|

PREPARATION OF FINANCIAL STATEMENTS OF NON-PROFIT ORGANIZATIONS FROM INCOMPLETE RECORDS |

| << NON-PROFIT ORGANIZATIONS |

| DEPARTMENTAL ACCOUNTS 1 >> |

Advance

Financial Accounting

(FIN-611)

VU

LESSON

# 8

PREPARATION

OF FINANCIAL STATEMENTS OF

NON-PROFIT

ORGANIZATIONS

FROM INCOMPLETE RECORDS

Questions

often require candidates to

prepare an Income & Expenditure

Account and

Balance

Sheet from incomplete records.

Generally, a summary of bank and

cash

transactions

is provided along with information

relating to opening and closing

assets

and

liabilities.

To

solve these types of

problems, the following steps

are followed:

1.

Prepare a receipt and payment

account (if not given in the

question).

2.

Prepare statement of affairs as on

opening date.

3.

Post the balances of assets and

liabilities from the statement of

affairs into the

relevant

ledger a/c as opening balance b/f or put

these in the working for

further

calculation of closing

balance.

4.

Pick up the revenue receipts

and payment and pass these from

the filter of

accruals

to calculate incomes and expenses for

the year.

5.

Prepare such ledger accounts

as are deemed necessary

(like subscription a/c).

6. Work out

depreciation charge for the

fixed assets and treat them

accordingly.

7.

Prepare trading account for

supporting trading activities

undertaken by the

non-trading

organization.

8.

Draft the income and

expenditure account and balance

sheet.

