|

Corporate

Finance FIN 622

VU

Lesson

31

CREDIT

POLICY

In this hand

out we shall discuss the

following topics:

Cash

discounts

o Cost

of discount

o Shortening

average collection

period

Credit

instrument

Analyzing

credit policy

o Revenue

effect

o Cost

effect

o Cost

of debt

o Probability

of default

Evaluating

client worthiness

Optimal

credit policy

Collection

policy

One Example of

debtors management

Cash

Discounts:

Cash

discounts are offered by the

seller to buyer in order to improve

its operating cycle and this

involves

some

cost that is the discount cost of

receiving early payment. This discount is

conditional subject to

payment

within a stipulated period of time which is

generally much shorter than

normal credit period.

For

example, term of "3/10, net 45"

means that discount of 3% is available

only if the payment is

received

within

first ten days of delivering

goods otherwise, full

invoice value will be

payable by the debtor on 45th

day.

There's

a cost of credit for seller. By availing

a discount for early payment the buyer is

often not in a

position

to ignore the cash discount.

Let's see

cost of discount to seller with the

help of an example.

For

example, the sale terms are

2/10 net 30 for a transaction in the

amount of Rs. 100,000/-.

If buyer

gives up discount, he pays Rs.

100,000/- on 30th day, and

will loose Rs. 2,000/-

(100,000 x 2%).

Look,

foregoing Rs 2,000/- may

look small but let's

annualize it and express it in

%age:

2,000/98,000

= 0.020408

Note

this is for 20 days.

For

computing the loss of not

taking discount on annual

basis,

We

will have 365/20 = 18.25 -

20-days period in one

year.

Effective

annual rate (EAR) =

(1.020408)18.25 = 44.58%

This

is only for Rs 2000 on Rs

100,000/-. You can well

imagine the business activity

that runs in million

of

rupees.

Discounts

also, for seller, shorten the

average collection period

(ACP).

Shortening

ACP:

A firm

has 30 days collection

period and it is offering

terms of 2/10, net 30 and

estimates that around 50%

customers

will avail this opportunity by paying

within 10 days. Remaining 50%

will pay after 30 days.

Now

the

ACP will be as

follows:

50% x 10

days + 50% x 30 days = 20

days

If

average sales are rs.2

million per month, then

receivable Rs 2 million x 1/3 =

666,666.00

Credit

Instrument

The

formal evidence of indebtedness is

invoice or dispatch note.

When

seller is supposed to dispatch

goods invoice may or may

not accompany goods, but

may accompany a

dispatch

note on which buyer acknowledges the

receipt of goods upon

arrival at buyer's

premises.

Analyzing

Credit Policy:

When a

firm allows credit to its

customers there are some

effects that should be

considered.

First,

allowing credit to customers means

that the revenues to the firm

will be delayed. A firm may

charge

higher

prices to the customers for

allowing them on credit and this will

result in increased sales.

Total

revenues

may increase but still the

company will receive it

late.

103

Corporate

Finance FIN 622

VU

Secondly,

if the company allows credit to customers

and then offers cash

discounts for early payment

from

debtors

it will incur cost of

discount. In other words, it is

reducing its profits.

After

allowing credit to parties the firm

must arrange some loans to

finance its short term operations.

Such

finances

do carry a handsome interest

rate and this need to be

considered.

Increasing

sales by allowing generous credit to

customers also increased the

probability of default and

thus

may

incur bad debts.

Evaluating

client worthiness:

A firm

who is in process of granting credit to the

customers should also consider the

business character of

the

customer. There are several

ways that could guide the

business as far as the credit worthiness

of the

client

and help decide whether to extend credit

or not.

The

following methods to evaluate the credit

worthiness are widely used in

business:

Financial

statements of vendor

Market

reputation

Banks

Previous

payment record

Financial

strength

Capacity

General

economic conditions in vendors

industry

We

have discussed the credit policy

and the question arises here

that what should be the optimal

credit

policy?

The

trade off between allowing

credit or not is a matter which we cannot

quantify exactly. We can

only

outline

a optimal credit policy. Thus far, we

have identified the following

costs associated with

granting

credit to the

customers:

a) The

return on receivables

b) The

losses from customers'

default bad

debts

c) The

collection and credit management

cost

If a

firm has very rigid credit

policy then the cost

associated will be low.

Resultantly, there will be

shortage

of credit

(extended to customers) and the

cost will incur in terms of

opportunity cost. This

opportunity cost

is the

extra profit from sales

due to the fact that credit was

declined. (One way of increasing

return is to

allow

credit to customers or also called

investment in debtors). This cost is

reduced as credit period is

increased.

