|

PROVISIONS, CONTINGENT LIABILITIES AND CONTINGENT ASSETS |

| << EVENTS AFTER THE BALANCE SHEET DATE |

| ACCOUNTING POLICIES, CHANGES IN ACCOUNTING ESTIMATES AND ERRORS 1 >> |

Advance

Financial Accounting

(FIN-611)

VU

LESSON

# 28

IAS

37 PROVISIONS, CONTINGENT LIABILITIES AND

CONTINGENT

ASSETS

DEFINITIONS:

The

following terms are used in

this Standard with the

meanings specified:

Liability:

A

liability is a present obligation of

the entity arising from past

events, the

settlement

of which is

expected to result in an outflow from the

entity of resources

embodying

economic

benefits. Definition of liability

can be divided into three

parts:

�

Present

obligation

�

Arising

from the past event

�

Probable

outflow of resources in future

Provision:

A

provision is a liability of uncertain

timing or amount. For a provision

following

points

must be kept in mind:

�

Present

obligation

�

Arising

from the past event

�

Probable

outflow of resources in future

�

Amount

can be estimated

reliably.

Provision

is created for two motives:

�

One

to reduce Assets

�

Second

to create a liability against

losses

Provision

that is created for reduction in

assets is of two types:

1.

Provision against receivables

(also known as contra to receivables

Provision

for doubtful debts)

2.

Provision against the expiry

of economic benefits of fixed

assets

(Provision

for depreciation/amortization).

IAS 37

does not talk about the

provisions created to reduce

the carrying amount of

assets.

It only talks about the

provision that is created to recognize a

liability against

probable

losses.

140

Advance

Financial Accounting

(FIN-611)

VU

Obligation

Event:

An

obligating event is an event

that creates a legal or

constructive obligation

that

results

in an entity having no realistic

alternative but to settle that

obligation.

�

Legal

Obligation:

A

legal obligation is an obligation

that derives from:

a) A

contract (through its

explicit or implicit

terms);

b)

Legislation; or

c)

Other operations of law.

�

Constructive

Obligation:

A

constructive obligation is an obligation

that derives from an entity's

actions where:

a) By an

established pattern of past

practice, published policies or a

sufficiently

specific

current statement, the

entity has indicated to

other parties that it

will

accept

certain responsibilities.

b) As a

result, the entity has

created a valid expectation on the

part of those other

parties

that it will discharge those

responsibilities.

Contingent

Liability:

A

contingent liability

is:

a) A

possible obligation that

arises from past events and

whose existence will be

confirmed

only by the occurrence or non-occurrence

of one or more

uncertain

future

events not wholly within the control of

the entity; or

b) A

present obligation that

arises from past events but is not

recognized because:

i.

It is not

probable that an outflow of resources

embodying economic

benefits

will be required to settle the

obligation.

ii.

The

amount of the obligation cannot be

measured with sufficient

reliability;

Contingent

Assets:

A

contingent asset is a possible

asset that arises from past

events and whose

existence

will be

confirmed only by the occurrence or

non-occurrence of one or more

uncertain

future

events not wholly within the control of

the entity.

Treatment

of Liabilities, Accruals &

Provisions:

