|

Financial Statements of Limited Companies |

| << STATEMENT OF CHANGES IN EQUITY |

| Financial Statements of Limited Companies >> |

Financial

Accounting (Mgt-101)

VU

Lesson-39

Financial

Statements of Limited

Companies

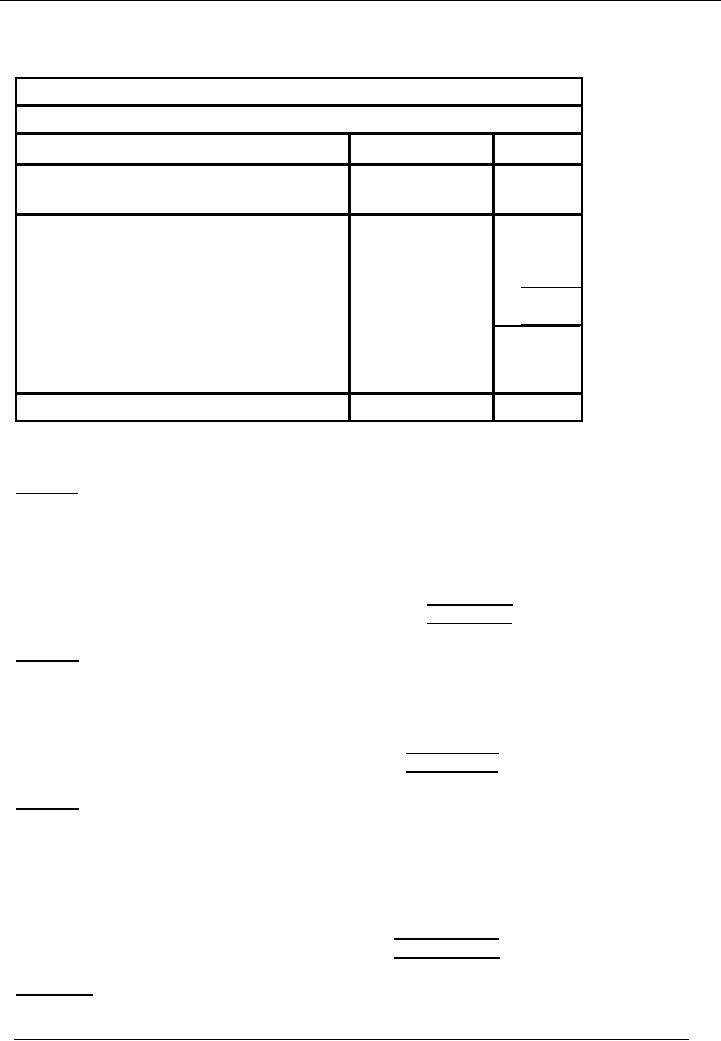

QUESTION

# 1

KKB (Private)

Limited is a manufacturing company.

Following list of balances

has been extracted from

its

books as on

June 30, 2002.

