|

Corporate

Finance FIN 622

VU

Lesson

15

RISK

AND RETURNS

The

following topics will be

discussed in this lecture.

Risk

and Uncertainty

Measuring

risk

Variability

of return Historical Return

Variance

of return

Standard

Deviation

RISK

AND UNCERTAINTY:

If you

buy an asset or any stock or

share, the gains or losses

you get on this investment are

called return on

investment. This

return has normally two

components. First, it is the income part

that you may receive

in

terms

of dividend (owning a share)

and second part comes

from the capital appreciation or increase

in the

market

value of that share.

The

above discussion suggests

that the reward of return

you get is the due to

bearing the risk. Risk

refers to

the

variability of returns. You

may get dividend on a share

say 2% or 15%, or even

you may not

get

anything

from the issuing firm. Look

at this simple example: the expected

returns (income part only)

can

vary

from 0 to 15%. This is

called risk. However, you can

use probabilities to determine

your return. For

instance,

if the economy remains in boom,

which has 60% chances, then

our return will be 8%. So

attaching

probability

we can to some extent, determine the

return under risk conditions.

The

other important thing to

remember is that greater the risk,

larger the profit.

Uncertainty,

refers to a situation where

our ability to attach a

probability to an outcome is

ceased.

From

hereafter, we shall discuss the

ways and means to measure

the risk.

HISTORICAL

RETURN ANALYSIS:

The

problem with most financial

planning is they accept a return

rate on each of your

investments and

project

your financial future on those

rates. The argument is over

a span of years your

investments will

return

that rate "on average."

Unfortunately this is an invalid and

risky assumption. Investment rates

vary

from

year to year. Sometimes they vary

greatly. We cannot accurately predict the

return rate on

investments

or the

inflation rate. Consider the

following simple

example

You

have $1000.00 invested and

you expect a 10.0% average

yearly return on your investment. In

two years

your

investment will be worth

$1210.00.

Now

lets assume your same

$1000.00 returns -10.00% the

first year and +30.00% the

second. Your

investments

after those two years are

worth only $1170.00 even

though your investment returned

"on

average"

10.0%.

The

above example demonstrates the

need for a mechanism to

account for the volatility of

investment

return

rates and the variability of

inflation. The J&L Financial Planner

has chosen to include

two

alternatives,

a Monte Carlo Analysis and a

Historical Return Analysis, as that

mechanism.

J&L

Financial Planner's Historical

Return Analysis

The

following paragraphs outline

how the Historical Return Analysis is

implemented by the J&L Financial

Planner.

The

J&L Financial Planner allows you to

create simple or complex financial

scenarios (financial plans)

revolving

around your existing accounts consisting

of investment, retirement, asset, and equity

accounts.

The

planner allows you to create

and assign up to 10 asset allocation

classes for each of your

accounts. A

simple

example would have you

create three asset allocation

classes Stocks, Bonds, and

Cash. You would

assign

each account the percentage of

each of its allocation classes. A mutual

fund account may consist

of

70

percent Stocks and 30

percent Bonds, whereas a

savings account would be 100

percent Cash. For

each

allocation

class you assign a historical

return data file

representing the returns for

that class over an

historical time

span. The planner comes with

6 example data files including 2

stock files, 2 bond files, 1

cash

file,

and an inflation file covering the

years 1928 through 2003.

The files are provided as

examples and

should be

replaced with data files

which meet your needs.

You can create and

edit up to 10 files,

each

corresponding to an

asset allocation class.

The

planner gives you two

options with the Historical Return

Analysis.

The

first allows you to execute

your financial plan over the historical

time span. This generates your

net

worth

for each year of your plan

based on the returns of the historical

data starting with the first

year of the

47

Corporate

Finance FIN 622

VU

data.

In the provided files this would generate

a net worth (a line graph) starting

with the returns from

1928.

Next

it would generate a net

worth starting with the returns

from 1929. It would do this

for each year of

your

financial plan.

The

second allows you to randomly

select return data from the

historical data files and use

that data to

calculate

your net worth over the span

of your financial plan. It also gives

you the option of selecting

the

number of

sequential years the program will

use. In other words, if you

select 10 years of sequential

data,

the program

randomly selects the first year

and then uses the data

from the files for the following 9

years

before randomly

selecting another year. For

example if you choose the number of

sequential years as 1

and

select

1000 trials it will randomly select

return data from the historical

data files for each year of

your plan

and

execute your plan 1000

times. This has the effect of a

Monte Carlo analysis with the random

data being

randomly

selected from real historical

return data.

