|

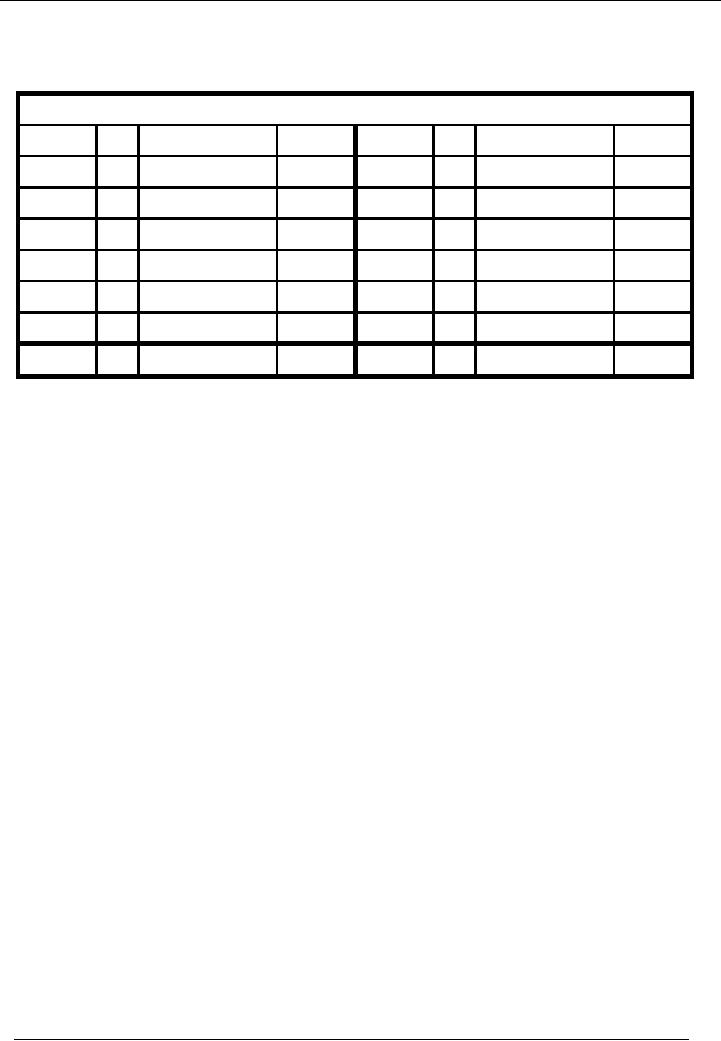

Sample Transactions of a Company |

| << Assets and Liabilities, Balance Sheet from trial balance |

| Sample Accounts of a Company >> |

Financial

Accounting (Mgt-101)

