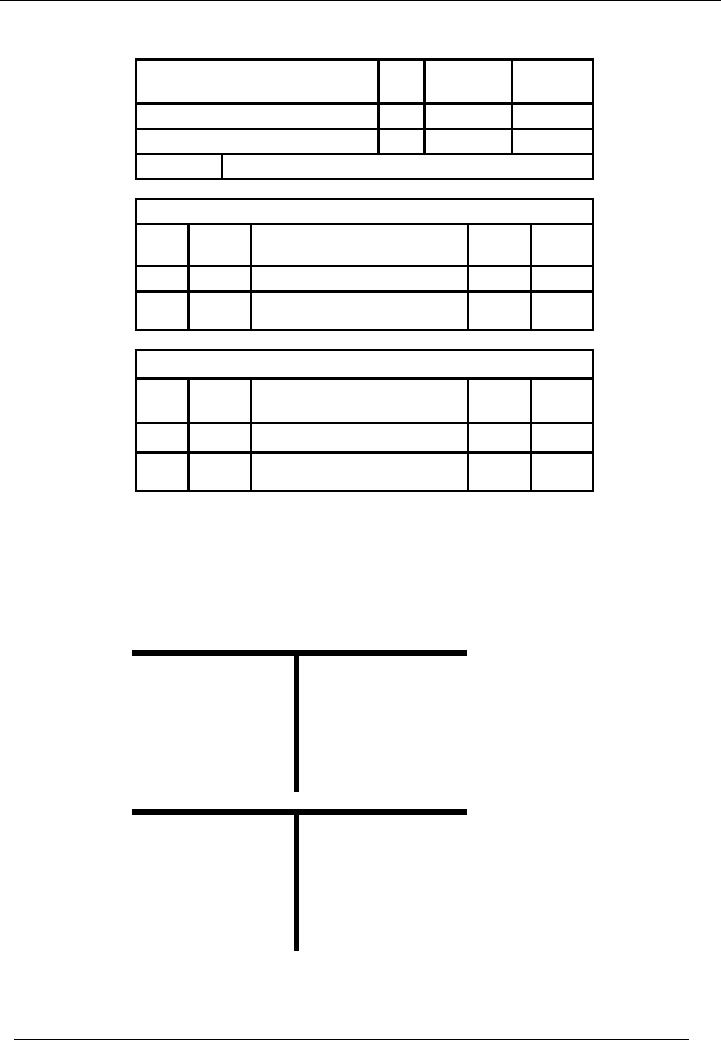

Completing

The Recording Both

Effects

Description

Code

Debit

Credit

#

Amount

Amount

Cash

01

100,000

Capital

02

100,000

Narration:

Capital

Introduced in Cash by

Owner

Capital

Account Account Code

02

Date

Voucher

Particulars / Narration

Debit

Credit

Number

Amount

Amount

20--

Jan 01

01

Capital

Introduced in cash by

100,000

Owner

Cash

Account

Account

Code 01

Date

Voucher

Particulars / Narration

Debit

Credit

Number

Amount

Amount

20--

Jan 01

01

Capital

Introduced in cash by

100,000

Owner

A Simple

Presentation of a Recorded Transaction is as

under:

Cash

Account

Code

01

Capital

Capital

Account

Code

02

Cash

100,000

21

Financial

Accounting (Mgt-101)

VU

The

Ledger Balance

�

In the

earlier lecture, we discussed

that in order to have the

total figure in respect of

each head of

expense/income,

asset/liability we need to maintain

different accounts.

�

We had

also said that each

account may have figures on

the debit as well as the credit

side.

�

Therefore, the

difference between the debit and the

credit sides, known as the BALANCE,

would

represent

the required total of the particular

account.

�

The

total of all balances on the

Debit side is ALWAYS equal

to the total of all balances on

the

Credit

side. This is called the

balancing of books of accounts. We will

study about this concept at a

later

stage.

�

The

balance may be written out

after every transaction in a third column

or calculated at the end of

a

specific time period (an

accounting period).

�

A

Debit balance is shown

without brackets and a

Credit balance is shown in

brackets (XYZ).