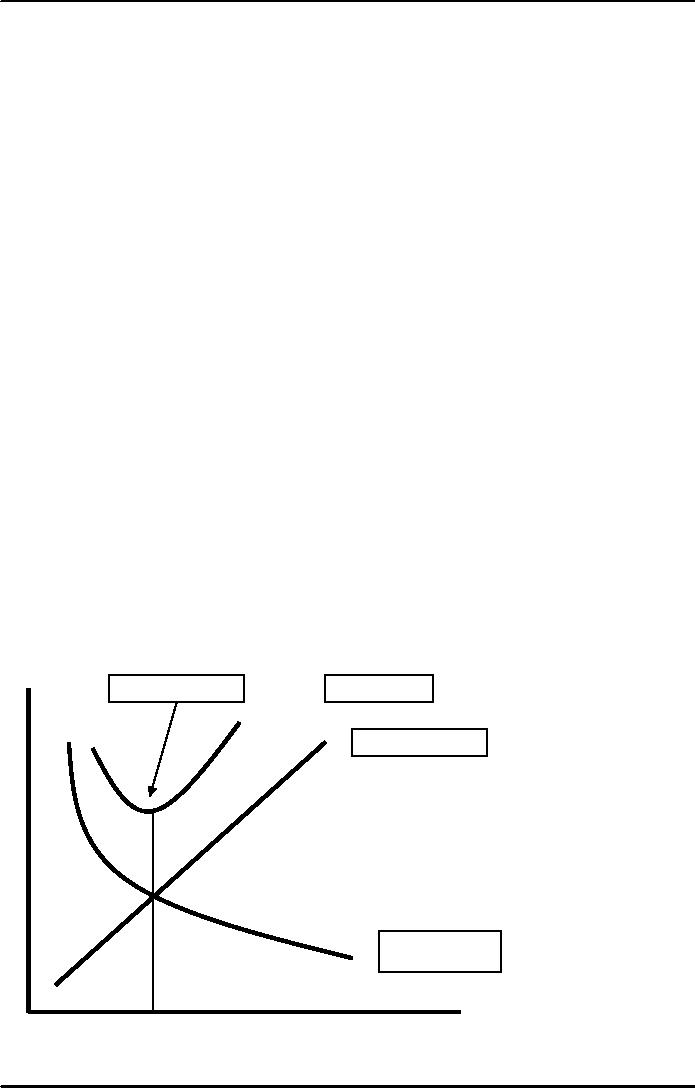

Optimal

Credit Level

Total

Cost

Carrying

Cost

Opportunity

Cost

104

Corporate

Finance FIN 622

VU

The

total of carrying cost and

the opportunity cost of credit policy is

called the total credit cost

curve. There

is a

point on the total cost

curve where the total credit

cost curve is minimized. This

point corresponds to

the

optimal amount of credit or investment in

receivables.

If the

firm extends more credit than the

minimum level the additional net cash

flow from new

customers

will

not cover the carrying costs

of the investment in receivables. If the level of

receivables is below this

limit

then the firm is forgoing

profit opportunities.

In

general the cost and benefits

from extending credit will depend on the

characteristics of particular firms

and

industries. For example, it is

likely that firms with

excess capacity, lower operational

costs and repeat

customers

will extend credit more than other

firms.

Collection

Policy:

This

is the last item in designing credit

policy. This phase

encompasses:

�

The

company must keep track of

average collection period (ACP).

The monitoring of ACP

will

also

consider seasonal

effects.

�

Aging

schedule: a compilation of accounts

receivable by the age of each

account.

�

Collection

effort for overdue or delinquent

accounts.

To

keep track of payment by

customers most firms will

monitor outstanding accounts. The

ACP should not

be

more than allowed to individual

customers. However, the seasonal

effects should also be

considered

while

monitoring the ACP. In seasonal

times ACP will fluctuate but

there should not be abnormal

increase

in

average period.

To

monitor the un-wanted stretches in ACP,

the firm can use the aging

analysis. Under this analysis,

each

customer

receivable age is determined using the

invoice date or processing

date. Normally, the age

is

determined in

three or four categories set

up on time basis. For example, if a

customer account shows

a

debit

balance of Rs. 550,000/- on

any specific date it can be

broken down on aging basis

like as follows:

Days

0

30

31-

60

61 90 >

90

75,000

150,000

200,000

125,000

If the

firm in above example allows

60 days credit to this customer, then

you can calculate that

Rs.

325,000/-

(sum of last two columns) is

delinquent or overdue amount, which has a

definite cost. This type

of

analysis helps identify the overdue

accounts and then efforts

are directed to recover such

amounts.

Collection

effort is not just limited

to send a letter or calling the client

but there are some

sensitive points

involved.

A situation where a customer is

source of substantial source of

sales or a major client and

loss of

which

would be colossal, then it

would be in firms interest not to

press for recovery even if

it over due.

However,

the recovery process should be handled by the

sales team and there

must be sense of strong

relationship

with the client. For normal

clients we can use reminder,

phone or send a representative

for

quick

collection.