VU

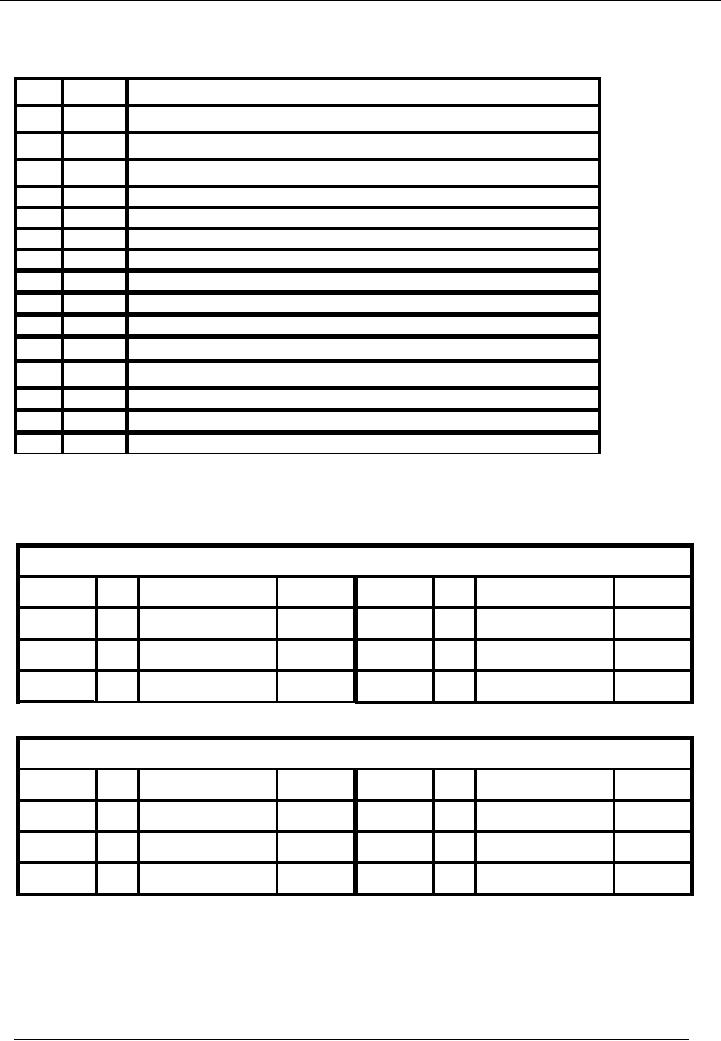

Lesson-10

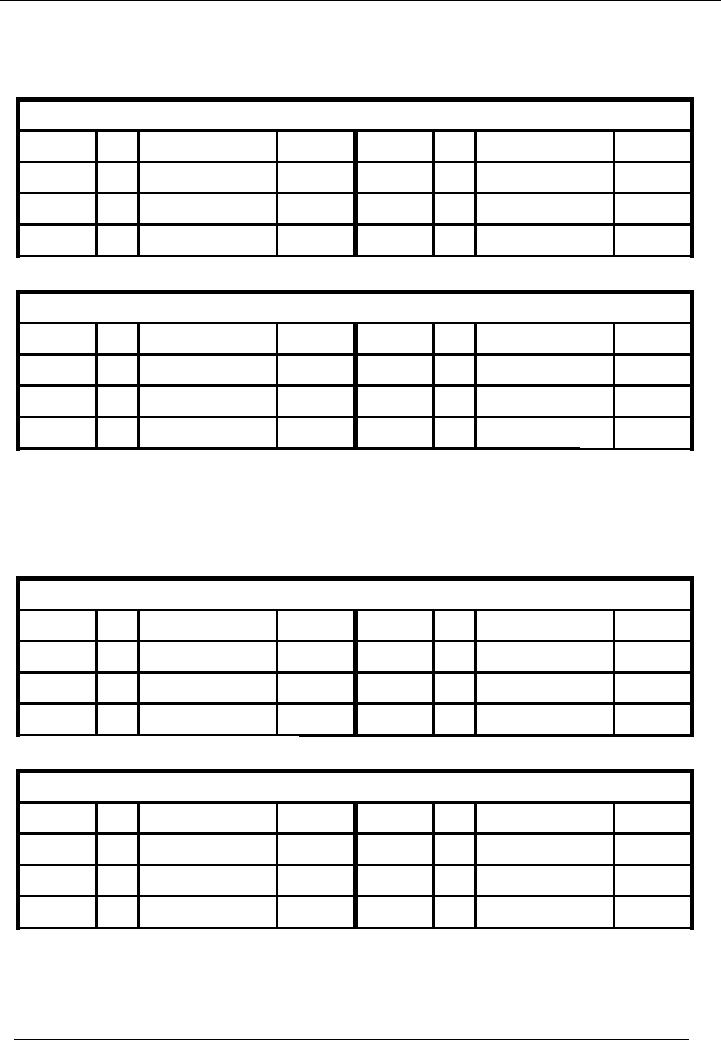

Transactions

of Ali Traders for the

month of January

No.

Date

Particulars

01

Jan

01

Started

business with Rs. 200,000 in

cash.

02

Jan

01

Opened a bank

account and deposited Rs.

195,000 in it.

03

Jan

02

Paid

for furniture Rs. 15,000

through cheque.

04

Jan

03

Paid

for vehicle Rs. 50,000

through cheque.

05

Jan

05

Bought

goods on credit from Mr. A

for Rs. 50,000.

06

Jan

06

Sold

goods for cash Rs.

60,000.

07

Jan

08

Purchased

goods for cash Rs.

20,000.

08

Jan

10

Returned

goods of Rs. 10,000 to Mr.

A.

09

Jan

12

Sold

goods on credit to Mr. B for

Rs. 40,000.

