|

Banking transactions, Bank reconciliation statements |

| << REVALUATION OF FIXED ASSETS |

| RECAP >> |

Financial

Accounting (Mgt-101)

VU

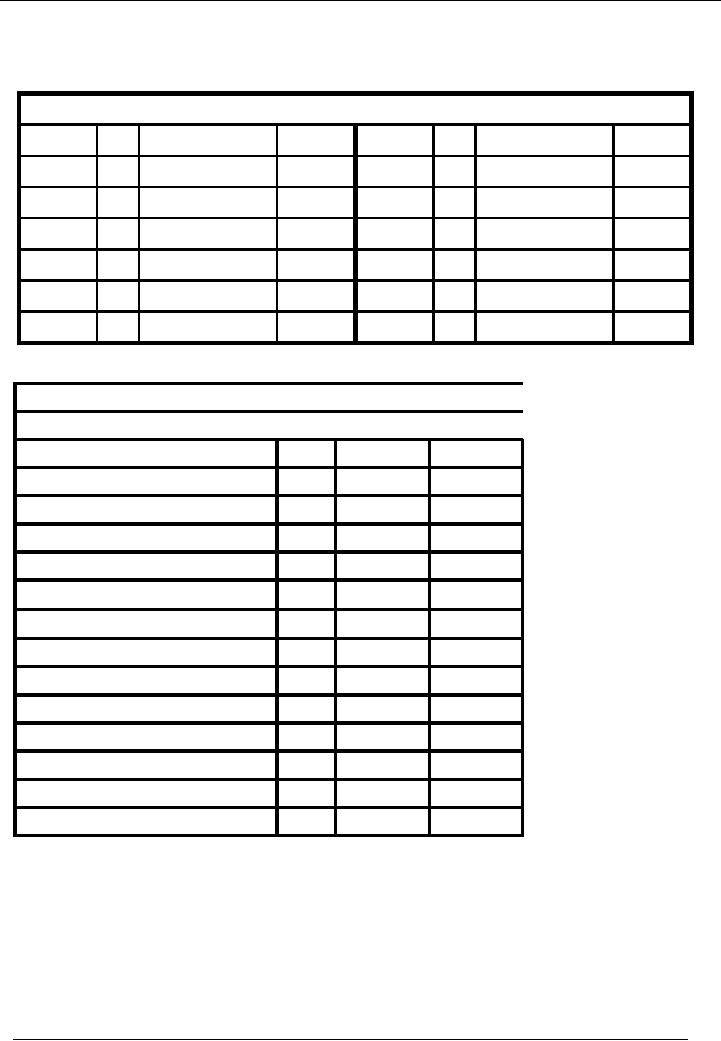

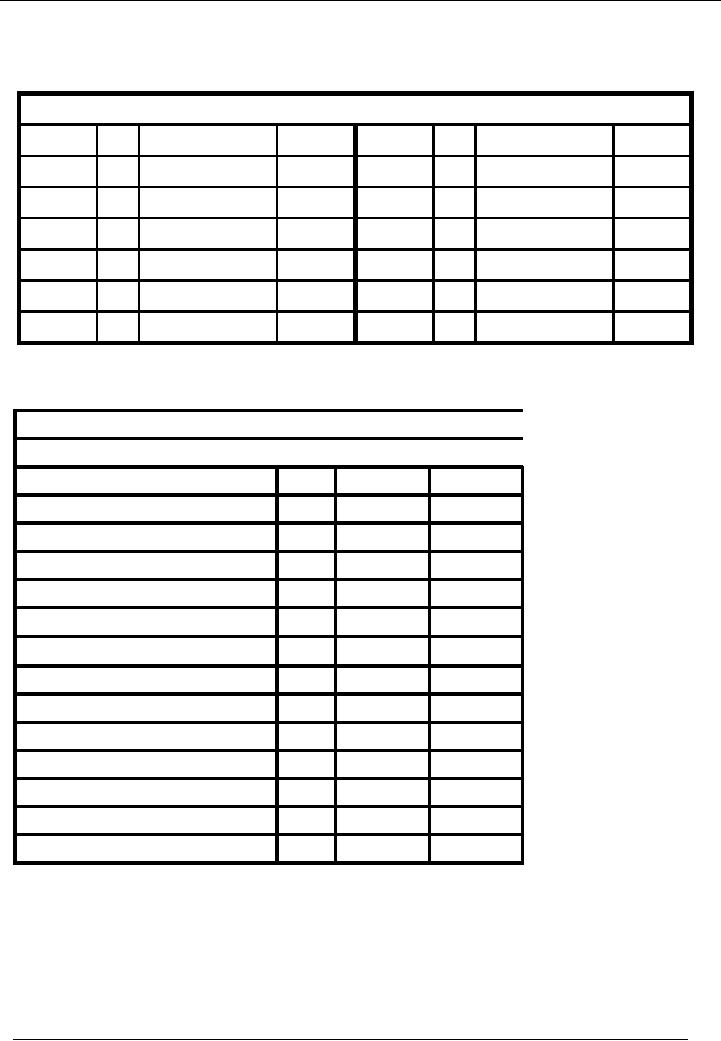

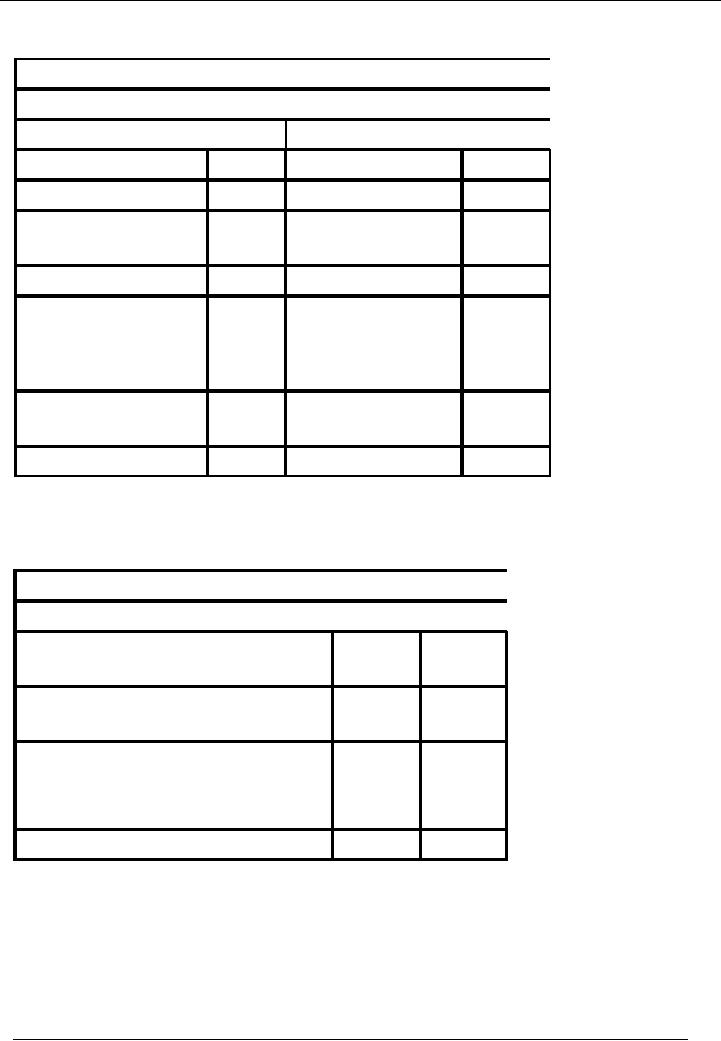

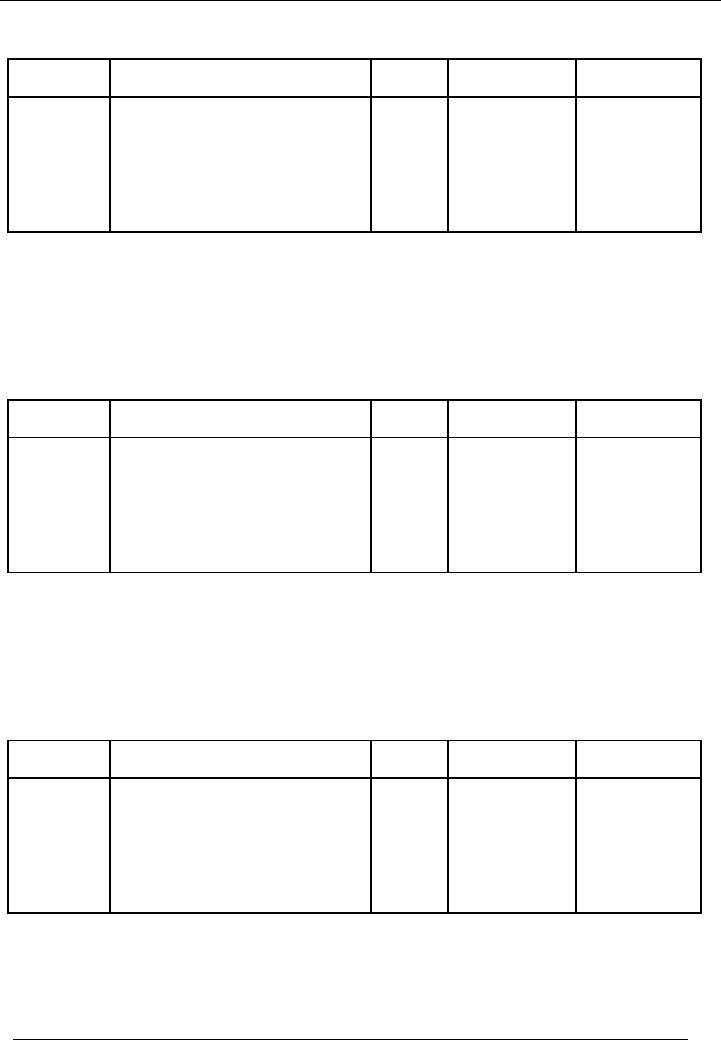

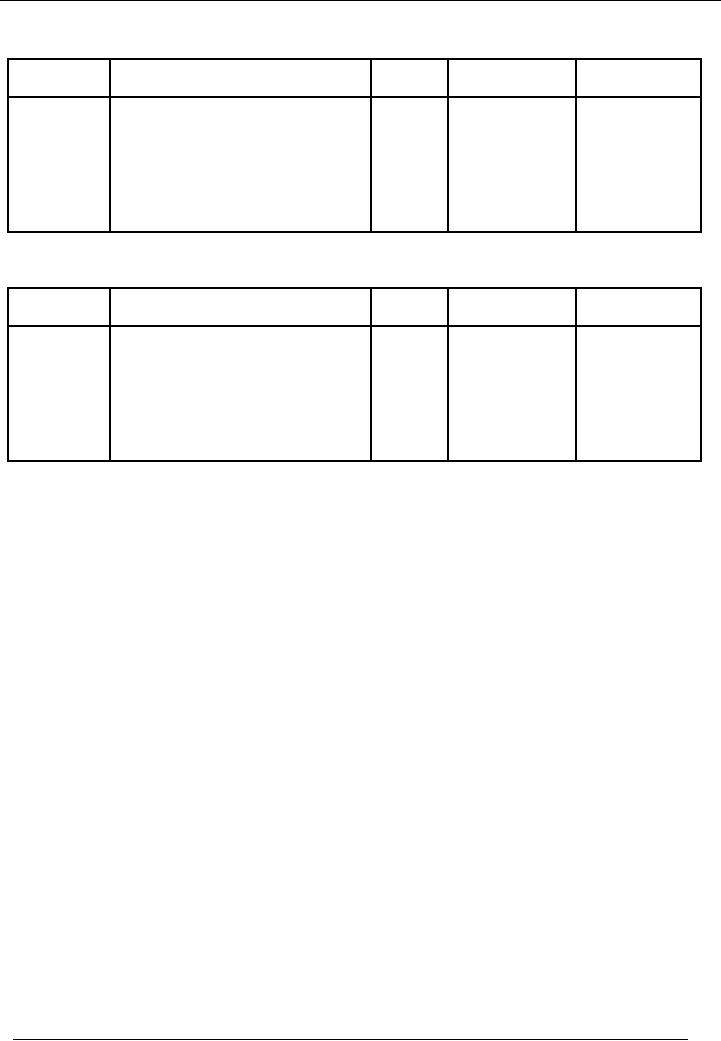

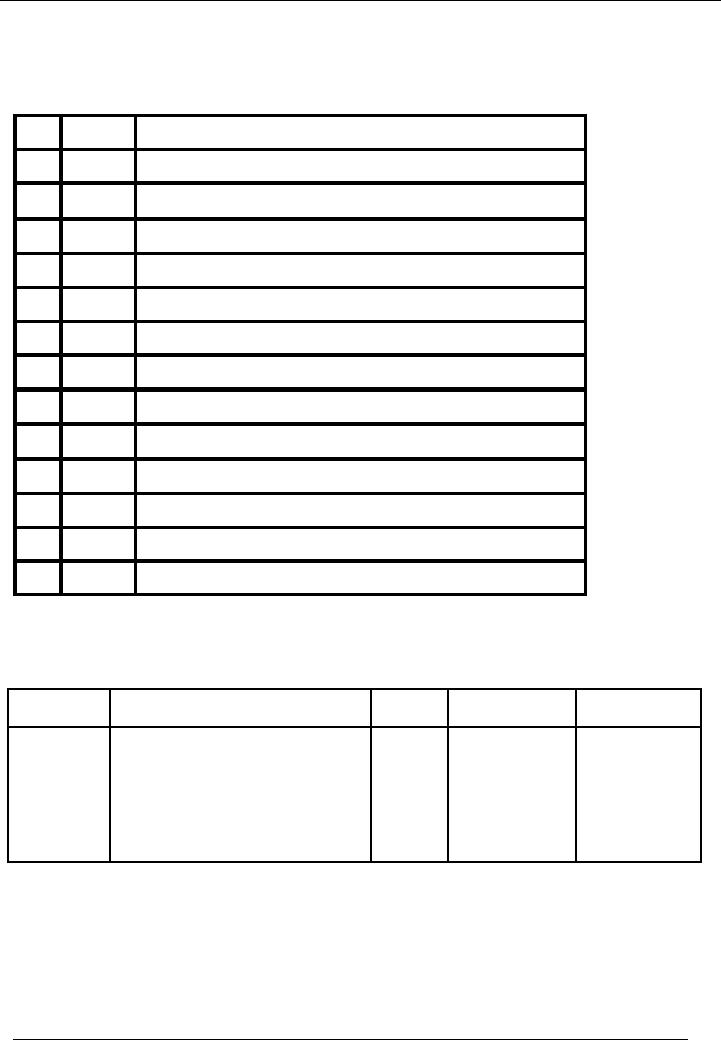

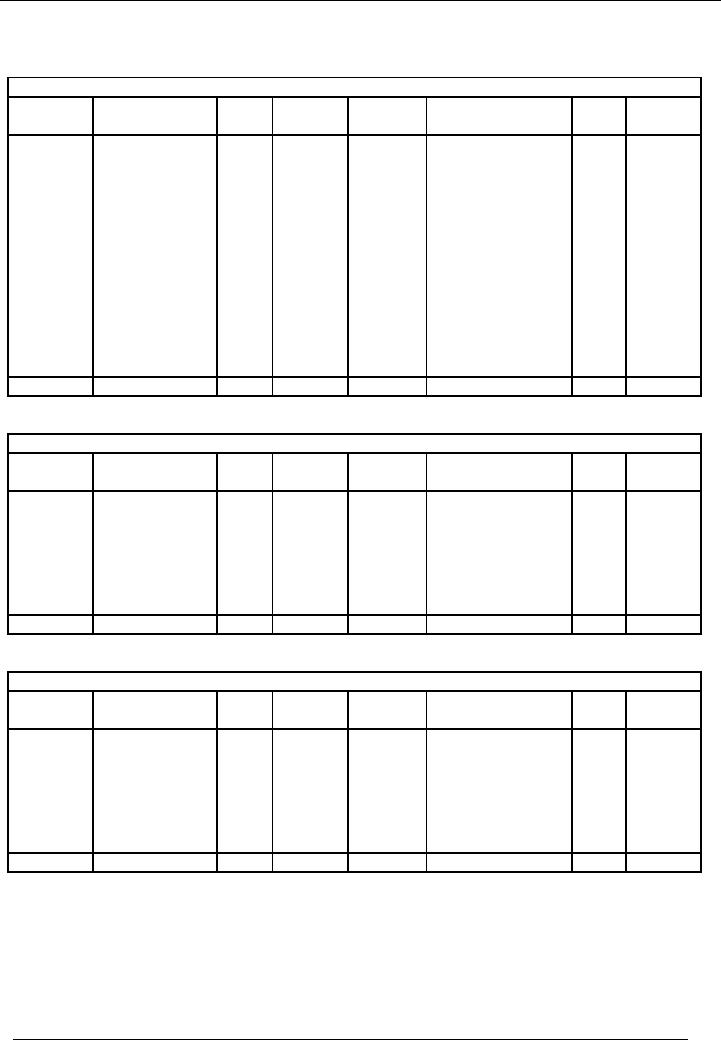

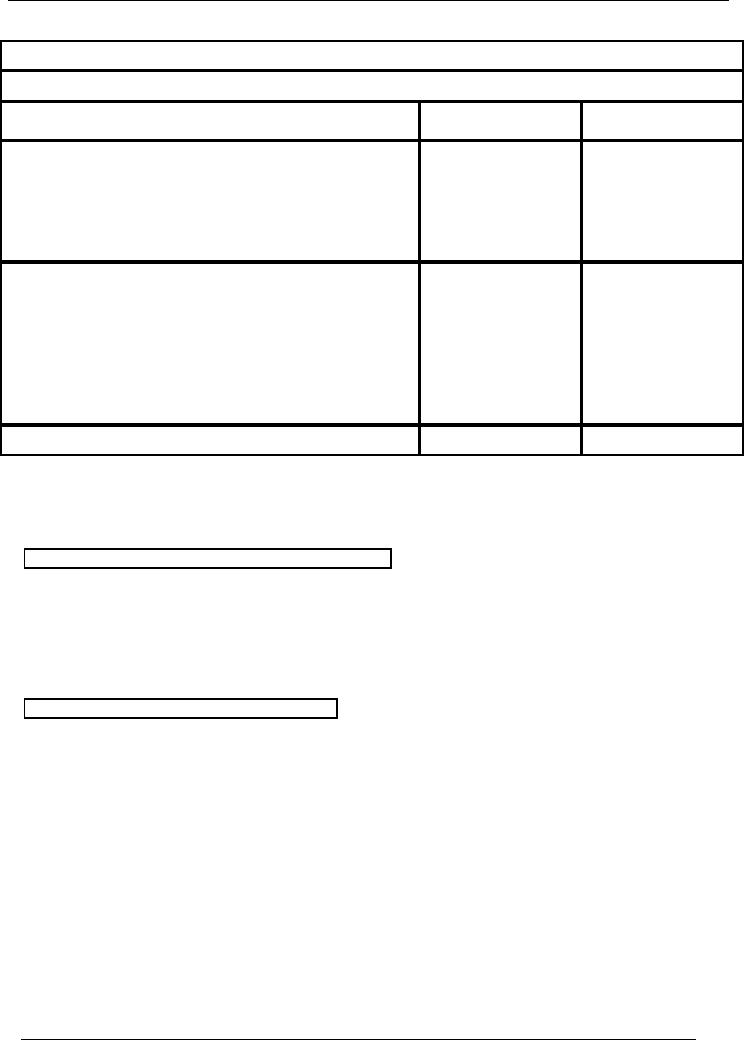

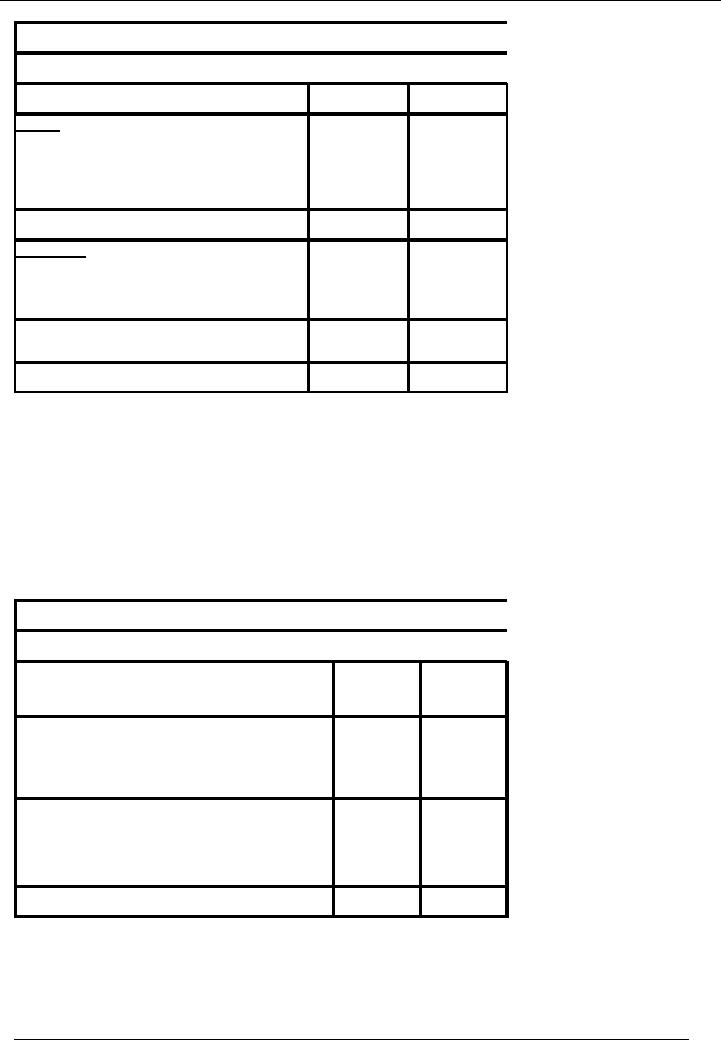

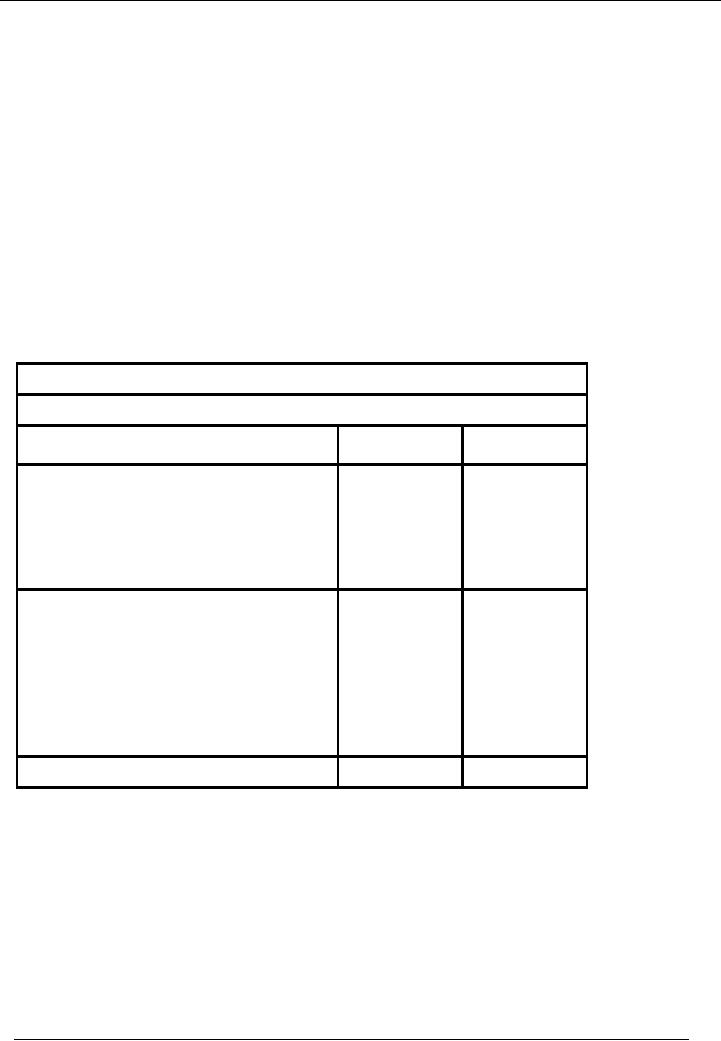

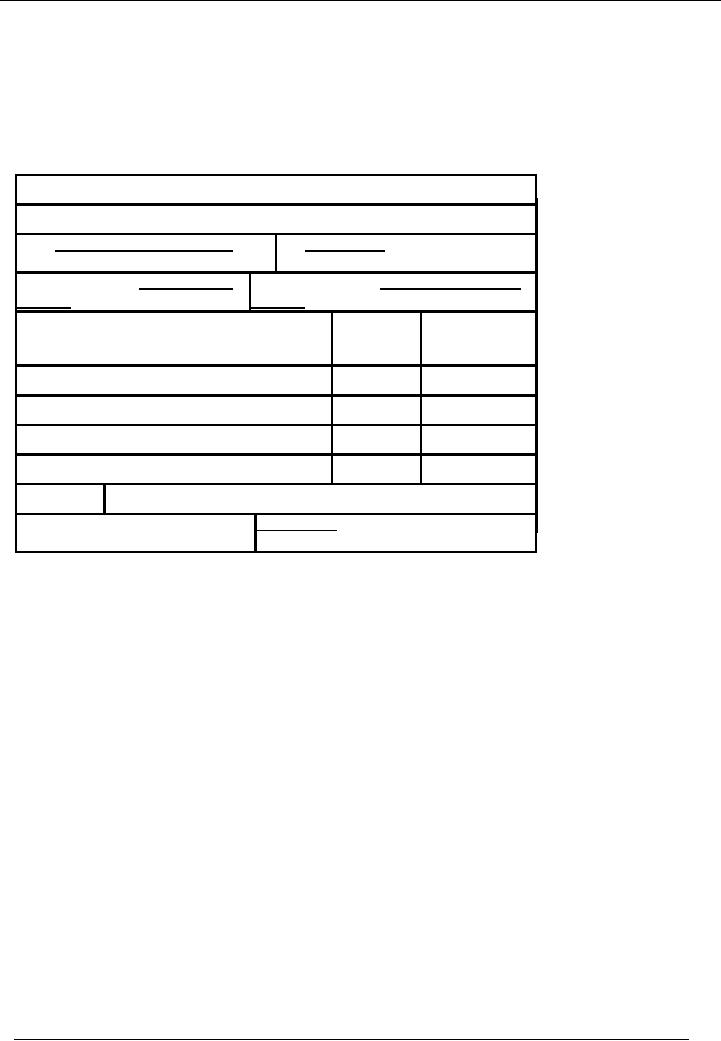

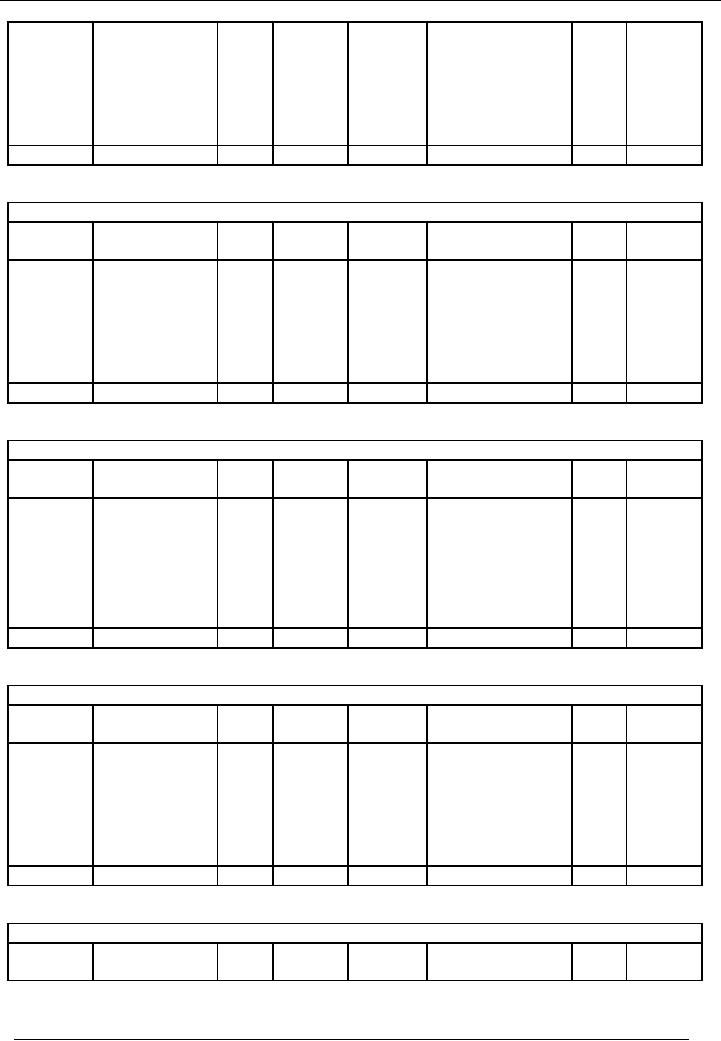

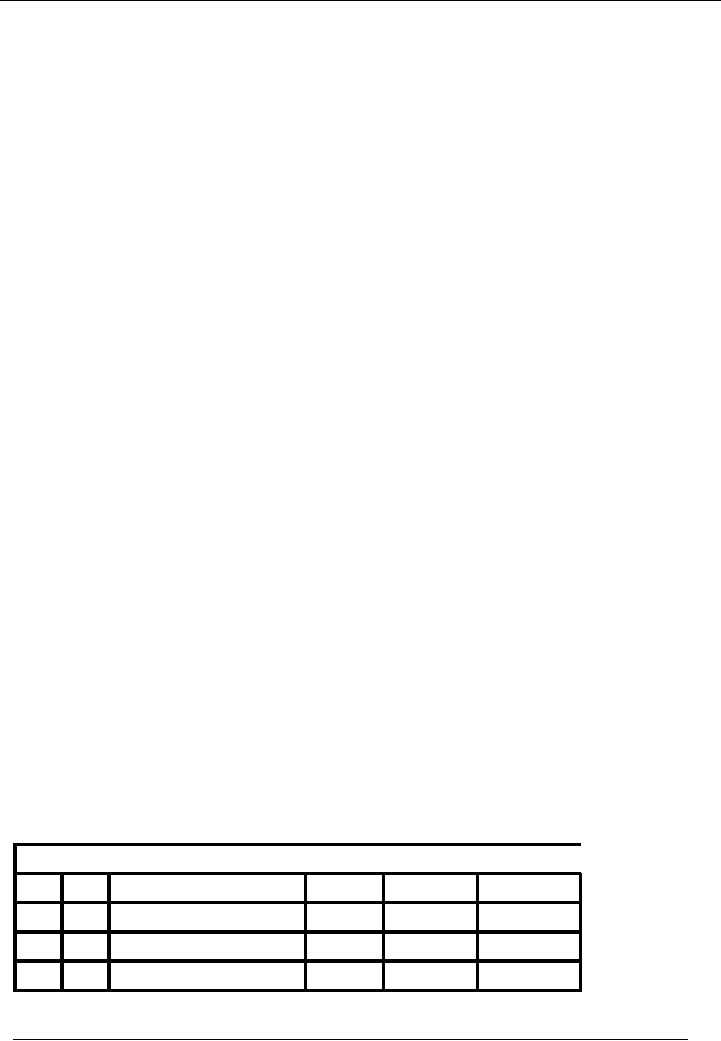

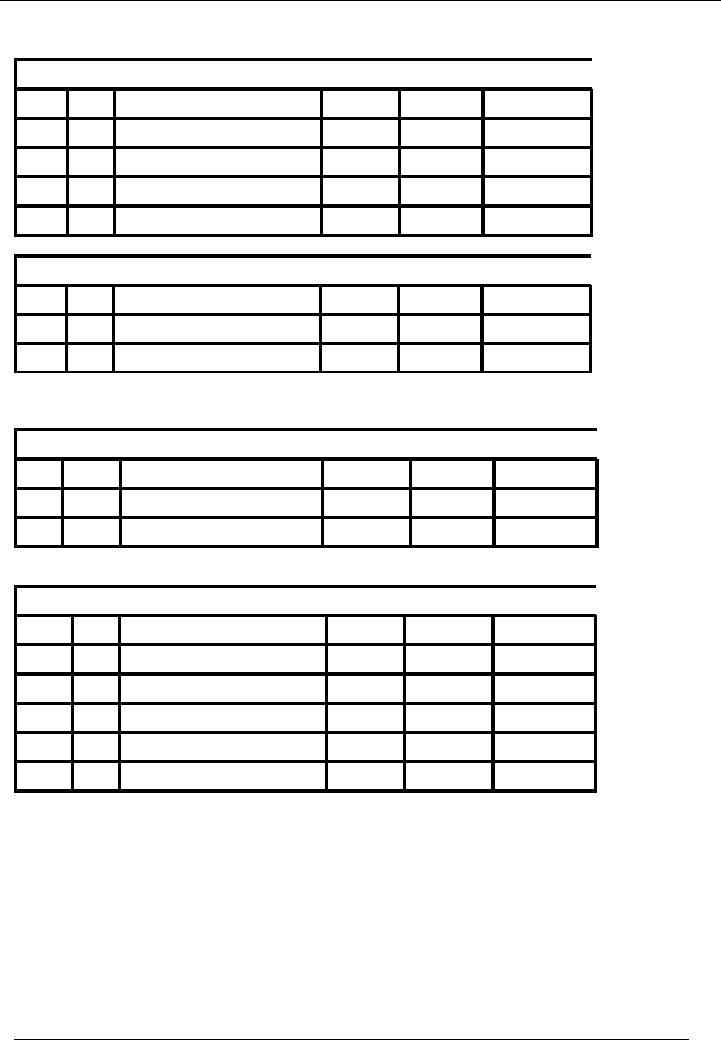

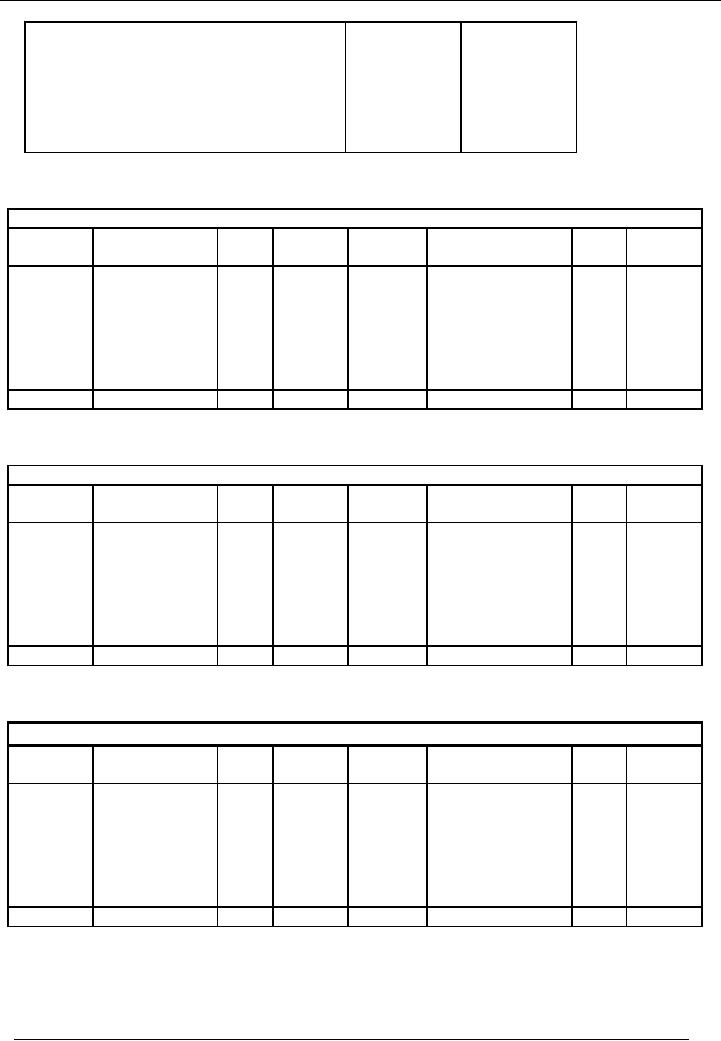

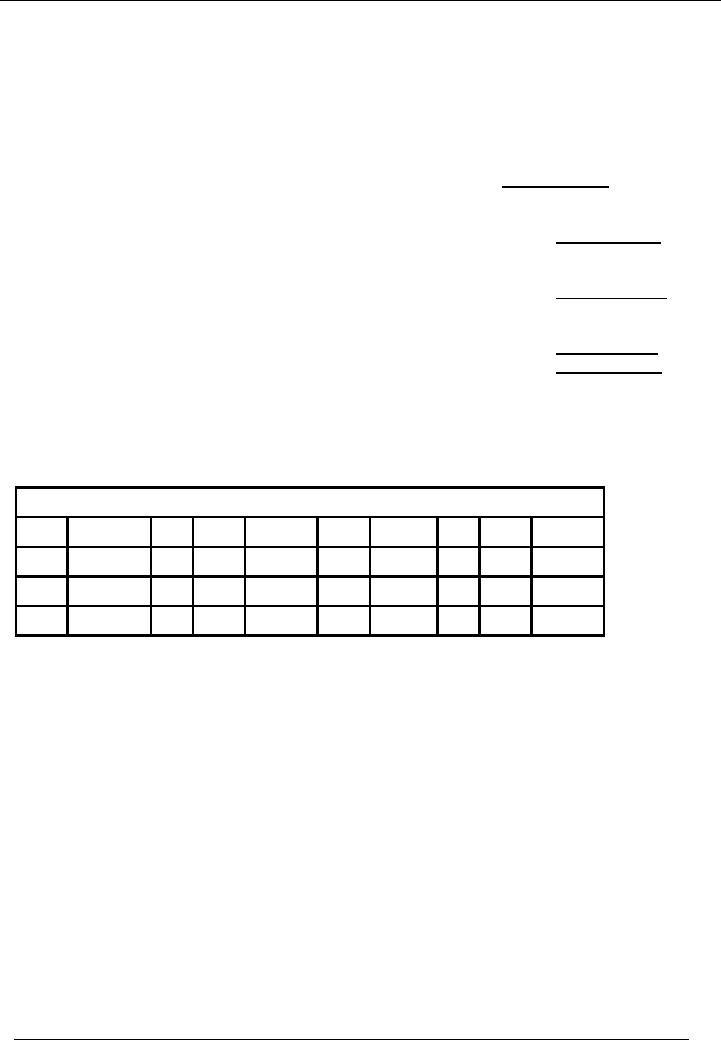

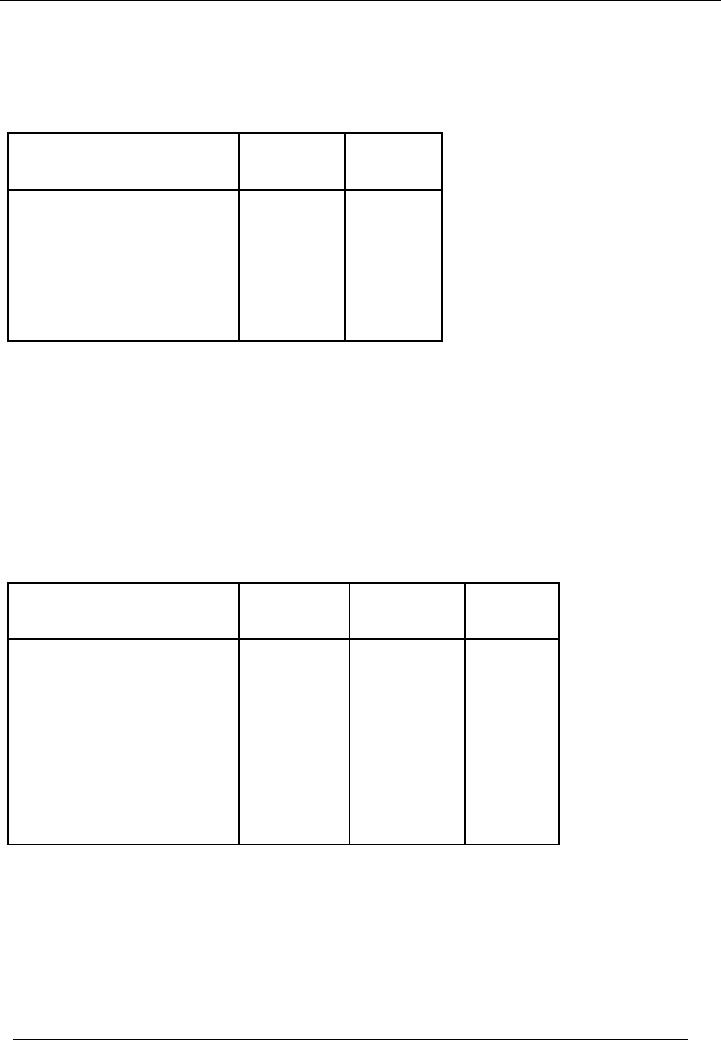

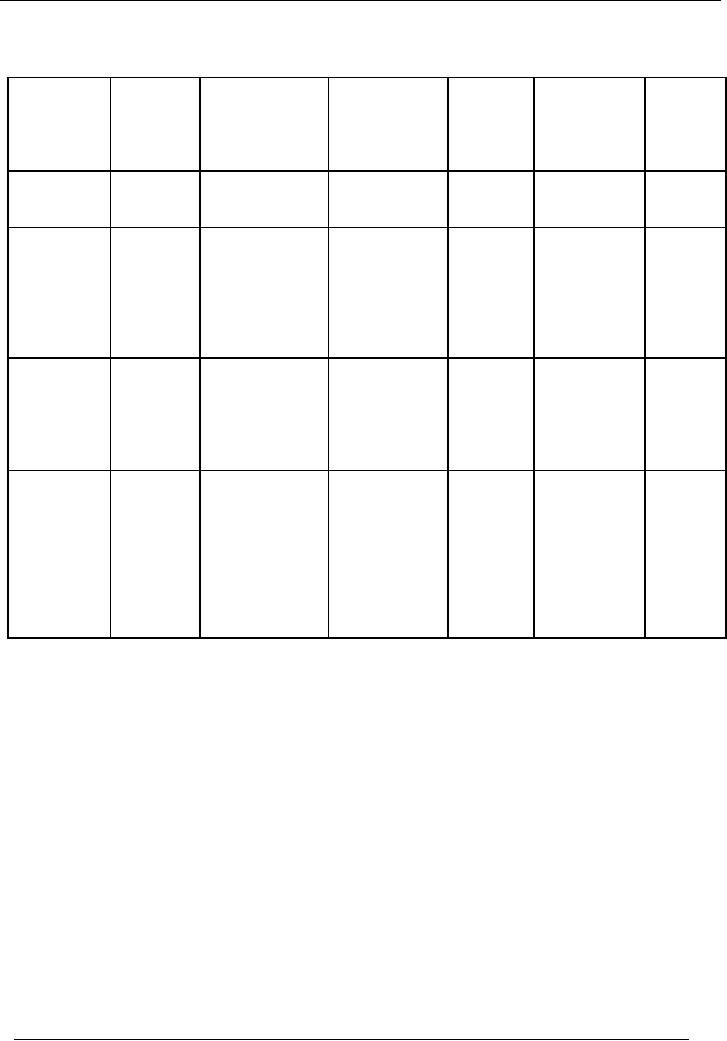

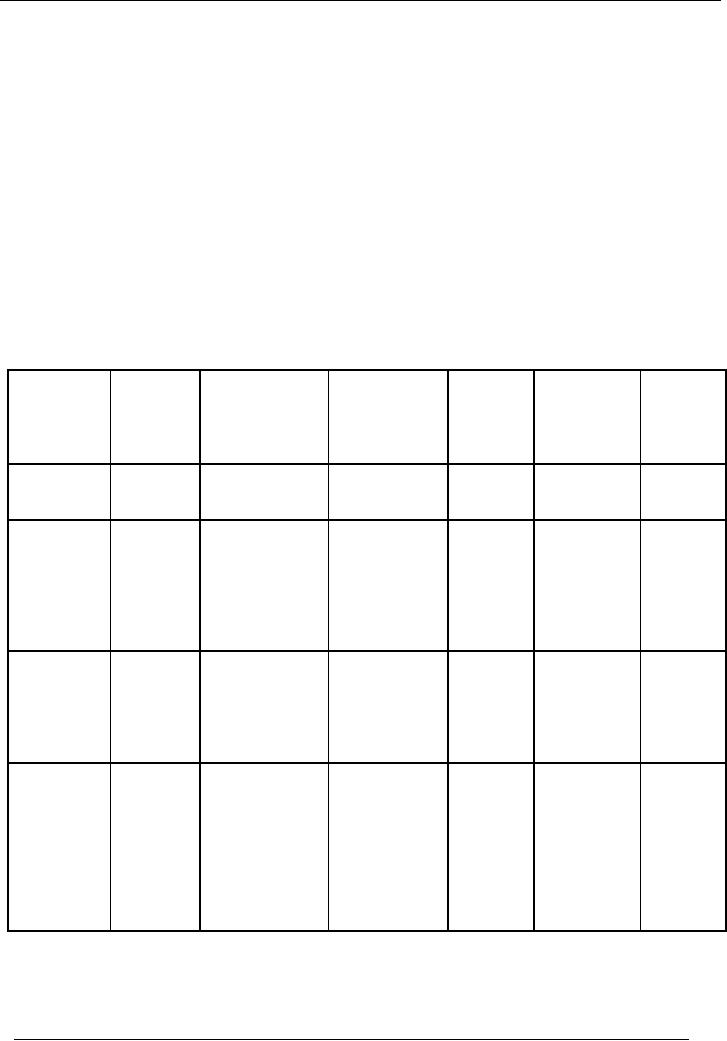

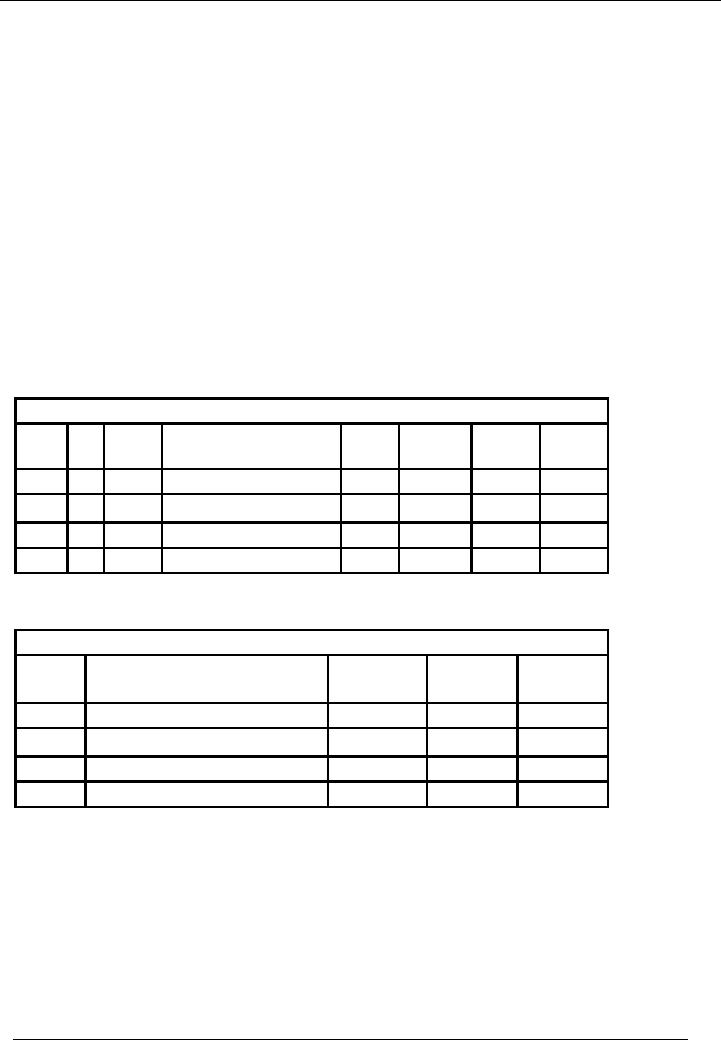

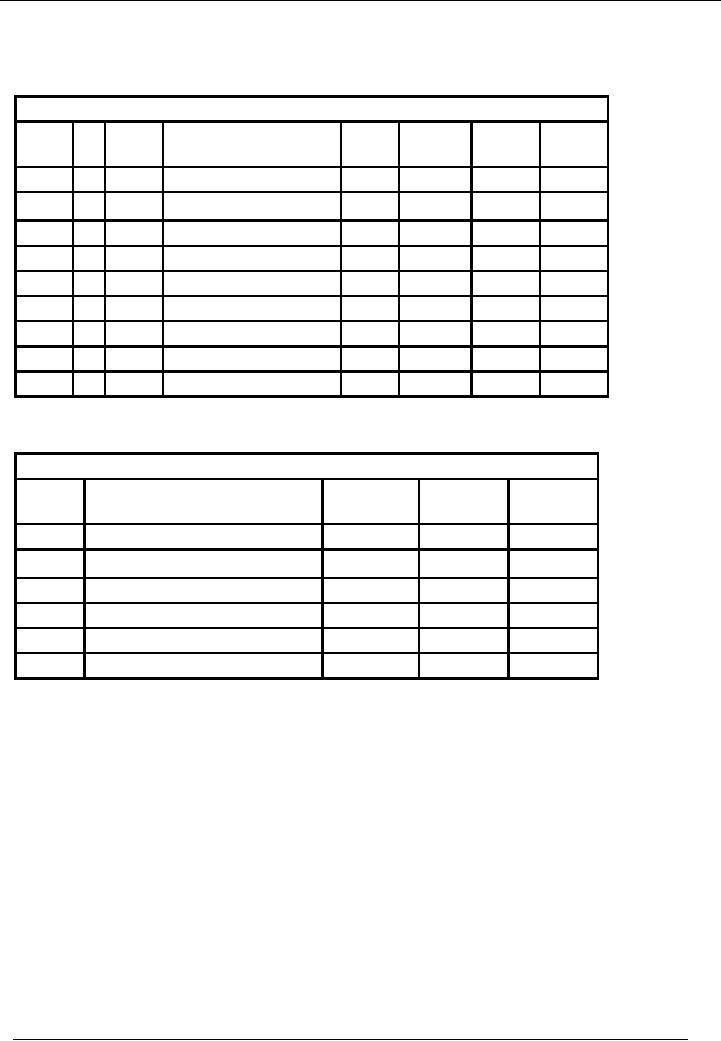

Vehicle

Account

Vehicle

Account

Code 05

Date

No.

Narration

Dr.

Rs.

Date

No.

Narration

Cr.

Rs.

03-01---

04 Furniture

purch.

50,000

0

50,000

Balance

50,000

50,000

50,000

Name

Of The Organization (Ali

Traders)

Trial

Balance As On ( January 31,

20--)

Title

of Account

Code

Dr.

Rs.

Cr.

Rs.

Cash

Account

01

35,000

Bank

Account

02

130,000

Capital

Account

03

200,000

Furniture

Account

04

15,000

Vehicle

Account

05

50,000

Total

54

Financial

Accounting (Mgt-101)

