|

SINGLE ENTRY CALCULATION OF MISSING INFORMATION |

| << CONVERSION OF SINGLE ENTRY IN DOUBLE ENTRY ACCOUNTING SYSTEM |

| SINGLE ENTRY CALCULATION OF MARKUP AND MARGIN >> |

Advance

Financial Accounting

(FIN-611)

VU

LESSON

# 4

SINGLE

ENTRY

CALCULATION

OF MISSING INFORMATION

As we

have already learned that a

medium sized entity will not be preparing

its books

of

accounts based on double entry

book keeping system rather

it will be maintaining

following

set of records in order to

prepare its financial

statements:

a)

Cash

Book

i.

Cash Account

ii.

Bank Account

b)

Debtors

(Accounts Receivables)

Ledger

c)

Creditors

(Accounts Payables)

Ledger

d)

Statement

of Affairs (Opening)

e)

Year-end

adjustments

i.

Closing stock

ii.

Depreciation of fixed assets

iii.

Provision for doubtful debts

iv.

Accruals and prepayments

v.

Disposal of Assets

Above

information provides sufficient

data which is required to prepare

Income

Statement

and Balance Sheet of the

entity.

For

students the question

becomes more complex when

the above set of records is

not

completely

prepared and some information is

missing from these records. In

this case

the

students have to put expertise in

searching out the missing

information firstly and

then to

prepare financial

statements.

Possible

missing information and the

procedure to ascertain that

information is being

discussed

hereunder:

Sales

Sales may be of

two types (i) Credit Sales, and

(ii) Cash Sales. Credit Sales will

be

ascertained

by preparing Debtors Account while

Cash Sales will be found out from

the

Cash

Book.

Question:

From

the following information, find

out the credit

sales:

Rupees

Opening

balance of Debtors

12,000

Returns

Inward

5,000

Cash

received from

debtors

45,000

Discount

allowed

3,000

Bad

Debts

1,500

Closing

balance of Debtors

10,000

Question:

From

the following cash transactions ascertain

the amount of cash

sales:

Rupees

Opening

Cash balance

5,000

Opening

Bank balance

10,000

14

Advance

Financial Accounting

(FIN-611)

VU

Cash

collected from

Debtors

20,000

Commission

received

5,000

Payment

to Creditors

10,000

Cash

purchases

20,000

Closing

Cash balance

10,000

Closing

Bank balance

15,000

Purchases

The

purchases may also be of two types

(i) Credit Purchases and

(ii) Cash Purchases.

Credit

Purchases will be ascertained by

preparing Creditors Account while

Cash

Purchases

will be appearing in the Cash

Book.

Question:

From

the following information, find

out the Credit

purchases:

Rupees

Opening

Creditors

7,600

Cash

paid to Creditors

20,000

Discount

received

500

Returns

outward

2,400

Closing

Creditors

9,500

Stocks/Inventory

Opening

stock appears in the

Statement of Affairs and Closing

stock is an item

given

in

the year end adjustments.

Some times these information

are hidden in this case

the

stock

balances will be ascertained through the

equation of cost of goods

sold i.e.

Opening

Stock + Purchases Closing

Stock = Cost of Goods

Sold

Question:

From

the following information, calculate opening

stock:

Rupees

Purchases

20,000

Sales

30,000

Closing

Stocks

10,000

Gross

profit

20%

of Sales

Drawings

Some

times cash drawings are

missing, this information

appears in payments side

of

the

cash book. Cash book is

prepared to ascertain drawings as a

balancing figure in

the

credit

side.