10

Jan

18

Mr. B

returned goods of Rs.

5,000.

11

Jan

21

Paid

through cheque to Mr. A Rs.

25,000.

12

Jan

25

Mr. B

Paid through cheque Rs.

20,000.

13

Jan

31

Paid

Salaries through cheque Rs.

5,000.

14

Jan

31

Accrued

expenses for the month Rs.

20,000.

15

Jan

31

Deposited in bank

Rs. 10,000.

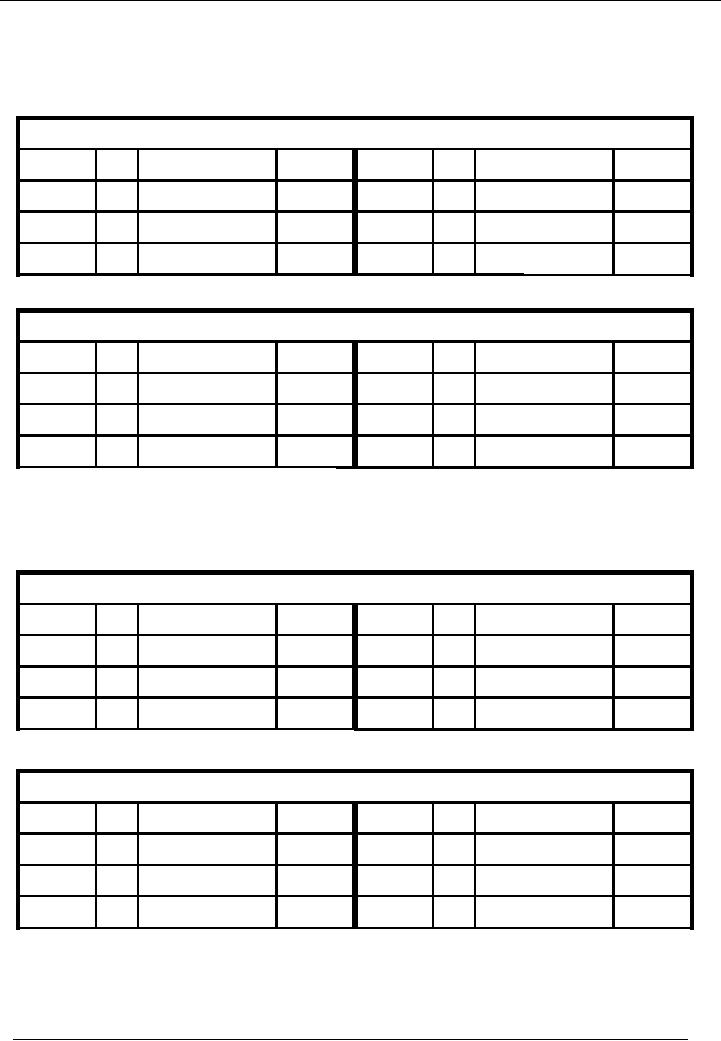

01

Started business with Rs.

200,000 in cash.

01

Started business with Rs.

200,000 in cash.

