|

SINGLE ENTRY CALCULATION OF MARKUP AND MARGIN |

| << SINGLE ENTRY CALCULATION OF MISSING INFORMATION |

| ACCOUNTING SYSTEM IN NON-PROFIT ORGANIZATIONS >> |

Advance

Financial Accounting

(FIN-611)

VU

LESSON

# 5

SINGLE

ENTRY

CALCULATION

OF MARKUP AND MARGIN

Cost

Structure

Cost

structure stands for the

percentage structure of Sales Revenue,

Cost of Goods

Sold

and Gross profit. Through cost

structure percentage of gross

profit is determined

over

the cost of goods sold and

over the sales revenue. It

can be expressed in

equation

like

this:

Sales

Revenue

Sales

Less

Cost

of Goods Sold

or

COGS

GP

Gross

profit

Markup

rate

Markup

rate is the rate of gross

profit over the cost of

goods sold, it is expressed

in

%age

and it is formulated like

this:

G P

x100 = %

COGS

In

calculating markup rate the

cost of goods sold is kept

equal to 100%. Suppose

the

markup

rate is 25% then the cost

structure in markup will be like

this:

Sales

125%

COGS

100%

GP

25%

Margin

rate

Margin

rate is the rate of gross

profit over the sales

revenue, it is expressed in

%age

and it is

formulated like this:

G P

x100 = %

Sales

In

calculating margin rate the

sales revenue is kept equal

to 100%. Suppose the

margin

rate

is 25% then the cost

structure in markup will be like

this:

Sales

100%

COGS

75%

25%

GP

These

markup/margin rates are used in

calculating gross profit or

cost of goods sold

or

even sales, it will all depend upon

the scenario. For

example:

19

Advance

Financial Accounting

(FIN-611)

VU

Scenario

I

Sales

Rs. 80,000

Purchases

(to be found)

Opening

Stock Rs. 6,000

Closing

Stock Rs. 2,000

Whereas

goods are sold at a markup of

25%

Solution

Scenario I

The

cost structure is like

this:

Sales

125%

COGS

100%

GP

25%

Gross

Profit = 80,000 x 25 = 16,000

125

Cost

of goods sold = Sales Gross

profit

=

80,000 16,000

=

64,000

Direct

calculation of Cost of goods

sold

= 80,000 x 100 =

64,000

125

Rs.

Opening

Stock (given)

=

6,000

Purchases

(balancing figure)

=

60,000

Cost

available for sale

=

66,000

Closing

Stock (given)

=

2,000

Cost

of goods sold

(calculated)

=

64,000

Scenario

II

Sales

(to be found)

Purchases

Rs. 155,000

Opening

Stock Rs. 10,000

Closing

Stock Rs. 15,000

Whereas

goods are sold at a margin

of 25%

Solution

Scenario II

The

cost structure is like

this:

Sales

100%

COGS

75%

GP

25%

Cost

of goods sold =

Opening

stock 10,000

Purchases

155,000

Closing

stock 15,000

150,000

Gross

Profit = 150,000 x 25 = 50,000

75

Sales =

Cost of goods sold + Gross

profit

20

Advance

Financial Accounting

(FIN-611)

VU

= 150,000 +

50,000

=

200,000

Direct

calculation of Sales

=150,000

x 100 = 200,000

75

ACCOUNTING

FOR NON-PROFIT ORGANIZATIONS

Introduction

Accounting

is a language to communicate and

understand financial

information,

every

organization, whether involve in business

or non business activities,

needs

accounting

to get financial

reports.

Non

profit organizations are not

involved in complex transactions

like trading of

goods

or services and manufacturing activities

therefore a very simple

accounting

system

can work.

Mainly

these organizations are

engaged in welfare activities or

the activities that

will

entertain

its members specifically and

others in general. A very commonly

understood

example

of such organizations is mosque or

church. Almost all of us use to

visit our

worship

place frequently and can

understand very easily that it is an

organization

where

we can have examples of

assets, liabilities, incomes and

expenses as well.