Solved

Problem 1

Karachi

Golf Club prepared the following Receipts

and Payments Account for the

year

ended

December 31, 2007

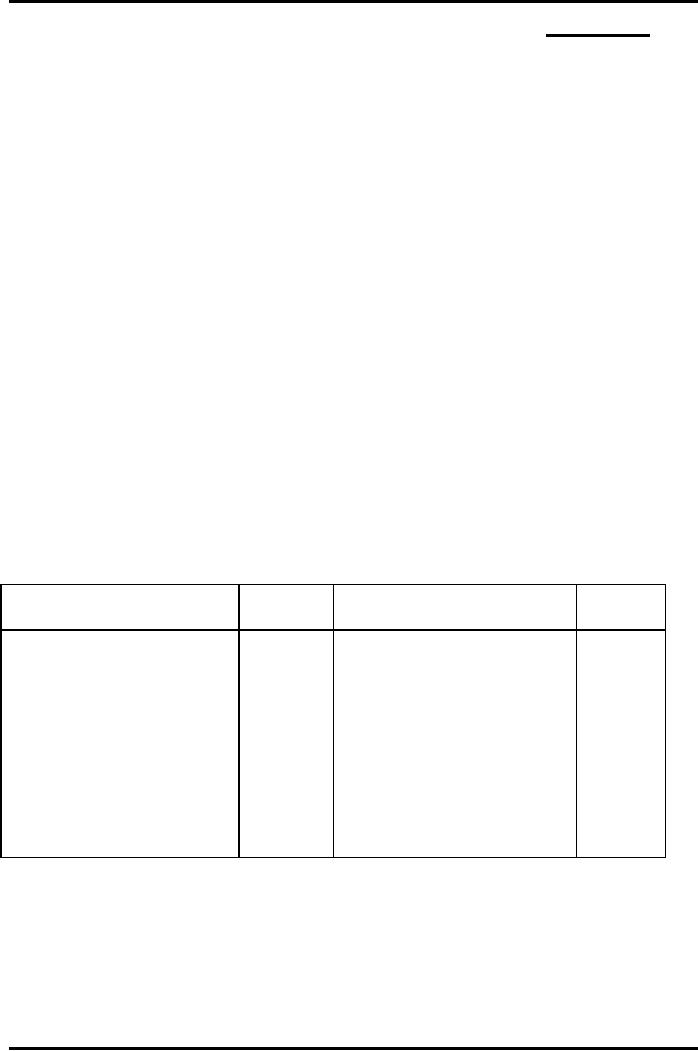

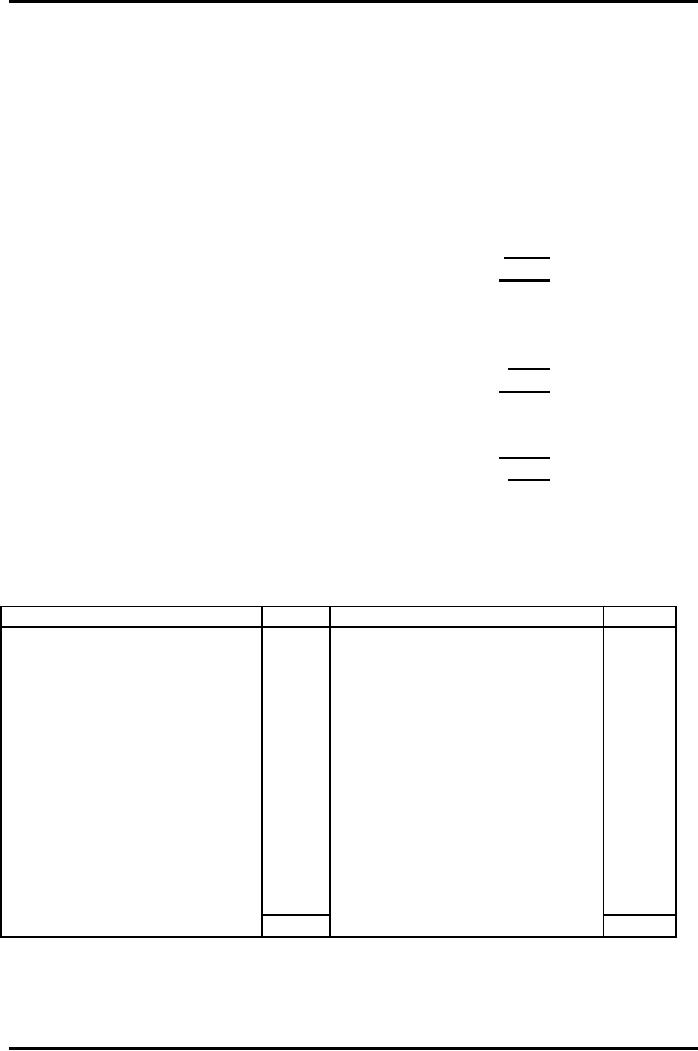

Receipts

Amount

Payments

Amount

Rupees

Rupees

Opening

balance b/f

3,800

Sports Equipments

10,000

Subscription

(purchased

on 1.9.2007)

2,000

Tournament expenses

4,000

2006

18,500

Electricity

500

2007

900

Printing

300

2008

3,400

Entrance

fees

Salaries

and wages

800

Expenses for exhibition

2,100

(capital

receipts)

1500

Closing Balance c/f

7,200

Interest

on Investment

27,500

27,500

Additional

information:

1.

Non-current assets of the club on

January 1, 2007 include the

following:

Rupees

Club

Ground

50,000

Sports

Equipment

15,500

Furniture

2,000

Investment

12,000

37

Advance

Financial Accounting

(FIN-611)

VU

2.

Subscription for 2007 collected in 2006

Rs. 500

3. Unpaid

subscriptions for 2007 Rs. 300

4.

Depreciation to be provided

@ 5%

p.a. on furniture and

@

20% p.a. on sports

equipment.

Required:

prepare

Income statement and balance

sheet for the year

2007.

