|

RECORDING OF PROVISION FOR BAD DEBTS |

| << Accounting Examples with Solutions |

| SUBSIDIARY BOOKS >> |

Financial

Accounting (Mgt-101)

VU

Lesson-25

RECORDING

OF PROVISION FOR BAD

DEBTS

�

Debit:

Provision

for Bad Debts (P&L)

Credit:

Provision

for Bad Debts

The

debit account is charged

against current years profit

and the credit head is shown as a

deduction from

debtors

in the balance sheet.

PRESENTATION

OF PROVISION FOR BAD

DEBTS

Extract

of P&L to show the

Provision

Profit

and Loss Account for the

year ended June 30,

20--

Gross

Profit

xxxxx

Less:

Admin Expenses

Provision

for bad debts

(5,000)

Extract

of Balance Sheet to show the

Provision

Current

Assets

Debtors

100,000

Provision

for Bad Debts

(5,000)

95,000

BAD

DEBTS & PROVISION FOR

BAD DEBTS

When

the bad debt for which

provision is already made is confirmed,

following entry is

passed:

Debit:

Provision

for Bad Debts

Credit:

Debtors

As

expense has already been

charged, therefore, no affect is given to P&L at this

point.

Reducing

the provision

Debit:

Provision

for Bad Debts (Balance

Sheet)

Credit:

Provision

for Bad Debts (P&L)

Increasing

the provision

Debit:

Provision

for Bad Debts (P&L)

Credit:

Provision

for bad debts

166

Financial

Accounting (Mgt-101)

VU

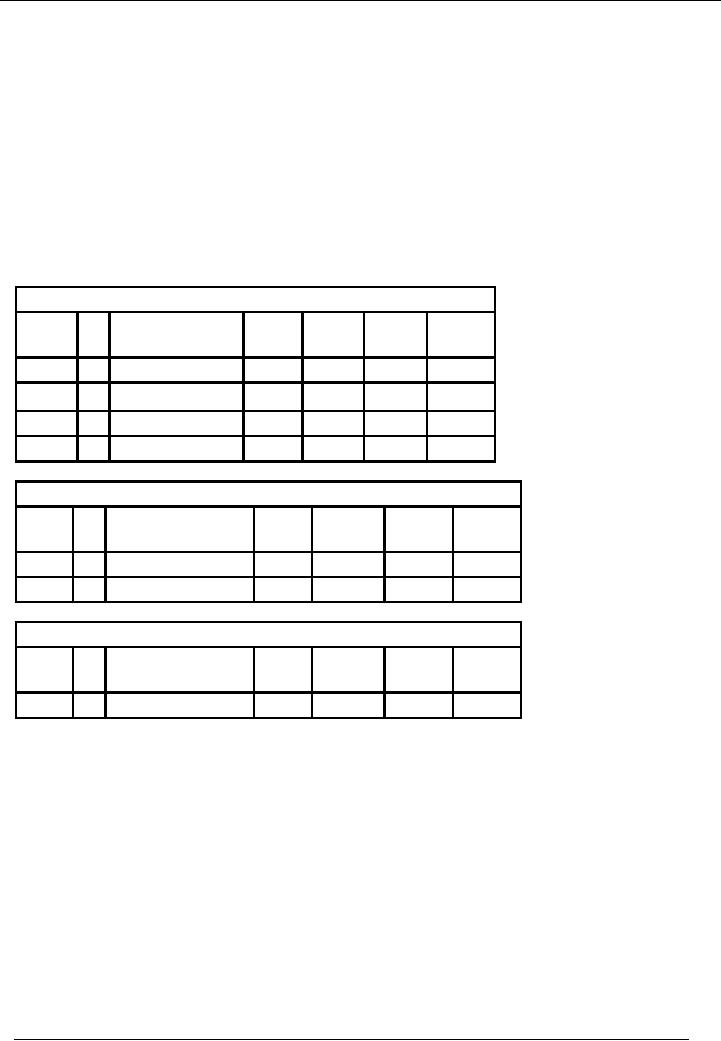

EXAMPLE

# 1

Following

information is available for A

Ltd. For the year ended

June 30, 2002.

