|

CONVERSION OF SINGLE ENTRY IN DOUBLE ENTRY ACCOUNTING SYSTEM |

| << PRACTICING ACCOUNTING FOR INCOMPLETE RECORDS |

| SINGLE ENTRY CALCULATION OF MISSING INFORMATION >> |

Advance

Financial Accounting

(FIN-611)

VU

LESSON

# 3

CONVERSION

OF SINGLE ENTRY IN DOUBLE

ENTRY ACCOUNTING

SYSTEM

1.

Accounting

for Medium scale business

entities

Businesses

grow by the time and so the

transactions also keep on becoming

complex. In this

situation

the system of knowing Net

profit through the Statement of

Profit or Loss does

not

suffice

the requirements of the management

nor the government agencies

put the level of

reliance on

such statement any

more.

Medium

scale business entities have

this much resources that

they can afford a semi

qualified

or a

reasonably good qualified accountant to

look after accounting issues

of the entity. But

such

accountants

are kept under the

supervision and guidance of the

accounting consultants who

are

qualified

accountant. These consultants provide

directions to the accountant to

maintain certain

books of

accounts and to extract summaries at

the end of the accounting

period. With the

help

of these

summaries the consultants

(qualified accountants) prepare

detailed Income

Statement

and Balance

Sheet for the medium

scale entity.

Such

Income Statement and Balance

Sheet is exactly the same

had there been a

systematic

double

entry accounting system

prevailing in practice.

1.1

Accounting

Records

Accountants

of these entities are

directed to maintain following

set of information,

which

although

does not constitute a

complete accounting system

but can work:

a)

Cash

Book

i. Cash

Account

ii.

Bank Account

b)

Debtors

(Accounts Receivables)

Ledger

c)

Creditors

(Accounts Payables) Ledger

d)

Statement of

Affairs (Opening)

e)

Year-end

adjustments

i. Closing

stock

ii.

Depreciation of fixed

assets

iii.

Provision for doubtful

debts

iv.

Accruals and prepayments

v. Disposal

of Assets

1.2

Preparation

of Financial Statements

Now

let's see how Income

Statement and Balance Sheet can be

prepared with the help of a

set

of

incomplete records. For this we will

analyze the contents of

Income Statement and

Balance

Sheet

item by item in the

following pages.

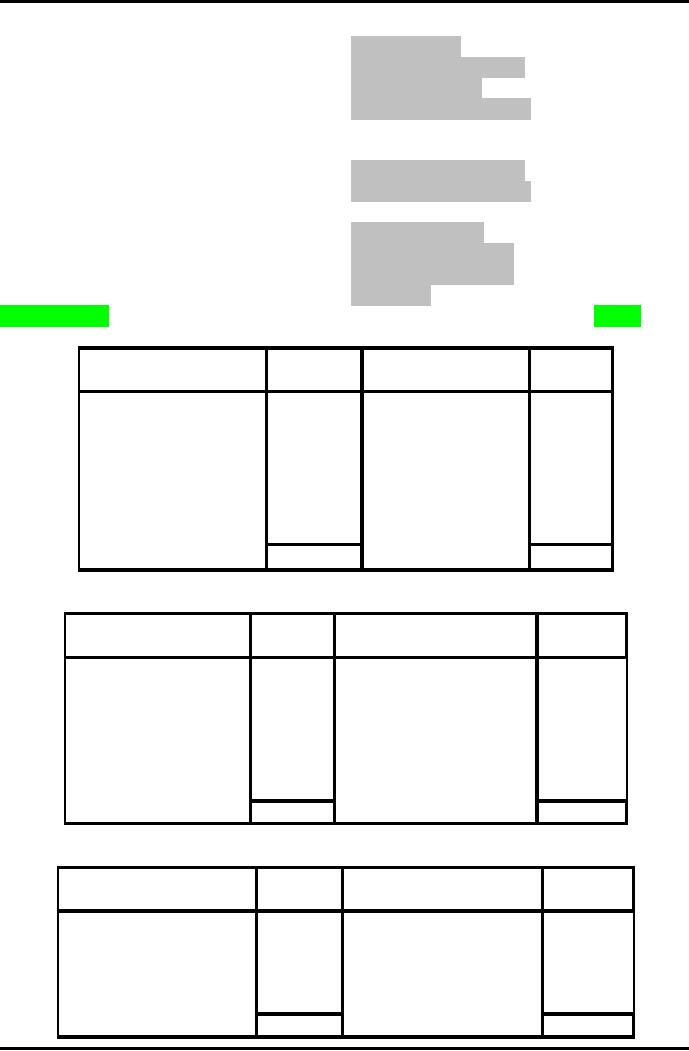

Name of

the Organization

Income

Statement

For

the year ended December 31

20x7

Source

of Information

Rs.

