|

GROUP ACCOUNTS |

| << DILUTED EARNINGS PER SHARE |

| Pre-acquisition Reserves >> |

Advance

Financial Accounting

(FIN-611)

VU

LESSON

# 36

GROUP

ACCOUNTS

It is

obvious from the name that

group accounts will be demonstrating

financial status

of

more than one entity. Group

accounts are the financial

statements of different

entities

operating in a group. Group of companies

is established in order to

obtain

benefits

of synergy, better management of

resources, and to avoid

competitive

business

environment.

Formation

of a group of companies takes place when

one company establishes

its

control

over another company. This

creates a relationship of parent and

subsidiary.

The

company that enjoys control

is named as parent company and

the company that is

controlled

is known as subsidiary company. In a group

there will be one

parent

company

with its one ore more than

one subsidiary companies.

Therefore, Group

means

a parent and all its

subsidiaries.

Control:

According

to IFRS 3 and IAS 27, Control

is the power to govern the financial and

operating

policies

of an entity so as to obtain benefits

from its activities.

Normally

control is assumed to exist when

the parent company acquires

majority

number of

ordinary share capital. But

according to the above

referred accounting

standards

control exists when any of the following

situation crops up.

When

the parent company:

1.

Has owned more than 50% of

the voting rights of subsidiary

company (Each

ordinary

share capital has one voting

right)

2.

Has power over more than

50% of the voting rights of

subsidiary company by

virtue of

agreement with other share-holders of

it.

3.

Has power to govern the

financial and operating policies of

subsidiary

company

by statute or under an agreement.

4.

Has power to appoint or remove a

majority of the directors of

subsidiary

company.

5.

Has power to cast the

majority of votes at meetings of

the board of directors

of

subsidiary

company.

Consolidated

Financial Statements:

A

single set of financial

statements that combine the

assets, liabilities, incomes

and

expenses

of a parent company and its

subsidiaries. In our syllabus we shall

learn how

to

prepare:

1.

Consolidated Balance

Sheet

2.

Consolidated Income

Statement

193

Advance

Financial Accounting

(FIN-611)

VU

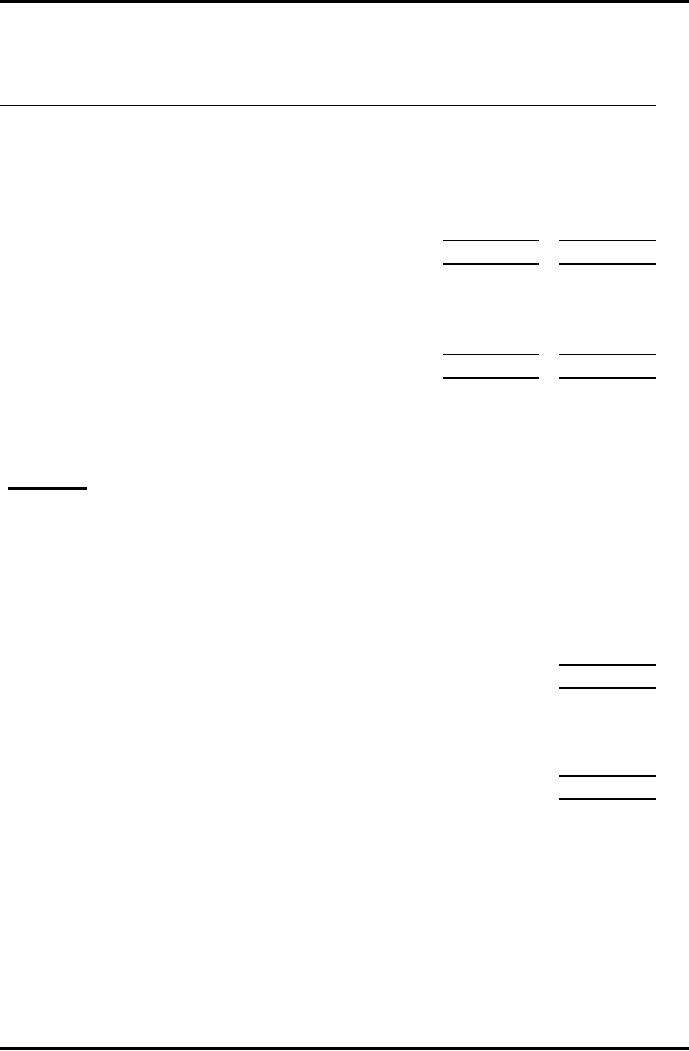

Group

Accounts

Example

- [ Case i ] Simple

Consolidation

Balance

Sheet as on 31st December

2008

S

P

Rs

Rs

400

Fixed

Assets

1,000

Investment

in S.

