|

ACCOUNTING SYSTEM IN NON-PROFIT ORGANIZATIONS |

| << SINGLE ENTRY CALCULATION OF MARKUP AND MARGIN |

| NON-PROFIT ORGANIZATIONS >> |

Advance

Financial Accounting

(FIN-611)

VU

LESSON

# 6

ACCOUNTING

SYSTEM IN NON-PROFIT ORGANIZATIONS

Non

profit organizations like

business entities are also

large, medium and small in

size.

A large organization will be having a

complete accounting system

along with a

full

fledge accounts department

where the double entry

accounting will be followed.

Whereas,

medium or small sized non profit

organization will be maintaining

few

books

of accounts and will not be having proper

accounting system.

Small

size non-profit

organization

We

can observe so many examples of a

small size non-profit

organizations around

us,

the

very commonly understood example will be of a

street library where cash

book

would

have been maintained as the

only book of account and finally a summary

of

that

cash book is prepared at the

end of the year just to

have an overview of the

total

receipts

and payment made during the

year.

Because

of the very simple and few transactions,

its members do not need to know

its

financial

position at the end of each

accounting period therefore

Income &

Expenditure

Account and Balance Sheet is not

prepared.

Large

size non-profit

organization

On

the contrary, member of the

large size organization will be

interested in all

financial

results of the entity and a

proper book-keeping system is

developed over

there.

The outcome of which is production of a

Trial Balance which is used to

prepare

Income

& Expenditure Account and Balance

Sheet.

Medium

size non-profit

organization

Medium

size non-profit organizations

although do not prepare proper

books of

accounts

but need to know the financial

status in terms of surplus

income and

financial

position of the organization.

Fro this purpose; rules of

conversion of single

entry into

the double entry are

followed and finally Income &

Expenditure Account

and

Balance Sheet is

prepared.

Practice

Question

(This

is not difficult at your

level to understand what

appears in debit and

credit

sides

of a trial balance and which

information is put in the

income & expenditure

and

with information relates to

the balance sheet. For

practicing purposes a

solved

problem

is shown hereunder)

From

the following Trial Balance of a

club prepare an Income &

Expenditure Account

for

the year ended on 31st March 2008 and Balance Sheet as on

that date:

26

Advance

Financial Accounting

(FIN-611)

VU

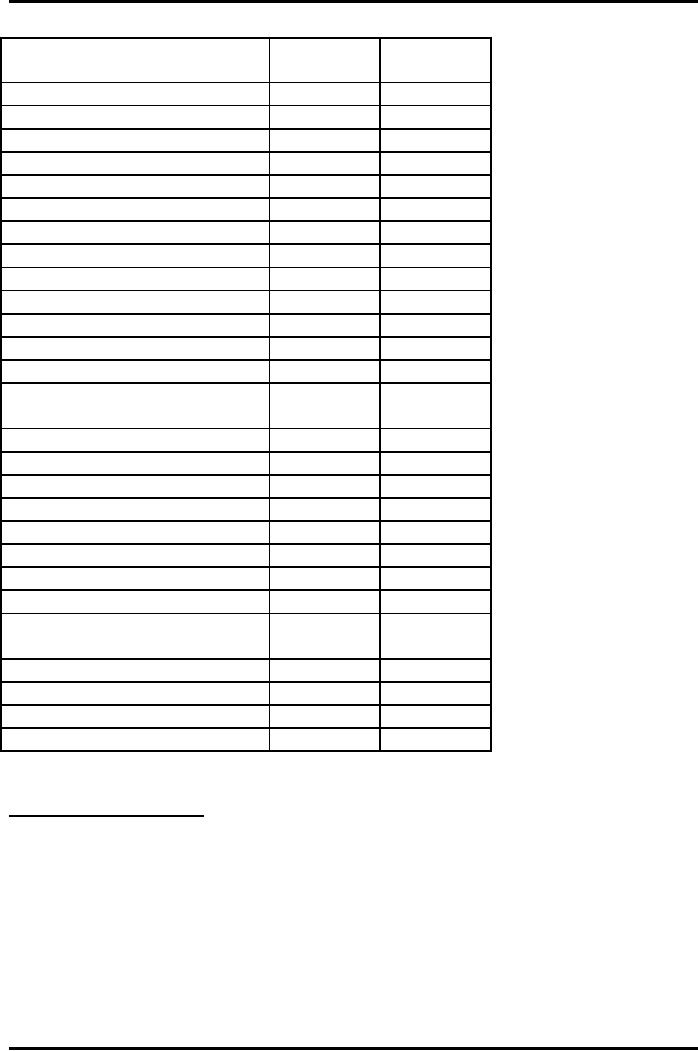

Particulars

Dr.