In

extreme circumstances, the company

has to refuse additional

supplies until the previous balance is

paid

or

even a legal action can be

initiated for recovery. But

it should be noted that there's a

significant legal cost

involved

in litigation.

105

Table of Contents:

- INTRODUCTION TO SUBJECT

- COMPARISON OF FINANCIAL STATEMENTS

- TIME VALUE OF MONEY

- Discounted Cash Flow, Effective Annual Interest Bond Valuation - introduction

- Features of Bond, Coupon Interest, Face value, Coupon rate, Duration or maturity date

- TERM STRUCTURE OF INTEREST RATES

- COMMON STOCK VALUATION

- Capital Budgeting Definition and Process

- METHODS OF PROJECT EVALUATIONS, Net present value, Weighted Average Cost of Capital

- METHODS OF PROJECT EVALUATIONS 2

- METHODS OF PROJECT EVALUATIONS 3

- ADVANCE EVALUATION METHODS: Sensitivity analysis, Profitability analysis, Break even accounting, Break even - economic

- Economic Break Even, Operating Leverage, Capital Rationing, Hard & Soft Rationing, Single & Multi Period Rationing

- Single period, Multi-period capital rationing, Linear programming

- Risk and Uncertainty, Measuring risk, Variability of return–Historical Return, Variance of return, Standard Deviation

- Portfolio and Diversification, Portfolio and Variance, Risk–Systematic & Unsystematic, Beta – Measure of systematic risk, Aggressive & defensive stocks

- Security Market Line, Capital Asset Pricing Model – CAPM Calculating Over, Under valued stocks

- Cost of Capital & Capital Structure, Components of Capital, Cost of Equity, Estimating g or growth rate, Dividend growth model, Cost of Debt, Bonds, Cost of Preferred Stocks

- Venture Capital, Cost of Debt & Bond, Weighted average cost of debt, Tax and cost of debt, Cost of Loans & Leases, Overall cost of capital – WACC, WACC & Capital Budgeting

- When to use WACC, Pure Play, Capital Structure and Financial Leverage

- Home made leverage, Modigliani & Miller Model, How WACC remains constant, Business & Financial Risk, M & M model with taxes

- Problems associated with high gearing, Bankruptcy costs, Optimal capital structure, Dividend policy

- Dividend and value of firm, Dividend relevance, Residual dividend policy, Financial planning process and control

- Budgeting process, Purpose, functions of budgets, Cash budgets–Preparation & interpretation

- Cash flow statement Direct method Indirect method, Working capital management, Cash and operating cycle

- Working capital management, Risk, Profitability and Liquidity - Working capital policies, Conservative, Aggressive, Moderate

- Classification of working capital, Current Assets Financing – Hedging approach, Short term Vs long term financing

- Overtrading – Indications & remedies, Cash management, Motives for Cash holding, Cash flow problems and remedies, Investing surplus cash

- Miller-Orr Model of cash management, Inventory management, Inventory costs, Economic order quantity, Reorder level, Discounts and EOQ

- Inventory cost – Stock out cost, Economic Order Point, Just in time (JIT), Debtors Management, Credit Control Policy

- Cash discounts, Cost of discount, Shortening average collection period, Credit instrument, Analyzing credit policy, Revenue effect, Cost effect, Cost of debt o Probability of default

- Effects of discounts–Not effecting volume, Extension of credit, Factoring, Management of creditors, Mergers & Acquisitions

- Synergies, Types of mergers, Why mergers fail, Merger process, Acquisition consideration

- Acquisition Consideration, Valuation of shares

- Assets Based Share Valuations, Hybrid Valuation methods, Procedure for public, private takeover

- Corporate Restructuring, Divestment, Purpose of divestment, Buyouts, Types of buyouts, Financial distress

- Sources of financial distress, Effects of financial distress, Reorganization

- Currency Risks, Transaction exposure, Translation exposure, Economic exposure

- Future payment situation – hedging, Currency futures – features, CF – future payment in FCY

- CF–future receipt in FCY, Forward contract vs. currency futures, Interest rate risk, Hedging against interest rate, Forward rate agreements, Decision rule

- Interest rate future, Prices in futures, Hedging–short term interest rate (STIR), Scenario–Borrowing in ST and risk of rising interest, Scenario–deposit and risk of lowering interest rates on deposits, Options and Swaps, Features of opti

- FOREIGN EXCHANGE MARKET’S OPTIONS

- Calculating financial benefit–Interest rate Option, Interest rate caps and floor, Swaps, Interest rate swaps, Currency swaps

- Exchange rate determination, Purchasing power parity theory, PPP model, International fisher effect, Exchange rate system, Fixed, Floating

- FOREIGN INVESTMENT: Motives, International operations, Export, Branch, Subsidiary, Joint venture, Licensing agreements, Political risk