|

A PERSON IS BOTH DEBTOR AND CREDITOR |

| << SUBSIDIARY BOOKS |

| RECTIFICATION OF ERROR >> |

Financial

Accounting (Mgt-101)

VU

Lesson-27

A

PERSON IS BOTH DEBTOR AND

CREDITOR

This

happens so many times in

business that a person is

both your debtor and

creditor. This means that

you

are

purchasing one thing from

him. So, you have to

pay him against that

purchase and at the same time

you

are

selling him another thing

for which he has to pay you.

For example, you purchase

item X from Mr. A for

Rs.

50,000 and sell him item Y

for Rs. 25,000. Now,

one way of settling the payable

and receivable is

that

you

can pay Mr. X 50,000

and ask him to pay

you Rs. 25,000. The

other and may be the wiser

method is that

you

pay him Rs. 25,000

and both transactions are

settled. This is how such

transactions are handled in

real

life.

JOURNAL

ENTRIES

�

Normally

where no control accounts

are maintained, following entries

will be recorded:

Debit:

A (payable/creditor) account

25,000

Credit:

A

(receivable/debtor) account

25,000

This

will bring down the balance

of A (receivable/debtor) account to 0 and

that of A

o

(payable/creditor)

account to 25,000. The other

entry will be:

Debit:

A (payable/creditor) account

25,000

Credit:

Cash /

Bank

25,000

This

will settle the payable

account fully.

o

�

Where

control accounts are being maintained the

above two entries are

still recorded but with

slight

modification:

Debit:

Creditors Control account

25,000

Credit:

Debtors

Control account

25,000

�

At the

same time A's account in Creditor's

ledger is debited with 25,000

and Credited in

Debtors'

ledger with the same

amount.

Debit:

A (payable/creditor) account

25,000

Credit:

Cash /

Bank

25,000

�

This

entry comes from the creditor's column of

cash / bank book payment

side as usual.

BAD

DEBTS

Provision

does not affect debtors

account in simple books. It will,

therefore, have no effect either on

debtor

control

account or debtors

ledger.

At the time of

actual bad debt, the journal

entry

Debit

Provision

/ Bad Debts

Credit

Individual

Debtors Account

If

control account system is in

operation, the debit entry

will be same but the credit effect

will go to Debtors

control

account with a credit effect to

Individual Debtors Account in

Debtors Ledger.

Similar

treatment is given to discounts received

and allowed.

184

Financial

Accounting (Mgt-101)

VU

RECORDING

OF BAD DEBTS IN CONTROL

ACCOUNTS

To

record bad debts in control

accounts, following entries

are recorded:

� In

case no provision was

created for doubtful

debts:

Debit:

Bad

Debts

Credit:

Debtors

Control Account

�

In

case provision was created

for doubtful debts:

Debit:

Provision

for Doubtful Debts

Credit:

Debtors

Control Account

Recording

is also made in the respective

accounts of the debtor in subsidiary

ledger.

RECORDING

OF DISCOUNTS RECEIVED IN CONTROL

ACCOUNTS

To

record discount received in control

accounts, following entry is

recorded:

Debit:

Creditors

Control Account

Credit:

Discount

Received Account

Recording

is also made in respective

accounts of the creditors in subsidiary

ledger.

RECORDING

OF DISCOUNTS ALLOWED IN CONTROL

ACCOUNTS

To

record discount allowed in control

accounts, following entry is

recorded:

Debit:

Discount

Allowed Account

Credit:

Debtors

Control Account

Recording

is also made in the respective

account of the debtors in subsidiary

ledger.

ILLUSTRATION

# 1

Following

information is given from the books of

Mr. A(Debtor) for the month

of June, 2002. You

are

required to

prepare Debtors Control

Account and work out the

closing balance of debtors

control account

of Mr.

A.

Opening

Balance Dr.

85,500

Transactions

during the month:

Sales

for the month

90,000

Sales

return for the month

2,500

Payments

received

140,000

Discount

allowed

5,000

Bad

debts written off

4,000

185

Financial

Accounting (Mgt-101)