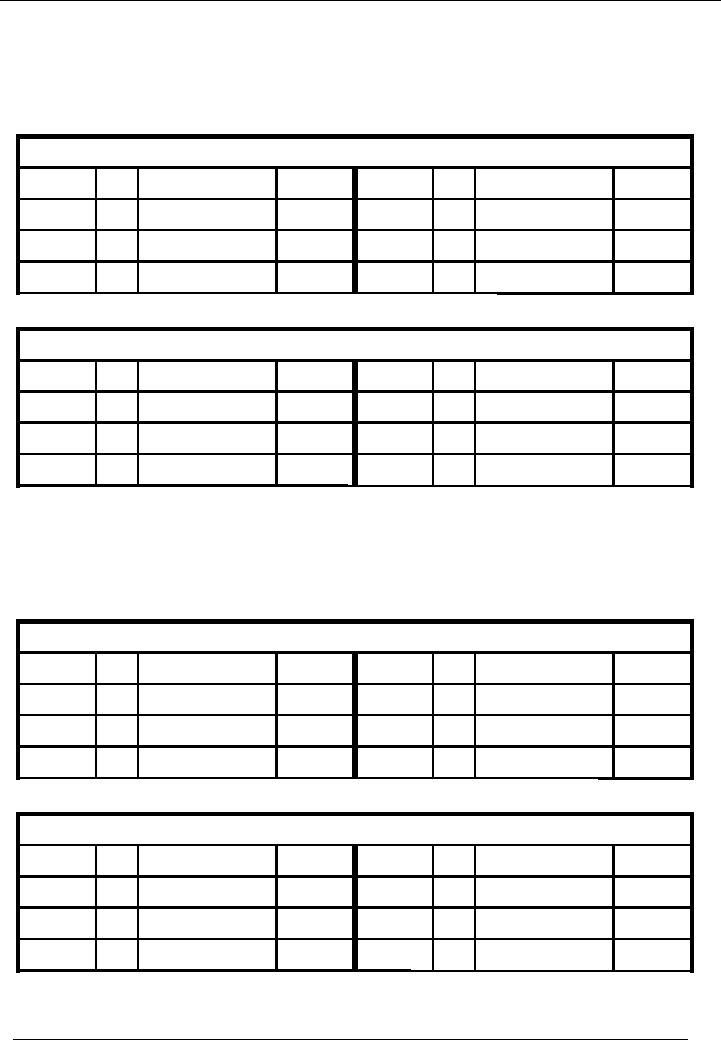

Cash

Account Code 01

Date

No.

Narration

Dr.

Rs.

Date

No.

Narration

Cr.

Rs.

01-01---

01 Capital

Introd.

200,000

Capital

Account Code 03

No.

Narration

Cr.

Rs.

Date

No.

Narration

Dr.

Rs.

Date

01-01---

01 Capital

Introd.

200,000

41

Financial

Accounting (Mgt-101)

VU

02

Deposited Rs. 195,000 in

bank.

Bank

Account Code 02

Date

No.

Narration

Dr.

Rs.

Date

No.

Narration

Cr.

Rs.

01-01---

02 Cash

deposited

195,000

Cash

Account Code 01

Date

No.

Narration

Dr.

Rs.

Date

No.

Narration

Cr.

Rs.

01-01---

02 Cash

deposited

195,000

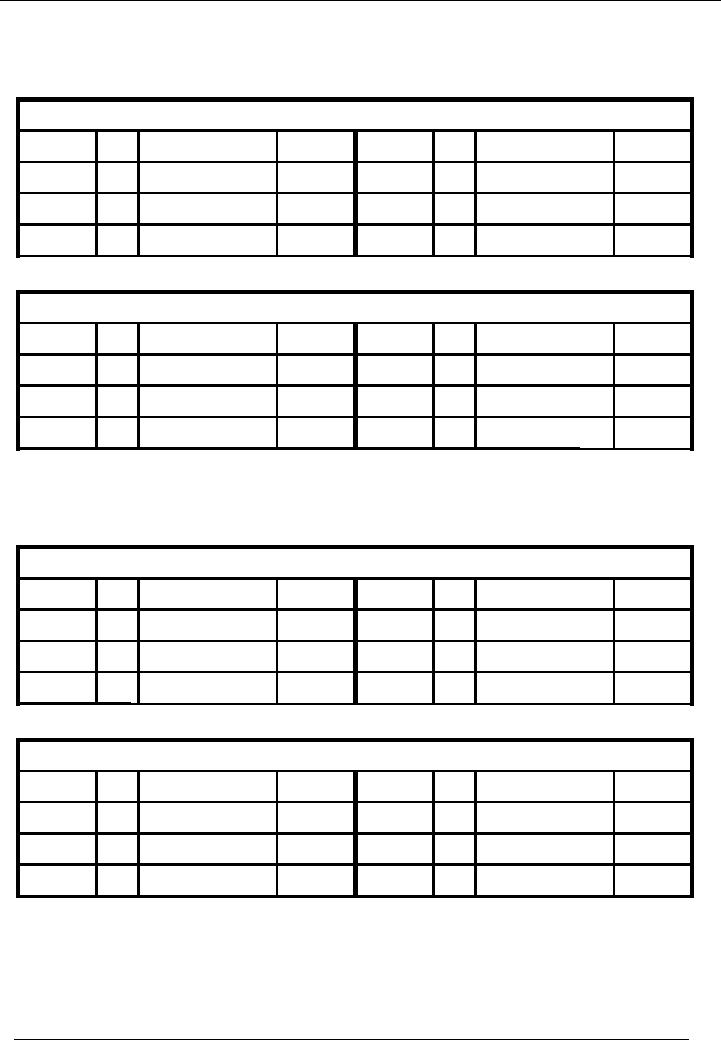

03 Paid

for furniture Rs. 15,000

through cheque.

