|

Financial Statements of Partnership firms |

| << Financial Statements Of Manufacturing Concern |

| INTEREST ON CAPITAL AND DRAWINGS >> |

Financial

Accounting (Mgt-101)

VU

Lesson-34

Financial

Statements of Partnership

firms

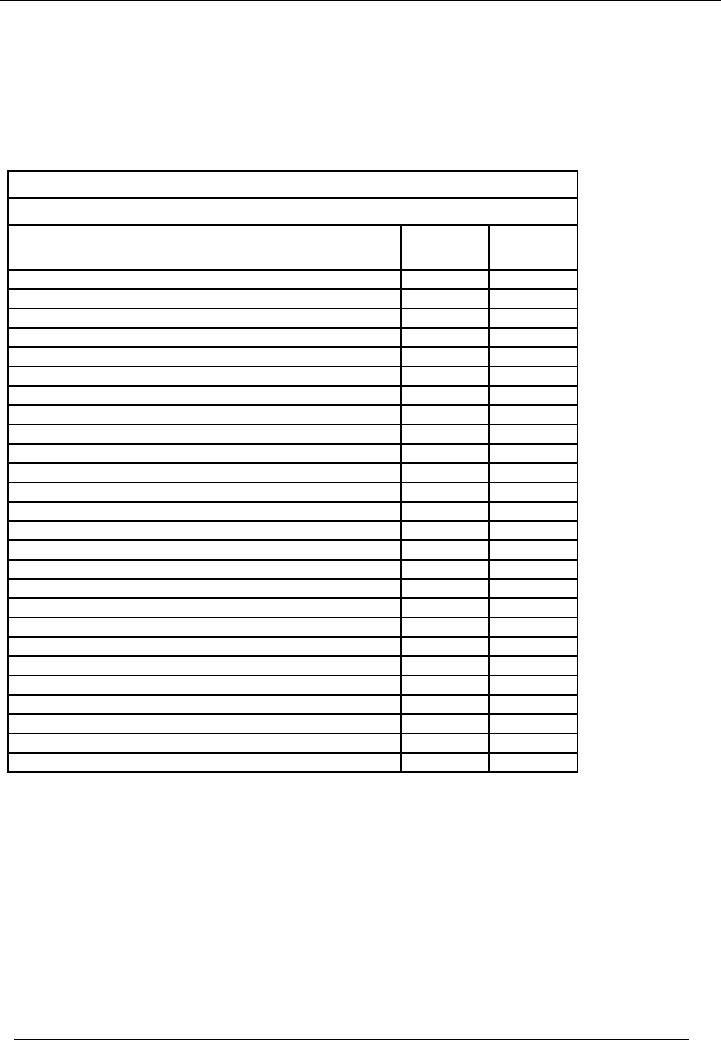

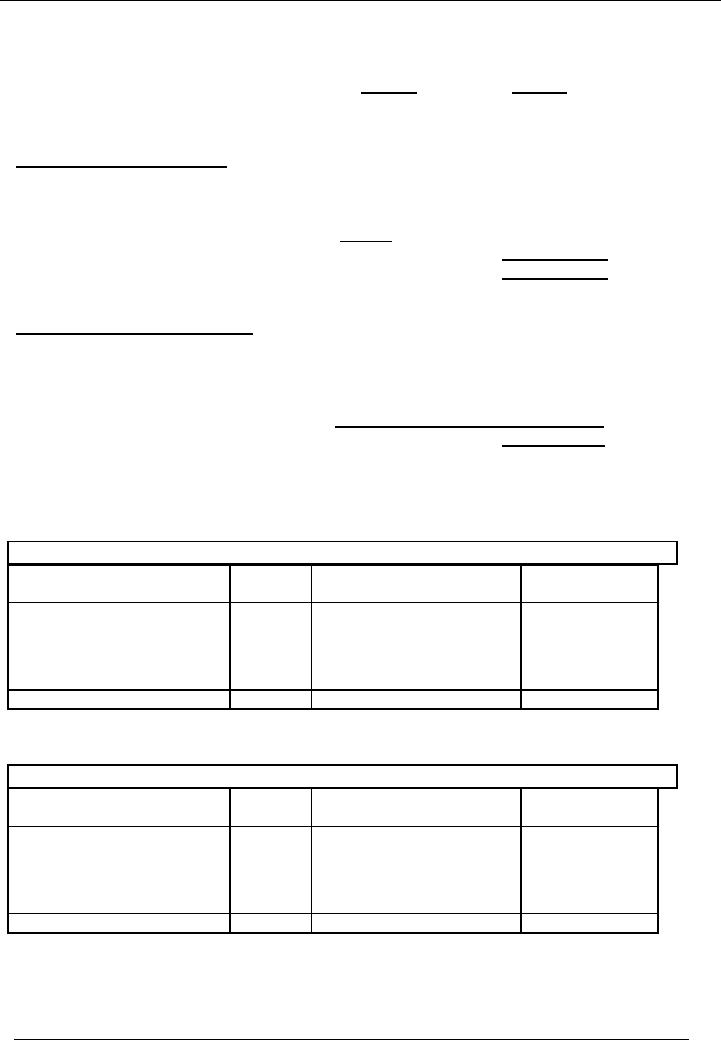

EXAMPLE

# 1

The

following trial balance was

extracted from A, B & Co. books on

June 30, 2002.