500

Current

Assets

400

200

1,900

600

Share

Capital

1,200

300

Reserves

500

200

Current

Liabilities

200

100

1,900

600

The

Parent Co. (P) acquired

100% shares of the

Subsidiary Co. (S) on

31st

December

2008.

Required:

Prepare

the Consolidated Balance

Sheet as on the same

date.

Solution

- [ Case i ]

Consolidated

Balance Sheet

As at 31

December 2008

Rs

Fixed

Assets

1,400

Current

Assets

600

2,000

Share

Capital

1,200

Reserves

500

Current

Liabilities

300

2,000

The

above example covers simple

consolidation of balance sheet

that explains

how

the assets and liabilities of subsidiary

company are consolidated with

the

assets and

liabilities of the parent

company. This also explains

that the cost of

investment

appearing in the parent

company gets cancelled with

the amount of

the

owner equity of the subsidiary

company. This cost of

investments is asset of

the

parent company made up from

its own sources therefore in

the consolidated

balance

sheet we have to replace the

cost of investment in subsidiary

company

with

net assets of it. The only

care is to be taken is to consolidate all

assets and

liabilities

individually and remember do not confuse why we

are not

consolidating

the owner equity of the

subsidiary company in the

parent

company's

owners' equity.

194

Advance

Financial Accounting

(FIN-611)

VU

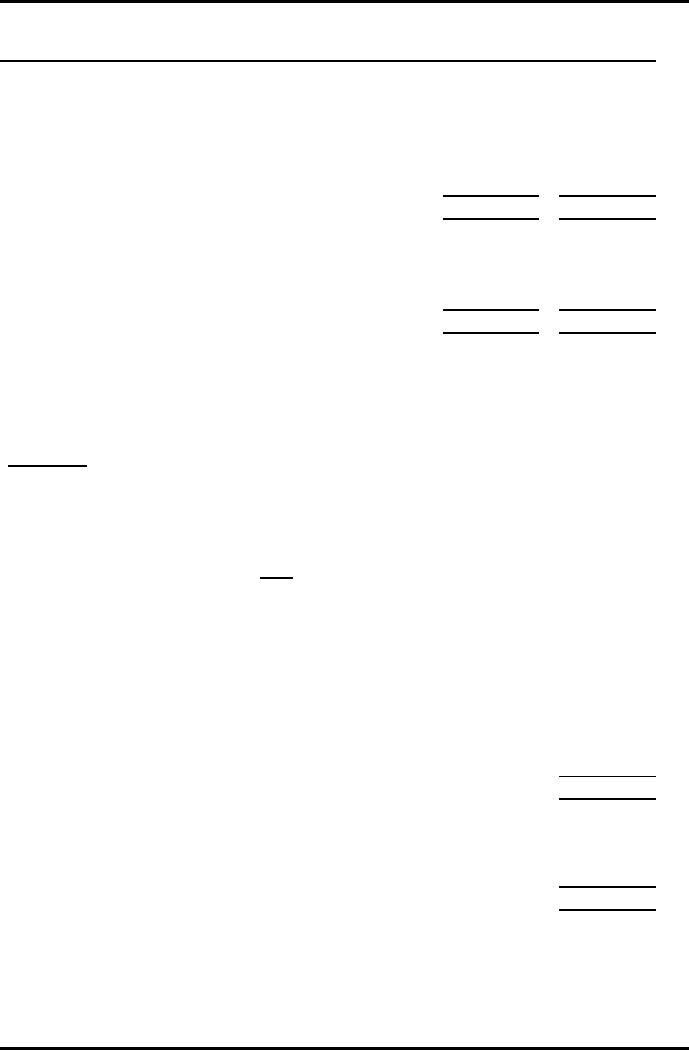

Example

- [ Case ii ] Goodwill

Balance

Sheet as on 31st December

2008

P

S

Rs

Rs

Fixed

Assets

1,000

400

Investment

in S.

