|

Corporate

Finance FIN 622

VU

Lesson

25

CASH

FLOW STATEMENT & WORKING

CAPITAL MANAGEMENT

The

following topics will be

discussed in this lecture.

Cash

flow statement

Direct

method

Indirect

method

Working

capital management

Cash

and operating cycle

Cash

Flow Statement

The

cash flow statement analyses

changes in cash and cash

equivalents during a period.

Cash and cash

equivalents

comprise cash on hand and

demand deposits, together with

short-term, highly liquid

investments

that are readily convertible to a

known amount of cash, and

that are subject to an

insignificant

risk of

changes in value. Guidance notes indicate

that an investment normally meets the

definition of a cash

equivalent

when it has a maturity of

three months or less from the

date of acquisition. Equity

investments

are

normally excluded, unless they

are in substance a cash equivalent

(e.g. preferred shares acquired

within

three

months of their specified redemption

date). Bank overdrafts which are

repayable on demand

and

which

form an integral part of an enterprise's

cash management are also

included as a component of cash

and

cash equivalents. [IAS

7.7-8]

Presentation

of the Cash Flow

Statement:

Cash

flows must be analyzed

between operating, investing and

financing activities. [IAS

7.10]

Key

principles specified by IAS 7 for the

preparation of a cash flow statement

are as follows:

� Operating

Activities are

the main revenue-producing activities of the

enterprise that are

not

investing or

financing activities, so operating cash

flows include cash received

from customers and

cash

paid to suppliers and employees

[IAS 7.14]

� Investing

Activities are

the acquisition and disposal of long-term

assets and other

investments

that

are not considered to be

cash equivalents [IAS

7.6]

� Financing

Activities are

activities that alter the equity capital

and borrowing structure of

the

enterprise

[IAS 7.6]

� interest

and dividends received and paid

may be classified as operating, investing, or

financing cash

flows,

provided that they are

classified consistently from

period to period [IAS

7.31]

� cash

flows arising from taxes on

income are normally

classified as operating, unless they can

be

specifically

identified with financing or investing

activities [IAS 7.35]

� for

operating cash flows, the direct method of

presentation is encouraged, but the

indirect method

is

acceptable [IAS 7.18]

The

direct

method shows

each major class of gross

cash receipts and gross

cash payments. The

operating

cash flows section of the

cash flow statement under the direct

method would appear

something

like this:

Cash

receipts from

customers

xx,xxx

Cash

paid to suppliers

xx,xxx

Cash

paid to employees

xx,xxx

Cash

paid for other operating

expenses

xx,xxx

Interest

paid

xx,xxx

Income

taxes paid

xx,xxx

Net

cash from operating

activities

xx,xxx

The

indirect

method adjusts

accrual basis net profit or

loss for the effects of

non-cash

transactions.

The operating cash flows

section of the cash flow

statement under the indirect

method

would appear something like

this:

Profit

before interest and income

taxes

xx,xxx

Add

back depreciation

xx,xxx

Add

back amortization of goodwill

xx,xxx

83

Corporate

Finance FIN 622

VU

Increase

in receivables

xx,xxx

Decrease

in inventories

xx,xxx

Increase

in trade payables

xx,xxx

Interest

expense

xx,xxx

Less

Interest accrued but not

yet paid

xx,xxx

Interest

paid

xx,xxx

Income

taxes paid

xx,xxx

Net

cash from operating

activities

xx,xxx

�

Cash

flows relating to extraordinary items should be

classified as operating, investing or

financing

as appropriate

and should be separately disclosed

[IAS 7.29]

� The

exchange rate used for

translation of transactions denominated in a foreign

currency and the

cash

flows of a foreign subsidiary should be

the rate in effect at the date of the

cash flows [IAS

7.25]

� Cash

flows of foreign subsidiaries should be

translated at the exchange rates

prevailing when the

cash

flows took place [IAS

7.26]

� As

regards the cash flows of

associates and joint

ventures, where the equity method is

used, the

cash

flow statement should report

only cash flows between the

investor and the investee;

where

proportionate

consolidation is used, the cash flow

statement should include the venturer's

share of

the

cash flows of the investee

[IAS 7.37-38]

� Aggregate

cash flows relating to acquisitions

and disposals of subsidiaries

and other business

units

should be

presented separately and

classified as investing activities, with

specified additional

disclosures.

