|

Comprehensive Workings in Group Accounts Consolidated Balance Sheet |

| << GROUP ACCOUNTS: Inter Co. Trading (when there is unrealized profit) |

Advance

Financial Accounting

(FIN-611)

VU

LESSON

# 45

GROUP

ACCOUNTS

Comprehensive

Workings in Group

Accounts

Consolidated

Balance Sheet

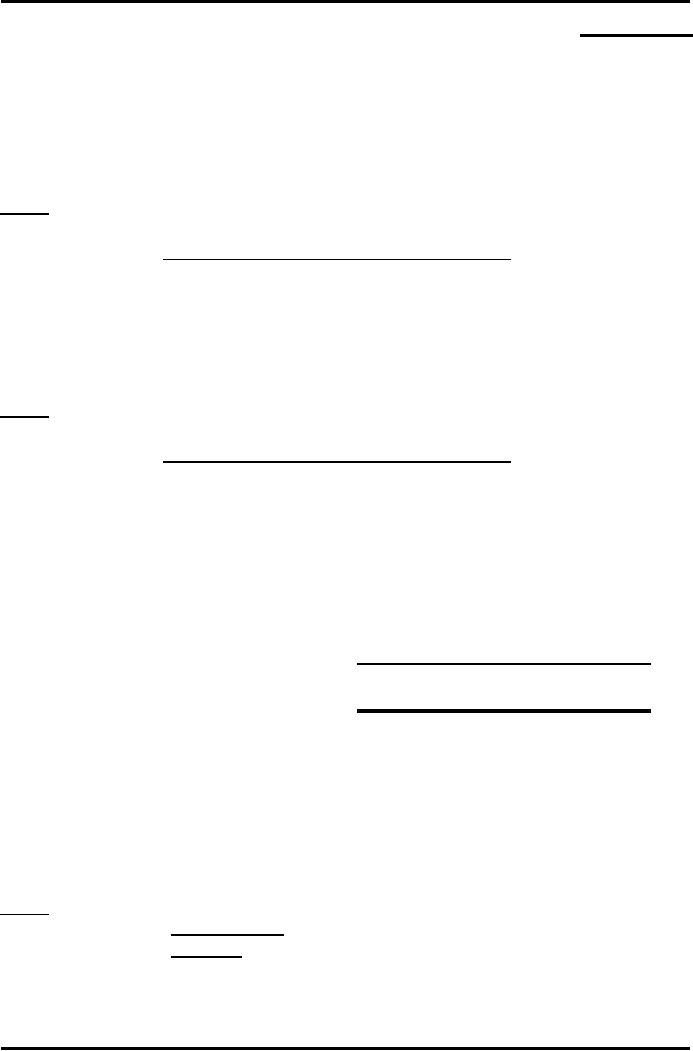

W-

1

Number of

ordinary shares of S Co

acquired

by P Co

x 100 =

%

H%

Total

number of ordinary shares in S Co

100 - H%

=

MI%

MI%

W-

2

Analysis

of equity of S Co for pre and

post

acquisition

Post-

Pre-acquisition

acquisition

All

Nil

Ordinary

share capital

on

the date of

after

the date

acquisition

of

acquisition

Reserves

All

Nil

Fair

value adjustment

Total

H% of

total

Parent's

share

Parent's

share

Minority's

MI% of

total

Minority's

share

share

W-

3

Calculation

of

Goodwill

Rs.

Costo

fo investment in S Co's

ordinary

shares

*****

less

Dividend received out of

the

*****

237

Advance

Financial Accounting

(FIN-611)

VU

preacquisition

profits

*****

Pre-acquistion

fair value of net assets

(owners' equity) of S Co

x

H%

*****

Goodwill

*****

less

Impairment

loss

(****)

Goodwill to be

presented in consolidated balance

sheet

*****

W-

4

Calculation

of Group

Reserves

Reserves

of Parent Co

All

add

Post acquisition equity of S Co to

the extent of H%

*****

less

Un-realized profit (if intra group

sale

from P to

S)

(All)

less

Un-realized profit (if intra group

sale from S to P) to the

extent

of H%

(****)

less

depreciation effect on fair

vale adjustment to the

extent of

H%

(****)

less

impairment loss of

goodwill

(****)

*****

W-

5

Calculation

of

Minority

Interest

Owners'

equity of S Co

All

add

Fair value Adjustment

All

less

URP (incase of intra group

sale from S

to

P)

(All)

less

Depreciation effect on fair

value

adjustment

(All)

Total

value

Total

Minority

Interest

=

Total

x MI%

Calculations

specific to the

scenario

238

Advance

Financial Accounting

(FIN-611)

