|

DEPARTMENTAL ACCOUNTS 1 |

| << PREPARATION OF FINANCIAL STATEMENTS OF NON-PROFIT ORGANIZATIONS FROM INCOMPLETE RECORDS |

| DEPARTMENTAL ACCOUNTS 2 >> |

Advance

Financial Accounting

(FIN-611)

VU

LESSON

# 9

DEPARTMENTAL

ACCOUNT

A

business entity where

diversified natures of economic

activities are undertaken

is

split

into number of departments for accounting

purposes. Generally it is

management

who will

decide the number of departments in which

the whole business is to be

divided,

but the criteria for identifying

the departments in an examination

question is

always

the separate sales/work-done

revenue.

Each

department is considered as a profit

centre, though none of the

departments is

separated

geographically from the rest of

the departments. This type of

organizational

subdivision

creates a need for internal

information about the

operating results

(profitability)

of each department. Based upon

the departmental knowledge

of

profitability

and growth rate the management

takes certain decisions e.g.

pricing,

costing,

sales promotion, closure

etc.

Allocation

of Incomes and Expenses

Until

unless the size of the

business entity is very large,

the entire book

keeping

system

for the entity is kept by a

central accounts department

along with some

departmental

specific records e.g. sales,

purchases, stocks and staff

salaries etc. Rest of

the

operating expenses and other

incomes need to be allocated

among the

departments

based on their nature, utility,

economic benefits and

belongingness.

For

allocation and division purposes

the expenses/incomes can be

categorized as:

1.

Separately identified

2.

Obvious just ratio

3.

Specific ratio/sales

ratio

4.

Un-allocable

Separately

identified

It

depends upon the size of the

entity that it can

separately identify its

expenses with

each

of the department, a large

entity will be incurring most of

the operating

expenses

that

are department specific e.g.

carriage inward, receiving and

handling, wages and

salaries,

electricity, telephone, repair and

maintenance, entertainment,

advertisement,

sales

promotion, selling commissions,

research and development cost

etc.

Obvious

just ratio

Most of

the expenses are allocated

on the most logical basis

that is obvious and

also

just.

Nature of the expenses and

nature of the business will

determine the basis

for

division.

Some important basis and

expenses are given

below:

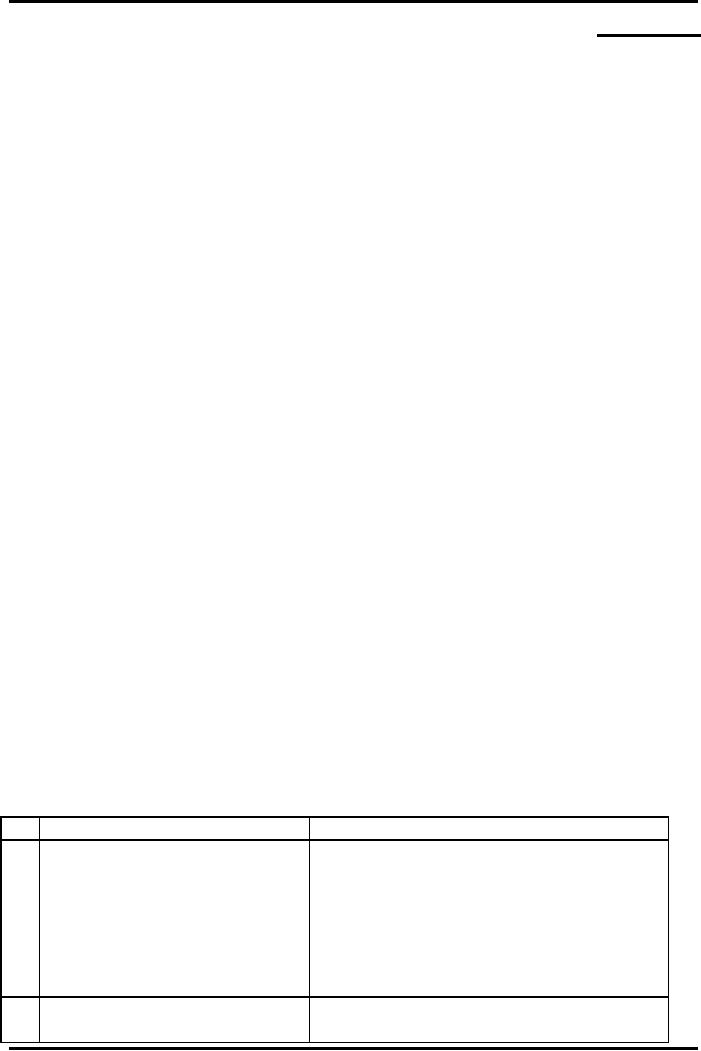

S#

Basis

Expenses

1

Sales/Work-done

Revenue

Selling

and distribution expenses

After

sales service

Discount

allowed

Carriage/freight

outward

Bad

debts

Selling

commissions

Advertisement

2

Number of

Employees

Salaries

and wages

Staff

welfare

43

Advance

Financial Accounting

(FIN-611)

VU

Canteen/cafeteria

facility

Group

insurance

3

Area

Occupied

Building

rent

Building

depreciation

Building

insurance

Building

repair and maintenance

Air

conditioning and heating

Property

tax

Inter-com

4

Purchases

of

goods/raw

Carriage/freight inward

material

Import

duties

Custom

tax

Receiving

and handling cost

Discount

received (income)

Specific

ratio or sales ratio

Still

there are some expenses

which provide economic benefits to

more than one

department

and should be allocated but the

ratio is not obvious, for such

expenses a

specific

ratio will be determined or otherwise

these will be divided in the

ratio of their

respective

departmental sales revenue.

These may include:

Insurance

on stock/inventory

Insurance

on plant and machinery

Power

and fuel

Depreciation/Amortization

Un-allocable

These

are the expenses which

provide economic benefits to

the business entity on

the

whole;

these cannot be identified with a

specific department. Such

expenses are often

incurred

against financial facilities.

Examples include; loss on

disposal of investments,

damages

paid for infringement of law, interest on

loan and bank overdrafts

etc.

There

are certain financial

incomes as well that cannot be

identified or allocated

among

the department e.g. interest

on investment, profit on disposal on

investments,

profit

on fixed deposits

etc.

All

these types of expenses and

incomes are shown in a general

profit and loss

account

where

profits or losses of each

department are clubbed to

ascertain the

operating

results

of the business on the

whole.

Allocation

of income tax

expense

Unlike

other operating expenses

income tax expense is

divided on the basis

of

departmental

operating profits. Some

students having knowledge of

income tax law

may

possibly get confused that

nevertheless there are

certain expenses or

losses

admissible

from the tax stand point

that are shown in the

general profit and

loss

account

have not yet been deducted from

the departmental operating

results then why

this

income tax expense is being

charged before subtracting

certain expenses.

Remember

this is just an allocation of

income tax expense (that

has already been

calculated)

among the different

departments. It has nothing to do with

the calculation

of

taxable profit or income tax

charge for the year.

44

Advance

Financial Accounting

(FIN-611)