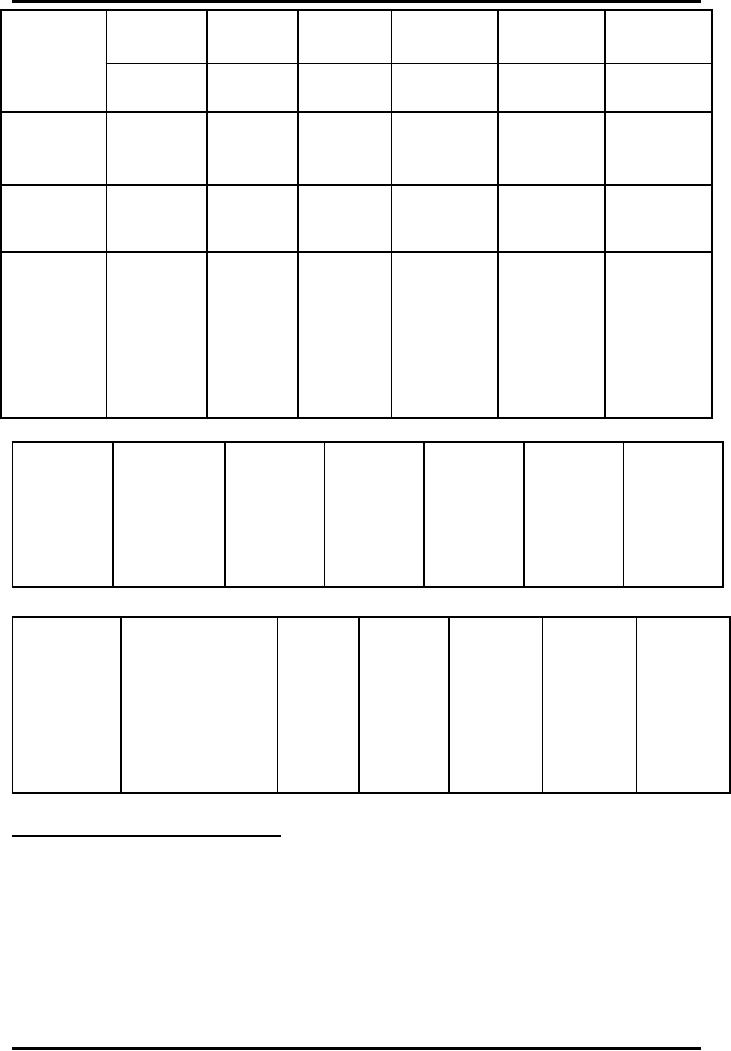

Liabilities

can be categorized as:

141

Advance

Financial Accounting

(FIN-611)

VU

1.

Certain liability

example

is Creditors against

supplies

2. Virtually

certain liability

example

is Accruals against

expenses

3.

Uncertain liability

example

is Provision against expected

losses

Liabilities

Accruals

Provisions

(certain)

(virtually

certain)

(uncertain)

Present

Present

obligation

Present

obligation

Status

obligation

Arising

from

Past

events

Past

events

Past

events

Outflow

of

resources

Probable

Probable

Probable

embodying

economic

benefits

Uncertain

(However

a

Measurement

of

Certain

Virtually

certain

amount

reliable

estimate

can

be made)

Dr.

Loss

Dr.

Expense

Dr.

Purchases

(Expenses)

Accounting

Cr.

treatment

Cr.

Creditors

Cr.

Provision for

Accrual/Owings

the

Loss

Virtually

certain:

Something

that involve a minor degree of

estimation. An example of such would

be

the

amount payable in Utility Bills. The

expense on the bill is for one month;

however

the

meter is read a couple of

days after the month

including charges for those

extra

days

as well.

Identifying

Contingent Liabilities:

Following

table will help to identify

whether the obligation is a

contingent liability

or

not in accordance with the

definition of IAS

37.

Case

1

Case

2

Case

3

Possible

Present

obligation

Present

obligation

Status

obligation

Arising

from

Past

events

Past

events

Past

events

Will be

confirmed

Outflow

of

resources

upon

the

Probable

Not

probable

embodying

occurrence

or

142

Advance

Financial Accounting

(FIN-611)

VU

economic

benefits

non-occurrence

of

future

events, not

in

the control of

the

entity

a]

Future events

a]

Probability is

not

remote

are

not remote

be b]

Probability is

Cannot

Amount

measured

reliably remote

b]

Future events

are

remote

a]

Disclosed in

a]

Disclosed in

notes

notes

Accounting

Disclosed

in notes

treatment

b] Not

disclosed

b] Not

disclosed in

in

notes

notes

Accounting

Requirements for recognizing Liabilities

and Assets:

Recognizing

liabilities and assets means to record

relevant accounting heads in

the

books

of accounts. IASB frame work and

relevant Accounting Standards

provide

guidelines

for recognizing liabilities and assets at

different stages.

Following

table will explain that which

type of liabilities and assets will be

treated in

what

way.

Stage

Liabilities

Assets

Recognize

Recognize

Certain

Virtually

certain

Recognize

Recognize

(Accruals/Owings)

Uncertain

Do not

recognize

(Probable/Provisio

Recognize

Disclose

only

n)

Do not

recognize

Contingent

Do

nothing

Disclose

only

Remote

Do

nothing

Do

nothing

Do

nothing:

`Do

nothing' means that the

event is to be ignored while preparing

the financial

statements.