VU

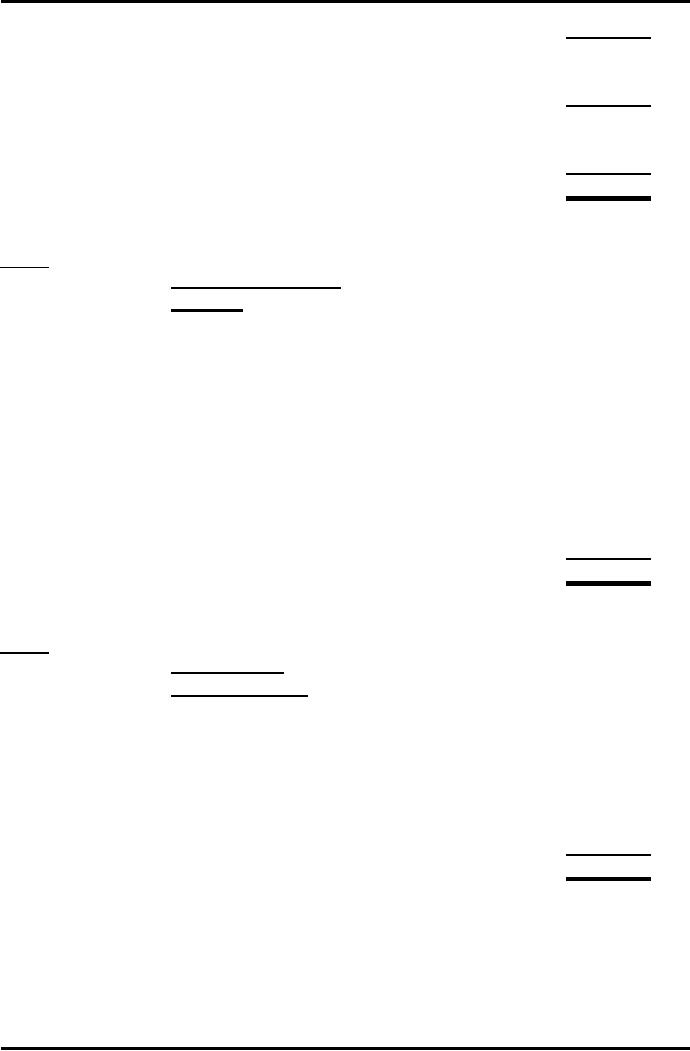

Scenario

Action

1

Intra group

loans

To be

cancelled

To be

cancelled and

balance

if any to be shown

Intra group

current

2

as

goods in transit or

cash

accounts

in

transit, as the case

may

be.

To be

cancelled to the

extent

of H%, the balance

Intra

group

3

to be shown in

the

dividend

consolidated

balance sheet

as

payable to Minority

To be

added in the group

4

Negative

goodwill

reserve

Reserves

as on the

opening

date of the year in

which

the S Co was

During

the year acquisition of S

Co

acquired

+ profit for the

5

and

calculation fo pre

acquisition

year

in which the S Co

reserves

was

acuired to the extend

of

the number of months

remained

in the group's

acquisition

Consolidated

Income Statement

W-

1

Calculation

of opening balance of

group's

retained

profits

Opening

balance of Retained profits of P

Co

All

add

Post acquisition opening

balance of retained profits of

S

Co x

H%

*****

less

Goodwill imapirment

loss

(****)

*****

W-

2

Calculation

of

Minority

Interest

Profit

after tax of S Co.

*****

less

Un-realized profit (if intra group

sales

from S to

P)

(****)

Net/Total

*****

239

Advance

Financial Accounting

(FIN-611)