VU

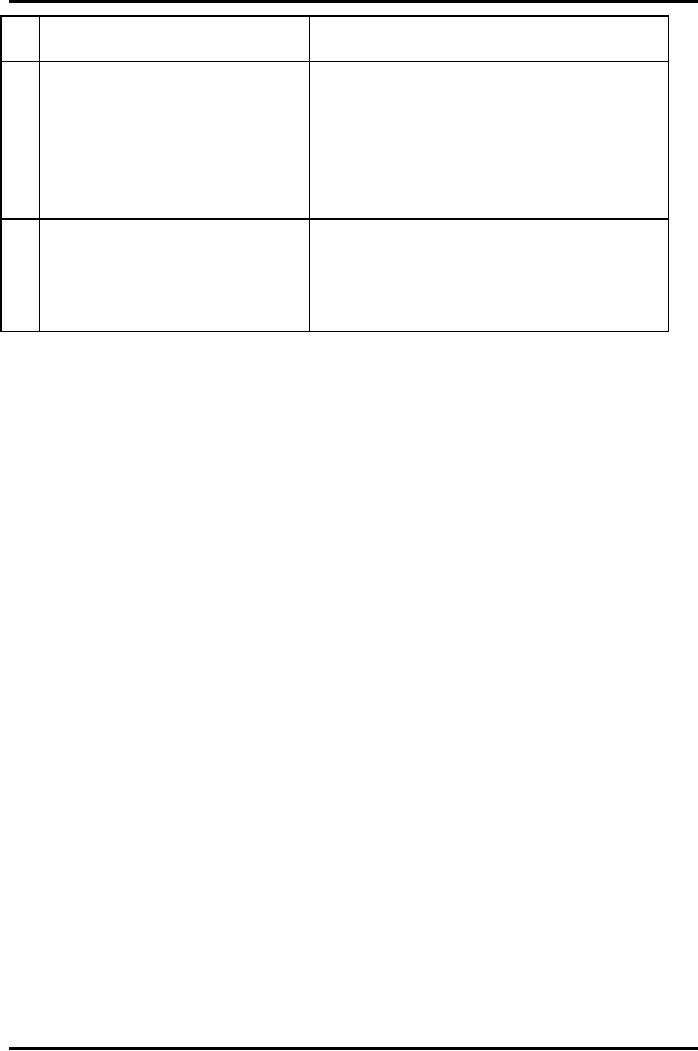

Format

of departmental profit and loss

account

Income

statement

For

the year ended December

31, 2008

Particulars

A

B

Total

***

Sales

***

***

***

Less

Cost of goods sold

***

***

***

Gross

profit

***

***

Less

Operating expenses

Salaries

& Wages

***

***

***

Rent,

rates & taxes

***

***

***

Repair

& renewal

***

***

***

Lighting

& heating

***

***

***

Profit

from operations

***

***

***

Add

Other incomes

***

***

***

Profit

before tax

***

***

***

Less

Income tax

***

***

***

Net

profit/Profit after

tax

***

***

***

Less

General expenses

-

-

***

Net

profit of the

business

***

Solved

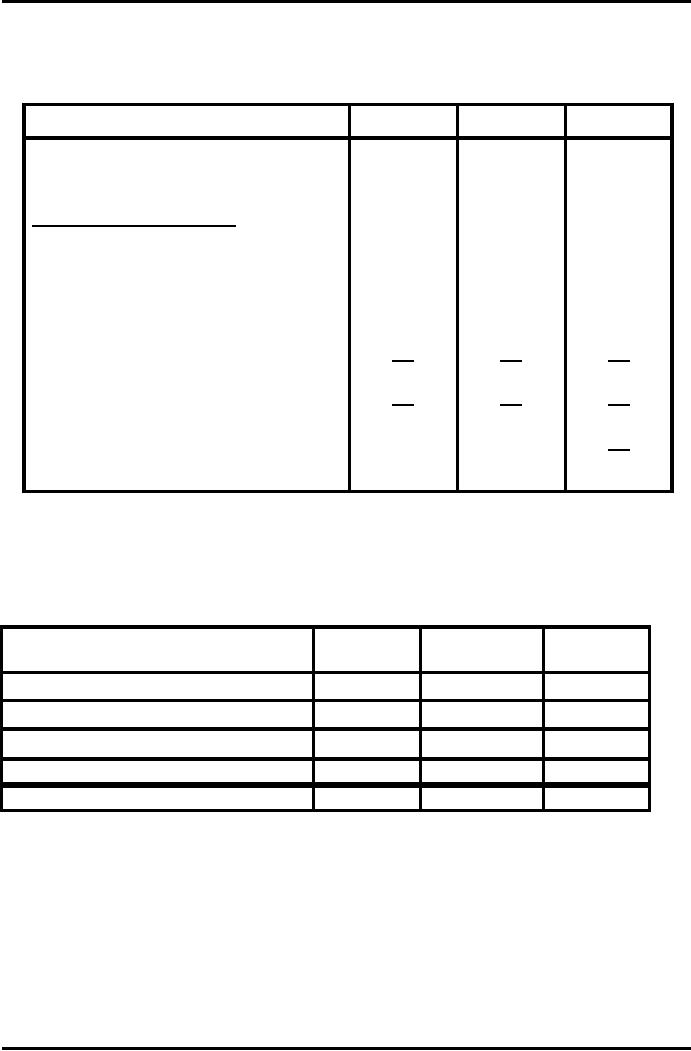

Problem:

From

the following information of Trendy Store

prepare departmental

Income

Statement

and also compute net profit

of the entity on the whole for

the year ending

on

31.12 2008

Particulars

Jewellery

Hairdressing

Clothing

Rs.

Rs.

Rs.

Opening

stock (1/1/2008)

2,000

1,500

3,000

Purchases

11,000

3,000

15,000

Closing

stock (31/12/2008)

3,000

2,500

4,000

Sales and work

done

18,000

9,000

27,000

Staff

salaries

2,800

5,000

6,000

Following

expenses cannot be traced to any

particular department:

Rupees

Rent

3,500

Repair

expenses

4,800

Air

conditioning & lighting

2,000

General

expenses

1,200

Basis

of allocation

Rent

& Air-conditioning expense Floor

space occupied

Repairs

& General expense

Sales

and work done

45

Advance

Financial Accounting

(FIN-611)

VU

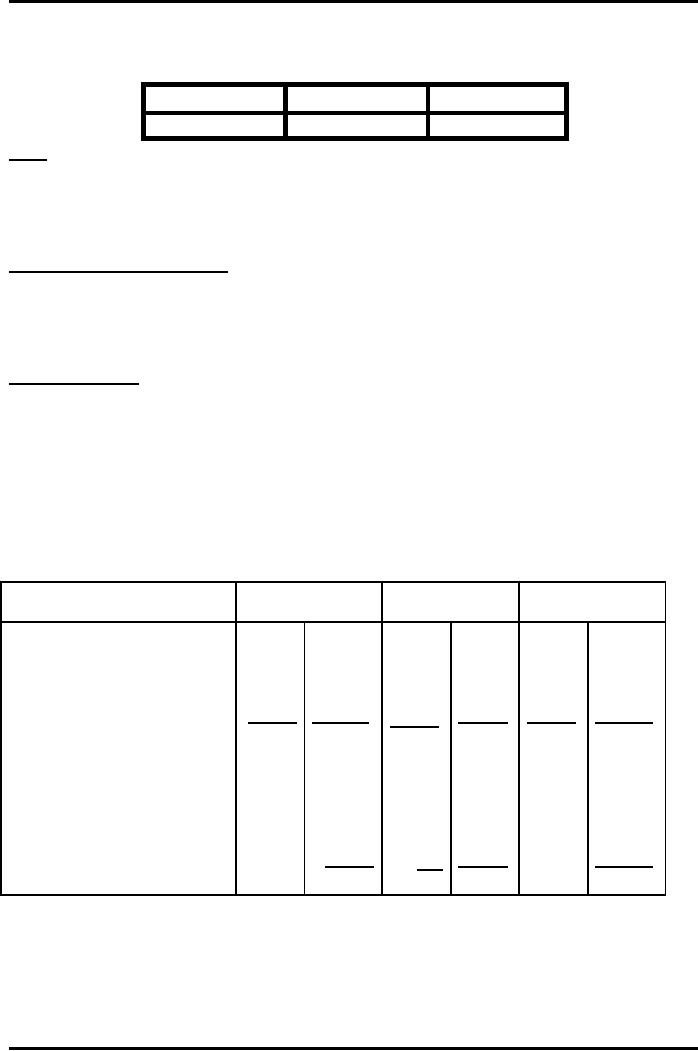

Floor

space occupied ratio:

Jewellery

Hairdressing

Clothing

1/5

1/2

3/10

Rent

Jewellery

3,500

x 1/5 =

700

Hairdressing

3,500

x 1/2 =

1,750

Clothing

3,500

x 3/10 =

1,050

Air

conditioning & lighting

Jewellery

2,000

x 1/5 =

400

Hairdressing

2,000

x 1/2 =

1,000

Clothing

2,000

x 3/10 =

600

Repair

expenses

Jewellery

4,800

x 18/54 =

1,600

Hairdressing

4,800

x 18/54 =

800

Clothing

4,800

x 18/54 =

2,400

Trendy

Store

Departmental

Trading and profit and

Loss Accounts

For

the year ended 31 December

2008

Jewellery

Hairdressing

Clothing

Rs.