But

remember non profit organizations do not

have owner's equity because

these are

not owned by any

one rather a managing

committee looks after all

affairs of the

organization.

Therefore there is no question of

owner's equity in the

financial

information

of non profit organizations.

Accounting

Records

Cash

book is prepared in a chronological

sequence; it is the only book of

original entry

that

is maintained by the accountant of a non

profit organization. At the

end of the

accounting

year a summary of total cash

receipts and total cash

payments is made

under

different heads, such summary is known as

Receipt and Payment

Account.

Cash

book will contain subscription

received on different dates during

the year where

as

the Receipt and Payment

Account will contain a single amount of

total subscription

received

during the year. Similarly

cash book contains payment

of salaries made on

different

dates of the year, whereas,

the Receipt and Payment

Account will show the

total

salaries paid during the

year as a single

information.

Memorandum

Records

A non

profit organization that has

a large number of members will also

maintain a

memorandum

record of members, and if that

organization is running activities

like

providing

medicines or providing library

facilities or running a sports club then

it will

also

be maintaining memorandum record for

the inventory items.

Financial

Statements

Non

profit organizations prepare

Income

and Expenditure Account

that

replaces

Income

Statement of a business concerns to

obtain surplus (excess of

incomes over the

expenses)

or deficit (excess of expenses

over the incomes).

Incomes

of a non profit

organization

Incomes

of a non profit organization mainly

include the

following:

21

Advance

Financial Accounting

(FIN-611)

VU

o Subscription

o Donation

o Entrance

fee

o Lockers

rent

o Membership

fee etc. etc.

All

these incomes are measured

according to the accrual

concept. Actual receipts

of

these

incomes are recorded in the

Cash Book and ultimately

become part of the

Receipt

and Payment account. Such

receipts are then adjusted with

the opening and

closing

owing/advance income to get

the balance of income that

belongs to the

current

accounting period.

For

example:

Rs.

55,000 subscription received during the

year ending on December 31

20x7 of which

Rs

5,000 relate to the

subscription due in the year

20x6 and Rs. 2,000 was

received in

advance

that was relating to the

year 20x8. Rs. 3,000

subscription of few members

was

received

in advance during the year

20x6 and Rs. 4,000

subscription relating to

the

year

20x7 is still due to be

received.

Rupees

Cash

received during the year

20x7

55,000

Less

Cash received not related to

year 20x7 (5,000 +

2,000)

7,000

Add

Income relating to the year

20x7 (3,000 + 7,000)

10,000

Subscription

income for the year

20x7

58,000

Subscription

(Income) Account

Debit

Rupees

Credit

Rupees

Opening

Due

5,000

Opening Advance

3,000

Closing

Advance

2,000

Cash Received

55,000

Income

(balancing figure)

58,000

Closing Due

7,000

Expenses

of a non profit

organization

Expenses

are also measured according

to the accrual concept. All

revenue

expenditures

appearing in the payment

side of the Cash Book

(Receipt and Payment

Account)

are adjusted with the

opening and closing balances of

outstanding and

prepaid

expenses. This process of

adjustment converts the

revenue payments in

expenses.

Such expenses are ultimately

matched with the Incomes to

calculate

surplus/deficit.

Balance

Sheet is

prepared to know the financial

position in the same way as

we

already

have studied for business

entities. The only difference in the

balance sheet of a

non

profit organization comparing with

the balance sheet of a

business entity is

that

there

will be no owner's equity instead

there will be a balance of accumulated

fund

also

known as capital fund in the balance

sheet of a non profit organization as a

main

source

of finance.

Accumulated

Fund

Like

owner's equity, accumulated fund is

also a difference of Assets and

Liabilities.