A, B &

company

Trial

balance as on June 30,

2002

Particulars

Amount

Amount

Dr.

(Rs.)

Cr.

(Rs.)

Building

Cost

750,000

Furniture

and Fixtures Cost

110,000

Accumulated

Dep. Building

250,000

Accumulated

Dep. Furniture

33,000

Debtors

162,430

Creditors

111,500

Cash

at Bank

6,770

Stock

on Jun 30, 2002

563,400

Sales

1,236,500

Cost

of goods Sold

710,550

Carriage

outward

12,880

Discounts

Allowed

1,150

Markup

on Bank Loan

40,000

Office

Expenses

24,160

Salaries

and Wages

189,170

Bad

Debts

5,030

Provision

for Bad Debts

4,000

Bank

Loan (Long Term)

400,000

Capital

A

350,000

B

295,000

Current

Account A

13,060

B

2,980

Drawings

A

64,000

B

56,500

Total

2,696,040

2,696,040

Notes:

�

Expenses

to be accrued, Office Expenses

Rs. 960, Wages

Rs.2,000.

�

Depreciate

Fixtures 10% and Building 5% on straight

line.

�

Reduce

provision for doubtful debts

to Rs. 3,200

�

Partnership

salary of A Rs. 8,000 is to be

accrued.

�

A and

B share profit and loss

equally.

You

are required to prepare profit &

loss account and the balance

sheet as at June 30,

2002.

.

225

Financial

Accounting (Mgt-101)