Summary

In

summary, the Historical Return Analysis

is able to estimate the probability of

achieving the success of

your

scenario by accounting for the

yearly variability in the two

main factors contributing to

its outcome,

the

return rate on your

investments and the inflation

rate. You can execute up to

a thousand trials of your

scenario.

Each trial is a fully independent

execution of your financial plan, where

each year the return

rate

on

your investments and the

inflation rate can take on a

range of values based on historical

asset class return

data.

The

large number of trials allows the

analysis to compute the statistical

probability your financial plan

will

be

successful. For example, if after

1000 trials, 750 of those

trials achieved your financial goals,

your

financial plan

success rate is

75.0%.

If

your financial plan success rate is

below your expectations the J&L

Financial Planner allows you to

make

easy

scenario changes to play "what-if"

with your financial

future.

VARIANCE

OF RETURN:

The

variance essentially measures the

average squared difference between the

actual returns and the

average

return.

The bigger this number is, the

more the actual returns tend

to differ from the average

return. Also,

the

larger the variance is the ore

spread out the returns will

be.

It is

pertinent to note here that

calculating variance and

standard deviation will be

different for historical

and

projected returns.

This

is usually very close to the correlation

squared. To understand what variance

explained means, think of

a

manager and a Style

Benchmark. Any variance in the difference

between manager and Style

Benchmark,

i.e.,

any variance in the excess

return of manager over

benchmark, represents a failure of the

Style

Benchmark

variance to explain the manager variance.

Hence, the quotient of variance of

excess return over

variance

of manager represents the unexplained

variance. The variance explained is 1

minus the unexplained

variance:

Variance

Explained = 1 - Var (e) /

Var (M)

Where:

Var

(M) = variance of manager

returns

Var

(e) = variance of excess

return of manager over

benchmark

STANDARD

DEVIATION:

Were

this set a sample drawn from a

larger population of children, and the

question at hand was the

standard

deviation of the population, convention

would replace the N (or 4)

here with N-1 (or

3).

The

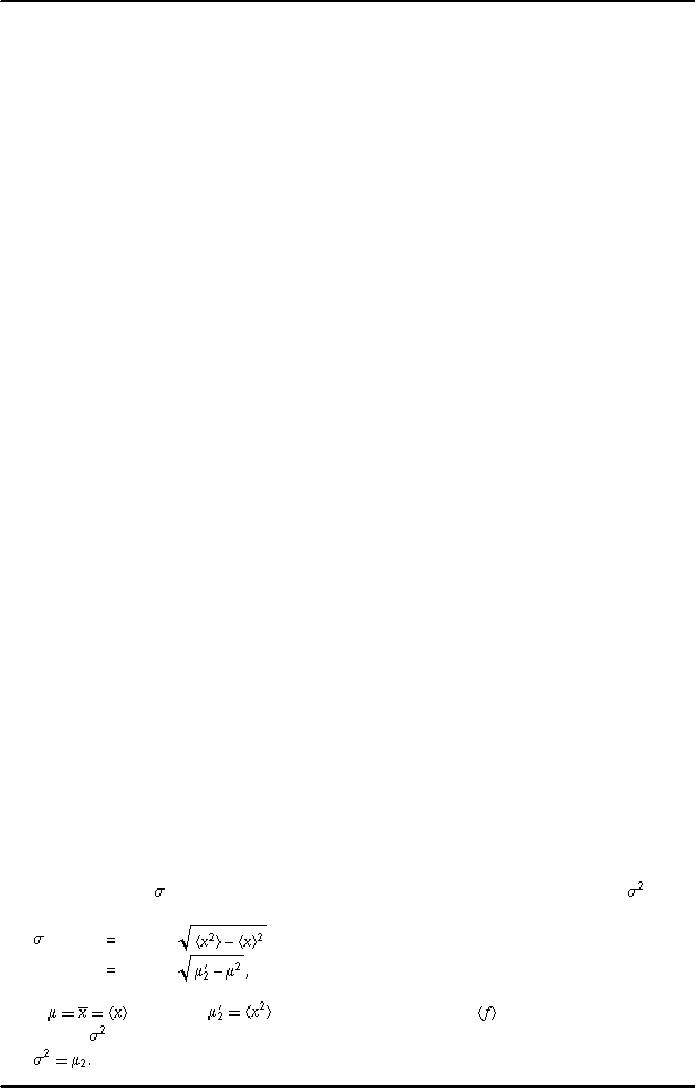

standard deviation of a probability

distribution is defined as the square

root of the variance ,

(1)