Bank

Account Code 02

Date

No.

Narration

Dr.

Rs.

Date

No.

Narration

Cr.

Rs.

02-01---

03 Furniture

purch.

15,000

Furniture

Account

Code 04

No.

Narration

Cr.

Rs.

Date

No.

Narration

Dr.

Rs.

Date

02-01---

03 Furniture

purch.

15,000

42

Financial

Accounting (Mgt-101)

VU

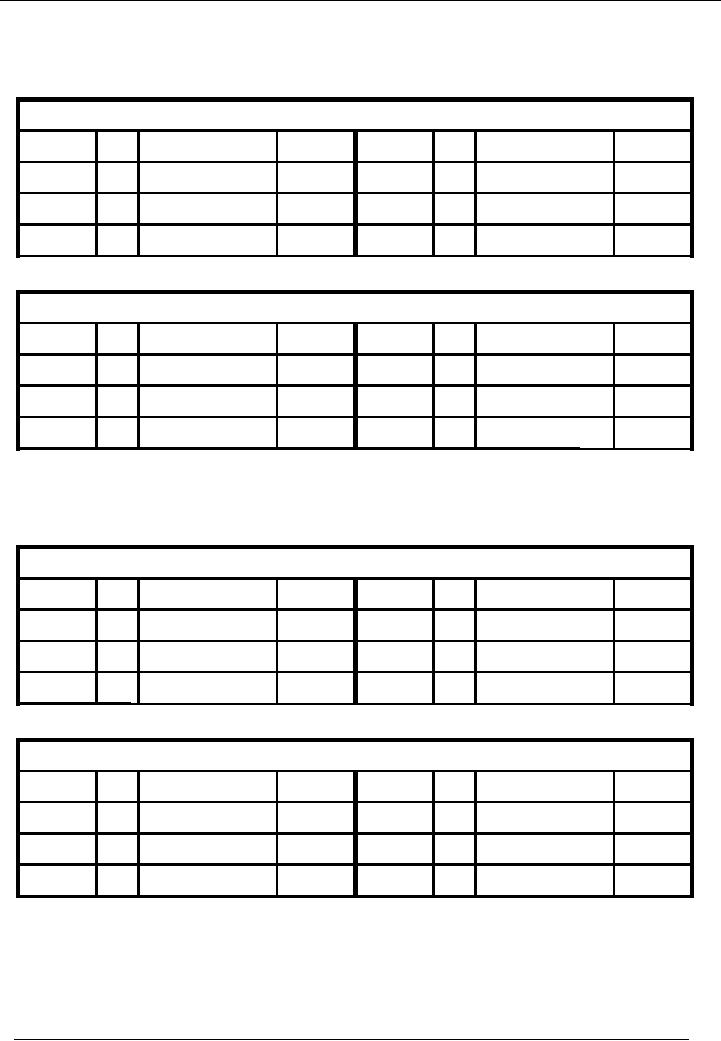

04 Paid

for vehicle Rs. 50,000

through cheque.

Vehicle

Account

Code 05

No.

Narration

Cr.

Rs.

Date

No.

Narration

Dr.

Rs.

Date

03-01---

04 Vehicle

purch.

50,000

Bank

Account Code 02

No.

Narration

Cr.

Rs.

Date

No.

Narration

Dr.

Rs.

Date

03-01---

04 Vehicle

purch.

50,000

05

Bought goods on credit from Mr. A

Rs. 50,000.

Purchases

Account

Code 06

No.

Narration

Cr.

Rs.

Date

No.

Narration

Dr.

Rs.

Date

05-01---

05 Goods

purch.

50,000

Mr. A

(Creditor)

Account

Code 07

Date

No.

Narration

Dr.

Rs.

Date

No.

Narration

Cr.

Rs.

