|

Corporate

Finance FIN 622

VU

Lesson

20

CAPITAL

STRUCTURE AND FINANCIAL

LEVERAGE

In this hand

out we shall cover the

following topics:

When

to use WACC?

Pure

Play

Capital

Structure and Financial

Leverage

WHEN TO

USE WACC:

As we

have covered in our lecture

that using WACC as discount

rate for discounting the cash

flow of

intended project,

is only feasible if the proposed

project fall within the firms existing

activities circle. For

example

if a Oil manufacturing concern plans to

establish another production facility

then the existing

WACC

of the firm can be used as discount

rate. However, if the same

firm is thinking to set up a

new

spinning

unit, then using existing

WACC would be fatal and

inappropriate.

WACC

of a company reflects the level of risk

and WACC is only appropriate discount

rate if the intended

investment is

replica of company's existing activities having

same level of risk.

Using

WACC as discount rate when the

intended project has

different risk level as of company then

it will

lead

to incorrect rejections and/or incorrect

acceptance.

For

example, a company having two

strategic units and one unit

having lower risk than the other,

using

WACC

to allocate resource will

end up putting lower funds to

high risk and larger funds to

low risk

division.

The

other side of this issue

emerges from the situation when a

firm is having more than one

line of

business.

For example a firm has

two divisions: one of these

has relatively low risk and the

other has high

risk.

In this

case, the firm's overall

WACC would be the sum of two

different costs of capital,

which is one for

each

business division. If two of

these are contenders for the

resources, the riskier division would

tend to

have

greater returns so it would be having the

major chunk. The other one

might have huge profit

potential

ends

up with insufficient resources

allocated.

Pure

Play

Using

WACC blindly can lead to

severe problems for a firm.

Because we cannot observe the returns

of

these

investment, there generally is no direct

way of coming up with the

beta. The approach must be

to find

a

project or another firm in the industry in

which our proposed project

falls. We can use the beta

of that

firm

along with the D/E ration prevalent in

that industry.

Once

we have the beta and D/E of the

firm or industry that resembles to

our project we can estimate

the

exact

beta and D/E of proposed project.

For example, if the industry (in

which our intended project

will

fall)

has a beta of 1.7 and D/E

ratio of 40:60, and we

intend to finance the new project

through equity only,

we can

calculate the exact beta of intended

project which, in turn will be

used to calculate the new

project

WACC

or discount rate to evaluate the project

cash flow. This process

may involve un-gearing and

re-

gearing.

Gbeta

x (E / E + D(1-t))

Formula

to un-gear equity Beta

=

Gbeta

= Geared beta (1.7 in our

example)

E

=

Weight of equity in capital

structure

D

=

Weight of debt in capital

structure

T

=

Tax rate

In this

example we need to un-gear the

beta. Why? Note that the

beta of the industry in which the

proposed

project

falls has D/E ratio of 40:60

but the new project shall be

all equity financed. We un-gear the

beta

that

means the financial risk element needs to

be removed from the geared beta of

1.7.

If we

plug in values in the above equation we

get the value of un-geared

beta of 1.3296, which is

also

WACC

as there is no debt. This should be used

as discount rate to evaluate future

cash flow of proposed

project.

66

Corporate

Finance FIN 622

VU

Pure

play refers to what has been

described above. We need to

gauge the systematic risk of the new

project

in

order to calculate the beta

and WACC to be used for

discounting cash flow.

Capital

Structure & Financial

Leverage:

FOR

the most part, a firm may

choose any capital

structure. Capital structure refers to

the combination of

financing

through equity and loans or debt. If

management might decided to

issue new shares and

pay off

bond

debt in order to reduce the

debt-equity ratio. Activities

like this are known as

capital restructuring.

This

is in fact a change of investment source

leaving the firm's assets

unchanged.

In the

last 4/5 lectures we

discussed the concept of WACC. It is simply the

firm's overall cost of

capital and

comprised

of weighted average of the costs of

various components of firm's

capital structure. Now

the

question

arises that what happens to

cost of capital when we change the

relative weights of debt or

equity?

The

value of firm is maximized

when WACC is at its lowest

level. As you know that WACC

is the discount

rate

appropriate to evaluate the cash flow,

the lower the discount rate the higher the

present value of cash

flow.

In other words, present

value and discount rate move in opposite

direction, lower WACC will

ensure

maximizing the

cash flow of the

firm.

Thus,

a firm must choose the

capital structure so that the

WACC is minimized. A capital structure

that

minimizes

the WACC would be better than the

other one which with higher

WACC.

