|

STANDARD FORMAT OF BALANCE SHEET |

| << STANDARD FORMAT OF PROFIT & LOSS ACCOUNT |

| DIFFERENT BUSINESS ENTITIES: Commercial, Non-commercial organizations >> |

Financial

Accounting (Mgt-101)

VU

Lesson-7

STANDARD

FORMAT OF BALANCE

SHEET

(LIABILITY

SIDE)

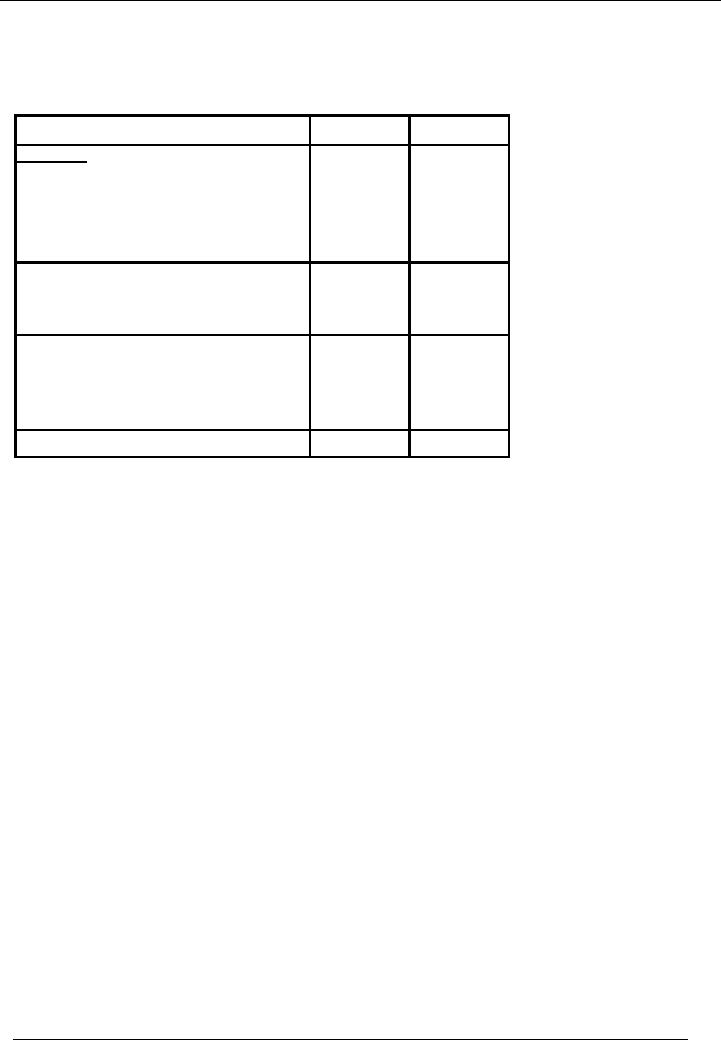

Particulars

Amount

Rs. Amount Rs.

Liabilities

Capital

and Reserves

Capital

X

Reserves

X

Profit

and Loss Account

X

X

Non

Current / Long Term

Liabilities

Long

term loans

X

Other

long term liabilities

X

X

Current

Liabilities

Trade

creditors and other

payables

X

Short term

borrowings

X

Current

portion of long term borrowings

X

X

Total

X

CAPITAL

Capital is the

first item shown on the liability

side of the balance sheet of an

organization. Capital is the

Money

invested in the business by the owners.

Capital is a liability for the business

as the business has to

pay

return

against this money and in

case the business is closed,

then it has to return the amount. Capital

is also

termed

as "Share Capital".

RECORDING

OF CAPITAL

Recording

of Capital is Simple

�

At the time of

receipt

Debit

Cash /

Bank

Credit

Capital

�

If the owner

contributes an asset instead of cash,

then

Debit

Asset

Account

Credit

Capital

�

When

the capital is repaid (this does not

happen in normal course of business,

but just in case)

Debit

Capital

Credit

Cash /

Bank

RESERVES

The

portion of profit which is

not paid to proprietor, but is

kept apart for meeting

some known or unknown

losses

is called Reserve, e.g.

Reserve fund, contingencies

reserve etc.

.

There

are two major types of

reserves:

�

Revenue

reserves

198

Financial

Accounting (Mgt-101)

VU

From

the view point of its

creation revenue reserve may

again be classified

into:

o

a.

General reserve

Reserve

which is not created for

any specific purpose, but

for strengthening the financial position of

the

business

is known as General Reserve, e.g.

Reserve fund, contingencies

reserve etc.

b.

Specific Reserve

Reserve

created for any special

purpose is known as Specific

Reserve. e.g., Dividend

Equalization fund,

Debenture sinking

fund etc.

Capital

Reserves

Capital

reserves, in most of the cases,

are created due to legal

requirements. Profit may

arise from sources,

other

than normal business

activity. For example,

profit on sale of fixed

assets or profit on revaluation of

fixed

assets. When a reserve is

created out of these

profits, it is termed as capital

reserve. One capital

reserve

about

which we already know is

"Fixed Assets Revaluation Reserve".

Capital reserves can be used

for

specific

purposes only.