05-01---

05 Goods

purch.

50,000

Creditor

�

A

person or organization to whom money is

payable by the business.

43

Financial

Accounting (Mgt-101)

VU

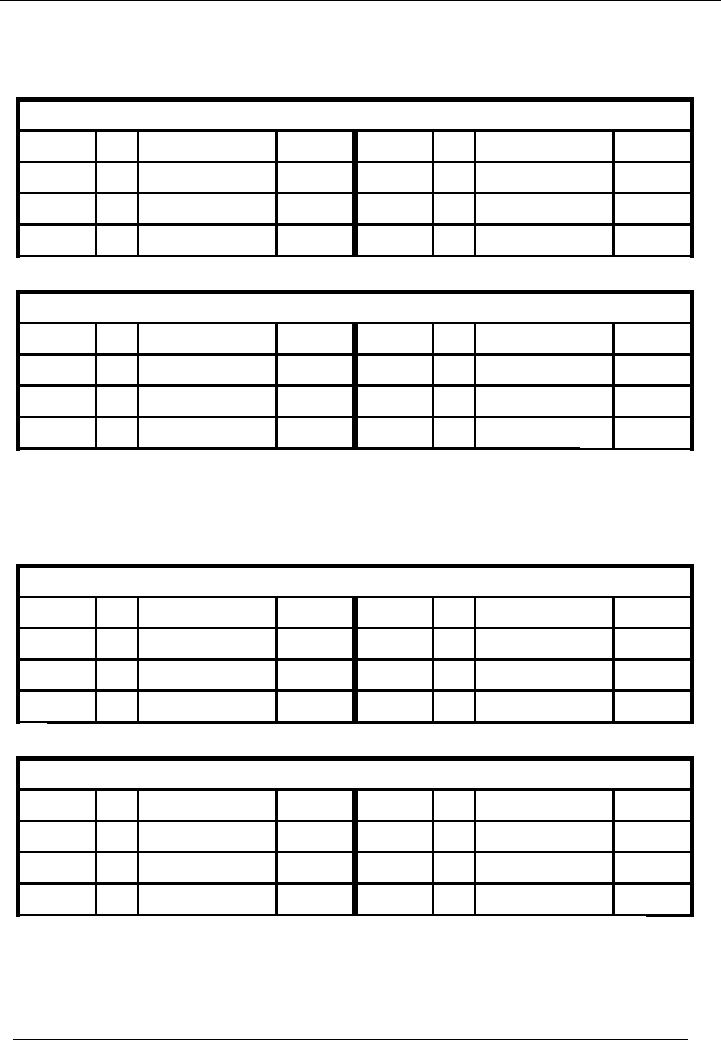

06 Sold

goods for cash Rs.

60,000.

Cash

Account Code 01

No.

Narration

Cr.

Rs.

Date

No.

Narration

Dr.

Rs.

Date

06-01---

06 Goods

sold

60,000

Sales

Account Code 08

No.

Narration

Cr.

Rs.

Date

No.

Narration

Dr.

Rs.