500

Current

Assets

400

200

1,900

600

Share

Capital

1,200

300

Reserves

500

150

Current

Liabilities

200

150

1,900

600

The

Parent Co. (P) acquired

100% shares of the

Subsidiary Co. (S) on

31st

December

2008.

Prepare

the Consolidated Balance

Sheet as on the

same

date.

Required:

Solution

- [ Case ii ]

Working for

Calculation of Good will:

Cost

of investment

500

Net assets of S

Co acquired

450

Good

will

50

Consolidated

Balance Sheet

As at 31

December 2008

Rs

Fixed

Assets

1,400

Goodwill

50

Current

Assets

600

2,050

Share

Capital

1,200

Reserves

500

Current

Liabilities

350

2,050

Good

Will:

Good

will is the excess of the

cost of investment made in

the subsidiary

company

over the fair value of

the net assets of the

subsidiary company

acquired.

195

Table of Contents:

- ACCOUNTING FOR INCOMPLETE RECORDS

- PRACTICING ACCOUNTING FOR INCOMPLETE RECORDS

- CONVERSION OF SINGLE ENTRY IN DOUBLE ENTRY ACCOUNTING SYSTEM

- SINGLE ENTRY CALCULATION OF MISSING INFORMATION

- SINGLE ENTRY CALCULATION OF MARKUP AND MARGIN

- ACCOUNTING SYSTEM IN NON-PROFIT ORGANIZATIONS

- NON-PROFIT ORGANIZATIONS

- PREPARATION OF FINANCIAL STATEMENTS OF NON-PROFIT ORGANIZATIONS FROM INCOMPLETE RECORDS

- DEPARTMENTAL ACCOUNTS 1

- DEPARTMENTAL ACCOUNTS 2

- BRANCH ACCOUNTING SYSTEMS

- BRANCH ACCOUNTING

- BRANCH ACCOUNTING - STOCK AND DEBTOR SYSTEM

- STOCK AND DEBTORS SYSTEM

- INDEPENDENT BRANCH

- BRANCH ACCOUNTING 1

- BRANCH ACCOUNTING 2

- ESSENTIALS OF PARTNERSHIP

- Partnership Accounts Changes in partnership firm

- COMPANY ACCOUNTS 1

- COMPANY ACCOUNTS 2

- Problems Solving

- COMPANY ACCOUNTS

- RETURNS ON FINANCIAL SOURCES

- IASB’S FRAMEWORK

- ELEMENTS OF FINANCIAL STATEMENTS

- EVENTS AFTER THE BALANCE SHEET DATE

- PROVISIONS, CONTINGENT LIABILITIES AND CONTINGENT ASSETS

- ACCOUNTING POLICIES, CHANGES IN ACCOUNTING ESTIMATES AND ERRORS 1

- ACCOUNTING POLICIES, CHANGES IN ACCOUNTING ESTIMATES AND ERRORS 2

- BORROWING COST

- EXCESS OF THE CARRYING AMOUNT OF THE QUALIFYING ASSET OVER RECOVERABLE AMOUNT

- EARNINGS PER SHARE

- Earnings per Share

- DILUTED EARNINGS PER SHARE

- GROUP ACCOUNTS

- Pre-acquisition Reserves

- GROUP ACCOUNTS: Minority Interest

- GROUP ACCOUNTS: Inter Company Trading (P to S)

- GROUP ACCOUNTS: Fair Value Adjustments

- GROUP ACCOUNTS: Pre-acquistion Profits, Dividends

- GROUP ACCOUNTS: Profit & Loss

- GROUP ACCOUNTS: Minority Interest, Inter Co.

- GROUP ACCOUNTS: Inter Co. Trading (when there is unrealized profit)

- Comprehensive Workings in Group Accounts Consolidated Balance Sheet