VU

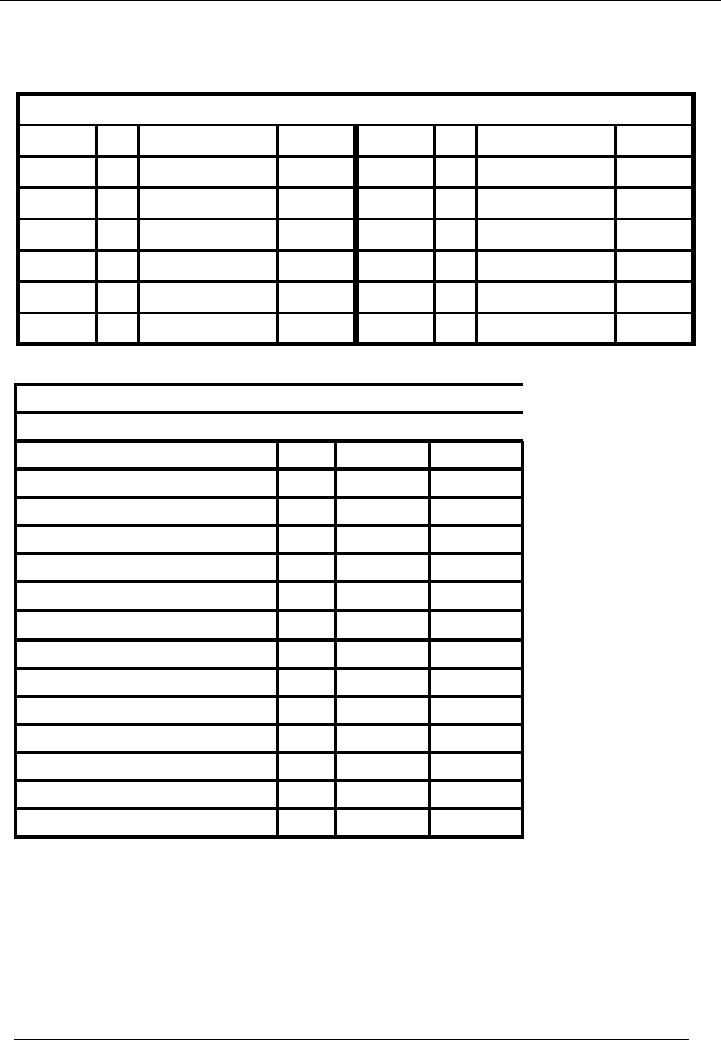

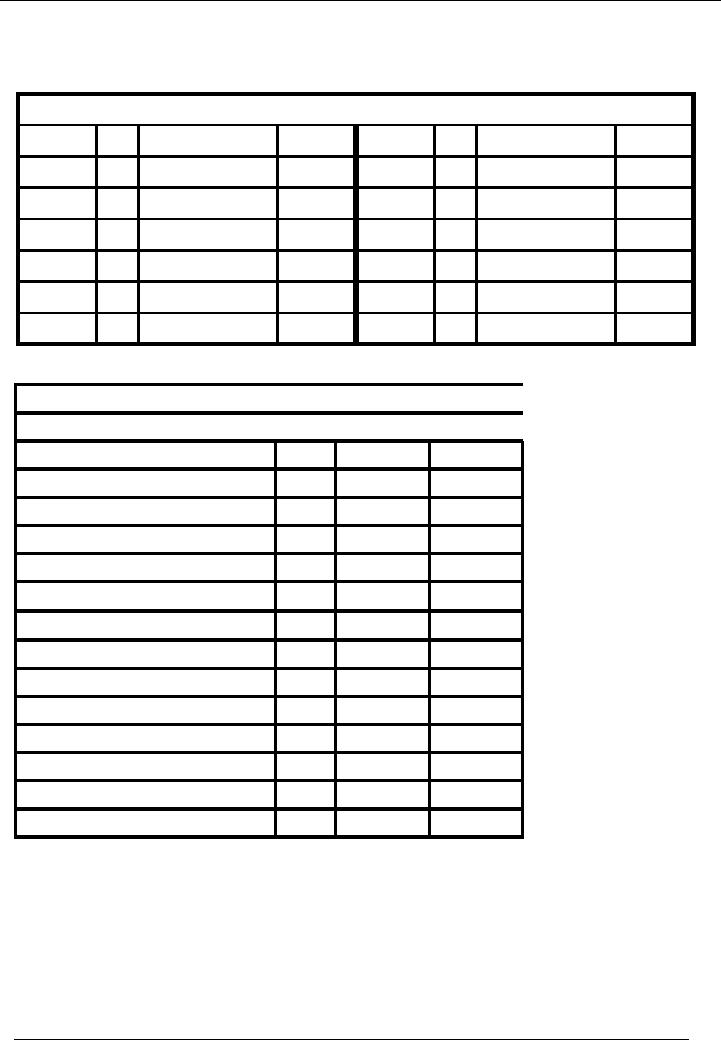

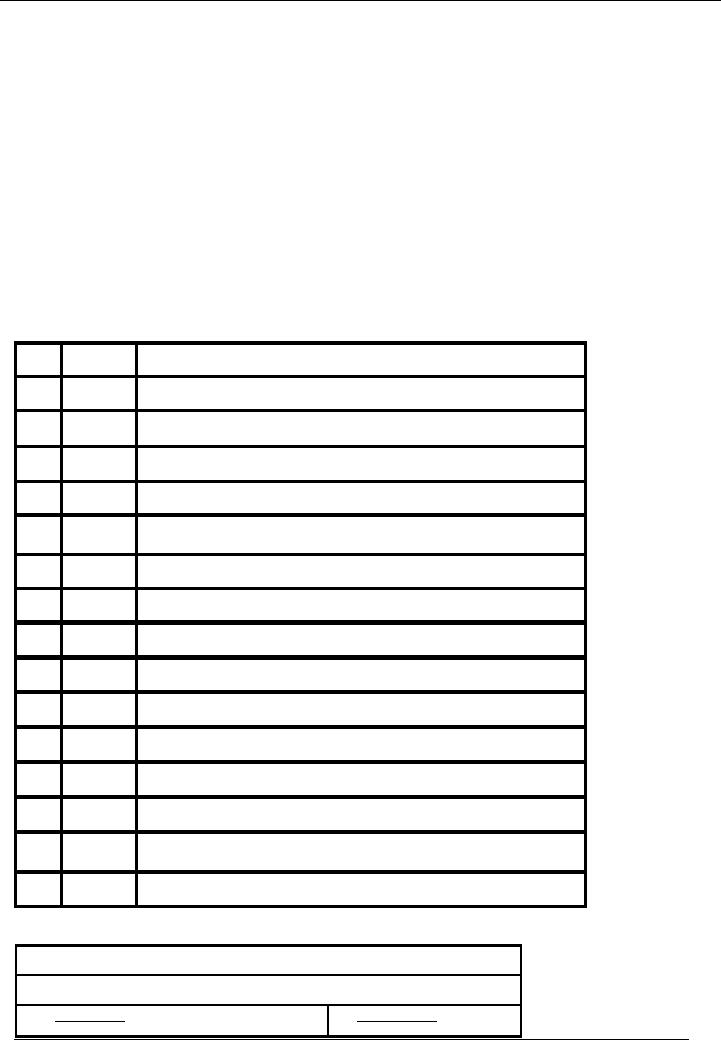

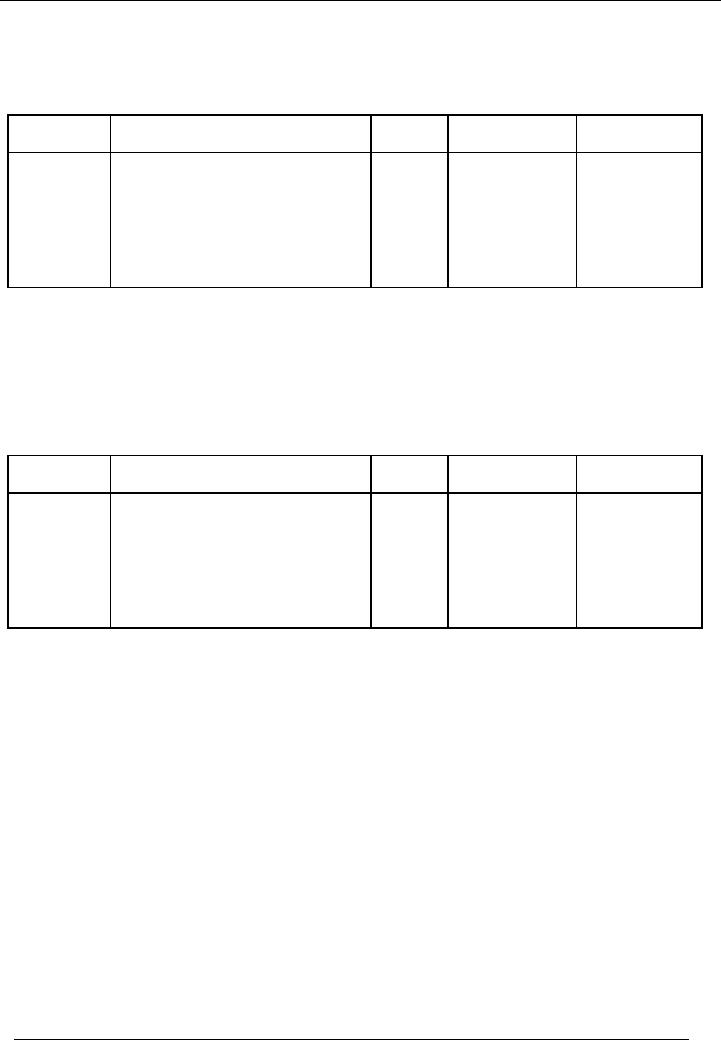

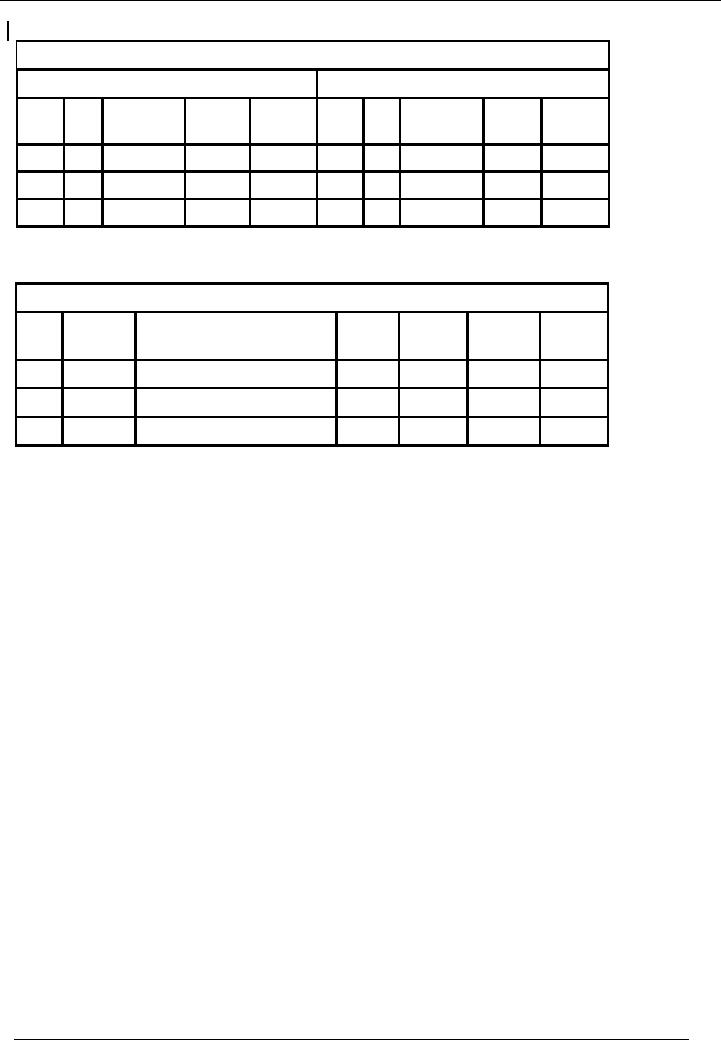

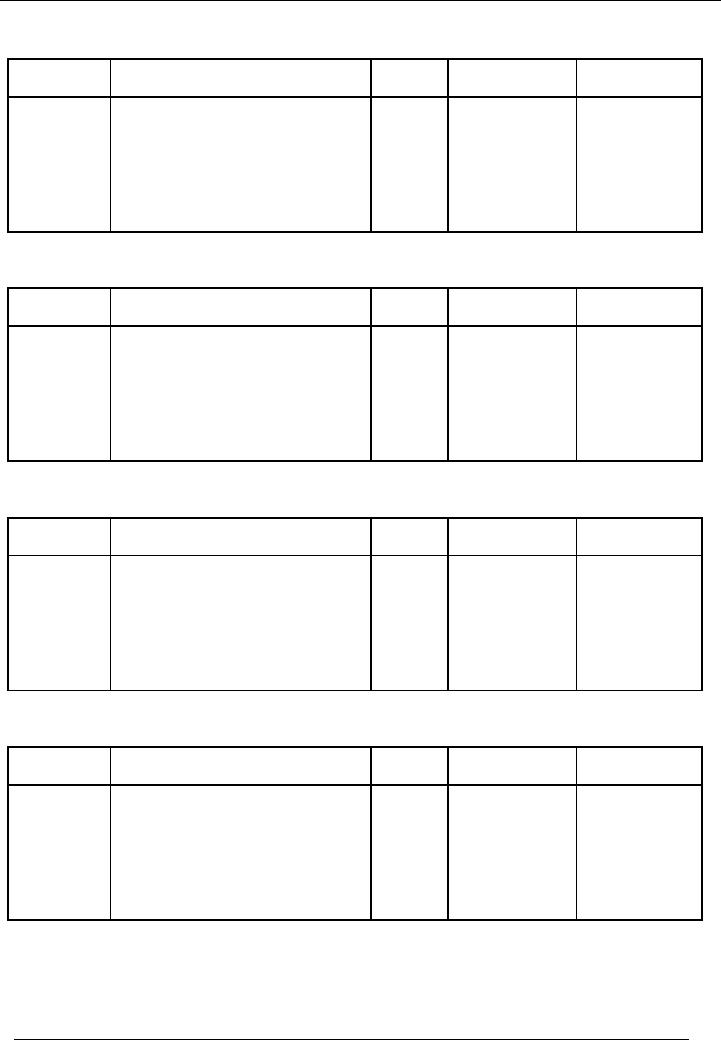

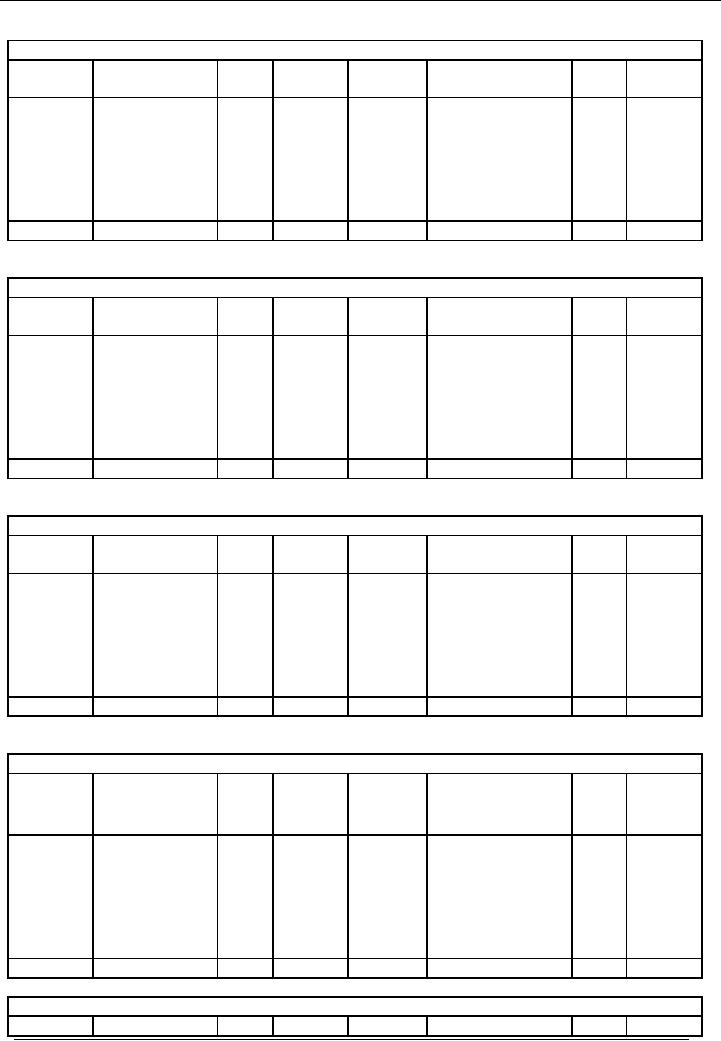

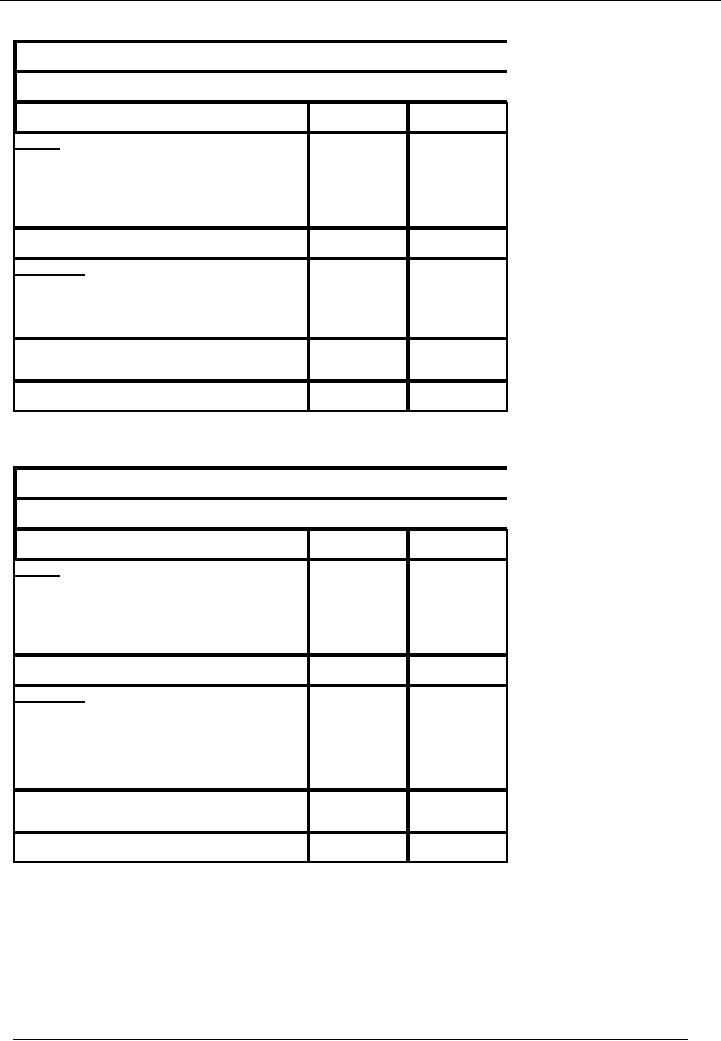

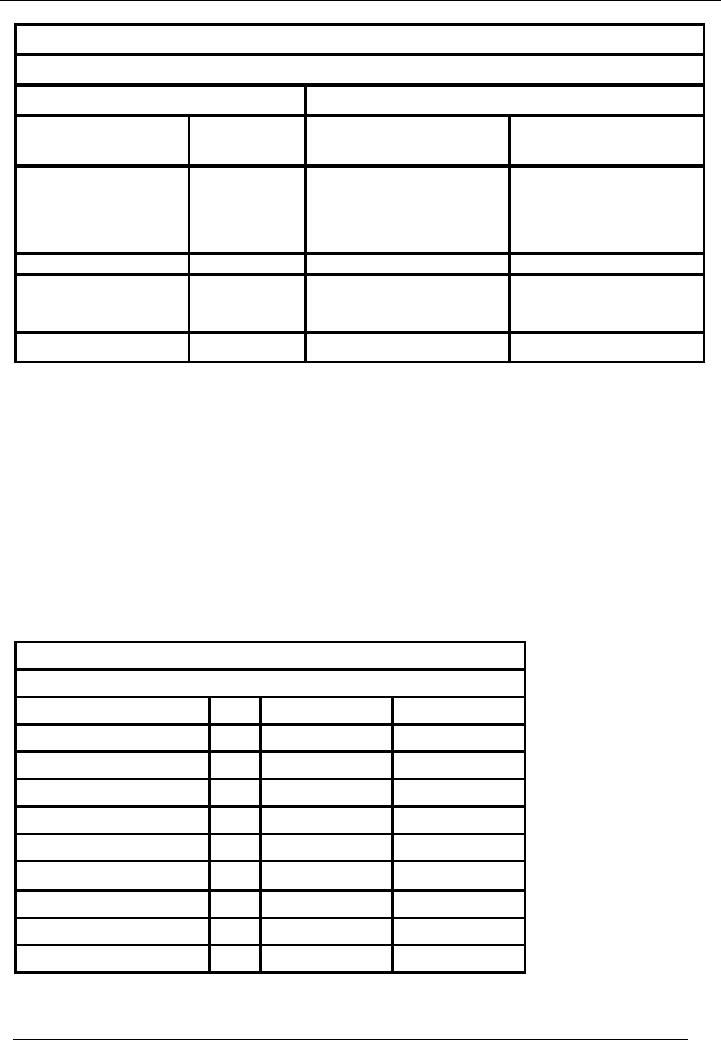

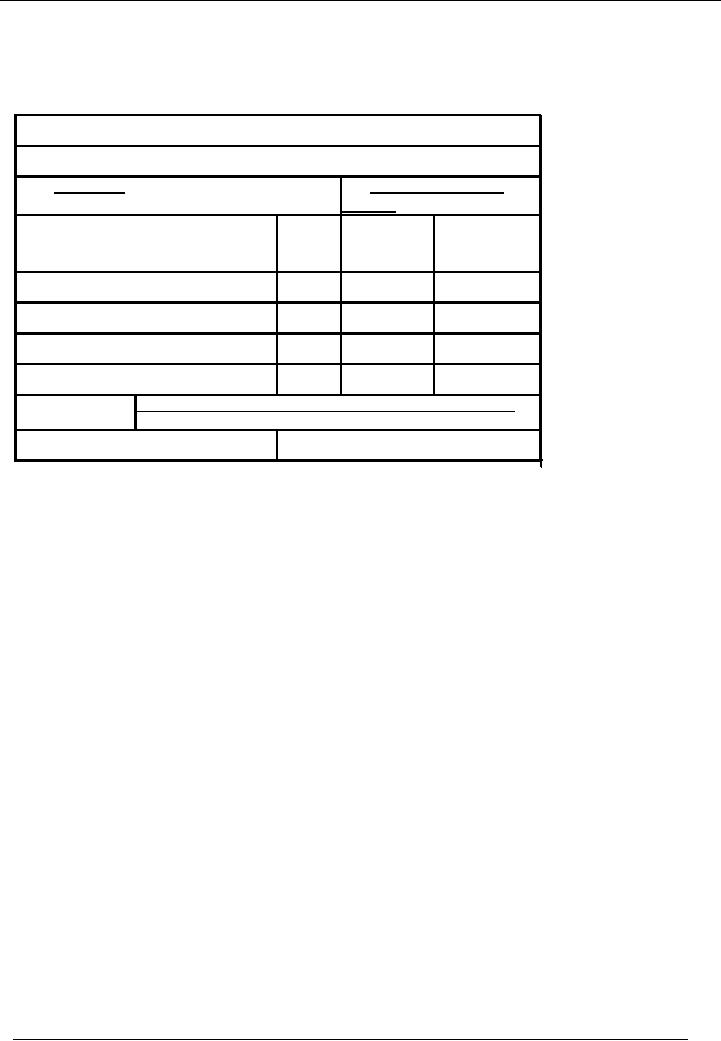

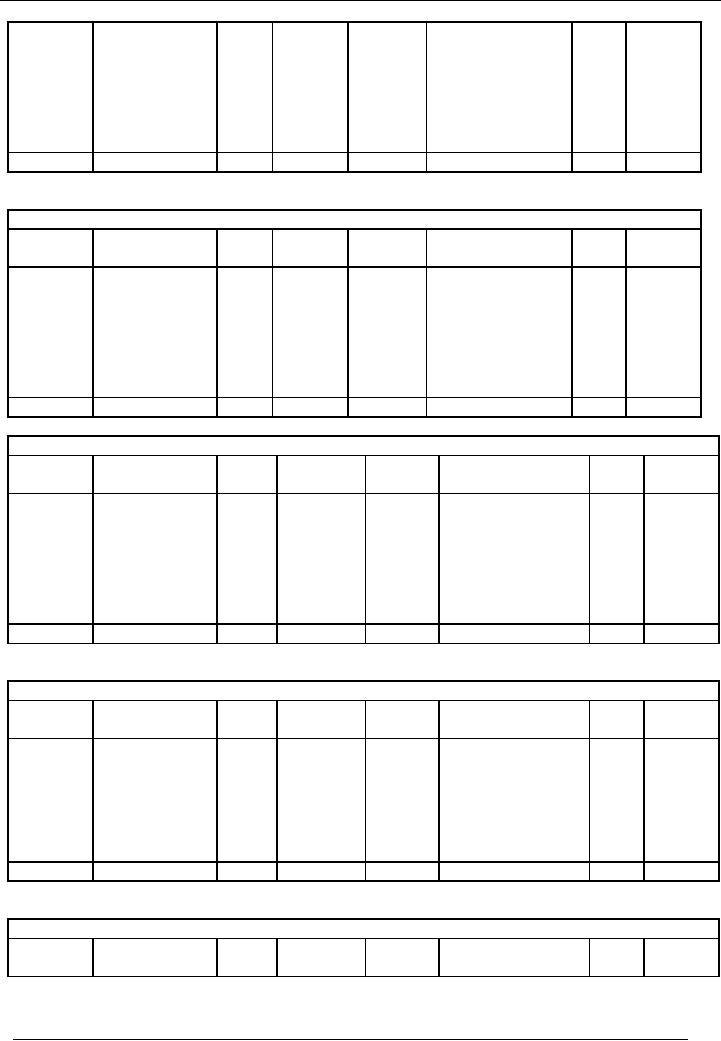

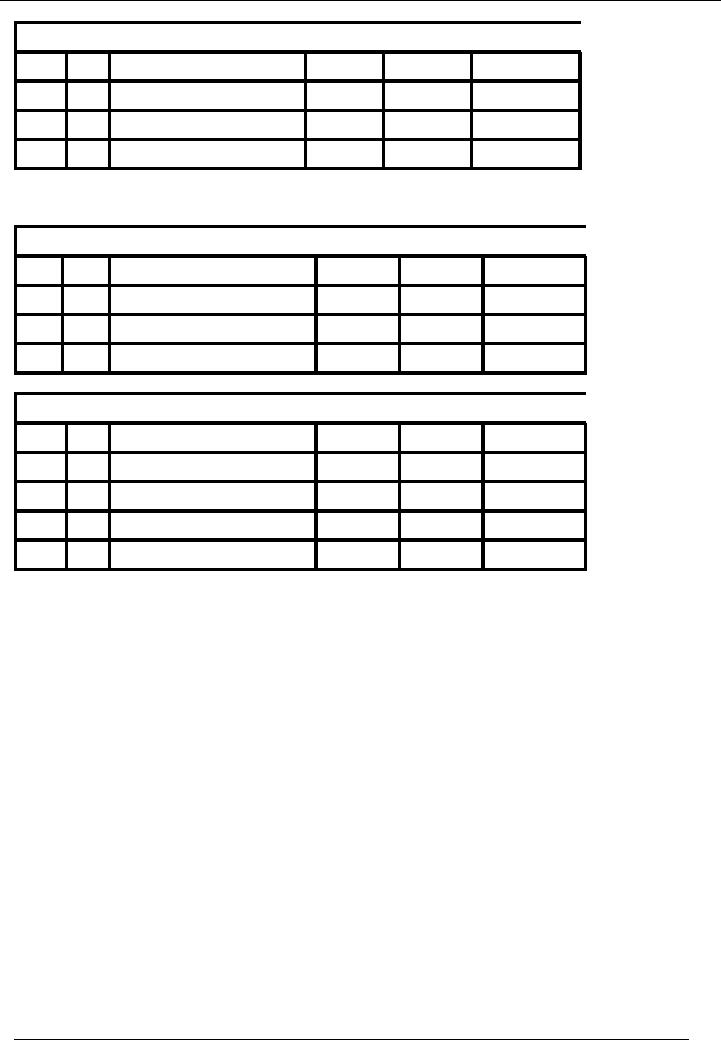

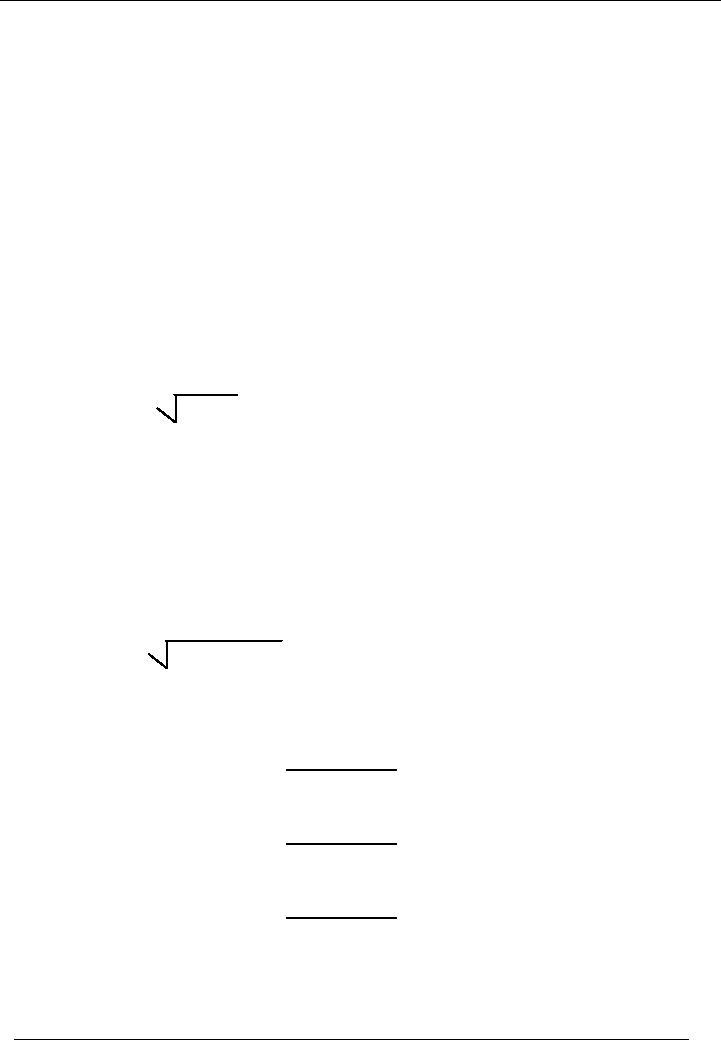

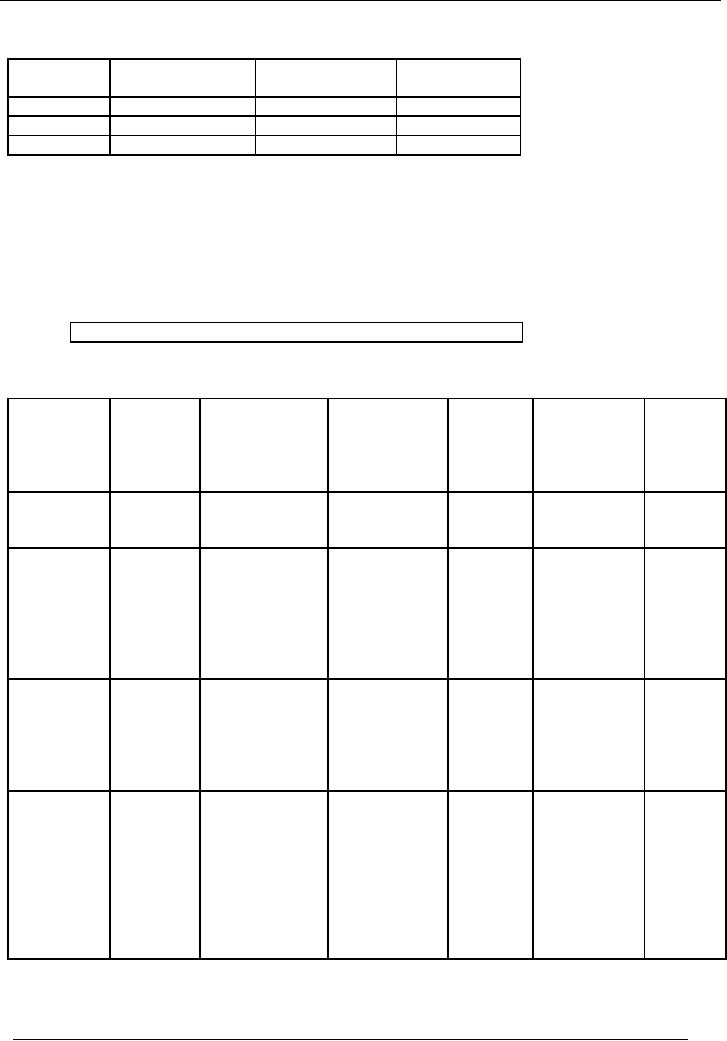

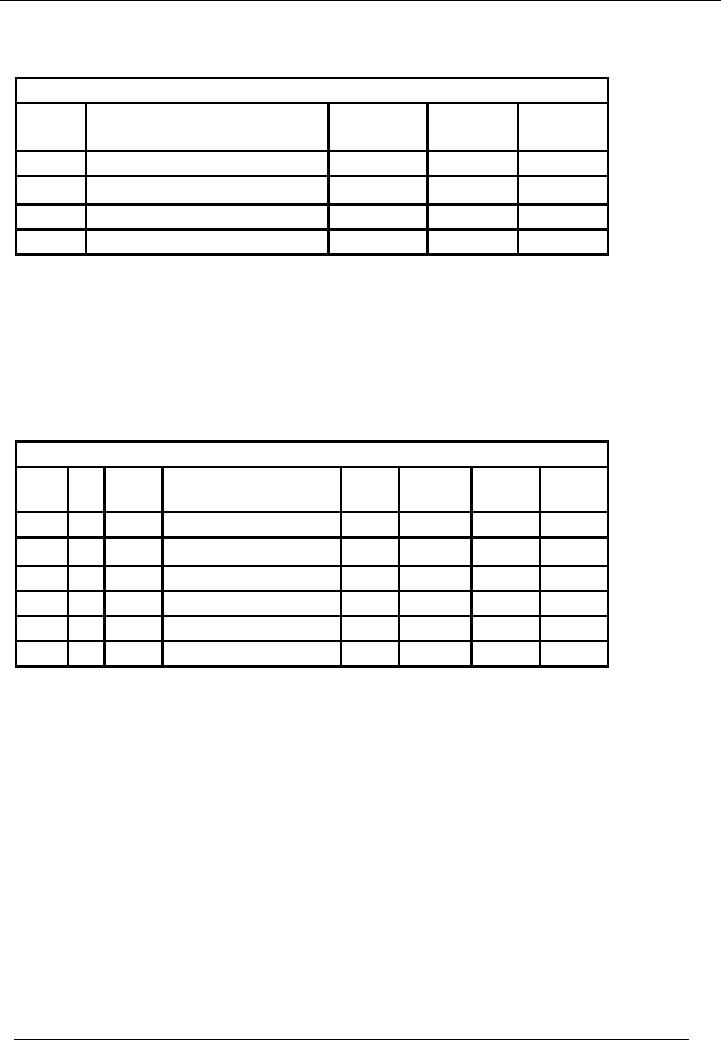

Purchases

Account

Purchases

Account

Code 06

No.

Narration

Cr.

Rs.

Date

No.

Narration

Dr.

Rs.

Date

05-01--- 05

Goods purch.

50,000

10-01---

10,000

08 Purchase