The aggregate cash paid or

received as consideration should be reported net of

cash

and

cash equivalents acquired or

disposed of [IAS

7.39]

� Cash

flows from investing and

financing activities should be reported gross by major

class of cash

receipts

and major class of cash

payments except for the

following cases, which may

be reported on

a net

basis: [IAS 7.22-24]

cash

receipts and payments on behalf of

customers (for example,

receipt and repayment

of

demand deposits by banks,

and receipts collected on behalf of

and paid over to the

owner of a

property)

cash

receipts and payments for

items in which the turnover is quick, the

amounts are

large,

and the maturities are short,

generally less than three

months (for example,

charges

and

collections from credit card customers,

and purchase and sale of

investments)

cash

receipts and payments relating to

fixed maturity

deposits

cash

advances and loans made to

customers and repayments

thereof

� investing

and financing transactions

which do not require the use of

cash should be excluded

from

the

cash flow statement, but

they should be separately disclosed

elsewhere in the financial

statements

[IAS 7.43]

� the

components of cash and cash

equivalents should be disclosed, and a

reconciliation presented to

amounts

reported in the balance sheet [IAS

7.45]

� the amount of

cash and cash equivalents

held by the enterprise that is

not available for use by

the

group

should be disclosed, together with a

commentary by management [IAS

7.48]

Defining

Working Capital

The

term working capital refers to the amount

of capital which is readily available to an

organization. That

is,

working capital is the difference between

resources in cash or readily convertible

into cash (Current

Assets)

and organizational commitments for

which cash will soon be

required (Current Liabilities).

Current

Assets are resources which

are in cash or will soon be

converted into cash in "the

ordinary course

of

business".

Current

Liabilities are commitments

which will soon require cash

settlement in "the ordinary

course of

business".

Thus:

WORKING

CAPITAL = CURRENT ASSETS - CURRENT

LIABILITIES

In a

department's Statement of Financial Position,

these components of working

capital are reported under

the

following headings:

84

Corporate

Finance FIN 622

VU

Current

Assets

� Liquid

Assets (cash and bank

deposits)

� Inventory

� Debtors

and Receivables

Current

Liabilities

� Bank

Overdraft

� Creditors

and Payables

� Other

Short Term Liabilities

The

Importance of Good Working

Capital Management

Working

capital constitutes part of the

Crown's investment in a department.

Associated with this is an

opportunity

cost to the Crown. (Money invested in

one area may "cost"

opportunities for investment in

other

areas.) If a department is operating with

more working capital than is

necessary, this over-investment

represents

an unnecessary cost to the Crown.

From a

department's point of view, excess

working capital means operating

inefficiencies. In addition,

unnecessary

working capital increases the amount of

the capital charge which

departments are required to

meet

from 1 July 1991.

Approaches

to Working Capital

Management

The

objective of working capital management

is to maintain the optimum balance of

each of the working

capital

components. This includes making

sure that funds are held as

cash in bank deposits for as

long as

and in

the largest amounts possible, thereby

maximizing the interest earned. However,

such cash may

more

appropriately be

"invested" in other assets or in

reducing other liabilities.

Working

capital management takes

place on two levels:

� Ratio

analysis can be used to

monitor overall trends in

working capital and to

identify areas

requiring

closer management (see

Chapter Three).

� The

individual components of working

capital can be effectively

managed by using

various

techniques

and strategies (see Chapter

Four).

When

considering these techniques

and strategies, departments

need to recognize that each

department has

a unique

mix of working capital

components. The emphasis

that needs to be placed on

each component

varies

according to department. For example,

some departments have significant

inventory levels;

others

have

little if any

inventory.

Furthermore,

working capital management is

not an end in itself. It is an integral

part of the department's

overall

management. The needs of

efficient working capital

management must be considered in

relation to

other

aspects of the department's financial and

non-financial performance.

