|

FINANCIAL STATEMENTS OF LISTED COMPANIES |

| << FINANCIAL STATEMENTS OF LISTED, QUOTED COMPANIES |

| FINANCIAL STATEMENTS OF LISTED COMPANIES >> |

Financial

Accounting (Mgt-101)

VU

Lesson-44

FINANCIAL

STATEMENTS OF LISTED

COMPANIES

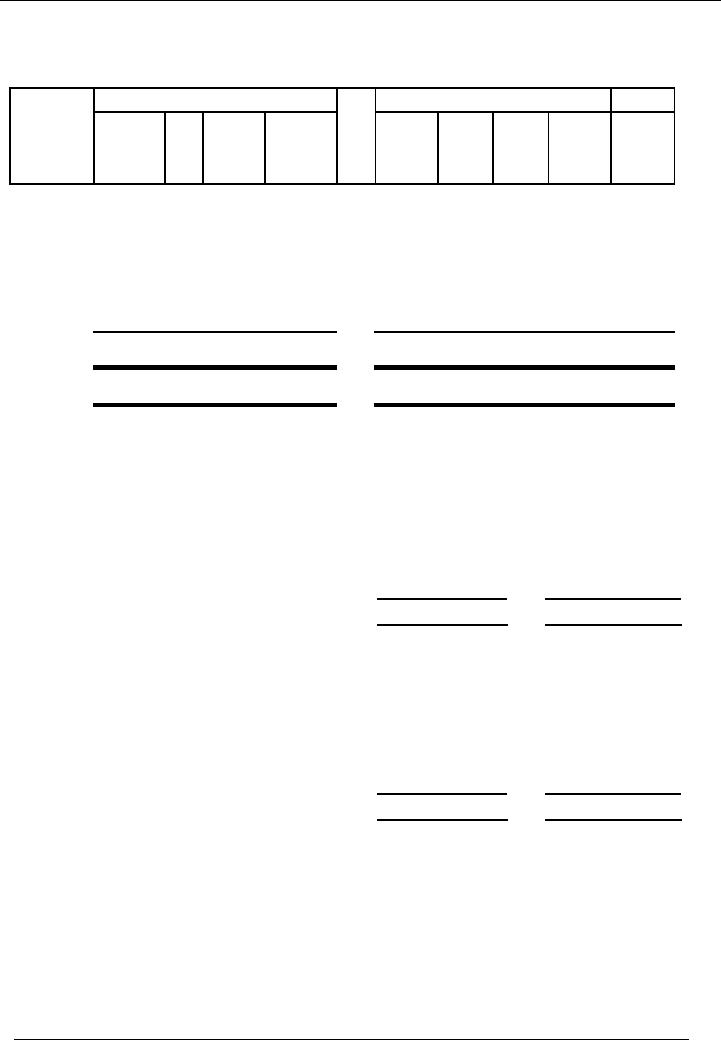

QUESTION

Beta

Ltd.

Trial

Balance for the Year

June 30, 2002

Debit

Credit

Rs.

Rs.

Fixed

Assets at Cost:

Building

500,000

Furniture

and Fixture

85,000

Vehicles

460,000

Accumulated

Depreciation

Building

190,500

Furniture

and Fixture

43,500

Vehicles

210,000

Sundry

Debtors

165,000

Long

Term investments

300,000

Goodwill

100,000

Cash

in hand

33,000

Cash

at bank

146,000

Purchases

755,000

Stock

July 01, 2001

Raw

Material

19,000

Work

in Process

14,500

Finished

Goods

35,000

Salaries

125,000

Misc.

Expense

6,600

Carriage

inward

4,300

Fuel &

Power

15,400

Wages

143,500

Salaries

Sales Staff

86,000

Financial

Charges

2,300

Sundry

Creditors

105,000

Share

Premium Reserve

300,000

Provision

for tax payable.

29,500

Accumulated

Profit Brought

Forward

93,300

Sales

1,363,800

Gain

on sale of vehicle

30,000

Return on

Investments

30,000

Loan

from Bank (Long Term)

100,000

Issued

Share Capital

500,000

283

Financial

Accounting (Mgt-101)

VU

TOTAL

2,995,600

2,995,600

Additional

Information:

�

The

authorized capital of the company is Rs.

800,000 divided into 80,000

shares of Rs. 10

each.

�

During

the year, a vehicle whose

cost and accumulated depreciation

were Rs. 150,000 and

Rs.

