|

STANDARD FORMAT OF PROFIT & LOSS ACCOUNT |

| << RECTIFICATION OF ERROR |

| STANDARD FORMAT OF BALANCE SHEET >> |

Financial

Accounting (Mgt-101)

VU

Lesson-29

STANDARD

FORMAT OF PROFIT & LOSS

ACCOUNT

Standard

format of profit & loss

account is shown as

follows:

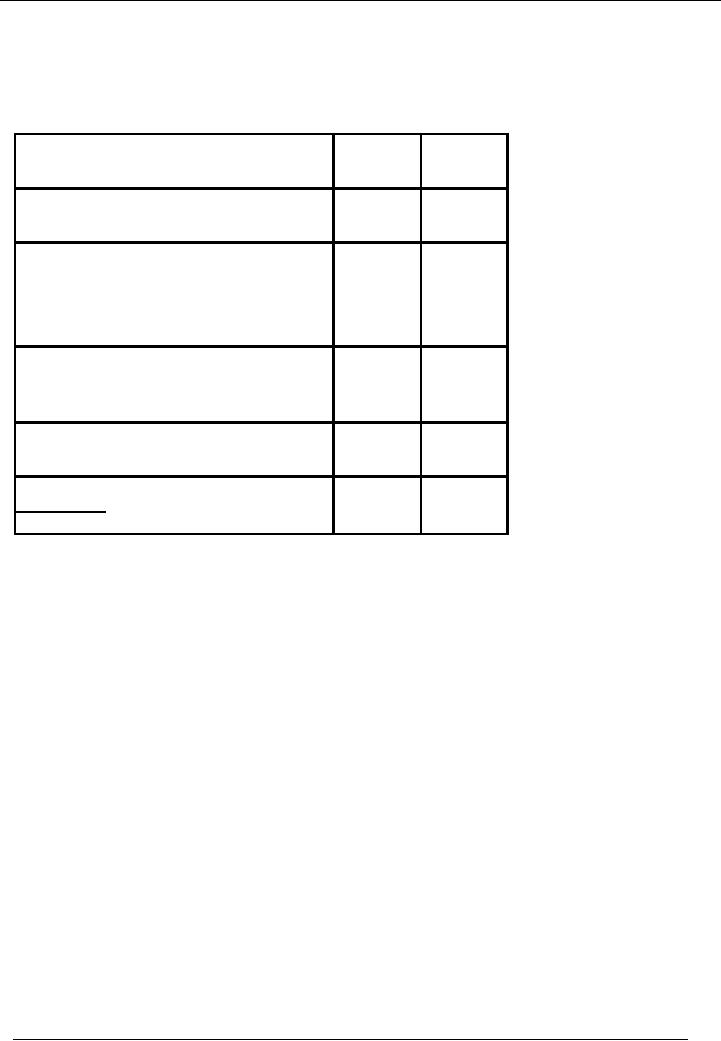

Particulars

Amount

Amount

Rs.

Rs.

Sales

X

Less:

Cost of Goods Sold

(X)

Gross

Profit

X

Less:

Administrative Expenses

Selling

Expenses

X

X

(X)

Operating

Profit

X

Less:

Financial Expenses

(x

)

Add :

Other income

Profit

Before Tax

X

Less:

Tax

(X)

Net

Profit After Tax for the

Year

X

Other

income

SALES

�

Sales

as we know are the revenue

against the sale of the product in

which the organization deals.

�

In

case of a service organization, there

will be Income against

Services Rendered instead of

Sales

and

there will be no Cost of

Sales or Gross

Profit.

COST

OF GOODS SOLD/GROSS

PROFIT

�

Cost

of goods sold is the cost incurred in

purchasing or manufacturing the product,

which an

organization is

selling plus any other

expense incurred in bringing the product

in salable condition.

Cost

of goods sold contain the following

heads of accounts:

o Purchase

of raw material/goods

o Wages

paid to employees for manufacturing of

goods

o Any

tax/freight is paid on purchases

o Any

expense incurred on carriage/transportation of

purchased items.

�

Gross

Profit = Sales Cost of

goods sold

OTHER

INCOME

� Other

income includes revenue from

indirect source of income,

such as return on investment,

profit

on PLS

account etc.

194

Financial

Accounting (Mgt-101)

VU

ADMINISTRATIVE

EXPENSES

�

Administrative

expenses are the expenses incurred in

running a business effectively.

Main

components

of this group are:

o Payment

of utility bills

o Payment

of rent

o Salaries

of employees

o General

office expenses

o Repair

& maintenance of office equipment &

vehicles.

�

It is

important to distribute expenses

properly among the three

classifications i.e. Cost of

Goods

Sold,

Administrative Expenses and

Selling Expenses to present the financial

statements fairly.

Take

the

example of following

costs:

o Salaries

and Wages

Although

both these terms mean

remuneration paid to labour and

employee

against

services.