22

Advance

Financial Accounting

(FIN-611)

VU

Accumulated

Fund = Assets

Liabilities

Accumulated

fund represents the funds that

are the source of the

Assets obtained or

constructed

for the organization. These funds

consist of grants, donations,

legacies,

entry

fees, life membership fees

etc.

Often in

the examination questions

Statement of Affairs is prepared to

find the opening

balance

of

accumulated fund.

Practice

Questions

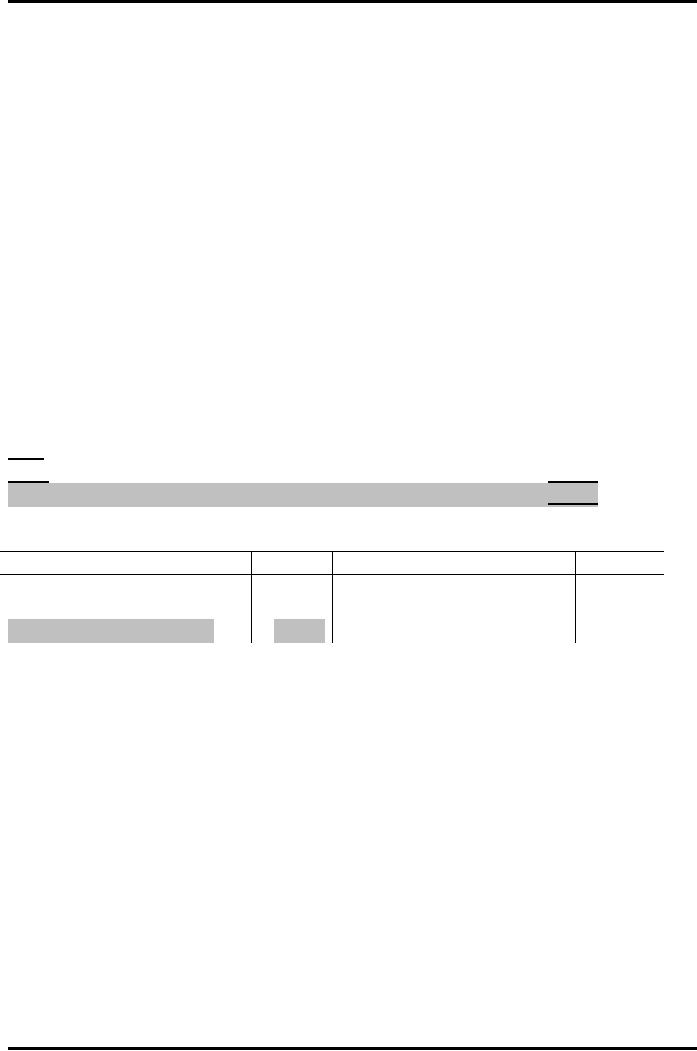

Q.

1

Following

balances were disclosed by

the books of Ali Shah

Traders where the

books

of

accounts were maintained on

single entry accounting

system:

31.12

2007

31.12.2008

Rupees

Rupees

Cash

at Bank

3,000

19,100

Cash

in hand

400

850

Stocks

22,000

25,000

Debtors

?

35,000

Creditors

23,400

18,500

Fixtures

and fittings

2,000

Motor

Car

1,000

Cash

Book analysis showed

following figures amongst

others:

Rupees

Rupees

Receipts

from customers 135,000

Motor

car repair

1,350

Discount

allowed

1,400

Printing

and stationery

800

Fresh

capital on 1.7.2008

2,000

Drawings

6,600

Salaries

upto 30.11.2008

11,000

Payments

to creditors

112,000

Office

rent upto 30.11.2008

2,200

Discount

received

1,200

Advertising

900

Electricity

charges

1,000

General

expenses

600

No

ready figures are available

for total sales but Ali Shah

maintains a steady

gross

profit

rate of 25% on sales.

There

were outstanding bills for

electricity Rs. 250,

Advertising Rs. 150, and

printing

Rs.