80,000

respectively was sold for

Rs. 100,000. The entry

has already been recorded in

the books

�

Depreciation

is to be charged on Building 5%,

Furniture and Fixture @ 10%

and Vehicles 20% on

written

down value. Full years

depreciation is charged in the year of

purchase whilst no depreciation

is

charged in the year of

disposal..

�

Stock

on June 30, 2002

o Raw

Material

22,000

o Work

in Process

15,000

o Finished

Goods

40,000

�

Distribution

of fuel and power:

o Administrative

Expenses 40%, Cost of Goods

Sold 60%

�

The

management of the company has

decided to maintain a provision for

doubtful debts at 5% of

debtors

from this year.

�

Long

term loan of Rs. 25,000 is

payable in the next financial

year.

�

Provision

for current year's tax Rs.

20,000.

You

are required to prepare a set of

financial statements for the year

ended June 30,

2002.

284

Financial

Accounting (Mgt-101)

VU

SOLUTION

Beta

Ltd.

Balance

Sheet as at June 30,

2002.

Note

2002

2001

Operating

Fixed Assets

3

531,375

671,000

Investments

300,000

50,000

831,375

721,000

Intangible

Assets

Goodwill

100,000

100,000

Current

Assets

Sundry

Debtors

4

156,750

175,000

Stock

in Trade

5

77,000

84,300

Cash

in hand

33,000

25,800

Cash

at bank

146,000

100,700

412,750

385,800

Current

Liabilities

Sundry

Creditors

105,000

150,500

Current

Maturity of Long Term

Loan

25,000

25,000

Tax

Payable

6

49,500

38,000

179,500

213,500

Working

Capital

233,250

172,300

Net

Capital Employed

1,164,625

993,300

Financed

by

Share

Capital and Reserves

Authorized

Capital

80,000

share of Rs. 10 each

800,000

800,000

Share

Capital

500,000

500,000

Share

premium reserve

300,000

300,000

Un-appropriated

Profit

289,625

93,300

Total

Share holders

Equity

1,089,625

893,300

75,000

100,000

Long

Term Loans

7

TOTAL

1,164,625

993,300

285

Financial

Accounting (Mgt-101)

VU

Beta

Ltd.

Profit and

Loss Account for the

year ended June 30,

2002.

Note

2002

2001

Rs.

Rs.

Net

Sales

1,363,800

x

Less:

Cost of Goods Sold

8

903,540

x

Gross

Profit

460,260

x

Add:

Other Income

9

60,000

x

520,260

x

Less:

Administrative

Expenses

10

215,635

x

Selling

Expenses

11

86,000

x

301,635

x

Operating

Profit

218,625

x

Less:

Financial Charges

2,300

x

Net

Profit / (Loss) Before

Tax

216,325

x

Lees:

Provision for Tax

20,000

x

Net

Profit / (Loss) After

Tax

196,325

x

Accumulated

Profit / (Loss) Brought

Forward

93,300

x

Accumulated

Profit / (Loss) Carried

Forward

289,625

x

286

Financial

Accounting (Mgt-101)

VU

Alfa

Ltd.

Cash

Flow Statement for the

year ended June 30,

2002

Note

2002

Cash

Flow From Operating

Activities

Profit

/ (Loss) Before Tax

216,325

Adjustment

for:

Depreciation

69,625

Provision

for Doubtful Debts

8,250

Gain

on Disposal of Fixed

Asset

(30,000)

Operating

Profit Before Working Capital

changes

264,200

(Increase)

/ Decrease in C. Assets

Sundry

Debtors

10,000

Stock

in Trade

7,300

17,300

Increase

/ (Decrease) in C. Liabilities

Sundry

Creditors

(45,500)

(45,500)

Cash

Generated From Operations

236,000

Income

Tax Paid

(8,500)

Net

Cash Flow from

Operations

227,500

Cash

Flow From Investing

Activities

Vehicles

100,000

Investments

(Long Term)

(250,000)

Net

Cash Flow From Investing

Activities

(150,000)

Cash

Flow from financing

Activities

Long

Term Loan Repaid

(25,000)

(25,000)

Net

Increase in Cash & Cash

Equivalents

52,500

O/B of

Cash and Cash

Equivalents

126,500

C/B of

Cash and Cash

Equivalents

179,000

287

Financial

Accounting (Mgt-101)

