|

Corporate

Finance FIN 622

VU

Lesson

05

BOND

Bond

is a contract between an investor and the

issuer a company. It is a debt instrument

that a company

uses

to raise the capital and in

return pay interest to the

investors at per the terms of

contract. Bonds are

redeemable

it means that after a period of

time the company (issuer) returns the

money to the investors

and

liquidates its liability. The

rate at which issuer pays

interest to investors is known as

coupon rate.

Features

of Bond:

Coupon

Interest: stated

interest payments per

period

Face

value: also

Par value or the principal

amount

Coupon

rate:

interest payments stated in

annualized term.

Duration

or maturity date: The

date on which company

returns the principal amount back to

investors.

Current

yield: Annual

coupon payments divided by

bond price.

Discount

Bond: A bond

which is sold less than the

face or par value is discount

bond.

Premium

Bond: A bond

which is sold more than the

face or par value is premium

bond.

Interest

Rate Risk &

Bonds

The

risk arising from fluctuating

interest rate is known as

interest rate risk.

Interest

rate risk depends on how

sensitive bond price is to

interest rate change.

This

sensitivity depends upon two

things:

- Time

to maturity

-

Coupon rate

A

small change in interest

rate will have greater

impact on the on YTM and bond

value.

BOND

VALUATION:

Bond

valuation is the process of determining the

fair price of a bond. As

with any security, the fair

value of

a bond

is the present value of the stream of

cash flows it is expected to

generate. Hence, the price or

value

of a

bond is determined by discounting the bond's

expected cash flows to the

present using the appropriate

discount

rate.

General

relationships

Bond

pricing

1)

General relationships:

a) The

present value relationship:

The

fair price of a straight bond is

determined by discounting the expected cash

flows:

Cash

flows:

The

periodic coupon payments C,

each of which is made once

every period;

The

par or face value F, which

is payable at maturity of the bond after

T periods.

Discount

rate:

r is the

market interest rate for

new bond issues with

similar risk ratings

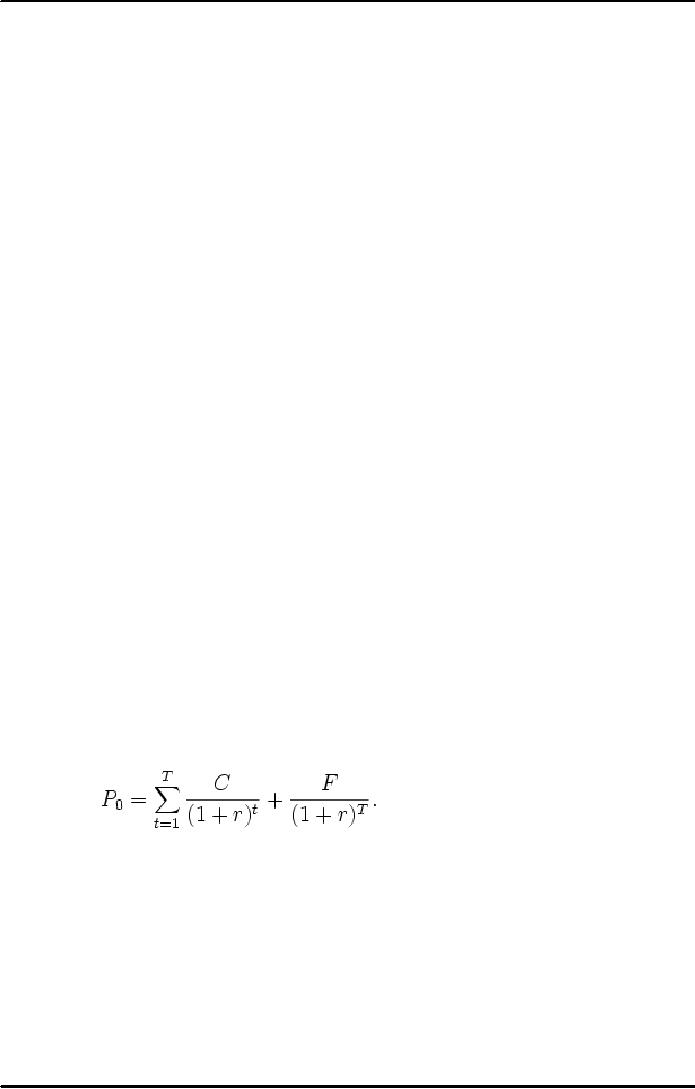

Bond

Price =

Because

the price is the present value of the

cash flows, there is an inverse

relationship between price

and

discount

rate: the higher the discount rates the

lower the value of the bond

(and vice versa). A bond

trading

below

its face value is trading at

a discount; a bond trading above

its face value is at a

premium.

b) Coupon

yield:

The

coupon yield is simply the coupon

payment (C) as a percentage of the

face value (F). Coupon

yield is

also

called nominal yield.