� Bad

Debts During the year

November

1,100

January

640

April

120

� At the

year end total debtors

amounted to Rs. 68,000 out

which Rs. 2,200 is

considered to be

doubtful

/ bad.

Show

the relevant accounts and extracts

from Profit and Loss

and Balance Sheet.

SOLUTION

A

Ltd.

Bad Debts

Account

Account

Code --

Date

Vr.

Narration /

Ledger

DR.

CR.

Balance

2002

#

Particulars

Code

Amount

Amount Dr/(Cr)

Nov

01

Bad

Debts

1,100

1,100

Jan

Bad

Debts

640

1,740

Apr

Bad

Debts

120

1,860

June

30

Transfer to

P&L

1,860

0

A

Ltd.Provision for Bad and

Doubtful Debts(P & L)Account

Code --

Date

Vr.

Narration /

Ledger

DR.

CR.

Balance

2002

#

Particulars

Code

Amount

Amount

Dr/(Cr)

Jun

30

Provision

for the Year

2,200

2,200

Jun

30

Transfer to

P&L

2,200

0

A Ltd.

Provision for Bad and

Doubtful Debts (B/S)

Account

Code --

Date

Vr.

Narration /

Ledger

DR.

CR.

Balance

2002

#

Particulars

Code

Amount

Amount

Dr/(Cr)

Jun

30

Provision

for the Year

2,200

(2,200)

PRESENTATION

A

Ltd.

Profit and

Loss Account for the

year ended June 30,

2002

Gross

Profit

-------

Less:

Expenses

Bad

Debts

(1,860)

Provision

for bad debts

(2,200)

167

Financial

Accounting (Mgt-101)

VU

Extract

of Balance Sheet As On June

30, 2002.

Current

Assets

Debtors

68,000

Provision

for Bad Debts

(2,200)

65,800

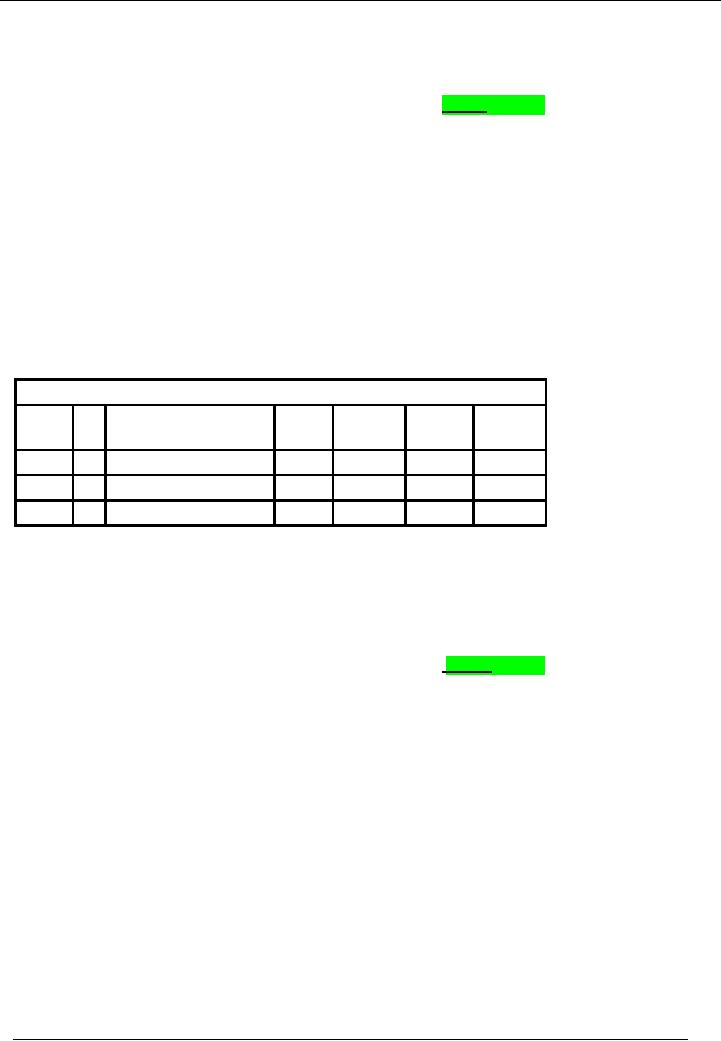

EXAMPLE

# 2

A

business creates a provision

for bad debts @ 5% of its

debtors on balance sheet

date.