(2)

Where

is the

mean,

is the

second raw moment, and

denotes an expectation

value.

is therefore

equal to the second central moment

(i.e., moment about the mean),

The

variance

(3)

48

Corporate

Finance FIN 622

VU

The

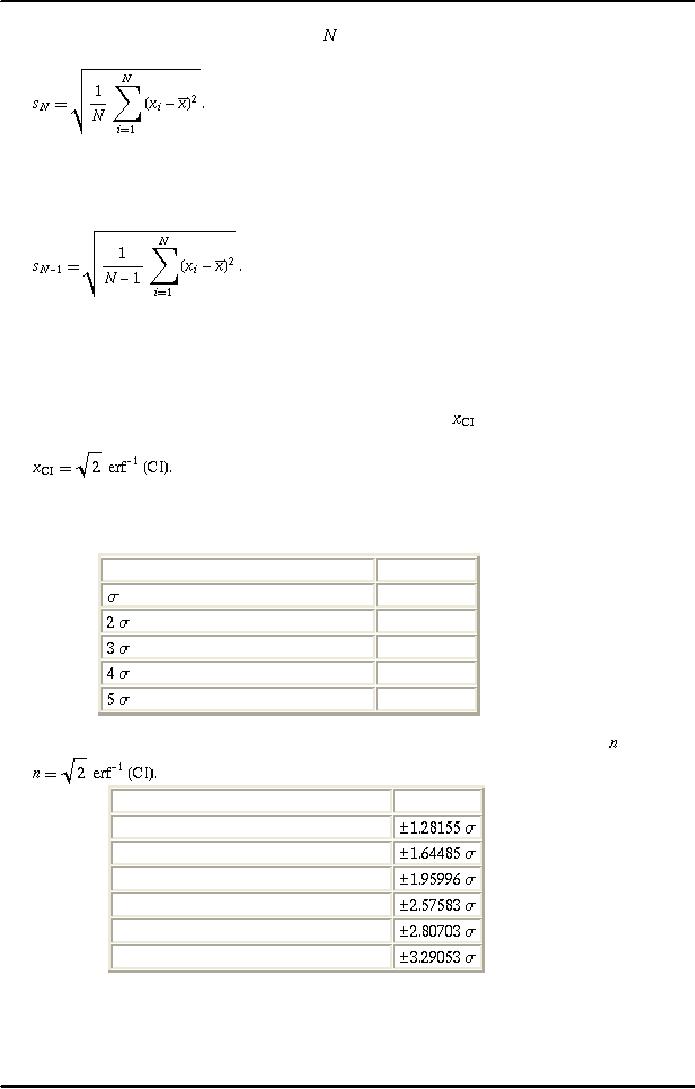

square root of the sample

variance of a set of

values

is the sample standard

deviation

(4)

The

sample standard deviation

distribution is a slightly complicated,

though well-studied and

well-

understood,

function.

However,

consistent with widespread

inconsistent and ambiguous

terminology, the square root of the

bias-

corrected

variance is sometimes also

known as the standard

deviation,

(5)

Physical

scientists often use the term root-mean

square as a synonym for

standard deviation when they refer

to the

square root of the mean

squared deviation of a quantity

from a given baseline.

The

standard deviation arises naturally in

mathematical statistics through

its definition in terms of

the

second

central moment. However, a more natural

but much less frequently

encountered measure of

average

deviation

from the mean that is used

in descriptive statistics is the

so-called mean

deviation.

The

variants value producing a confidence

interval CI is often denoted ,

and

(6)

The

following table lists the confidence

intervals corresponding to the first few multiples of the

standard

deviation.

