|

Corporate

Finance FIN 622

VU

Lesson

29

INVENTORY

MANAGEMENT

The

following topics will be

discussed in this lecture.

Miller-Orr

Model of cash

management

Inventory

management

Inventory

costs

Economic

order quantity

Reorder

level

Discounts

and EOQ

Miller-Orr

Model for Cash

Management:

Most

firms maintain a minimum amount of cash on hand to

meet daily obligations or as a requirement

from

the firm's bank. A

maximum amount may also be

specified to reflect the tradeoff between

the transaction

cost

of investing in liquid assets (e.g.

Money Market Funds) and the

cost of lost interest if the cash is

not

invested.

The Miller-Orr model computes the

spread between the minimum

and maximum cash

balance

limits

as

Spread

=

3(0.75 x transaction cost x

variance of daily cash flows / daily

interest rate) ^(1/3)

(where

a^b is used to denote "a to the power

b").

The

maximum cash balance is the

spread plus the minimum cash

balance, which is assumed to be

known.

The

"return

point" is

defined as the minimum cash

balance plus spread/3.

Whenever

the cash balance hits (or

exceeds) the maximum, the firm should

invest the difference between

the amount

available and the return

point; if the minimum is reached,

sufficient securities should be sold

to

bring

it up to the return point.

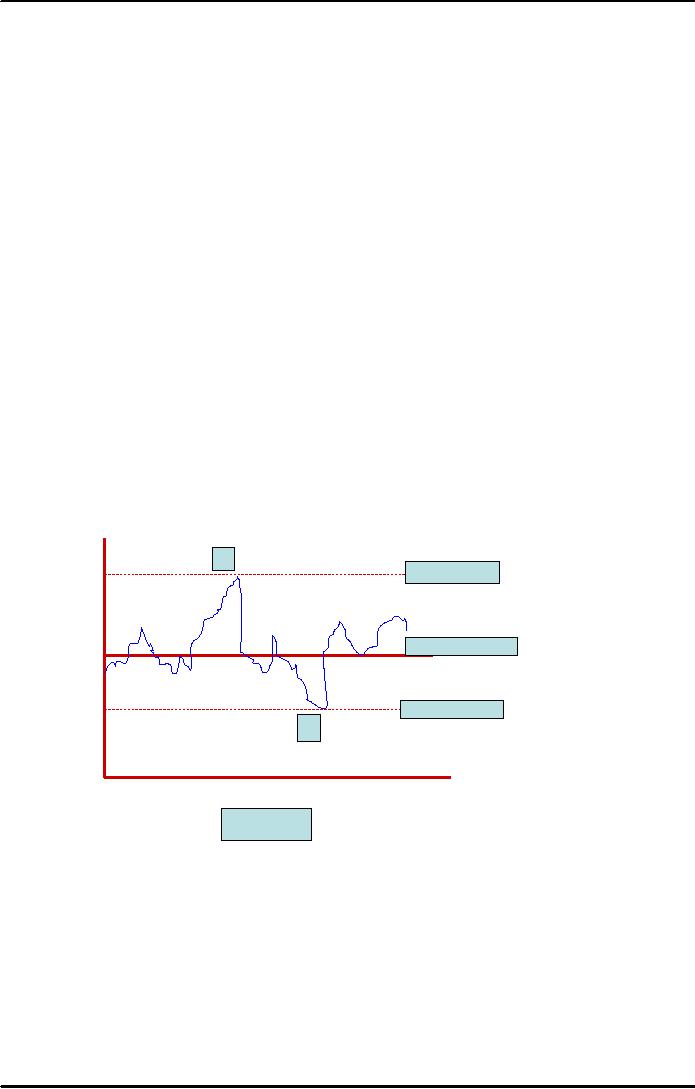

� MILLER-ORR

MODEL:

A

CASH

UPPER

LIMIT

RETURN

POINT

LOWER

LIMIT

B

TIME

Graph

Explanation:

When

cash balance reaches point

`A', the upper limit, company

will invest the surplus to bring

down the

cash

balance to return

point.

When

cash balance touches down

point `B', the lower limit,

the company would liquidate

some of its

securities

to increase the balance back to

return point.