Sales

Cash

Sales

Cash

Book receipts side

Credit

Sales

Debtors

account Dr side

Cost of Goods

Sold

Opening

Stock

Statement of

Affairs

9

Advance

Financial Accounting

(FIN-611)

VU

Purchases

Cash

Purchases

Cash

Book payment side

Credit

Purchases

Creditors

account Cr side

Closing

Stock

Year-end

Adjustments

Gross

Profit

Operating

Expenses

Cash

based expenses

Cash

Book payment side

Adjusted

with:

Accrued

Expenses

S O

A-opening/Year-end Adjustments

Prepaid

Expenses

S O

A-opening/Year-end Adjustments

Expenses

against receivables

Bad

Debts/Discounts

Debtors

account Cr side

Provision

for doubtful debts

S O

A-opening/Year-end Adjustments

Expenses

against fixed assets

Depreciation

Year-end

Adjustments

Loss on

disposal

S O

A-opening/Cash Book receipts

Profit

from operations

Other

Income

Cash

based income

Cash

Book receipts side

Adjusted

with:

Accrued

incomes

S O

A-opening/Year-end Adjustments

Unearned

incomes

S O

A-opening/Year-end Adjustments

Incomes

against payables

Discounts

Creditors

accounts Dr side

Incomes

against fixed assets

Gain on

disposal

S O

A-opening/Cash Book receipts

Net

profit

Result

Name of

the Organization

Balance

Sheet

As on December 31

20x7

Source

of Information

Rs.

Assets

Fixed

Assets

S O

A-opening

Addition

Cash

Book payment side

Disposal

Year-end

Adjustments

Depreciation

Year-end

Adjustments

Investments

S O

A-opening

Addition

Cash

Book payment side

Disposal

Year-end

Adjustments

Current

Assets

Stocks

Year-end

Adjustments

Debtors

Debtors

Account

Prepaid

expenses

Year-end

Adjustments

Accrue

incomes

Year-end

Adjustments

Bank

Cash

Book (Bank Account)

Cash

Cash

Book (Cash Account)

Total

Result

10

Advance

Financial Accounting

(FIN-611)

VU

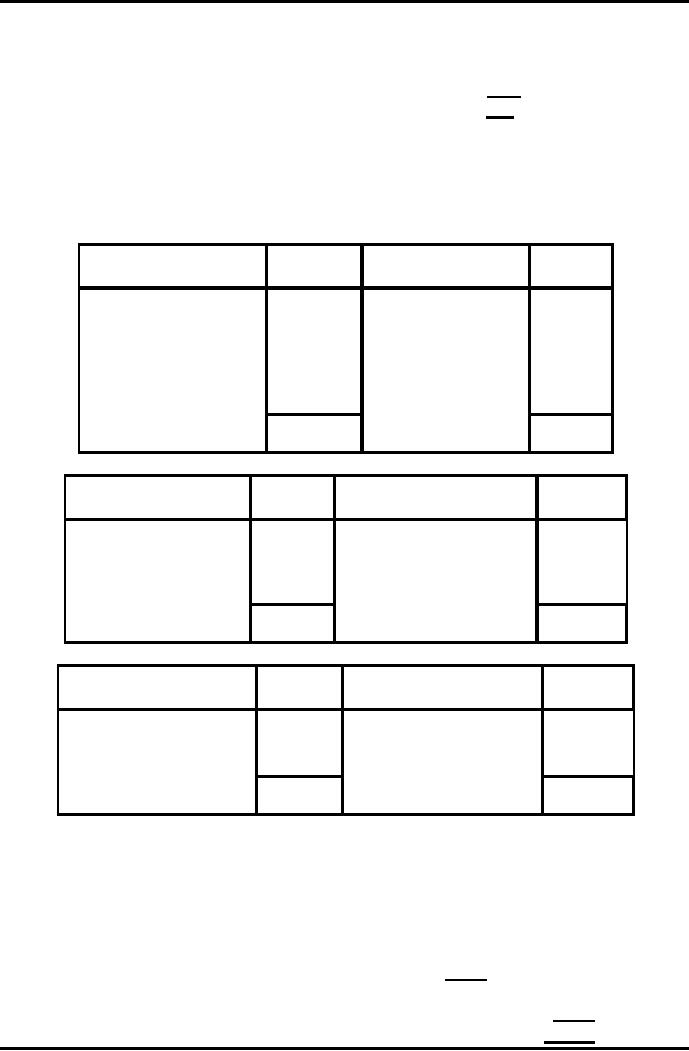

Owner's

Equity

Opening

balance

S O

A-opening

Fresh

capital

Cash

Book receipts side

Net

profit

Income

Statement

Drawings

Cash

Book payment side

Liabilities

Loans

Further

loan taken

Cash

Book receipts side

Repayment of

loan

Cash

Book payment side

Current

liabilities

Creditors

Creditors

Account

Accrued

expenses

Year-end

Adjustments

Unearned

incomes

Year-end

Adjustments

Bank

overdraft

Cash

Book

Total

Result

Cash

Book

Payment

Amount

Receipts

Amount

Rs.