VU

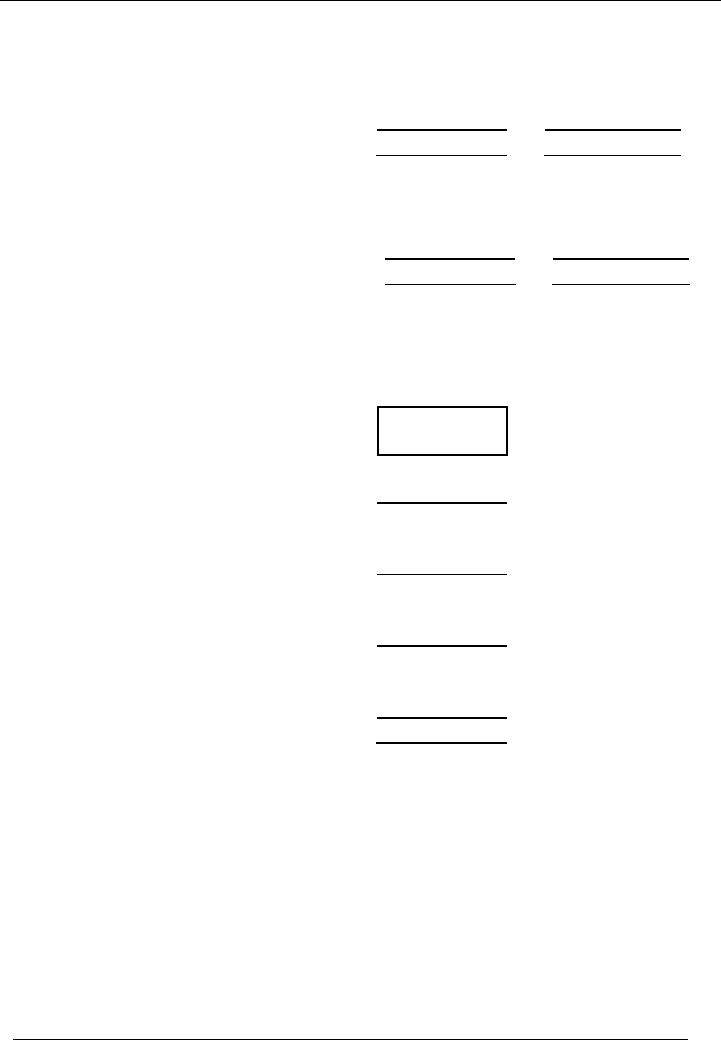

Beta

Ltd.

Statement

of Changes in Equity for the

Year Ended June 30,

2002

Share

Share

Premium

Un-app.

Total

Capital

Reserve

Profit

Balance

as on June 30, 2000

x

x

x

x

Profit

after tax for the year

x

x

Dividend

(x)

(x)

Balance

as on June 30, 2001

500,000

300,000

93,300

893,300

Shares

Issued

x

x

Profit

after tax for the year

196,325

196,325

750,000

250,000

289,625

1,089,625

NOTES

TO THE ACCOUNTS

1.

Company and its

operations

o The

company is a public limited

company incorporated in Pakistan and

manufacture ---

---------

2. Significant

accounting policies

o These

accounts have been prepared

in accordance with the requirements of

the

Companies

Ordinance 1984 and International

accounting standards as applicable

in

Pakistan.

o Historical

costs

� Historical

costs are used as a basis

for valuing transactions.

o Revenue

Recognition

� Sales

are recorded upon delivery of

goods to the customers.

o Other

Policies

� Income

from bank deposits, loans

and advances are recognized

on accrual basis.

� Working

of all figures and Fixed

assets schedule are included in the

notes to the

accounts

288

Financial

Accounting (Mgt-101)

VU

Note

# 3

Fixed

Assets at WDV

Rs'

000

Cost

R

Accumulated

Depreciation

WDV

Particulars

As

On

As

On

A

As

On

On

For

As

On

As

On

Jul

01

Add.

Disp.

Jun

30

T

Jul

01

Disp.

