|

Corporate

Finance FIN 622

VU

Lesson

26

WORKING

CAPITAL MANAGEMENT

The

following topics will be

discussed in this lecture.

- Working

capital management

o Risk,

Profitability and

Liquidity

- Working

capital policies

o Conservative

o Aggressive

o Moderate

- Risk

and return of current

liabilities

Working

Capital Management

Decisions

relating to working capital and short

term financing are referred to as working

capital management.

These

involve managing the relationship between

a firm's short-term assets and its

short-term liabilities. The

goal

of Working capital management is to

ensure that the firm is able

to continue its operations and that

it

has

sufficient cash flow to

satisfy both maturing short-term debt and

upcoming operational expenses.

Decision

Criteria

By

definition, Working capital

management entails short term decisions -

generally, relating to the next

one

year

period - which is "reversible".

These decisions are therefore

not taken on the same basis

as Capital

Investment

Decisions (NPV or related, as

above) rather they will be based on

cash flows and / or

profitability.

� One

measure of cash flow is

provided by the cash conversion cycle -

the net number of days from

the

outlay of cash for raw

material to receiving payment from the

customer. As a management

tool,

this metric

makes explicit the inter-relatedness of

decisions relating to inventories,

accounts

receivable

and payable, and cash.

Because this number effectively

corresponds to the time that the

firm's

cash is tied up in operations and

unavailable for other

activities, management generally

aims

at a

low net count.

� In this

context, the most useful measure of

profitability is Return on capital (ROC).

The result is

shown

as a percentage, determined by dividing relevant

income for the 12 months by

capital

employed;

Return on equity (ROE) shows this result

for the firm's shareholders. Firm

value is

enhanced

when, and if, the return on

capital, which results from

working capital

management,

exceeds

the cost of capital, which

results from capital investment

decisions as above.

ROC

measures

are therefore useful as a management

tool, in that they link short-term

policy with long-

term

decision making.

Management

of Working Capital

Guided

by the above criteria, management will

use a combination of policies

and techniques for

the

management

of working capital. These

policies aim at managing the current

assets (generally cash and

cash

equivalent,

inventories and debtors) and the short

term financing, such that cash

flows and returns

are

acceptable.

� Cash

Management.

Identify the cash balance

which allows for the

business to meet day to

day

expenses,

but reduces cash holding

costs.

� Inventory

Management.

Identify the level of inventory which

allows for

uninterrupted

production

but reduces the investment in raw

materials - and minimizes reordering

costs - and

hence

increases cash flow.

� Debtor's

Management.

Identify the appropriate credit policy,

i.e. credit terms which will

attract

customers,

such that any impact on

cash flows and the cash

conversion cycle will be offset

by

increased

revenue and hence Return on Capital

(or vice versa).

� Short

Term Financing.

Identify the appropriate source of financing, given

the cash conversion

cycle:

the inventory is ideally financed by credit granted by

the supplier; however, it may be

necessary

to utilize a bank loan (or

overdraft), or to "convert debtors to

cash" through

"factoring".

Financial

Risk Management

Risk

Management is the process of measuring

risk and then developing and

implementing strategies to

manage

that risk. Financial risk management

focuses on risks that can be

managed ("hedged") using

traded

87

Corporate

Finance FIN 622

VU

financial

instruments (typically changes in

commodity prices , internet

rates, foreign exchange

rates and

stock

prices). Financial risk management will

also play an important role in

cash management.

This

area is related to corporate finance in

two ways. Firstly, firm

exposure to business risk is a direct

result

of previous

Investment and Financing decisions.

Secondly, both disciplines

share the goal of creating,

or

enhancing,

firm value. All large

corporations have risk management teams,

and small firms

practice

informal,

if not formal, risk

management.

Derivatives

are the instruments most commonly

used in financial risk management.

Because unique

derivative

contracts tend to be costly to

create and monitor, the most

cost-effective financial risk

management

methods usually involve

derivatives that trade on

well-established financial markets.