Coupon

yield = C / F

c)

Current yield:

The

current yield is simply the coupon

payment (C) as a percentage of the

bond price (P).

Current

yield = C / P0

17

Corporate

Finance FIN 622

VU

d)

Yield to Maturity:

The

yield to maturity (YTM), is the discount

rate which returns the maket

price of the bond. It is thus

the

internal

rate of return of an investment in the

bond made at the observed

price. YTM can also be used

to

price

a bond, where it is used as the required

return on the bond.

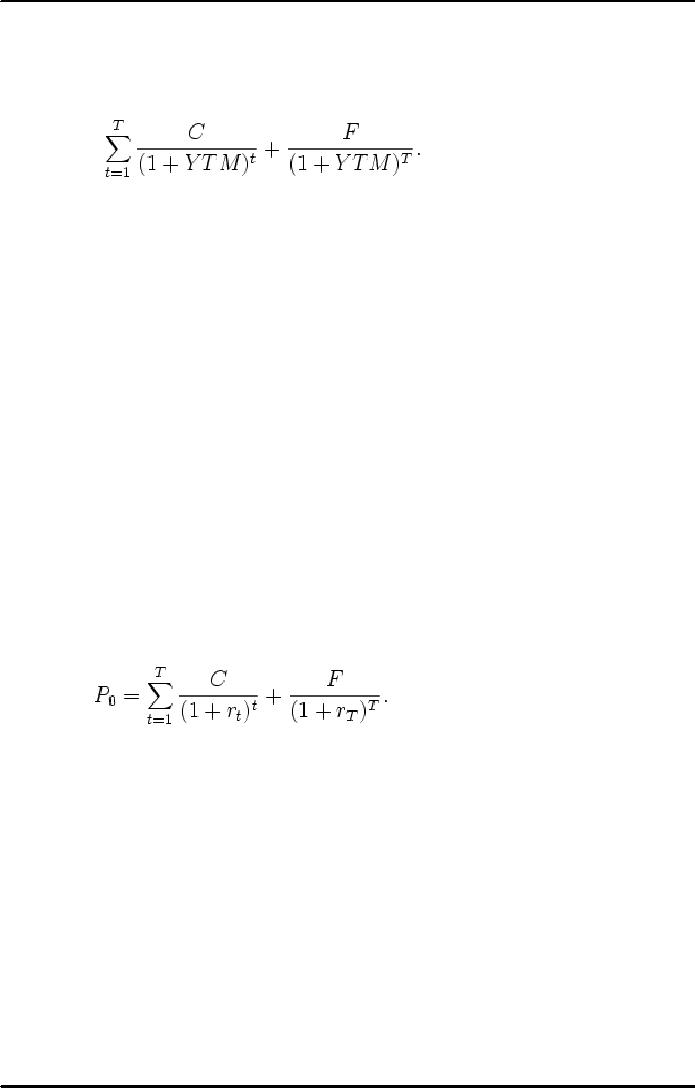

Solve

for YTM where

Market

Price =

To

achieve a return equal to

YTM, the bond owner must invest

each coupon received at this

rate.

Points to

remember:

For a

bond selling above the face

value is said to sell at premium. It

means investor who buys it at

a

premium

face a capital loss over the

life of bond. So return on

bond will be less than the

current yield.

For a

bond selling below the face

value is said to sell at

discount. This means capital

gain at maturity. The

return

on this bond is greater than its current

yield.

If

interest rates do not

change, the bond price

changes with time so that

total return on the bond is

equal to

yield

to maturity.

If YTM

increases, the rate of return

will be less than

yield.

If the YTM

decreases, the rate of return

will be greater than

yield.

2) Bond

pricing:

a)

Relative price approach:

Here

the bond will be priced relative to a

benchmark, usually a government security.

The discount rate

used

to

value the bond is determined based on the

bond's rating relative to a government

security with similar

maturity.

The better the quality of the bond, the

smaller the spread between

its required return and

the

YTM of the

benchmark. This required return is

then used to discount the bond

cash flows.

b) Arbitrage

free pricing approach:

In this

approach, the bond price

will reflect its arbitrage

free price. Here, each cash

flow is priced separately

and is

discounted at the same rate as the

corresponding government issue Zero

coupon bond. Since

each

bond

cash flow is known with

certainty, the bond price today must be

equal to the sum of each of

its cash

flows

discounted at the corresponding risk free

rate - i.e. the corresponding government

security.