450. Provide for doubtful debts upto 5%

of the debtors. Motor car and

fixtures are

to be

depreciated by 20% and 10%

respectively.

Prepare

Income Statement for the

year ended 31-12-2008 and

Balance Sheet as on

that

date.

Hints:

1.

Calculate purchases as balancing

figure in creditors

account

2.

Calculate cash sales as

balancing figure in the cash

book

3.

Calculate total sales with

the help of cost

structure

4.

Calculate credit sales by

subtracting cash sales from

the total sales

5.

Calculate opening debtors

balance as balancing figure in

debtors account

6. Calculate

opening capital from the

statement of affairs

23

Advance

Financial Accounting

(FIN-611)

VU

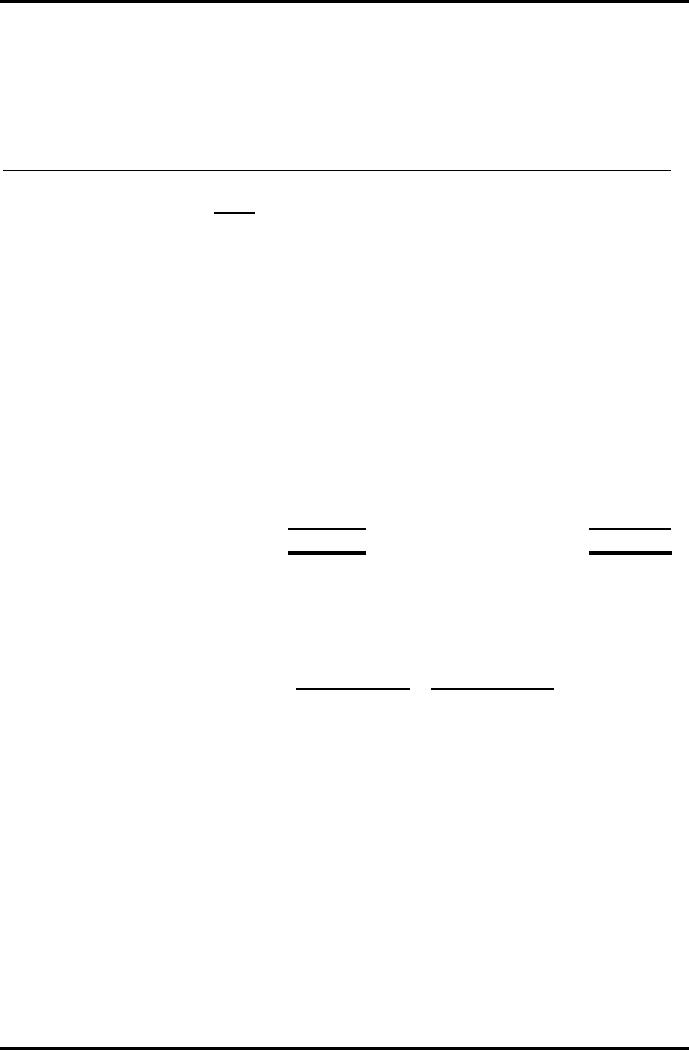

Q2.

Given

below is the receipts and

payments account of Hameed

Amusement Club:

Receipts

and Payments

Account

For

the year ended 31st

December, 2006

Receipts

Rs.

Payments

Rs.

Salary

of secretary

3,600

Balance

Cash

60

Bank

3,000

3,060

Subscription

9,000

Honorarium

450

(including

subscription for

2005

Rs. 150)

Sale

of old furniture on Jan 1,

750

Wages

2,400

2006

Sale

of old newspapers

50

Charities

2,000

Legacies

3,000

Printing

and

300

stationery

Interest

on investments

1,200

Postage

100

(cost

of investment Rs.