Range

CI

0.6826895

0.9544997

0.9973002

0.9999366

0.9999994

To

find the standard deviation

range corresponding to a given confidence interval,

solve (5) for ,

giving

(7)

CI

range

0.800

0.900

0.950

0.990

0.995

0.999

49

Table of Contents:

- INTRODUCTION TO SUBJECT

- COMPARISON OF FINANCIAL STATEMENTS

- TIME VALUE OF MONEY

- Discounted Cash Flow, Effective Annual Interest Bond Valuation - introduction

- Features of Bond, Coupon Interest, Face value, Coupon rate, Duration or maturity date

- TERM STRUCTURE OF INTEREST RATES

- COMMON STOCK VALUATION

- Capital Budgeting Definition and Process

- METHODS OF PROJECT EVALUATIONS, Net present value, Weighted Average Cost of Capital

- METHODS OF PROJECT EVALUATIONS 2

- METHODS OF PROJECT EVALUATIONS 3

- ADVANCE EVALUATION METHODS: Sensitivity analysis, Profitability analysis, Break even accounting, Break even - economic

- Economic Break Even, Operating Leverage, Capital Rationing, Hard & Soft Rationing, Single & Multi Period Rationing

- Single period, Multi-period capital rationing, Linear programming

- Risk and Uncertainty, Measuring risk, Variability of return–Historical Return, Variance of return, Standard Deviation

- Portfolio and Diversification, Portfolio and Variance, Risk–Systematic & Unsystematic, Beta – Measure of systematic risk, Aggressive & defensive stocks

- Security Market Line, Capital Asset Pricing Model – CAPM Calculating Over, Under valued stocks

- Cost of Capital & Capital Structure, Components of Capital, Cost of Equity, Estimating g or growth rate, Dividend growth model, Cost of Debt, Bonds, Cost of Preferred Stocks

- Venture Capital, Cost of Debt & Bond, Weighted average cost of debt, Tax and cost of debt, Cost of Loans & Leases, Overall cost of capital – WACC, WACC & Capital Budgeting

- When to use WACC, Pure Play, Capital Structure and Financial Leverage

- Home made leverage, Modigliani & Miller Model, How WACC remains constant, Business & Financial Risk, M & M model with taxes

- Problems associated with high gearing, Bankruptcy costs, Optimal capital structure, Dividend policy

- Dividend and value of firm, Dividend relevance, Residual dividend policy, Financial planning process and control

- Budgeting process, Purpose, functions of budgets, Cash budgets–Preparation & interpretation

- Cash flow statement Direct method Indirect method, Working capital management, Cash and operating cycle

- Working capital management, Risk, Profitability and Liquidity - Working capital policies, Conservative, Aggressive, Moderate

- Classification of working capital, Current Assets Financing – Hedging approach, Short term Vs long term financing

- Overtrading – Indications & remedies, Cash management, Motives for Cash holding, Cash flow problems and remedies, Investing surplus cash

- Miller-Orr Model of cash management, Inventory management, Inventory costs, Economic order quantity, Reorder level, Discounts and EOQ

- Inventory cost – Stock out cost, Economic Order Point, Just in time (JIT), Debtors Management, Credit Control Policy

- Cash discounts, Cost of discount, Shortening average collection period, Credit instrument, Analyzing credit policy, Revenue effect, Cost effect, Cost of debt o Probability of default

- Effects of discounts–Not effecting volume, Extension of credit, Factoring, Management of creditors, Mergers & Acquisitions

- Synergies, Types of mergers, Why mergers fail, Merger process, Acquisition consideration

- Acquisition Consideration, Valuation of shares

- Assets Based Share Valuations, Hybrid Valuation methods, Procedure for public, private takeover

- Corporate Restructuring, Divestment, Purpose of divestment, Buyouts, Types of buyouts, Financial distress

- Sources of financial distress, Effects of financial distress, Reorganization

- Currency Risks, Transaction exposure, Translation exposure, Economic exposure

- Future payment situation – hedging, Currency futures – features, CF – future payment in FCY

- CF–future receipt in FCY, Forward contract vs. currency futures, Interest rate risk, Hedging against interest rate, Forward rate agreements, Decision rule

- Interest rate future, Prices in futures, Hedging–short term interest rate (STIR), Scenario–Borrowing in ST and risk of rising interest, Scenario–deposit and risk of lowering interest rates on deposits, Options and Swaps, Features of opti

- FOREIGN EXCHANGE MARKET’S OPTIONS

- Calculating financial benefit–Interest rate Option, Interest rate caps and floor, Swaps, Interest rate swaps, Currency swaps

- Exchange rate determination, Purchasing power parity theory, PPP model, International fisher effect, Exchange rate system, Fixed, Floating

- FOREIGN INVESTMENT: Motives, International operations, Export, Branch, Subsidiary, Joint venture, Licensing agreements, Political risk