Financial

Leverage

The

amount of debt in capital structure of a

firm is known as financial leverage. In

other words, how a

firm

utilizes

the amount of debt. The more debt in

capital structure, there is

greater financial leverage.

Financial

leverage magnifies the payoffs to

shareholders. It means that it

increases the profit and

loss with

more

percentage than a percentage

change in sales. It may be

possible that financial

leverage does not

affect

the

cost of capital. It is true then

firm capital structure

becomes irrelevant.

For

example, a firm is all

equity financed. Total

assets are Rs. 6.0

million which are finance by

200,000

shares

of Rs. 20 each. It is assumed

that EBIT (Earning before

Interest & Tax) is Rs. 800,000 in

first year

and

Rs. 1.20 million in second

year. In this case, EPS

(Earning per share) will be

Rs. 2.67 & Rs.4 per

share

respectively

in first and second year.

The ROE (Return on Equity) is

13.33% and 20% respectively

for year

1 &

2.

Now

consider that the firm

decides to employ debt in it capital

structure. The asset side

will remain

constant

at Rs. 6.0 million. In the

proposed restructuring the D/E ratio of 1 is applied.

It means that Rs. 3

million

will be invested from equity

and Rs. 3 million of debt is

employed. Interest rate is

assumed at 10%.

Assuming

the same level of EBIT in both

years, the EPS is now Rs.

3.33 and Rs.6 and

ROE has jumped to

16.67%

and 30% in first and second

year respectively.

This

magic is played by the financial

leverage. It has increased

both EPS AND ROE after debt

was mixed

up in the

capital structure.

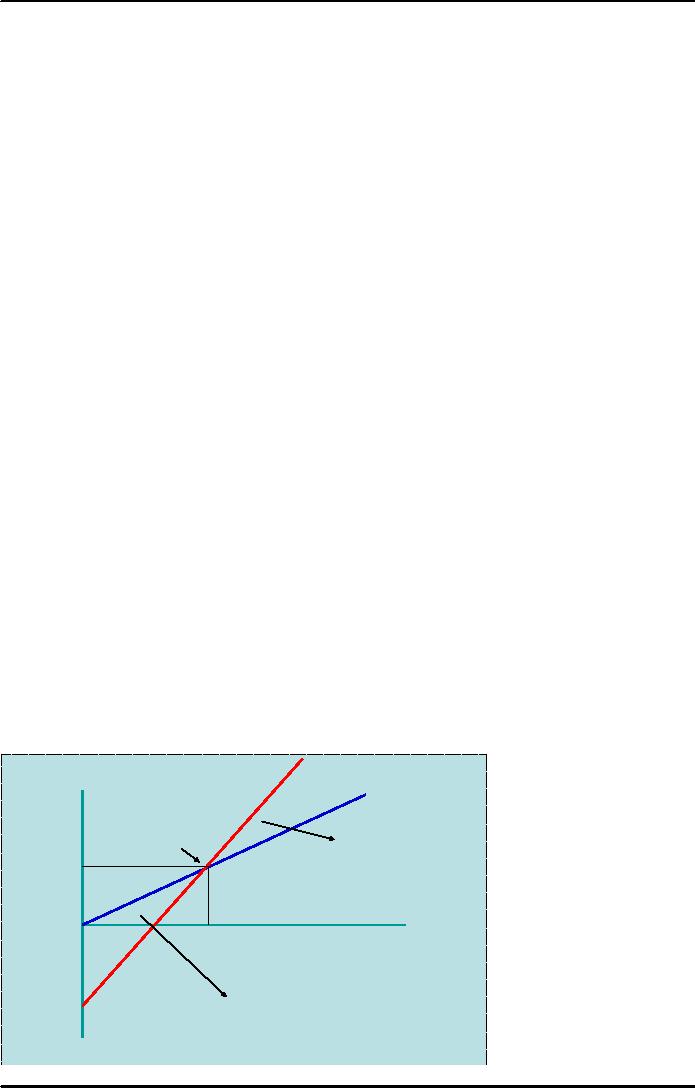

Y

DEBT

EPS

NO

DEBT

BE

+ FIN

LEVERAGE

2

X

300000

600,000

EBIT

-2

-IVE FIN

LEVERAGE

67

Corporate

Finance FIN 622

VU

Financial

leverage can also increase

the losses as well. Looking at the graph

above, if the EBIT is

not

enough

then it magnifies the losses. At

EBIT of Rs. 600,000 the EPS

is Rs. 2/-. If the EBIT is

less than

point

BE it represents the negative impact of

debt. If the EBIT is falling right to the

BE point it increase

the

return, the positive financial

leverage.