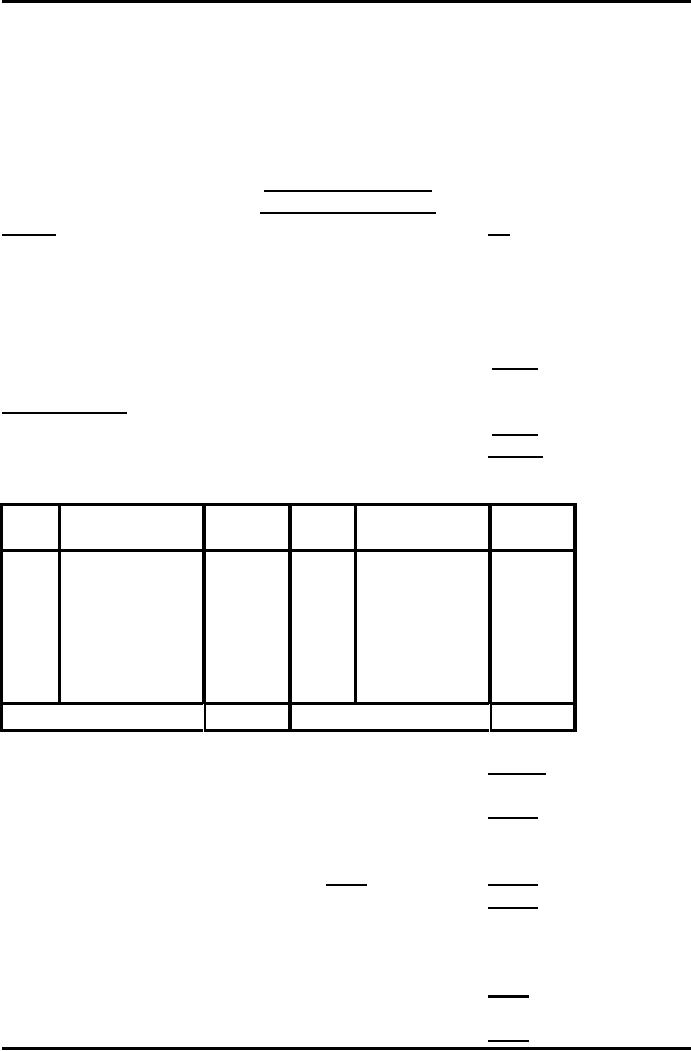

Statement

of Affairs

As on

January 1, 2007

Assets

Rs

Club

ground

50,000

Sports

equipment

15,500

Furniture

2,000

Investments

12,000

Subscription

due

2,000

Cash

balance

3,800

85,300

Less

Liabilities

Subscription

received in advance

500

Capital

fund

84,800

Sports

Equipment Account

Date

Particulars

Amount

Date Particulars

Amount

Rupees

Rupees

1

Jan Opening

balance

15,500 31

Dec Depreciation

3,767

2007

2007

1 Sep

Addition

10,000 31

Dec Balance

21,733

2007

During the year

2007

25,500

25,500

Sports

Equipment

Rupees

Opening

balance

15,500

Add

Addition 1.9.2007

10,000

25,500

Less

Depreciation

15,500 x

20%

3,100

3,767

10,000 x

20% x 4/12 667

Net

book value

21,733

Furniture

Opening

balance

2,000

Add

Addition

1.9.2007

0

2,000

Less

Depreciation

2,000

x 5%

100

38

Advance

Financial Accounting

(FIN-611)