Date

06-01---

06 Goods

sold

60,000

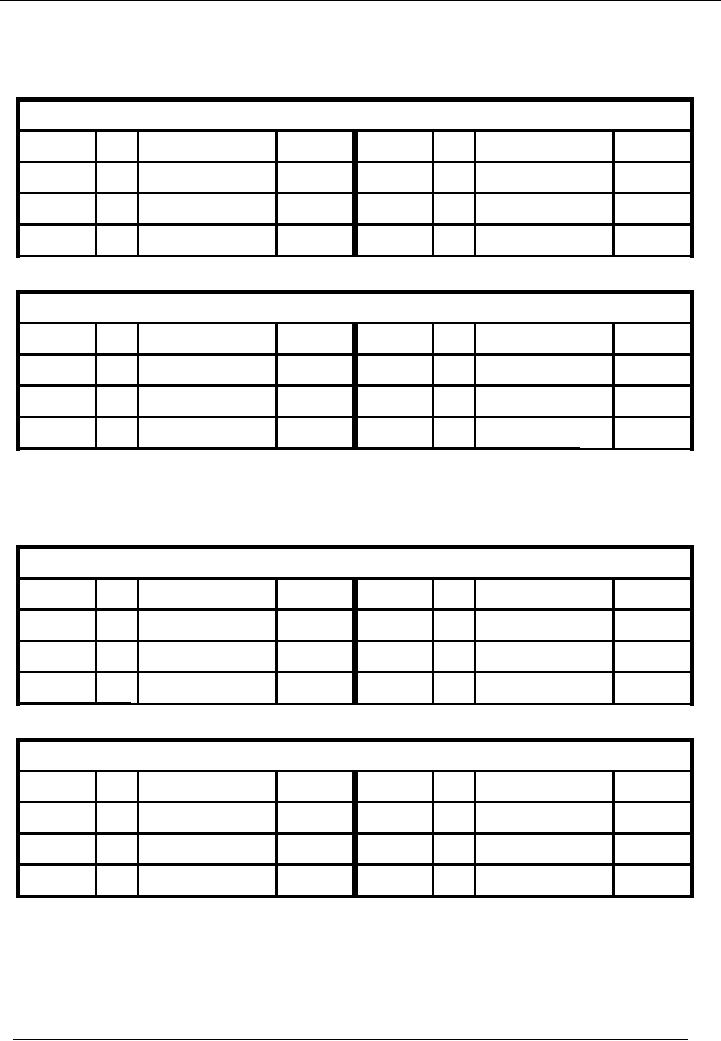

07

Purchased goods for cash

Rs. 20,000.

Purchases

Account

Code 06

No.

Narration

Cr.

Rs.

Date

No.

Narration

Dr.

Rs.

Date

08-01---

07 Goods

purch.

20,000

Cash

Account Code 01

Date

No.

Narration

Dr.

Rs.

Date

No.

Narration

Cr.

Rs.

08-01---

07 Goods

purch.

20,000

44

Financial

Accounting (Mgt-101)

VU

08

Returned goods of Rs. 10,000

to Mr. A.

Mr. A

(Creditor)

Account

Code 07

No.

Narration

Cr.

Rs.

Date

No.

Narration

Dr.

Rs.

Date

10-01---

08 Purchase

return

10,000

Purchases

Account

Code 06

No.

Narration

Cr.

Rs.

Date

No.

Narration

Dr.

Rs.

Date

10-01---

08 Purchase

return

10,000

09 Sold

goods on credit to Mr. B for

Rs. 40,000.

Sales

Account Code 08

Date

No.

Narration

Dr.

Rs.

Date

No.

Narration

Cr.

Rs.

12-01---

09 Goods

sold

40,000

Mr. B

(Debtor) Account Code

09

Date

No.

Narration

Dr.

Rs.

Date

No.

Narration

Cr.

Rs.

12-01---

09 Goods

sold

40,000

Debtor

�

A

person or organization from whom

money is receivable by the

business.

45

Financial

Accounting (Mgt-101)

VU

10 Mr. B

returned goods of Rs.

5,000.

Sales

Account Code 08

Date

No.

Narration

Dr.

Rs.

Date

No.

Narration

Cr.

Rs.

18-01---

10 Sales

return

5,000

Mr. B

(Debtor)

Account

Code 09

Date

No.

Narration

Dr.

Rs.

Date

No.

Narration

Cr.

Rs.

18-01---

10 Sales

return

5,000

11 Paid

through cheque to Mr. A Rs.

25,000.

Mr. A

(Creditor)

Account

Code 07

Date

No.

Narration

Dr.

Rs.

Date

No.

Narration

Cr.

Rs.

21-01---

11 Paid to

Mr. A

25,000

Bank

Account Code 02

Date

No.

Narration

Dr.

Rs.

Date

No.

Narration

Cr.

Rs.

21-01---

11 Paid to

Mr. A

25,000

46

Financial

Accounting (Mgt-101)

VU

12 Mr. B Paid

through cheque Rs.

20,000.

Bank

Account Code 02

No.

Narration

Cr.

Rs.

Date

No.

Narration

Dr.

Rs.

Date

25-01---

12 Received

from B

20,000

Mr. B

(Debtor) Account Code

09

No.

Narration

Cr.

Rs.

Date

No.

Narration

Dr.

Rs.

Date

25-01---

12 Received

from B

20,000

13 Paid

Salaries through cheque Rs.

5,000.

