|

METHODS OF PROJECT EVALUATIONS 3 |

| << METHODS OF PROJECT EVALUATIONS 2 |

| ADVANCE EVALUATION METHODS: Sensitivity analysis, Profitability analysis, Break even accounting, Break even - economic >> |

Corporate

Finance FIN 622

VU

Lesson

11

METHODS

OF PROJECT EVALUATIONS

The

following topics will be

discussed in this hand out.

Methods

of Project evaluations:

Payback

Period Method

Discounted

Payback Period

Accounting

Rate of Return ARR

Profitability

Index PI

THE

PAYBACK PERIOD

(PP)

The

time it takes the cash inflows

from a capital investment project to

equal the cash outflows,

usually

expressed

in years'. When deciding between

two or more competing projects, the

usual decision is to

accept

the

one with the shortest

payback.

Payback

is often used as a "first

screening method". By this, we

mean that when a capital

investment project

is being

considered, the first question to ask

is: 'How long will it

take to pay back its

cost?' The company

might

have a target payback, and

so it would reject a capital

project unless its payback

period was less than

a

certain

number of years.

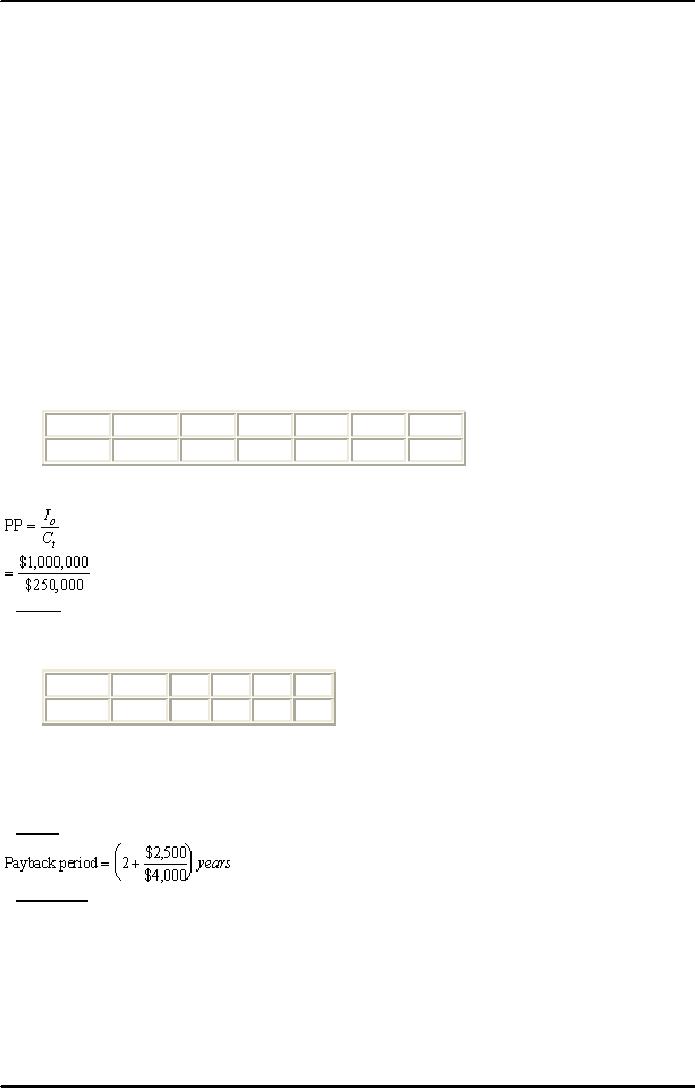

Example

1:

Years

0

1

2

3

4

5

Project A

1,000,000 250,000 250,000

250,000 250,000

250,000

For a

project with equal annual

receipts:

= 4

years

Example

2:

Years

0

1

2

3

4

Project B -

10,000 5,000 2,500 4,000

1,000

Payback

period lies between year 2

and year 3. Sum of money

recovered by the end of the second

year

=

$7,500, i.e. ($5,000 +

$2,500)

Sum of

money to be recovered by end of

3rd year

=

$10,000 - $7,500

=

$2,500

=

2.625 years

Disadvantages

of the payback

method:

* It

ignores the timing of cash

flows within the payback

period, the cash flows after the

end of payback

period

and therefore the total project

return.

* It

ignores the time value of money.

This means that it does

not take into account the

fact that $1 today is

worth

more than $1 in one year's

time. An investor who has $1 today can

either consume it immediately or

alternatively

can invest it at the prevailing interest

rate, say 30%, to get a

return of $1.30 in a year's

time.