68

Table of Contents:

- INTRODUCTION TO SUBJECT

- COMPARISON OF FINANCIAL STATEMENTS

- TIME VALUE OF MONEY

- Discounted Cash Flow, Effective Annual Interest Bond Valuation - introduction

- Features of Bond, Coupon Interest, Face value, Coupon rate, Duration or maturity date

- TERM STRUCTURE OF INTEREST RATES

- COMMON STOCK VALUATION

- Capital Budgeting Definition and Process

- METHODS OF PROJECT EVALUATIONS, Net present value, Weighted Average Cost of Capital

- METHODS OF PROJECT EVALUATIONS 2

- METHODS OF PROJECT EVALUATIONS 3

- ADVANCE EVALUATION METHODS: Sensitivity analysis, Profitability analysis, Break even accounting, Break even - economic

- Economic Break Even, Operating Leverage, Capital Rationing, Hard & Soft Rationing, Single & Multi Period Rationing

- Single period, Multi-period capital rationing, Linear programming

- Risk and Uncertainty, Measuring risk, Variability of return–Historical Return, Variance of return, Standard Deviation

- Portfolio and Diversification, Portfolio and Variance, Risk–Systematic & Unsystematic, Beta – Measure of systematic risk, Aggressive & defensive stocks

- Security Market Line, Capital Asset Pricing Model – CAPM Calculating Over, Under valued stocks

- Cost of Capital & Capital Structure, Components of Capital, Cost of Equity, Estimating g or growth rate, Dividend growth model, Cost of Debt, Bonds, Cost of Preferred Stocks

- Venture Capital, Cost of Debt & Bond, Weighted average cost of debt, Tax and cost of debt, Cost of Loans & Leases, Overall cost of capital – WACC, WACC & Capital Budgeting

- When to use WACC, Pure Play, Capital Structure and Financial Leverage

- Home made leverage, Modigliani & Miller Model, How WACC remains constant, Business & Financial Risk, M & M model with taxes

- Problems associated with high gearing, Bankruptcy costs, Optimal capital structure, Dividend policy

- Dividend and value of firm, Dividend relevance, Residual dividend policy, Financial planning process and control

- Budgeting process, Purpose, functions of budgets, Cash budgets–Preparation & interpretation

- Cash flow statement Direct method Indirect method, Working capital management, Cash and operating cycle

- Working capital management, Risk, Profitability and Liquidity - Working capital policies, Conservative, Aggressive, Moderate

- Classification of working capital, Current Assets Financing – Hedging approach, Short term Vs long term financing

- Overtrading – Indications & remedies, Cash management, Motives for Cash holding, Cash flow problems and remedies, Investing surplus cash

- Miller-Orr Model of cash management, Inventory management, Inventory costs, Economic order quantity, Reorder level, Discounts and EOQ

- Inventory cost – Stock out cost, Economic Order Point, Just in time (JIT), Debtors Management, Credit Control Policy

- Cash discounts, Cost of discount, Shortening average collection period, Credit instrument, Analyzing credit policy, Revenue effect, Cost effect, Cost of debt o Probability of default

- Effects of discounts–Not effecting volume, Extension of credit, Factoring, Management of creditors, Mergers & Acquisitions

- Synergies, Types of mergers, Why mergers fail, Merger process, Acquisition consideration

- Acquisition Consideration, Valuation of shares

- Assets Based Share Valuations, Hybrid Valuation methods, Procedure for public, private takeover

- Corporate Restructuring, Divestment, Purpose of divestment, Buyouts, Types of buyouts, Financial distress

- Sources of financial distress, Effects of financial distress, Reorganization

- Currency Risks, Transaction exposure, Translation exposure, Economic exposure

- Future payment situation – hedging, Currency futures – features, CF – future payment in FCY

- CF–future receipt in FCY, Forward contract vs. currency futures, Interest rate risk, Hedging against interest rate, Forward rate agreements, Decision rule

- Interest rate future, Prices in futures, Hedging–short term interest rate (STIR), Scenario–Borrowing in ST and risk of rising interest, Scenario–deposit and risk of lowering interest rates on deposits, Options and Swaps, Features of opti

- FOREIGN EXCHANGE MARKET’S OPTIONS

- Calculating financial benefit–Interest rate Option, Interest rate caps and floor, Swaps, Interest rate swaps, Currency swaps

- Exchange rate determination, Purchasing power parity theory, PPP model, International fisher effect, Exchange rate system, Fixed, Floating

- FOREIGN INVESTMENT: Motives, International operations, Export, Branch, Subsidiary, Joint venture, Licensing agreements, Political risk