These

standard

derivative instruments include options,

future contacts, forward

contacts, and swaps.

Working

Capital Policies

� Conservative

Use permanent capital

for permanent assets and

temporary assets.

� Moderate

Match the maturity of the assets

with the maturity of the

financing.

� Aggressive

Use short-term financing to finance

permanent assets.

Let's

view the characteristics of each

policy.

1.

CONSERVATIVE WORKING CAPITAL

POLICY;

high level of investment in current

assets

support any level of sales

and production

high liquidity level

Avoid short-term financing to

reduce risk, but decreases the

potential for maximum

value

creation

because of the high cost of

long-term debt and equity

financing.

Borrowing long-term is considered

less risky than borrowing

short-term.

This approach involves the

use of long-term debt and

equity to finance all long-term

fixed

assets

and permanent assets, in

addition to some part of temporary

current assets.

The firm has a large

amount of net working capital. It is a relatively

low-risk position.

The safety of conservative

approach has a cost.

Long-term financing is generally

more expensive than short-term

financing.

2.

AGGRESSIVE WORKING CAPITAL

POLICY;

Low level of investment

More short-term financing is used

to finance current assets.

Support

low level of production &

sales

Borrowing short-term is considered

more risky than borrowing

long-term.

Firm risk increases, due to the

risk of fluctuating interest rates,

but the potential for

higher

returns

increases because of the generally

low-cost financing.

This

approach involves the use of short-term

debt to finance at least the firm's

temporary

assets,

some or all of its permanent

current assets, and possibly

some of its long-term

fixed

assets.

(Heavy reliance on short term

debt)

The firm has very

little net working capital. It is

more risky.

May be a negative net working

capital. It is very risky

3.

MODERATE WORKING CAPITAL

POLICY

This

approach tries to balance risk

and return concerns.

Temporary current assets that are

only going to be on the balance sheet

for a short time

should be financed

with short-term debt, current liabilities. And,

permanent current assets

and

long-term fixed assets that

are going to be on the balance sheet

for a long time should

be financed

from long-term debt and

equity sources.

The firm has a

moderate amount of net working capital.

It is a relatively amount of risk

balanced

by a relatively moderate amount of expected

return.

In the

real world, each firm

must decide on its balance

of financing sources and

its

approach

to working capital management

based on its particular industry and the

firm's

risk

and return strategy.

88

Corporate

Finance FIN 622

VU

LIQUIDITY

& PROFITABILITY:

�

Lenders prefer a company having a

large excess of current assets

over current liabilities whereas

the

owners

prefer a high return.

� Current

assets have the advantage of being

liquid, but holding them is

not very profitable.

�

Cash account is paid no

interest.

� Accounts

receivable earns no

return.

�

Inventory earns no return

until it is sold.

�

Non-current assets can be

profitable, but they are

usually not very

liquid.

�

Firms are usually

faced with creating

trade-off in their working

capital management

policy.

� They

seek a balance between

liquidity and profitability

that reflects their desire

for profit and

their

need

for liquidity.

OPTIMAL

LEVEL OF CURRENT ASSETS

A

firm's optimal level of current assets is

reached when the optimal level of cash,

inventory, accounts

receivable,

and other current assets is

achieved.

Cash:

firms try to keep just enough

cash on hand to conduct day-to-day business,

while investing extra

amounts

in short-term marketable

securities.

Inventory:

firms seek the level that reduces lost

sales due to lack of

inventory, while at the same

time

holding

down bad debt and

collection expenses through

sound credit policies.