Even a disclosure of the

same is not required in the

notes to the

accounts.

143

Advance

Financial Accounting

(FIN-611)

VU

Recognizing

different transactions/events in

Accordance with IAS

37:

Expense/Loss

Measurement

of

Status/Recognize

Accounting

entry

amount

as

(Status)

Certain

Identified

as

Dr.

Expense

(Invoice/supporti

Liability

present

ng

documents

Cr.

Payable

obligation

based)

Virtually

certain

Dr.

Expense

Identified

as

(Invoice/supporti

Accrued

liability

Cr.

present

ng

documents

obligation

Accrual/Owings

based)

Uncertain

(amount

can be

Dr.

Expense

Identified

as

estimated

reliably

(Loss)

present

Provision

liability

with

probable

Cr.

Provision for

obligation

outflow

of

loss

resources)

Uncertain

(amount

can not

be

estimated

Identified

as

reliably

although

Contingent

No

entry.

present

there

is

a

liability

Disclose

only

obligation

probability

of

outflow

of

resources)

Uncertain

(without

any

Identified

as

Contingent

No

entry.

present

probability

of

liability

Disclose

only

obligation

outflow

resources)

Uncertain

(possible

outflow

of

resources are

Unidentified

Contingent

No

entry.

(possible

based

on future

liability

Disclose

only

obligation)

events

not in

control

of the

entity)

Unidentified

No

entry.

No

(remote

Uncertain

No

recognition

disclosure

obligation)

144

Advance

Financial Accounting

(FIN-611)

VU

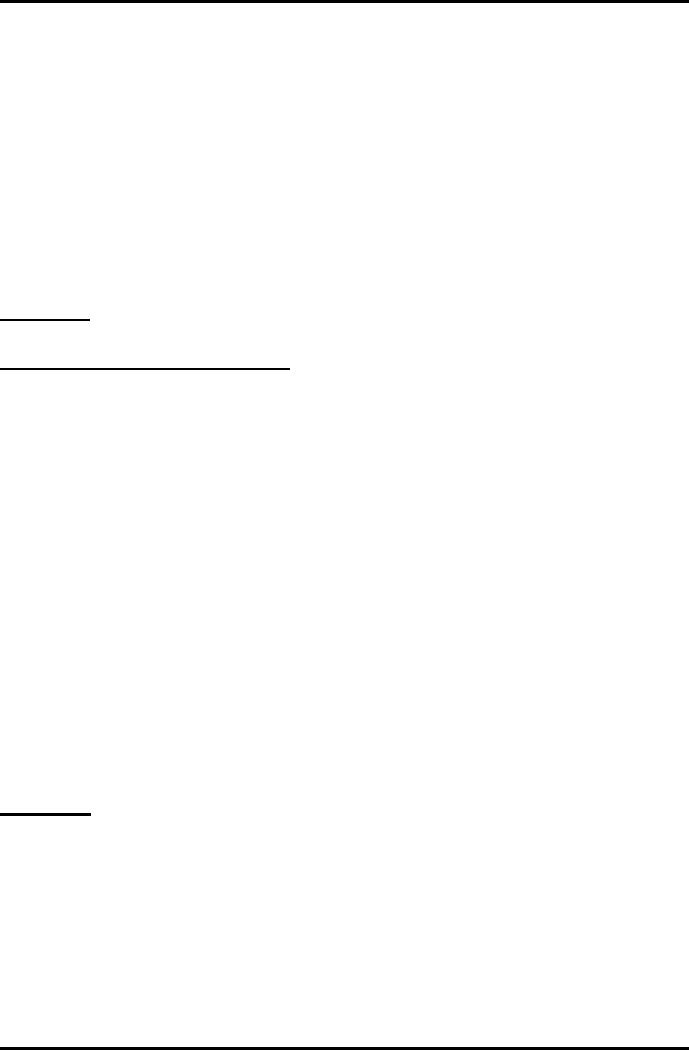

Accrued

Provision

Contingent

Contingent

Contingent

Creditors

Expense

liability

liability

liability

liability

Liability

Virtually

Certain

Uncertain

Uncertain

Uncertain

Possible

certain

1:

Present

X

obligation

2:

Arising

from

past

events

3:

Probable

outflow

of

resources

X

embodying

economic

benefit

in

future

4:

Reliable

estimation

As

per

As

per

of

the

iouprev

-/

Invoice

X

-

amount

s

X/

received

(can

be

Invoice

measured

reliably)

Losses

against

Expense

warranty

No

entry

No

entry

No

entry

5: Expense/Resources

A/C

Dr.

only

only

only

Accounting

Provision

disclosure disclosure

disclosure

Payable

A/C

Accrual

treatment

for is

required is required is

required

A/C

Warranty

Cr.