Rs.

Opening

balance

xxx

All payments

either

xxx

relating to

capital or

All

receipts

either

xxx

revenue

payments

relating

to capital or

xxx

revenue

receipts

Closing

balance

xxx

xxx

Debtors

Account

Decrease

in Debtors

Amount

Increase in

Debtors

Amount

Rs.

Rs.

Opening

balance

xxx

Cash

received from debtors

Xxx

Discount

allowed

xxx

Bad

debts

Credit

sales

xxx

xxx

Sales

return

xxx

Closing

balance

xxx

xxx

xxx

Creditors

Account

Decrease

in Creditors

Amount

Increase in

Creditors

Amount

Rs.

Rs.

Cash paid to

creditors

xxx

Opening

balance

xxx

Discount

received

xxx

Credit

purchase

xxx

Purchase

return

xxx

Closing

balance

xxx

xxx

xxx

11

Advance

Financial Accounting

(FIN-611)

VU

Statement

of Affairs as on opening date

Opening

Assets

xxx

Opening

Liabilities

(xxx)

Owner's

Equity

xxx

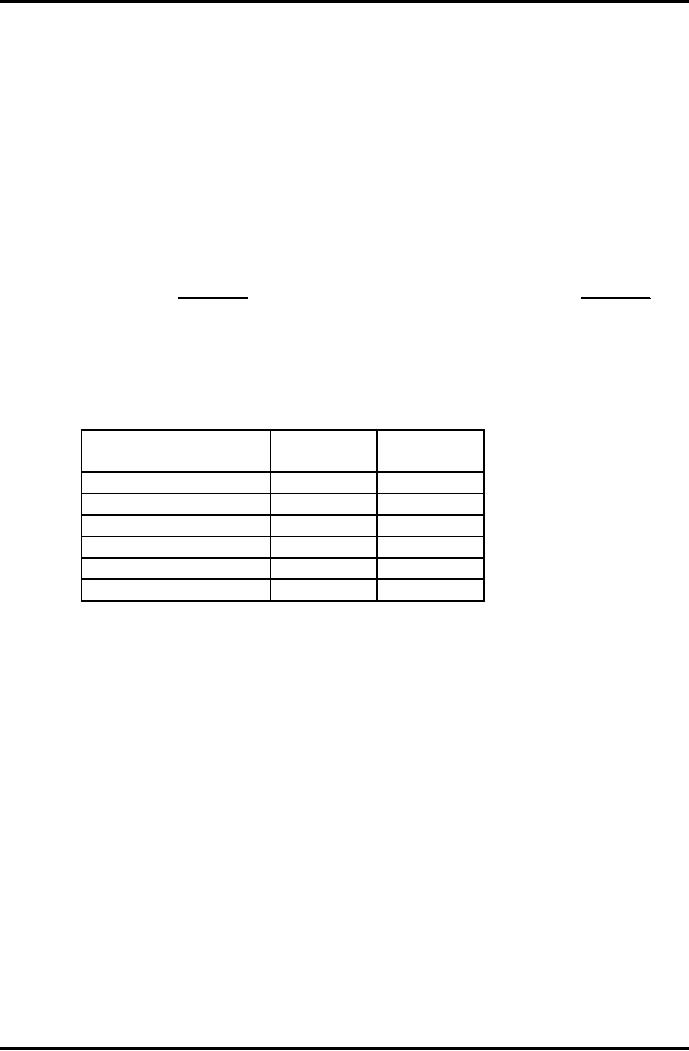

Practice

Questions

Q.1

From

the following given

information you are required

to prepare Income Statement

and

Balance

Sheet for the year

2007.

Cash

Book

Receipts

Amount

Payment

Amount

Rs.

Rs.

Opening

balance b/f

1,500

Salaries and wages

2,000

Cash

sales

12,000 Rent

and rates

800

Received

from Debtors

25,000

Electricity bill

500

Loan

from brother

10,000

Drawings

15,000

Paid to

creditors

24,000

Closing

balance c/f

6,200

48,500

48,500

Debtors

Account

Amount

Amount

Rs.

Rs.