VU

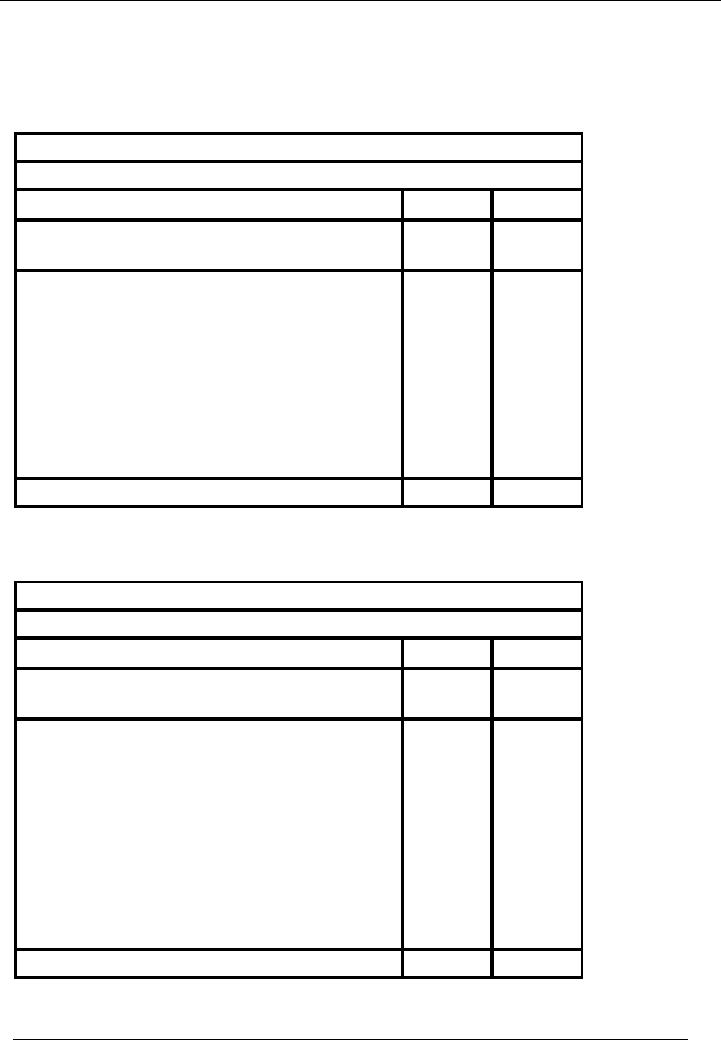

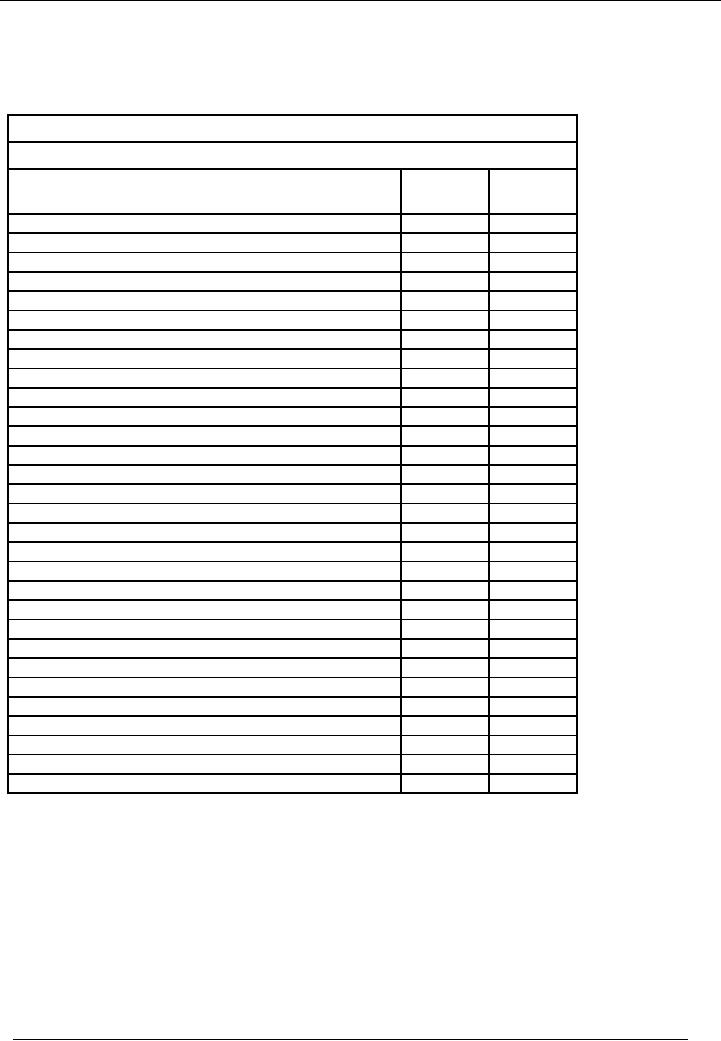

SOLUTION

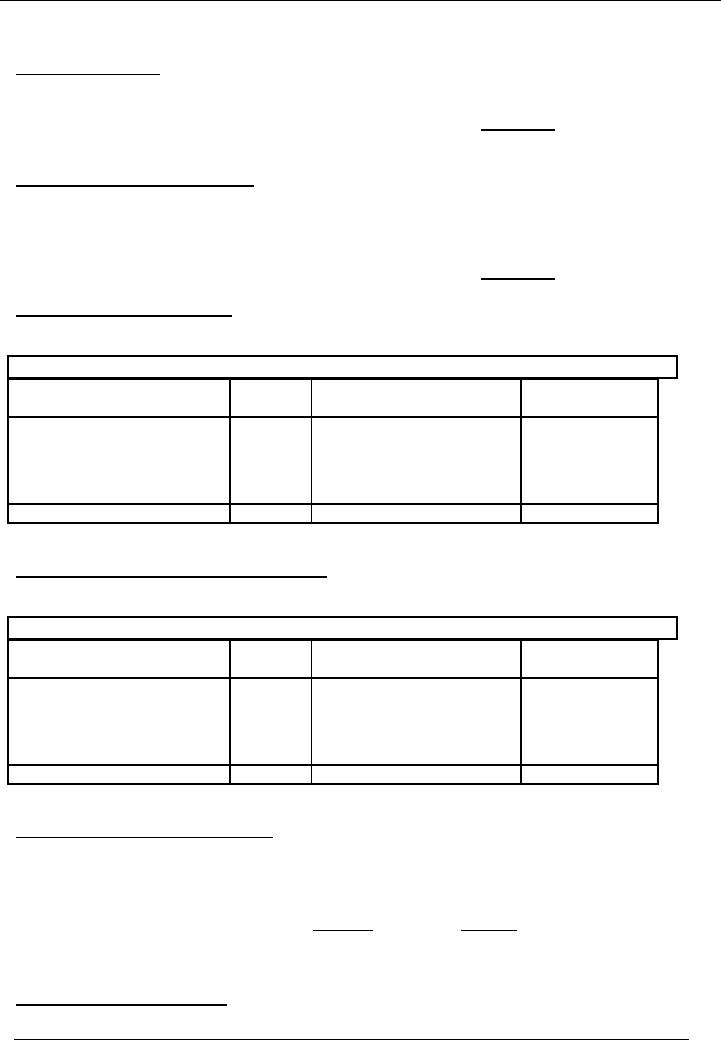

PROFIT

& LOSS ACCOUNT

A, B, &

Co

Profit and

Loss Account for the

Year Ending June 30,

20-2

Particulars

Note

Amount

Rs. Amount Rs

Sales

1,236,500

Less:

Cost of Goods Sold (material

consumed)

(710,550)

Gross

Profit

525,950

Less:

Expenses

Wages

and Salaries

1

191,170

Office

Expenses

2

25,120

Carriage

Out

12,880

Discount

Allowed

1,150

Markup

on Loan

40,000

Provision

for Doubtful Debt

3

4,230

Depreciation

4

48,500

(323,050)

Net

Profit

202,900

In

above solution, bad debts

are grouped with provision

for doubtful debts. In the

following solution,

bad

debts

and provision for doubtful

debts are shown

separately.