� On

Jan 01, 2002 the balance of

Provision was 6,600.

� During

the year debts written off

amounted to Rs. 5,400.

� On

December 31, 2002, debtors

totaled Rs. 62,000.

� Show

Bad debts Account and

provision for bad debts

account.

SOLUTION

Required

closing balance of

Provision

62000

x 5% = 3,100

Provision

for Bad and Doubtful Debts

Account (B/S)

Account

Code --

Date

Vr.

Narration /

Ledger

DR.

CR.

Balance

2002

#

Particulars

Code

Amount

Amount

Dr/(Cr)

Jan

01

Opening

Balance

6,600

(6,600)

Bad

Debts

5,400

(1,200)

Dec

31

Provision

for bad debts

1,900

(3,100)

PRESENTATION

Extract

of Balance Sheet

Current

Assets

Debtors

62,000

Provision

for Bad Debts

(3,100)

58,900

CONTROL

ACCOUNTS

We

have studied about

Purchases, Sales, Debtors

and Creditors in our previous lectures.

We have also

studied

that trial balance works as a

check of mathematical accuracy of the

book keeping. If the trial

balance

is not

balanced, then it indicates an

error in recording of transactions. To

detect this error one has to

go

through

all the transactions during the

year to detect the error. Now, if the

size of the business is small,

it

would

be easier to detect the difference. But

if the business is large, then it

becomes difficult to detect

the

difference. To

solve this problem, a system of checks is

devised so that the ledger

accounts are distributed

in

smaller

groups and a trial is

prepared for every

group.

Usually

with the growth of business, the number

of suppliers (creditors) and

customers (debtors) grow. So,

if

we open a

separate ledger account for

every creditor and debtor,

then the general ledger and

trial balance

would

become too voluminous to

manage. Therefore, in order to simplify

things, one ledger each

is

maintained

for Debtors and Creditors.

The Debtors Ledger is called

Total Debtors Ledger or Sales

Ledger

Control

Account (as

Credit sales are recorded in

this account). The Creditors Ledger is

called Total

Creditors

Ledger or Purchase

Ledger Control Account (as

Credit purchases are

recorded in this ledger).

In General

Ledger one account is kept

for all the Debtors, called

Debtors

Control Account, and

one for

Creditors,

called Creditors

Control Account.

168

Financial

Accounting (Mgt-101)

VU

The

principle on which control

accounts are based is simple

and is as follows:

� If the

opening balance of an account is

known, together with the total of

deductions and additions

entered

in the account, the closing balance

can be calculated.

� The

same method is applied to the whole

ledger, the total of opening

balances together with the

additions

and deductions during the

period should give the total of closing

balances.

� Therefore,

individual creditor's and debtor's

accounts are opened in the

total creditors' ledger

and

total

debtors ledger and their

summarized figures are

posted in the respective Control Accounts

in

the General

Ledger.

The

principle described above

can be illustrated as follows:

Take

the example of Total Debtors

Account:

� Total

of Opening Balances

Dr.

Rs.

200,000

� Add.

Total of Debit

entries

Rs.

650,000

850,000

�

Less

Total of Credit

entries

Rs.

(300,000)

650,000

The

balance of Debtors control

account in the general ledger should be

Rs. 650,000. If this is not

so, then

there

is an error in the procedure of recording,

which should be traced

out.