return

20,000

08-01---

07 Goods

purch.

70,000

10,000

Balance

60,000

70,000

70,000

Name

Of The Organization (Ali

Traders)

Trial

Balance As On ( January 31,

20--)

Title

of Account

Code

Dr.

Rs.

Cr.

Rs.

Cash

Account

01

35,000

Bank

Account

02

130,000

Capital

Account

03

200,000

Furniture

Account

04

15,000

Vehicle

Account

05

50,000

Purchases

Account

06

60,000

Total

55

Financial

Accounting (Mgt-101)

VU

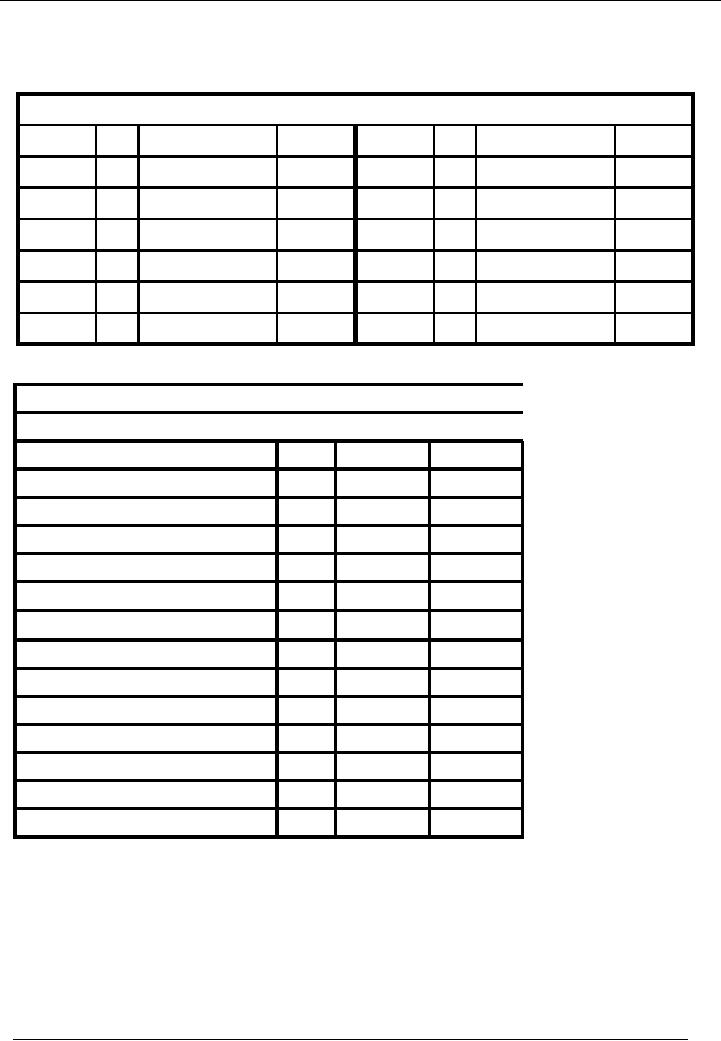

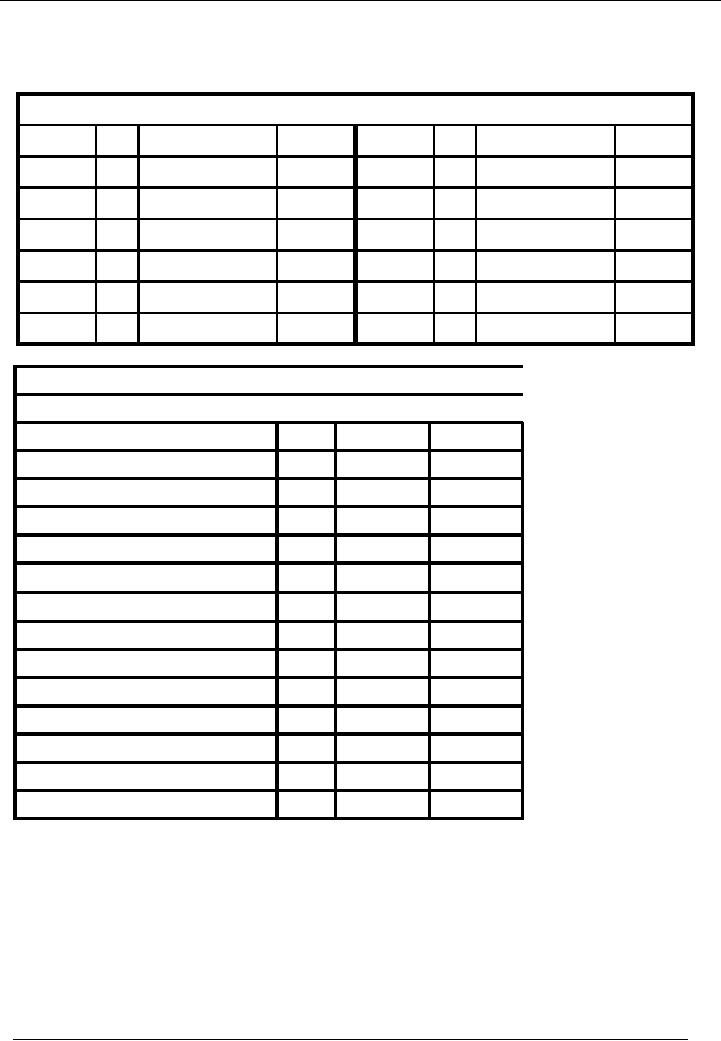

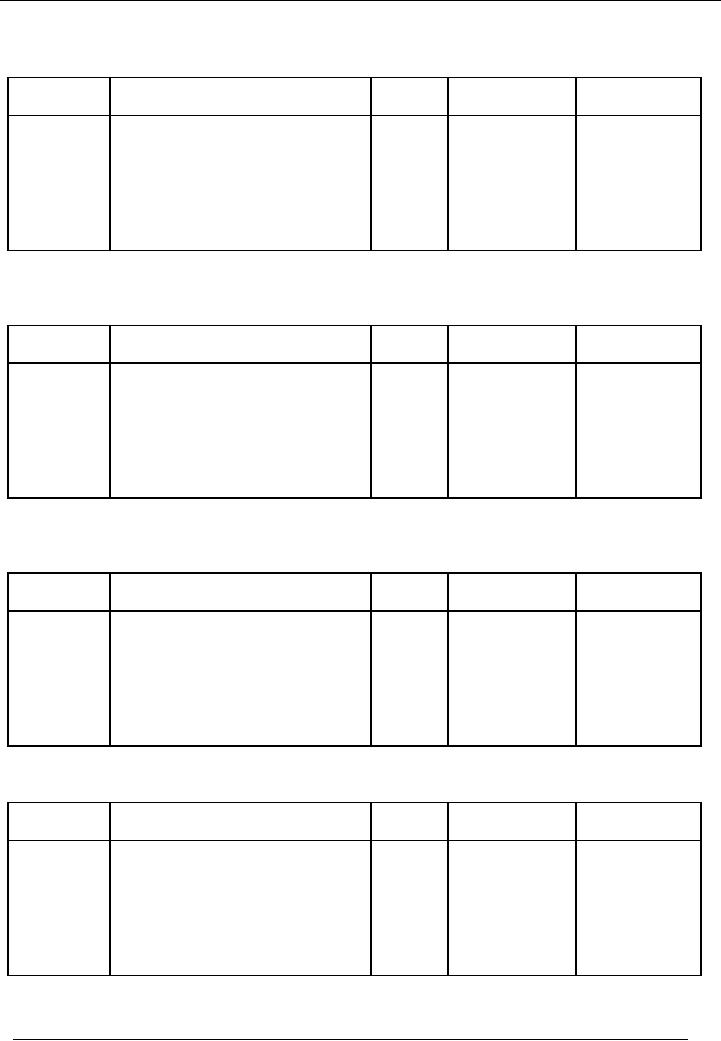

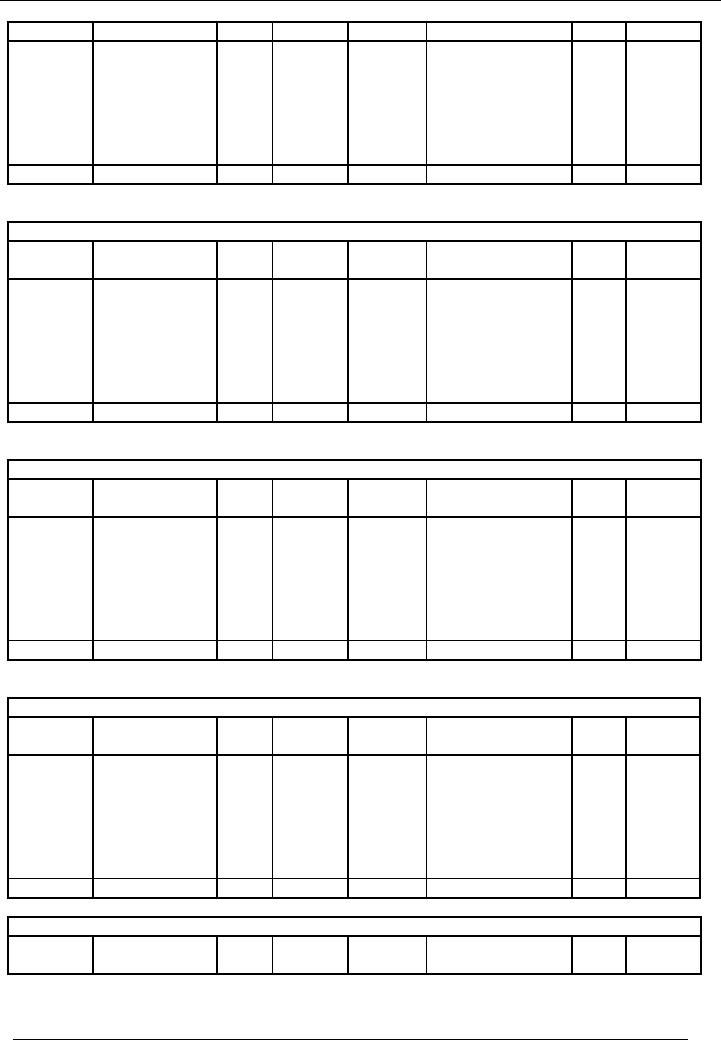

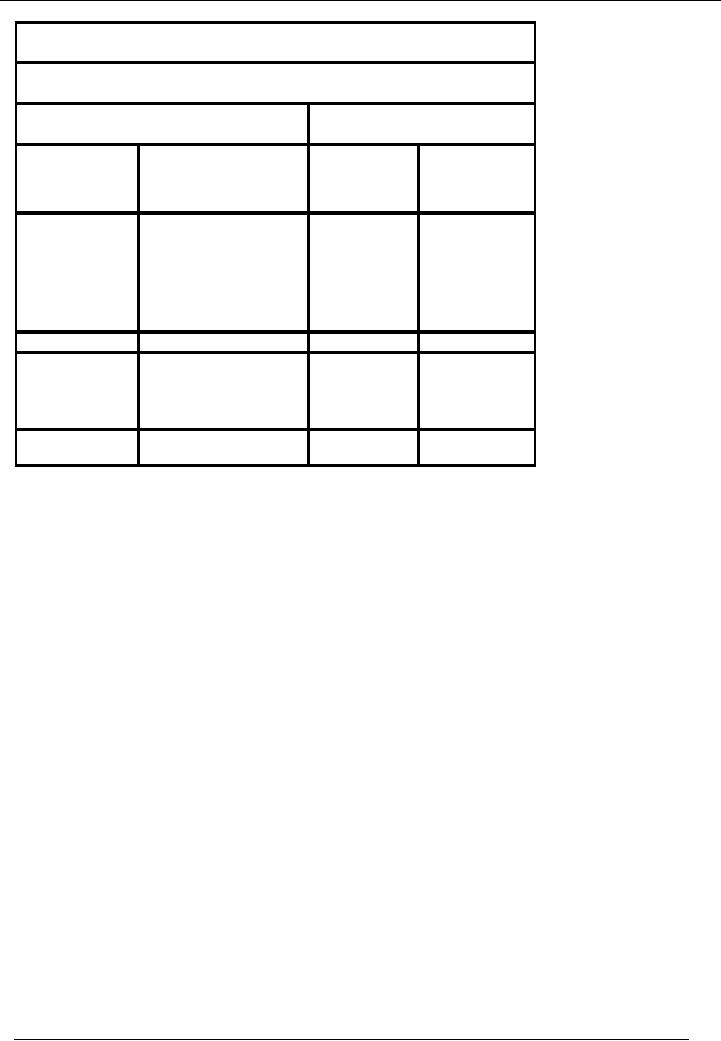

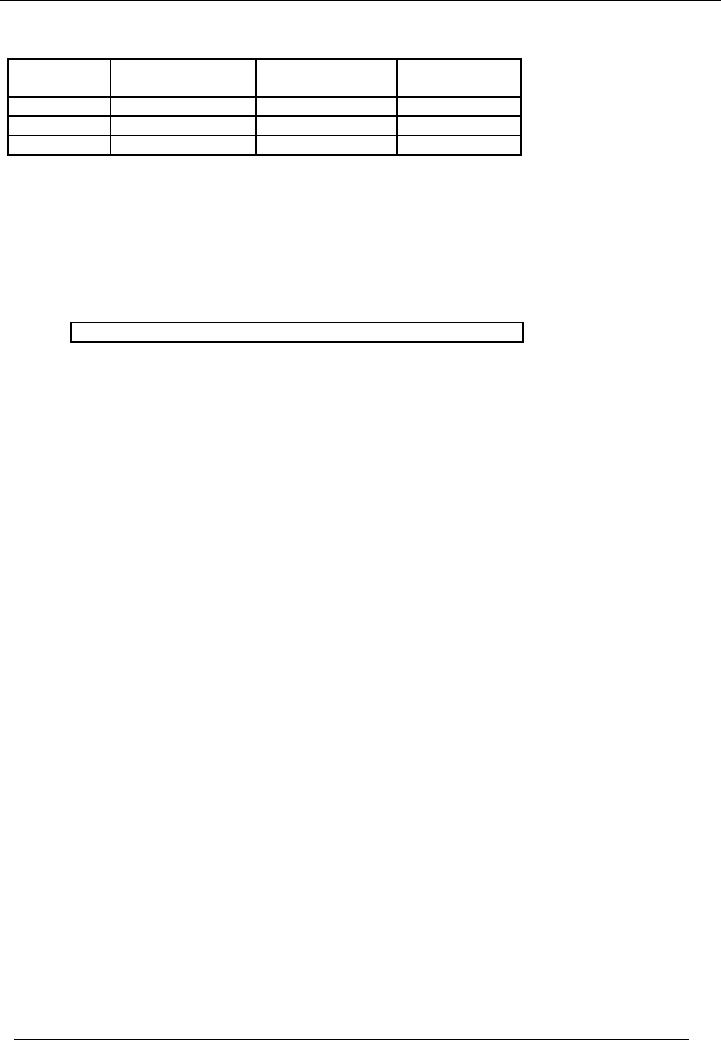

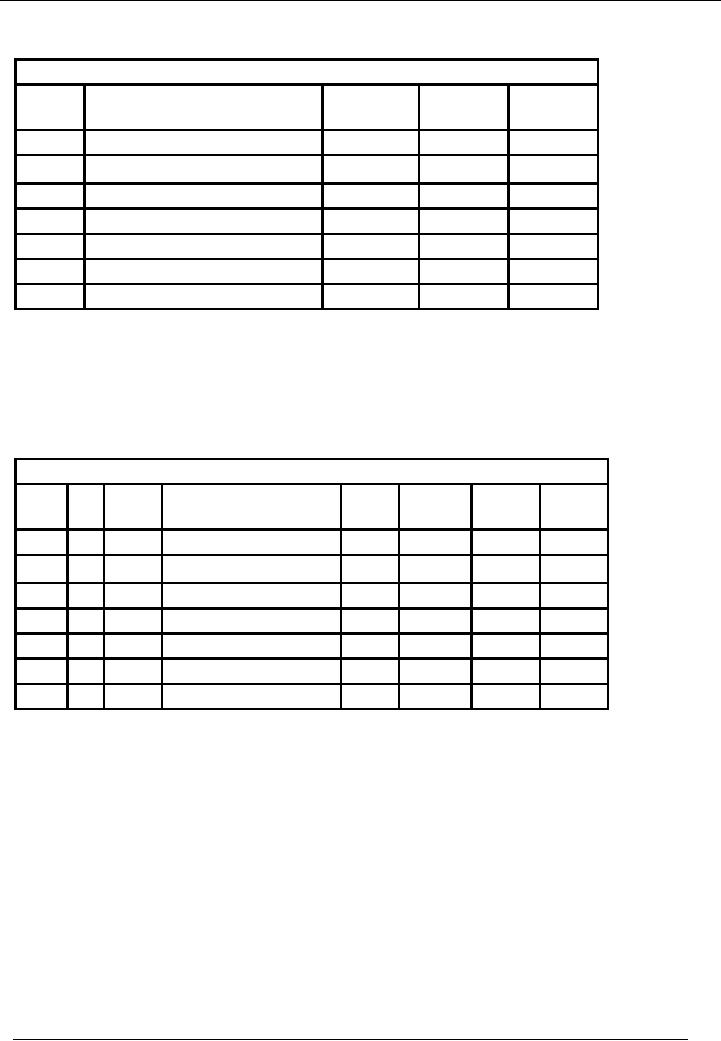

Mr. A

(Supplier)

Mr. A

(Creditor)

Account

Code 07

No.