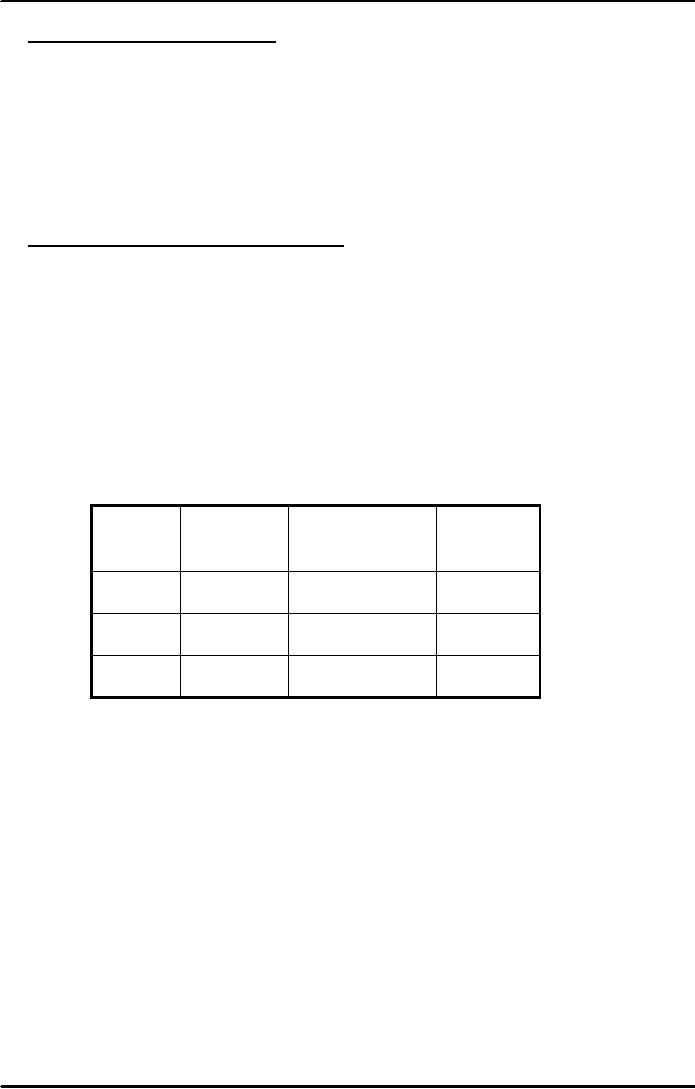

� PROJECTING

THE ALL THREE POLICIES

� CONSERVATIVE

= A

� MODERATE =

B

� AGGRESSIVE

= C

LIQUIDITY

PROFITABILITY

RISK

HIGH

A

C

C

NOR

B

B

B

LOW

C

A

A

The

chart tells us two

things:

- Profitability

varies inversely with

liquidity; increased liquidity

can be achieved at the expense

of

(decreased)

profitability

- Profitability

& risk have same direction; in order

to have greater profitability, we

need to take

greater

risk.

- Conclusion:

optimal

level of each current asset will

depend on the management's

attitude

towards

risk & return.

Risk

and Return of Current

Liabilities

The

goal of the return management

process is to maximize earnings in the

context of an acceptable level of

risk.

Firm's

working capital is financed from

short-term borrowing, long-term

borrowing, equity financing, or

some

mixture of all three.

The

choice of the firm's working

capital financing depends on

manager's desire for profit

versus their

degree

of risk aversion.

The

balance between the risk and

return of financing options

depends on the firm, its financial

managers,

and

its financing

approaches.

89

Table of Contents:

- INTRODUCTION TO SUBJECT

- COMPARISON OF FINANCIAL STATEMENTS

- TIME VALUE OF MONEY

- Discounted Cash Flow, Effective Annual Interest Bond Valuation - introduction

- Features of Bond, Coupon Interest, Face value, Coupon rate, Duration or maturity date

- TERM STRUCTURE OF INTEREST RATES

- COMMON STOCK VALUATION

- Capital Budgeting Definition and Process

- METHODS OF PROJECT EVALUATIONS, Net present value, Weighted Average Cost of Capital