Cash

Operating Cycle

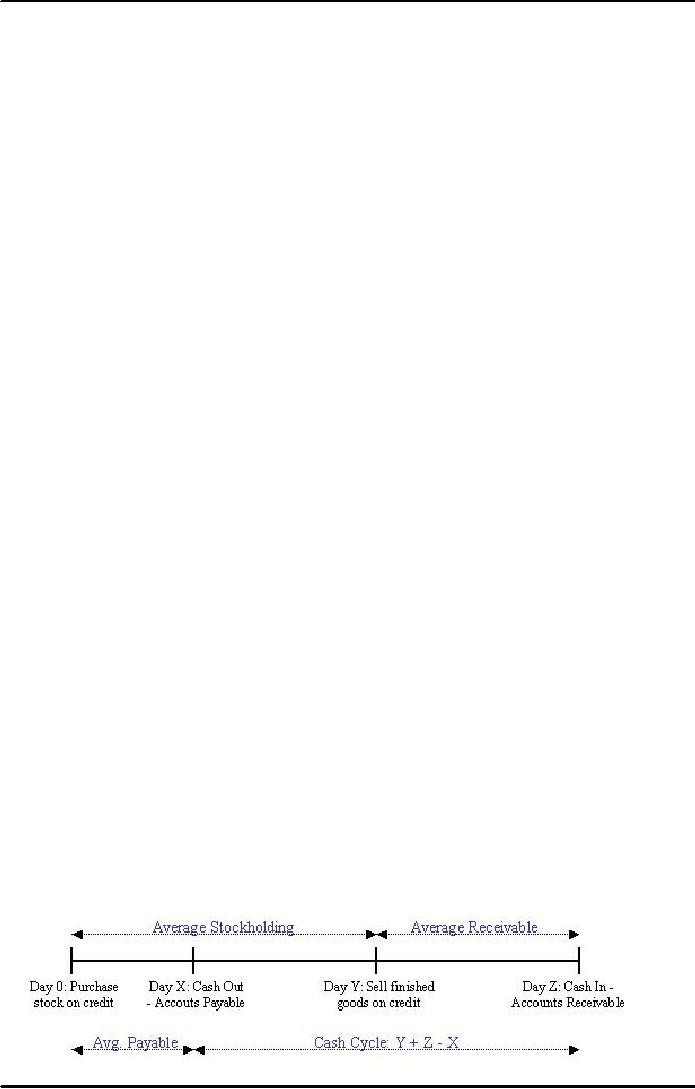

Cash

Conversion Cycle, also

known as the asset conversion cycle, net

operating cycle, working

capital

cycle

or just cash cycle, is used

in the financial analysis of a business.

The higher the number, the longer a

firm's

money is tied up in business operations

and unavailable for other

activities such as investing.

The

cash

conversion cycle is the number of days

between paying for raw

materials and receiving cash

from

selling

goods made from that

raw material.

� Cash

Conversion Cycle = Average Stockholding

Period (in days) + Average

Receivables Processing

Period

(in days) - Average Payables

Processing Period (in

days)

with:

� Average

Stockholding Period (in days) =

Closing Stock / Average

Daily Purchases

� Average

Receivables Processing Period (in

days) = Accounts Receivable / Average

Daily Credit

Sales

� Average

Payable Processing Period (in

days) = Accounts Payable / Average

Daily Credit

Purchases

85

Corporate

Finance FIN 622

VU

A short

cash conversion cycle indicates

good working capital

management. Conversely, a long

cash

conversion

cycle suggests that capital

is tied up while the business

waits for customers to

pay.

It is

possible for a business to

have a negative cash conversion

cycle, i.e. receiving customer

payments

before having to

pay suppliers. Examples are

typically companies that employ

Just in Time practices such

as

Dell,

and companies that buy on

extended credit terms and

sell for cash, such as

Tesco.

The

longer the production process, the more

cash the firm must keep

tied up in inventories. Similarly, the

longer it

takes customers to pay their

bills, the higher the value of accounts

receivable. On the other hand,

if

a firm

can delay paying for its

own materials, it may reduce

the amount of cash it needs. In other

words,

accounts

payable reduce net working

capital.