Narration

Cr.

Rs.

Date

No.

Narration

Dr.

Rs.

Date

10,000

05-01---

05 Goods

purch.

50,000

10-01---

08 Purchase

return

25,000

21-01---

11 Paid to

Mr. A

35,000

50,000

Balance

15,000

50,000

50,000

Name

Of The Organization (Ali

Traders)

Trial

Balance As On ( January 31,

20--)

Title

of Account

Code

Dr.

Rs.

Cr.

Rs.

Cash

Account

01

35,000

Bank

Account

02

130,000

Capital

Account

03

200,000

Furniture

Account

04

15,000

Vehicle

Account

05

50,000

Purchases

Account

06

60,000

Mr.

A (Creditor)

07

15,000

Total

56

Financial

Accounting (Mgt-101)

VU

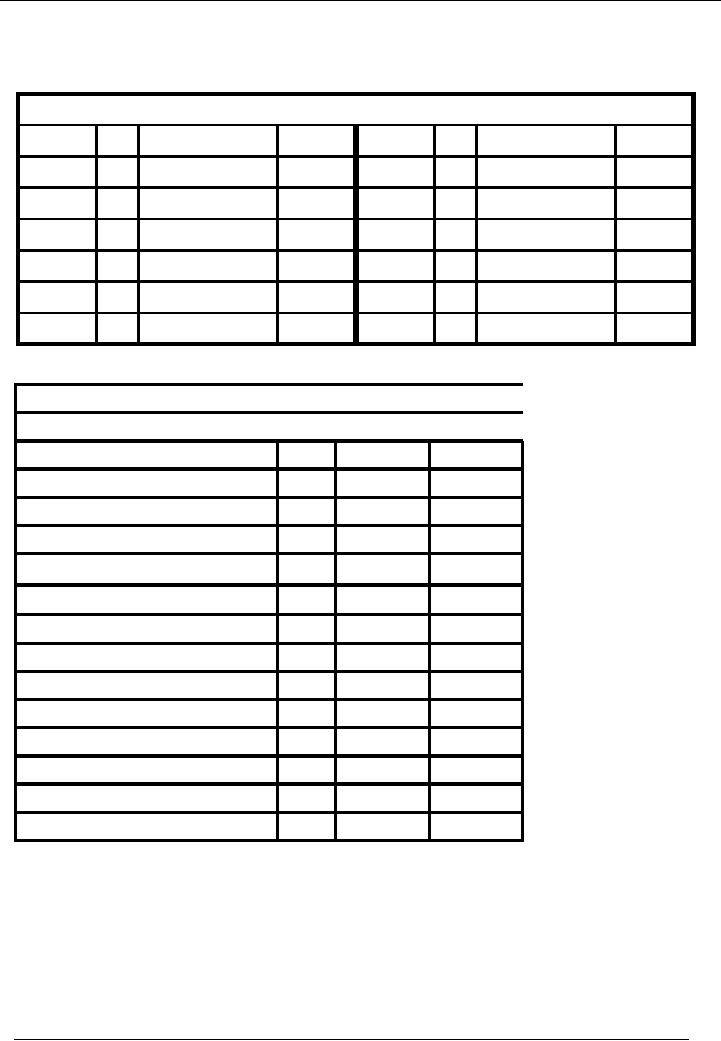

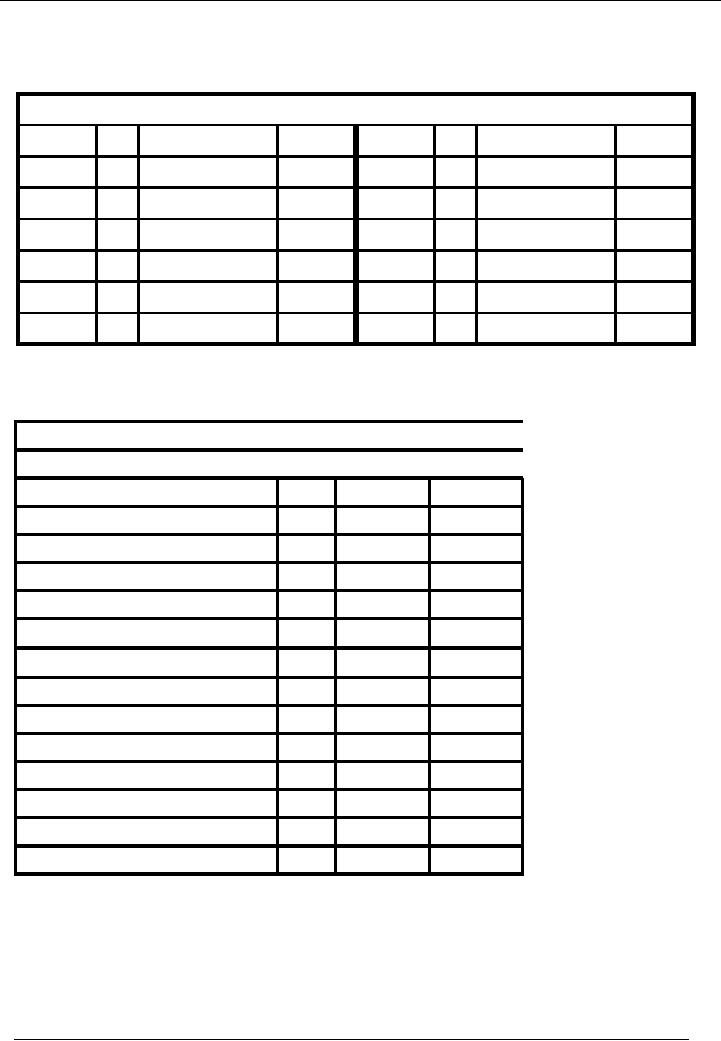

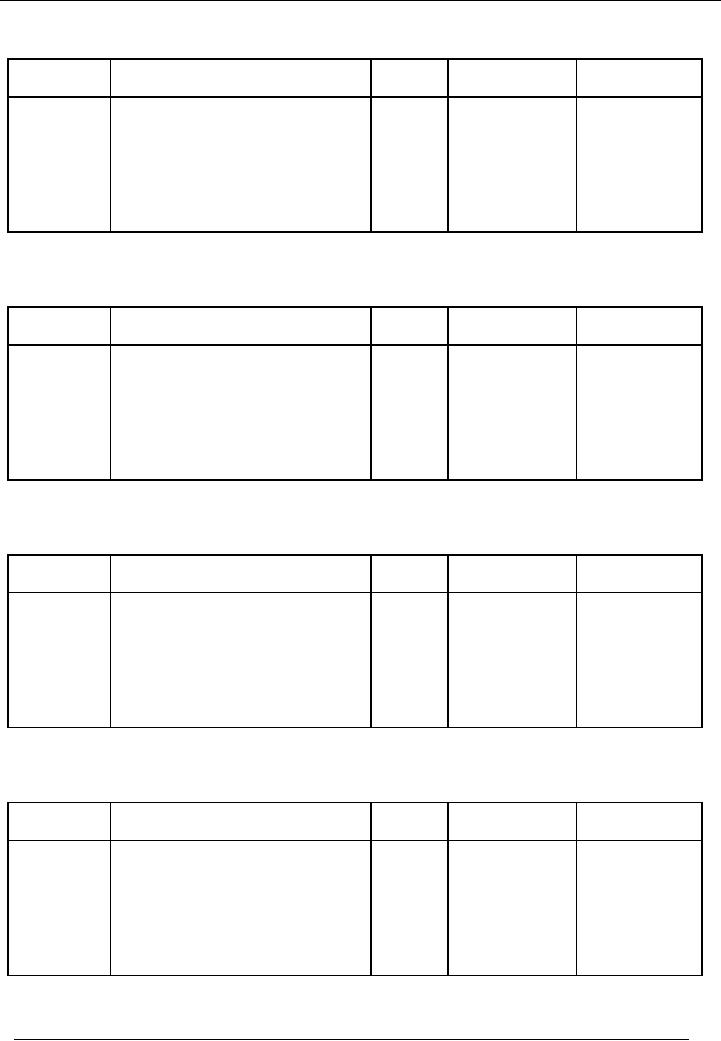

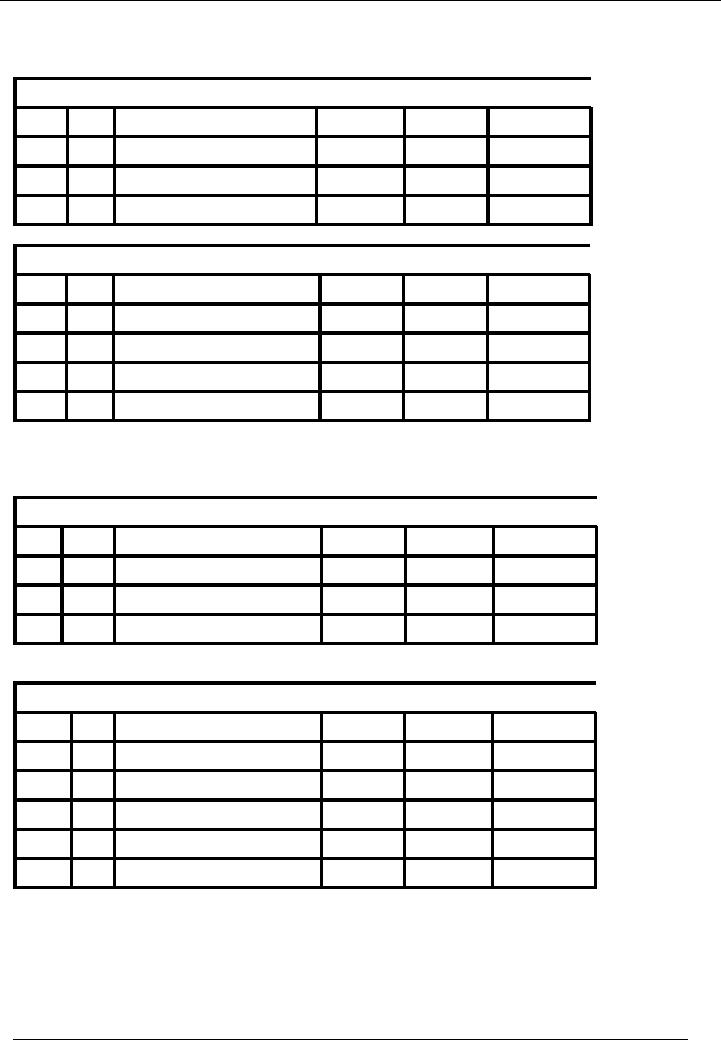

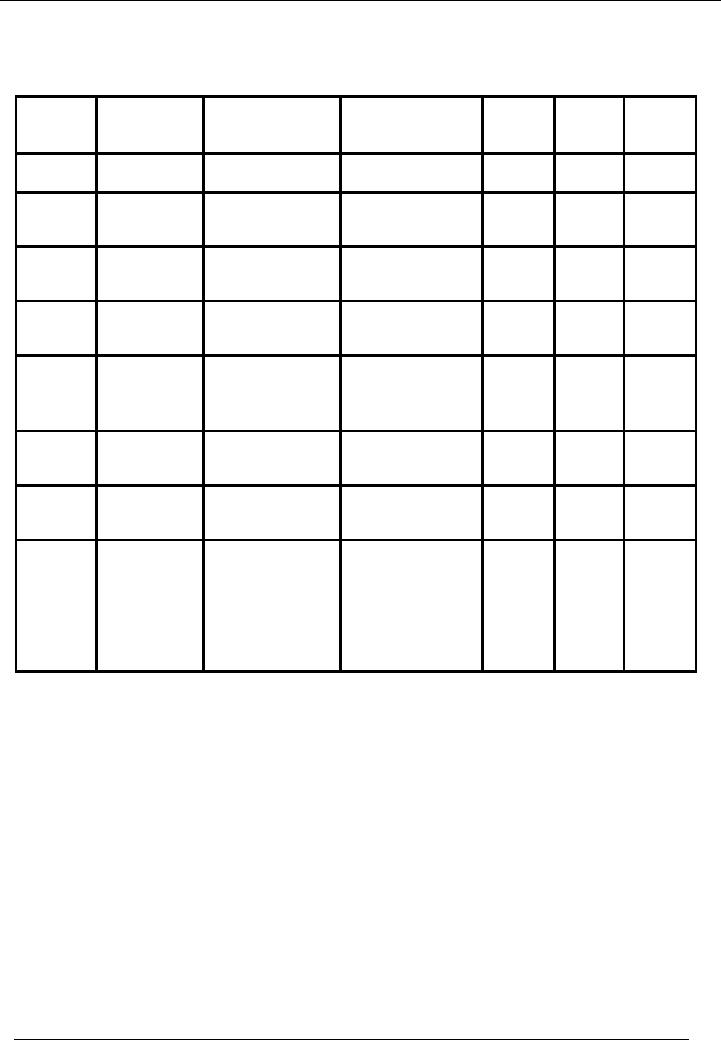

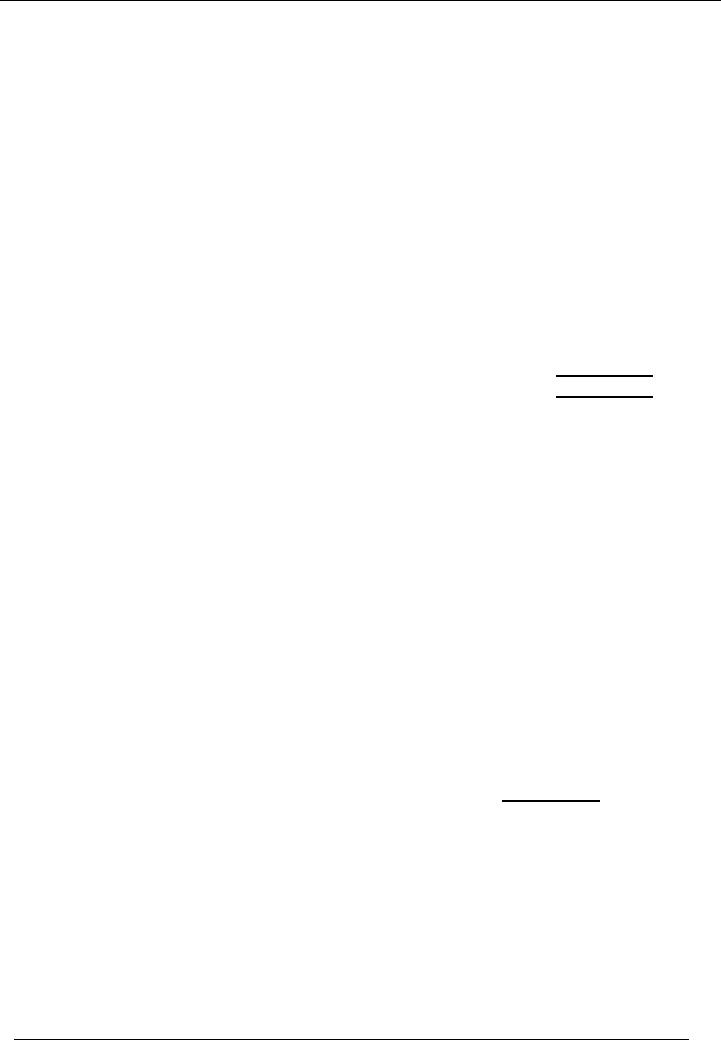

Sales

Sales

Account Code 08

No.

Narration

Cr.

Rs.

Date

No.

Narration

Dr.

Rs.

Date

18-01---

10 Sales

return

5,000

06-01---

06 Goods

sold

60,000

40,000

12-01---

09 Goods

sold

5,000

100,000

Balance

95,000

100,000

100,000

Name

Of The Organization (Ali

Traders)

Trial

Balance As On ( January 31,

20--)

Title

of Account

Code

Dr.

Rs.

Cr.

Rs.

Cash

Account

01

35,000

Bank

Account

02

130,000

Capital

Account

03

200,000

Furniture

Account

04

15,000

Vehicle

Account

05

50,000

Purchases

Account

06

60,000

Mr.

A (Creditor)

07

15,000

Sales

08

95,000

Total

57

Financial

Accounting (Mgt-101)

VU

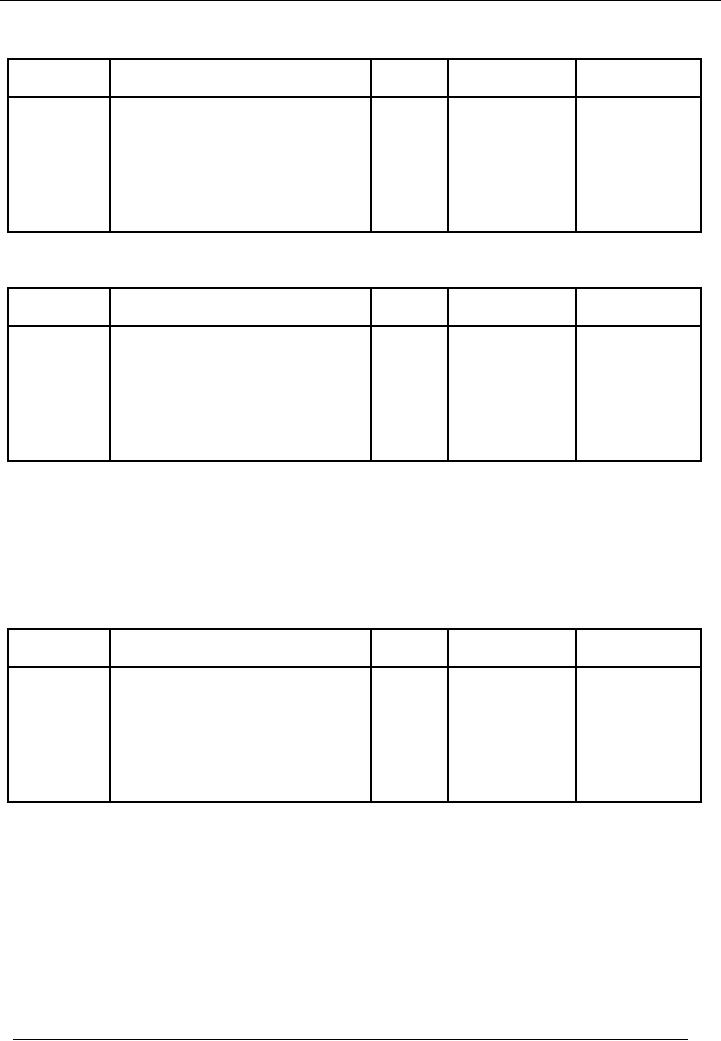

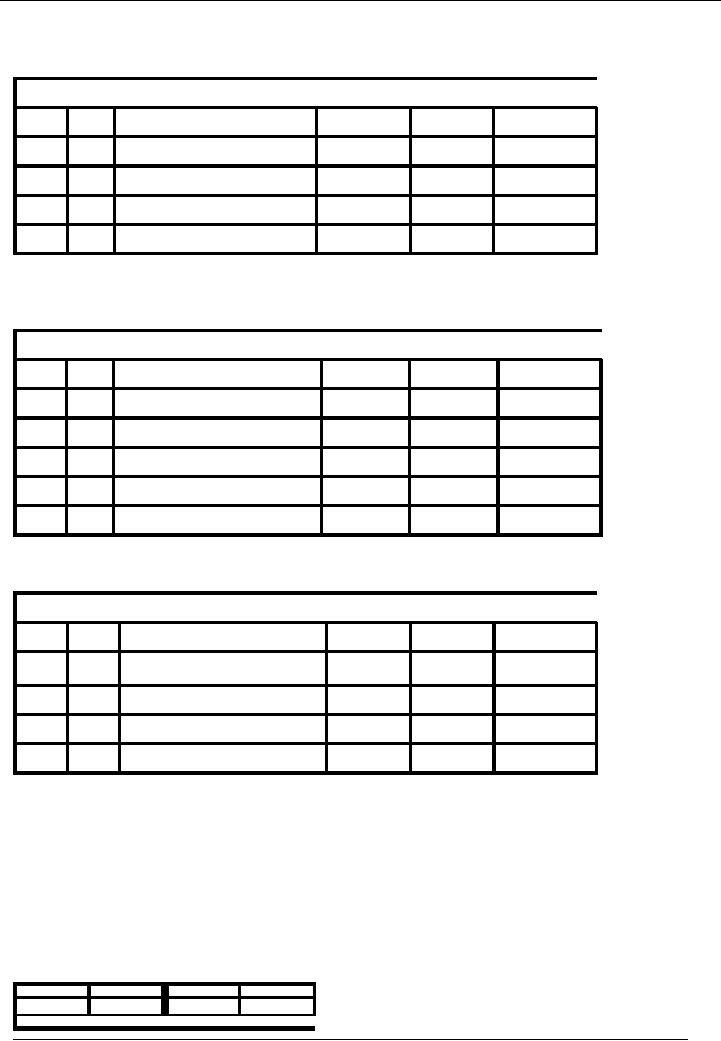

Mr. B

(Customer)

Mr. B

(Debtor) Account Code

09

Date

No.

Narration

Dr.

Rs.

Date

No.

Narration

Cr.

Rs.

12-01---

09 Goods

sold

40,000

18-01---

10 Sales

return

5,000

20,000

25-01---

12 Received

from B

40,000

25,000

Balance

15,000

40,000

40,000

Name

Of The Organization (Ali

Traders)

Trial

Balance As On ( January 31,

20--)

Title

of Account

Code

Dr.

Rs.

Cr.

Rs.

Cash

Account

01

35,000

Bank

Account

02

130,000

Capital

Account

03

200,000

Furniture

Account

04

15,000

Vehicle

Account

05

50,000

Purchases

Account

06

60,000

Mr.

A (Creditor)

07

15,000

Sales

08

95,000

Mr.

B (Debtor)

09

15,000

Total

58

Financial

Accounting (Mgt-101)

VU

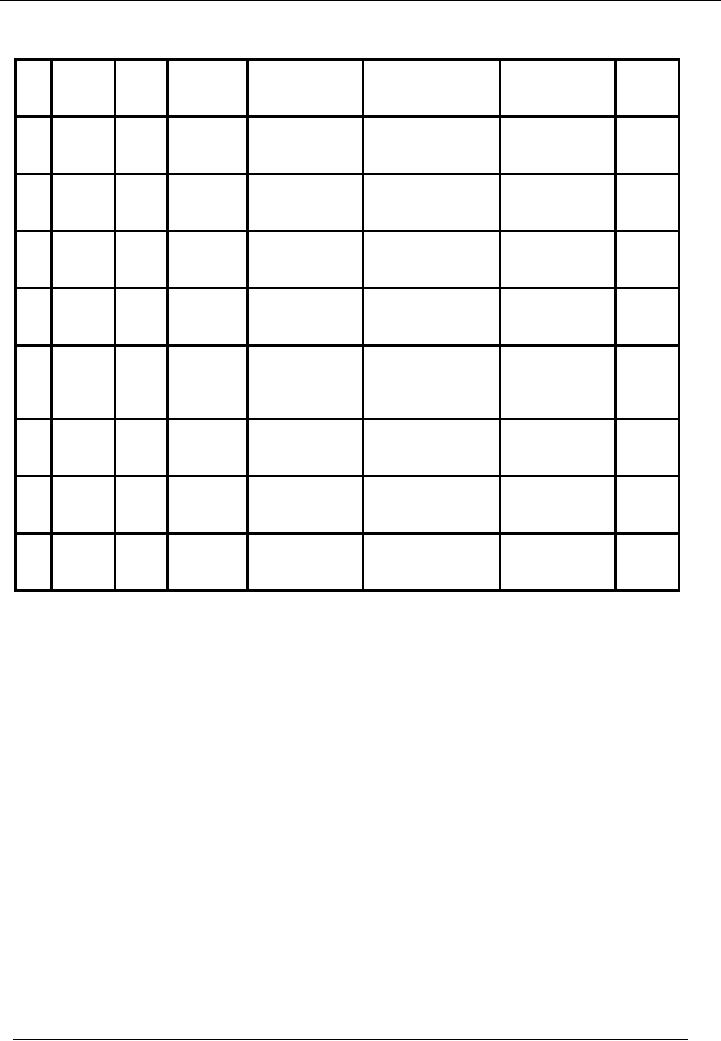

Salaries

Salaries

Account

Code 10

No.

Narration

Cr.

Rs.

Date

No.

Narration

Dr.

Rs.

Date

31-01---

13 Salaries

paid

5,000

0

5,000

Balance

5,000

5,000

5,000

Name

Of The Organization (Ali

Traders)

Trial

Balance As On ( January 31,

20--)

Title

of Account

Code

Dr.

Rs.

Cr.

Rs.

Cash

Account

01

35,000

Bank

Account

02

130,000

Capital

Account

03

200,000

Furniture

Account

04

15,000

Vehicle

Account

05

50,000

Purchases

Account

06

60,000

Mr.

A (Creditor)

07

15,000

Sales

08

95,000

Mr.

B (Debtor)

09

15,000

Salaries

10

5,000

Total

59

Financial

Accounting (Mgt-101)

VU

Expenses

Expenses

Account

Code 11

No.

Narration

Cr.

Rs.

Date

No.

Narration

Dr.

Rs.

Date

31-01---

14 Exp.

accrued

20,000

20,000

0

Balance

20,000

20,000

20,000

Name

Of The Organization (Ali

Traders)

Trial

Balance As On ( January 31,

20--)

Title

of Account

Code

Dr.

Rs.

Cr.

Rs.

Cash

Account

01

35,000

Bank

Account

02

130,000

Capital

Account

03

200,000

Furniture

Account

04

15,000

Vehicle

Account

05

50,000

Purchases

Account

06

60,000

Mr.

A (Creditor)

07

15,000

Sales

08

95,000

Mr.

B (Debtor)

09

15,000

Salaries

10

5,000

Expenses

11

20,000

Total

60

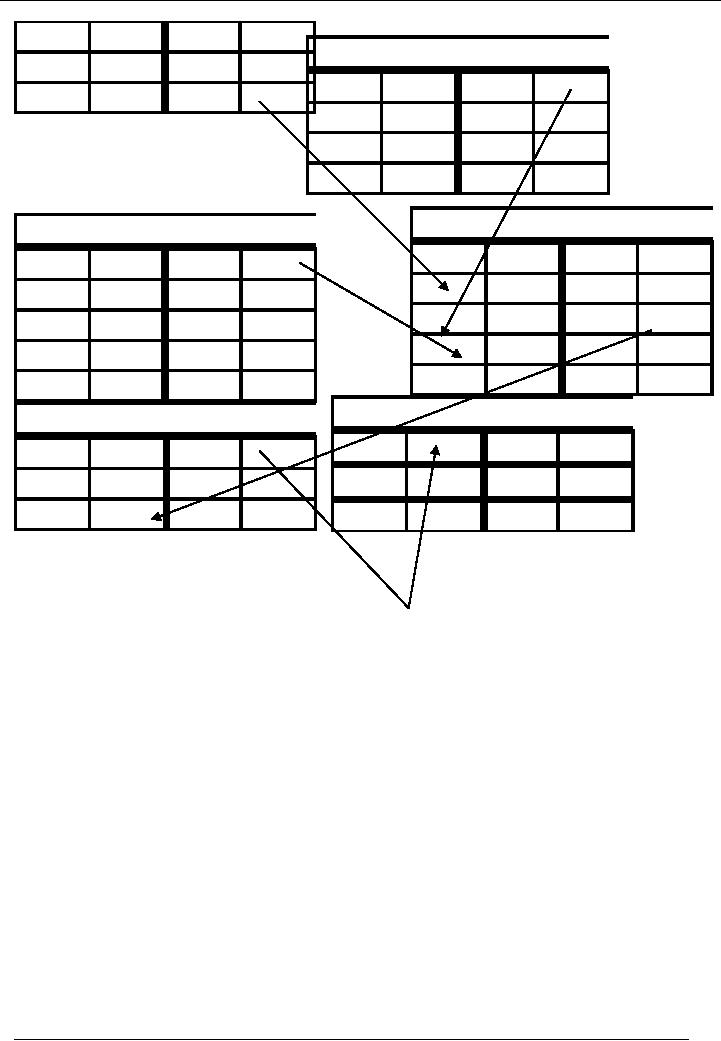

Financial

Accounting (Mgt-101)

VU

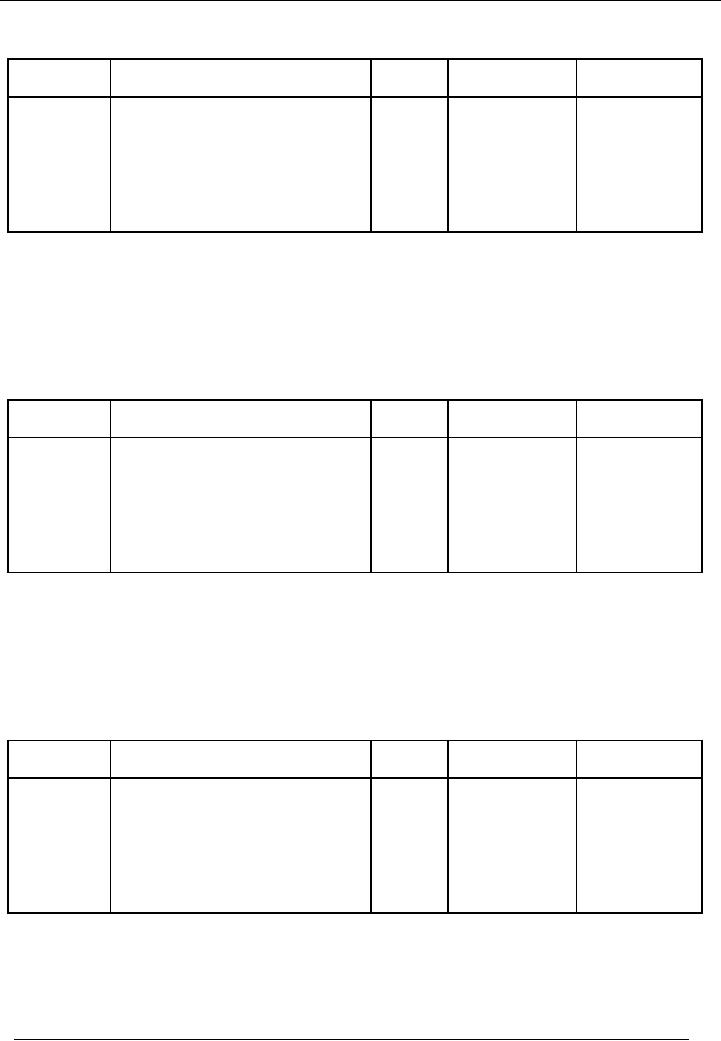

Expenses

Payable

Expenses

Payable

Account

Code 12

No.