Upper

and lower limits are

determined as explained above.

These

limits depend upon variance

of cash flow, transaction

cost and interest

rate.

If

variability of cash flow is

high and transaction cost is

high too, then the limits

will be wide apart,

otherwise

narrow would suffice.

If

interest rates are high

then the narrow limits would be

set.

96

Corporate

Finance FIN 622

VU

To

keep interest cost as low as

possible, the return point is

set 1/3 of the spread

between the lower and

upper

limit.

Inventory

Management:

Inventory

management is the active control program

which allows the management of

sales, purchases

and

payments.

Inventory

management software helps

create invoices, purchase

orders, receiving lists,

payment receipts

and

can print bar coded

labels. An inventory management

software system configured to

your warehouse,

retail or

product line will help to

create revenue for your

company. The Inventory

Management will

control

operating costs and provide better

understanding. We are your

source for inventory

management

information,

inventory management software

and tools.

A

complete Inventory Management

Control system contains the

following components:

� Inventory

Management Definition

� Inventory

Management Terms

� Inventory

Management Purposes

� Definition

and Objectives for Inventory

Management

� Organizational

Hierarchy of Inventory

Management

� Inventory

Management Planning

� Inventory

Management Controls for

Inventory

� Determining

Inventory Management Stock

Levels

�

1. Inventory

costs

Inventory

costs depend on the amount of space

required, and how much that

space costs. If the

assumption

is

made that every part

spends an equal amount of time

located in inventory, then the

cost of inventory can

be

shared equally amongst all

parts. This simplification leads to

equation 3.4.1 as an expression for

the

inventory

costs:

Carrying

cost:

Cost

of holding an item in inventory.

Ordering

cost:

Cost

of replenishing inventory

Shortage

Cost:

Temporary or

permanent loss of sales when

demand customers don't find

the product in the market

and

switch

over to substitute

products.

2.

Economic order

quantity

EOQ

The

amount of orders that minimizes

total variable

costs required to

order and hold inventory.

Re-order

quantity is the quantity for

which order is placed when the

stock reached re-orders level. By

fixing

this

quantity the purchaser has

not to be to re-calculate the quantity to

be purchased each time he orders

for

material.

Re-order

quantity is known as economic

order quantity because it is the

quantity which is most

economical

to order. In

other words, economic order

quantity is that size of

quantity of the order which

gives

maximum

economy in purchasing any

material and ultimately contributes

towards maintaining the material

at the

optimum level and minimum

cost.

While

setting economic order

quantity, two types of cost

should be taken into

account:

1. Ordering

Cost: This

is the cost of placing an order

with the supplier. Because of so many

factors

involved,

it is quite difficult to quantify this

cost. It mainly includes the cost of

stationary, salaries of

those

engaged in receiving and inspection,

salaries of those engaged in

placing an order, etc.

2. Cost

of Carrying Stock: This

is the cost of holding the stock in

storage.

It

includes the following:

(a)

cost of operating the stores,(salaries, rent,

stationary)

(b) the

incidence of insurance

cost;

(c)

interest on the capital locked up in

store;

(d)

Deterioration and wastage of

material.