DIFFERENCE

BETWEEN RESERVE AND

PROVISION

Both

reserves and provisions are

created out of revenues of the

business, but they differ

from each other.

� Creating

a provision is necessary to show a true

profit for the period,

whereas the reserve is

created

on the discretion

of the owner, out of profits.

� Provision

is to be made, even, if there is a

loss; Reserves are created

out of profits only.

� Reserve

is shown as liability in the balance

sheet, Provision is shown as a

reduction from the

asset

against

which it is created.

� Provision

is used specifically for the

purpose for which it is

made, Reserves are usually

general and

can be

used for any

purpose.

PROFIT

AND LOSS ACCOUNT

�

Profit

and Loss Account or Accumulated

Profit and Loss Account

shows the balance of

un-

distributed

profit accumulated over the

periods.

�

In the

first year of business, this

account shows following

figure:

Profits

for the year

X

Less:

Transferred to Reserve

(X)

Less:

Profit distributed

(X)

Balance

carried to Balance

Sheet

X

�

In

Subsequent years, balance

brought forward from previous

years and profit for the

year is added

and

distributed as above and the

balance is carried to next

year.

�

This

is why; it is termed as Accumulated Profit

and Loss Account.

199

Financial

Accounting (Mgt-101)

VU

LONG

TERM LOANS

�

The

owners of the business may feel

that their business can

flourish, if there are more

funds. These

funds

can be arranged from their

own resources, if possible, or they

can ask a bank or

financial

institution

for funds. This loan, if extended by bank

for a period of more than

one year is termed as

a long

term loan. There can be other sources of

long term loans as well, e.g. Term

Finance

Certificates

and Debentures, where money

is borrowed from general

public under certain

legal

restrictions.

OTHER

LONG TERM

LIABILITIES

These

include all other liabilities

that are payable after a

period of one year of balance

sheet date. For

example,

staff gratuity and other

benefits, taxes and

liabilities that become

payable after a period of one

year.

CURRENT

LIABILITIES

Current

Liabilities are the obligations of the

business that are payable

within twelve months of the

balance

sheet

date. Creditors, all accrued

expenses are the examples of current

liabilities of the business

because

business

is expected to pay these

back within one accounting

period.

CURRENT

PORTION OF LONG TERM

LIABILITIES

Long

term loans are usually

payable in installments. Therefore, at

every year end, some

portion of the loan

becomes

payable within one year of

the balance sheet date. The

portion that becomes payable

within the

next

accounting period is transferred to

current liabilities and classified under

current portion of long term

liabilities.

Format of current

liabilities shown in the balance

sheet is as follows:

Current

Liabilities

Trade

Creditors

Short Term

Borrowings

Other

Short Term Liabilities

Salaries

Payable

Accrued

Expenses

Bills

payable

Advances

from Customers

Current

Portion of Long Term

Liabilities

200

Table of Contents:

- Introduction to Financial Accounting

- Basic Concepts of Business: capital, profit, budget

- Cash Accounting and Accrual Accounting

- Business entity, Single and double entry book-keeping, Debit and Credit

- Rules of Debit and Credit for Assets, Liabilities, Income and Expenses

- flow of transactions, books of accounts, General Ledger balance

- Cash book and bank book, Accounting Period, Trial Balance and its limitations

- Profit & Loss account from trial balance, Receipt & Payment, Income & Expenditure and Profit & Loss account

- Assets and Liabilities, Balance Sheet from trial balance

- Sample Transactions of a Company

- Sample Accounts of a Company

- THE ACCOUNTING EQUATION

- types of vouchers, Carrying forward the balance of an account

- ILLUSTRATIONS: Ccarrying Forward of Balances

- Opening Stock, Closing Stock

- COST OF GOODS SOLD STATEMENT

- DEPRECIATION

- GROUPINGS OF FIXED ASSETS

- CAPITAL WORK IN PROGRESS 1

- CAPITAL WORK IN PROGRESS 2

- REVALUATION OF FIXED ASSETS

- Banking transactions, Bank reconciliation statements

- RECAP

- Accounting Examples with Solutions

- RECORDING OF PROVISION FOR BAD DEBTS

- SUBSIDIARY BOOKS

- A PERSON IS BOTH DEBTOR AND CREDITOR

- RECTIFICATION OF ERROR

- STANDARD FORMAT OF PROFIT & LOSS ACCOUNT

- STANDARD FORMAT OF BALANCE SHEET

- DIFFERENT BUSINESS ENTITIES: Commercial, Non-commercial organizations

- SOLE PROPRIETORSHIP

- Financial Statements Of Manufacturing Concern

- Financial Statements of Partnership firms

- INTEREST ON CAPITAL AND DRAWINGS

- DISADVANTAGES OF A PARTNERSHIP FIRM

- SHARE CAPITAL

- STATEMENT OF CHANGES IN EQUITY

- Financial Statements of Limited Companies

- Financial Statements of Limited Companies

- CASH FLOW STATEMENT 1

- CASH FLOW STATEMENT 2

- FINANCIAL STATEMENTS OF LISTED, QUOTED COMPANIES

- FINANCIAL STATEMENTS OF LISTED COMPANIES

- FINANCIAL STATEMENTS OF LISTED COMPANIES