Narration

Cr.

Rs.

Date

No.

Narration

Dr.

Rs.

Date

31-01---

14 Exp.

accrued

20,000

0

20,000

Balance

20,000

20,000

20,000

Name

Of The Organization (Ali

Traders)

Trial

Balance As On ( January 31,

20--)

Title

of Account

Code

Dr.

Rs.

Cr.

Rs.

Cash

Account

01

35,000

Bank

Account

02

130,000

Capital

Account

03

200,000

Furniture

Account

04

15,000

Vehicle

Account

05

50,000

Purchases

Account

06

60,000

Mr.

A (Creditor)

07

15,000

Sales

08

95,000

Mr.

B (Debtor)

09

15,000

Salaries

10

5,000

Expenses

11

20,000

Expenses

Payable

12

20,000

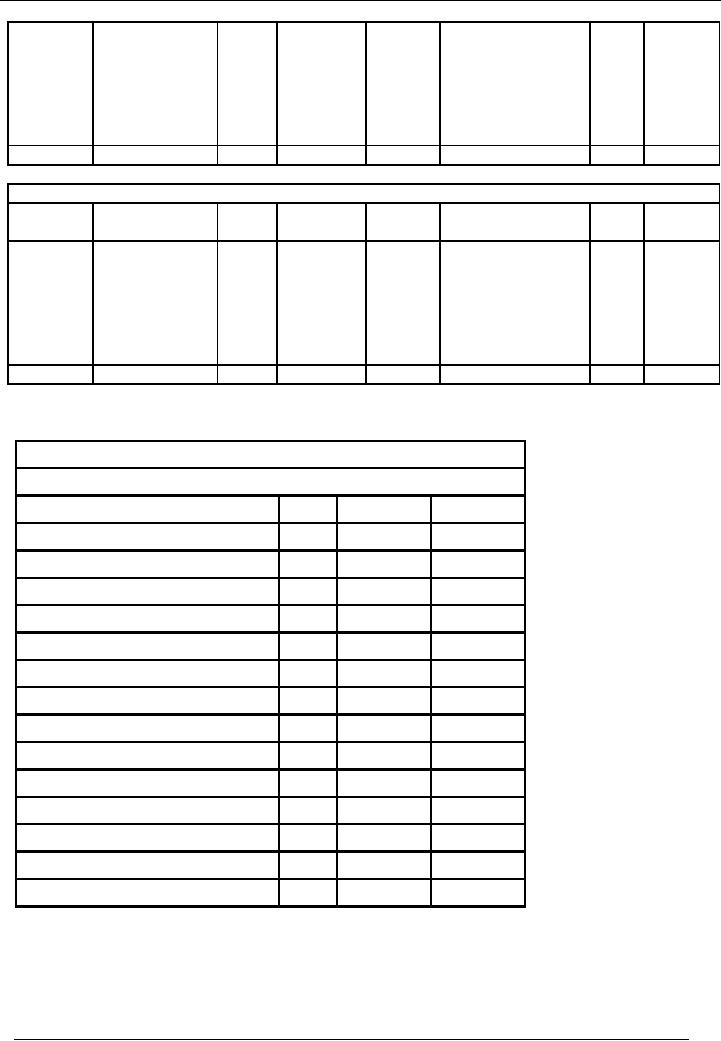

Total

330,000

330,000

61

Financial

Accounting (Mgt-101)

VU

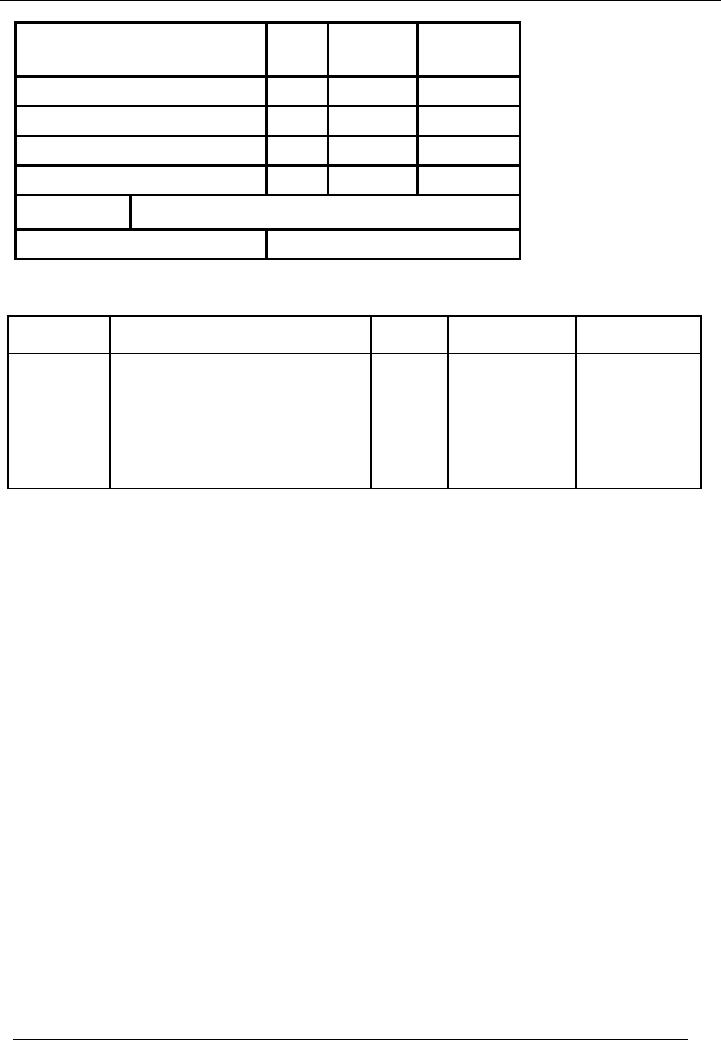

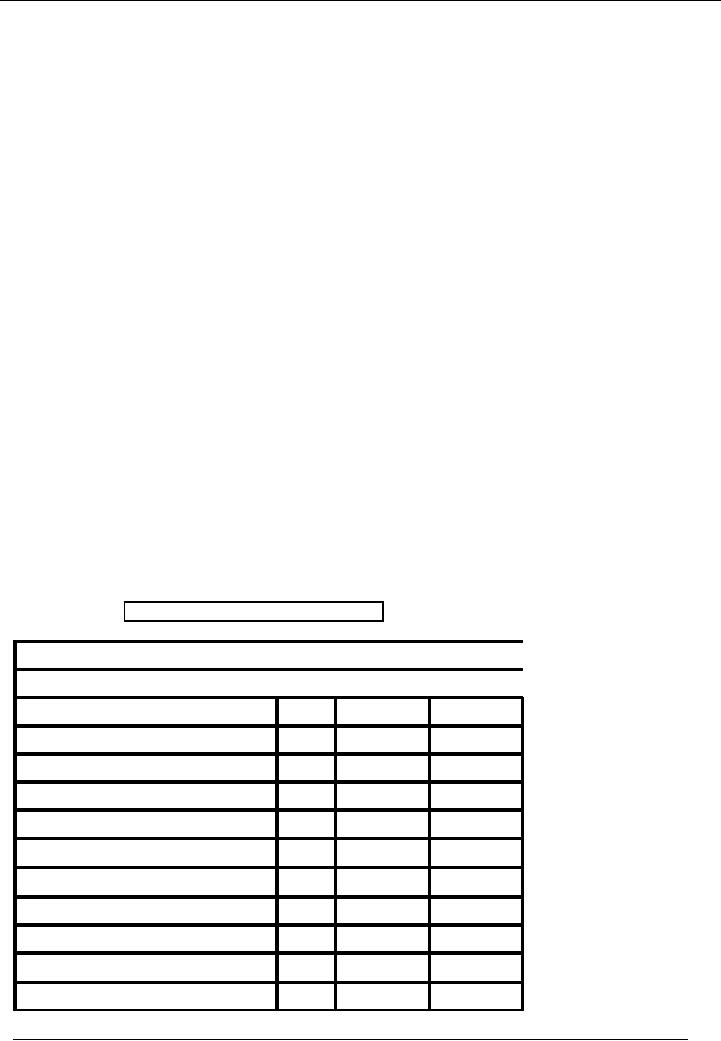

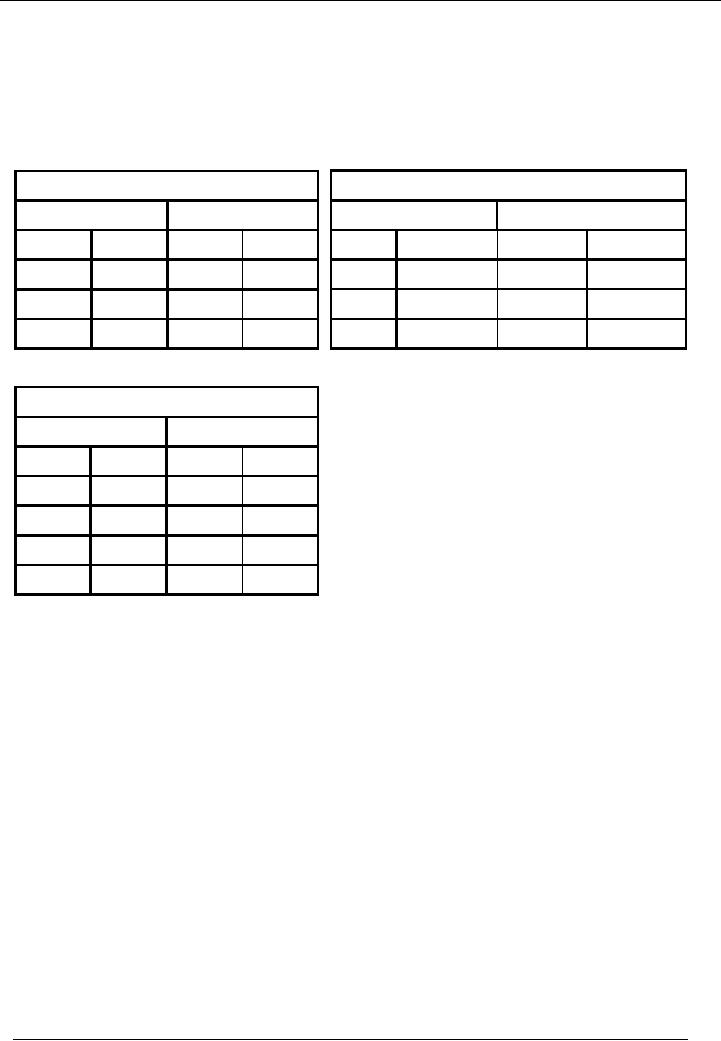

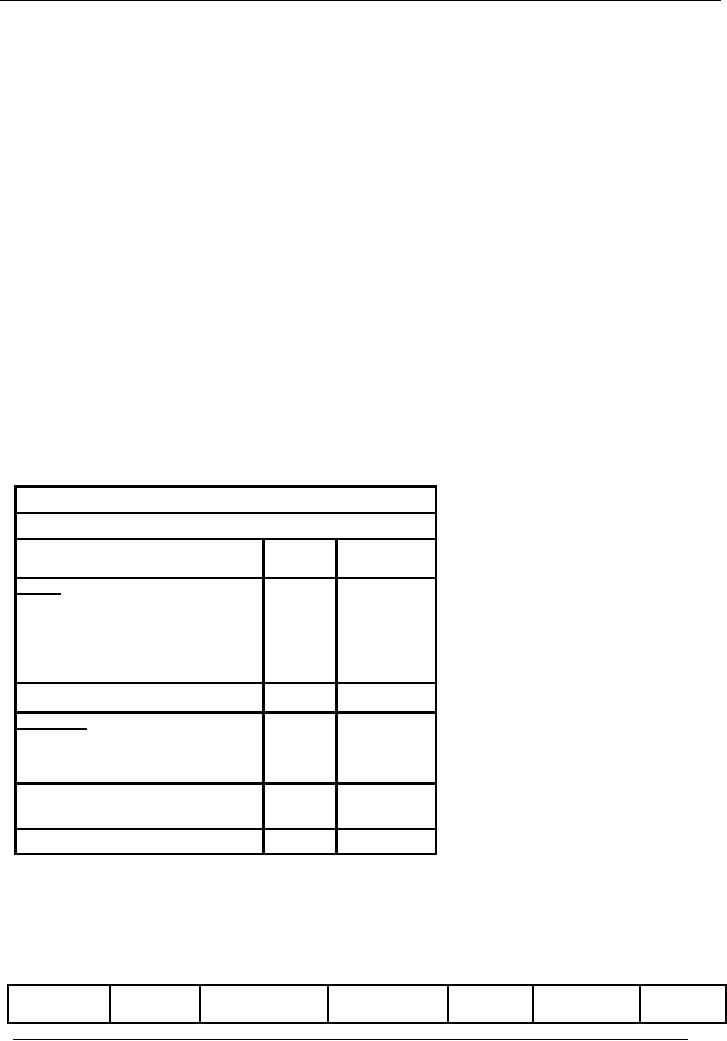

PROFIT

AND LOSS ACCOUNT (ACCOUNT

FORM)

Name

of the Entity (Ali

Traders)

Profit and

Loss Account for the

Month Ending January 31,

20--

Debit

Credit

Particulars

Rs.

Particulars

Rs.

Cost

of Sale (Purchases)

60,000

Income

95,000

Gross

Profit

35,000

(income

Cost of Sale)

Total

95,000

Total

95,000

Admin

Expenses

25,000

Gross

Profit

35,000

Salaries

5,000

Expenses

20,000

Net

Profit

10,000

(gross

Profit expenses)

Total

35,000

Total

35,000

PROFIT

AND LOSS ACCOUNT (EPORT

FORM)

Name

of the Entity (Ali

Traders)

Profit and

Loss Account for the

Month Ending January 31,

20--

Particulars

Amount

Amount

Rs.

Rs.

Income

/ Sales / Revenue

95,000

Less:

Cost of Goods

Sold

(60,000)

Gross

Profit

35,000

Less:

Administrative Expenses

(25,000)

(25,000)

Net

Profit

10,000

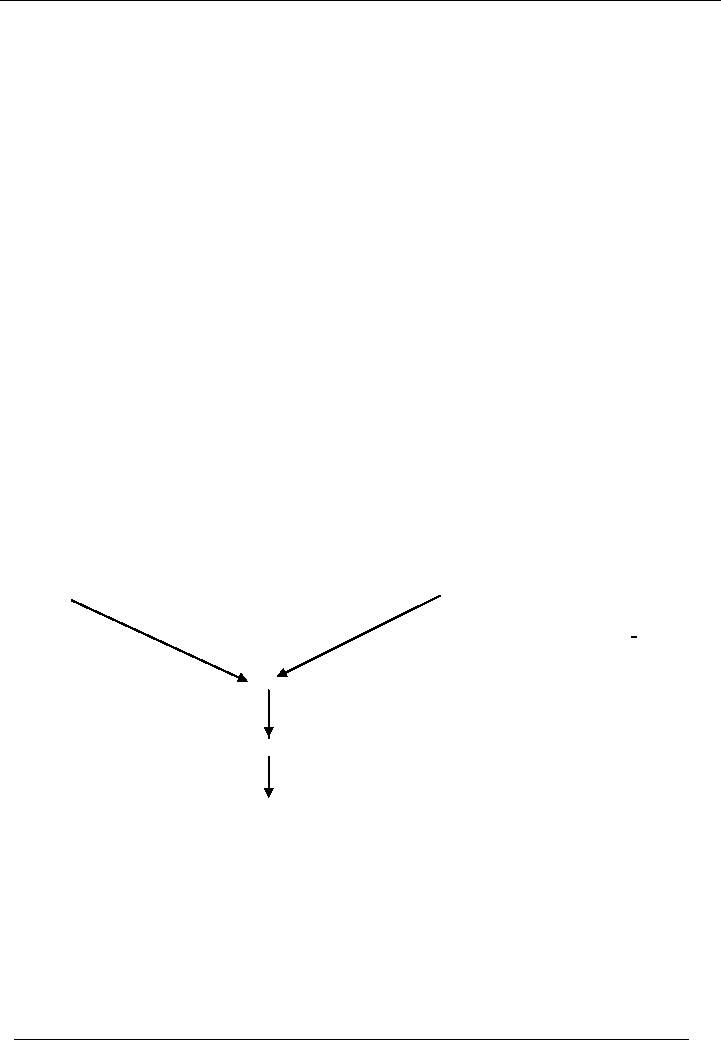

Rules

of debit & credit

�

Any

account that obtains a benefit is

Debit and

�

Anything

that will provide benefit to

the business is Credit.

�

Both

these statements may look

different but in fact if we consider

that whenever an

account

benefits as a

result of a transaction it will

have to return that benefit

to the business then both

the

statements

will look like different

sides of the same picture.

Rules

of debit & credits can

also be explained like:

62

Financial

Accounting (Mgt-101)

VU

�

EXPENDITURE

o Increase

in Expenditure is Debit

o Decrease

in Expenditure is Credit

�

INCOME

o Increase

in Income is Credit

o Decrease

in Income is Debit

�

ASSETS

o Increase

in Asset is Debit

o Decrease

in Asset is Credit

�

LIABILITY

o Increase

in Liability is Credit

o Decrease

in Liability is Debit

Now we

will explain these rules

with the help of the following

illustration:

No.

Date

Particulars

01

Jan

01

Mr.

Rizwan invests Rs. 100,000

to commence his

business.

02

Jan

03

He

opened an account with bank &

deposited Rs. 30,000.

03

Jan

05

He borrows

Rs. 50,000 from Mr.

Saleem at 12% per

annum.

04

Jan

07

He

purchased furniture worth

Rs. 20,000 for

cash.

05

Jan

09

He

purchased goods (for resale)

worth of Rs. 10,000 from

Mr. Afzal

on

credit.

06

Jan

10

He

sold goods for cash

Rs. 5,000

07

Jan

12

He

sold goods for Rs.

5,000 to Mr. Naeem on credit

basis.

08

Jan

15

Cash

deposited in bank Rs.

5,000

09

Jan

16

He

purchased stationery fore Rs.

3,000.

10

Jan

18

He

purchased office equipment for

Rs. 10,000 and paid by

cheque.

11

Jan

19

He returned

defective goods to Mr. Afzal

worth Rs. 1,000.

12

Jan

25

Goods

are returned by Mr. Naeem

Rs. 500 to the

business.

13

Jan

30

Cash

paid to Mr. Afzal Rs. 9,000

in full settlement of his

claim.

14

Jan

31

Cash

received from Mr. Naeem

Rs. 4,500 in full settlement

of his

account.

15

Jan

31

Cash

withdrawn from the bank Rs.

500.

Now

first document that we prepare in

accounting is the voucher. We will book

first entry in voucher,

i.e.

Name Of

Company

Type

Of Voucher

Date:

1-1-02--

No:

01

63

Financial

Accounting (Mgt-101)

VU

Description

Code

Debit

Credit

Amount

#

Amount

Cash

01

100,000

Capital

02

100,000

Total:

100,000

100,000

Narration:

Capital

Introduced in Cash by Mr.

Rizwan.

Prepared

By:

Checked

by:

Same

entry is presented in simpler

form:

Date

Particulars

Code

#

Amount(Dr.)

Amount(Cr.)

Rs.

Rs.

01-01-2002

Cash

A/c

01

100,000

Capital

A/c

02

100,000

Capital

Introduced in Cash by

Mr.

Rizwan

In this

case, cash account is debited

because cash account has

obtained benefit and Capital account

is

credited

because business has obtained

benefit because of capital

account.

This

statement can also be

interpreted like

this:

As

cash is an asset and it is

increased in this case, so cash is

debited. Capital is a liability and

increase in

liability

is credit. In this case capital is

increased, hence it is

credited.

64

Financial

Accounting (Mgt-101)

VU

ENTRY

# 2

First, we

will book this entry in

voucher.

Name Of

Company

Type

Of Voucher

Date:

3-1-02--

No:

01

Description

Code

Debit

Credit

Amount

#

Amount

Bank

03

30,000

Cash

01

30,000

Total:

30,000

30,000

Narration:

Deposited

cash in bank.

Prepared

By:

Checked

by:

Again,

the same entry in simple

form

Date

Particulars

Code

#

Amount(Dr.)

Amount(Cr.)

Rs.

Rs.

03-01-2002

Bank

A/c

03

30,000

Cash

A/c

01

30,000

Deposited

cash in bank.

Again,

bank account is debited because bank

account has obtained benefit

and Cash account is

credited

because

business has obtained benefit

because of cash

account.

This

statement can also be

interpreted like

this:

As bank is an

asset and it is increased in this

case, so bank is debited. Cash is an

asset and decrease in asset

is

credit. In this

case cash is decreased,

hence it is credited

From

now onward, we will present

entry in simple

form.

65

Financial

Accounting (Mgt-101)

VU

ENTRY

# 3

Date

Particulars

Code

#

Amount(Dr.)

Amount(Cr.)

Rs.

Rs.

05-01-2002

Cash

A/c

01

50,000

Loan

A/c

04

50,000

Obtained

loan from Mr. Saleem.

Cash

account is debited because cash

account has obtained benefit

and Loan account is credited

because

business

has obtained benefit because of

Loan account.

This

statement can also be

interpreted like

this:

As

cash is an asset and it is

increased in this case, so cash is

debited. Loan is a liability and

increase in liability

is credit. In this

case Loan is increased,

hence it is credited

ENTRY

# 4

Date

Particulars

Code

#

Amount(Dr.)

Amount(Cr.)

Rs.

Rs.

07-01-2002

Furniture

A/c

05

20,000

20,000

Cash

A/c

01

Purchased

furniture for cash

Again,

furniture account is debited because

furniture account has obtained

benefit and Cash account

is

credited

because business has obtained

benefit because of cash

account.

This

statement can also be

interpreted like

this:

As

furniture is an asset and it is

increased in this case, so furniture is

debited. Cash is an asset and

decrease in

asset

is credit. In this case cash is

decreased, hence it is

credited.

ENTRY

# 5

Date

Particulars

Code

#

Amount(Dr.)

Amount(Cr.)

Rs.

Rs.

09-01-2002

Purchases

A/c

06

10,000

Mr.

Afzal(Creditors) A/c

07

10,000

Purchased

goods from Mr. Afzal

on

credit

Purchase

account is debited because purchase

account has obtained benefit

and Creditors account is

credited

because

business has obtained benefit

because of Creditors account.

This

statement can also be

interpreted like

this:

As

purchase is an expense and it is

increased in this case, so purchase is

debited. Creditors are liabilities

and

increase

in liability is credit. In this case Creditors

are increased, hence it is

credited.

66

Financial

Accounting (Mgt-101)

VU

Creditor

is any third person or organization, to

whom business has to pay in

future.

ENTRY

# 6

Date

Particulars

Code

#

Amount(Dr.)

Amount(Cr.)

Rs.

Rs.

10-01-2002

Cash

A/c

01

5,000

Sale

A/c

08

5,000

Sold

goods for cash

Cash

account is debited because cash

account has obtained benefit

and Sale account is credited

because

business

has obtained benefit because of

Sale account.

This

statement can also be

interpreted like

this:

As

cash is an asset and it is

increased in this case, so cash is

debited. Sale is an income and

increase in income

is credit. In this

case income is increased,

hence it is credited

ENTRY

# 7

Date

Particulars

Code

#

Amount(Dr.)

Amount(Cr.)

Rs.

Rs.

12-01-2002

Mr.

Naeem(Debtors) A/c

09

5,000

Sale

A/c

08

5,000

Sold

goods to Mr. Naeem on

credit

Debtors

account is debited because Debtors

account has obtained benefit

and Sale account is

credited

because

business has obtained benefit

because of Sale

account.

This

statement can also be

interpreted like

this:

As

Debtors is an asset and it is

increased in this case, so debtors

account is debited. Sale is an income

and

increase

in income is credit. In this case income

is increased, hence it is

credited

Debtor is

any third person or organization,

from whom cash is receivable

by the business.

67

Financial

Accounting (Mgt-101)

VU

ENTRY

# 8

Date

Particulars

Code

#

Amount(Dr.)

Amount(Cr.)

Rs.

Rs.

15-01-2002

Bank

A/c

03

5,000

Cash

A/c

01

5,000

Cash

deposited in bank

ENTRY

# 9

Date

Particulars

Code

#

Amount(Dr.)

Amount(Cr.)

Rs.

Rs.

16-01-2002

Stationery

A/c

10

3,000

Cash

A/c

01

3,000

Stationery

purchased for cash

Stationery

account is debited because stationery

account has obtained benefit

and Cash account is

credited

because

business has obtained benefit

because of Cash

account.

This

statement can also be

interpreted like

this:

As stationery is an

expense and it is increased in this

case, so stationery is debited. Cash is an

asset and

decrease

in asset is credit. In this case Cash is

decreased, hence it is

credited

ENTRY

# 10

Date

Particulars

Code

#

Amount(Dr.)

Amount(Cr.)

Rs.

Rs.

18-01-2002

Office

Equipment A/c

11

10,000

Bank

A/c

03

10,000

Office

equipment purchased by

cheque

Office

Equipment account is debited because

Office Equipment account has

obtained benefit and Bank

account

is credited because business has obtained

benefit because of Bank

account.

This

statement can also be

interpreted like

this:

As

Office Equipment is an asset

and it is increased in this case, so

Office Equipment is debited. Bank is

an

asset

and decrease in asset is credit. In this

case bank account is decreased,

hence it is credited

68

Financial

Accounting (Mgt-101)

VU

ENTRY

# 11

Date

Particulars

Code

#

Amount(Dr.)

Amount(Cr.)

Rs.

Rs.

19-01-2002

Mr.

Afzal(Creditors) A/C

07

1,000

Purchase

return A/C

12

1,000

Creditors

account is debited because Creditors

account has obtained benefit

and Purchase return account

is

credited

because business has obtained

benefit because of Purchase

return account.

This

statement can also be

interpreted like

this:

As Creditors is a

liability and it is decreased in this

case, so Creditors is debited. Purchase

return is an

expense

and decrease in expense is credit, So it

is credited.

ENTRY

# 12

Date

Particulars

Code

#

Amount(Dr.)

Amount(Cr.)

Rs.

Rs.

25-01-2002

Sales

return A/C

13

500

09

500

Mr.

Naeem(Debtors) A/C

Goods

returned by Mr.

Naeem(Debtors)

Sales

return account is debited because

Sales return account has

obtained benefit and Debtors is

credited

because

business has obtained benefit

because of Debtors

account.

This

statement can also be

interpreted like

this:

As

sales return is decrease in

income and decrease in

income is debit, so it is debited.

Debtors account is

decreased

and decrease in asset is credit, so it is

credited.

ENTRY

# 13

Date

Particulars

Code

#

Amount(Dr.)

Amount(Cr.)

Rs.

Rs.

30-01-2002

Mr.

Afzal(Creditors) A/C

07

9,000

Cash

A/C

01

9,000

Cash

paid to Mr. Afzal(Creditors)

69

Financial

Accounting (Mgt-101)

VU

ENTRY

# 14

Date

Particulars

Code

#

Amount(Dr.)

Amount(Cr.)

Rs.

Rs.

31-01-2002

Cash

A/C

01

4,500

Mr.

Naeem(Debtors) A/C

09

4,500

Cash

received from Mr.

Naeem(Debtors)

ENTRY

# 15

Date

Particulars

Code

#

Amount(Dr.)

Amount(Cr.)

Rs.

Rs.

31-01-2002

Cash

A/C

01

500

Bank

A/C

03

500

Cash

withdrawn from bank

CASH

AND BANK BOOK

�

Ledger

is a book that keeps

separate record for each

account;

�

The

Account or Head of Account is a

systematic record of transactions of

one type; and

�

Like

other things, a separate account is

also required to record the movements in

cash (usually called

cash

in hand) and bank account

(usually called cash at

bank).

�

If the

volume of transactions is high

then we can separate books

for cash and bank

account.

�

These

separate books for cash and

bank account are called cash

book and bank book

respectively.

�

The

Cash Book records all the

movements in the cash

account.