Opening

balance b/f

8,000

Cash

received

from

25,000

debtors

200

Credit

sales

22,000

Discount allowed

300

Bad

debts

4,500

30,000

Closing balance c/f

30,000

Creditors

Account

Amount

Amount

Rs.

Rs.

Cash paid to

creditors

24,000

Opening balance

5,500

Discount

received

400 Credit

purchase

25,000

Closing

balance c/f

6,100

30,500

30,500

Statement

of Affairs as on opening date

Rupees

Opening

Assets

Furniture

20,000

Stocks

6,000

Debtors

8,000

Cash

1,500

35,500

Opening

Liabilities

Creditors

5,500

Owner's

Equity

30,000

12

Advance

Financial Accounting

(FIN-611)

VU

Year

end adjustments

Closing

stock Rs. 3,200; rent

prepaid Rs. 200; salaries

owing Rs. 500; and furniture

is to be

depreciated @

10%.

Q.2

Following is

a summary of Kashif's bank

account for the ended 31

December 2007:

Rs.

Rs.

Balance

1.1 207

405

Payments to

creditors for goods

29,487

Receipts

from debtors

37,936

Rent

1,650

Balance

31.12.2007

602

Rates

890

Sundry

expenses

375

Drawings

6,541

38,943

38,943

All of the

business takings have been

paid into the bank with

the exception of Rs. 9,630.

Out of

this,

Kashif has paid wages of Rs.

5,472, drawings of Rs. 1,164

and purchase of goods Rs.

2,994.

The following additional

information is available:

31.12.2006

31.12.2007

Rs.

Rs.

Stock

13,682

15,144

Creditors

for goods

5,624

7,389

Debtors

for goods

9,031

8,624

Rates

prepaid

210

225

Rent

owing

150

-

Fixtures at

valuation

2,500

2,250

You are to

draw up profit and loss account

for the year ended 31

December 2007 and balance

sheet as on

that date. Show all of

your workings.

13

Table of Contents:

- ACCOUNTING FOR INCOMPLETE RECORDS

- PRACTICING ACCOUNTING FOR INCOMPLETE RECORDS

- CONVERSION OF SINGLE ENTRY IN DOUBLE ENTRY ACCOUNTING SYSTEM

- SINGLE ENTRY CALCULATION OF MISSING INFORMATION

- SINGLE ENTRY CALCULATION OF MARKUP AND MARGIN

- ACCOUNTING SYSTEM IN NON-PROFIT ORGANIZATIONS

- NON-PROFIT ORGANIZATIONS

- PREPARATION OF FINANCIAL STATEMENTS OF NON-PROFIT ORGANIZATIONS FROM INCOMPLETE RECORDS

- DEPARTMENTAL ACCOUNTS 1

- DEPARTMENTAL ACCOUNTS 2

- BRANCH ACCOUNTING SYSTEMS

- BRANCH ACCOUNTING

- BRANCH ACCOUNTING - STOCK AND DEBTOR SYSTEM

- STOCK AND DEBTORS SYSTEM

- INDEPENDENT BRANCH

- BRANCH ACCOUNTING 1

- BRANCH ACCOUNTING 2

- ESSENTIALS OF PARTNERSHIP

- Partnership Accounts Changes in partnership firm

- COMPANY ACCOUNTS 1

- COMPANY ACCOUNTS 2

- Problems Solving

- COMPANY ACCOUNTS

- RETURNS ON FINANCIAL SOURCES

- IASB’S FRAMEWORK

- ELEMENTS OF FINANCIAL STATEMENTS

- EVENTS AFTER THE BALANCE SHEET DATE

- PROVISIONS, CONTINGENT LIABILITIES AND CONTINGENT ASSETS

- ACCOUNTING POLICIES, CHANGES IN ACCOUNTING ESTIMATES AND ERRORS 1

- ACCOUNTING POLICIES, CHANGES IN ACCOUNTING ESTIMATES AND ERRORS 2

- BORROWING COST

- EXCESS OF THE CARRYING AMOUNT OF THE QUALIFYING ASSET OVER RECOVERABLE AMOUNT

- EARNINGS PER SHARE

- Earnings per Share

- DILUTED EARNINGS PER SHARE

- GROUP ACCOUNTS

- Pre-acquisition Reserves

- GROUP ACCOUNTS: Minority Interest

- GROUP ACCOUNTS: Inter Company Trading (P to S)

- GROUP ACCOUNTS: Fair Value Adjustments

- GROUP ACCOUNTS: Pre-acquistion Profits, Dividends

- GROUP ACCOUNTS: Profit & Loss

- GROUP ACCOUNTS: Minority Interest, Inter Co.

- GROUP ACCOUNTS: Inter Co. Trading (when there is unrealized profit)

- Comprehensive Workings in Group Accounts Consolidated Balance Sheet