97

Corporate

Finance FIN 622

VU

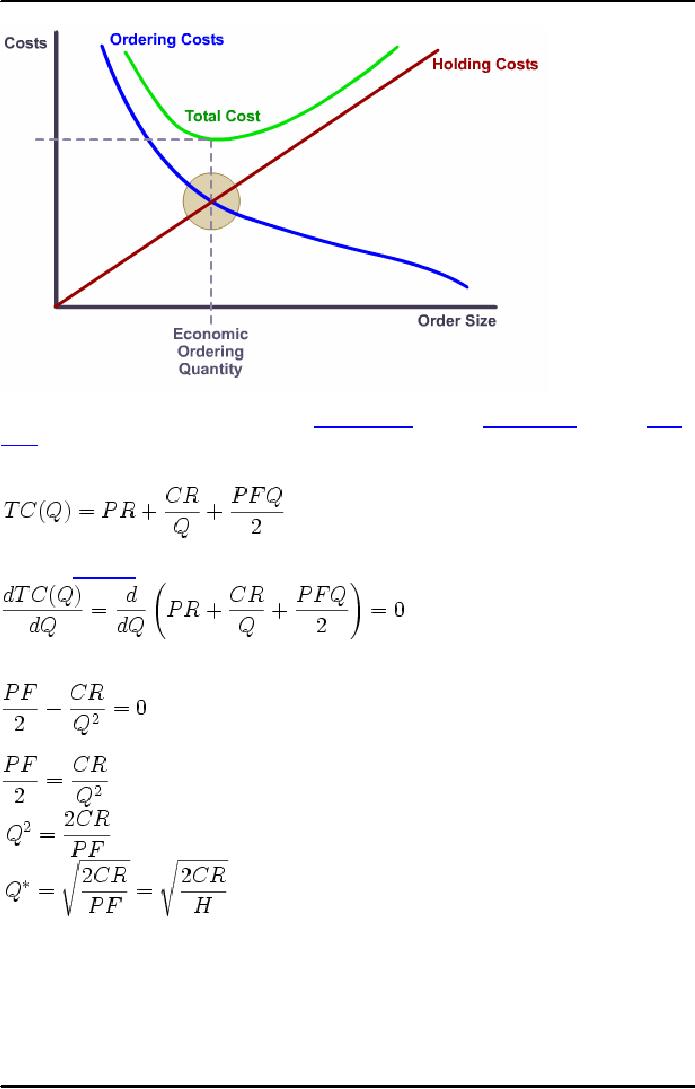

A

graph illustrating the relationship

amongst the Ordering

Costs curve,

the Holding

Costs curve,

the Total

Costs

curve

and the Economic ordering

quantity

The

single item EOQ formula can

be seen as the minimum point of the

following cost

function:

Total

cost = purchase cost + order

cost + holding cost, which

corresponds to:

.

Taking

the derivative

of

both sides of the equation and

setting equal to zero, one

obtains

.

The

result of this differentiation

is:

Solving

for Q:

.

3.

Reorder level

This

is that level of material at which

purchase requisition is initiated

for fresh supplies. This is

fixed some

where

between minimum level and

maximum level. This is fixed in

such a way that by re-ordering

when

material

falls to this level, then in the normal

course of events, new

supplies will be received

just before the

minimum

level is reached. Its formula

is:

Re-order

Level = Maximum consumption * Maximum

re-order period

The

following factors are

considered in fixing this level:

98

Corporate

Finance FIN 622

VU

1.

Rate of consumption of the

material

2.

Minimum level

3.

Delivery time; i.e., the time normally

taken from the time of initiating a

purchase requisition, to the

receipts

of material

4.

Variation in delivery time.

4. Discounts

and EOQ

Discounts

are reductions

to a basic price.

They could modify either the manufacturer's

list price

(determined by the

manufacturer and often

printed on the package), the retail price

(set by the retailer and

often

attached to the product

with a

sticker), or the list price (which is

quoted to a potential buyer, usually

in

written

form). The market price

(also called effective price) is the

amount actually paid. The purpose

of

discounts

is to increase short-term sales, move

out-of-date stock, reward

valuable customers, or

encourage

distribution

channel members

to perform a function. Some

discounts and allowances are

forms of sales

promotion.

EOQ

The

amount of orders that minimizes

total variable

costs required to

order and hold inventory.

Re-order

quantity is the quantity for

which order is placed when the

stock reached re-orders level. By

fixing

this

quantity the purchaser has

not to be to re-calculate the quantity to

be purchased each time he orders

for

material.