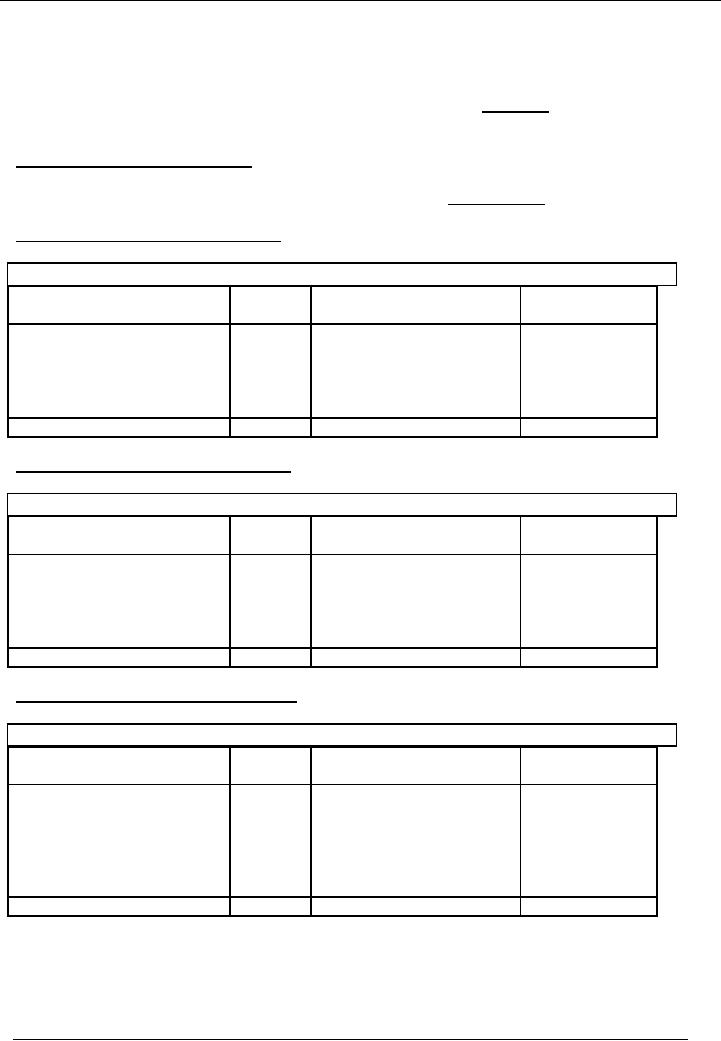

A, B, &

Co

Profit and

Loss Account for the

Year Ending June 30,

20-2

Particulars

Note

Amount

Rs. Amount Rs.

Sales

1,236,500

Less:

Cost of Goods Sold (material

consumed)

(710,550)

Gross

Profit

525,950

Less:

Expenses

Wages

and Salaries

1

191,170

Office

Expenses

2

25,120

Carriage

Out

12,880

Discount

Allowed

1,150

Markup

on Loan

40,000

0Bad

Debts

5,030

Provision

for Doubtful Debts not

required

3(a)

(800)

Depreciation

4

48,500

(323,050)

Net

Profit

202,900

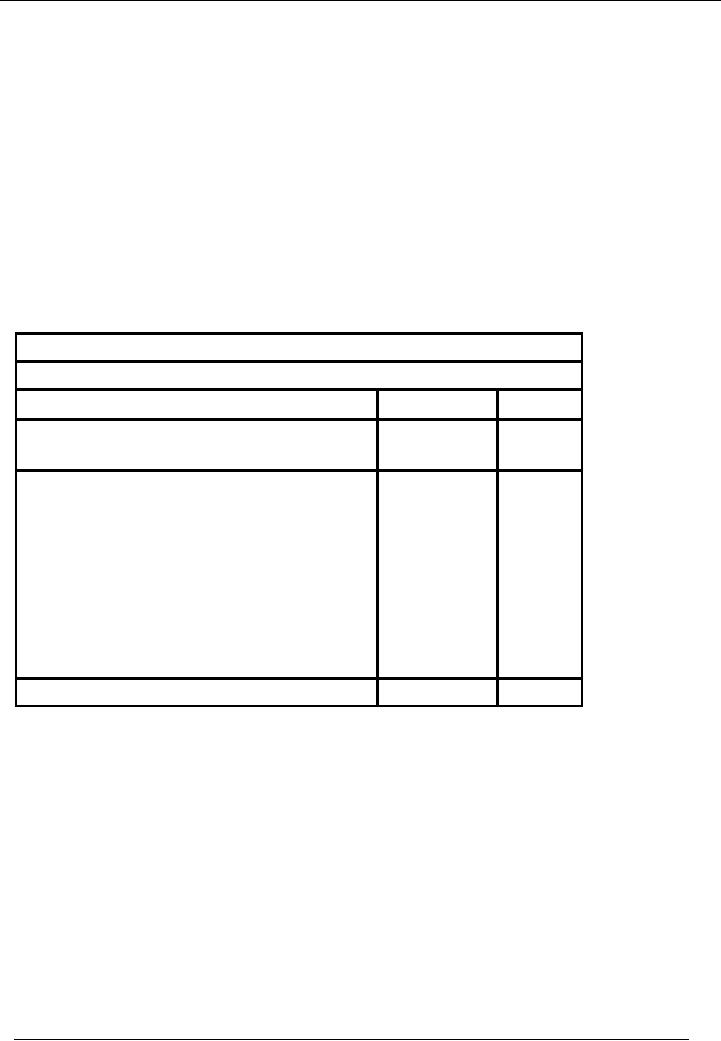

PROFIT

& LOSS APPROPRIATION

ACCOUNT

226

Financial

Accounting (Mgt-101)