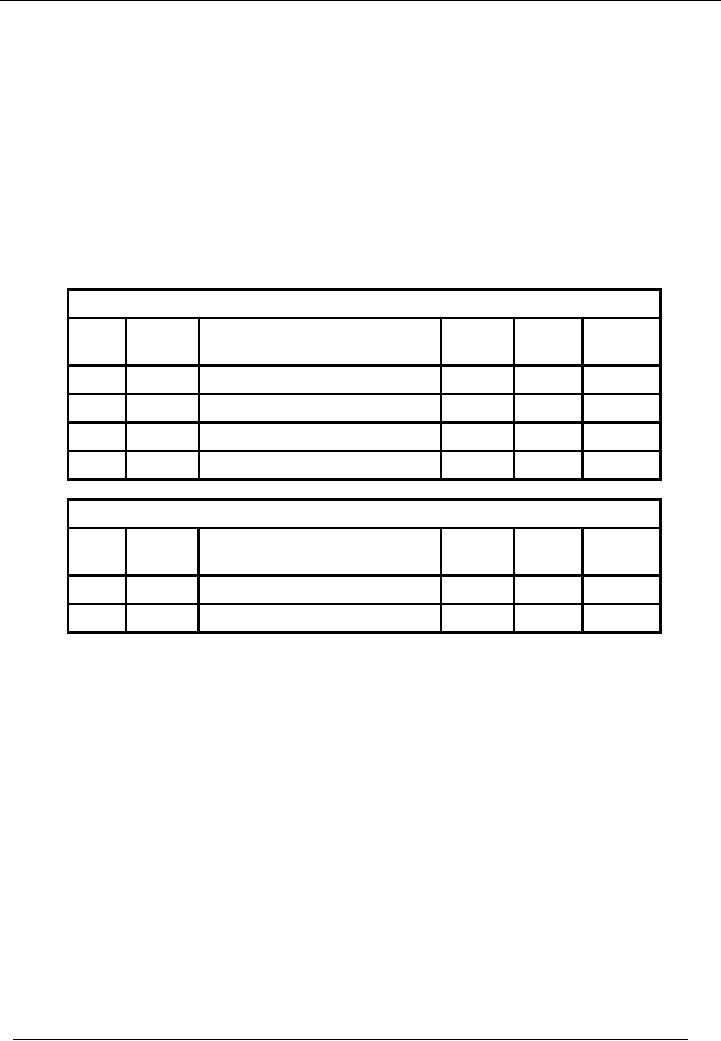

Cash

Account

Account

Code 01

Date

Voucher

Narration

/

Debit

Credit

Balance

Number

Particulars

Amount

Amount

Dr/(Cr)

20--

Jan

01

01

Capital

Introduced in cash by Owner

100,000

100,000

Jan

01

02

Cash

Paid for Purchase of

Building

50,000

50,000

Jan

02

03

Cash

Paid for Purchase of

Furniture

10,000

40,000

Capital

Account

Account

Code 02

Date

Voucher

Narration

/

Debit

Credit

Balance

Number

Particulars

Amount

Amount

Dr/(Cr)

20--

Jan

01

01

Capital

Introduced in cash by

Owner

100,000

(100,000)

22

Table of Contents:

- Introduction to Financial Accounting

- Basic Concepts of Business: capital, profit, budget

- Cash Accounting and Accrual Accounting

- Business entity, Single and double entry book-keeping, Debit and Credit

- Rules of Debit and Credit for Assets, Liabilities, Income and Expenses

- flow of transactions, books of accounts, General Ledger balance

- Cash book and bank book, Accounting Period, Trial Balance and its limitations

- Profit & Loss account from trial balance, Receipt & Payment, Income & Expenditure and Profit & Loss account

- Assets and Liabilities, Balance Sheet from trial balance

- Sample Transactions of a Company

- Sample Accounts of a Company

- THE ACCOUNTING EQUATION

- types of vouchers, Carrying forward the balance of an account

- ILLUSTRATIONS: Ccarrying Forward of Balances

- Opening Stock, Closing Stock

- COST OF GOODS SOLD STATEMENT

- DEPRECIATION

- GROUPINGS OF FIXED ASSETS

- CAPITAL WORK IN PROGRESS 1

- CAPITAL WORK IN PROGRESS 2

- REVALUATION OF FIXED ASSETS

- Banking transactions, Bank reconciliation statements

- RECAP

- Accounting Examples with Solutions

- RECORDING OF PROVISION FOR BAD DEBTS

- SUBSIDIARY BOOKS

- A PERSON IS BOTH DEBTOR AND CREDITOR

- RECTIFICATION OF ERROR

- STANDARD FORMAT OF PROFIT & LOSS ACCOUNT

- STANDARD FORMAT OF BALANCE SHEET

- DIFFERENT BUSINESS ENTITIES: Commercial, Non-commercial organizations

- SOLE PROPRIETORSHIP

- Financial Statements Of Manufacturing Concern

- Financial Statements of Partnership firms

- INTEREST ON CAPITAL AND DRAWINGS

- DISADVANTAGES OF A PARTNERSHIP FIRM

- SHARE CAPITAL

- STATEMENT OF CHANGES IN EQUITY

- Financial Statements of Limited Companies

- Financial Statements of Limited Companies

- CASH FLOW STATEMENT 1

- CASH FLOW STATEMENT 2

- FINANCIAL STATEMENTS OF LISTED, QUOTED COMPANIES

- FINANCIAL STATEMENTS OF LISTED COMPANIES

- FINANCIAL STATEMENTS OF LISTED COMPANIES