Rs.

Rs.

Sales

and work done

18,000

9,000

27,000

Cost

of goods or materials:

2,000

3,000

Stock

01.01.2008

1,500

15,000

Add

Purchases

11,000

3,000

Less

Stock 31.12.2008

(3,000)

(10,000)

(4,000)

(14,000)

(2,000)

(2,500)

Gross

Profit

8,000

7,000

13,000

Less

Expenses

Wages

6,000

2,800

5,000

Rent

1,050

700

1,750

Administration

Expenses

2,400

1,600

800

Air

conditioning & lighting

600

400

1,000

General

expenses

200

(8,750)

600

(5,900)

(10,650)

400

Net

Profit / (Loss)

2,350

2,100

(1,750)

46

Table of Contents:

- ACCOUNTING FOR INCOMPLETE RECORDS

- PRACTICING ACCOUNTING FOR INCOMPLETE RECORDS

- CONVERSION OF SINGLE ENTRY IN DOUBLE ENTRY ACCOUNTING SYSTEM

- SINGLE ENTRY CALCULATION OF MISSING INFORMATION

- SINGLE ENTRY CALCULATION OF MARKUP AND MARGIN

- ACCOUNTING SYSTEM IN NON-PROFIT ORGANIZATIONS

- NON-PROFIT ORGANIZATIONS

- PREPARATION OF FINANCIAL STATEMENTS OF NON-PROFIT ORGANIZATIONS FROM INCOMPLETE RECORDS

- DEPARTMENTAL ACCOUNTS 1

- DEPARTMENTAL ACCOUNTS 2

- BRANCH ACCOUNTING SYSTEMS

- BRANCH ACCOUNTING

- BRANCH ACCOUNTING - STOCK AND DEBTOR SYSTEM

- STOCK AND DEBTORS SYSTEM

- INDEPENDENT BRANCH

- BRANCH ACCOUNTING 1

- BRANCH ACCOUNTING 2

- ESSENTIALS OF PARTNERSHIP

- Partnership Accounts Changes in partnership firm

- COMPANY ACCOUNTS 1

- COMPANY ACCOUNTS 2

- Problems Solving

- COMPANY ACCOUNTS

- RETURNS ON FINANCIAL SOURCES

- IASB’S FRAMEWORK

- ELEMENTS OF FINANCIAL STATEMENTS

- EVENTS AFTER THE BALANCE SHEET DATE

- PROVISIONS, CONTINGENT LIABILITIES AND CONTINGENT ASSETS

- ACCOUNTING POLICIES, CHANGES IN ACCOUNTING ESTIMATES AND ERRORS 1

- ACCOUNTING POLICIES, CHANGES IN ACCOUNTING ESTIMATES AND ERRORS 2

- BORROWING COST

- EXCESS OF THE CARRYING AMOUNT OF THE QUALIFYING ASSET OVER RECOVERABLE AMOUNT

- EARNINGS PER SHARE

- Earnings per Share

- DILUTED EARNINGS PER SHARE

- GROUP ACCOUNTS

- Pre-acquisition Reserves

- GROUP ACCOUNTS: Minority Interest

- GROUP ACCOUNTS: Inter Company Trading (P to S)

- GROUP ACCOUNTS: Fair Value Adjustments

- GROUP ACCOUNTS: Pre-acquistion Profits, Dividends

- GROUP ACCOUNTS: Profit & Loss

- GROUP ACCOUNTS: Minority Interest, Inter Co.

- GROUP ACCOUNTS: Inter Co. Trading (when there is unrealized profit)

- Comprehensive Workings in Group Accounts Consolidated Balance Sheet