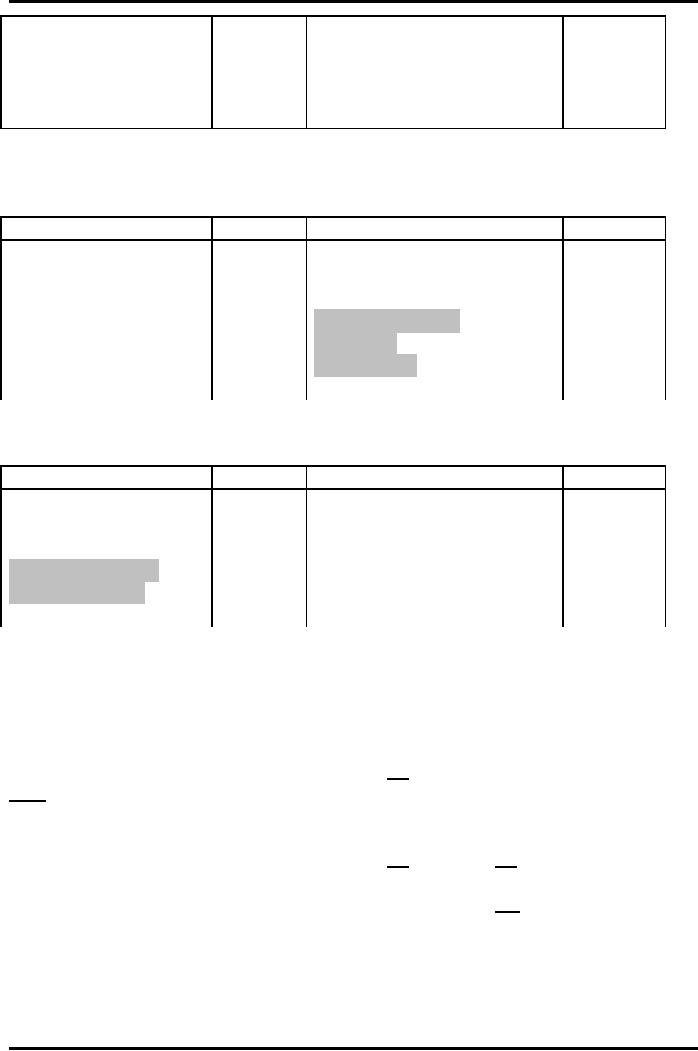

Information

in Cash Book

Receipts

Rupees

Payments

Rupees

Opening

Balance b/f

Cash

purchases

Cash

Sales

Paid

to creditors

Received

from debtors

Operating

expenses

Other

incomes

Purchase

of assets

Fresh

capital

Repayment

of loan

15

Advance

Financial Accounting

(FIN-611)

VU

Loan

taken

Drawings

Sales

proceeds of assets

Investments

Fixed

deposits

Closing

balance c/f

Information

in Debtors Account

Debit

Rupees

Credit

Rupees

Opening

Balance b/f

Cash

received from debtors

Credit

Sales

Cheques

received form

debtors

Discount

Allowed

Bad

Debts

Sales

returns

Closing

Balance c/f

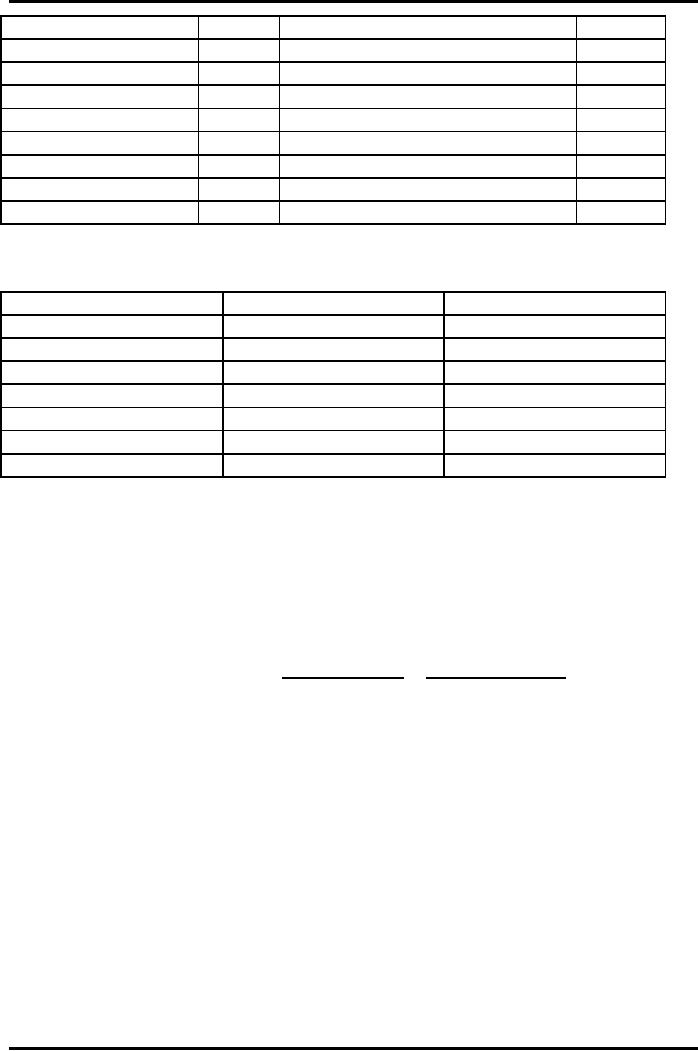

Information

in Creditors Account

Debit

Rupees

Credit

Rupees

Cash

paid to creditors

Opening

Balance b/f

Cheques

paid to

Credit

Purchases

creditors

Discount

Received

Purchase

returns

Closing

Balance c/f

Information

in Statement of Affairs

(Opening)

Rs.

Rs.

All

Assets

Fixed

Assets

***

Investments

***

***

Current

Assets

***

Less

All

Liabilities

Loans

***

***

Current

Liabilities

***

Owner's

Equity.