- METHODS OF PROJECT EVALUATIONS 2

- METHODS OF PROJECT EVALUATIONS 3

- ADVANCE EVALUATION METHODS: Sensitivity analysis, Profitability analysis, Break even accounting, Break even - economic

- Economic Break Even, Operating Leverage, Capital Rationing, Hard & Soft Rationing, Single & Multi Period Rationing

- Single period, Multi-period capital rationing, Linear programming

- Risk and Uncertainty, Measuring risk, Variability of return–Historical Return, Variance of return, Standard Deviation

- Portfolio and Diversification, Portfolio and Variance, Risk–Systematic & Unsystematic, Beta – Measure of systematic risk, Aggressive & defensive stocks

- Security Market Line, Capital Asset Pricing Model – CAPM Calculating Over, Under valued stocks

- Cost of Capital & Capital Structure, Components of Capital, Cost of Equity, Estimating g or growth rate, Dividend growth model, Cost of Debt, Bonds, Cost of Preferred Stocks

- Venture Capital, Cost of Debt & Bond, Weighted average cost of debt, Tax and cost of debt, Cost of Loans & Leases, Overall cost of capital – WACC, WACC & Capital Budgeting

- When to use WACC, Pure Play, Capital Structure and Financial Leverage

- Home made leverage, Modigliani & Miller Model, How WACC remains constant, Business & Financial Risk, M & M model with taxes

- Problems associated with high gearing, Bankruptcy costs, Optimal capital structure, Dividend policy

- Dividend and value of firm, Dividend relevance, Residual dividend policy, Financial planning process and control

- Budgeting process, Purpose, functions of budgets, Cash budgets–Preparation & interpretation

- Cash flow statement Direct method Indirect method, Working capital management, Cash and operating cycle

- Working capital management, Risk, Profitability and Liquidity - Working capital policies, Conservative, Aggressive, Moderate

- Classification of working capital, Current Assets Financing – Hedging approach, Short term Vs long term financing

- Overtrading – Indications & remedies, Cash management, Motives for Cash holding, Cash flow problems and remedies, Investing surplus cash

- Miller-Orr Model of cash management, Inventory management, Inventory costs, Economic order quantity, Reorder level, Discounts and EOQ

- Inventory cost – Stock out cost, Economic Order Point, Just in time (JIT), Debtors Management, Credit Control Policy

- Cash discounts, Cost of discount, Shortening average collection period, Credit instrument, Analyzing credit policy, Revenue effect, Cost effect, Cost of debt o Probability of default

- Effects of discounts–Not effecting volume, Extension of credit, Factoring, Management of creditors, Mergers & Acquisitions

- Synergies, Types of mergers, Why mergers fail, Merger process, Acquisition consideration

- Acquisition Consideration, Valuation of shares

- Assets Based Share Valuations, Hybrid Valuation methods, Procedure for public, private takeover

- Corporate Restructuring, Divestment, Purpose of divestment, Buyouts, Types of buyouts, Financial distress

- Sources of financial distress, Effects of financial distress, Reorganization

- Currency Risks, Transaction exposure, Translation exposure, Economic exposure

- Future payment situation – hedging, Currency futures – features, CF – future payment in FCY

- CF–future receipt in FCY, Forward contract vs. currency futures, Interest rate risk, Hedging against interest rate, Forward rate agreements, Decision rule

- Interest rate future, Prices in futures, Hedging–short term interest rate (STIR), Scenario–Borrowing in ST and risk of rising interest, Scenario–deposit and risk of lowering interest rates on deposits, Options and Swaps, Features of opti

- FOREIGN EXCHANGE MARKET’S OPTIONS

- Calculating financial benefit–Interest rate Option, Interest rate caps and floor, Swaps, Interest rate swaps, Currency swaps

- Exchange rate determination, Purchasing power parity theory, PPP model, International fisher effect, Exchange rate system, Fixed, Floating

- FOREIGN INVESTMENT: Motives, International operations, Export, Branch, Subsidiary, Joint venture, Licensing agreements, Political risk