Here

the discount rate per cash

flow, rt, must match

that of the corresponding zero coupon

bond's rate.

Bond

Price =

18

Table of Contents:

- INTRODUCTION TO SUBJECT

- COMPARISON OF FINANCIAL STATEMENTS

- TIME VALUE OF MONEY

- Discounted Cash Flow, Effective Annual Interest Bond Valuation - introduction

- Features of Bond, Coupon Interest, Face value, Coupon rate, Duration or maturity date

- TERM STRUCTURE OF INTEREST RATES

- COMMON STOCK VALUATION

- Capital Budgeting Definition and Process

- METHODS OF PROJECT EVALUATIONS, Net present value, Weighted Average Cost of Capital

- METHODS OF PROJECT EVALUATIONS 2

- METHODS OF PROJECT EVALUATIONS 3

- ADVANCE EVALUATION METHODS: Sensitivity analysis, Profitability analysis, Break even accounting, Break even - economic

- Economic Break Even, Operating Leverage, Capital Rationing, Hard & Soft Rationing, Single & Multi Period Rationing

- Single period, Multi-period capital rationing, Linear programming

- Risk and Uncertainty, Measuring risk, Variability of return–Historical Return, Variance of return, Standard Deviation

- Portfolio and Diversification, Portfolio and Variance, Risk–Systematic & Unsystematic, Beta – Measure of systematic risk, Aggressive & defensive stocks

- Security Market Line, Capital Asset Pricing Model – CAPM Calculating Over, Under valued stocks

- Cost of Capital & Capital Structure, Components of Capital, Cost of Equity, Estimating g or growth rate, Dividend growth model, Cost of Debt, Bonds, Cost of Preferred Stocks

- Venture Capital, Cost of Debt & Bond, Weighted average cost of debt, Tax and cost of debt, Cost of Loans & Leases, Overall cost of capital – WACC, WACC & Capital Budgeting

- When to use WACC, Pure Play, Capital Structure and Financial Leverage

- Home made leverage, Modigliani & Miller Model, How WACC remains constant, Business & Financial Risk, M & M model with taxes

- Problems associated with high gearing, Bankruptcy costs, Optimal capital structure, Dividend policy

- Dividend and value of firm, Dividend relevance, Residual dividend policy, Financial planning process and control

- Budgeting process, Purpose, functions of budgets, Cash budgets–Preparation & interpretation

- Cash flow statement Direct method Indirect method, Working capital management, Cash and operating cycle

- Working capital management, Risk, Profitability and Liquidity - Working capital policies, Conservative, Aggressive, Moderate

- Classification of working capital, Current Assets Financing – Hedging approach, Short term Vs long term financing

- Overtrading – Indications & remedies, Cash management, Motives for Cash holding, Cash flow problems and remedies, Investing surplus cash

- Miller-Orr Model of cash management, Inventory management, Inventory costs, Economic order quantity, Reorder level, Discounts and EOQ

- Inventory cost – Stock out cost, Economic Order Point, Just in time (JIT), Debtors Management, Credit Control Policy

- Cash discounts, Cost of discount, Shortening average collection period, Credit instrument, Analyzing credit policy, Revenue effect, Cost effect, Cost of debt o Probability of default

- Effects of discounts–Not effecting volume, Extension of credit, Factoring, Management of creditors, Mergers & Acquisitions

- Synergies, Types of mergers, Why mergers fail, Merger process, Acquisition consideration

- Acquisition Consideration, Valuation of shares

- Assets Based Share Valuations, Hybrid Valuation methods, Procedure for public, private takeover

- Corporate Restructuring, Divestment, Purpose of divestment, Buyouts, Types of buyouts, Financial distress

- Sources of financial distress, Effects of financial distress, Reorganization

- Currency Risks, Transaction exposure, Translation exposure, Economic exposure

- Future payment situation – hedging, Currency futures – features, CF – future payment in FCY

- CF–future receipt in FCY, Forward contract vs. currency futures, Interest rate risk, Hedging against interest rate, Forward rate agreements, Decision rule

- Interest rate future, Prices in futures, Hedging–short term interest rate (STIR), Scenario–Borrowing in ST and risk of rising interest, Scenario–deposit and risk of lowering interest rates on deposits, Options and Swaps, Features of opti

- FOREIGN EXCHANGE MARKET’S OPTIONS

- Calculating financial benefit–Interest rate Option, Interest rate caps and floor, Swaps, Interest rate swaps, Currency swaps

- Exchange rate determination, Purchasing power parity theory, PPP model, International fisher effect, Exchange rate system, Fixed, Floating

- FOREIGN INVESTMENT: Motives, International operations, Export, Branch, Subsidiary, Joint venture, Licensing agreements, Political risk