|

GROUP ACCOUNTS: Minority Interest, Inter Co. |

| << GROUP ACCOUNTS: Profit & Loss |

| GROUP ACCOUNTS: Inter Co. Trading (when there is unrealized profit) >> |

Advance

Financial Accounting

(FIN-611)

VU

LESSON

# 43

GROUP

ACCOUNTS

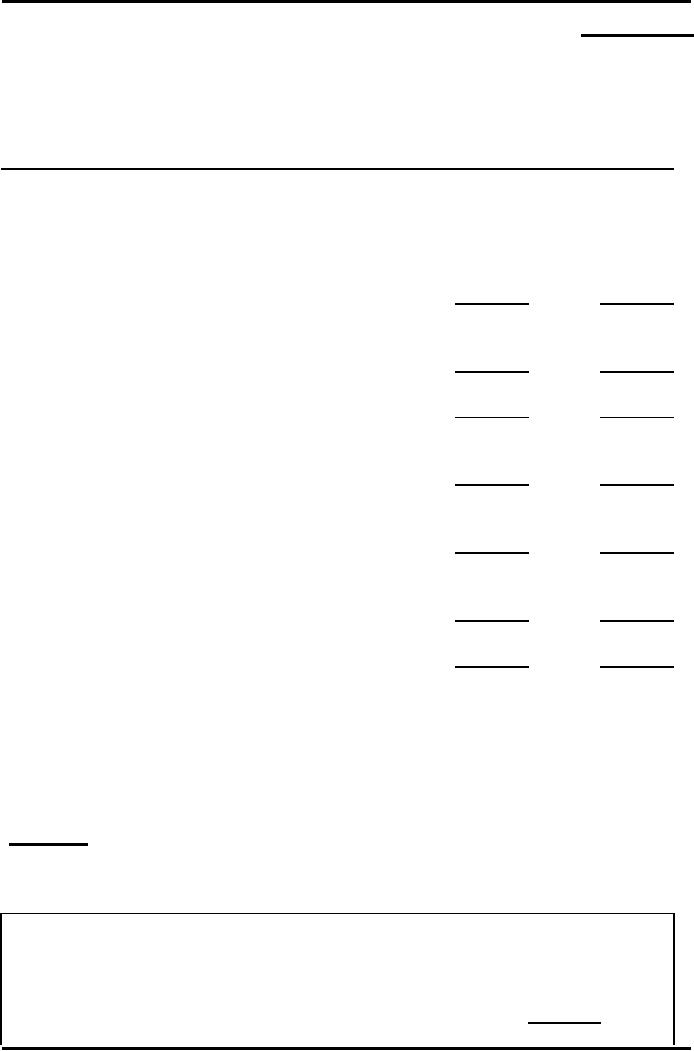

Example

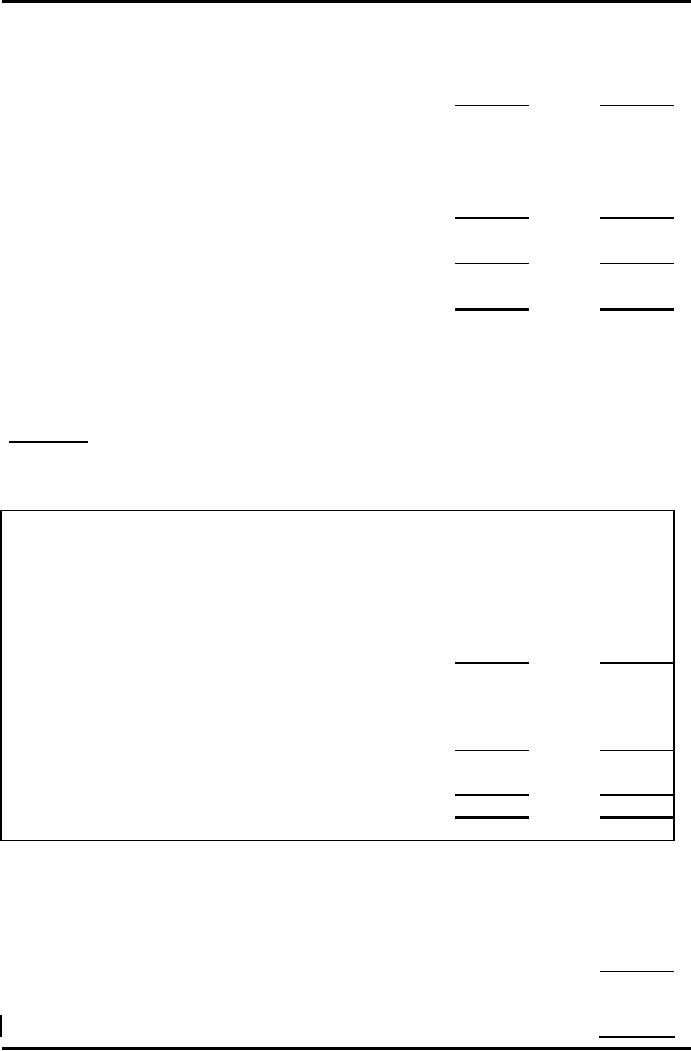

- [ Case v ] Minority Interest, Inter

Co.

Dividends

Income

Statement for the year ended

31st December 2008

P

S

Rs.

Rs.

Sales

7,500

4,000

Cost

of Goods

Sold

(4,500)

(2,900)

Gross

Profit

3,000

1,100

Operating

Expenses

(1,800)

(600)

Operating

Profit

1,200

500

Dividend

Income

100

Net

Profit before

Tax

1,300

500

Income

Tax

(520)

(200)

Net

Profit after

Tax

780

300

Dividend

Paid

(250)

(125)

530

175

Retained

Profits

b/f

1,000

450

Retained

Profits

c/f

1,530

625

The

Parent Co. (P) acquired

80% equity of the Subsidary

Co. (S) on 1st

January

2003 for

Rs.1,700 when S's paid up

share capital was Rs.1,250

& it's reserves

were

worth

Rs.50. (Assume all reserves

comprise only of Retained Profits).

Total

amount of

goodwill has been

impaired

Prepare

the Consolidated Income

Statement for the

year

Required:

ended 31/12/2008.

Solution

- [ Case v ]

Computation

of Goodwill

Rs.

Rs.

Cost of

Acquisition

