|

Corporate

Finance FIN 622

VU

Lesson

27

WORKING

CAPITAL MANAGEMENT

The

following topics will be

discussed in this lecture.

Classification

of working capital

Current

Assets Financing Hedging

approach

Short term Vs

long term financing

Risk

of short & long term financing

Trade

off of short & long term

financing

Classifications

of Working Capital

Working

capital or current assets can be

classified according to

- Components:

like inventory, cash,

securities, receivables

- Time

basis: it may be temporary or

permanent.

Temporary

working capital is the amount of investment in current

assets that varies according

to the

seasonal

requirements. For example,

consider an ice cream manufacturing

firm. During the months of

May

September the manufacturer has to

keep the maximum inventory to support

high level sales. During

off-

season

like from November to

January the sales are

extremely low and lower

investment in inventory is

required.

Now consider if a festival like

Eid or Christmas is falling

during December and this

would result

in

high sales, then a temporary

increase in inventory would be required

to support this sale level.

Permanent

working capital is the minimum investment

in current assets that is required

support long-term

minimum

need. Permanent working

capital resembles to fixed

assets in two aspects. First the

dollar

investment is

long term despite contradiction

that assets being financed are

called `current'. Second,

for a

growing

firm, the need to increase the

minimum permanent working

capital is the same as of fixed

assets.

However,

there is a case of difference between the

permanent working capital

and fixed asset that

is the

later

always changing

constantly.

Like

permanent working capital, temporary

working capital also

comprises of current assets in a

constantly

changing

form. However, because the

need for this part of the

firm's total current assets is

seasonal, we

want to

consider financing this level of current

assets from a source which

can itself be seasonal

or

temporary in

nature. In the next section we

pick up the problem of how to

finance current assets.

Short

Term & Long Term

Mix

Investment

in current asset does involve a

trade off between the risk

and profitability. As a matter of

fact

the current

liabilities side of working

capital does not consist of

active decision variables in the

sense; you

cannot defer

payment to creditors beyond certain

limits. Same is true for accrued

expenses like electricity,

payroll

etc. There's no big room

for playing with current liabilities

which are also termed as

spontaneous

source

of finance. As the underlying investment in current

assets grows, accounts

payable and accruals

also

tend to grow, in

part financing the increase in

assets. The issue here is

how to handle assets not

supported

by

spontaneous financing. This is termed as

residual financing requirements

that is net investment after

deducting

spontaneous financing.

Current

Assets Financing Hedging

Approach

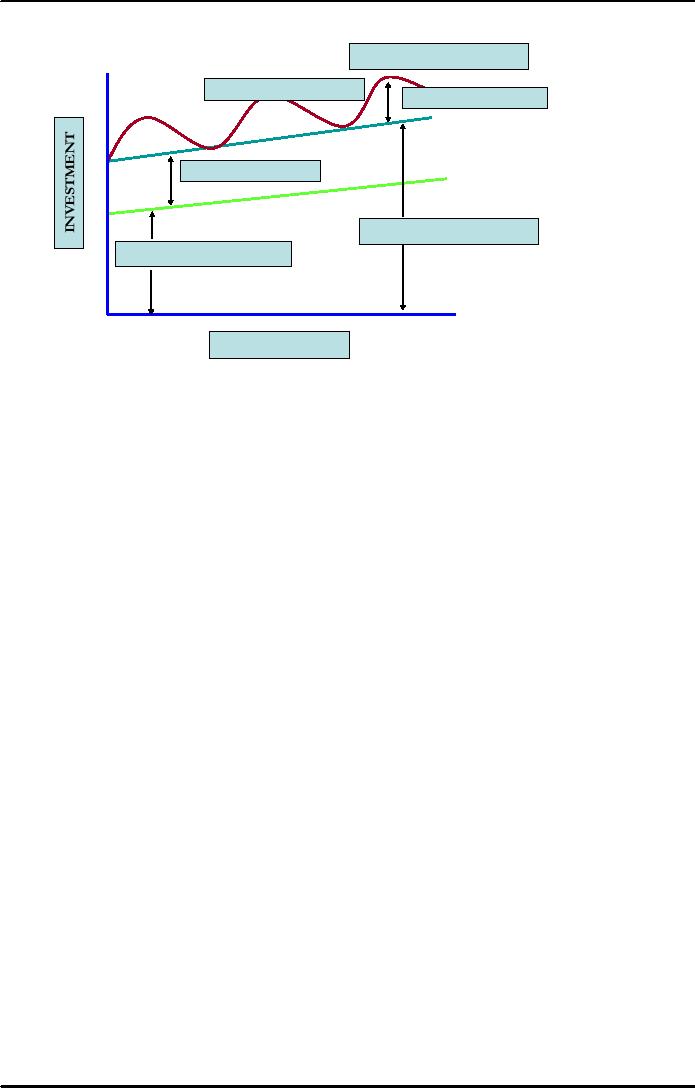

Under

this approach each asset

would be offset with a

financing instrument of the same

maturity. Short

term

seasonal investment requirements should be financed

through short term loans and

permanent current

asset

and all fixed assets should

be financed through long term loan

and equity. This can be illustrated

from

the

following figure:

90

Corporate

Finance FIN 622

VU

HEDGING

POLICY

TEMPORARY

CA

SHORT TERM

LOANS

PERMANENT

CA

LONG TERM

LOANS

NON CURRENT

ASSETS

TIME

This

shows that financing will be

employed even when it is not

needed. With a hedging approach

to

financing, the

borrowing and payment

schedule for short term financing

would be arranged to

correspond

to the

expected swings in current assets

less spontaneous financing.