Salaries

Account

Code 10

No.

Narration

Cr.

Rs.

Date

No.

Narration

Dr.

Rs.

Date

31-01---

13 Salaries

paid

5,000

Bank

Account Code 02

Date

No.

Narration

Dr.

Rs.

Date

No.

Narration

Cr.

Rs.

31-01---

13 Salaries

paid

5,000

47

Financial

Accounting (Mgt-101)

VU

14

Accrued expenses for the

month Rs. 20,000.

Expenses

Account

Code 11

No.

Narration

Cr.

Rs.

Date

No.

Narration

Dr.

Rs.

Date

31-01---

14 Exp.

accrued

20,000

Accrued

Expenses / Expenses

Payable

Account

Code 12

No.

Narration

Cr.

Rs.

Date

No.

Narration

Dr.

Rs.

Date

31-01---

14 Exp.

accrued

20,000

15

Deposited in bank Rs.

10,000.

Bank

Account Code 02

No.

Narration

Cr.

Rs.

Date

No.

Narration

Dr.

Rs.

Date

31-01---

15 Cash

deposited

50,000

Cash

Account Code 01

Date

No.

Narration

Dr.

Rs.

Date

No.

Narration

Cr.

Rs.

31-01---

15 Cash

deposited

10,000

48

Financial

Accounting (Mgt-101)

VU

Bank

Account

Bank

Account Code 02

No.

Narration

Cr.

Rs.

Date

No.

Narration

Dr.

Rs.

Date

195,000

02-01---

03 Furniture

purch.

15,000

01-01---

02 Cash

deposited

20,000

03-01---

25-01---

12 Received

from B

50,000

04 Vehicle

purch.

10,000

21-01---

31-01---

15 Cash

deposited

11 Paid to

Mr. A

25,000

5,000

31-01---

13 Salaries

paid

49

Table of Contents:

- Introduction to Financial Accounting

- Basic Concepts of Business: capital, profit, budget

- Cash Accounting and Accrual Accounting

- Business entity, Single and double entry book-keeping, Debit and Credit

- Rules of Debit and Credit for Assets, Liabilities, Income and Expenses

- flow of transactions, books of accounts, General Ledger balance

- Cash book and bank book, Accounting Period, Trial Balance and its limitations

- Profit & Loss account from trial balance, Receipt & Payment, Income & Expenditure and Profit & Loss account

- Assets and Liabilities, Balance Sheet from trial balance

- Sample Transactions of a Company

- Sample Accounts of a Company

- THE ACCOUNTING EQUATION

- types of vouchers, Carrying forward the balance of an account

- ILLUSTRATIONS: Ccarrying Forward of Balances

- Opening Stock, Closing Stock

- COST OF GOODS SOLD STATEMENT

- DEPRECIATION

- GROUPINGS OF FIXED ASSETS

- CAPITAL WORK IN PROGRESS 1

- CAPITAL WORK IN PROGRESS 2

- REVALUATION OF FIXED ASSETS

- Banking transactions, Bank reconciliation statements

- RECAP

- Accounting Examples with Solutions

- RECORDING OF PROVISION FOR BAD DEBTS

- SUBSIDIARY BOOKS

- A PERSON IS BOTH DEBTOR AND CREDITOR

- RECTIFICATION OF ERROR

- STANDARD FORMAT OF PROFIT & LOSS ACCOUNT

- STANDARD FORMAT OF BALANCE SHEET

- DIFFERENT BUSINESS ENTITIES: Commercial, Non-commercial organizations

- SOLE PROPRIETORSHIP

- Financial Statements Of Manufacturing Concern

- Financial Statements of Partnership firms

- INTEREST ON CAPITAL AND DRAWINGS

- DISADVANTAGES OF A PARTNERSHIP FIRM

- SHARE CAPITAL

- STATEMENT OF CHANGES IN EQUITY

- Financial Statements of Limited Companies

- Financial Statements of Limited Companies

- CASH FLOW STATEMENT 1

- CASH FLOW STATEMENT 2

- FINANCIAL STATEMENTS OF LISTED, QUOTED COMPANIES

- FINANCIAL STATEMENTS OF LISTED COMPANIES

- FINANCIAL STATEMENTS OF LISTED COMPANIES