1,700

Ordinary

Share Capital of S

80%

of Rs.1,250

1,000

Pre-acquisition

Retained Profits of S

80%

of Rs.50

40

(1,040)

660

227

Advance

Financial Accounting

(FIN-611)

VU

Goodwill

totally impaired

(660)

0

Computation

of opening balance of Group's Retained

Profits

Rs.

Rs.

Total

amount of opening balance of retained

profits of P Co

1,000

Post

acquisition part in opening balance of

retained profits of S Co

opening

balance of retained profits

of

S

Co

450

pre-acquisition

retained

profits

-50

to the

extent of H%

i.e.80%

400

320

Opening

balance of Group's Retained

Profits b/f

1,320

Goodwill

impairment loss

(660)

660

Computation

of Minority Interest

Rs.

Profits

after tax of S Co. to the

extent of MI%

20%

of Rs.300

60

Consolidated

Income Statement

For

the year ended 31st December

2008

Rs.

Sales

11,500

Cost of

Goods Sold

(7,400)

Gross

Profit

4,100

Operating

Expenses

(2,400)

Operating

Profit

1,700

Income

Tax

(720)

Net

Profit after Tax

980

Minority

Interest

(60)

920

Dividend

Paid

(250)

670

Retained

Profits b/f

660

Retained

Profits c/f

1,330

Note:

In

consolidated income statement

the amount of dividend paid by

the

S

Co. is completely eleminated, only

the amount of dividend paid

by

the

P Co is shown.