The

rational behind hedging

policy that if long term

loans are used to finance

the short term or temporary

current

assets then the firm will be

paying interest when the funds are

not actually needed. It is

clear from

the

graphical view of the hedging policy

that loans will only be

employed during the seasonal

need period.

Hedging

approach to financing suggests

that apart from current

installments on long term debt, a

firm

should

not employ current borrowings during

seasonal troughs for asset

needs as per the above figure.

As

the

seasonal need asset arises

it will borrow on short term basis.

This loan will be used to

pay off the

borrowing

with the cash released as the

recently financed temporary assets were

eventually reduced. For

example,

a seasonal increase in inventory

for Eid selling will be

financed with a shot term loan. As

the

inventory

was reduced through sales,

debtors will be built up.

The cash needed to repay the

loan would

come

from the collection from

debtors. In this way financing

will only be employed when

needed.

Thus

loan to support seasonal

need would generate

necessary fund to repayment in

normal course of

operation.

This is known as self-liquidating

principle.

Short

Term Vs Long Tem

Financing

Although

the exact maturity matching of

future cash flow and

debt repayments is possible under

conditions

of certainty

but it is not appropriate when surrounded by

uncertainty. Net cash flow

will be off from the

estimates

keeping in view the firm's business

risk. Resultantly the schedule of

maturities of debt is very

significant in

assessing the risk-profitability trade

off.

In

general the shorter the maturity schedule

of a firm's debt, the greater the risk

that fir firm will

default on

principal

and interest payment.

Suppose a firm seeks a short term

loan for capital expenditure.

The cash

flows

from the capital expenditure will

not be sufficient in the short run to

pay off the loan. As a result,

the

company

bears the risk that the lender may

not renew the loan at

maturity. This refinancing risk could be

reduced

in the first place by financing the

plant on a long term basis the

expected loan term future

cash

flows

being sufficient to retire the debt in an

orderly manner. Thus

committing funds to a long term

asset

and

borrowing short term carries the risk

that the firm may not be

able to renew it loan. If the company

is

surrounded by

bad times, the creditors

might regard renewal as too

risky and demand immediate

payment.

Apart

from refinancing risk, uncertainty is

there associated with

interest cost. When firm

finances with long

term

loans it is aware of exact

interest cost over the

period of time for which

loans are needed. If it

uses

short term

loans then it is uncertain of interest

cost. Secondly, we are well

aware that short term

interest

91

Corporate

Finance FIN 622

VU

rates

fluctuate more than long

term. A firm forced to finance its short

term debt in a period of high

interest

rates

may pay on overall interest

cost on short term loan that is higher

than it would have been

originally on

long

term loan. In short not knowing the short term

interest cost of loans is to

some extent a risk to the

company.

The

Risk Vs Cost Trade off:

The

risk between long and short term

financing should be balanced against the

interest costs. The

longer

the

maturity schedule of loan, the more

expensive will be the financing. Further

to this, the firm will be

paying

interest cost on loans when

the loans / debts are not

needed. Therefore, there are

cost inducements

to

finance funds requirements on a short term

basis.

Eventually

we can work out the trade

off between risk and

profitability. As per our

discussion over last

couple

of pages, we know that short term

loans have greater risk than

long term loans but are

comparatively

cheap.

The margin of safety would

depend on the variance between the

cash flow and payment of

debt.

Also,

margin of safety will depend

on the risk preference of the

management.

The

management will finance a

part of its expected

seasonal investment, less payables

and accruals on long

term

basis. If there's no deviation in

cash flow as estimated, the

firm will pay interest on

excess debt during

seasonal

dips when the funds are not

needed. Peak season

requirements can be financed through

long term

loan.

The higher the long term loans the

more conservative financing

policy and therefore, the higher

interest

cost.

Under

aggressive policy the firm

would finance part of its

permanent current asset with short term

debts.

This

would require that firm must

renew the debt at maturity, which

represents some risk to the firm.

The

greater

the portion of permanent assets financed

with short term loans, the more

aggressive the policy is.

In

this

case, the expected margin of safety

linked with firm's policy

can be negative, positive or

even zero.

Now we

are in a position to sum up

our discussion or conservative

and aggressive policies.

Here are the

salient

features of both policies

with regard to investment in current

assets:

Conservative

Policy:

o Firm

finances a part of seasonal

fund requirements less

accounts payable on long term

basis.

o If

cash flow estimates do not

deviate far from actual, it

will pay interest on debt

when actually

funds

are not needed.

o Higher

the long term financing line,

more conservative policy and

higher cost.