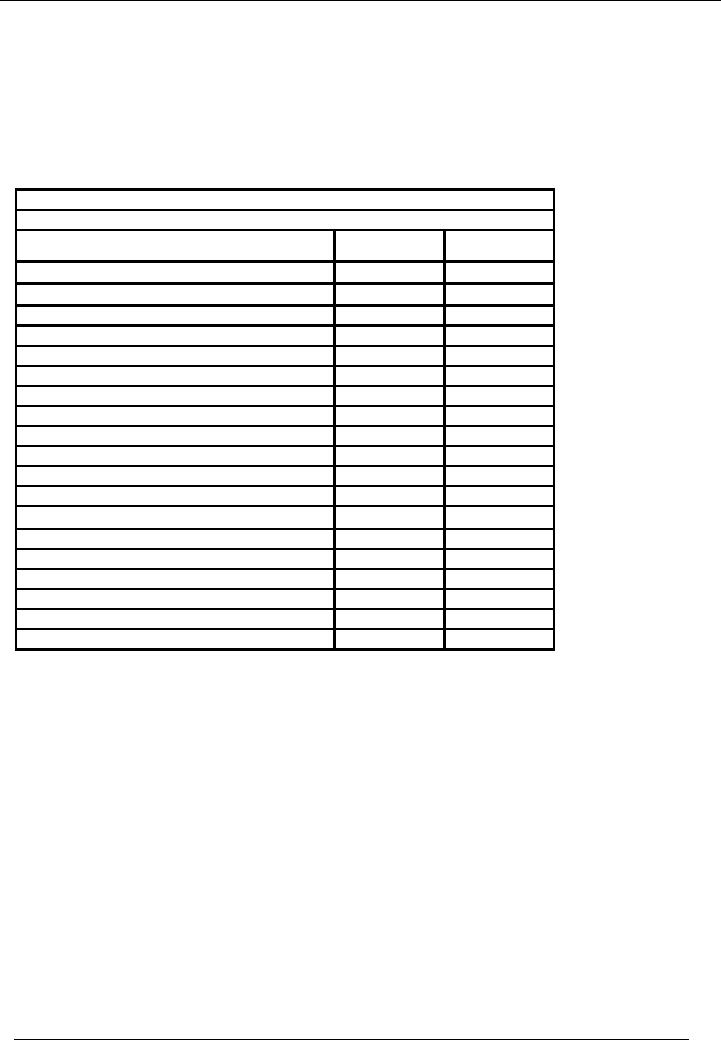

KKB

(Private) Limited

Trial

Balance As At June 30,

2002

Debit

Rs.

Credit

Rs.

Authorized

Share Capital

500,000

Paid

up Capital

300,000

Debentures

240,000

Accumulated

Profit and Loss

Account

49,489

General

Reserve

8,000

Creditors

27,360

Accumulated

Depreciation

Motor

Vehicles

46,050

Building

66,000

Furniture

and Fixtures

11,250

Proposed

Dividend

15,000

Land

120,000

Building

315,000

Motor

Vehicles

187,500

Furniture

and Fixture

34,500

Stock

in Trade

48,630

Debtors

42,525

Bank

Balance

14,994

TOTAL

763,149

763,149

Note:

All

items of profit and loss

have been accounted for in

calculating the balance of accumulated

profit and loss

account,

except for Depreciation

which is to be charged at 10% on WDV on

all depreciable

assets.

Required

Prepare

the balance sheet of Beta (Private)

Limited As on June 30,

2002.

251

Financial

Accounting (Mgt-101)