86

Table of Contents:

- INTRODUCTION TO SUBJECT

- COMPARISON OF FINANCIAL STATEMENTS

- TIME VALUE OF MONEY

- Discounted Cash Flow, Effective Annual Interest Bond Valuation - introduction

- Features of Bond, Coupon Interest, Face value, Coupon rate, Duration or maturity date

- TERM STRUCTURE OF INTEREST RATES

- COMMON STOCK VALUATION

- Capital Budgeting Definition and Process

- METHODS OF PROJECT EVALUATIONS, Net present value, Weighted Average Cost of Capital

- METHODS OF PROJECT EVALUATIONS 2

- METHODS OF PROJECT EVALUATIONS 3

- ADVANCE EVALUATION METHODS: Sensitivity analysis, Profitability analysis, Break even accounting, Break even - economic

- Economic Break Even, Operating Leverage, Capital Rationing, Hard & Soft Rationing, Single & Multi Period Rationing

- Single period, Multi-period capital rationing, Linear programming

- Risk and Uncertainty, Measuring risk, Variability of return–Historical Return, Variance of return, Standard Deviation

- Portfolio and Diversification, Portfolio and Variance, Risk–Systematic & Unsystematic, Beta – Measure of systematic risk, Aggressive & defensive stocks

- Security Market Line, Capital Asset Pricing Model – CAPM Calculating Over, Under valued stocks

- Cost of Capital & Capital Structure, Components of Capital, Cost of Equity, Estimating g or growth rate, Dividend growth model, Cost of Debt, Bonds, Cost of Preferred Stocks

- Venture Capital, Cost of Debt & Bond, Weighted average cost of debt, Tax and cost of debt, Cost of Loans & Leases, Overall cost of capital – WACC, WACC & Capital Budgeting

- When to use WACC, Pure Play, Capital Structure and Financial Leverage

- Home made leverage, Modigliani & Miller Model, How WACC remains constant, Business & Financial Risk, M & M model with taxes

- Problems associated with high gearing, Bankruptcy costs, Optimal capital structure, Dividend policy

- Dividend and value of firm, Dividend relevance, Residual dividend policy, Financial planning process and control

- Budgeting process, Purpose, functions of budgets, Cash budgets–Preparation & interpretation

- Cash flow statement Direct method Indirect method, Working capital management, Cash and operating cycle

- Working capital management, Risk, Profitability and Liquidity - Working capital policies, Conservative, Aggressive, Moderate

- Classification of working capital, Current Assets Financing – Hedging approach, Short term Vs long term financing

- Overtrading – Indications & remedies, Cash management, Motives for Cash holding, Cash flow problems and remedies, Investing surplus cash

- Miller-Orr Model of cash management, Inventory management, Inventory costs, Economic order quantity, Reorder level, Discounts and EOQ

- Inventory cost – Stock out cost, Economic Order Point, Just in time (JIT), Debtors Management, Credit Control Policy

- Cash discounts, Cost of discount, Shortening average collection period, Credit instrument, Analyzing credit policy, Revenue effect, Cost effect, Cost of debt o Probability of default

- Effects of discounts–Not effecting volume, Extension of credit, Factoring, Management of creditors, Mergers & Acquisitions

- Synergies, Types of mergers, Why mergers fail, Merger process, Acquisition consideration

- Acquisition Consideration, Valuation of shares

- Assets Based Share Valuations, Hybrid Valuation methods, Procedure for public, private takeover

- Corporate Restructuring, Divestment, Purpose of divestment, Buyouts, Types of buyouts, Financial distress

- Sources of financial distress, Effects of financial distress, Reorganization

- Currency Risks, Transaction exposure, Translation exposure, Economic exposure

- Future payment situation – hedging, Currency futures – features, CF – future payment in FCY

- CF–future receipt in FCY, Forward contract vs. currency futures, Interest rate risk, Hedging against interest rate, Forward rate agreements, Decision rule

- Interest rate future, Prices in futures, Hedging–short term interest rate (STIR), Scenario–Borrowing in ST and risk of rising interest, Scenario–deposit and risk of lowering interest rates on deposits, Options and Swaps, Features of opti

- FOREIGN EXCHANGE MARKET’S OPTIONS

- Calculating financial benefit–Interest rate Option, Interest rate caps and floor, Swaps, Interest rate swaps, Currency swaps

- Exchange rate determination, Purchasing power parity theory, PPP model, International fisher effect, Exchange rate system, Fixed, Floating

- FOREIGN INVESTMENT: Motives, International operations, Export, Branch, Subsidiary, Joint venture, Licensing agreements, Political risk