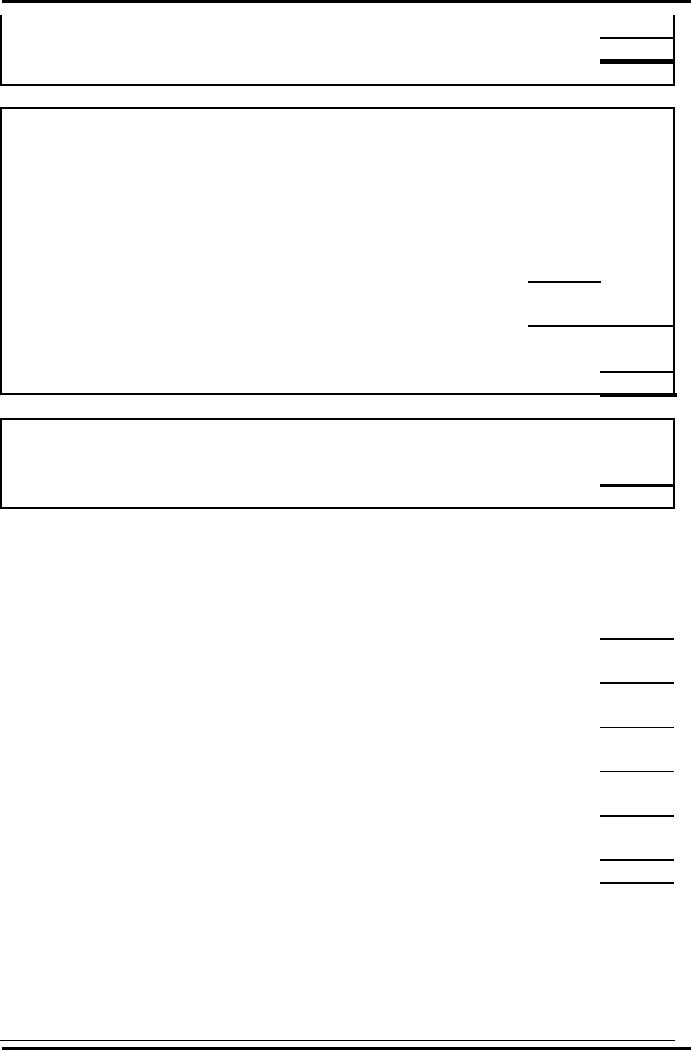

Example

- [ Case vi ] Inter Co. Trading

(when there is no

URP)

228

Advance

Financial Accounting

(FIN-611)

VU

Income

Statement for the year ended

31st December 2008

P

S

Rs.

Rs.

Sales

7,500

4,000

Cost

of Goods

Sold

(4,500)

(2,900)

Gross

Profit

3,000

1,100

Operating

Expenses

(1,800)

(600)

Operating

Profit

1,200

500

Dividend

Income

100

1,300

500

Income

Tax

(520)

(200)

Net

Profit after

Tax

780

300

Preference

Dividend

Ordinary

Dividend

250

125

Dividend

Paid

(250)

(125)

530

175

Retained

Profits

b/f

1,000

450

Retained

Profits

c/f

1,530

625

The

Parent Co. (P) acquired

80% equity of the Subsidary

Co. (S) on 1st

January

2003 for

Rs.1,700 when S's paid up

share capital was Rs.1,250

& it's reserves

were

worth

Rs.50. During the year S

sold to P goods costing

Rs.1,000 & selling price

of

Rs.1,250.

(Assume all reserves comprise only of

Retained Profits). Goodwill

has

been

impaired sofar.

Prepare

the Consolidated Income

Statement for the

year

Required:

ended 31/12/2008.

Solution

- [ Case vi

]

Computation

of Goodwill

Rs.

Rs.

Cost of

Acquisition

1,700

Ordinary

Share Capital of S

80%

of Rs.1,250

1,000

Pre-acquisition

Retained Profits of S

80%

of Rs.50

40

(1,040)

660

Goodwill

totally impaired

(660)

0

229

Advance

Financial Accounting

(FIN-611)

VU

Computation

of opening balance of Group's Retained

Profits

Rs.