* It is

unable to distinguish between projects

with the same payback

period.

34

Corporate

Finance FIN 622

VU

* It

may lead to excessive investment in

short-term projects.

Advantages

of the payback

method:

� Payback

can be important: long

payback means capital tied

up and high investment risk.

The method

also

has the advantage that it

involves a quick, simple calculation and

an easily understood concept.

DISCOUNTED

PAYBACK PERIOD:

Length

of time required to recover the initial

cash outflow from the discounted

future

cash inflows. This is

the

approach

where the present values of

cash inflows are cumulated

until they equal the initial investment.

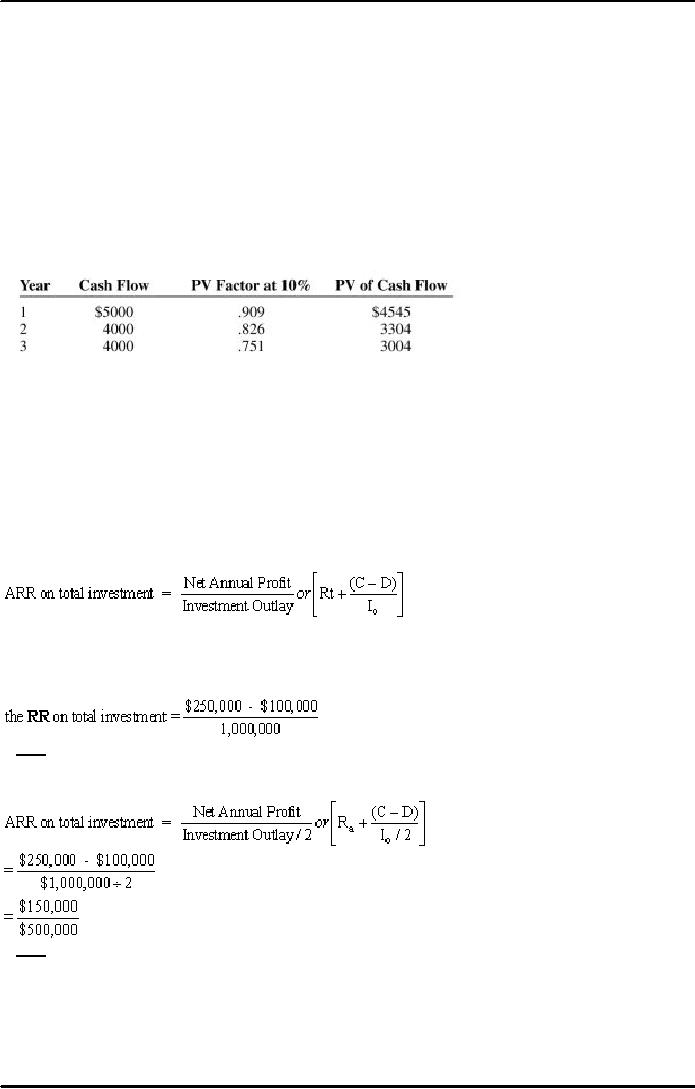

For

example,

assume a machine purchased

for $5000 yields cash

inflows of $5000, $4000, and

$4000. The cost

of

capital is 10%. Then we

have

The

payback period (without discounting the

future cash flows) is exactly 1

year. However, the

discounted

payback

period is a little over 1

year because the first year

discounted cash flow of

$4545 is not enough to

cover

the initial investment of $5000. The

discounted payback period is

1.14 years (1 year + ($5000

-

$4545)/$3304 = 1

year + .14 year).

THE

ACCOUNTING RATE OF RETURN -

(ARR):

The

ARR method also called the

return on capital employed (ROCE) or the

return on investment (ROI)

method of

appraising a capital project is to

estimate the accounting rate of

return that the project

should

yield. If it

exceeds a target rate of

return, the project will be

undertaken.

Note

that net annual profit

excludes depreciation.

Example:

A

project has an initial

outlay of $1 million and

generates net receipts of $250,000

for 10 years.

Assuming

straight-line depreciation of $100,000 per

year:

=

15%

=

30%

Disadvantages:

* It

does not take account of the

timing of the profits from an

investment.

* It

implicitly assumes stable

cash receipts over

time.

35

Corporate

Finance FIN 622

VU

* It is

based on accounting profits

and not cash flows.

Accounting profits are

subject to a number of

different

accounting treatments.

* It is a relative

measure rather than an absolute

measure and hence takes no

account of the size of the

investment.