VU

Net

book value

1,900

Subscription

Income

Subscriptions

received during the

year

21,400

Less

Opening due

2,000

Add

Closing due

300

Add

Opening advance

500

Less

Closing advance

900

19,300

Income

& Expenditure Account

For

the year ended December

31, 2007

Rupees

Incomes

Rupees

Subscription

19,300

20,800

Interest

on Investment

1,500

Expenses

Tournament

expenses

4,000

Electricity

500

Printing

300

Salaries

and wages

3,400

Exhibition

expenses

2,100

Depreciation

furniture

100

Sports

equipment

3,767

14,167

6,633

Owner's

Equity

Opening

capital

xxx

Add Net

profit

xxx

Add

Fresh capital

xxx

Less

Drawings

xxx

Closing

capital

xxx

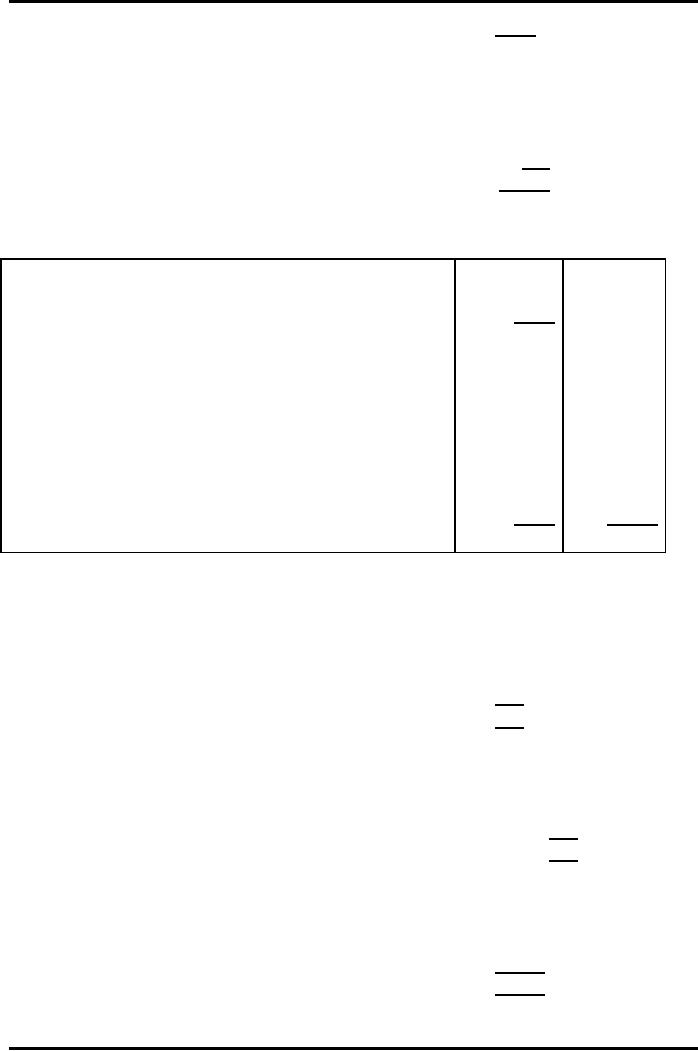

Capital

Fund

Opening

capital fund

xxx

Add

Surplus

xxx

Add

Capital receipts during the

year

xxx

Closing

capital fund

xxx

Capital

fund as on December 31,

2007

Rupees

Opening

capital

84,800

Add

Surplus

6,633

Add

Capital receipts

800

Closing

capital fund

92,233

39

Advance

Financial Accounting

(FIN-611)

VU

Balance

Sheet

As on

December 31, 2007

Amount

Capital fund &

Amount

Assets

Rupees

Liabilities

Rupees

Club

building

50,000

Capital fund

92,233

Sports

equipment

21,733

Subscription received in

Furniture

1,900

advance

900

Investments

12,000

Subscription

due

300

Cash

7,200

93,133

93,133

Some

of the non-profit organizations

believe on self sufficiency.

These types of

organizations

run a trading activity within the

organization. These may include

a

canteen,

a juice shop, a book shop, a

tuck shop etc. Following is a

solved problem that

covers

working for such trading

activity.

Solved

Problem 2

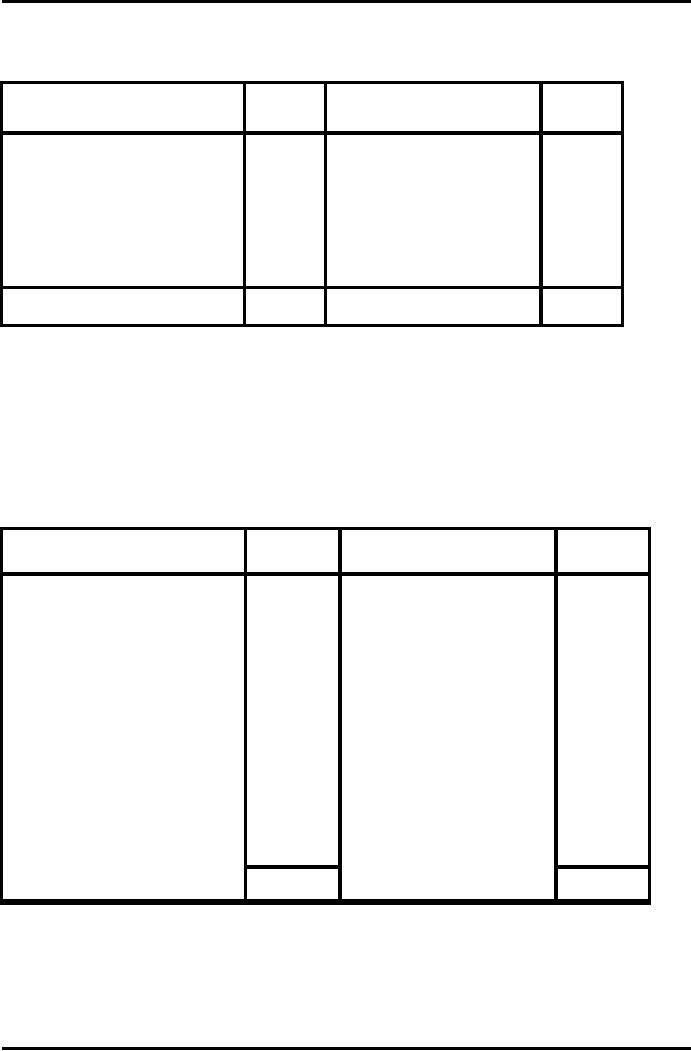

The

following summary of the Cash Book

has been prepared by the

Treasure of a club.