Provisions

and Other

Liabilities:

Provisions

can be distinguished from other

liabilities such as trade

payables and

accruals

because there is uncertainty

about the timing or amount of the

future

expenditure

required in settlement. By

contrast:

a)

Trade payables are

liabilities to pay for goods or services

that have been

received

or supplied and have been

invoiced or formally agreed with

the

supplier;

and

145

Advance

Financial Accounting

(FIN-611)

VU

b)

Accruals are liabilities to pay for

goods or services that have

been received or

supplied

but have not been paid,

invoiced or formally agreed with the

supplier,

including

amounts due to employees (for

example amounts relating to

accrued

vacation

pay).

Although it is

sometimes necessary to estimate

the amount or timing of accruals,

the

uncertainty

is generally much less than for

provisions. Accruals are

often reported as

part

of trade and other payables,

whereas provisions are

reported separately.

Relationship

between Provisions and

Contingent Liabilities:

This

Standard distinguishes

between:

a)

Provisions which are recognized as

liabilities (assuming that a

reliable

estimate

can be made) because they

are present obligations and it is

probable

that

an outflow of resources embodying

economic benefits will be required

to

settle

the obligations; and

b)

Contingent liabilities which are

not recognized as liabilities because

they are

either:

i.

Possible

obligations, as it has yet to be

confirmed whether the entity

has

a

present obligation that

could lead to an outflow of

resources

embodying

economic benefits; or

ii.

Present

obligations that do not meet

the recognition criteria in

this

Standard

(because either it is not probable

that an outflow of resources

embodying

economic benefits will be required to

settle the obligation,

or

a

sufficiently reliable estimate of

the amount of the obligation

cannot be

made).

RECOGNITION:

Provisions:

A

provision shall be recognized

when:

a) An

entity has a present

obligation (legal or constructive) as a

result of a past

event;

b) It is

probable that an outflow of resources

embodying economic benefits will

be

required

to settle the obligation;

and

c) A

reliable estimate can be

made of the amount of the

obligation.

If

these conditions are not

met, no provision shall be

recognized.

Present

Obligation:

In

rare cases it is not clear

whether there is a present

obligation. In these cases, a

past

event

is deemed to give rise to a

present obligation if,

taking account of all

available

146

Advance

Financial Accounting

(FIN-611)

VU

evidence,

it is more likely than not,

that a present obligation

exists at the balance

sheet

date.

In

almost all cases it will be clear

whether a past event has

given rise to a

present

obligation.

In rare cases, for example in a law

suit, it may be disputed either

whether

certain

events have occurred or

whether those events result

in a present obligation. In

such

a case, an entity determines whether a

present obligation exists at

the balance

sheet

date by taking into account of all

available evidence, including for

example, the

opinion

of experts. The evidence

considered includes any additional

evidence

provided

by events after the balance

sheet date. On the basis of

such evidence:

a)

Where it is more likely than

not, that a present

obligation exists at the

balance

sheet

date, the entity recognizes

a provision (if the recognition

criteria are met);

and

b)

Where it is more likely that

no present obligation exists at

the balance sheet

date,

the entity discloses

ability, unless the

possibility of an outflow of

resources

embodying

economic benefits is

remote.

Past

Events:

A

past event that leads to a

present obligation is called an

obligating event. For

an

event

to be an obligating event, it is

necessary that the entity

has no realistic

alternative

to settling the obligation

created by the event. This

is the case only:

a)

Where the settlement of the

obligation can be enforced by law;

or

b) In

case of a constructive obligation,

the event creates valid

expectations in other

parties

that the entity will

discharge the

obligation.

Probable

Outflow of Resources Embodying

Economic Benefits:

For

a liability to qualify for recognition

there must be not only a present

obligation but

also

the probability of an outflow of

resources embodying economic

benefits to settle

that

obligation. For the purpose

of this Standard, an outflow of resources

or other

event

is regarded as probable if the

event is more likely than not to

occur i.e. the

probability

that the event will occur is

greater than the probability

that it will not.