* It

takes no account of the length of the

project.

* It

ignores the time value of

money.

The

payback and ARR methods in

practice:

Despite the

limitations of the payback method, it is the method

most widely used in practice. There

are a

number of

reasons for this:

* It is a

particularly useful approach for

ranking projects where a

firm faces liquidity

constraints and

requires

fast

repayment of investments.

* It is appropriate

in situations where risky investments

are made in uncertain markets

that are subject to

fast

design and product changes

or where future cash flows

are particularly difficult to

predict.

* The

method is often used in

conjunction with NPV or IRR

method and acts as a first

screening device to

identify

projects which are worthy of

further investigation.

* It is

easily understood by all levels of

management.

* It provides an

important summary method: how

quickly will the initial investment be

recouped?

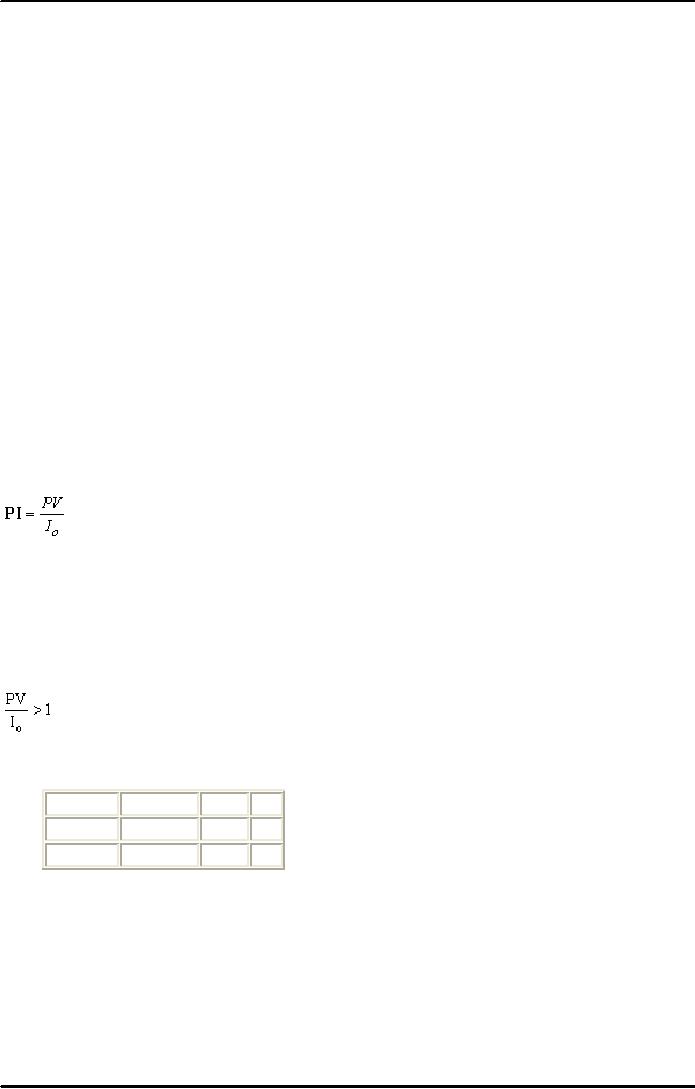

THE

PROFITABILITY INDEX PI:

This is

also known as benefit-cost ratio. It is a

relationship between the PV of all the

future cash flows

and

the

initial investment. This relationship is expressed as

a number calculated by dividing the PV of

all cash

flows

by initial investment.

This is a

variant of the NPV method.

Decision

rule:

PI > 1;

accept the project

PI < 1;

reject the project

If NPV

= 0, we have:

NPV =

PV - Io = 0

PV = Io

Dividing

both sides by Io we

get:

PI of

1.2 means that the project's

profitability is 20%.

Example:

PV of CF

Io

PI

Project A

100

50

2.0

Project B

1,500

1,000

1.5

Decision:

Choose

option B because it maximizes the firm's

profitability by $1,500.

Disadvantage

of PI:

Like

IRR it is a percentage and therefore

ignores the scale of investment.

The

NPV method is preferred over the PI method.

This is because PI greater than 1

implies that the Net

Present

Value of the project is positive.

Secondly, NPV clearly states

whether to undertake or reject a

project

or not and return a dollar

value by which the economic

contribution is made to value of

firm. This is

not

the case with PI which only

expresses the relative profitability of

projects being considered.

