|

GROUP ACCOUNTS: Minority Interest |

| << Pre-acquisition Reserves |

| GROUP ACCOUNTS: Inter Company Trading (P to S) >> |

Advance

Financial Accounting

(FIN-611)

VU

LESSON

# 38

GROUP

ACCOUNTS

Rs.

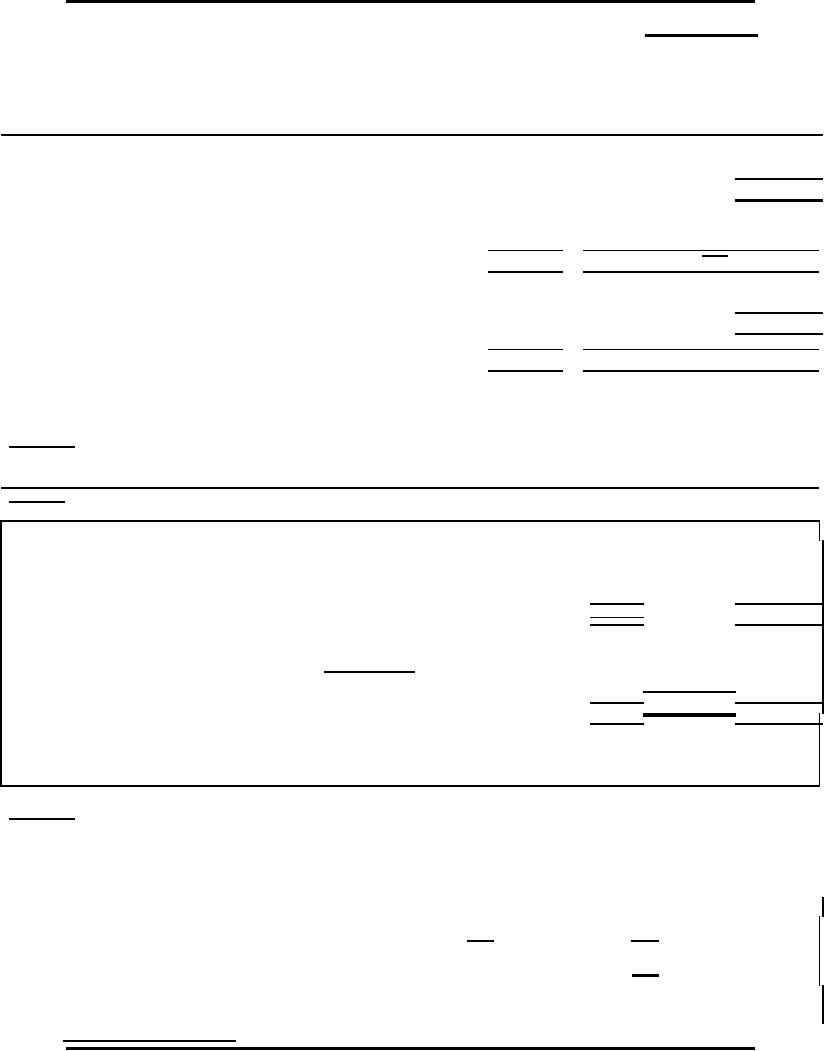

EixamplssetsCase vi ]

Minority Interest

F xed A e - [

1,450

Balance

Sheet as on 31st December

2008

Goodwill

100

P

S

Current

Assets

550

Rs.

Rs.

2,100

Fixed

Assets

1,000

450

Investment in

S.

550

Share

Capital

1,200

Rer e v s

CusrernteAssets

350

150

600

1,900

600

1,800

Minority

Interest

100

1,900

SharrenCLipibillities

Cur e t a

ata

1,200

300

200

Reserves

600

200

2,100

Current

Liabilities

100

100

1,900

600

The Parent

Co. (P) acquired 80%

shares of the Subsidiary Co.

(S) on 31st December

2008

Prepare

the Consolidated Balance

Sheet as at 31/12/2008.

Required:

Eolutione - [ Csee iv]ii ] Minority

Interest, Pre-acquisition Reserves,

Goodwill

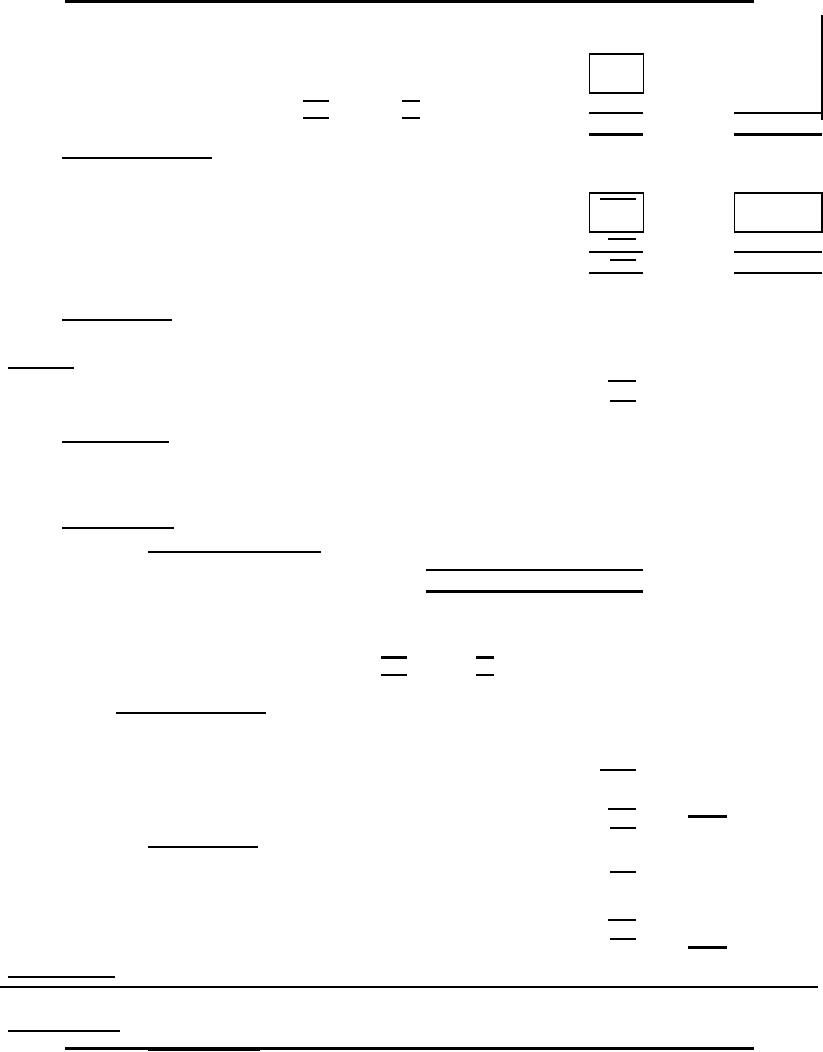

Sxampl

- [

Caas

v

Working

Balance

Sheet as on 31st December

2008

P

S

Calculation of

Goodwill

Rs.

Rs.

1Rs.0

Rs.

Fixed

Assets

,00

450

Investment in

S.

Investment

500

500

SharrenCApitets

Cur e t

assal

300

400

150

Reserves

1,200

900

600

500

@

Share

Capital

180%

,200

300

400

Reserves

600

200

Current

Liabilities

100

100

Minority

Interest

100

1,900

600

Simple

calculation of Minority Interest is as

under

The

erar'entuito.o(fP)ubsidiiaey

Compshares MI% e Subsidiary

Co. (S) on 15t 0an20%

2008=when it's reserves

were worth

OwnP s eq Cy S

acqu r r d 80% any @ of

th

s0J x

uary

=

100

Rs.120.

Goodwill impaired with Rs.

33 during the year.

Alternatively we

may split the Balance

sheet of S Co. into the

share of parent company and

the share of minority

interest.

R

quired:

Net amount

of the colPrenarf MIe

Clonsohieatmountlanceinoreetinteatst1/12/2008.

ump oe th wil be t l d

aed Ba of m Sh ity as re 3.

H%

MI%

Fioledion -

etCase vii ]

S x ut Ass [

s

360

90

Current

Assets

120

30

Workings

W-1

Determine

the % of holding by dividing

the number of equity shares

acquired with the

Current

Liabilities

(80)

(20)

H%

80%

total

number of shares of the

subsidiary company

%age

representing the minority

interest is very simple to

calculate, just subtract

H%

100

MI%

20%

from

100

Minority

interest is the figure that

represents the owners'

equity of the minority share

holders in the group.

Therefore it is

shown

separately but within the

owners' equity class

consolidated balance

sheet.

W-2

Consolidated

Balance Sheet

Analysis of

Equity of S Co

As at 31 December

2008

201

Advance

Financial Accounting

(FIN-611)

VU

Pre-

Post-

Fixed

Assets

1,000

450

Acquisition

acquisition

Investment in

S.

500

Dividend

Receivable

40

Share

Capital

300

Nil

Other

Current Assets

360

Reserves

120

80

Current

Assets

400

150

420

80

1,900

600

W-3

Calculation of

goodwill

Rupees

Shate f

investment

r

oCapital

1,500

200

300

Cos

Pre

ervessition equity of S

Co.