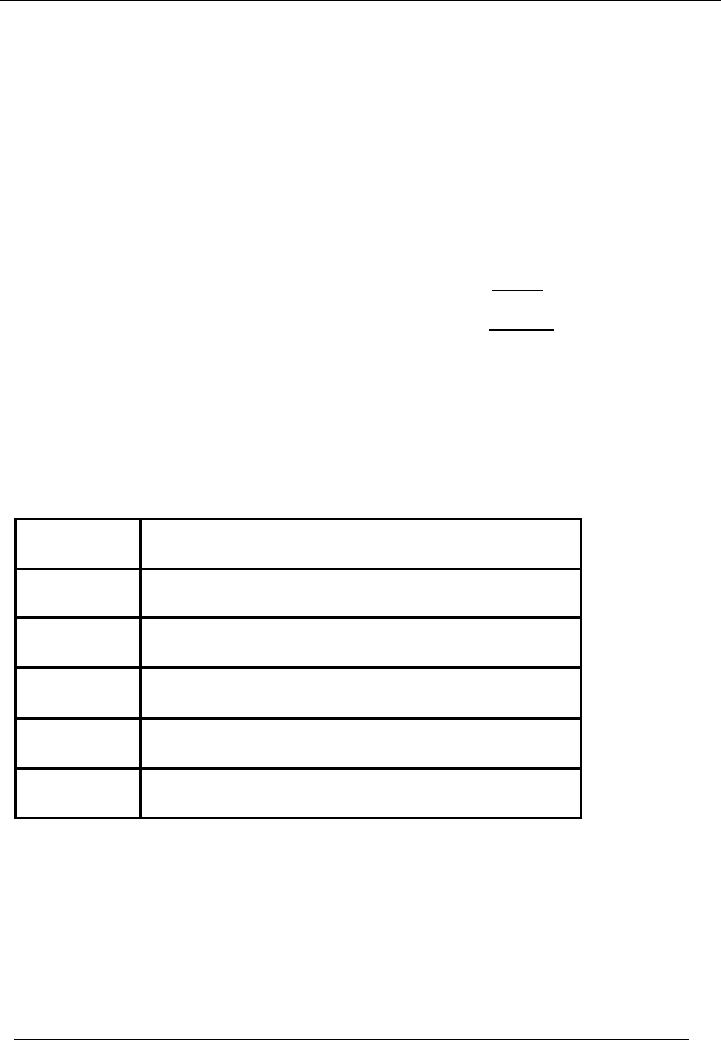

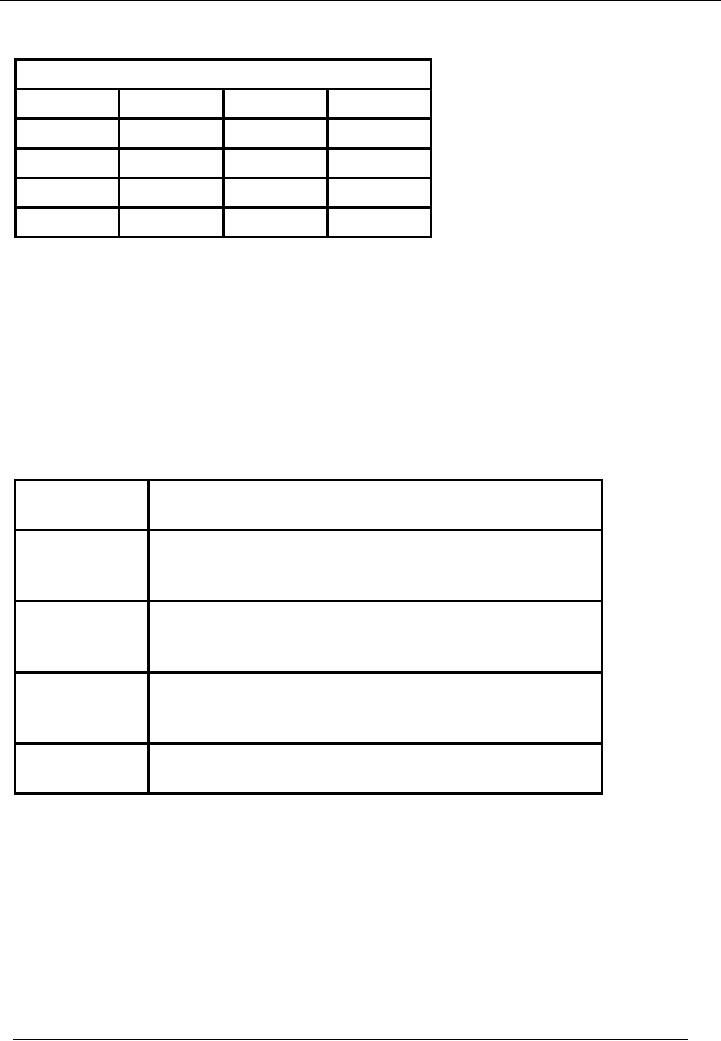

INFORMATION

FOR CONTROL ACCOUNTS

DEBTORS

In the

above illustration, we used

some information. Now we

will study the sources from

which the

information

is obtained.

Type

of

Source of Information

Information

Opening

balance List of debtors

balances drawn up to the end of previous

period.

of

debtors

Credit

Sales

A

separate book is maintained to record

individual transactions.

Totals

are drawn from this

book

Sales

Return

A

separate book is maintained to record

individual transactions.

Totals

are drawn from this

book

Cheques/Cash

List

of receipts is extracted from

cash and bank book.

Received

Closing

Balance

This

is the balancing figure that

can also be checked from the

list of

individual

balance of debtors.

169

Financial

Accounting (Mgt-101)

VU

Consider

the following data:

Sales

Journal

Date

Invoice

#

Name

Amount

Jan,

20--

A

10,000

Jan,

20--

B

12,500

Jan,

20--

C

15,000

Total

37,500

Total

of sales journal will be

recorded in the Debtors Control

Account through the following

entry:

Debit:

Debtors

Control Account

37,500

Credit:

Sales

Account

37,500

Note

that cash sales are not included in this

whole process. They are

directly recorded in the

general

ledger.

INFORMATION

FOR CONTROL ACCOUNTS

CREDITORS

The

information flow in case of

creditors is similar to debtors,

which is listed here:

Opening

balance of List of creditors

balances drawn up to the end of previous

period.

debtors

Credit

Purchases

A

separate book is (purchase

journal) is maintained to record

individual

transaction. Totals are drawn from this

book

Purchase

Return

A

separate book is (purchase

return journal) is maintained to

record

individual

transaction. Totals are drawn from this

book

Cheques/Cash

Paid List of payments is

extracted from cash and bank

book. Or a separate

column is

maintained in cash and bank books for

this purpose.

Closing

Balance

This is the

balancing figure that can

also be checked from the

list of

individual

balance of debtors.

170

Financial

Accounting (Mgt-101)

VU

Consider

the following data:

Purchase

Journal

Date

Invoice

#

Name

Amount

Jan,

20--

X

5,500

Jan,

20--

Y

9,000

Jan,

20--

Z

8,500

Total

23,000

Total

of purchase journal will be

recorded in the Creditors Control Account

through the following entry:

Debit:

Purchases

Account

23,500

Credit:

Creditors

Control Account

23,500

Note

that cash purchases are not

included in this whole process. They

are directly recorded in

the

general

ledger.