VU

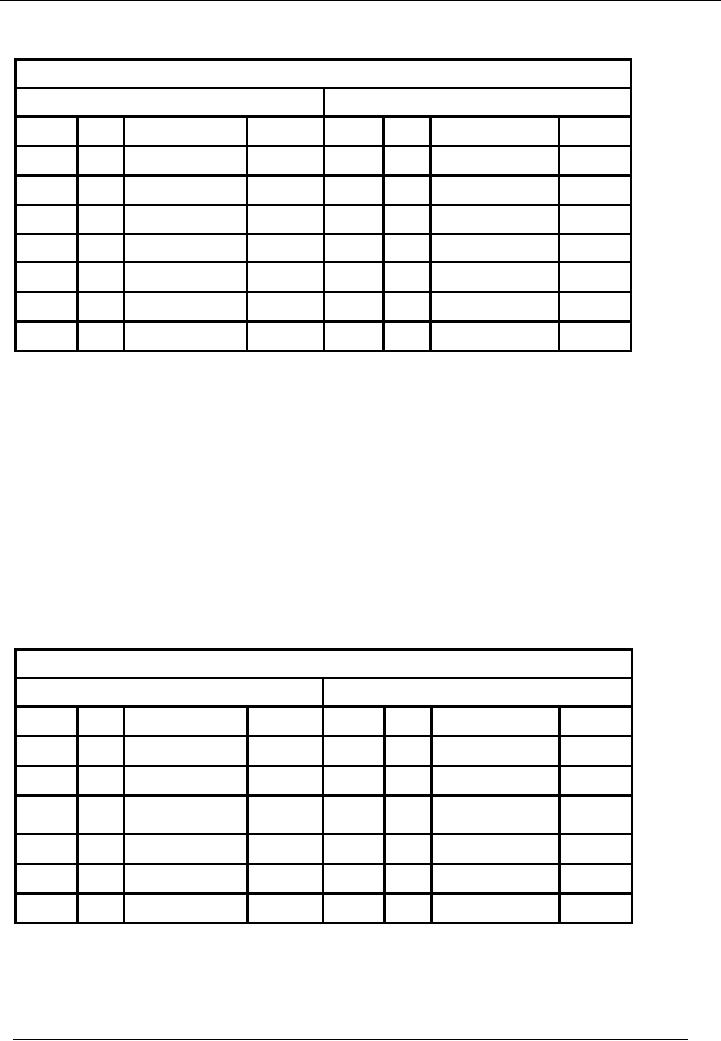

SOLUTION

Debtors

Control Account

Debit

Side

Credit

Side

Date

No.

Narration

Dr.

Rs.

Date

No.

Narration

Cr.

Rs.

Jun

01

Bal

B/F

85,500

Jun

Returns

2,500

Jun

Sales

90,000

Jun

Receipts

140,000

Jun

Discount

allowed

5,000

Bad

Debts

4,000

Jun

31

Bal

C/F

24,000

Total

175,500

Total

175,500

ILLUSTRATION

# 2

Following

information is given from the books of

Mr. B(Creditor) for the

month of June, 2002. You

are

required to

prepare Creditors Control Account

and work out the closing

balance of Creditors control

account

of Mr. B.

Opening

Balance

Cr.

65,000

Transactions

during the month:

Purchases

for the month

70,000

Purchases

return for the month

5,000

Payments

made

90,000

Discount

received

3,000

SOLUTION

Creditors

Control Account

Debit

Side

Credit

Side

Date

No.

Narration

Dr.

Rs.

Date

No.

Narration

Cr.

Rs.

Jun

Returns

5,000

Jun 01

Bal

B/F

65,000

Jun

Payments

90,000

Jun

Total

purchases

70,000

Jun

Discounts

3,000

received

Jun

31

Bal

C/F

37,000

Total

135,000

Total

135,000

ILLUSTRATION

# 3

186

Financial

Accounting (Mgt-101)

VU

The

financial year of Atif Brothers is closed

on June 30, 2002. You

are required to prepare Debtors

control

account

and Creditor control account

from the data given below:

Opening

balance

Debtors

150,000

Creditors

250,000

Sales

Cash

Note

1

180,000

Credit

260,000

Purchases

Cash

Note

1

120,000

Credit

200,000

Total

receipts

Note

2

350,000

Total

payments

Note

2

250,000

Discount

allowed

15,000

Discount

received

10,000

Bad

debts written off

25,000

Increase

in provision for doubtful

debts

Note

3

5,000

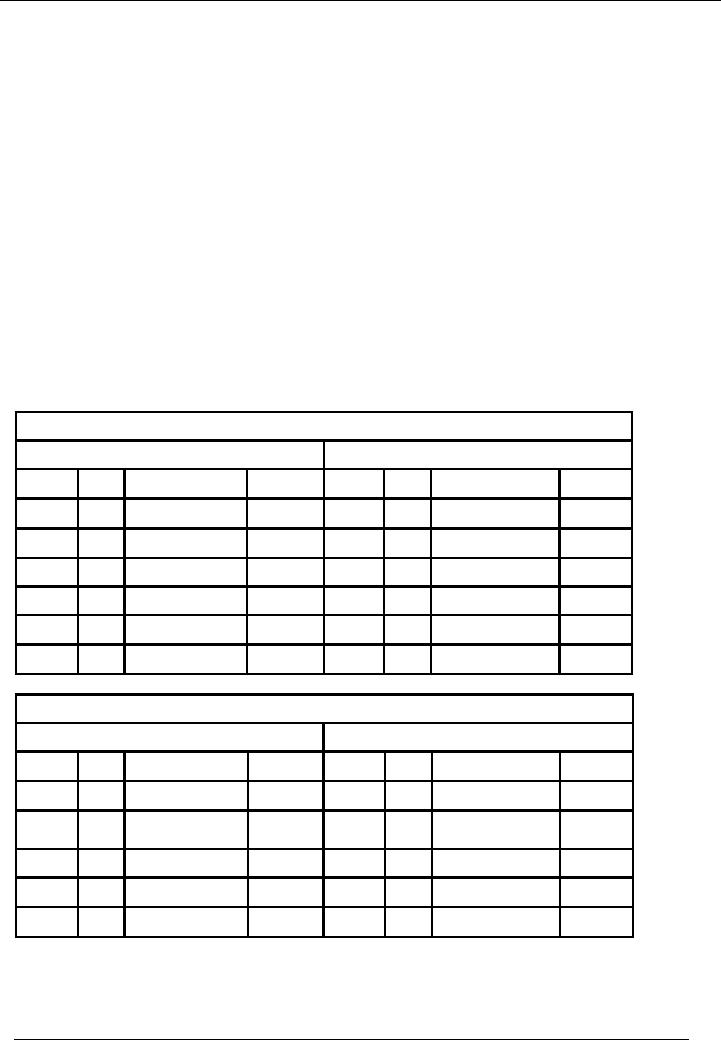

SOLUTION

Debtors

Control Account

Debit

Side

Credit

Side

Date

No.

Narration

Dr.

Rs.

Date

No.

Narration

Cr.

Rs.

Jun

01

Bal

B/F

150,000

Jun

Receipts(N2)

170,000

Jun

Sales(N1)

260,000

Jun

Discount

allowed

15,000

Bad

Debts

25,000

Jun

31

Bal

C/F

200,000

Total

410,000

Total

410,000

Creditors

Control Account

Debit

Side

Credit

Side

Date

No.

Narration

Dr.

Rs.

Date

No.

Narration

Cr.

Rs.

Jun

Payments

130,000

Jun 01

Bal

B/F

250,000

Jun

Discounts

10,000

Jun

Total

purchases

200,000

received

Jun

31

Bal

C/F

310,000

Total

450,000

Total

450,000

Notes to

the accounts

187

Financial

Accounting (Mgt-101)

VU

1.

In

control accounts, only cash

sales/purchases are dealt

with. Credit sales/purchases

are not

included in

control accounts,

2.

Receipts/Payments

include both cash and credit

receipts/payments. So, we enter the

figures in

control

accounts, after deducting cash

sales/purchases from total

receipts/payments. i. e.

Receipts

= 350,000 180,000 =

170,000

Payments

= 250,000 120,000 =

130,000

3.

Provision for doubtful debts

has no effect on control accounts.

So, any change in provision

will not

affect

actual bad debts.

BENEFITS

OF SUBSIDIARY LEDGERS

�

Subsidiary

ledgers contain the record of all

individuals Debtors and

Creditors.

�

Subsidiary

ledgers give information about the

main clients and slow

moving clients which

is

helpful

for the management in decision

making.

�

If the

business has distributors in

different areas, subsidiary

ledger gives information

about

sale

of different distributors in different

areas which are helpful

for the management in

decision

making.

188

Table of Contents:

- Introduction to Financial Accounting

- Basic Concepts of Business: capital, profit, budget

- Cash Accounting and Accrual Accounting

- Business entity, Single and double entry book-keeping, Debit and Credit

- Rules of Debit and Credit for Assets, Liabilities, Income and Expenses

- flow of transactions, books of accounts, General Ledger balance

- Cash book and bank book, Accounting Period, Trial Balance and its limitations

- Profit & Loss account from trial balance, Receipt & Payment, Income & Expenditure and Profit & Loss account

- Assets and Liabilities, Balance Sheet from trial balance

- Sample Transactions of a Company

- Sample Accounts of a Company

- THE ACCOUNTING EQUATION

- types of vouchers, Carrying forward the balance of an account

- ILLUSTRATIONS: Ccarrying Forward of Balances

- Opening Stock, Closing Stock

- COST OF GOODS SOLD STATEMENT

- DEPRECIATION

- GROUPINGS OF FIXED ASSETS

- CAPITAL WORK IN PROGRESS 1

- CAPITAL WORK IN PROGRESS 2

- REVALUATION OF FIXED ASSETS

- Banking transactions, Bank reconciliation statements

- RECAP

- Accounting Examples with Solutions

- RECORDING OF PROVISION FOR BAD DEBTS

- SUBSIDIARY BOOKS

- A PERSON IS BOTH DEBTOR AND CREDITOR

- RECTIFICATION OF ERROR

- STANDARD FORMAT OF PROFIT & LOSS ACCOUNT

- STANDARD FORMAT OF BALANCE SHEET

- DIFFERENT BUSINESS ENTITIES: Commercial, Non-commercial organizations

- SOLE PROPRIETORSHIP

- Financial Statements Of Manufacturing Concern

- Financial Statements of Partnership firms

- INTEREST ON CAPITAL AND DRAWINGS

- DISADVANTAGES OF A PARTNERSHIP FIRM

- SHARE CAPITAL

- STATEMENT OF CHANGES IN EQUITY

- Financial Statements of Limited Companies

- Financial Statements of Limited Companies

- CASH FLOW STATEMENT 1

- CASH FLOW STATEMENT 2

- FINANCIAL STATEMENTS OF LISTED, QUOTED COMPANIES

- FINANCIAL STATEMENTS OF LISTED COMPANIES

- FINANCIAL STATEMENTS OF LISTED COMPANIES