VU

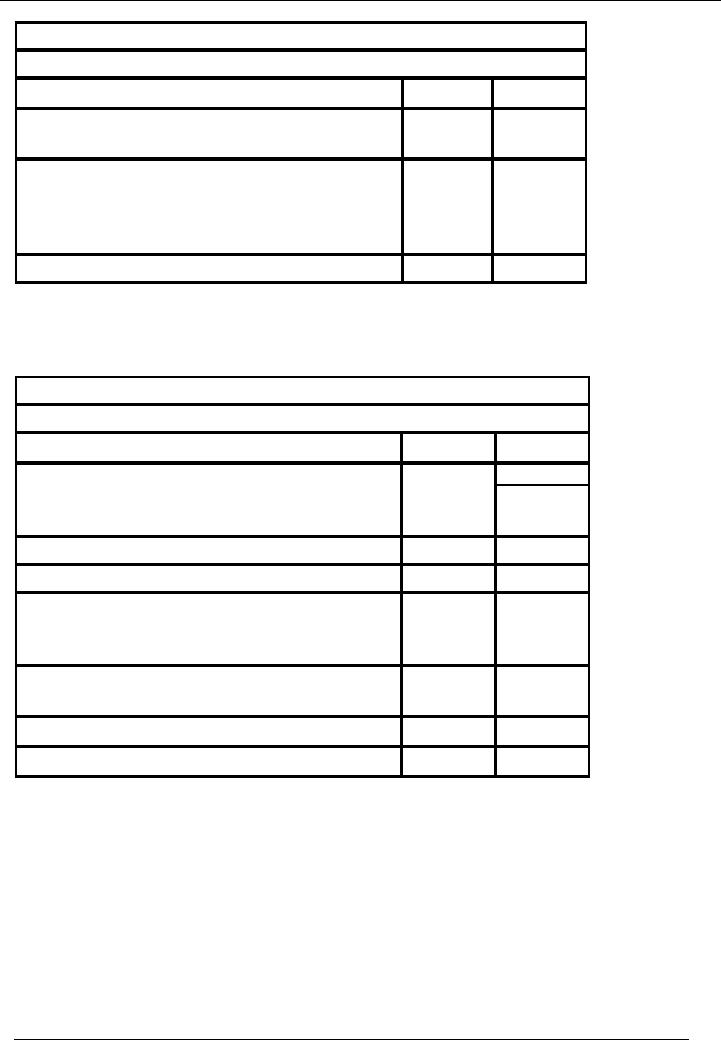

A, B, &

Co

Profit

Distribution Account

Particulars

Note

Amount

Rs. Amount Rs.

Net

Profit

202,900

Less:

Partner's Salary A

(8,000)

Distributable

Profit

194,900

Less:

Partner's Share in

Profit

A (50% of

194,900)

97,450

B (50% of

194,900)

97,450

(194,900)

0

BALANCE

SHEET

A, B, &

Co

Balance

Sheet As At June 30,

2002

Particulars

Note

Amount

Rs. Amount Rs.

Fixed

Assets at WDV

4

528,500

Current

Assets

5

729,400

Current

Liabilities

6

(114,460)

Working

Capital

614,940

Total

1,143,440

Financed

By:

Capital

A

350,000

B

295,000

645,000

Current

Account A

7

54,510

B

8

43,930

98,440

Long

Term Loan

400,000

Total

1,143,440

227

Financial

Accounting (Mgt-101)