VU

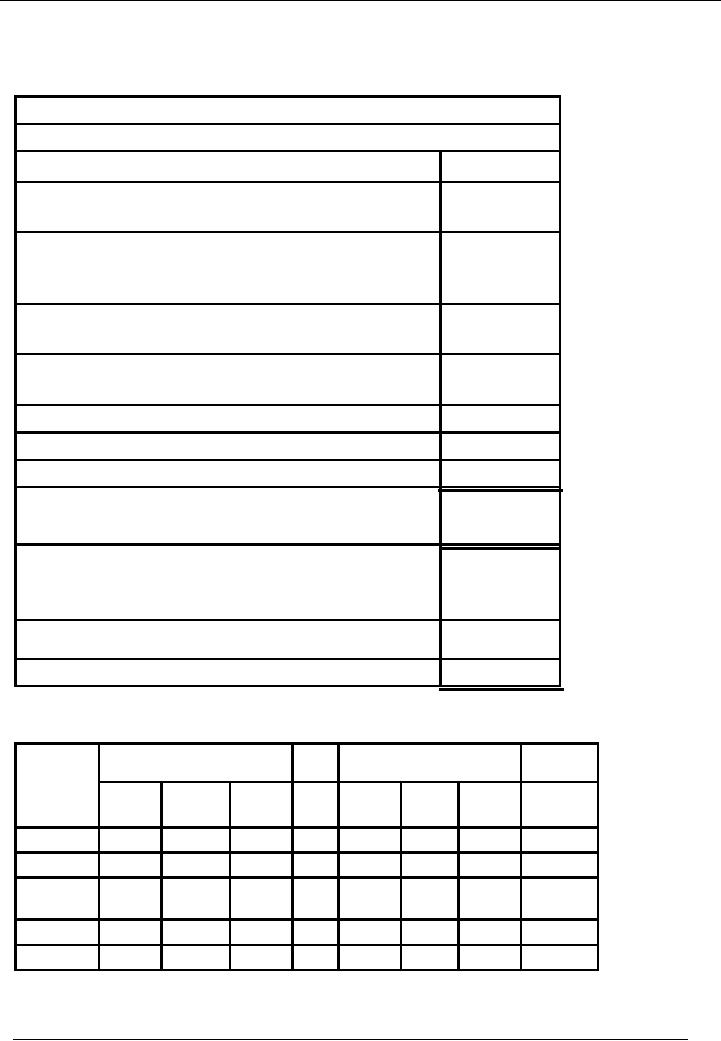

SOLUTION

Balance

Sheet

KKB

(Private) Limited

Balance

Sheet As At June 30,

2002

Particulars

Note

Amount

Rs.

Fixed

Assets at WDV

1

492,330

Current

Assets

Debtors

42,525

Stock

in Trade

48,630

Bank

Balance

14,994

106,149

Current

Liabilities

Creditors

27,360

Proposed

Dividend

15,000

42,360

Working

Capital

63,789

Net

Assets Employed

556,119

Financed

By:

Authorized

Capital

50,000

Shares of Rs. 10 each

500,000

Paid

Up Capital

30,000

Shares of Rs. 10 each

300,000

General

Reserve

8,000

Accumulated

Profit and Loss

Account

2

8,119

Share

Holders Equity

316,119

Debentures

240,000

Total

556,119

Note

1 Fixed Assets at WDV

Accumulated

Cost

Rate

WDV

Depreciation

Particulars

As At

Addition/ As At

As At

For The As At

As

At

1-7-01

Deletion 30-6-02

1-7-01

Year 30-6-02

30-6-02

Land

120,000

0

120,000

0

0

0

0

120,000

Building

315,000

0

315,000

10

66,000

24,900

90,900

224,100

Furniture

&

Fixtures

34,500

0

34,500

10

11,250

2,325

13,575

20,925

Vehicles

187,500

0

187,500

10

46,050

14,145 60,195

127,305

TOTAL

657,000

0

657,000

123,300

41,370 164,670

492,330

252

Financial

Accounting (Mgt-101)

VU

Note

2 Accumulated Profit and Loss

Account

Balance

As Per Trial Balance

49,489

Less:

Depreciation for the Year (note 1)

(41,370)

8,119

As depreciation is

charged in profit & loss

account and we did not

prepare profit & loss

account, in this case,

so depreciation

will be deducted from

accumulated profit & loss

account.