99

Table of Contents:

- INTRODUCTION TO SUBJECT

- COMPARISON OF FINANCIAL STATEMENTS

- TIME VALUE OF MONEY

- Discounted Cash Flow, Effective Annual Interest Bond Valuation - introduction

- Features of Bond, Coupon Interest, Face value, Coupon rate, Duration or maturity date

- TERM STRUCTURE OF INTEREST RATES

- COMMON STOCK VALUATION

- Capital Budgeting Definition and Process

- METHODS OF PROJECT EVALUATIONS, Net present value, Weighted Average Cost of Capital

- METHODS OF PROJECT EVALUATIONS 2

- METHODS OF PROJECT EVALUATIONS 3

- ADVANCE EVALUATION METHODS: Sensitivity analysis, Profitability analysis, Break even accounting, Break even - economic

- Economic Break Even, Operating Leverage, Capital Rationing, Hard & Soft Rationing, Single & Multi Period Rationing

- Single period, Multi-period capital rationing, Linear programming

- Risk and Uncertainty, Measuring risk, Variability of return–Historical Return, Variance of return, Standard Deviation

- Portfolio and Diversification, Portfolio and Variance, Risk–Systematic & Unsystematic, Beta – Measure of systematic risk, Aggressive & defensive stocks

- Security Market Line, Capital Asset Pricing Model – CAPM Calculating Over, Under valued stocks

- Cost of Capital & Capital Structure, Components of Capital, Cost of Equity, Estimating g or growth rate, Dividend growth model, Cost of Debt, Bonds, Cost of Preferred Stocks

- Venture Capital, Cost of Debt & Bond, Weighted average cost of debt, Tax and cost of debt, Cost of Loans & Leases, Overall cost of capital – WACC, WACC & Capital Budgeting

- When to use WACC, Pure Play, Capital Structure and Financial Leverage

- Home made leverage, Modigliani & Miller Model, How WACC remains constant, Business & Financial Risk, M & M model with taxes

- Problems associated with high gearing, Bankruptcy costs, Optimal capital structure, Dividend policy

- Dividend and value of firm, Dividend relevance, Residual dividend policy, Financial planning process and control

- Budgeting process, Purpose, functions of budgets, Cash budgets–Preparation & interpretation

- Cash flow statement Direct method Indirect method, Working capital management, Cash and operating cycle

- Working capital management, Risk, Profitability and Liquidity - Working capital policies, Conservative, Aggressive, Moderate

- Classification of working capital, Current Assets Financing – Hedging approach, Short term Vs long term financing

- Overtrading – Indications & remedies, Cash management, Motives for Cash holding, Cash flow problems and remedies, Investing surplus cash

- Miller-Orr Model of cash management, Inventory management, Inventory costs, Economic order quantity, Reorder level, Discounts and EOQ

- Inventory cost – Stock out cost, Economic Order Point, Just in time (JIT), Debtors Management, Credit Control Policy

- Cash discounts, Cost of discount, Shortening average collection period, Credit instrument, Analyzing credit policy, Revenue effect, Cost effect, Cost of debt o Probability of default

- Effects of discounts–Not effecting volume, Extension of credit, Factoring, Management of creditors, Mergers & Acquisitions

- Synergies, Types of mergers, Why mergers fail, Merger process, Acquisition consideration

- Acquisition Consideration, Valuation of shares

- Assets Based Share Valuations, Hybrid Valuation methods, Procedure for public, private takeover

- Corporate Restructuring, Divestment, Purpose of divestment, Buyouts, Types of buyouts, Financial distress

- Sources of financial distress, Effects of financial distress, Reorganization

- Currency Risks, Transaction exposure, Translation exposure, Economic exposure

- Future payment situation – hedging, Currency futures – features, CF – future payment in FCY

- CF–future receipt in FCY, Forward contract vs. currency futures, Interest rate risk, Hedging against interest rate, Forward rate agreements, Decision rule

- Interest rate future, Prices in futures, Hedging–short term interest rate (STIR), Scenario–Borrowing in ST and risk of rising interest, Scenario–deposit and risk of lowering interest rates on deposits, Options and Swaps, Features of opti

- FOREIGN EXCHANGE MARKET’S OPTIONS

- Calculating financial benefit–Interest rate Option, Interest rate caps and floor, Swaps, Interest rate swaps, Currency swaps

- Exchange rate determination, Purchasing power parity theory, PPP model, International fisher effect, Exchange rate system, Fixed, Floating

- FOREIGN INVESTMENT: Motives, International operations, Export, Branch, Subsidiary, Joint venture, Licensing agreements, Political risk