�

A cash

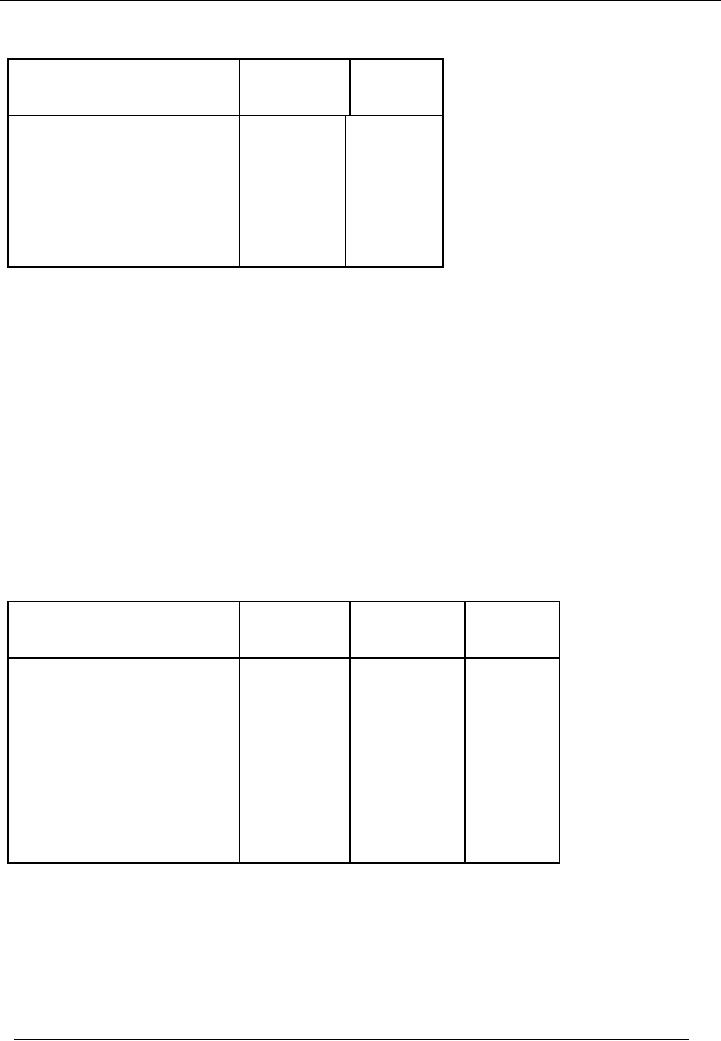

book would look like

one of the two samples shown

here

70

Financial

Accounting (Mgt-101)

VU

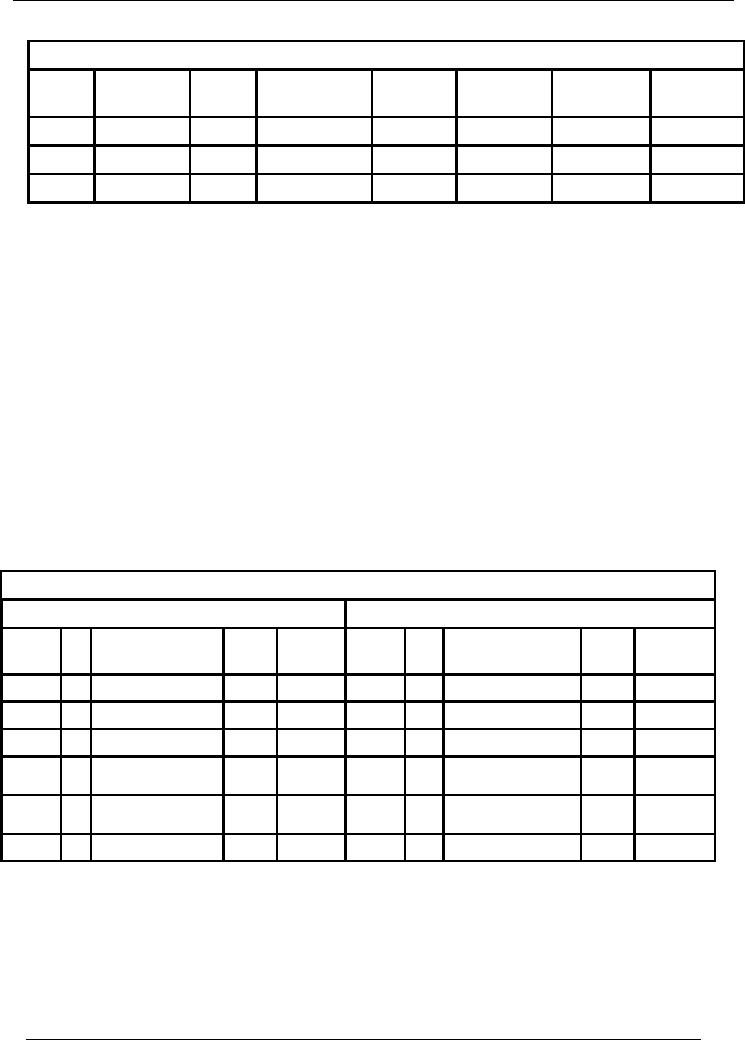

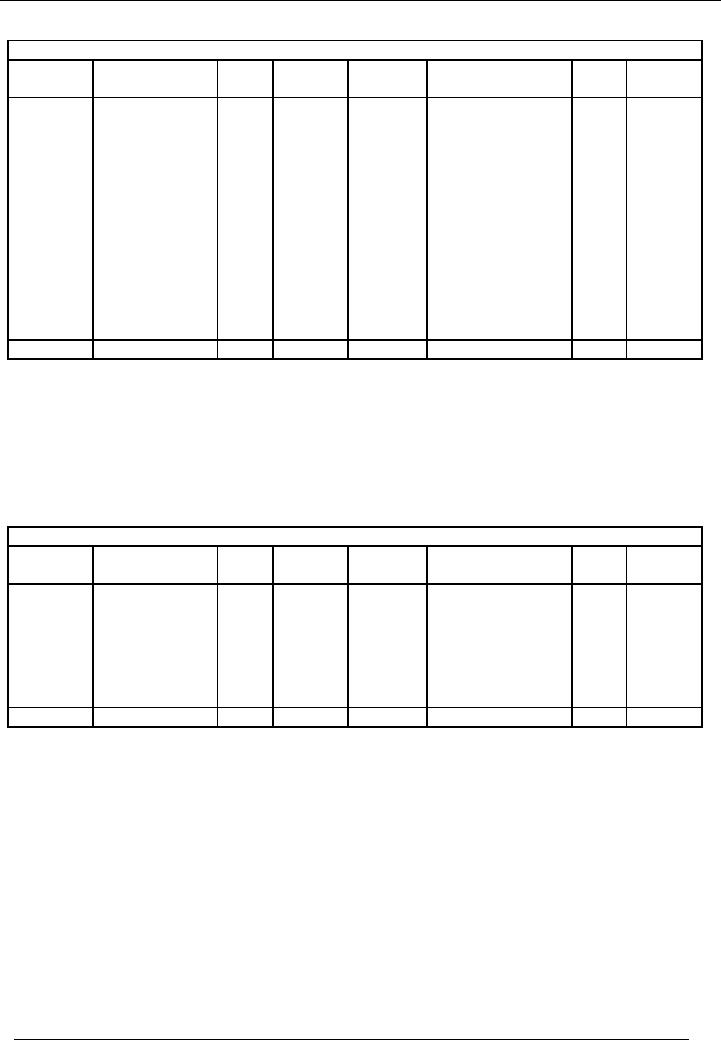

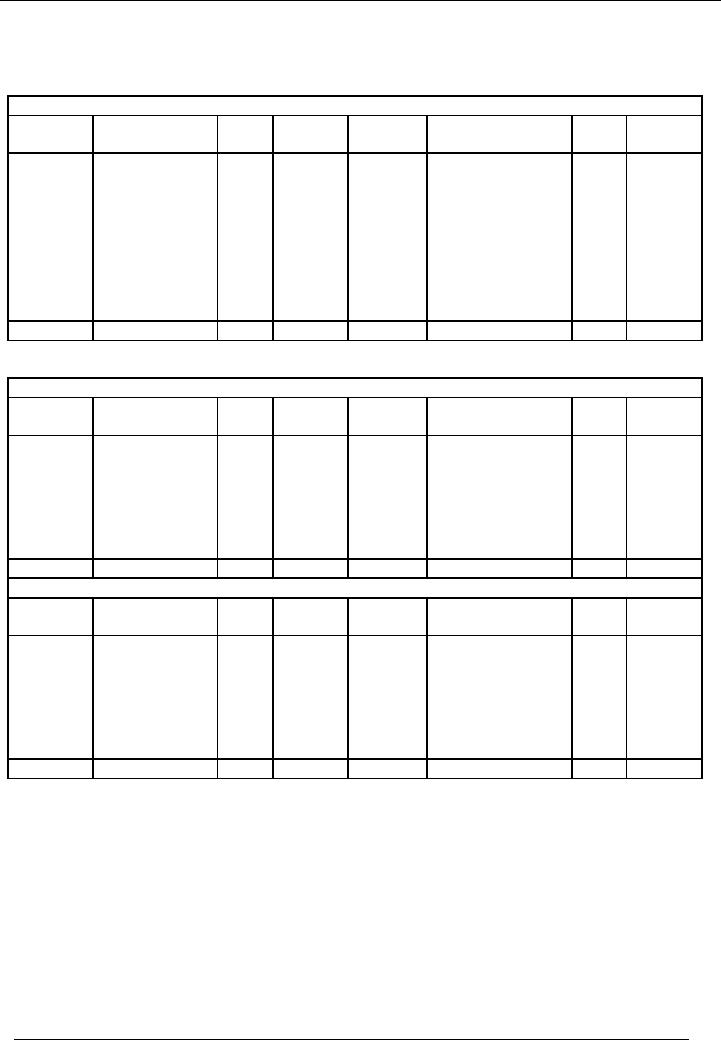

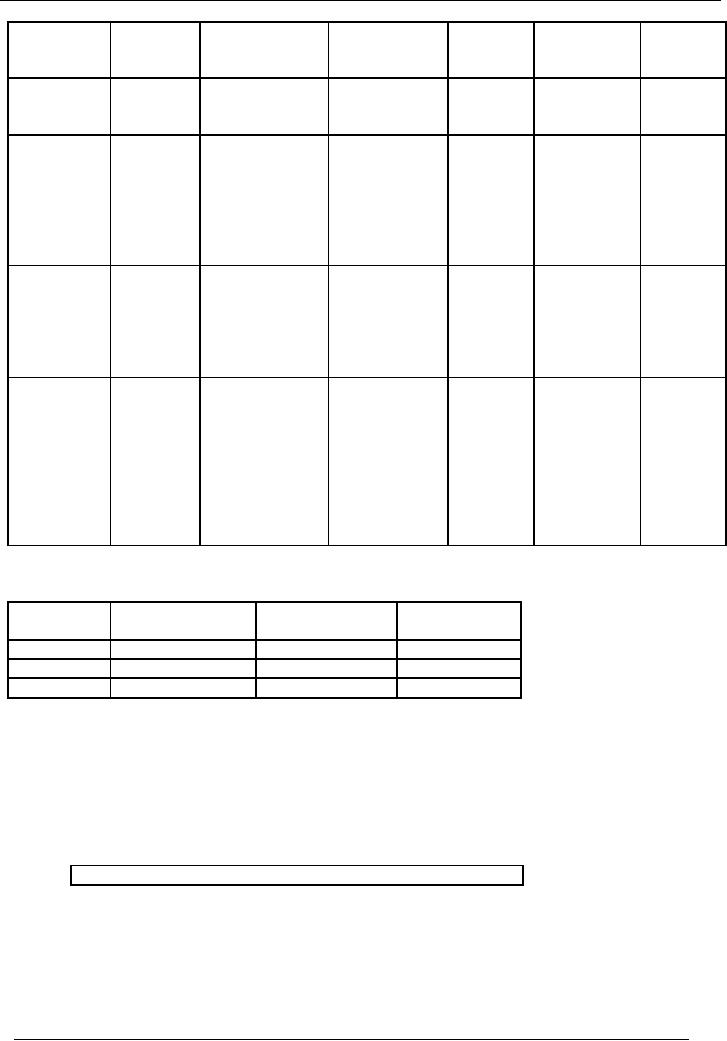

Cash

Book

Account

Code 01

Receipt

Side

Payment

Side

Date

No. Narration /

Ledger

Receipt

Date No. Narration / Ledger

Payment

Particulars

Code

Amount

Particulars

Code Amount

OR

Cash

Book

Account

Code 01

Date

Voucher

Narration

/

Ledger

Receipt

Payment

Balance

Number

Particulars

Code

Amount

Amount

Dr/(Cr)

THE

CASH BOOK

�

In the

first format / presentation,

receipts (Debits) are written on

left hand side of the page

and

payments

(Credits) on the right hand

side.

�

In the

second presentation, instead of

using two pages, we use

two columns on the same

page.

�

Both

these presentations are

correct.

�

In the

second format, we have an

additional facility of knowing the

balance of the account after

every

transaction.

�

Whereas

in the first one, we have to

add up the receipts and

payments every time we need to

know

the

balance.

�

Moreover,

the second format utilizes

less space, therefore, we

will use this format in our

future

discussions

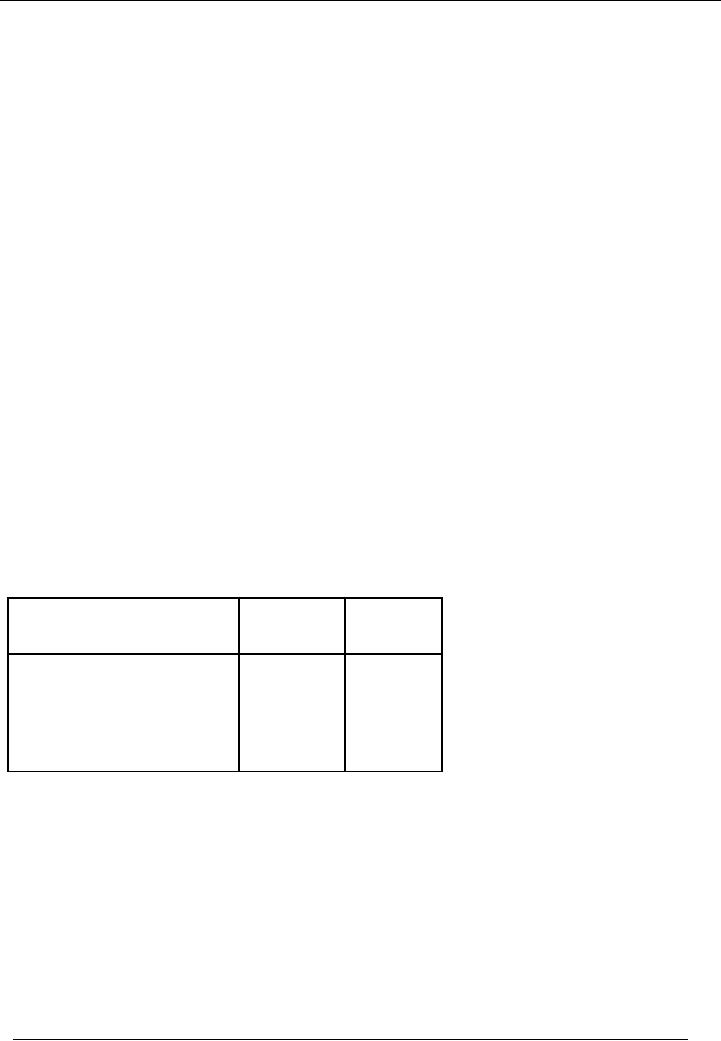

THE

BANK BOOK

�

The

Bank book records all the

movements in the bank account.

�

The

format of the bank book is the same as

that of cash book axcept

for an additional column

for

Cheque

Number.

�

Again,

we can use either two pages

OR two columns to present the bank

book.

71

Financial

Accounting (Mgt-101)

VU

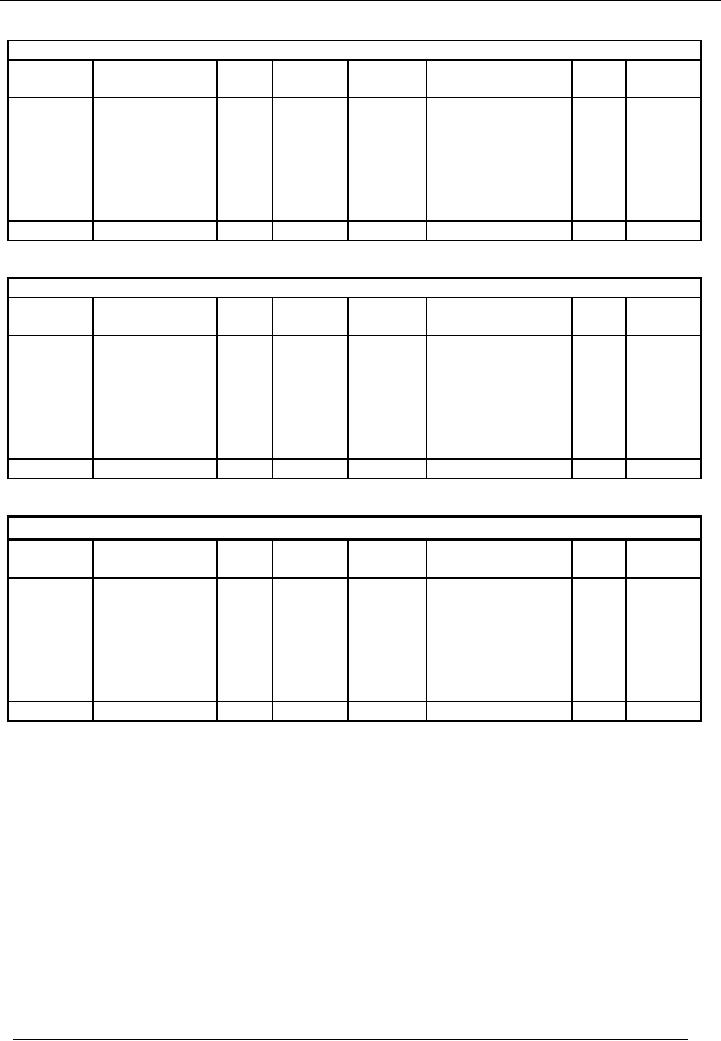

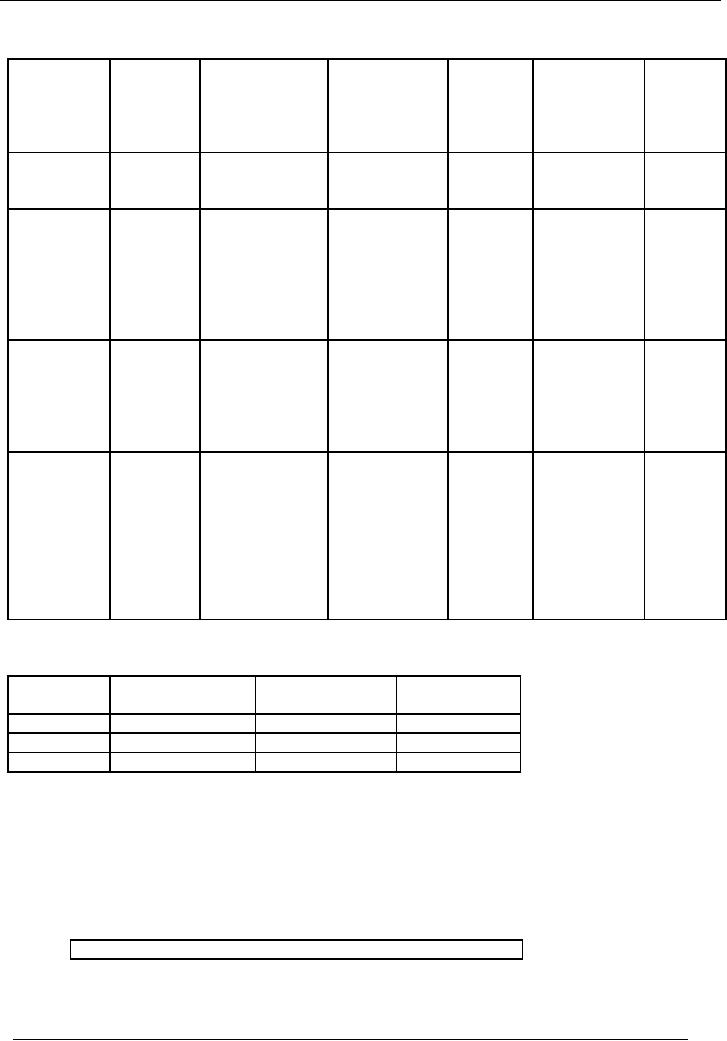

Bank

Book (Bank Account

Number)

Account

Code 02

Date

Voucher

Chq.

Narration

/

Ledger

Receipt

Payment

Balance

Number

No.

Particulars

Code

Amount

Amount

Dr/(Cr)

�

As you

can see that except

for a few minor differences,

the formats of Cash and Bank book

are

almost

similar to that of the General

Ledger.

�

The

differences are explained

here:

�

The

title of debit and credit

columns has been changed to

receipt and payment

respectively. It is not

necessary

to make this change. But, it is done to

simplify things as we know that in

case of cash and

bank,

debit side would signify

receipt and credit side

would represent

payment.

�

There is an

additional column titled ledger

code. In this column, we write the code

of the other head

of

account that is affected by the

transaction. This helps in understanding the

complete transaction

at a

glance.

�

There

may be a column for cheque number in the

bank book.

�

It may

be noted that in case the organization

operates more than one bank

account, separate

ledger

accounts

will be opened in bank book

for each account.

Now we

will summarize all cash

transactions in both two

page cash book & one

page cash book for

the

convenience

of the reader.

Two

page cash book will be

presented asunder:

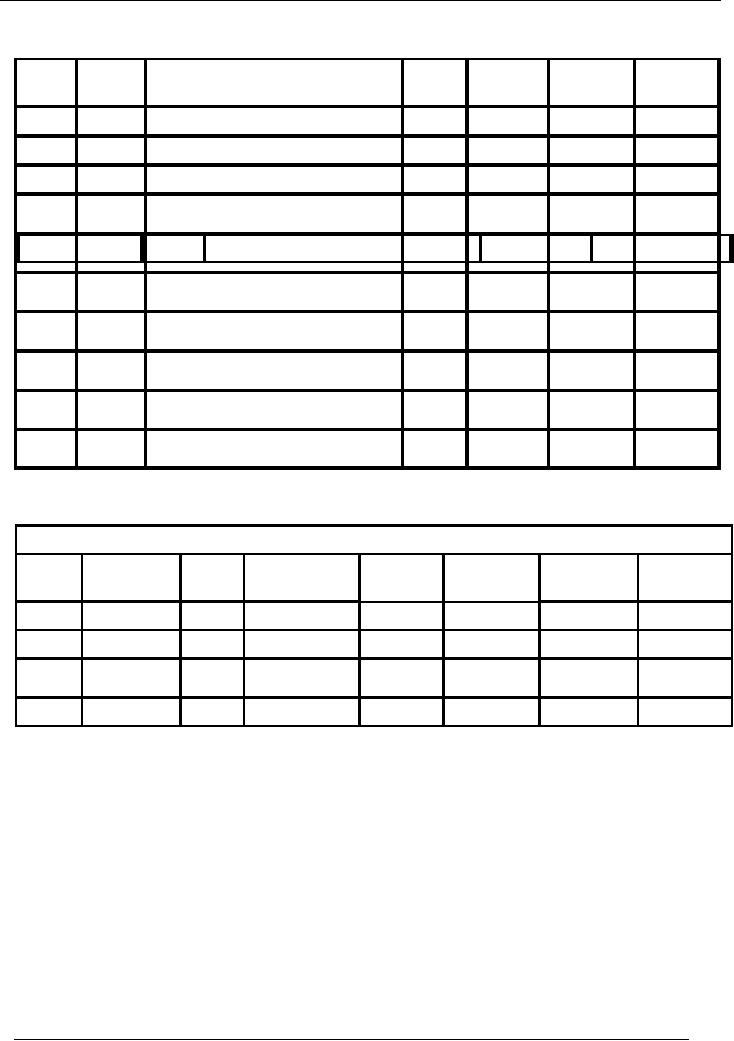

Cash

Account

Account

Code 01

Receipt

Side

Payment

Side

Date

No.

Narration

/

Ledger

Receipt

Date

No.

Narration

/

Ledger

Payment

Particulars

Code

Amount

Particulars

Code

Amount

Jan-1

Capital

introduced

02

100,000

Jan-3

Deposited in

bank

03

30,000

Jan-5

Loan

received

04

50,000

Jan-7

Furniture

purchased

05

20,000

Jan-10

Goods

sold

08

5,000

Jan-15

Deposited in

bank

03

5,000

Jan-31

Received

from

09

4,500

Jan-16

Stationery

purchased

10

3,000

debtors

Jan-31

Cash

drawn from

03

500

Jan-30

Paid

to creditors

07

9,000

bank

72

Financial

Accounting (Mgt-101)

VU

Same

record will be presented in

two column cash book

now

Date

Voucher

Narration

/

Ledger

Receipt

Payment

Balance

Number

Particulars

Code

Amount

Amount

Dr/(Cr)

Jan-1

Capital

introduced

02

100,000

100,000

Jan-3

Deposited in

bank

03

(30,000)

70,000

Jan-5

Loan

received

04

50,000

120,000

(20,000)

Jan-7

Furniture

purchased

05

100,000

Goods

soGoods sold

ld

08

5,000

105,000

0

Jan-10

5,00

(5,000)

Jan-15

Deposited in

bank

03

100,000

(3,000)

Jan-16

Stationery

purchased

10

97,000

(9,000)

Jan-30

Paid

to creditors

07

88,000

Jan-31

Received

from debtors

09

4,500

92,500

Jan-31

Cash

drawn from bank

03

500

93,000

Now,

we will present Bank entries in bank

book.

Bank

Book (Bank Account # xxx)

Account Code 02

Date

Voucher

Chq.

Narration

/

Ledger

Receipt

Payment

Balance

Number

No.

Particulars

Code

Amount

Amount

Dr/(Cr)

Jan-3

Cash

deposited

01

30,000

30,000

Jan-15

Cash

deposited

01

5,000

35,000

Jan-18

Off.

Equip.

11

(10,000)

25,000

purchased

Jan-31

Cash

drawn

01

(500)

24,500

RECOMMENDED

READING

After

reading this lecture, you

will be able to read

� Chapter

# 2 of business accounting by Frank

Woods

� Chapter

# 2, 3 of accounting by M. Arif &

Sohail Afzal

73

Financial

Accounting (Mgt-101)

VU

ILLUSTRATION

Nawab

Sons started their business

in the month of March, 2002.

Following are their

transactions for the

month.

Pass journal entries,

prepare ledger accounts, and

make their profitability

analyses.

No.

Date

Particulars

01

Mar.

01

Started

business with Rs.

150,000

02

Mar.

05

Purchased

office furniture for cash

Rs. 2,000

03

Mar.

07

Purchased

goods for cash Rs.

9,000

04

Mar.

10

Paid

carriage on purchases Rs.

250

05

Mar.

12

Purchased

goods from Saleem &co.

Rs. 7,000

06

Mar.

13

Sold

goods for cash Rs.

12,000

07

Mar.

15

Sold

goods to Usman & Sons

Rs. 25,000

08

Mar.

21

Received

cash From Usman & Sons

Rs. 25,000

09

Mar.

21

Paid

cash to Saleem &co Rs.

7,000

10

Mar.

23

Paid

salaries for the month Rs.

2,500

11

Mar.

25

Paid

rent Rs. 3,000

12

Mar.

29

Purchased

stationery Rs.2,000

13

Mar.

31

Utility

bills are accrued Rs.

5,000

JOURNAL

ENTRIES

ENTRY

# 1

Date

Particulars

Code

#

Amount(Dr.)

Amount(Cr.)

Rs.

Rs.

03-01-2002

Cash

A/c

01

150,000

Capital

A/c

02

150,000

Started

business with cash.

74

Financial

Accounting (Mgt-101)

VU

ENTRY

# 2

Date

Particulars

Code

#

Amount(Dr.)

Amount(Cr.)

Rs.

Rs.

01-05-2002

Office

Furniture A/c

03

2,000

Cash

A/c

01

2,000

Purchased

office furniture

ENTRY

# 3

Date

Particulars

Code

#

Amount(Dr.)

Amount(Cr.)

Rs.

Rs.

03-07-2002

Purchases

A/c

04

9,000

Cash

A/c

01

9,000

Purchased

goods for cash.

ENTRY

# 4

Date

Particulars

Code

#

Amount(Dr.)

Amount(Cr.)

Rs.

Rs.

03-10-2002

Carriage

on purchase A/c

05

250

Cash

A/c

01

250

Paid

carriage on purchase.

ENTRY

# 5

Date

Particulars

Code

#

Amount(Dr.)

Amount(Cr.)

Rs.

Rs.

03-12-2002

Purchases

A/c

04

7,000

Salim

& co.(Creditors)

06

7,000

Purchased

goods on credit

75

Financial

Accounting (Mgt-101)

VU

ENTRY

# 6

Date

Particulars

Code

#

Amount(Dr.)

Amount(Cr.)

Rs.

Rs.

03-13-2002

Cash

A/c

01

12,000

Sale

A/c

07

12,000

Goods

sold for cash.

ENTRY

# 7

Date

Particulars

Code

#

Amount(Dr.)

Amount(Cr.)

Rs.

Rs.

03-15-2002

Usman

& Sons(Debtors) A/c

08

25,000

25,000

Sale

A/c

07

Goods

sold on credit.

ENTRY

# 8

Date

Particulars

Code

#

Amount(Dr.)

Amount(Cr.)

Rs.

Rs.

03-21-2002

Cash

A/c

01

25,000

Usman

& Sons(Debtors A/c

08

25,000

Cash

received from Usman &

Sons

ENTRY

# 9

Date

Particulars

Code

#

Amount(Dr.)

Amount(Cr.)

Rs.

Rs.

03-21-2002

Salim

& co.(Creditors) A/c

06

7,000

Cash

A/c

01

7,000

Paid

cash to Salim &

co.

76

Financial

Accounting (Mgt-101)

VU

ENTRY

# 10

Date

Particulars

Code

#

Amount(Dr.)

Amount(Cr.)

Rs.

Rs.

03-23-2002

Salaries

A/c

09

2,500

Cash

A/c

01

2,500

Started

business with cash.

ENTRY

# 11

Date

Particulars

Code

#

Amount(Dr.)

Amount(Cr.)

Rs.

Rs.

03-25-2002

Rent

A/c

10

3,000

Cash

A/c

01

3,000

Paid

rent..

ENTRY

# 12

Date

Particulars

Code

#

Amount(Dr.)

Amount(Cr.)

Rs.

Rs.

03-29-2002

Stationery

A/c

11

2,000

2,000

Cash

A/c

01

Stationery

purchased.

ENTRY

# 13

Date

Particulars

Code

#

Amount(Dr.)

Amount(Cr.)

Rs.

Rs.

03-31-2002

Utility

Bills A/c

12

5,000

Accrued

Expenses A/c

13

5,000

Accrual of

utility bills for the

month..

77

Financial

Accounting (Mgt-101)

VU

LEDGER

ACCOUNTS

Cash

Account

Account

code # 1

Date

Particulars

Code

Amount

Date

Particulars

Code

Amount

#

Rs.

(Dr.)

#

Rs.

(Cr.)

1-3-02

Commenced

02

150,000

5-3-02

Office

furniture

03

2,000

business

purchased

13-3-02

Goods

sold

07

12,000

7-3-02

Goods

purchased

04

9,000

21-3-02

Received

from

10-3-02

Carriage

paid

05

250

debtors

08

25,000

21-3-02

Paid

to creditors

06

7,000

23-3-02

Paid

salaries

09

2,500

25-3-02

Paid

rent

10

3,000

29-3-02

Paid

for stationery

11

2,000

BALANCE

161,250

Total

187,000

Total

187,000

Capital

Account

Account

code # 2

Date

Particulars

Code

Amount

Date

Particulars

Code

Amount

#

Rs.

(Dr.)

#

Rs.

(Cr.)

1-3-02

Cash

introduced

01

150,000

BALANCE

150,000

Total

150,000

Total

150,000

Office

furniture Account

Account

code # 3

Date

Particulars

Code

Amount

Date

Particulars

Code

Amount

#

Rs.

(Dr.)

#

Rs.

(Cr.)

5-3-02

Office

furniture

01

2,000

purchased

BALANCE

2,000

Total

2,000

Total

2,000

78

Financial

Accounting (Mgt-101)

VU

Purchases

Account

Account

code # 4

Date

Particulars

Code

Amount

Date

Particulars

Code

Amount

#

Rs.

(Dr.)

#

Rs.

(Cr.)

7-3-02

Purchased

01

9,000

goods

12-3-02

Purchased

7,000

goods

on credit

BALANCE

16,000

Total

16,000

Total

16,000

Carriage

on purchase Account Account

code # 5

Date

Particulars

Code

Amount

Date

Particulars

Code

Amount

#

Rs.

(Dr.)

#

Rs.

(Cr.)

10-3-02

Paid

carriage on

01

250

purchase

BALANCE

250

Total

250

Total

250

Salim

& co.(Creditors) Account

Account

code # 6

Date

Particulars

Code

Amount

Date

Particulars

Code

Amount

#

Rs.

(Dr.)

#

Rs.

(Cr.)

12-3-02

Purchased

04

7,000

21-3-02

Paid

cash

01

7,000

goods

BALANCE

0

Total

7,000

Total

7,000

Sale

Account Account code #

7

Date

Particulars

Code

Amount

Date

Particulars

Code

Amount

#

Rs.

(Dr.)

#

Rs.

(Cr.)

13-3-02

Goods

sold

01

12,000

15-3-02

Goods

sold on

08

credit

25,000

BALANCE

37,000

Total

37,000

Total

37,000

Usman

& sons(Debtors) Account

Account

code # 8

Date

Particulars

Code

Amount

Date

Particulars

Code

Amount

79

Financial

Accounting (Mgt-101)

VU

#

Rs.

(Dr.)

#

Rs.

(Cr.)

15-3-02

Goods

sold

07

25,000

21-3-02

Received

cash

01

25,000

BALANCE

0

Total

25,000

Total

25,000

Salaries

Account

Account

code # 9

Date

Particulars

Code

Amount

Date

Particulars

Code

Amount

#

Rs.

(Dr.)

#

Rs.

(Cr.)

23-3-02

Salaries

paid

01

2,500

BALANCE

2,500

Total

2,500

Total

2,500

Rent

Account Account code #

10

Date

Particulars

Code

Amount

Date

Particulars

Code

Amount

#

Rs.

(Dr.)

#

Rs.

(Cr.)

Rent

paid

01

3,000

25-3-02

BALANCE

3,000

Total

3,000

Total

3,000

Stationery

Account

Account

code # 11

Date

Particulars

Code

Amount

Date

Particulars

Code

Amount

#

Rs.

(Dr.)

#

Rs.

(Cr.)

29-3-02

Stationery

01

2,000

purchased

BALANCE

2,000

Total

2,000

Total

2,000

Utility

Bills Account

Account

code # 12

Date

Particulars

Code

Amount

Date

Particulars

Code

Amount

#

Rs.

(Dr.)

#

Rs.

(Cr.)

80

Financial

Accounting (Mgt-101)

VU

31-3-02

Accrued

utility

13

5,000

bills

BALANCE

5,000

Total

5,000

Total

5,000

Accrued

Expenses Account Account

code # 13

Date

Particulars

Code

Amount

Date

Particulars

Code

Amount

#

Rs.

(Dr.)

#

Rs.

(Cr.)

31-3-02

Accrued

utility

12

5,000

bills

BALANCE

5,000

Total

5,000

Total

5,000

TRIAL

BALANCE

Saeed

& co.

Trial

Balance As On ( January 31,

2002)

Title

of Account

Code

Dr.

Rs.

Cr.

Rs.

Cash

Account

01

161,250

Capital

Account

02

150,000

Furniture

Account

03

2,000

Purchases

Account

04

16,000

Carriage

on purchase account

05

250

Salim&

co. (Creditor)

06

0

Sales

07

37,000

Usman

& co. (Debtor)

08

0

Salaries

09

2,500

Rent

10

3,000

Stationery

11

2,000

Utility

billst

12

5,000

Accrued

expenses

13

5,000

Total

192,000

192,000

81

Financial

Accounting (Mgt-101)

VU

Saeed

& Co.

Profit &

Loss Account for the

period ended January 31,

2002

Particulars

Amount

Amount

Rs.

Rs.

37,000.