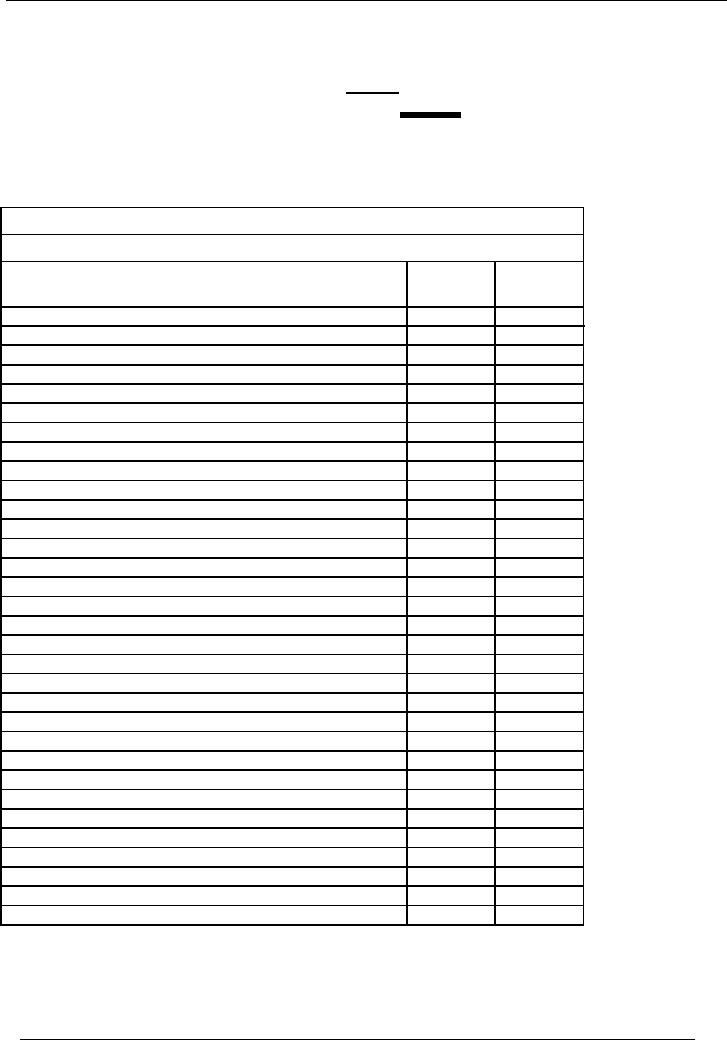

QUESTION

# 2

ABC

Limted

Trial

balance as on June 30,

2002

Particulars

Amount

Amount

Dr.

(Rs.)

Cr.

(Rs.)

Authorized

Share Capital (Face value

Rs. 10 each)

1,500,000

Paid

up Capital

1,200,000

Share

Premium

75,000

General

Reserve

150,000

Accumulated

profit brought

forward

215,000

Opening

Stock

902,000

Sales

4,575,000

Purchases

2,196,000

Motor

Expenses

164,000

Bad

debts

31,000

Carriage

inward

38,000

Debenture

Mark Up

40,000

Mark

up on bank overdraft

19,000

Wages

832,000

Directors'

Remuneration

210,000

General

Expenses

154,000

Long

Term Investments

340,000

Income

from shares in related

companies

36,000

Discount

allowed & received

55,000

39,000

Profit

on property sale

100,000

Building

at cost

1,200,000

Plant

And Machinery at cost

330,000

Motor

Vehicles at cost

480,000

Provision

for Depreciation: Building

375,000

Plant &

Machinery

195,000

Motor

Vehicles

160,000

Goodwill

40,000

Patents

& Trade Marks

38,000

Trade

Debtors & Creditors

864,000

392,000

Bank

Overdraft

21,000

Debenture

10%

400,000

Total

7,933,000

7,933,000

Notes:

� Closing

stock is valued at Rs.

103,000.

� Depreciate

building @ 10%, Plant & Machinery @

20% and Vehicles @

25%.

� Provision

for tax to be created Rs.

236,000.

253

Financial

Accounting (Mgt-101)

VU

You

are required to prepare Financial

Statements of ABC Limited as on

June 30, 2002.