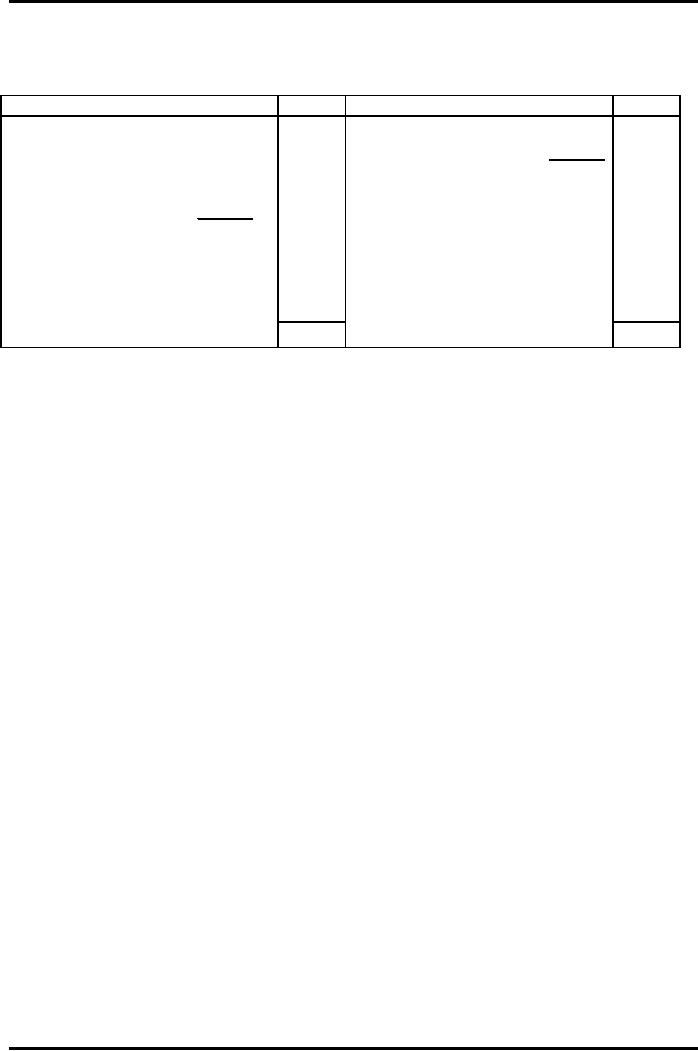

Receipts

Amount

Payment

Amount

Rupees

Rupees

Cash

in hand & at bank

Wages-Outdoor

staff

13,380

on April 1,

2007

4,740

Restaurant

purchases

50,400

Member's

subscription

29,720

Rent-18

months June 30,

7,500

Entrance

fee

3,200

2008

Restaurant

fee

56,800

Rates

2,200

Games

competition receipts

Secretary

salary

3,120

13,640

Lighting,

Cleaning &

Dues

to secretary

7,700

80

for

petty expenses

Sanitary

service

Competition

prizes

4,000

Printing,

postage &

6,000

Sundries

Fixed

deposit in bank

8,000

Balance

5,880

108,180

108,180

On April 1,

2007, the club assets were:

Furniture and Equipment Rs.

48,000; Restaurant

stocks

Rs. 2,600; Stock of prizes

Rs. 800, and Rs 5,200 owed for

supplies to the

restaurant.

40

Advance

Financial Accounting

(FIN-611)

VU

On March

31, 2008 the restaurant

Stocks were Rs. 3,000 and

prizes on hand were

Rs.

500 while

the club owed Rs. 5,600 for

restaurant supplies.

It

was also found that member's

subscription unpaid on March 31,

2008, amounted to

Rs.

1,000 and that the amount of

Rs. 29,720 shown in cash book

included Rs. 700 in

respect

of previous year and Rs. 400

paid in advance for the following

year.

Working

for trading

activity

Rupees

Supplies

Cash

paid

50,400

Less

Opening due

5,200

Add

Closing due

5,600

Supplies

purchase expenses

50,800

Cost

of goods sold

Purchases

of supplies

50,800

Add

opening stock

2,600

Less

closing stock

3,000

Cost

of goods sold

50,400

Trading

Account

Sales

56,800

Less

Cost of Goods Sold

50,400

6,400

CLUB

Income

and Expenditure

Account

For

the year ended

31.03.2008

Expenditure

Rs.