***

Practice

Questions

Q.1

Ehsan

ul Haq has kept records of

his business transactions in a

single entry form, but

he did not

realize that he had to record

cash

drawings. His

bank account for the

year

20�8

is as follows:

16

Advance

Financial Accounting

(FIN-611)

VU

Rs

Rs

Balance

1.1.2008

1,890

Cash

withdrawn from bank

5,400

Receipts

from debtors

44,656

Trade

Creditors

31,695

Loan

from T Hughes

2,000

Rent

2,750

Rates

1,316

Drawings

3,095

Sundry

Expenses

1,642

Balance

31.12.2008

2,648

48,546

48,546

Records

of cash paid were: Sundry

expenses Rs. 122; Trade

creditors Rs. 642.

Cash

sales

amounted to Rs. 698. The

following information is also

available:

Rs

Rs

Cash

in Hand

Trade

Creditors

48

93

Debtors

4,896

5,091

Rent

Owing

6,013

7,132

Rates

in Advance

-

250

Van

(at valuation)

282

312

Stock

2,800

2,400

11,163

13,021

You

are to draw up a trading and profit and

loss account for the year

ended 31

December

20�8 and a balance sheet as at

that date. Show all of your

workings.

Q2.

Following

is the position of assets and liabilities

of MR. A who keeps his book

by

single

entry system:

January

01

December

31

2006

2006

Debtors

5,300

8,800

Creditors

1,500

1,950

Stock

1,700

1,900

Fixed

assets

2,140

1,740

Following

are other details:

Rs.

Total

sales (including cash sales

Rs. 500)

10,000

Total

purchases (including cash

purchases Rs.

4,500

2,050)

1,000

General

expenses of business

Drawings

300

Cash

in hand and at bank

410

Payment

for fixed assets

500

17

Advance

Financial Accounting

(FIN-611)

VU

Stock

of Rs. 500 was used by the

proprietor for his personal

use and material of Rs.

50

was

used for constructing a part of

plant. A how interest on capital at 5%

p.a.

You

are required to

prepare:

a.

Trading and profit and loss

account for the year ending

December 31, 2006,

and

b.

Balance sheet as on December

31, 2006.

Answers

(Capital

in the beginning Rs. 7,000,

Gross Profit Rs. 6,250,

Net Profit Rs.

3,930,

Balance

Sheet total Rs.

12,850).

18

Table of Contents:

- ACCOUNTING FOR INCOMPLETE RECORDS

- PRACTICING ACCOUNTING FOR INCOMPLETE RECORDS

- CONVERSION OF SINGLE ENTRY IN DOUBLE ENTRY ACCOUNTING SYSTEM

- SINGLE ENTRY CALCULATION OF MISSING INFORMATION

- SINGLE ENTRY CALCULATION OF MARKUP AND MARGIN

- ACCOUNTING SYSTEM IN NON-PROFIT ORGANIZATIONS

- NON-PROFIT ORGANIZATIONS

- PREPARATION OF FINANCIAL STATEMENTS OF NON-PROFIT ORGANIZATIONS FROM INCOMPLETE RECORDS

- DEPARTMENTAL ACCOUNTS 1

- DEPARTMENTAL ACCOUNTS 2

- BRANCH ACCOUNTING SYSTEMS

- BRANCH ACCOUNTING

- BRANCH ACCOUNTING - STOCK AND DEBTOR SYSTEM

- STOCK AND DEBTORS SYSTEM

- INDEPENDENT BRANCH

- BRANCH ACCOUNTING 1

- BRANCH ACCOUNTING 2

- ESSENTIALS OF PARTNERSHIP

- Partnership Accounts Changes in partnership firm

- COMPANY ACCOUNTS 1

- COMPANY ACCOUNTS 2

- Problems Solving

- COMPANY ACCOUNTS

- RETURNS ON FINANCIAL SOURCES

- IASB’S FRAMEWORK

- ELEMENTS OF FINANCIAL STATEMENTS

- EVENTS AFTER THE BALANCE SHEET DATE

- PROVISIONS, CONTINGENT LIABILITIES AND CONTINGENT ASSETS

- ACCOUNTING POLICIES, CHANGES IN ACCOUNTING ESTIMATES AND ERRORS 1

- ACCOUNTING POLICIES, CHANGES IN ACCOUNTING ESTIMATES AND ERRORS 2

- BORROWING COST

- EXCESS OF THE CARRYING AMOUNT OF THE QUALIFYING ASSET OVER RECOVERABLE AMOUNT

- EARNINGS PER SHARE

- Earnings per Share

- DILUTED EARNINGS PER SHARE

- GROUP ACCOUNTS

- Pre-acquisition Reserves

- GROUP ACCOUNTS: Minority Interest

- GROUP ACCOUNTS: Inter Company Trading (P to S)

- GROUP ACCOUNTS: Fair Value Adjustments

- GROUP ACCOUNTS: Pre-acquistion Profits, Dividends

- GROUP ACCOUNTS: Profit & Loss

- GROUP ACCOUNTS: Minority Interest, Inter Co.

- GROUP ACCOUNTS: Inter Co. Trading (when there is unrealized profit)

- Comprehensive Workings in Group Accounts Consolidated Balance Sheet