VU

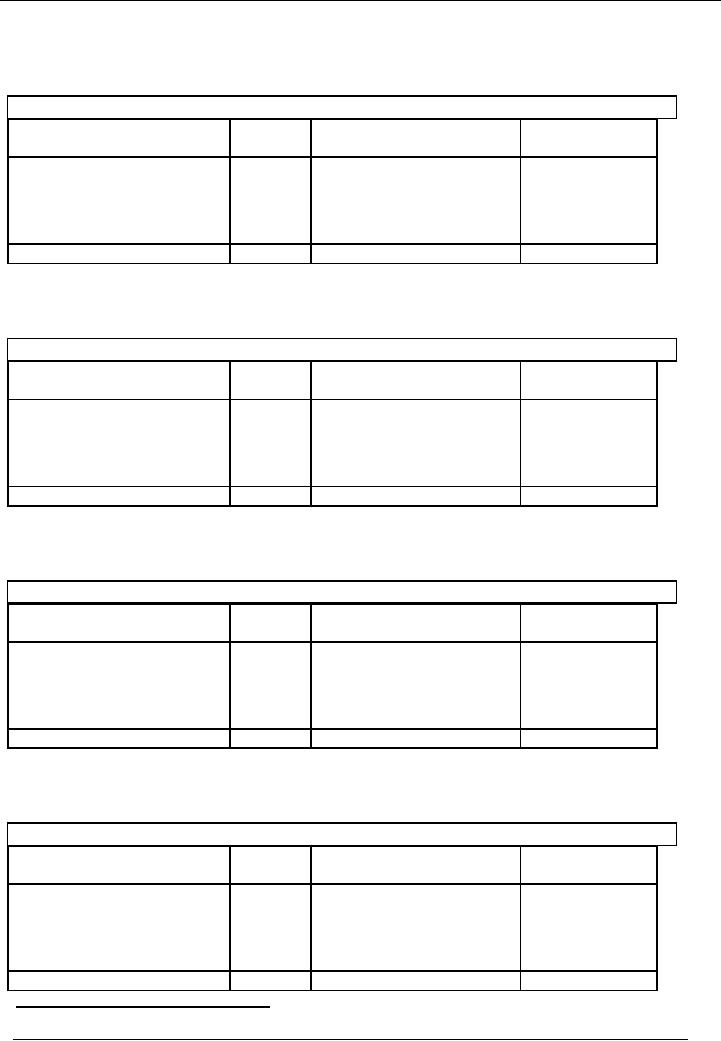

NOTES

TO THE ACCOUNTS:

NOTE #

1

Salaries

Salaries

Account

Account

Code --------

Particulars

Amount

Particulars

Amount

Dr.

(Rs.)

Cr.

(Rs.)

Salaries

paid

189,170

Salaries

payable

2,000

Balance

b/d

191,170

Total

191,170

Total

191,170

NOTE #

2

Office

Expenses

Office

Expenses Account

Account

Code --------

Particulars

Amount

Particulars

Amount

Dr.

(Rs.)

Cr.

(Rs.)

Office

Expenses paid

24,160

Office

Expenses payable

960

25,120

Balance

b/d

Total

25,120

Total

25,120

NOTE #

3

Provision

for Doubtful Debts

Provision

for Doubtful Debts

Account

Account

Code --------

Particulars

Amount

Particulars

Amount

Dr.

(Rs.)

Cr.

(Rs.)

Bad

Debts

5,030

Opening Balance

4,000

Balance

c/d

3,200

Transfer to

Profit & Loss

Account

4,230

Total

8,230

Total

8,230

NOTE #

3(a) Provision for Doubtful

Debts

Provision

for Doubtful Debts

Account

Account

Code --------

Particulars

Amount

Particulars

Amount

Dr.

(Rs.)

Cr.

(Rs.)

Provision

not required

800

Opening Balance

4,000

Balance

c/d

3,200

Total

4,000

Total

4,000

NOTE #

4

Fixes

Assets at WDV

228

Financial

Accounting (Mgt-101)

VU

Acc.

Dep.

WDV

Cost

Rate

Opening For the Yr.

Closing

Building

750,000

5%

250,000

37,500

287,500

462,500

Furniture

110,000

10%

33,000

11,000

44,000

66,000

48,500

528,500

NOTE #

5

Current

Assets

Stocks

563,400

Debtors

162,430

159,230

Less:

Provision (note3)

3,200

Bank

6,770

Total

729,400

NOTE #

6

Current

Liabilities

Creditors

111,500

Exp.

Payable:

Salaries

2,000

Off.

Exp

2,960

Total

114,460

NOTE #

7

A's

Current Account

A's

Current Account

Account

Code --------

Particulars

Amount

Particulars

Amount

Dr.

(Rs.)

Cr.

(Rs.)

Drawings

64,000

Opening Balance

13,060

Profit

for the year

97,450

Salary

8,000

Balance

c/d

54,510

Total

118,510

Total

118,510

NOTE #

8

B's

Current Account

B's

Current Account

Account

Code --------

Particulars

Amount

Particulars

Amount

Dr.

(Rs.)

Cr.

(Rs.)

Drawings

56,500

Opening Balance

2,980

Profit

for the year

97,450

Balance

c/d

43,930

Total

100,430

Total

100,430

229

Financial

Accounting (Mgt-101)

VU

EXAMPLE

# 2

Atif,

Amir and Babar are

partners in a firm. They share

profit and losses in the

ratio 5: 3: 2 respectively.

Their

trial balance as on June 30,

2002 is as follows:

Atif,

Amir, Babar &

company

Trial

balance as on June 30,

2002

Particulars

Amount

Amount

Dr.

(Rs.)

Cr.

(Rs.)

Sales

210,500

Returns

inward

6,800

Purchases

137,190

Carriage

inward

1,500

Opening

stock

42,850

Discount

allowed

110

Salaries

and Wages

18,296

Bad

debts

1,234

Provision

for bad debts

800

General

expenses

945

Rent

and rates

2,565

Postages

2,450

Motor

expenses

3,940

Motor

van at cost

12,500

Office

equipment at cost

8,400

Accumulated

depreciation Motor van

4,200

Accumulated

depreciation Office equipment

2,700

Creditors

24,356

Debtors

37,178

Cash

at bank

666

Drawings:

Atif

12,610

Amir

8,417

Babar

6,216

Current

accounts: Atif

1,390

Amir

153

Babar

2,074

Capital

accounts: Atif

30,000

Amir

16,000

Babar

12,000

Total

304,020

304,020

230

Financial

Accounting (Mgt-101)

VU

The

following notes are relevant to

June 30, 2002

�

Stock

on June 30,2002 is Rs.