36

Table of Contents:

- INTRODUCTION TO SUBJECT

- COMPARISON OF FINANCIAL STATEMENTS

- TIME VALUE OF MONEY

- Discounted Cash Flow, Effective Annual Interest Bond Valuation - introduction

- Features of Bond, Coupon Interest, Face value, Coupon rate, Duration or maturity date

- TERM STRUCTURE OF INTEREST RATES

- COMMON STOCK VALUATION

- Capital Budgeting Definition and Process

- METHODS OF PROJECT EVALUATIONS, Net present value, Weighted Average Cost of Capital

- METHODS OF PROJECT EVALUATIONS 2

- METHODS OF PROJECT EVALUATIONS 3

- ADVANCE EVALUATION METHODS: Sensitivity analysis, Profitability analysis, Break even accounting, Break even - economic

- Economic Break Even, Operating Leverage, Capital Rationing, Hard & Soft Rationing, Single & Multi Period Rationing

- Single period, Multi-period capital rationing, Linear programming

- Risk and Uncertainty, Measuring risk, Variability of return–Historical Return, Variance of return, Standard Deviation

- Portfolio and Diversification, Portfolio and Variance, Risk–Systematic & Unsystematic, Beta – Measure of systematic risk, Aggressive & defensive stocks

- Security Market Line, Capital Asset Pricing Model – CAPM Calculating Over, Under valued stocks

- Cost of Capital & Capital Structure, Components of Capital, Cost of Equity, Estimating g or growth rate, Dividend growth model, Cost of Debt, Bonds, Cost of Preferred Stocks

- Venture Capital, Cost of Debt & Bond, Weighted average cost of debt, Tax and cost of debt, Cost of Loans & Leases, Overall cost of capital – WACC, WACC & Capital Budgeting

- When to use WACC, Pure Play, Capital Structure and Financial Leverage

- Home made leverage, Modigliani & Miller Model, How WACC remains constant, Business & Financial Risk, M & M model with taxes

- Problems associated with high gearing, Bankruptcy costs, Optimal capital structure, Dividend policy

- Dividend and value of firm, Dividend relevance, Residual dividend policy, Financial planning process and control

- Budgeting process, Purpose, functions of budgets, Cash budgets–Preparation & interpretation

- Cash flow statement Direct method Indirect method, Working capital management, Cash and operating cycle

- Working capital management, Risk, Profitability and Liquidity - Working capital policies, Conservative, Aggressive, Moderate

- Classification of working capital, Current Assets Financing – Hedging approach, Short term Vs long term financing

- Overtrading – Indications & remedies, Cash management, Motives for Cash holding, Cash flow problems and remedies, Investing surplus cash

- Miller-Orr Model of cash management, Inventory management, Inventory costs, Economic order quantity, Reorder level, Discounts and EOQ

- Inventory cost – Stock out cost, Economic Order Point, Just in time (JIT), Debtors Management, Credit Control Policy

- Cash discounts, Cost of discount, Shortening average collection period, Credit instrument, Analyzing credit policy, Revenue effect, Cost effect, Cost of debt o Probability of default

- Effects of discounts–Not effecting volume, Extension of credit, Factoring, Management of creditors, Mergers & Acquisitions

- Synergies, Types of mergers, Why mergers fail, Merger process, Acquisition consideration

- Acquisition Consideration, Valuation of shares

- Assets Based Share Valuations, Hybrid Valuation methods, Procedure for public, private takeover

- Corporate Restructuring, Divestment, Purpose of divestment, Buyouts, Types of buyouts, Financial distress

- Sources of financial distress, Effects of financial distress, Reorganization

- Currency Risks, Transaction exposure, Translation exposure, Economic exposure

- Future payment situation – hedging, Currency futures – features, CF – future payment in FCY

- CF–future receipt in FCY, Forward contract vs. currency futures, Interest rate risk, Hedging against interest rate, Forward rate agreements, Decision rule

- Interest rate future, Prices in futures, Hedging–short term interest rate (STIR), Scenario–Borrowing in ST and risk of rising interest, Scenario–deposit and risk of lowering interest rates on deposits, Options and Swaps, Features of opti

- FOREIGN EXCHANGE MARKET’S OPTIONS

- Calculating financial benefit–Interest rate Option, Interest rate caps and floor, Swaps, Interest rate swaps, Currency swaps

- Exchange rate determination, Purchasing power parity theory, PPP model, International fisher effect, Exchange rate system, Fixed, Floating

- FOREIGN INVESTMENT: Motives, International operations, Export, Branch, Subsidiary, Joint venture, Licensing agreements, Political risk