VU

Net/Total amount

x MI% =

Minority

Interest

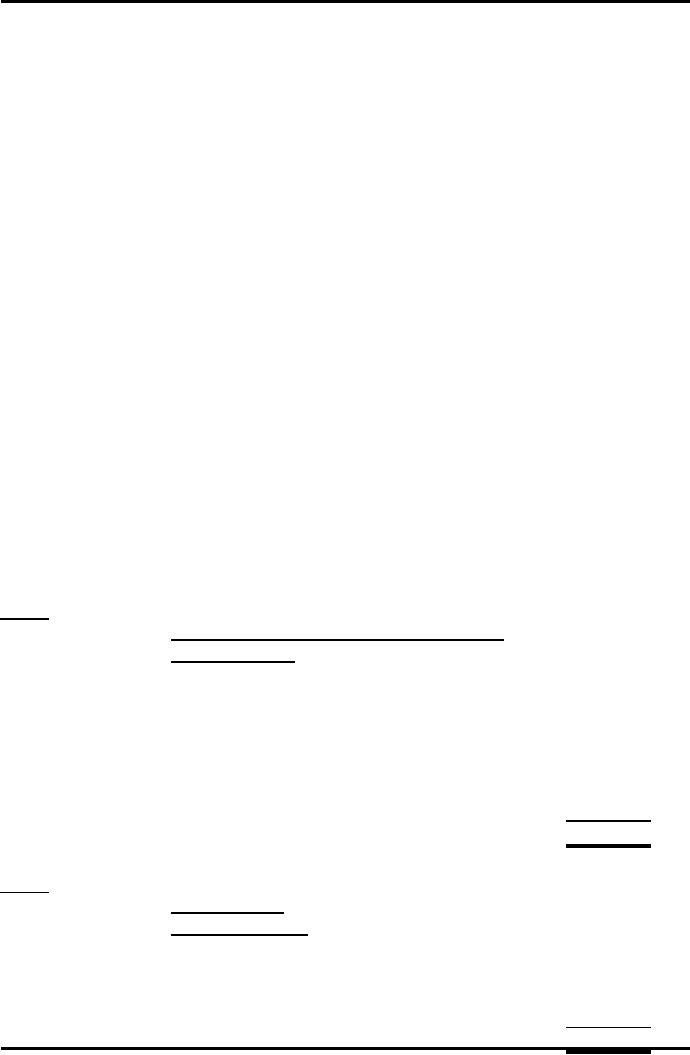

Calculations

specific to the

scenario

To be

cancelled. TIP:

All

amount

of

dividend paid by the S Co

will

Intra

group

be

eliminated only the amount of

1

dividend

dividend

paid by the P Co will

appear

in the

Consolidated

Income

Statement

Deduct

the same amount from

the

sales

and also from the cost

of

2

Intra group

trading

goods

sold in the

consolidated

income

statement

Add in

the cosolidated cost

of

goods

sold and subtract from

the

profit

after tax of S Co

before

applying

MI% to

calculate

3

Unrealized

profits

Minority

interest (only when the

intra

group trading is from S to P)

If it is

intra group trading from P

to S then do

nothin for Minority

Interest

calculation

240

Table of Contents:

- ACCOUNTING FOR INCOMPLETE RECORDS

- PRACTICING ACCOUNTING FOR INCOMPLETE RECORDS

- CONVERSION OF SINGLE ENTRY IN DOUBLE ENTRY ACCOUNTING SYSTEM

- SINGLE ENTRY CALCULATION OF MISSING INFORMATION

- SINGLE ENTRY CALCULATION OF MARKUP AND MARGIN

- ACCOUNTING SYSTEM IN NON-PROFIT ORGANIZATIONS

- NON-PROFIT ORGANIZATIONS

- PREPARATION OF FINANCIAL STATEMENTS OF NON-PROFIT ORGANIZATIONS FROM INCOMPLETE RECORDS

- DEPARTMENTAL ACCOUNTS 1

- DEPARTMENTAL ACCOUNTS 2

- BRANCH ACCOUNTING SYSTEMS

- BRANCH ACCOUNTING

- BRANCH ACCOUNTING - STOCK AND DEBTOR SYSTEM

- STOCK AND DEBTORS SYSTEM

- INDEPENDENT BRANCH

- BRANCH ACCOUNTING 1

- BRANCH ACCOUNTING 2

- ESSENTIALS OF PARTNERSHIP

- Partnership Accounts Changes in partnership firm

- COMPANY ACCOUNTS 1

- COMPANY ACCOUNTS 2

- Problems Solving

- COMPANY ACCOUNTS

- RETURNS ON FINANCIAL SOURCES

- IASB’S FRAMEWORK

- ELEMENTS OF FINANCIAL STATEMENTS

- EVENTS AFTER THE BALANCE SHEET DATE

- PROVISIONS, CONTINGENT LIABILITIES AND CONTINGENT ASSETS

- ACCOUNTING POLICIES, CHANGES IN ACCOUNTING ESTIMATES AND ERRORS 1

- ACCOUNTING POLICIES, CHANGES IN ACCOUNTING ESTIMATES AND ERRORS 2

- BORROWING COST

- EXCESS OF THE CARRYING AMOUNT OF THE QUALIFYING ASSET OVER RECOVERABLE AMOUNT

- EARNINGS PER SHARE

- Earnings per Share

- DILUTED EARNINGS PER SHARE

- GROUP ACCOUNTS

- Pre-acquisition Reserves

- GROUP ACCOUNTS: Minority Interest

- GROUP ACCOUNTS: Inter Company Trading (P to S)

- GROUP ACCOUNTS: Fair Value Adjustments

- GROUP ACCOUNTS: Pre-acquistion Profits, Dividends

- GROUP ACCOUNTS: Profit & Loss

- GROUP ACCOUNTS: Minority Interest, Inter Co.

- GROUP ACCOUNTS: Inter Co. Trading (when there is unrealized profit)

- Comprehensive Workings in Group Accounts Consolidated Balance Sheet