51,060.

�

Rent

in advance Rs. 120.

�

Increase

provision for bad debts to

Rs. 870.

�

Salaries:

Amir Rs.1,200, Babar Rs.

700.

�

Interest

on capital @ 10%.

�

Depreciate

Motor van Rs. 2,500 and

office equipment Rs.

1,680.

You

are required to draw up a set of

final accounts as on June

30, 2002.

SOLUTION

PROFIT

& LOSS ACCOUNT

Atif,

Amir, Babar & company

Profit and

Loss Account for the

Year Ending June 30,

20-2

Particulars

Note

Amount

Rs.

Amount

Rs

Sales

1

203,700

Less:

Cost of Goods Sold

2

(130,480)

Gross

Profit

73,220

Less:

Expenses

Wages

and Salaries

18,296

General

Expenses

945

Rent

and Rates

3

2,445

Postages

2,450

Motor

Expenses

3,940

Discount

Allowed

110

Provision

for Doubtful Debt

4

1,304

Depreciation

5

4,180

(33,670)

Net

Profit

39,550

231

Financial

Accounting (Mgt-101)

VU

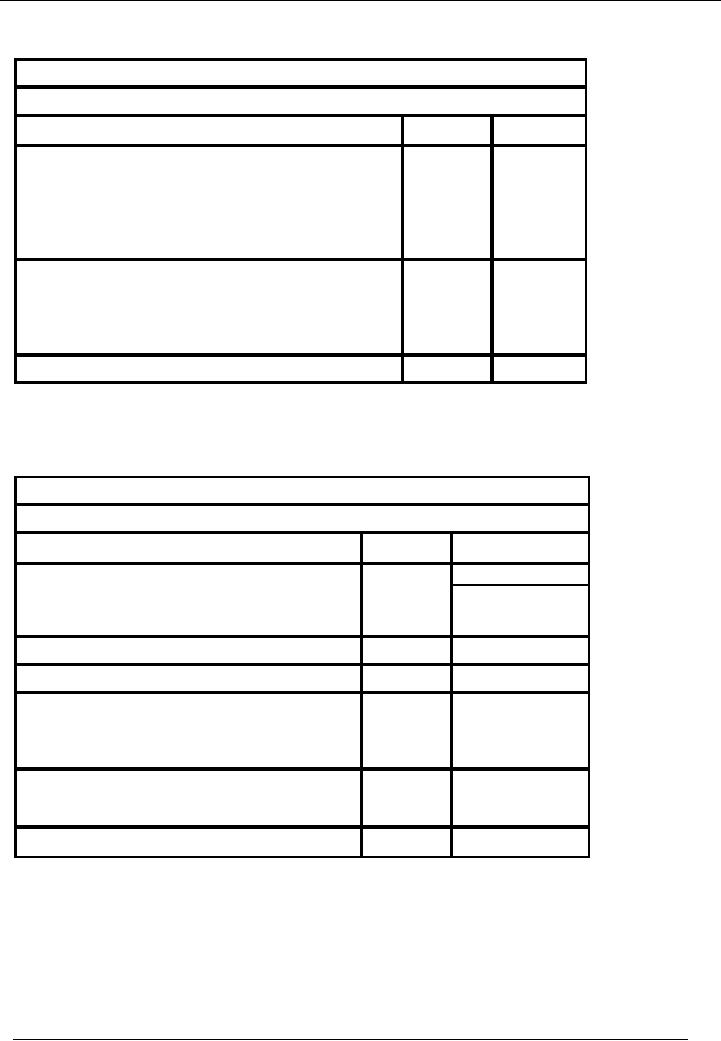

PROFIT

& LOSS APPROPRIATION

ACCOUNT

Atif,

Amir, Babar & company

Profit

Distribution Account

Particulars

Note

Amount

Rs. Amount Rs.

Net

Profit

39,550

Less:

Partner's Salary

Amir

(1,200)

Babar

(700)

Less:

Interest on capital Atif (10% of

30,000)

(3,000)

Amir

(10% of 16,000)

(1,600)

Babar

(10% of 12,000)

(1,200)

Distributable

Profit

31,850

Less:

Partner's Share in

Profit

Atif

(5/10 of 31,850)

15,925

Amir

(3/10 of 31,850)

9,555

Babar

(2/10 of 31,850)

6,370

(31,850)

0

BALANCE

SHEET

Atif,

Amir, Babar & company

Balance

Sheet As At June 30,

2002

Particulars

Note

Amount

Rs.

Amount

Rs.

Fixed

Assets at WDV

5

9,820

Current

Assets

6

88,154

Current

Liabilities

7

(24,356)

Working

Capital

63,798

Total

73,618

Financed

By:

Capital

Atif

30,000

Amir

16,000

Babar

12,000

58,000

Current

Account Atif

8

7,705

Amir

9

3,785

Babar

10

4,128

15,618

Total

73,618

232

Financial

Accounting (Mgt-101)

VU

NOTES

TO THE ACCOUNTS

Note

# 1

Sales

Rs.