Income

/ Sales / Revenue (See Note

#1)

Less:

Cost of Goods

Sold

(16,250)

(See

Note # 1)

Gross

Profit

20,750.

Less:

Admin. Expenses

(12,500)

(See

Note # 2)

Net

Profit/ (Loss)

8,250

Note

# 1 Cost of goods

sold

Purchases

16,000

Add:

carriage on purchase

250

Cost

of goods sold

16,250

Note

# 2 Admin. Expenses

Salaries

2,500

Rent

3,000

Stationery

2,000

Utility

bills

5,000

Total

Admin. Expenses

12,500

RECOMMENDED

READING

After

reading this lecture, you

will be able to read

� Chapter

# 3 of business accounting by Frank

Woods

� Chapter

# 5 of accounting by M. Arif & Sohail

Afzal.

82

Financial

Accounting (Mgt-101)

VU

Lesson-12

THE

ACCOUNTING EQUATION

Resources

in the business = Resources

supplied by the

owner

In

accounting, terms are used

to describe things. The amount of

resources supplied by the owner is

called

capital. The

actual resources which are

in the business are called

assets. This

means that the

accounting

equation

above, when the owner has supplied all

the resources, can be shown

as:

Assets=Capital

Usually,

people, other than the owner

has supplied some of the assets.

Liabilities

are

the name given to the

amounts

owing to these people for

these assets. The equation

has now changed

to:

Assets=Capital

+ Liabilities

It can

be seen that two sides of

the equation will have the same

totals. This is because we are

dealing with

the

same thing with two

different points of view. It

is:

Resources

in the business = Resources:

who supplied them

Assets

= Capital + Liabilities

It is a

fact that total of each

side will always equal

one another, and this will

always be true no matter

how

many

transactions there may be.

The actual assets, capital

and liabilities may change,

but the total of the

assets

will always equal to the

total of capital and

liabilities.

Assets

consist of property of all kinds,

such as buildings, machinery, stocks of

goods and motor

vehicles.

Also

benefits such as debts owned by customers

and the amount of money in the bank

accounts are

included.

Liabilities

consist of money owing for

goods supplied to the business and

for expenses. Also loans

made to

the

firm are included.

Capital is

often called the owner's net

worth.

Working

capital

Working

capital of the business is the net value

of current assets & current

liabilities.

Current

assets are

the resources of the business that

are expected to be received

within 12 months in an

accounting

period.

Current

liabilities are

the amount owing to the business that is

expected to be paid within one

year in a

financial

year.

So,

working capital is the net of what is

receivable in an accounting year &

what is payable in that year

or:

Working

Capital = Current Assets

Current Liabilities

For

instance, current assets of the business

worth Rs.100,000 & current

liabilities of the business has

the

value

of Rs. 75,000. Then working

capital is Rs.

25,000.

i.e.,

(100,000-75,000).

83

Financial

Accounting (Mgt-101)

VU

STOCK

Stock

is termed as "value of goods

available to the business that

are ready for sale".

For accounting

purposes,

stock is of two

types:

� Opening

stock

� Closing

stock

Opening

stock is the

value of goods available for

sale in the beginning of an accounting

year. For purpose

of financial

reporting, opening stock is

added to the purchases for the

year to become a part of cost

of

goods

sold. As this is

available in the beginning of the year, it is

assumed that it will be

consumed in the

accounting

year. That is why; it becomes a

part of cost

of goods sold.

Stock of previous year is the

opening

stock

in present year.

Closing

stock is the

value of goods unsold at the end of

accounting year. For

purposes of making financial

statements,

it is deducted from cost of

goods sold & is shown as an

asset in the balance

sheet. As this is

the

value

of goods that are yet to be

sold, so it cannot be included in cost of

goods sold. That is why it

is

deducted

from cost of good sold. On

the other hand, its benefit

will be received in the next

accounting year,

so it is

shown as an asset in the balance

sheet.

Now,

the

contents of cost of goods

sold are:

Opening

stock

Plus:

purchases

Plus:

Freight/ carriage paid on

purchases

Less:

closing stock

For

instance, opening stock of a

business worth Rs. 15,000,

business purchased goods of

Rs. 12,000 for the

year

& also paid Rs. 1,500 as

carriage on purchases. The

value of closing stock at the

end of the year is

Rs.

10,000.

Then, value of closing stock

is calculated as under:

Opening

stock

15,000

Add:

purchases

12,000

Add:

carriage on purchase

1,500

Less:

closing stock

(10,000)

Cost

of goods sold

18,500

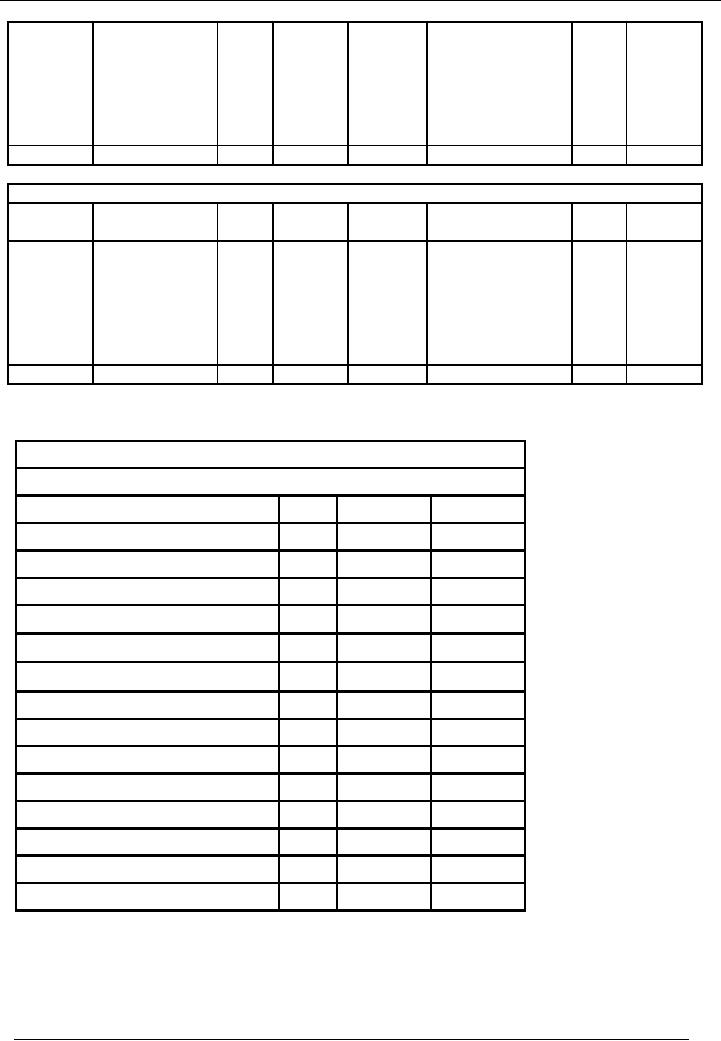

Ali

Traders

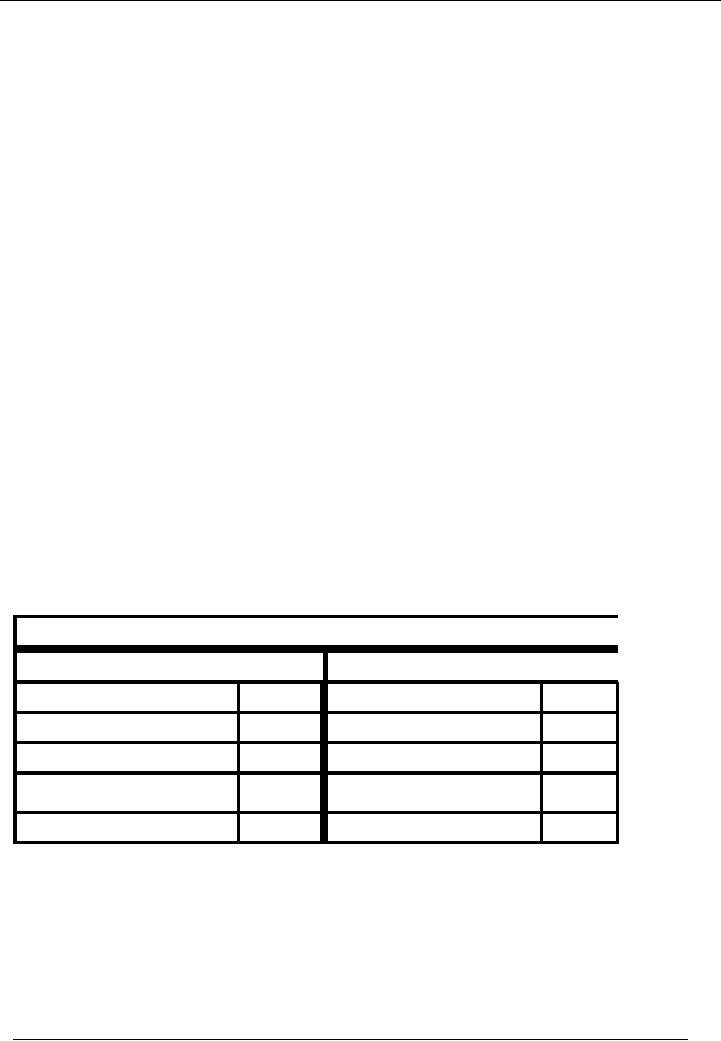

Trial

Balance As On January 31,

20--

Title

of Account

Code

Dr.

Rs.

Cr.

Rs.

Cash

Account

01

35,000

Bank

Account

02

130,000

Capital

Account

03

200,000

Furniture

Account

04

15,000

Vehicle

Account

05

50,000

Purchases

Account

06

60,000

Mr. A

(Creditor)

07

15,000

Sales

08

95,000

Mr. B

(Debtor)

09

15,000

Salaries

10

5,000

84

Financial

Accounting (Mgt-101)

VU

Expenses

11

20,000

Expenses

Payable

12

20,000

Total

330,000

330,000

The

Accounting Equation.

Assets

= Capital + Liabilities

Assets

= 35,000+130,000+15,000+50,000+15,000= 245,000

Capital =

200,000

Liabilities

= 15,000 + 20,000 =

35,000

Capital +

Liabilities = 235,000

We ignore the

Net Profit Rs.10000 (Net

profit is added in capital

account)

When

we added Net profit in

capital then;

Assets

= Capital + Liabilities

245000

= 210000+35000

245000

= 245000

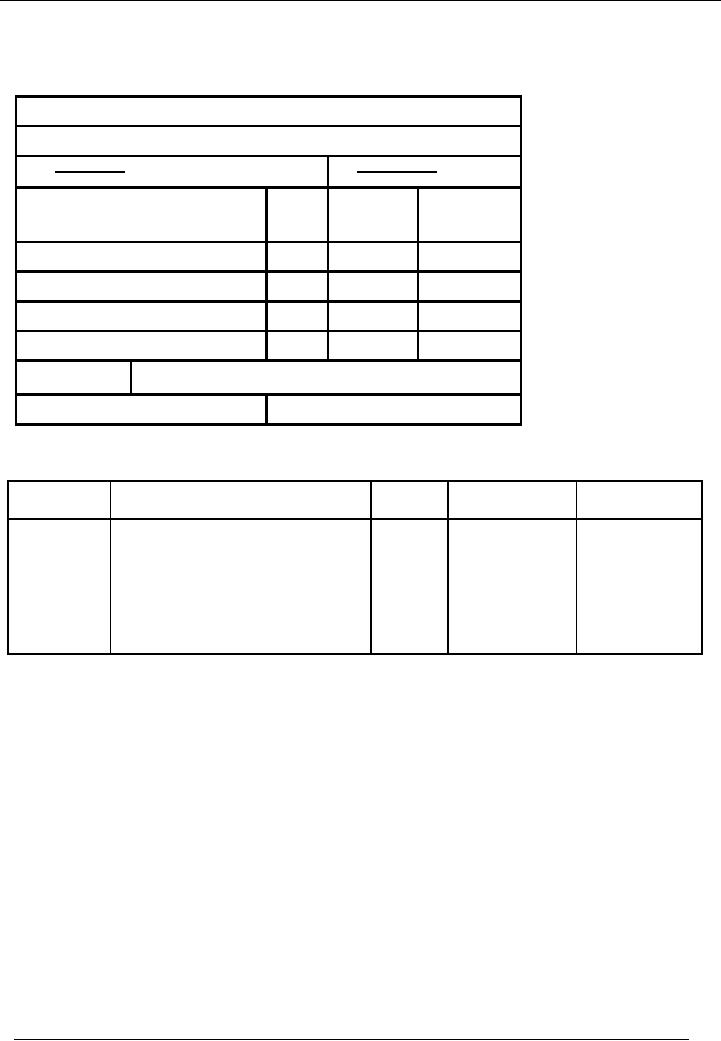

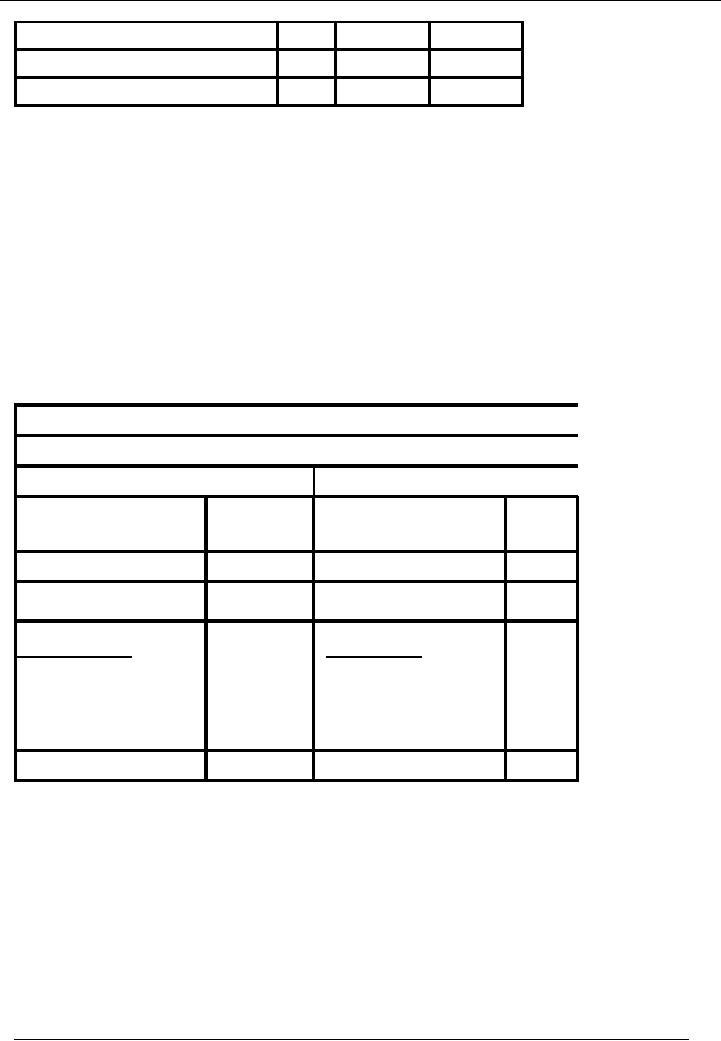

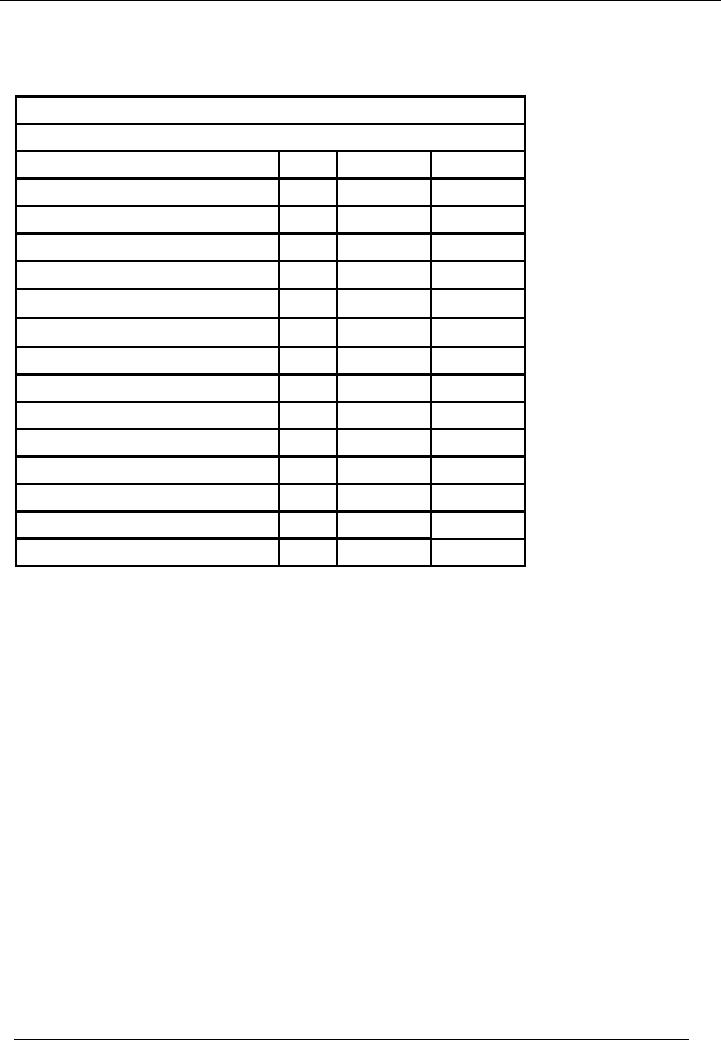

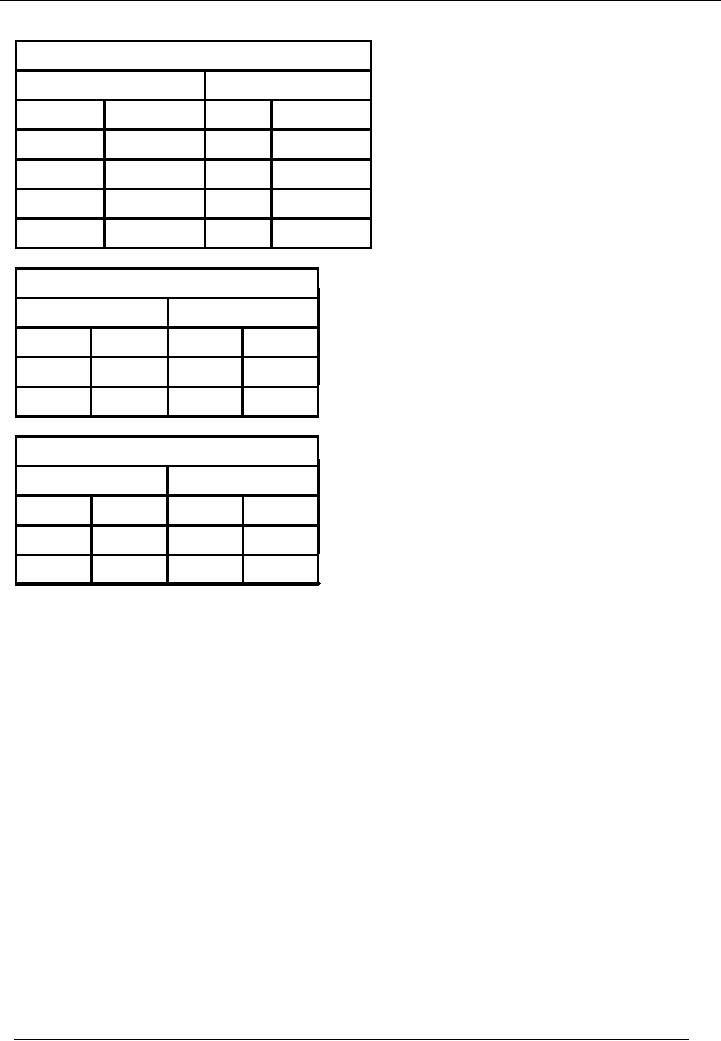

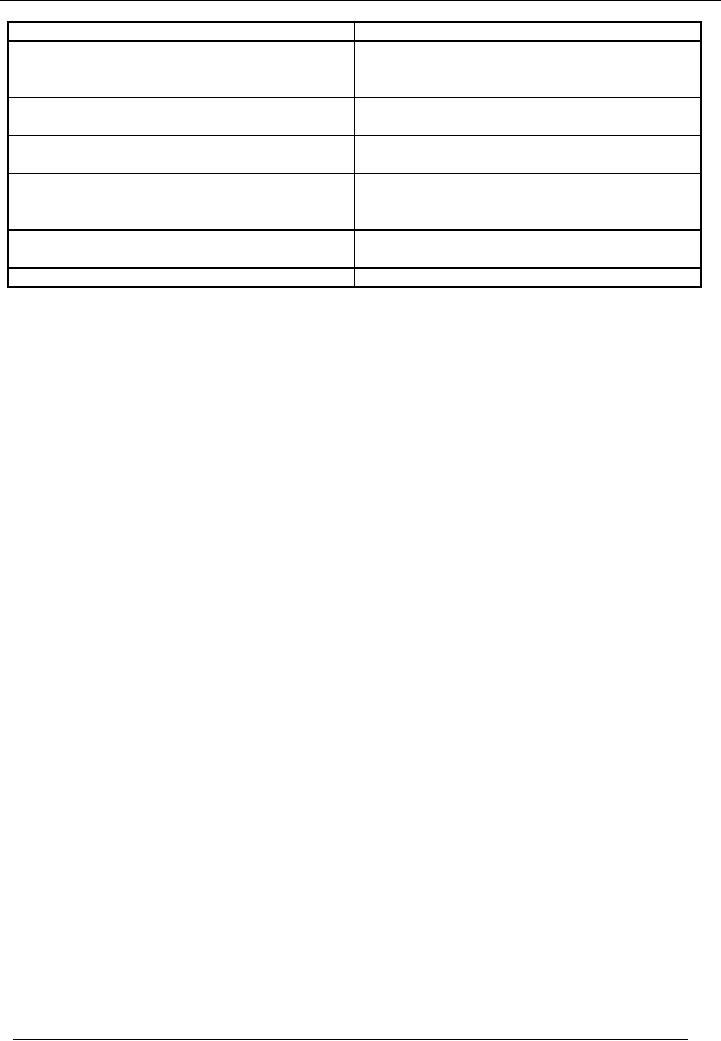

Account

form Balance Sheet

Name of the

Entity (Ali traders)

Balance

Sheet As At (January 31,

20--)

Liabilities

Assets

Particulars

Amount

Rs.

Particulars

Amount

Rs.

Capital

200.000

Fixed Assets

65,000

Profit

and Loss Account

10,000

Furniture

15,000

50000

210,000

Vehicle

Current

Liabilities

Current

Assets

Mr.

A

15,000

Mr.

B

15,000

Exp.

payable

20,000

35,000

Bank

130,000

180,000

Cash

35,000

Total

245,000

Total

245,000

85

Financial

Accounting (Mgt-101)

VU

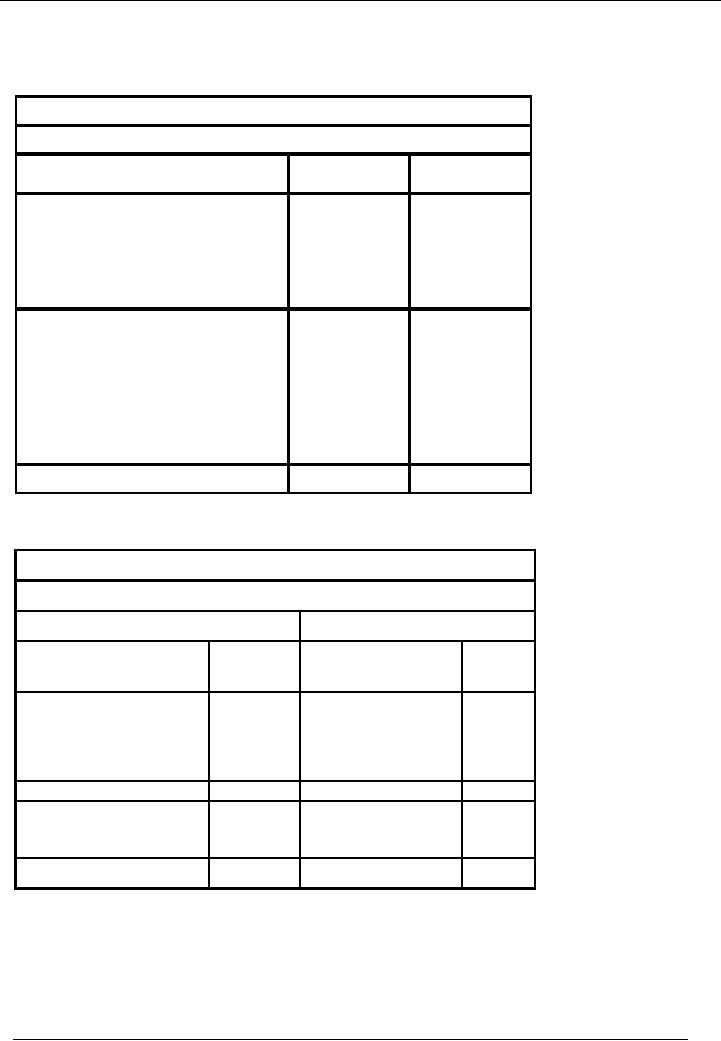

Report

form Balance Sheet

Ali

traders

Balance

Sheet As At January 31,

20--

Particulars

Amount

Rs.

Amount

Rs.

Assets

Fixed

Assets

65,000

Current

Assets

180,000

Total

245,000

Liabilities

Capital

200,000

Profit

and Loss Account

10,000

210,000

Current

Liabilities

35,000

Total

245,000

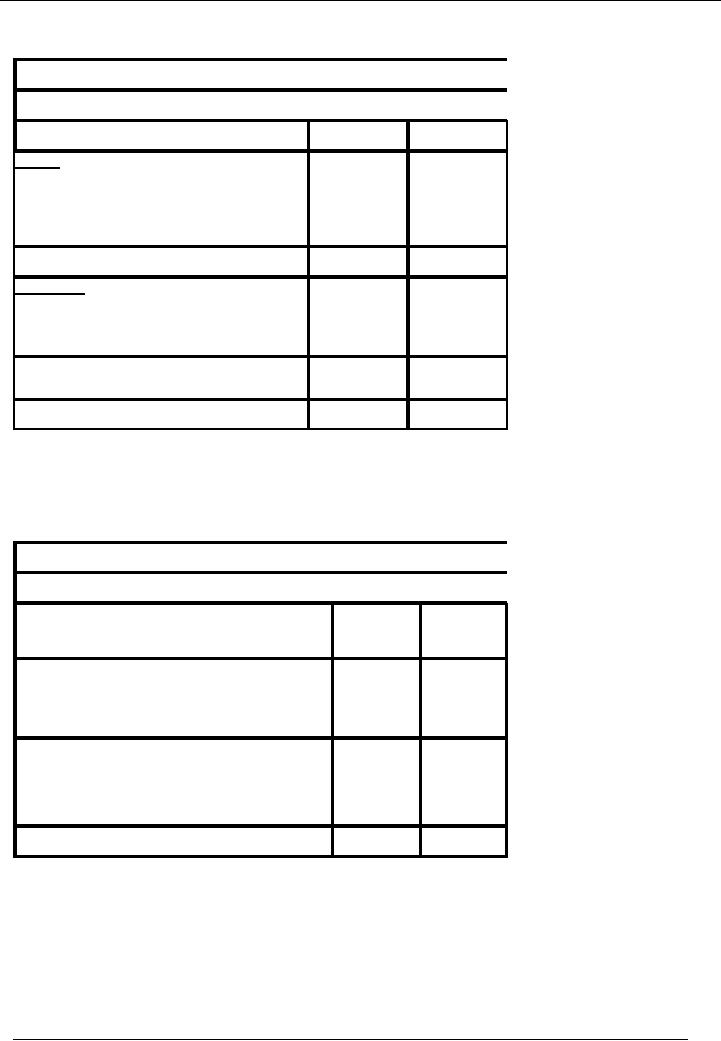

Treatment of

closing stock

If

closing stock is Rs.10000

then;

Name of the

Entity (Ali Traders)

Profit

and Loss Account for the

Month Ending January 31,

20--

Particulars

Amount

Amount

Rs.

Rs.

Income

/ Sales / Revenue

95,000

Less:

Cost of Goods Sold (

60,000 - 1,000 )

(59,000)

(59,000)

Gross

Profit

36,000

Less:

Administrative Expenses

(25,000)

(25,000)

Net

Profit

11,000

86

Financial

Accounting (Mgt-101)

VU

Ali

traders

Balance

Sheet As At January 31,

20--

Particulars

Amount

Rs.

Amount

Rs.

Assets

Fixed

Assets

65,000

Current

Assets (180,000

+ 1,000)

181,000

Total

246,000

Liabilities

Capital

200,000

Profit

and Loss Account

11,000

210,000

Current

Liabilities

35,000

Total

246,000

Treatment of

Depreciation

In

Profit and Loss Account it

is considered as expense and in

Balance Sheet it is deducted

from the

concerned

asset.

If

useful life of an asset is 50

month and considered that

there is no residual value

then,

�

Dividing

total cost by life of the

asset.

�

Rs.65,000

/ 50 months = Rs.1,300 monthly

charge

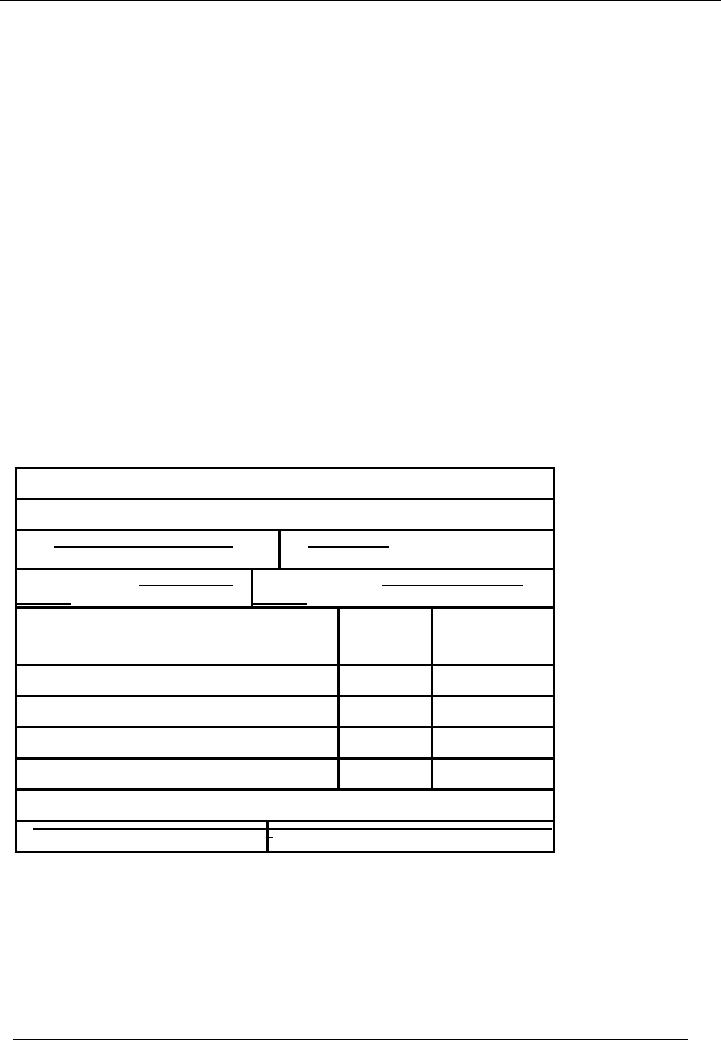

Name of the

Entity (Ali Traders)

Profit

and Loss Account for the

Month Ending January 31,

20--

Particulars

Amount

Amount

Rs.

Rs.

Income

/ Sales / Revenue

95,000

Less:

Cost of Goods Sold (

60,000-1,000 )

59,000

(59,000)

Gross

Profit

36,000

Less:

Administrative Expenses

25,000

Depreciation

1,300

(26,300)

Net

Profit

9,700

87

Financial

Accounting (Mgt-101)

VU

Ali

traders

Balance

Sheet As At January 31,

20--

Particulars

Amount

Rs.

Amount

Rs.

Assets

Fixed

Assets (65,000

1,300)

63,700

Current

Assets (180,000 +

1,000)

181,000

Total

244,700

Liabilities

Capital

200,000

Profit

and Loss Account

9,700

209,700

Current

Liabilities

35,000

Total

244,700

Distribution

of Profits / Drawing

Ali

traders

Balance

Sheet As At January 31,

20--

Particulars

Amount

Rs.

Amount

Rs.

Assets

Fixed

Assets (65,000

1300)

63,700

Current

Assets (181,000

- 5,000)

176,000

Total

239,700

Liabilities

Capital

200,000

Profit

and Loss Account

9,700

Drawing

(5,000)

204,700

Current

Liabilities

35,000

Total

239,700

88

Financial

Accounting (Mgt-101)

VU

Illustration

Consider

the trial balance given

hereunder:

Saeed

& co.

Trial

Balance As On ( January 31,

2002)

Title

of Account

Code

Dr.

Rs.

Cr.

Rs.