The

Jun

30

Jun

30

2001

2002

E

2001

Year

2002

2002

Building

500,000

-

-

500,000

5

190,500

-

15,475

205,975

294,025

Furniture

and

Fixture

85,000

-

-

85,000

10

43,500

-

4,150

47,650

37,350

Vehicles

610,000

-

150,000

460,000

20

290,000

80,000

50,000

260,000

200,000

1,195,000

-

150,000

1,045,000

524,000

80,000

69,625

513,625

531,375

Total

2002

Total

2001

x

x

x

x

x

x

1,195,000

524,000

671,000

Note

# 4

Sundry

Debtors

2002

2001

Debtors

165,000

175,000

Less:

Provision for Doubtful

Debts

(8,250)

-

156,750

175,000

Note

# 5

Stock

in Trade

Raw

Material

22,000

25,000

Work

in Process

15,000

16,800

Finished

Goods

40,000

42,500

77,000

84,300

289

Financial

Accounting (Mgt-101)

VU

Note

# 6

Tax

Payable

Tax

Payable as Per Trial

Balance

29,500

20,000

Current

Year's Provision

20,000

18,000

49,500

38,000

Note

# 7

Long

Term Loans

Long

Term Loan

100,000

125,000

Less:

Current Maturity of Long Term

Loan

25,000

25,000

75,000

100,000

Note

# 8

Cost

of goods sold

Opening

Stock - Raw Material

19,000

Add:

Cost of Material

Purchased

Purchases

755,000

Add:

Carriage Inward

4,300

759,300

Less:

Closing Stock - Raw

Material

22,000

Raw

Material Consumed

756,300

Wages

143,500

Fuel

and Power

9,240

909,040

Add:

Opening Stock - Work in

Process

14,500

Less:

Closing Stock - Work in

Process

15,000

908,540

Add:

Opening Stock - Finished

Goods

35,000

Less:

Closing Stock - Finished

Goods

40,000

903,540

290

Financial

Accounting (Mgt-101)

VU

Note

# 9

Other

Income

Gain

on sale of vehicle

30,000

Return on

investments

30,000

60,000

Note

# 10

Administrative

Expenses

Salaries

125,000

6,160

Fuel

and Power

Misc.

Expense

6,600

Provision

for Doubtful Debts

8,250

Depreciation

69,625

215,635

Note

# 11

Selling

Expenses

Salaries

(Sales Staff)

86,000

291

Table of Contents:

- Introduction to Financial Accounting

- Basic Concepts of Business: capital, profit, budget

- Cash Accounting and Accrual Accounting

- Business entity, Single and double entry book-keeping, Debit and Credit

- Rules of Debit and Credit for Assets, Liabilities, Income and Expenses

- flow of transactions, books of accounts, General Ledger balance

- Cash book and bank book, Accounting Period, Trial Balance and its limitations

- Profit & Loss account from trial balance, Receipt & Payment, Income & Expenditure and Profit & Loss account

- Assets and Liabilities, Balance Sheet from trial balance

- Sample Transactions of a Company

- Sample Accounts of a Company

- THE ACCOUNTING EQUATION

- types of vouchers, Carrying forward the balance of an account

- ILLUSTRATIONS: Ccarrying Forward of Balances

- Opening Stock, Closing Stock

- COST OF GOODS SOLD STATEMENT

- DEPRECIATION

- GROUPINGS OF FIXED ASSETS

- CAPITAL WORK IN PROGRESS 1

- CAPITAL WORK IN PROGRESS 2

- REVALUATION OF FIXED ASSETS

- Banking transactions, Bank reconciliation statements

- RECAP

- Accounting Examples with Solutions

- RECORDING OF PROVISION FOR BAD DEBTS

- SUBSIDIARY BOOKS

- A PERSON IS BOTH DEBTOR AND CREDITOR

- RECTIFICATION OF ERROR

- STANDARD FORMAT OF PROFIT & LOSS ACCOUNT

- STANDARD FORMAT OF BALANCE SHEET

- DIFFERENT BUSINESS ENTITIES: Commercial, Non-commercial organizations

- SOLE PROPRIETORSHIP

- Financial Statements Of Manufacturing Concern

- Financial Statements of Partnership firms

- INTEREST ON CAPITAL AND DRAWINGS

- DISADVANTAGES OF A PARTNERSHIP FIRM

- SHARE CAPITAL

- STATEMENT OF CHANGES IN EQUITY

- Financial Statements of Limited Companies

- Financial Statements of Limited Companies

- CASH FLOW STATEMENT 1

- CASH FLOW STATEMENT 2

- FINANCIAL STATEMENTS OF LISTED, QUOTED COMPANIES

- FINANCIAL STATEMENTS OF LISTED COMPANIES

- FINANCIAL STATEMENTS OF LISTED COMPANIES