Sales

210,500

Less:

Return inward

(6,800)

Net

Sales

203,700

Note

# 2

Cost

of goods sold

Opening

Stock

42,850

Add:

Purchases

137,190

Add:

Carriage inward

1,500

Less:

Closing Stock

(51,060)

130,480

NOTE #

3

Rent

and Rates

Rent

and Rates Account

Account

Code --------

Particulars

Amount

Particulars

Amount

Dr.

(Rs.)

Cr.

(Rs.)

Office

Expenses paid

2,565

Advance Rent

120

2,445

Balance

b/d

Total

2,565

Total

2,565

NOTE #

4

Provision

for Doubtful Debts

Provision

for Doubtful Debts

Account

Account

Code --------

Particulars

Amount

Particulars

Amount

Dr.

(Rs.)

Cr.

(Rs.)

Bad

Debts

1,234

Opening Balance

800

Balance

c/d

870

Transfer to

Profit & Loss

Account

1,304

Total

2,104

Total

2,104

Note

# 5

Fixed

Assets at WDV

Acc.

Dep.

WDV

Cost

Opening

For the Yr. Closing

Motor

Van

12,500

4,200

2,500

6,700

5,800

Office

Equipment

8,400

2,700

1,680

4,380

4,020

4,180

9,820

Note

# 6

Current

Assets

233

Financial

Accounting (Mgt-101)

VU

Stock

51,060

Debtors

37,178

Less:

Provision for doubtful

debts

(870)

Cash

at bank

666

Advance

rent

120

88,154

Note

# 7

Current

Liabilities

Creditors

24,356

NOTE #

8

Atif's

Current Account

Atif's

Current Account

Account

Code --------

Particulars

Amount

Particulars

Amount

Dr.

(Rs.)

Cr.

(Rs.)

Drawings

12,610

Opening Balance

1,390

Interest

on Capital

3,000

Profit

for the year

15,925

Balance

c/d

7,705

Total

20,315

Total

20,315

NOTE #

9

Amir's

Current Account

Amir's

Current Account

Account

Code --------

Particulars

Amount

Particulars

Amount

Dr.

(Rs.)

Cr.

(Rs.)

Opening

Balance

153

Salary

1,200

Drawings

8,417

Interest on Capital

1,600

Profit

for the year

9,555

3,785

Balance

c/d

Total

12,355

Total

12,355

NOTE #

10

Babar's

Current Account

Babar's

Current Account

Account

Code --------

Particulars

Amount

Particulars

Amount

Dr.

(Rs.)

Cr.

(Rs.)

Drawings

6,216

Opening Balance

2,074

Salary

700

Interest

on Capital

1,200

Profit

for the year

6,370

Balance

c/d

4,128

Total

10,344

Total

10,344

234

Table of Contents:

- Introduction to Financial Accounting

- Basic Concepts of Business: capital, profit, budget

- Cash Accounting and Accrual Accounting

- Business entity, Single and double entry book-keeping, Debit and Credit

- Rules of Debit and Credit for Assets, Liabilities, Income and Expenses

- flow of transactions, books of accounts, General Ledger balance

- Cash book and bank book, Accounting Period, Trial Balance and its limitations

- Profit & Loss account from trial balance, Receipt & Payment, Income & Expenditure and Profit & Loss account

- Assets and Liabilities, Balance Sheet from trial balance

- Sample Transactions of a Company

- Sample Accounts of a Company

- THE ACCOUNTING EQUATION

- types of vouchers, Carrying forward the balance of an account

- ILLUSTRATIONS: Ccarrying Forward of Balances

- Opening Stock, Closing Stock

- COST OF GOODS SOLD STATEMENT

- DEPRECIATION

- GROUPINGS OF FIXED ASSETS

- CAPITAL WORK IN PROGRESS 1

- CAPITAL WORK IN PROGRESS 2

- REVALUATION OF FIXED ASSETS

- Banking transactions, Bank reconciliation statements

- RECAP

- Accounting Examples with Solutions

- RECORDING OF PROVISION FOR BAD DEBTS

- SUBSIDIARY BOOKS

- A PERSON IS BOTH DEBTOR AND CREDITOR

- RECTIFICATION OF ERROR

- STANDARD FORMAT OF PROFIT & LOSS ACCOUNT

- STANDARD FORMAT OF BALANCE SHEET

- DIFFERENT BUSINESS ENTITIES: Commercial, Non-commercial organizations

- SOLE PROPRIETORSHIP

- Financial Statements Of Manufacturing Concern

- Financial Statements of Partnership firms

- INTEREST ON CAPITAL AND DRAWINGS

- DISADVANTAGES OF A PARTNERSHIP FIRM

- SHARE CAPITAL

- STATEMENT OF CHANGES IN EQUITY

- Financial Statements of Limited Companies

- Financial Statements of Limited Companies

- CASH FLOW STATEMENT 1

- CASH FLOW STATEMENT 2

- FINANCIAL STATEMENTS OF LISTED, QUOTED COMPANIES

- FINANCIAL STATEMENTS OF LISTED COMPANIES

- FINANCIAL STATEMENTS OF LISTED COMPANIES