Cr.

Rupees

Rupees

General

fund

30,000

Cash

in hand

2,000

Cash

at bank

3,000

Sundry

debtors

2,400

Sundry

creditors

1,500

Loan

@ 15% (1-07-2007)

20,000

Furniture

& Fixture

10,000

Building

40,000

Stock

of clod drink

500

Rent

6,000

Rate,

Taxes & Insurance

600

Secretary

Honorarium

1,200

Entrance

fee

1,000

Subscription

received in

1,500

advance

Salaries

& Wages

5,800

Extension

of building

10,000

Printing

& Stationary

1,000

Legal

charges

500

Annual

subscription

30,000

Card

& Billiard room receipts

4,000

Sundry

expenses

1,600

Cold

drink sales

5,000

Repair

of building and

400

furniture

Utility

expenses

1,000

Purchase

of clod drink

4,000

Interest

on Loan

1,000

Total

92,000

92,000

Additional

Information

1.

Subscription for the year

end outstanding Rs.

2,000

2.

Write off depreciation @10%

per annum on furniture and 2% on

building

including

the extension.

3.

Stock of clod drinks Rs.

1,000

27

Advance

Financial Accounting

(FIN-611)

VU

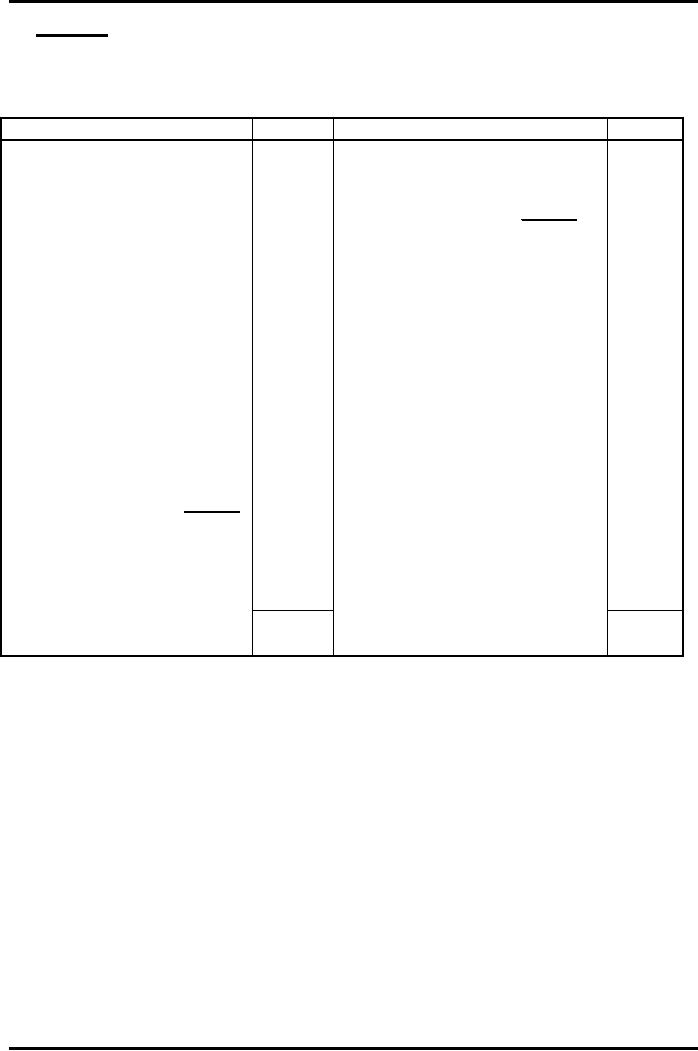

Solution

------

Club

Income

and Expenditure Account

For

the year ended

31.03.2008

Expenditure

Rs.