Resacqui

600

200

420 x

80%

(336)

Dividend

Payable

70

50

164

Other

Current Liabilities

30

50

Impairment

loss

(33)

Current

Liabilities

100

100

Goodwill

131

1,900

600

W-4

The

ParGnoup R(P) rves

ired 80% shares of the

Subsidiary Co. (S) on 1st

January 2008 when its

reserves were worth

e rt Co.

eseacqu

Rs.120.

Goodwill impaired during the

year Rs. 33.

All

reserves of P Co

600

Post

acquisition reserves of S Co to the

extent of H%

80 x

80%

64

Prepare

the Consolidated Balance

Sheet as at 31/12/2008.

Required:

Impairment

loss

(33)

631

Solution - [

Case viii ]

W-5

W-1

Minority

Interest

Determine

the % of holding by dividing

the number of equity shares

acquired with the

O%ners'

equity of Subsi%ary

Compaota@ um% r of share= of

the subsidia5y 0

ompany

Hw

80di

tny l n MI be

r0 c x

20%

=

s

100

%age

representing the minority

interest is very simple to

calculate, just subtract

H%

MI%

20%

from

100

Post-

acq

Detailed

working

Total

Pre-acq

W-2

Ownernalequity

foEquCy . f S Co

A s' ysis o f S it o

o

500

420

80

Holding -

80%

(400)

(336)

(64)

Pre-

Post-

100

Minority

Interest - 20%

84

16

Acquisition

acquisition

Share

Capital

300

Nil

Reserves

120

80

420

80

W-3

Consolidated

Balance Sheet

Calculation of

goodwill

Rupees

As at 31 December

2008

Rs.

Cost of

investment

420 x

80%

500

Fixed

Assets

1,450

Pre

acquisition equity of S

Co.

(336)

Goodwill

131

164

Current

Assets

550

Impairment

loss

(33)

2,131

Goodwill

131

W-4

Group

Reserves

Share

Capital

1,200

All

reserves of P Co.

600

631

Post

acquisition reserves of S Co to the

extent of

Reserves

1,831

H%

80 x

80%

164

Minority

Interest

00

1,931

Goodwill

impaired

(33)

Current

Liabilities

200

631

2,131

W-5

Minority

Interest

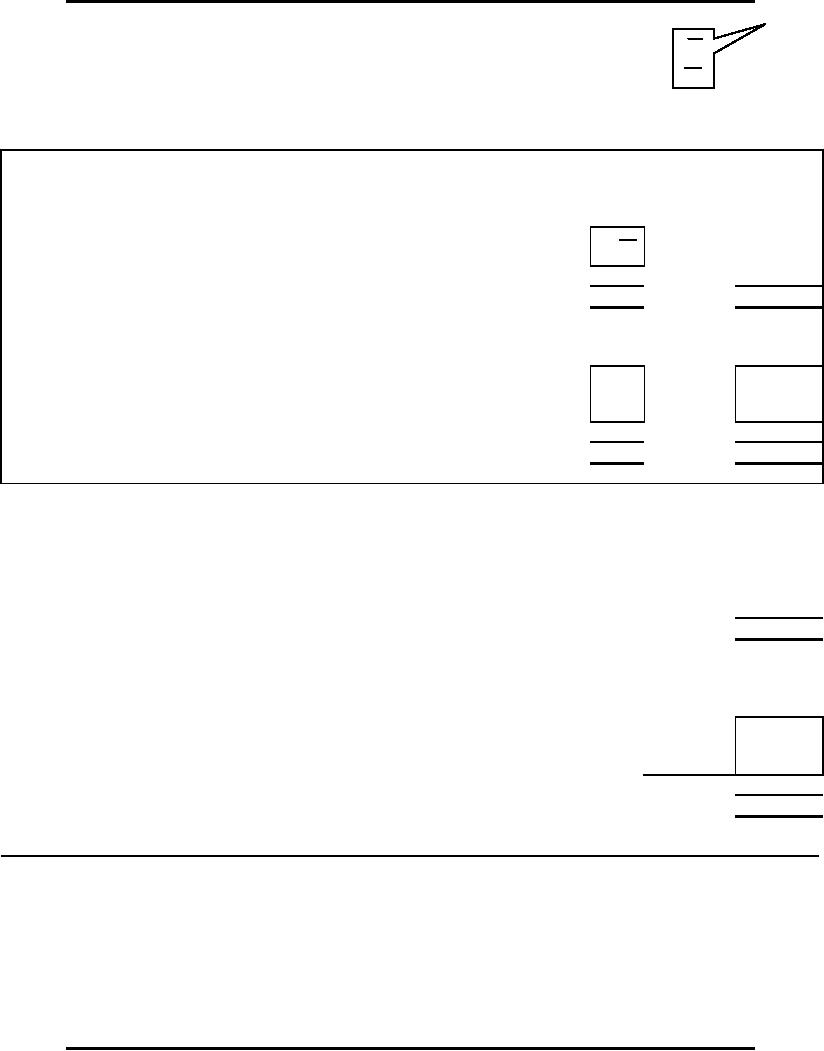

Example - [

Case viii ] Minority Interest,

Inter-Company Dividends

Owners'