Income

Rs.

To

Wages Outdoor

staff

13,380

By Members' subscriptions

29,620

To

Rent

5,000

By Games competition

receipts

13,640

6,400

To

Rates

2,200

By Restaurant profit

To

Secretary's Salary

3,120

To

Lighting, cleaning

and

sanitary

services

7,700

To

Competition prizes

4,300

To

Printing, postage and

sundries

6,000

To

depreciation on Furniture &

Equipment

10%

4,800

To

Excess of Income over

Expenditure

3,160

49,660

49,660

41

Advance

Financial Accounting

(FIN-611)

VU

CLUB

Balance

Sheet

As at

31.03.2008

Liabilities

Rs.

Assets

Rs.

Capital

Fund:

Furniture

& Equipment

48,000

Opening

Balance

50,390

Less:

10% Depreciation

4,800

43,200

Add:

Entrance Fees

3,200

Restaurant

Stock

3,000

Add:

Excess of Income

Prizes

in hand

500

56,750

Fixed deposit with

bank

8,000

over

Expenditure

3,160

Subscriptions

received in advance

Cash

in hand at bank

5,880

Creditor

for restaurant supply

400

Prepaid Rent (April to June

2008)

1,250

Due

to secretary

5,600

Subscriptions outstanding

1,000

80

62,830

62,830

42

Table of Contents:

- ACCOUNTING FOR INCOMPLETE RECORDS

- PRACTICING ACCOUNTING FOR INCOMPLETE RECORDS

- CONVERSION OF SINGLE ENTRY IN DOUBLE ENTRY ACCOUNTING SYSTEM

- SINGLE ENTRY CALCULATION OF MISSING INFORMATION

- SINGLE ENTRY CALCULATION OF MARKUP AND MARGIN

- ACCOUNTING SYSTEM IN NON-PROFIT ORGANIZATIONS

- NON-PROFIT ORGANIZATIONS

- PREPARATION OF FINANCIAL STATEMENTS OF NON-PROFIT ORGANIZATIONS FROM INCOMPLETE RECORDS

- DEPARTMENTAL ACCOUNTS 1

- DEPARTMENTAL ACCOUNTS 2

- BRANCH ACCOUNTING SYSTEMS

- BRANCH ACCOUNTING

- BRANCH ACCOUNTING - STOCK AND DEBTOR SYSTEM

- STOCK AND DEBTORS SYSTEM

- INDEPENDENT BRANCH

- BRANCH ACCOUNTING 1

- BRANCH ACCOUNTING 2

- ESSENTIALS OF PARTNERSHIP

- Partnership Accounts Changes in partnership firm

- COMPANY ACCOUNTS 1

- COMPANY ACCOUNTS 2

- Problems Solving

- COMPANY ACCOUNTS

- RETURNS ON FINANCIAL SOURCES

- IASB’S FRAMEWORK

- ELEMENTS OF FINANCIAL STATEMENTS

- EVENTS AFTER THE BALANCE SHEET DATE

- PROVISIONS, CONTINGENT LIABILITIES AND CONTINGENT ASSETS

- ACCOUNTING POLICIES, CHANGES IN ACCOUNTING ESTIMATES AND ERRORS 1

- ACCOUNTING POLICIES, CHANGES IN ACCOUNTING ESTIMATES AND ERRORS 2

- BORROWING COST

- EXCESS OF THE CARRYING AMOUNT OF THE QUALIFYING ASSET OVER RECOVERABLE AMOUNT

- EARNINGS PER SHARE

- Earnings per Share

- DILUTED EARNINGS PER SHARE

- GROUP ACCOUNTS

- Pre-acquisition Reserves

- GROUP ACCOUNTS: Minority Interest

- GROUP ACCOUNTS: Inter Company Trading (P to S)

- GROUP ACCOUNTS: Fair Value Adjustments

- GROUP ACCOUNTS: Pre-acquistion Profits, Dividends

- GROUP ACCOUNTS: Profit & Loss

- GROUP ACCOUNTS: Minority Interest, Inter Co.

- GROUP ACCOUNTS: Inter Co. Trading (when there is unrealized profit)

- Comprehensive Workings in Group Accounts Consolidated Balance Sheet