Where

it is not probable that a present

obligation exists, an entity

discloses a

contingent

liability, unless the

possibility of an outflow of resources

embodying

economic

benefits is remote.

Reliable

Estimate of the

Obligation:

The

use of estimates is an essential

part of the preparation of

financial statements and

does

not undermine their reliability.

This is especially true in the

case of provisions,

which by

their nature are more

uncertain than most other

balance sheet items.

147

Advance

Financial Accounting

(FIN-611)

VU

Contingent

Liabilities:

An

entity shall not recognize a

contingent liability. A contingent

liability is disclosed

unless

the possibility of an outflow of

resources embodying economic

benefits is

remote.

Contingent

liabilities may develop in a way not

initially expected. Therefore, they

are

assessed

continually to determine whether an

outflow of resources embodying

economic

benefits has become

probable. If it becomes probable

that an outflow of

future

economic benefits will be required for an

item previously dealt with as

a

contingent

liability, a provision is recognized in

the financial statements of

the period

in which

the change in probability

occurs (except in the

extremely rare

circumstances

where

no reliable estimate can be

made).

Example-1:

Extract

from Notes to the

Accounts:

a)

Guarantees issued by banks on

behalf the company;

b)

Claims against the company

were not acknowledged as debt by

the company.

As

the management is confident

that the matter would be

settled in her favor;

consequently

no provision has been made

in the financial statements in

respect

of

the disputed

liabilities.

Contingent

Assets:

An

entity shall not recognize a

contingent asset. Contingent assets

usually arise from

unplanned

or other unexpected events

that give rise to the

possibility of an inflow of

economic

benefits to the entity. An

example is a claim that an

entity is pursuing

through

legal processes, where the

outcome is uncertain.

Contingent

assets are not recognized in financial

statements since this may

result in

the

recognition of income that may

never be realized. However, when

the realization

of

income is virtually certain, then the

related asset is not a contingent

asset and its

recognition

is appropriate.

A

contingent asset is disclosed

where an inflow of economic benefits is

probable.

Example-2:

The

company has filed a suit

against SA Ltd. claming damages

amounting to Rs.

600,000.

The legal advisors of the

company are of the opinion

that the company will

win

the case.

148

Advance

Financial Accounting

(FIN-611)

VU

MEASUREMENT:

Best

Estimate:

The

amount recognized as a provision shall be

the best estimate of the

expenditure

required

to settle the present

obligation at the balance

sheet date.

The

estimates of outcome and financial

effect are determined by the

judgment of the

management

of the entity, supplemented by

experience of similar transactions and

in

some

cases, reports from independent

experts. The evidence

considered includes any

additional

evidence provided by events

after the balance sheet

date.

Example-3:

An

entity sells goods with a warranty under

which customers are covered for

the cost

of

repairs of any manufacturing defects

that become apparent within

the first six

months

after purchase. If minor defects

were detected in all products

sold, repair costs

of

Rs. 1 million would result. If major

defects were detected in all

products sold, repair

costs

of Rs. 4 million would result. The

entities past experience and future

expectations

indicate

that, for the coming year,

75 percent of the goods sold

will have no defects, 20

percent

of the goods sold will have

minor defects and 5 percent of the

goods sold will

have

major defects. In accordance with

3.1.4.2, an entity assesses

the probability of an

outflow for

the warranty obligations as a

whole.

The

expected value of the cost

of repairs is:

(75%

of Nil) + (20% of Rs. 1 m) + (5% of

Rs. 4 m) = Rs.

400,000.

CHALLANGES

IN PROVISION:

Provision

shall be reviewed at each

balance sheet date and

adjusted to reflect

the

current

best estimate. If it is no longer

probable that an outflow of

resources

embodying

economic benefits will be required to

settle the obligation, the

provision

shall

be reversed.

USE

OF PROVISIONS:

A

provision shall be used only for

expenditures for which the provision

was originally

recognized.

Only

expenditures that relate to

the original provision are

set against it.

Setting

expenditures

against a provision that was

originally recognized for another

purpose

would

conceal the impact of two

different events.

Example-8:

A

damage claim of Rs. 15 million for

breach of contract has been

served on the

company.