equity of Subsidiary Company @

MI%

=

500 x

20%

=

100

Balance

Sheet as on 31st December

2008

P

S

Detailed

working

Pos.t-

Rs

Rs.

Total

Pre-acq

Detailed

working

202

Advance

Financial Accounting

(FIN-611)

VU

acq

40

Owners'

equity of S Co.

500

420

80

10

Holding -

80%

(400)

(336)

(64)

50

Minority

Interest - 20%

100

84

16

W-6

Cancellation

effects of Intra group

Dividend

P

S

Rs.

Rs.

Fixed

Assets

1,000

450

Investment in

S.

500

Dividend

Receivable

40

Other

Current Assets

360

Current

Assets

400

150

1,900

600

Share

Capital

1,200

300

Reserves

600

200

Dividend

Payable

70

50

Other

Current Liabilities

30

50

Current

Liabilities

100

100

1,900

600

Consolidated

Balance Sheet

As at 31 December

2008

Rs.

Rs.

Fixed

Assets

1,450

Goodwill

131

Current

Assets

510

2,091

Share

Capital

1,200

Reserves

631

Minority

Interest

100

Other

current liabilities

80

Dividend

payable by P

70

Dividends

due to minority

10

80

Current

Liabilities

160

2,091

203

Table of Contents:

- ACCOUNTING FOR INCOMPLETE RECORDS

- PRACTICING ACCOUNTING FOR INCOMPLETE RECORDS

- CONVERSION OF SINGLE ENTRY IN DOUBLE ENTRY ACCOUNTING SYSTEM

- SINGLE ENTRY CALCULATION OF MISSING INFORMATION

- SINGLE ENTRY CALCULATION OF MARKUP AND MARGIN

- ACCOUNTING SYSTEM IN NON-PROFIT ORGANIZATIONS

- NON-PROFIT ORGANIZATIONS

- PREPARATION OF FINANCIAL STATEMENTS OF NON-PROFIT ORGANIZATIONS FROM INCOMPLETE RECORDS

- DEPARTMENTAL ACCOUNTS 1

- DEPARTMENTAL ACCOUNTS 2

- BRANCH ACCOUNTING SYSTEMS

- BRANCH ACCOUNTING

- BRANCH ACCOUNTING - STOCK AND DEBTOR SYSTEM

- STOCK AND DEBTORS SYSTEM

- INDEPENDENT BRANCH

- BRANCH ACCOUNTING 1

- BRANCH ACCOUNTING 2

- ESSENTIALS OF PARTNERSHIP

- Partnership Accounts Changes in partnership firm

- COMPANY ACCOUNTS 1

- COMPANY ACCOUNTS 2

- Problems Solving

- COMPANY ACCOUNTS

- RETURNS ON FINANCIAL SOURCES

- IASB’S FRAMEWORK

- ELEMENTS OF FINANCIAL STATEMENTS

- EVENTS AFTER THE BALANCE SHEET DATE

- PROVISIONS, CONTINGENT LIABILITIES AND CONTINGENT ASSETS

- ACCOUNTING POLICIES, CHANGES IN ACCOUNTING ESTIMATES AND ERRORS 1

- ACCOUNTING POLICIES, CHANGES IN ACCOUNTING ESTIMATES AND ERRORS 2

- BORROWING COST

- EXCESS OF THE CARRYING AMOUNT OF THE QUALIFYING ASSET OVER RECOVERABLE AMOUNT

- EARNINGS PER SHARE

- Earnings per Share

- DILUTED EARNINGS PER SHARE

- GROUP ACCOUNTS

- Pre-acquisition Reserves

- GROUP ACCOUNTS: Minority Interest

- GROUP ACCOUNTS: Inter Company Trading (P to S)

- GROUP ACCOUNTS: Fair Value Adjustments

- GROUP ACCOUNTS: Pre-acquistion Profits, Dividends

- GROUP ACCOUNTS: Profit & Loss

- GROUP ACCOUNTS: Minority Interest, Inter Co.

- GROUP ACCOUNTS: Inter Co. Trading (when there is unrealized profit)

- Comprehensive Workings in Group Accounts Consolidated Balance Sheet