Cash

Account

01

161,250

Capital

Account

02

150,000

Furniture

Account

03

2,000

Purchases

Account

04

16,000

Carriage

on purchase account

05

250

Salim&

co. (Creditor)

06

0

Sales

07

37,000

Usman

& co. (Debtor)

08

0

Salaries

09

2,500

sRent

10

3,000

Stationery

11

2,000

Utility

billst

12

5,000

Accrued

expenses

13

5,000

Total

192,000

192,000

89

Financial

Accounting (Mgt-101)

VU

(This

trial balance is extracted

from the solved illustration, in

lecture 11)

Let's

say, the value of closing

stock at the end of the period is

Rs. 2,000. Then profit &

loss account will

bear

the

following change.

Saeed

& Co.

Profit &

Loss Account for the

period ended January 31,

2002

Particulars

Amount

Amount

Rs.

Rs.

37,000.

Income

/ Sales / Revenue (See

Note

16,250

2,000

(14,250)

#1)

Less:

Cost of Goods Sold

Closing

stock

Gross

Profit

22,750.

Less:

Admin. Expenses

(12,500)

(See

Note # 2)

Net

Profit/ (Loss)

10,250

Its

effect in the balance sheet is as

follows:

Saeed

& Co.

Balance

Sheet As At January 31,

2002

Liabilities

Assets

Particulars

Amount

Particulars

Amount

Rs.

Rs.

Capital

150,000

Fixed Assets

Profit and

Loss Account

10,250

Furniture

Account

2,000

160,250

Current

Liabilities

Current

Assets

Accrued

Expenses

5,000

Cash

161,250

Closing

Stock

2,000

Total

165,250

Total

165,250

This is a

practical demonstration of the treatment of closing

stock. But, we are not

mentioning the journal

entry

of closing stock at this stage. It

will be discussed in detail, when we will

study the topic of fixed

assets.

DEPRECIATION

Depreciation

is the method of charging cost of

fixed assets to the profit &

loss account as an

expense.

Fixed

Assets are those assets

which are:

90

Financial

Accounting (Mgt-101)

VU

� Of

long life

� To be

used in the business

� Not

bought with the main purpose

of resale.

When

an expense is incurred, it is charged to

profit & loss account of the

same accounting period in

which it

has

incurred. Fixed assets are

used for longer period of time.

Now, the question is how to charge a

fixed

asset

to profit & loss account.

For this purpose, estimated

life of the asset is determined.

Estimated life is the

number of

years in which a fixed asset

is expected to be used. Then,

total cost of the asset is

divided by total

number of

estimated years. The value,

so determined, is called `depreciation

for that year' and is

charged to

profit

& loss account. The same

amount is deducted from total

cost of fixed asset. The net

amount (after

deducting

depreciation) is called ``Written Down

Value''.

For

instance, an asset has a

cost of Rs. 150,000. It is

expected to be used for ten

years. Depreciation to be

charged

to profit & loss account is

Rs. 15,000, i-e. cost of

asset/estimated life. In this case, it

will be

150,000/10

= 15,000.

That

is why depreciation is called an

accounting estimate.

To

understand its accounting

treatment, consider the above mentioned

illustration

Let's

suppose the useful life of

furniture is five years.

Then, depreciation for the year

will be (2,000/5 =

400).

Now,

the profit & loss account

will show the following

picture:

Saeed

& Co.

Profit &

Loss Account for the

year ended January 31,

2002

Particulars

Amount

Amount

Rs.

Rs.

37,000.

Income

/ Sales / Revenue (See Note

#1)

Less:

Cost of Goods

Sold

(16,250)

Gross

Profit

20,750.

Less:

Admin. Expenses + Depreciation

12,500

+ 400

(12,900)

Net

Profit/ (Loss)

9,850

Balance

sheet will look like

this:

91

Financial

Accounting (Mgt-101)

VU

Saeed

& Sons

Balance

Sheet As At January 31,

2002

Liabilities

Assets

Particulars

Amount

Particulars

Amount

Rs.

Rs.

Capital

150,000

Fixed Assets

Profit and

Loss Account

9,850

Furniture

Account

2,000

Less:

depreciation

(400)

159,850

1,600

Current

Liabilities

Current

Assets

Accrued

Expenses

5,000

Cash

161,250

Closing

Stock

2,000

Total

164,850

Total

164,850

Treatment of

depreciation is practically demonstrated at this

point. Its journal entry

will be discussed in

detail, when we

cover the topic `Fixed

Assets'.

DRAWING

Capital is the

cash or kind invested by the owner of the

business. Sometimes, the owner wants to

take cash

or

kind out of the business for

personal use. This is known as

drawing.

Any money taken out as

drawings

will reduce

capital.

The

capital account is very important

account. To stop it getting full of

small details, cash items of

drawings

are

not entered in the capital

account. Instead, a drawing account is

opened, and all transactions

are entered

there.

Sometimes

goods are also taken by the

owner of the business. These are

also known as

drawings.

To

understand the accounting treatment of

drawings, look into the

following trial

balance:

Saeed

& co.

Trial

Balance As On ( January 31,

2002)

Title

of Account

Code

Dr.

Rs.

Cr.

Rs.

Cash

Account

01

161,250

Capital

Account

02

160,000

Furniture

Account

03

2,000

Drawings

04

10,000

Profit

& loss account

05

8,250

Salim&

co. (Creditor)

06

0

Usman

& co. (Debtor)

07

0

Accrued

expenses

08

5,000

Total

173,250

173,250

BALANCE

SHEET

92

Financial

Accounting (Mgt-101)

VU

Saeed

& Sons

Balance

Sheet As At January 31,

2002

Liabilities

Assets

Particulars

Amount

Particulars

Amount

Rs.

Rs.

Capital

160,000

Fixed

Assets

Profit and

Loss

8,250

Furniture

2,000

Account

(10,000)

Account

Less:

Drawings

158,250

Current

Current

Liabilities

5,000

Assets

161,250

Accrued

Expenses

Cash

Total

163,250

Total

163,250

93

Financial

Accounting (Mgt-101)

VU

Lesson-13

LEARNING

OBJECTIVE

After

studying this lecture, you should be able

to:

� Understand

different types of

vouchers.

� How

to book entry in voucher.

� Carrying

forward the balance of an

account.

VOUCHER

In

book keeping, voucher is the first

document to record an entry. Normally three

types of vouchers are

used.

i-e.:

� Receipt

voucher

� Payment

voucher

� Journal

voucher

RECEIPT

VOUCHER

Receipt

voucher is used to record cash or bank

receipt. Receipt vouchers

are of two types.

i-e.

� Cash

receipt voucher

� Bank

receipt voucher

Cash

receipt voucher denotes receipt of

cash; bank receipt voucher indicates

receipt of cheque or

demand

draft.

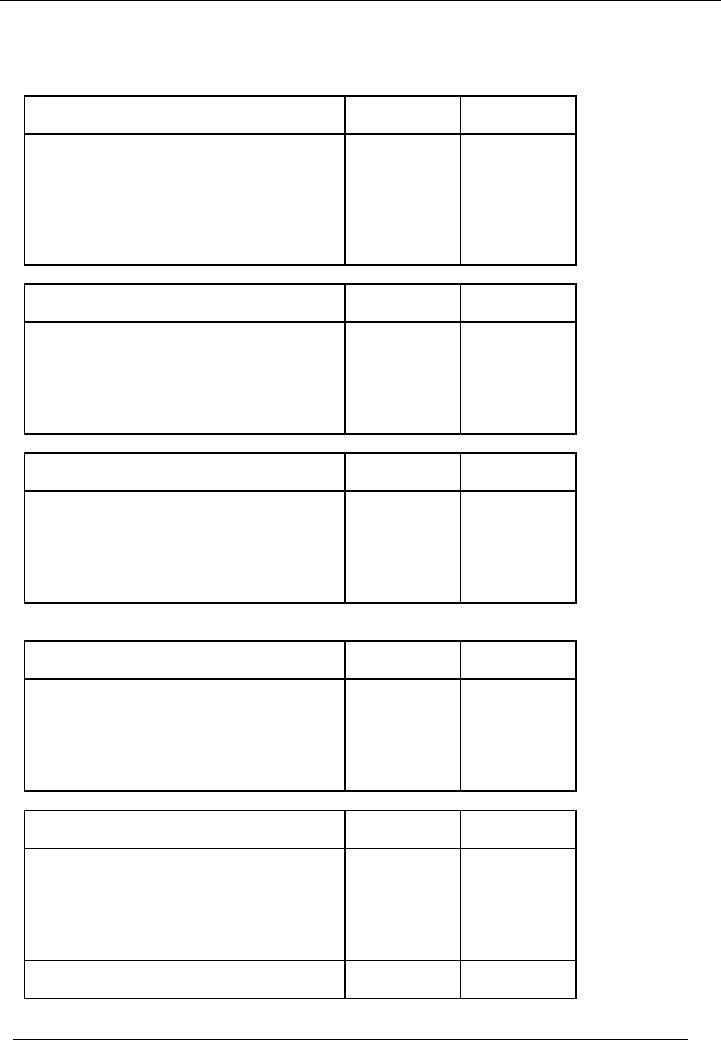

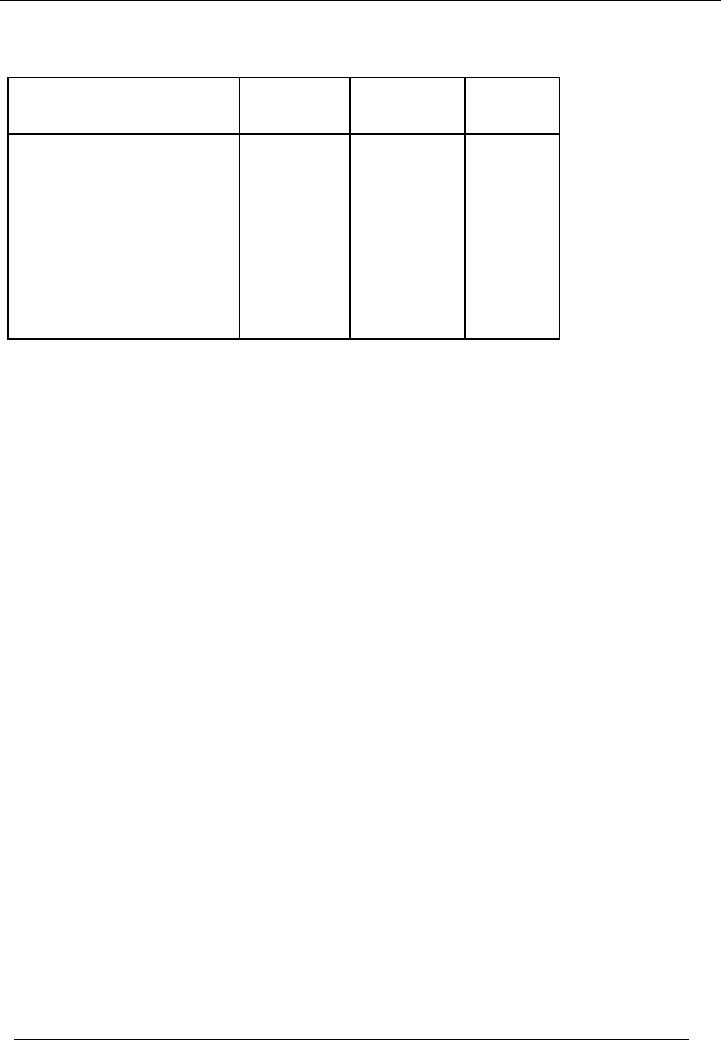

Standard format of cash

receipt voucher is given below:

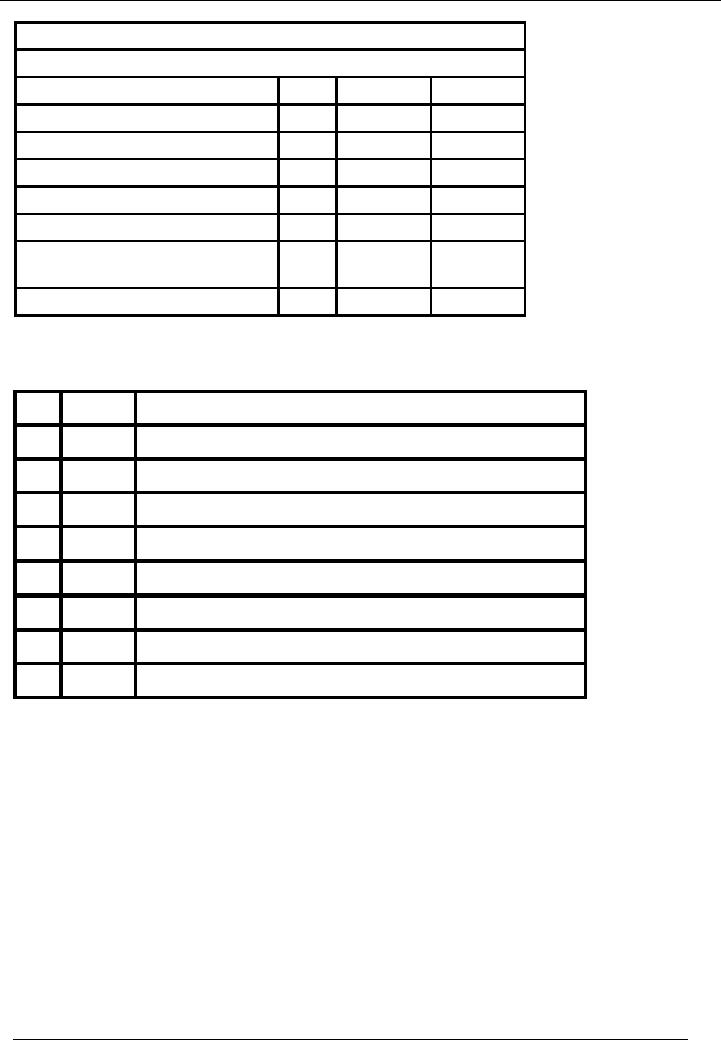

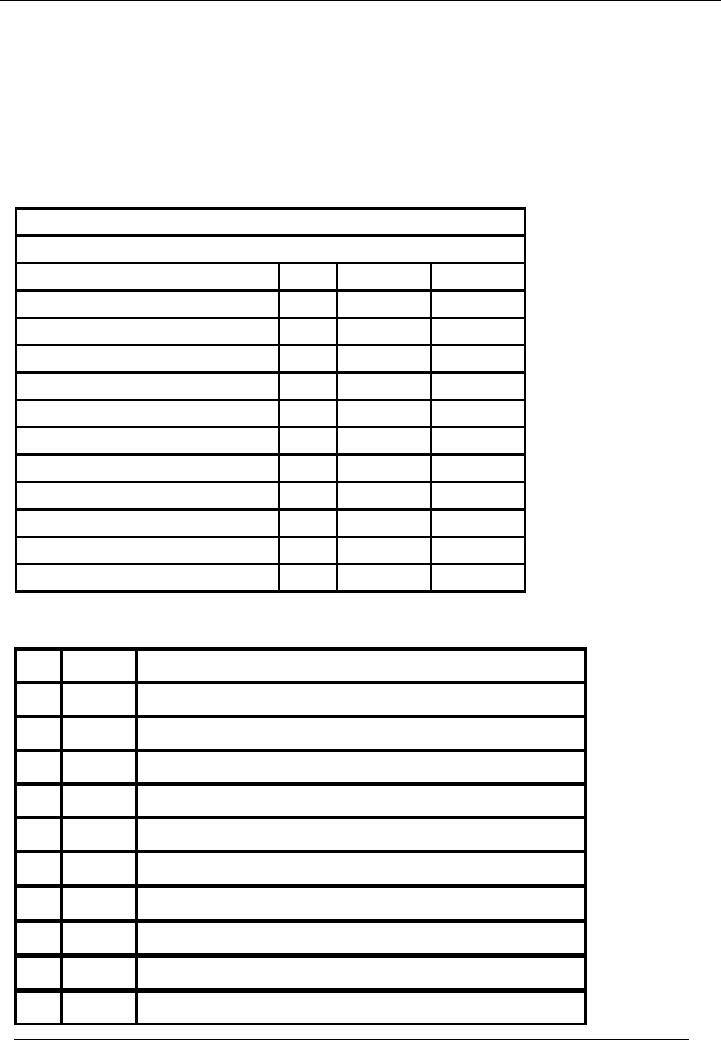

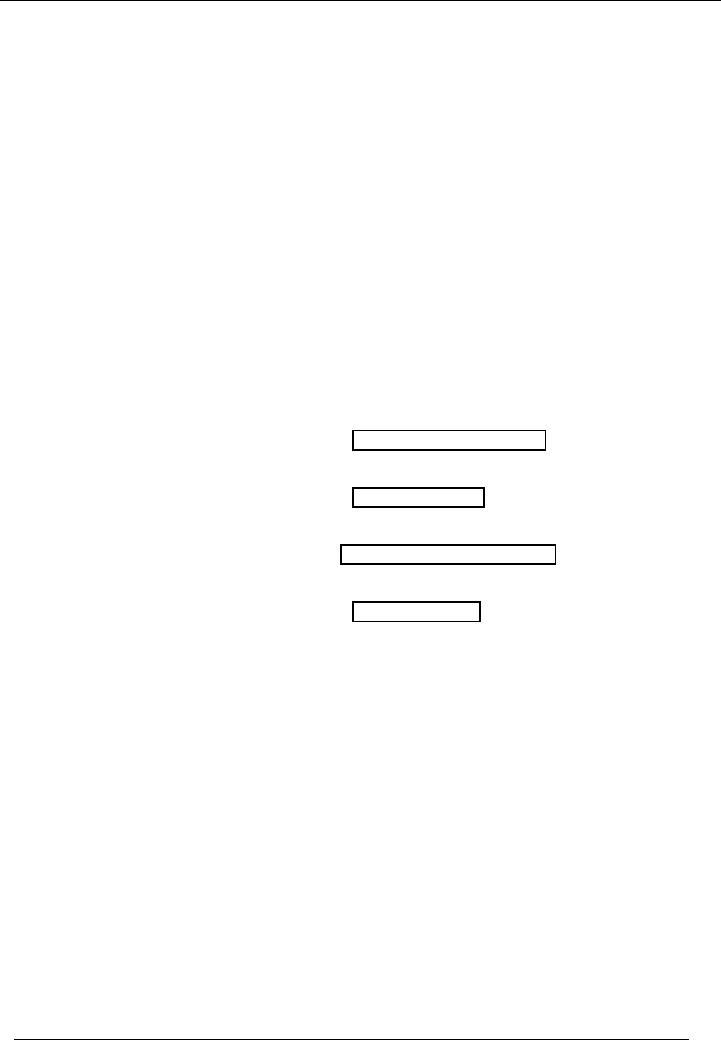

Name of the

Organization

Bank

Receipt / Cash Receipt OR

Receipt

Voucher

Date:

No:

Description

/ Title:

Cash /

Bank code:

Description

/

Code

Credit

Title

of Account

#

Amount

Total:

Narration:

Prepared

By:

Checked

By:

94

Financial

Accounting (Mgt-101)

VU

PAYMENT

VOUCHER

Payment

voucher is used to record a payment of

cash or cheque. Payment

vouchers are of two types.

i.e.

� Cash

Payment voucher

� Bank

Payment voucher

Cash

Payment voucher denotes Payment of

cash, bank Payment voucher indicates

payment by cheque or

demand

draft. Standard format of

cash Payment voucher is given

below:

Name of the

Organization

Bank

Payment / Cash Payment OR

Payment

Voucher

No:

Date:

Description

/ Title:

Cash /

Bank code:

Description

/

Code

Credit

Title

of Account

#

Amount

Total:

Naration

Prepared

By:

Checked

By:

95

Financial

Accounting (Mgt-101)

VU

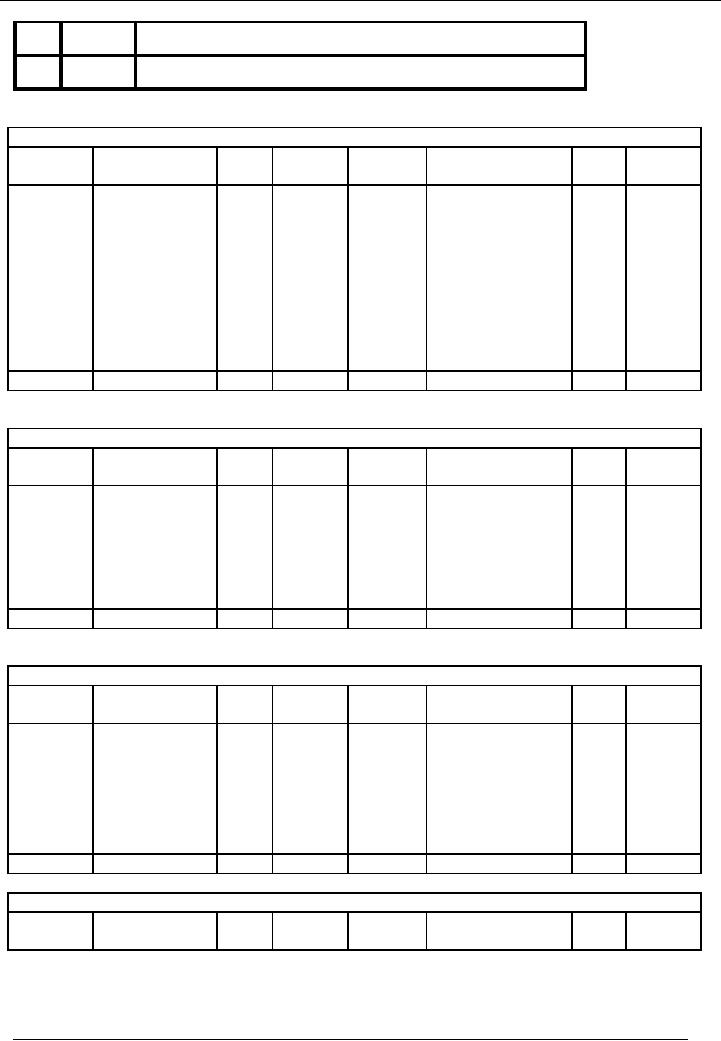

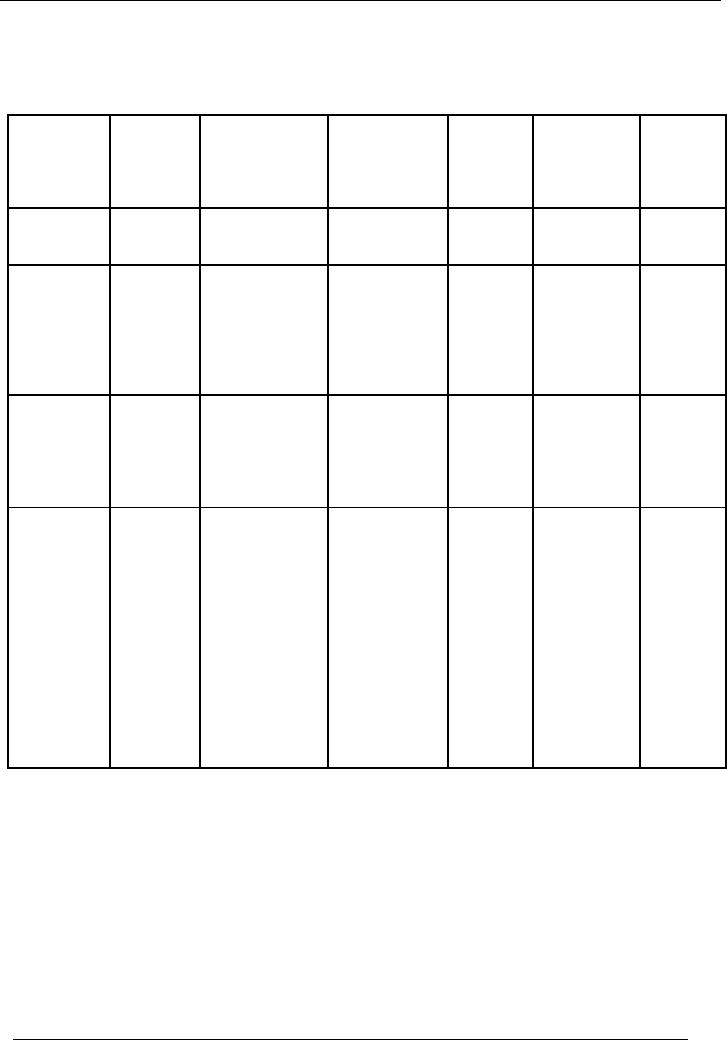

JOURNAL

VOUCHER

Journal

voucher is used to record transactions

that do not affect cash or bank.

Standard format of

journal

voucher is given

hereunder:

Name Of

Organization

Journal

Voucher

Date:

No:

Description

Code

Debit

Credit

Amount

#

Amount

Total:

Narration:

Prepared

By:

Checked

by:

HOW TO

CARRY FORWARD A

BALANCE

It is

already mentioned that in `T'

account, at the end of accounting

period, if one side is

greater than the

other

side, balancing figure will

be written on the lesser side as

balance. For instance, if amount on

debit side

is

greater than the amount on credit side,

the balancing figure is written on the

credit side as balance & it is

known

as Debit

Balance. On the

other hand, if amount on the credit side

is greater than that of amount

on

the

debit side, the balance is

shown on the debit side. It is

called the Credit

Balance.

At the

start of next accounting

period, these balances are

carried forward. Debit

balance is written on the

credit

side, but it is the excess of

debit side over the credit

side, when it is carried

forward, it is written on the

debit

side. For example, ledger

account of cash is given below:

96

Financial

Accounting (Mgt-101)

VU

Cash

Account

Account

code # 1

Date

Particulars

Code

Amount

Date

Particulars

Code

Amount

#

Rs.

(Dr.)

#

Rs.

(Cr.)

1-3-02

Commenced

02

150,000

5-3-02

Office

furniture

03

2,000

business

purchased

13-3-02

Goods

sold

07

12,000

7-3-02

Goods

purchased

04

9,000

250

21-3-02

Received

from

10-3-02

Carriage

paid

05

7,000

debtors

08

25,000

21-3-02

Paid

to creditors

06

2,500

23-3-02

Paid

salaries

09

3,000

25-3-02

Paid

rent

10

29-3-02

Paid

for stationery

11

2,000

BALANCE

161,250

Total

187,000

Total

187,000

This

cash account is showing the

balance of Rs. 161,250 on the credit

side. This balance is excess

of debit

side

over the credit side and, therefore, is

called the debit

balance. When

it is carried

forward it is

written

on the

debit side because debit

side of the cash account is

greater & Rs. 161,250 is the

balancing amount of

the

debit side of cash account.

So, it is an asset & it will be

used for further expenses in

the forth coming

period.

This

is another example of accrued

expenses:

Accrued

Expenses Account

Account

code # 13

Date

Particulars

Code

Amount

Date

Particulars

Code

Amount

#

Rs.

(Dr.)

#

Rs.

(Cr.)

31-3-02

Accrued

utility

12

5,000

bills

BALANCE

5,000

Total

5,000

Total

5,000

In this

account, balance is written on the

debit side & it is called the credit

balance. As this balance

represents

excess of credit side over

debit side, when it is carried

forward it is

again written on the credit

side.

It can

also be explained like

this:

� Debit

balance when carried forward, is written

on the debit side

� Credit

balance when carried forward, is written

on the credit

side

This

is further explained with the help of the

following solved

illustration:

ILLUSTRATION

Following

is the trial balance of Saeed &

sons for the month ended

January 31, 2002

97

Financial

Accounting (Mgt-101)

VU

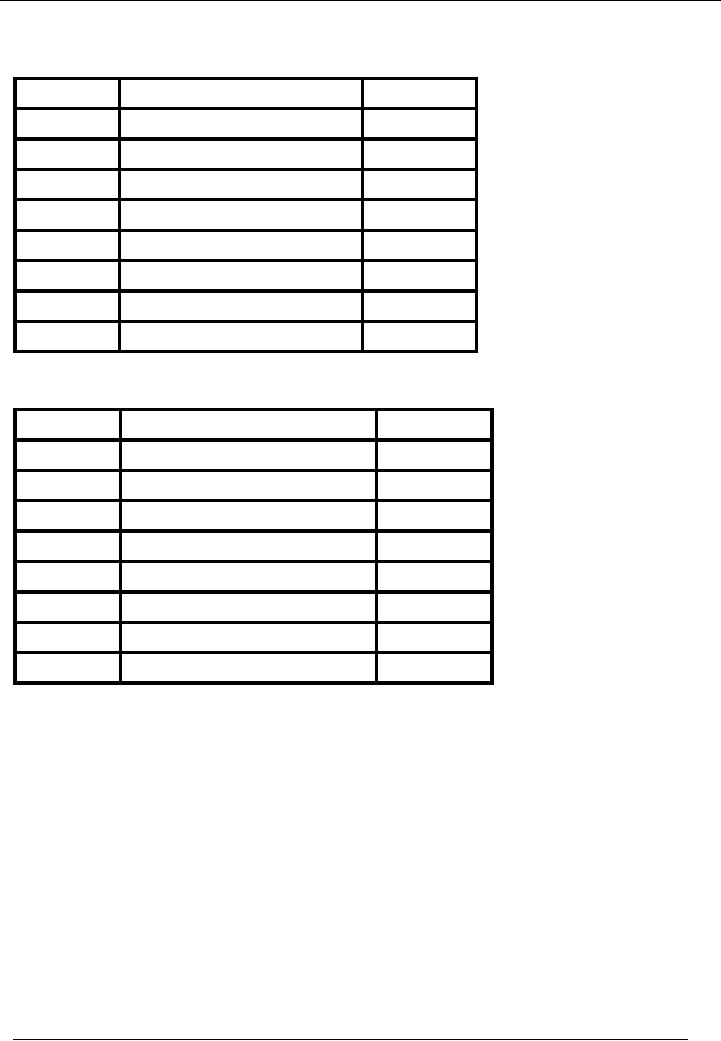

Saeed

& Sons.

Trial

Balance As On ( January 31,

2002)

Title

of Account

Code

Dr.

Rs.

Cr.

Rs.

Cash

Account

01

55,000

Accrued

expense Account

02

10,000

Bank

Account

03

25,000

Loan

Account

04

100,000

Furniture

Account

05

20,000

Office

Equipment

06

10,000

Total

110,000

110,000

In the

month of February, following

transactions took

place:

No.

Date

Particulars

01

Feb

07

They

purchased stationery worth of Rs.

5,000

02

Feb

10

They paid

their first installment of loan Rs.

10,000

03

Feb

12

They

received a cheque from a

customer of Rs. 5,000

04

Feb

17

Accrued

expenses of Rs. 5,000 are

paid.

05

Feb

20

They

purchased furniture of Rs.

1,000

06

Feb

23

Office

equipment of Rs. 2,000 is

sold

07

Feb

25

Staff

salaries are paid by cheque

Rs. 10,000

08

Feb

28

Sold

goods for cash

Rs.2,000

98

Financial

Accounting (Mgt-101)

VU

SOLUTION

The

ledger accounts of Saeed &

Sons will bear the following

changes:

Cash

Account

Account

code # 1

Date

Particulars

Code

Amount

Date

Particulars

Code

Amount

#

Rs.

(Dr.)

#

Rs.

(Cr.)

1-2-02

Balance

c/f

55,000

7-2-02

Stationery

10

5,000

23-2-02

Sold

office

06

2,000

purchased

equipment

10-2-02

Loan

paid

04

10,000

28-2-02

Sold

goods

01

2,000

17-2-02

Accrued

expenses

02

paid

5,000

Furniture

05

purchased

1,000

Balance

c/d

38,000

Total

59,000

Total

59,000

Accrued

Expenses

Account

code # 2

Date

Particulars

Code

Amount

Date

Particulars

Code

Amount

#

Rs.

(Dr.)

#

Rs.

(Cr.)

17-2-02

Accrued

01

5,000

1-1-02

Balance

c/f

10,000

expenses

paid

Balance

c/d

5,000

Total

10,000

Total

10,000

Bank

Account

Account

code # 3

Date

Particulars

Code

Amount

Date

Particulars

Code

Amount

#

Rs.

(Dr.)

#

Rs.

(Cr.)

17-2-02

Balance

c/f

01

25,000

25-2-02

Salaries

paid

10,000

12-2-02

Cheque

received

07

5,000

Balance

c/d

20,000

Total

30,000

Total

30,000

99

Financial

Accounting (Mgt-101)

VU

Loan

Account

Account

code # 4

Date

Particulars

Code

Amount

Date

Particulars

Code

Amount

#

Rs.

(Dr.)

#

Rs.

(Cr.)

10-2-02

Installment

paid

01

10,000

Balance

c/f

100,000

Balance

c/d

90,000

Total

100,000

Total

100,000

Furniture

Account

Account

code # 5

Date

Particulars

Code

Amount

Date

Particulars

Code

Amount

#

Rs.

(Dr.)

#

Rs.

(Cr.)

10-2-02

Balance

c/f

20,000

23-2-02

20-2-02

Furniture

01

1,000

purchased

Balance

c/d

21,000

Total

21,000

Total

21,000

Office

Equipment Account

Account

code # 6

Date

Particulars

Code

Amount

Date

Particulars

Code

Amount

#

Rs.

(Dr.)

#

Rs.

(Cr.)

10-2-02

Balance

c/f

10,000

Office

Equipment

01

2,000

sold

Balance

c/d

8,000

Total

10,000

Total

10,000

Balance

c/f is balance carried forward &

balance c/d is balance Carried

down.

100

Financial

Accounting (Mgt-101)

VU

Lesson-14

We

have demonstrated the carrying