The company's legal counsel

is of the view that it is probable

that the

damages

will be awarded to plaintiff. So,

the company makes a

provision. In the

next

149

Advance

Financial Accounting

(FIN-611)

VU

year

the case is decided in the

favor of the plaintiff. The

company has to pay Rs.

12

million.

Another suit filed against

the company is also decided

in this year. The

company

has to pay Rs. 2 million in respect of

this case.

Required:

How will you

account for above two

payments?

Solution:

i.

The

first payment of Rs. 12 million

shall be charged to provision and

remaining

provision

should be reversed.

Provision

for claim

15,000,000

Cash

12,000,000

Profit

& Loss (Reversal of

provision)

3,000,000

ii.

The

second payment of Rs. 2 million

shall be charged to P & L

Account

separately.

Damages

Expenses (P & L A/c)

2,000,000

Cash

2,000,000

Application

of the Recognition and

Measurement Rules:

Future

Operating Losses:

a)

Provisions shall not be recognized for

future operating losses.

b)

Future operating losses do not

meet the definition of a

liability and the

general

recognition

criteria set out for

provisions.

c) An

expectation of future operating losses is

an indication that certain assets

of

the

operation may be impaird. An entity

tests these assets for impairment

under

IAS-36

Impairment of Assets.

Onerous

Contracts:

If an

entity has a contract that

is onerous, the present

obligation under the

contract

shall

be recognized and measured as a

provision.

150

Table of Contents:

- ACCOUNTING FOR INCOMPLETE RECORDS

- PRACTICING ACCOUNTING FOR INCOMPLETE RECORDS

- CONVERSION OF SINGLE ENTRY IN DOUBLE ENTRY ACCOUNTING SYSTEM

- SINGLE ENTRY CALCULATION OF MISSING INFORMATION

- SINGLE ENTRY CALCULATION OF MARKUP AND MARGIN

- ACCOUNTING SYSTEM IN NON-PROFIT ORGANIZATIONS

- NON-PROFIT ORGANIZATIONS

- PREPARATION OF FINANCIAL STATEMENTS OF NON-PROFIT ORGANIZATIONS FROM INCOMPLETE RECORDS

- DEPARTMENTAL ACCOUNTS 1

- DEPARTMENTAL ACCOUNTS 2

- BRANCH ACCOUNTING SYSTEMS

- BRANCH ACCOUNTING

- BRANCH ACCOUNTING - STOCK AND DEBTOR SYSTEM

- STOCK AND DEBTORS SYSTEM

- INDEPENDENT BRANCH

- BRANCH ACCOUNTING 1

- BRANCH ACCOUNTING 2

- ESSENTIALS OF PARTNERSHIP

- Partnership Accounts Changes in partnership firm

- COMPANY ACCOUNTS 1

- COMPANY ACCOUNTS 2

- Problems Solving

- COMPANY ACCOUNTS

- RETURNS ON FINANCIAL SOURCES

- IASB’S FRAMEWORK

- ELEMENTS OF FINANCIAL STATEMENTS

- EVENTS AFTER THE BALANCE SHEET DATE

- PROVISIONS, CONTINGENT LIABILITIES AND CONTINGENT ASSETS

- ACCOUNTING POLICIES, CHANGES IN ACCOUNTING ESTIMATES AND ERRORS 1

- ACCOUNTING POLICIES, CHANGES IN ACCOUNTING ESTIMATES AND ERRORS 2

- BORROWING COST

- EXCESS OF THE CARRYING AMOUNT OF THE QUALIFYING ASSET OVER RECOVERABLE AMOUNT

- EARNINGS PER SHARE

- Earnings per Share

- DILUTED EARNINGS PER SHARE

- GROUP ACCOUNTS

- Pre-acquisition Reserves

- GROUP ACCOUNTS: Minority Interest

- GROUP ACCOUNTS: Inter Company Trading (P to S)

- GROUP ACCOUNTS: Fair Value Adjustments

- GROUP ACCOUNTS: Pre-acquistion Profits, Dividends

- GROUP ACCOUNTS: Profit & Loss

- GROUP ACCOUNTS: Minority Interest, Inter Co.

- GROUP ACCOUNTS: Inter Co. Trading (when there is unrealized profit)

- Comprehensive Workings in Group Accounts Consolidated Balance Sheet