|

METHODS OF PROJECT EVALUATIONS, Net present value, Weighted Average Cost of Capital |

| << Capital Budgeting Definition and Process |

| METHODS OF PROJECT EVALUATIONS 2 >> |

Corporate

Finance FIN 622

VU

Lesson

09

METHODS

OF PROJECT EVALUATIONS

The

following topics will be

discussed in this hand out.

Methods

of Project evaluations:

NPV

Associated

topics that will be covered

are:

Weighted

Average Cost of Capital

Opportunity

cost

Net

present value

(NPV)

There

are two aspects of NPV

method of project evaluation. First is the initial

investment or upfront cost

and

second, is the benefits (like cash

flow) emerging from the

project.

First

aspect is pretty simple. As it is

incurred in the current or present time, there

are no issues

associated

with

its measurement. On the other

side, benefits shall be reaped in

future and involves time

value of

money,

making the measurement complex and

difficult.

NPV

measures the NET benefit by which the

value of a firm would

increase in case the project

in

undertaken.

As on

overview of this method, the present

value of future cash flow is

calculated using a discount

rate.

And if

this PV of future cash flow is

greater than the initial investment, the

NPV is stated as "positive".

Alternatively,

this suggests that project is

worth undertaking and financially viable.

If the PV of future cash

flow

is less than initial investment,

then it is better to scrap the

project.

The

NPV method is used for evaluating the

desirability of investments or projects.

Net Present Value is

found

by subtracting the required investment:

NPV =

PV required investment

The

building worth Rs.

2,000,000, but this does not

mean that you are

Rs. 2,000,000 better off.

You

committed

Rs. 1,900,000, and therefore

your net present value is

calculated by using the above

formula:

NPV =

2,000,000 1,900,000 = Rs.

100,000

In

other words, your office

development is worth more than it costs,

it makes a net contribution to

value.

The

formula for calculating NPV

can be written as:

NPV = Co + C1

/ 1 + r

Where:

Co = the

cash flow at time o or investment and

therefore cash outflow

r = the discount

rate/the required minimum rate of

return on investment

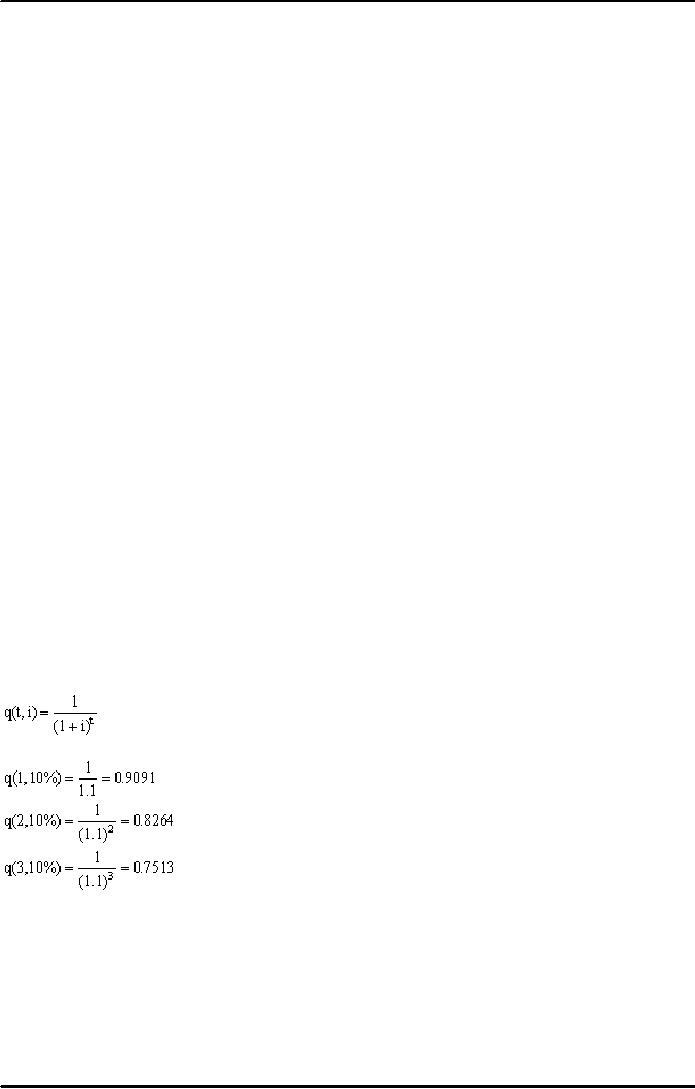

The

discount factor r can be calculated

using:

Examples:

Decision

rule:

If NPV

is positive (+): accept the

project

If NPV

is negative (-): reject the

project

Weighted

Average Cost of

Capital:

A calculation of a

firm's cost of capital in which

each category of capital is

proportionately weighted.

All

capital

sources - common stock, preferred stock,

bonds and any other

long-term debt - are included in

a

27

Corporate

Finance FIN 622

VU

WACC

calculation.

WACC

is calculated by multiplying the cost of

each capital component by its

proportional weight and

then

summing:

WACC =

E / V * Re + D / V * Rd * ( 1 Tc )

Where:

Re =

cost of equity

Rd =

cost of debt

E =

market value of the firm's equity

D =

market value of the firm's

debt

V=E+D

E/V =

percentage of financing that is

equity

D/V =

percentage of financing that is

debt

Tc = corporate tax

rate

Broadly

speaking, a company's assets

are financed by either debt or equity.

WACC is the average of the

costs

of these sources of financing, each of

which is weighted by its respective

use in the given situation. By

taking

a weighted average, we can see how

much interest the company

has to pay for every

dollar it

finances.

A firm's

WACC is the overall required return on

the firm as a whole and, as

such, it is often used

internally

by

company directors to determine the

economic feasibility of expansionary

opportunities and mergers. It

is

the appropriate

discount rate to use for

cash flows with risk that is

similar to that of the overall

firm.

Opportunity

Cost:

The

cost of an alternative that must be

forgone in order to pursue a certain

action is called opportunity

cost.

Put another

way, the benefits you could have

received by taking an alternative

action.

There is a

difference in return between a chosen

investment and one that is

necessarily passed up. Say

you

invest in a

stock and it returns a

paltry 2% over the year. In

placing your money in the

stock, you gave up

the

opportunity of another investment - say, a risk-free

government bond yielding 6%. In this

situation,

your

opportunity costs are 4%

(6%-2%).

The

opportunity cost of going to

college is the money you

would have earned if you

worked instead. On the

one

hand, you lose four

years of salary while getting

your degree; on the other

hand, you hope to earn

more

during

your career, thanks to your

education, to offset the lost

wages.

Here's

another example: if a gardener decides to

grow carrots, his or her

opportunity cost is the

alternative

crop

that might have been

grown instead (potatoes,

tomatoes, pumpkins, etc.).

In

both cases, a choice between

two options must be made. It

would be an easy decision if

you knew the

end

outcome; however, the risk that you could

achieve greater "benefits"

(be they monetary or otherwise)

with

another option is the opportunity

cost.

28

Table of Contents:

- INTRODUCTION TO SUBJECT

- COMPARISON OF FINANCIAL STATEMENTS

- TIME VALUE OF MONEY

- Discounted Cash Flow, Effective Annual Interest Bond Valuation - introduction

- Features of Bond, Coupon Interest, Face value, Coupon rate, Duration or maturity date

- TERM STRUCTURE OF INTEREST RATES

- COMMON STOCK VALUATION

- Capital Budgeting Definition and Process

- METHODS OF PROJECT EVALUATIONS, Net present value, Weighted Average Cost of Capital