Income

Rs.

By

Subscriptions

30,000

To

Consumption of

cold

3,500

Add:

Outstanding

2,000

32,000

drink

6,000

To

Rent

600

4,000

By

Card &

Billiard

Room

To

Rates, taxes &

insurance

1,200

Receipts

5,000

To

Secretary's honorarium

1,000

By

Cold Drinks

To

Entrance fees

5,800

To

Salaries & wages

1,000

To

Printing and Stationary

500

To

Legal charges

1,600

To Sundry

expenses

To

Repairs to building and

400

furniture

1,000

To Utility

Bills

To

interest on loan

1,000

Outstanding

Add:

2,250

1,250

2,000

To

Depreciation

14,150

To

Excess of income over

Expenditure

Surplus

41,000

41,000

28

Advance

Financial Accounting

(FIN-611)

VU

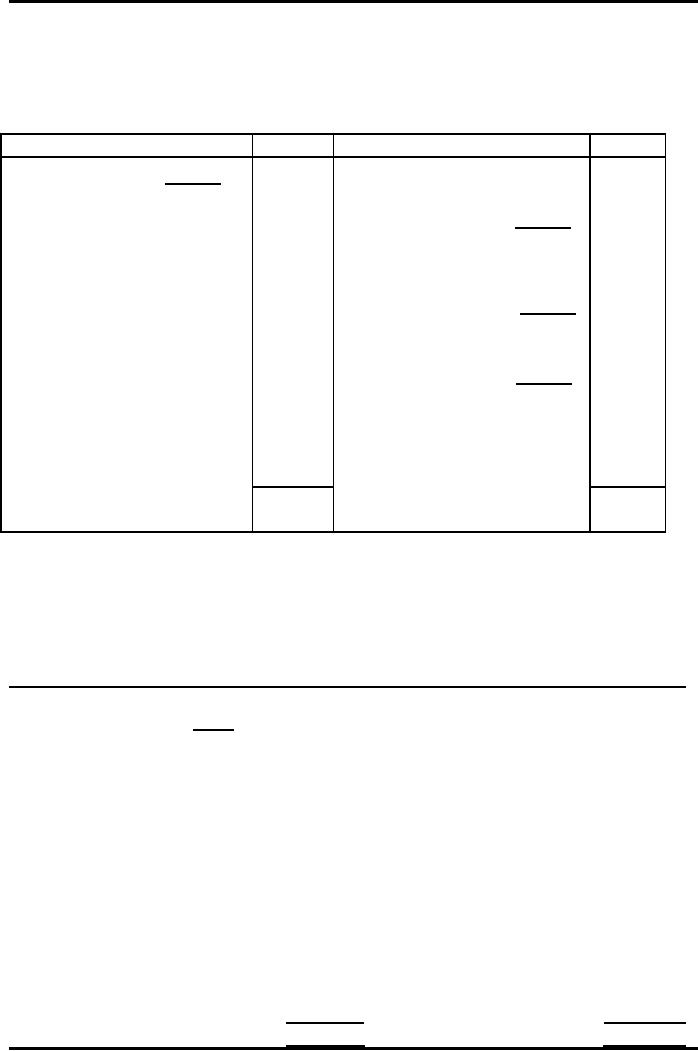

-----

Club

Balance

Sheet

As at

31.03.2008

Liabilities

Rs.

Assets

Rs.

Capital

Fund

30,000

Club

House

40,000

Add:

Surplus

14,150

44,150

Add:

Extension

10,000

Sundry

Creditors

1,500

50,000

15%

Loan

20,000

Less:

Depreciation

1,000

49,000

Interest

on

Loan

1,250

(Outstanding)

Furniture

&

Fixture

10,000

Subscriptions

received in

1,500

9,000

Less

: Depreciation 1,000

advance

Stock

in hand:

Cigars

400

1,000

Wine

600

2,400

Sundry

Debtors

2,000

Subscription

due

3,000

Cash

at Bank

2,000

Cash

in hand

68,400

68,400

Q2.

Given

below is the receipts and

payments account of Hameed

Amusement Club:

Receipts

and Payments

Account

For

the year ended 31st

December, 2007

Receipts

Rs.