Wages

usually denotes remuneration paid to daily

wages labour. Whereas

salary

denotes

payments to permanent

employees.

Salaries

can be classified in any of the

classifications mentioned below.

� Salaries

/ wages paid to labour and

supervisors/officers working for

the

manufacturing of

goods become a part of Cost

of Goods Sold.

� Salaries

and benefits of general administrative staff

becomes part of

Administrative

Expenses

� Salaries

and benefits of sales and marketing staff

become part of

selling

expenses.

�

Other

expenses like Depreciation, Utilities

and Maintenance can also be

classified in all

three,

depending

upon the exact nature of the

expenditure.

SELLING

EXPENSES

�

Selling

expenses are the expenses incurred

directly in connection with the sale of

goods. This head

contains:

o Transportation/carriage

of goods sold

o Tax/freight

paid on sale

�

If the

expense head `salaries'

includes salaries of sales staff. It

will be excluded from

salaries &

appear

under the heading of `selling

expenses'.

FINANCIAL

EXPENSES

�

Financial

expenses are the interest paid on bank

loan & charges deducted by bank on

entity's bank

accounts.

These are shown separately

in the Profit and Loss

Account. These

includes:

o Interest

on loan

o Bank

charges

�

There

is, however, one exception and

that is the interest paid on loan

taken to build an asset

is

capitalized

as cost of the asset up to the time that

asset is completed.

INCOME

TAX

�

Different

types of entities have to pay

income tax at different

rates.

�

At the time of

preparing annual financial statements, an

estimate of expected tax liability is

made.

�

A

provision is then, created equal to

that estimate.

195

Financial

Accounting (Mgt-101)

VU

�

You

should remember the treatment of Provision

for Doubtful debts. Same is

the case with income

tax

i.e. provision is made at the time of

preparing accounts which is then

adjusted accordingly at the

time when

actual tax expense is

known.

BALANCE

SHEET (ASSET

SIDE)

Standard

format of the balance sheet is given as

follows:

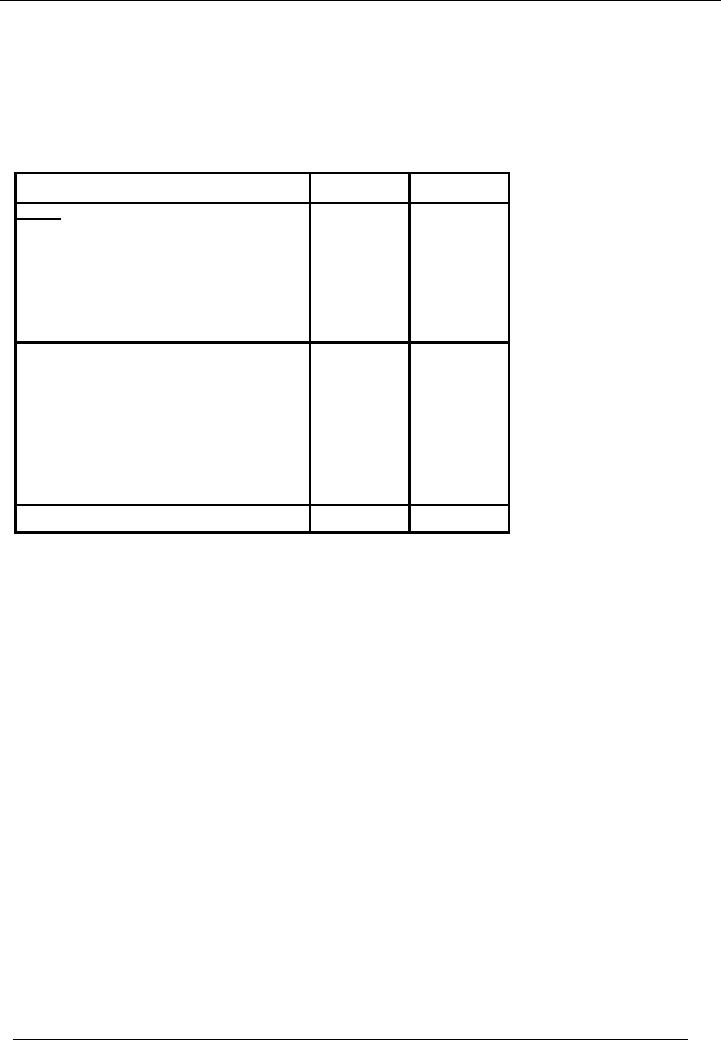

Particulars

Amount

Rs.

Amount

Rs.

Assets

Non

Current Assets

Fixed

Assets

X

Capital

Work In Progress

X

Deferred

Costs

X

Long

Term Investments

X

Current

Assets

Stocks

X

Trade

debtors and Other

Receivables

X

Prepayments

X

Short Term

Investments

X

Cash

and Bank

X

Total

X

X

FIXED

ASSETS

�

Fixed

assets are the assets of

permanent nature that a

business acquires, such as

plant, machinery,

building,

furniture, vehicles

etc.