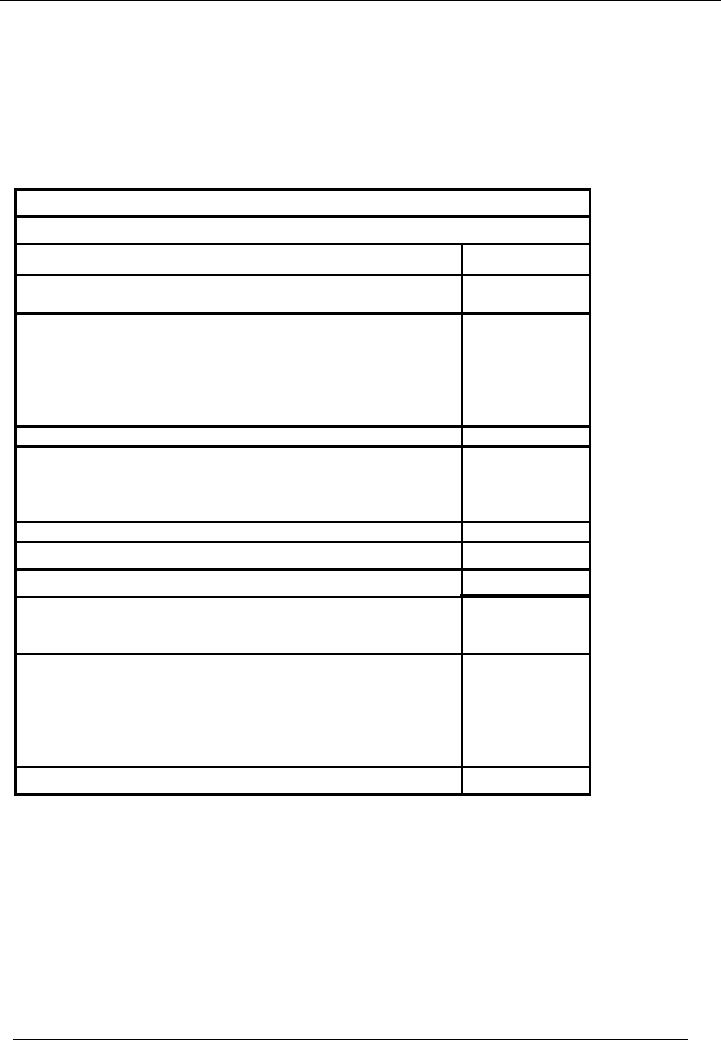

SOLUTION

Balance

Sheet

ABC

Limted

Balance

Sheet As At June 30,

2002

Particulars

Note

Fixed

Assets at WDV

3-a

1,090,500

Long

Term Investments

340,000

1,430,500

Current

Assets

Debtors

864,000

Stock

in Trade

103,000

Goodwill

40,000

Patents

& Trade Marks

38,000

1,045,000

Current

Liabilities

Creditors

392,000

Provision

For Tax

236,000

Bank

Overdraft

21,000

649,000

Working

Capital

396,000

Net

Assets Employed

1,826,500

Financed

By:

Authorized

Capital

50,000

Shares of Rs. 10 each

1,500,000

Paid

Up Capital

30,000

Shares of Rs. 10 each

1,200,000

Share

Premium

75,000

General

Reserve

150,000

Accumulated

Profit and Loss

Account

1,500

Debentures

400,000

Total

1,826,500

254

Financial

Accounting (Mgt-101)

VU

PROFIT

AND LOSS ACCOUNT

ABC

Limted

Profit and

Loss Account for the

Year Ending June 30,

20-2

Particulars

Note

Amount

Rs.

Amount

Rs

Sales

4,575,000

Less:

Cost of Goods Sold

1

(3,865,000)

Gross

Profit

710,000

Add:

other income

2

175,000

Less:

Administrative Expenses

3

803,500

Less:

Financial Expenses

4

59,000

(862,500)

Profit

before tax

22,500

Less:

Provision for Tax

(236,000)

Profit

after tax

(213,500)

Add:

Accumulated Profit b/f

215,000

Net

Profit Carried Forward

1,500

NOTES

Note

# 1

Cost

of goods sold

Opening

Stock

902,000

Add:

Purchases

2,196,000

Wages

832,000

Add:

Carriage in

38,000

Less:

Closing Stock

(103,000)

Total

3,865,000

Note

# 2

Other

Incomes

Income

from shares in related

companies

36,000

Discount

received

39,000

Profit

on property sale

100,000

Total

175,000

Note

# 3

Administrative

Expenses

Motor

Expenses

164,000

Bad

Debts

31,000

Directors'