20,000)

Endowment

fund receipts

10,000

Rent

and taxes

1,200

Proceeds

of concerts

800

Upkeep

of land

500

Advertisement

in year book

40

Sports

material

2,500

Balance

14,850

27,900

27,900

Current

assets and liabilities as on 31st

December, 2005 and 31st December, 2006

are as

follows:

31.12.2005

31.12.2006

Rs.

Rs.

Subscription

in arrears

200

450

Subscription

in advance

300

600

Furniture

2,000

1,080

Depreciation

was 10% p.a. on the

furniture left after selling a

part of it. It was

decided

that

half of the legacies may be

capitalized.

24

Advance

Financial Accounting

(FIN-611)

VU

Required:

Prepare

income and expenditure account for

the year ending 31st

December, 2006 and

balance

sheet as on that

date.

You

are also required to show

calculations for the loss on

sale of furniture.

Answers

(Excess

of expenditure over income

Rs. 630, Balance Sheet

total Rs. 36,430,

Capital

fund

in the beginning Rs. 24,960,

Loss on sale of furniture

Rs. 50).

25

Table of Contents:

- ACCOUNTING FOR INCOMPLETE RECORDS

- PRACTICING ACCOUNTING FOR INCOMPLETE RECORDS

- CONVERSION OF SINGLE ENTRY IN DOUBLE ENTRY ACCOUNTING SYSTEM

- SINGLE ENTRY CALCULATION OF MISSING INFORMATION

- SINGLE ENTRY CALCULATION OF MARKUP AND MARGIN

- ACCOUNTING SYSTEM IN NON-PROFIT ORGANIZATIONS

- NON-PROFIT ORGANIZATIONS

- PREPARATION OF FINANCIAL STATEMENTS OF NON-PROFIT ORGANIZATIONS FROM INCOMPLETE RECORDS

- DEPARTMENTAL ACCOUNTS 1

- DEPARTMENTAL ACCOUNTS 2

- BRANCH ACCOUNTING SYSTEMS

- BRANCH ACCOUNTING

- BRANCH ACCOUNTING - STOCK AND DEBTOR SYSTEM

- STOCK AND DEBTORS SYSTEM

- INDEPENDENT BRANCH

- BRANCH ACCOUNTING 1

- BRANCH ACCOUNTING 2

- ESSENTIALS OF PARTNERSHIP

- Partnership Accounts Changes in partnership firm

- COMPANY ACCOUNTS 1

- COMPANY ACCOUNTS 2

- Problems Solving

- COMPANY ACCOUNTS

- RETURNS ON FINANCIAL SOURCES

- IASB’S FRAMEWORK

- ELEMENTS OF FINANCIAL STATEMENTS

- EVENTS AFTER THE BALANCE SHEET DATE

- PROVISIONS, CONTINGENT LIABILITIES AND CONTINGENT ASSETS

- ACCOUNTING POLICIES, CHANGES IN ACCOUNTING ESTIMATES AND ERRORS 1

- ACCOUNTING POLICIES, CHANGES IN ACCOUNTING ESTIMATES AND ERRORS 2

- BORROWING COST

- EXCESS OF THE CARRYING AMOUNT OF THE QUALIFYING ASSET OVER RECOVERABLE AMOUNT

- EARNINGS PER SHARE

- Earnings per Share

- DILUTED EARNINGS PER SHARE

- GROUP ACCOUNTS

- Pre-acquisition Reserves

- GROUP ACCOUNTS: Minority Interest

- GROUP ACCOUNTS: Inter Company Trading (P to S)

- GROUP ACCOUNTS: Fair Value Adjustments

- GROUP ACCOUNTS: Pre-acquistion Profits, Dividends

- GROUP ACCOUNTS: Profit & Loss

- GROUP ACCOUNTS: Minority Interest, Inter Co.

- GROUP ACCOUNTS: Inter Co. Trading (when there is unrealized profit)

- Comprehensive Workings in Group Accounts Consolidated Balance Sheet