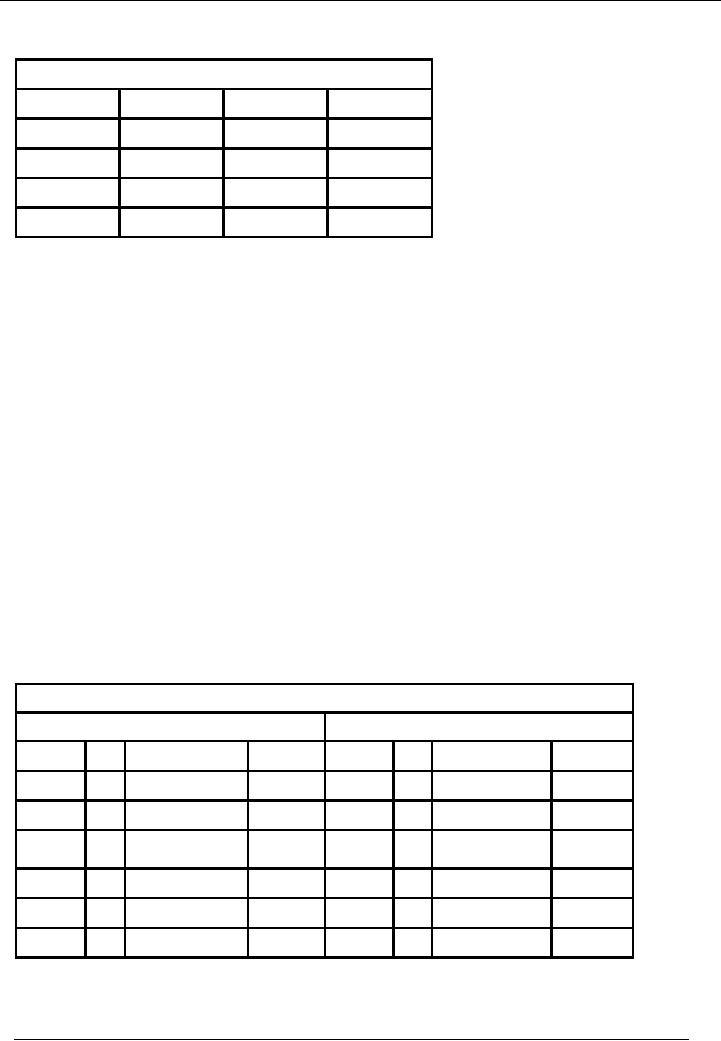

EXAMPLE

# 1

Prepare

a Creditors Control Account from the

following data and work

out the closing balance on

April 30,

of

creditors.

Apr.

1

Opening

Balance

44,500

Totals

for May:

Total

Credit Purchases

32,000

Purchase

Return

6,200

Cheques

and Cash paid

28,800

Discounts

received

2,500

SOLUTION

Creditors

Control Account

Account

Code --

Debit

Side

Credit

Side

Date

No.

Narration

Dr.

Rs.

Date

No.

Narration

Cr.

Rs.