Rs.

Total

amount of opening balance of retained

profits of P Co

1,000

Post

acquisition part in opening balance of

retained profits of S Co

opening

balance of retained profits

of

S

Co

450

pre-acquisition

retained

profits

-50

to the

extent of H%

i.e.80%

400

320

Opening

balance of Group's Retained

Profits b/f

1,320

Goodwill

impairment loss

(660)

660

Computation

of Minority Interest

Rs.

Profits

after tax of S Co. to the

extent of MI%

20%

of Rs.300

60

Consolidated

Income Statement

For

the year ended 31st December

2008

Rs.

(7,500+4,000-

Sales

1,250)

10,250

(4,500+2,900-

Cost of

Goods Sold

1250)

(6,150)

Gross

Profit

4,100

Operating

Expenses

(2,400)

Profit

before tax

1,700

Income

Tax

(720)

Net

Profit after Tax

980

Minority

Interest

(60)

920

Dividend

Paid

(250)

670

Retained

Profits b/f

660

Retained

Profits c/f

1,330

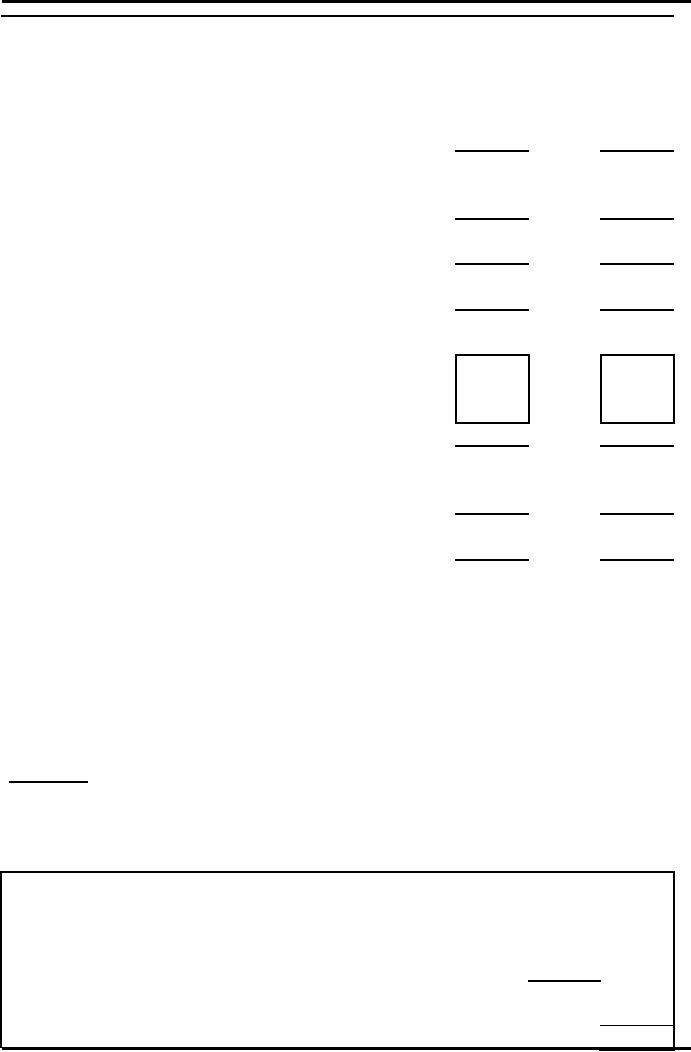

Example

- [ Case viii ] During the Year

Acquisition of Wholly

Owned

Subsidiary

Income

Statement for the year ended

31st December 2008

P

S

230

Advance

Financial Accounting

(FIN-611)

VU

Rs.

Rs.

Sales

900

600

Cost

of Goods

Sold

(400)

(360)

Gross

Profit

500

240

Operating

Expenses

(200)

(48)

Selling

& Distribution

Expenses

(100)

(36)

Operating

Profit

200

156

Income

Tax

(90)

(72)

Net

Profit after

Tax

110

84

The

Parent Co. (P) acquired

100% equity of the Subsidary

Co. (S) on 30th

September

2008. (Assume profits and

losses accrue evenly throughout

the year).