Remuneration

210,000

General

Expenses

154,000

Depreciation

(Note

# 3-a)

189,500

Discount

allowed

55,000

Total

803,500

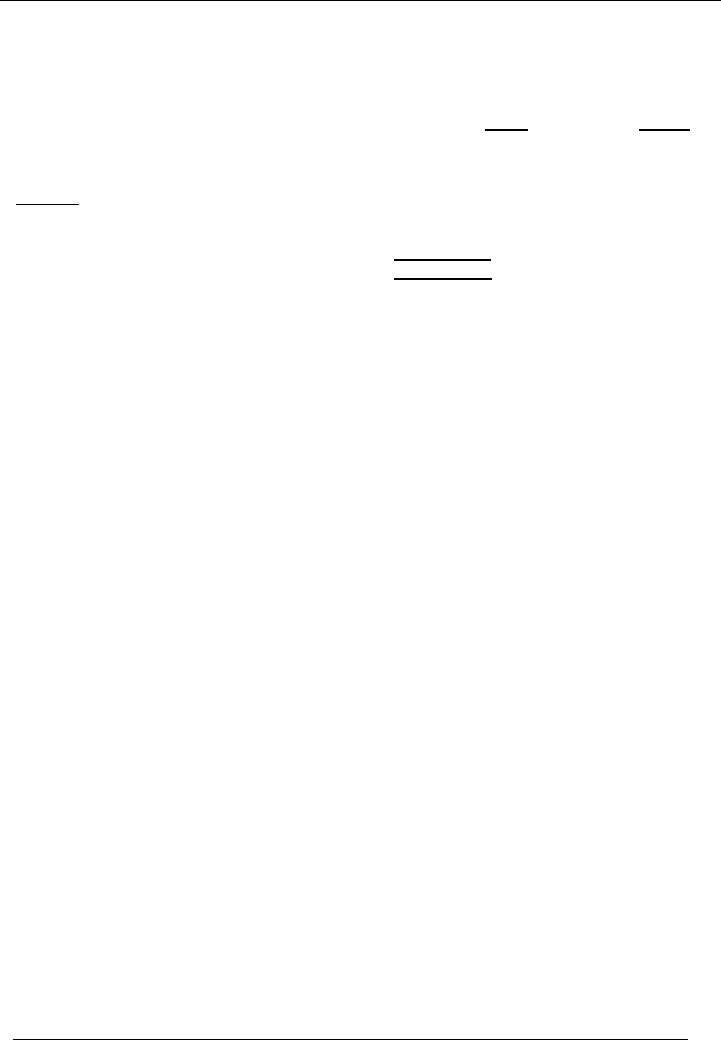

Fixed

Assets at WDV

Note

# 3-a

255

Financial

Accounting (Mgt-101)

VU

.

Acc.

Dep

WDV

Cost

Rate

Opening

For

the Yr.

Closing

Building

1,200,000

10%

375,000

82,500

457,500

742,500

Plant &

Machinery

330,000

20%

195,000

27,000

222

000

108,000

240,000

240,000

Motor

Vehicles

480,000

25%

160,000

80,000

189,500

1,090,500

Financial

Expenses

Note

# 4

Debenture

Mark up

40,000

Mark

up on Bank Overdraft

19,000

Total

59,000

256

Table of Contents:

- Introduction to Financial Accounting

- Basic Concepts of Business: capital, profit, budget

- Cash Accounting and Accrual Accounting

- Business entity, Single and double entry book-keeping, Debit and Credit

- Rules of Debit and Credit for Assets, Liabilities, Income and Expenses

- flow of transactions, books of accounts, General Ledger balance

- Cash book and bank book, Accounting Period, Trial Balance and its limitations

- Profit & Loss account from trial balance, Receipt & Payment, Income & Expenditure and Profit & Loss account

- Assets and Liabilities, Balance Sheet from trial balance

- Sample Transactions of a Company

- Sample Accounts of a Company

- THE ACCOUNTING EQUATION

- types of vouchers, Carrying forward the balance of an account

- ILLUSTRATIONS: Ccarrying Forward of Balances

- Opening Stock, Closing Stock

- COST OF GOODS SOLD STATEMENT

- DEPRECIATION

- GROUPINGS OF FIXED ASSETS

- CAPITAL WORK IN PROGRESS 1

- CAPITAL WORK IN PROGRESS 2

- REVALUATION OF FIXED ASSETS

- Banking transactions, Bank reconciliation statements

- RECAP

- Accounting Examples with Solutions

- RECORDING OF PROVISION FOR BAD DEBTS

- SUBSIDIARY BOOKS

- A PERSON IS BOTH DEBTOR AND CREDITOR

- RECTIFICATION OF ERROR

- STANDARD FORMAT OF PROFIT & LOSS ACCOUNT

- STANDARD FORMAT OF BALANCE SHEET

- DIFFERENT BUSINESS ENTITIES: Commercial, Non-commercial organizations

- SOLE PROPRIETORSHIP

- Financial Statements Of Manufacturing Concern

- Financial Statements of Partnership firms

- INTEREST ON CAPITAL AND DRAWINGS

- DISADVANTAGES OF A PARTNERSHIP FIRM

- SHARE CAPITAL

- STATEMENT OF CHANGES IN EQUITY

- Financial Statements of Limited Companies

- Financial Statements of Limited Companies

- CASH FLOW STATEMENT 1

- CASH FLOW STATEMENT 2

- FINANCIAL STATEMENTS OF LISTED, QUOTED COMPANIES

- FINANCIAL STATEMENTS OF LISTED COMPANIES

- FINANCIAL STATEMENTS OF LISTED COMPANIES