April

30

Purchase

return

6,200

April 01

Balance

B/F

44,500

April

30

Payments

28,800

April 30

Total

Purchases

`32,000

April

30

Discounts

2,500

received

Balance

C/F

39,000

Total

76,500

Total

76,500

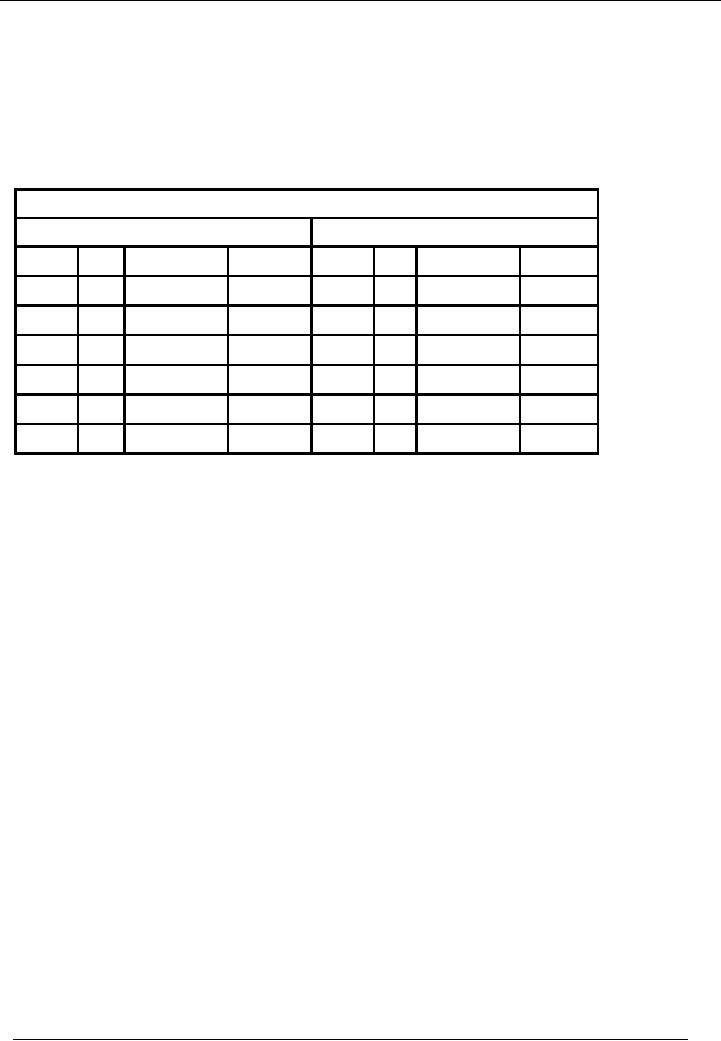

EXAMPLE

# 2

Prepare

a Debtors control Account

from the following data and

work out the closing balance

on May 31, of

debtors.

171

Financial

Accounting (Mgt-101)

VU

May 1

Opening Balance

70,000

Totals

for May

Total

Credit Sales (Sales

Journal)

26,000

Returns

Inward (Sales Inward

Journal)

3,400

Cheques

and Cash received

46,000

Discounts

allowed

3,700

SOLUTION

Debtors

Control Account

Account

Code --

Debit

Side

Credit

Side

Date

No.

Narration

Dr.

Rs.

Date

No.

Narration

Cr.

Rs.

May1

Bal

B/F

70,000

May31

Returns

3,400

May31

Total

sales

26,000

May31

Receipts

46,000

May31

Discounts

3,700

May31

Bal

C/F

42,900

Total

96,000

Total

96,000

172

Table of Contents:

- Introduction to Financial Accounting

- Basic Concepts of Business: capital, profit, budget

- Cash Accounting and Accrual Accounting

- Business entity, Single and double entry book-keeping, Debit and Credit

- Rules of Debit and Credit for Assets, Liabilities, Income and Expenses

- flow of transactions, books of accounts, General Ledger balance

- Cash book and bank book, Accounting Period, Trial Balance and its limitations

- Profit & Loss account from trial balance, Receipt & Payment, Income & Expenditure and Profit & Loss account

- Assets and Liabilities, Balance Sheet from trial balance

- Sample Transactions of a Company

- Sample Accounts of a Company

- THE ACCOUNTING EQUATION

- types of vouchers, Carrying forward the balance of an account

- ILLUSTRATIONS: Ccarrying Forward of Balances

- Opening Stock, Closing Stock

- COST OF GOODS SOLD STATEMENT

- DEPRECIATION

- GROUPINGS OF FIXED ASSETS

- CAPITAL WORK IN PROGRESS 1

- CAPITAL WORK IN PROGRESS 2

- REVALUATION OF FIXED ASSETS

- Banking transactions, Bank reconciliation statements

- RECAP

- Accounting Examples with Solutions

- RECORDING OF PROVISION FOR BAD DEBTS

- SUBSIDIARY BOOKS

- A PERSON IS BOTH DEBTOR AND CREDITOR

- RECTIFICATION OF ERROR

- STANDARD FORMAT OF PROFIT & LOSS ACCOUNT

- STANDARD FORMAT OF BALANCE SHEET

- DIFFERENT BUSINESS ENTITIES: Commercial, Non-commercial organizations

- SOLE PROPRIETORSHIP

- Financial Statements Of Manufacturing Concern

- Financial Statements of Partnership firms

- INTEREST ON CAPITAL AND DRAWINGS

- DISADVANTAGES OF A PARTNERSHIP FIRM

- SHARE CAPITAL

- STATEMENT OF CHANGES IN EQUITY

- Financial Statements of Limited Companies

- Financial Statements of Limited Companies

- CASH FLOW STATEMENT 1

- CASH FLOW STATEMENT 2

- FINANCIAL STATEMENTS OF LISTED, QUOTED COMPANIES

- FINANCIAL STATEMENTS OF LISTED COMPANIES

- FINANCIAL STATEMENTS OF LISTED COMPANIES