- METHODS OF PROJECT EVALUATIONS 2

- METHODS OF PROJECT EVALUATIONS 3

- ADVANCE EVALUATION METHODS: Sensitivity analysis, Profitability analysis, Break even accounting, Break even - economic

- Economic Break Even, Operating Leverage, Capital Rationing, Hard & Soft Rationing, Single & Multi Period Rationing

- Single period, Multi-period capital rationing, Linear programming

- Risk and Uncertainty, Measuring risk, Variability of return–Historical Return, Variance of return, Standard Deviation

- Portfolio and Diversification, Portfolio and Variance, Risk–Systematic & Unsystematic, Beta – Measure of systematic risk, Aggressive & defensive stocks

- Security Market Line, Capital Asset Pricing Model – CAPM Calculating Over, Under valued stocks

- Cost of Capital & Capital Structure, Components of Capital, Cost of Equity, Estimating g or growth rate, Dividend growth model, Cost of Debt, Bonds, Cost of Preferred Stocks

- Venture Capital, Cost of Debt & Bond, Weighted average cost of debt, Tax and cost of debt, Cost of Loans & Leases, Overall cost of capital – WACC, WACC & Capital Budgeting

- When to use WACC, Pure Play, Capital Structure and Financial Leverage

- Home made leverage, Modigliani & Miller Model, How WACC remains constant, Business & Financial Risk, M & M model with taxes

- Problems associated with high gearing, Bankruptcy costs, Optimal capital structure, Dividend policy

- Dividend and value of firm, Dividend relevance, Residual dividend policy, Financial planning process and control

- Budgeting process, Purpose, functions of budgets, Cash budgets–Preparation & interpretation

- Cash flow statement Direct method Indirect method, Working capital management, Cash and operating cycle

- Working capital management, Risk, Profitability and Liquidity - Working capital policies, Conservative, Aggressive, Moderate

- Classification of working capital, Current Assets Financing – Hedging approach, Short term Vs long term financing

- Overtrading – Indications & remedies, Cash management, Motives for Cash holding, Cash flow problems and remedies, Investing surplus cash

- Miller-Orr Model of cash management, Inventory management, Inventory costs, Economic order quantity, Reorder level, Discounts and EOQ

- Inventory cost – Stock out cost, Economic Order Point, Just in time (JIT), Debtors Management, Credit Control Policy

- Cash discounts, Cost of discount, Shortening average collection period, Credit instrument, Analyzing credit policy, Revenue effect, Cost effect, Cost of debt o Probability of default

- Effects of discounts–Not effecting volume, Extension of credit, Factoring, Management of creditors, Mergers & Acquisitions

- Synergies, Types of mergers, Why mergers fail, Merger process, Acquisition consideration

- Acquisition Consideration, Valuation of shares

- Assets Based Share Valuations, Hybrid Valuation methods, Procedure for public, private takeover

- Corporate Restructuring, Divestment, Purpose of divestment, Buyouts, Types of buyouts, Financial distress

- Sources of financial distress, Effects of financial distress, Reorganization

- Currency Risks, Transaction exposure, Translation exposure, Economic exposure

- Future payment situation – hedging, Currency futures – features, CF – future payment in FCY

- CF–future receipt in FCY, Forward contract vs. currency futures, Interest rate risk, Hedging against interest rate, Forward rate agreements, Decision rule

- Interest rate future, Prices in futures, Hedging–short term interest rate (STIR), Scenario–Borrowing in ST and risk of rising interest, Scenario–deposit and risk of lowering interest rates on deposits, Options and Swaps, Features of opti

- FOREIGN EXCHANGE MARKET’S OPTIONS

- Calculating financial benefit–Interest rate Option, Interest rate caps and floor, Swaps, Interest rate swaps, Currency swaps

- Exchange rate determination, Purchasing power parity theory, PPP model, International fisher effect, Exchange rate system, Fixed, Floating

- FOREIGN INVESTMENT: Motives, International operations, Export, Branch, Subsidiary, Joint venture, Licensing agreements, Political risk