Aggressive

Policy:

Part

of permanent current assets is financed

with short term debt.

o

The

company must arrange renewal

of short term debt. It involves risk.

o

The

greater portion of permanent current

assets is financed with short term debt,

more

o

aggressive

policy it is.

Expected margin of

safety regarding ST <> LT financing

can be positive, negative or

o

neutral. Later

would be hedging policy.

Margin

of safety can be increased by

increasing the liquid

assets.

o

Risk

of cash insolvency can be

reduced by stretching the maturity

schedule of debt or

o

carrying

larger amounts of current

assets

92

Table of Contents:

- INTRODUCTION TO SUBJECT

- COMPARISON OF FINANCIAL STATEMENTS

- TIME VALUE OF MONEY

- Discounted Cash Flow, Effective Annual Interest Bond Valuation - introduction

- Features of Bond, Coupon Interest, Face value, Coupon rate, Duration or maturity date

- TERM STRUCTURE OF INTEREST RATES

- COMMON STOCK VALUATION

- Capital Budgeting Definition and Process

- METHODS OF PROJECT EVALUATIONS, Net present value, Weighted Average Cost of Capital

- METHODS OF PROJECT EVALUATIONS 2

- METHODS OF PROJECT EVALUATIONS 3

- ADVANCE EVALUATION METHODS: Sensitivity analysis, Profitability analysis, Break even accounting, Break even - economic

- Economic Break Even, Operating Leverage, Capital Rationing, Hard & Soft Rationing, Single & Multi Period Rationing

- Single period, Multi-period capital rationing, Linear programming

- Risk and Uncertainty, Measuring risk, Variability of return–Historical Return, Variance of return, Standard Deviation

- Portfolio and Diversification, Portfolio and Variance, Risk–Systematic & Unsystematic, Beta – Measure of systematic risk, Aggressive & defensive stocks

- Security Market Line, Capital Asset Pricing Model – CAPM Calculating Over, Under valued stocks

- Cost of Capital & Capital Structure, Components of Capital, Cost of Equity, Estimating g or growth rate, Dividend growth model, Cost of Debt, Bonds, Cost of Preferred Stocks

- Venture Capital, Cost of Debt & Bond, Weighted average cost of debt, Tax and cost of debt, Cost of Loans & Leases, Overall cost of capital – WACC, WACC & Capital Budgeting

- When to use WACC, Pure Play, Capital Structure and Financial Leverage

- Home made leverage, Modigliani & Miller Model, How WACC remains constant, Business & Financial Risk, M & M model with taxes

- Problems associated with high gearing, Bankruptcy costs, Optimal capital structure, Dividend policy

- Dividend and value of firm, Dividend relevance, Residual dividend policy, Financial planning process and control

- Budgeting process, Purpose, functions of budgets, Cash budgets–Preparation & interpretation

- Cash flow statement Direct method Indirect method, Working capital management, Cash and operating cycle

- Working capital management, Risk, Profitability and Liquidity - Working capital policies, Conservative, Aggressive, Moderate

- Classification of working capital, Current Assets Financing – Hedging approach, Short term Vs long term financing

- Overtrading – Indications & remedies, Cash management, Motives for Cash holding, Cash flow problems and remedies, Investing surplus cash

- Miller-Orr Model of cash management, Inventory management, Inventory costs, Economic order quantity, Reorder level, Discounts and EOQ

- Inventory cost – Stock out cost, Economic Order Point, Just in time (JIT), Debtors Management, Credit Control Policy

- Cash discounts, Cost of discount, Shortening average collection period, Credit instrument, Analyzing credit policy, Revenue effect, Cost effect, Cost of debt o Probability of default

- Effects of discounts–Not effecting volume, Extension of credit, Factoring, Management of creditors, Mergers & Acquisitions

- Synergies, Types of mergers, Why mergers fail, Merger process, Acquisition consideration

- Acquisition Consideration, Valuation of shares

- Assets Based Share Valuations, Hybrid Valuation methods, Procedure for public, private takeover

- Corporate Restructuring, Divestment, Purpose of divestment, Buyouts, Types of buyouts, Financial distress

- Sources of financial distress, Effects of financial distress, Reorganization

- Currency Risks, Transaction exposure, Translation exposure, Economic exposure

- Future payment situation – hedging, Currency futures – features, CF – future payment in FCY

- CF–future receipt in FCY, Forward contract vs. currency futures, Interest rate risk, Hedging against interest rate, Forward rate agreements, Decision rule

- Interest rate future, Prices in futures, Hedging–short term interest rate (STIR), Scenario–Borrowing in ST and risk of rising interest, Scenario–deposit and risk of lowering interest rates on deposits, Options and Swaps, Features of opti

- FOREIGN EXCHANGE MARKET’S OPTIONS

- Calculating financial benefit–Interest rate Option, Interest rate caps and floor, Swaps, Interest rate swaps, Currency swaps

- Exchange rate determination, Purchasing power parity theory, PPP model, International fisher effect, Exchange rate system, Fixed, Floating

- FOREIGN INVESTMENT: Motives, International operations, Export, Branch, Subsidiary, Joint venture, Licensing agreements, Political risk