Payments

Rs.

Balance

Cash

260

Salary

of secretary

2,600

Bank

3,000

3,260

Subscription

8,000

Honorarium

350

(including

subscription for 2005

Rs.

150)

Sale

of old furniture on Jan 1,

750

Wages

3,400

2006

Sale

of old newspapers

80

Charities

1,500

Legacies

3,500

Printing

and stationery

400

Interest

on investments

1,200

Postage

100

(cost

of investment Rs.

20,000)

Endowment

fund receipts

10,000

Rent

and taxes

1,400

Proceeds

of concerts

800

Upkeep

of land

500

Advertisement

in year book

40

Sports

material

2,500

Balance

14,850

27,900

27,900

29

Advance

Financial Accounting

(FIN-611)

VU

Current

assets and liabilities as on 31st

December, 2006 and 31st December, 2007

are as

follows:

31.12.2006

31.12.2007

Rs.

Rs.

Subscription

in arrears

250

475

Subscription

in advance

310

620

Furniture

2,000

1,080

Depreciation

was 15% p.a. on the

furniture left after selling a

part of it. It was

decided

that

half of the legacies may be

capitalized.

Required:

Prepare

income and expenditure

account for the year

ending 31st December, 2007

and

balance sheet as on that

date.

You

are also required to show

calculations for the loss on

sale of furniture.

30

Table of Contents:

- ACCOUNTING FOR INCOMPLETE RECORDS

- PRACTICING ACCOUNTING FOR INCOMPLETE RECORDS

- CONVERSION OF SINGLE ENTRY IN DOUBLE ENTRY ACCOUNTING SYSTEM

- SINGLE ENTRY CALCULATION OF MISSING INFORMATION

- SINGLE ENTRY CALCULATION OF MARKUP AND MARGIN

- ACCOUNTING SYSTEM IN NON-PROFIT ORGANIZATIONS

- NON-PROFIT ORGANIZATIONS

- PREPARATION OF FINANCIAL STATEMENTS OF NON-PROFIT ORGANIZATIONS FROM INCOMPLETE RECORDS

- DEPARTMENTAL ACCOUNTS 1

- DEPARTMENTAL ACCOUNTS 2

- BRANCH ACCOUNTING SYSTEMS

- BRANCH ACCOUNTING

- BRANCH ACCOUNTING - STOCK AND DEBTOR SYSTEM

- STOCK AND DEBTORS SYSTEM

- INDEPENDENT BRANCH

- BRANCH ACCOUNTING 1

- BRANCH ACCOUNTING 2

- ESSENTIALS OF PARTNERSHIP

- Partnership Accounts Changes in partnership firm

- COMPANY ACCOUNTS 1

- COMPANY ACCOUNTS 2

- Problems Solving

- COMPANY ACCOUNTS

- RETURNS ON FINANCIAL SOURCES

- IASB’S FRAMEWORK

- ELEMENTS OF FINANCIAL STATEMENTS

- EVENTS AFTER THE BALANCE SHEET DATE

- PROVISIONS, CONTINGENT LIABILITIES AND CONTINGENT ASSETS

- ACCOUNTING POLICIES, CHANGES IN ACCOUNTING ESTIMATES AND ERRORS 1

- ACCOUNTING POLICIES, CHANGES IN ACCOUNTING ESTIMATES AND ERRORS 2

- BORROWING COST

- EXCESS OF THE CARRYING AMOUNT OF THE QUALIFYING ASSET OVER RECOVERABLE AMOUNT

- EARNINGS PER SHARE

- Earnings per Share

- DILUTED EARNINGS PER SHARE

- GROUP ACCOUNTS

- Pre-acquisition Reserves

- GROUP ACCOUNTS: Minority Interest

- GROUP ACCOUNTS: Inter Company Trading (P to S)

- GROUP ACCOUNTS: Fair Value Adjustments

- GROUP ACCOUNTS: Pre-acquistion Profits, Dividends

- GROUP ACCOUNTS: Profit & Loss

- GROUP ACCOUNTS: Minority Interest, Inter Co.

- GROUP ACCOUNTS: Inter Co. Trading (when there is unrealized profit)

- Comprehensive Workings in Group Accounts Consolidated Balance Sheet