Prepare

the Consolidated Income

Statement for the

year

Required:

ended 31/12/2008.

Solution

- [ Case viii ]

Income

Statement for the year ended

31st December 2008

12

3

months

months

S

S

Rs.

Rs.

Sales

600

150

Cost of

Goods Sold

(360)

(90)

Gross

Profit

240

60

Operating

Expenses

(48)

(12)

Selling

& Distribution

Expenses

(36)

(9)

Operating

Profit

156

39

Income

Tax

(72)

(18)

Net

Profit after Tax

84

21

Consolidated

Income Statement

For

the year ended 31st December

2008

Rs.

Sales

1,050

Cost of

Goods Sold

(490)

Gross

Profit

560

Operating

Expenses

(212)

Selling

& Distribution

(109)

231

Advance

Financial Accounting

(FIN-611)

VU

Expenses

Operating

Profit

239

Income

Tax

(108)

Net

Profit after Tax

131

232

Table of Contents:

- ACCOUNTING FOR INCOMPLETE RECORDS

- PRACTICING ACCOUNTING FOR INCOMPLETE RECORDS

- CONVERSION OF SINGLE ENTRY IN DOUBLE ENTRY ACCOUNTING SYSTEM

- SINGLE ENTRY CALCULATION OF MISSING INFORMATION

- SINGLE ENTRY CALCULATION OF MARKUP AND MARGIN

- ACCOUNTING SYSTEM IN NON-PROFIT ORGANIZATIONS

- NON-PROFIT ORGANIZATIONS

- PREPARATION OF FINANCIAL STATEMENTS OF NON-PROFIT ORGANIZATIONS FROM INCOMPLETE RECORDS

- DEPARTMENTAL ACCOUNTS 1

- DEPARTMENTAL ACCOUNTS 2

- BRANCH ACCOUNTING SYSTEMS

- BRANCH ACCOUNTING

- BRANCH ACCOUNTING - STOCK AND DEBTOR SYSTEM

- STOCK AND DEBTORS SYSTEM

- INDEPENDENT BRANCH

- BRANCH ACCOUNTING 1

- BRANCH ACCOUNTING 2

- ESSENTIALS OF PARTNERSHIP

- Partnership Accounts Changes in partnership firm

- COMPANY ACCOUNTS 1

- COMPANY ACCOUNTS 2

- Problems Solving

- COMPANY ACCOUNTS

- RETURNS ON FINANCIAL SOURCES

- IASB’S FRAMEWORK

- ELEMENTS OF FINANCIAL STATEMENTS

- EVENTS AFTER THE BALANCE SHEET DATE

- PROVISIONS, CONTINGENT LIABILITIES AND CONTINGENT ASSETS

- ACCOUNTING POLICIES, CHANGES IN ACCOUNTING ESTIMATES AND ERRORS 1

- ACCOUNTING POLICIES, CHANGES IN ACCOUNTING ESTIMATES AND ERRORS 2

- BORROWING COST

- EXCESS OF THE CARRYING AMOUNT OF THE QUALIFYING ASSET OVER RECOVERABLE AMOUNT

- EARNINGS PER SHARE

- Earnings per Share

- DILUTED EARNINGS PER SHARE

- GROUP ACCOUNTS

- Pre-acquisition Reserves

- GROUP ACCOUNTS: Minority Interest

- GROUP ACCOUNTS: Inter Company Trading (P to S)

- GROUP ACCOUNTS: Fair Value Adjustments

- GROUP ACCOUNTS: Pre-acquistion Profits, Dividends

- GROUP ACCOUNTS: Profit & Loss

- GROUP ACCOUNTS: Minority Interest, Inter Co.

- GROUP ACCOUNTS: Inter Co. Trading (when there is unrealized profit)

- Comprehensive Workings in Group Accounts Consolidated Balance Sheet