�

Fixed

assets are presented at cost

less accumulated depreciation OR revalued

amount.

CAPITAL

WORK IN PROGRESS

�

If an

asset is not completed at

that time when balance sheet is

prepared, all costs incurred on

that

asset

up to the balance sheet date

are transferred to an account

called Capital

Work in Progress

Account.

This

account is shown separately in the

balance sheet below the

fixed assets. Capital

work

in

progress account contains

all expenses incurred on the asset

until it is converted into

working

condition.

All these expenses will

become part of the cost of

that asset. When an asset is

completed

and it

is ready to work, all costs

will transfer to the relevant asset

account.

196

Financial

Accounting (Mgt-101)

VU

DEFERRED

COSTS

�

An

expense that has a future

benefit in excess of one

year and recorded in a

capital asset account

LONG

TERM AND SHORT TERM

INVESTMENTS

�

Where

a business has surplus funds, it is

better to invest those funds where these

can generate a

return

greater than PLS

accounts.

�

These

investments can be of different

types e.g. shares of other

companies, fixed deposits

with

banks,

government securities, national savings

etc.

�

For

presentation purposes, these investments

are classified in two

categories, long term and

short

term

investments.

�

Investments

made with the intention that

they will be held for a period longer

than twelve months

are

classified as long term and

those made for a period

equal to or shorter than 12 months

are

classified

as short term.

Following

things are important to note

here:

�

Classification

is to be made every time a balance

sheet is prepared and the

period is to be calculated

from

the date of balance

sheet.

�

This

means that an investment made

for 2 years on May 2000

will be classified as long

term

investment in

accounts prepared on Jun 30,

2000 and the same investment

will be classified as

current investment

in the accounts prepared on June

30, 2001.

�

An investment

may initially be made as current

investment. Subsequently, if it is decided to

hold it

for a

longer period, then its

classification will have to be

changed accordingly and vice

versa.

�

Therefore,

investments are checked for

classification every time a balance

sheet is prepared and

presented

accordingly.

CURRENT

ASSETS

Current

Assets are

the receivables that are

expected to be received within

one year of the balance

sheet

date.

Debtors, closing stock & all

accrued incomes are the

examples of Current Assets because

these are

expected

to be received within one

accounting period from the

balance sheet date.

It is

important to note that

assets and liabilities are presented in

the balance sheet in the

order of

their

maturity i.e. assets / liabilities having

longer life are presented

first and assets / liabilities

having

shorter life are presented

later.

197

Table of Contents:

- Introduction to Financial Accounting

- Basic Concepts of Business: capital, profit, budget

- Cash Accounting and Accrual Accounting

- Business entity, Single and double entry book-keeping, Debit and Credit

- Rules of Debit and Credit for Assets, Liabilities, Income and Expenses

- flow of transactions, books of accounts, General Ledger balance

- Cash book and bank book, Accounting Period, Trial Balance and its limitations

- Profit & Loss account from trial balance, Receipt & Payment, Income & Expenditure and Profit & Loss account

- Assets and Liabilities, Balance Sheet from trial balance

- Sample Transactions of a Company

- Sample Accounts of a Company

- THE ACCOUNTING EQUATION

- types of vouchers, Carrying forward the balance of an account

- ILLUSTRATIONS: Ccarrying Forward of Balances

- Opening Stock, Closing Stock

- COST OF GOODS SOLD STATEMENT

- DEPRECIATION

- GROUPINGS OF FIXED ASSETS

- CAPITAL WORK IN PROGRESS 1

- CAPITAL WORK IN PROGRESS 2

- REVALUATION OF FIXED ASSETS

- Banking transactions, Bank reconciliation statements

- RECAP

- Accounting Examples with Solutions

- RECORDING OF PROVISION FOR BAD DEBTS

- SUBSIDIARY BOOKS

- A PERSON IS BOTH DEBTOR AND CREDITOR

- RECTIFICATION OF ERROR

- STANDARD FORMAT OF PROFIT & LOSS ACCOUNT

- STANDARD FORMAT OF BALANCE SHEET

- DIFFERENT BUSINESS ENTITIES: Commercial, Non-commercial organizations

- SOLE PROPRIETORSHIP

- Financial Statements Of Manufacturing Concern

- Financial Statements of Partnership firms

- INTEREST ON CAPITAL AND DRAWINGS

- DISADVANTAGES OF A PARTNERSHIP FIRM

- SHARE CAPITAL

- STATEMENT OF CHANGES IN EQUITY

- Financial Statements of Limited Companies

- Financial Statements of Limited Companies

- CASH FLOW STATEMENT 1

- CASH FLOW STATEMENT 2

- FINANCIAL STATEMENTS OF LISTED, QUOTED COMPANIES

- FINANCIAL STATEMENTS OF LISTED COMPANIES

- FINANCIAL STATEMENTS OF LISTED COMPANIES