|

EVENTS AFTER THE BALANCE SHEET DATE |

| << ELEMENTS OF FINANCIAL STATEMENTS |

| PROVISIONS, CONTINGENT LIABILITIES AND CONTINGENT ASSETS >> |

Advance

Financial Accounting

(FIN-611)

VU

LESSON

27

IAS 10

EVENTS AFTER THE BALANCE

SHEET DATE

Before

starting discussion on the IAS 10

that is about the events

that occur after

the

balance

sheet date, let us

differentiate between

the:

�

Draft

Financial Statements and

�

Published

Financial Statements

Draft

financial statements:

Draft

financial statements are one

that are prepared by the

accounts department,

audited

by the external auditors and put in front

of the board of directors for

approval.

Published

financial statements:

Published

financial statements are one

that has been approved by

the board of

directors

and has also been published

for issuance to the shareholders of

the company.

Here

we must also discuss different

dates that are pertinent to

the IAS 10

for

better

understanding.

�

Balance

Sheet Date

�

Date

of the Board of Director's

Meeting (BOD)

�

Date

of the Annual General Meeting

(AGM)

Balance

sheet date:

It is

the closing date on which

the balance sheet is

prepared. This is the

closing date of

the

accounting year.

Date

of BOD meeting:

It is

the date in which the

directors approve the

financial statements of the

company.

This

date is obviously after the

balance sheet date but

before the date of

annual

general

meeting (AGM). The BOD

meeting should be held at least 21

days before the

date

of the annual general

meeting. Because members of

the company should

receive

21

days notice of the AGM along

with the published financial

statements.

Date

of AGM:

It is

the date that should not be

after the expiry of four

months (in Pakistani

scenario

according

to the requirements of the

securities and exchange commission of

Pakistan-

SECP) and

six months (in international

scenario according to the

provisions of IAS-1)

133

Advance

Financial Accounting

(FIN-611)

VU

Note:

The

BOD holds meeting after

the balance sheet date but

before the annual

general

meeting.

Events

after the balance sheet

date

These

are those events, favorable

and unfavorable, that occur

between the balance

sheet

date and the date when the

financial statements are

authorized for issue. Two

types

of events can be

identified:

(a)

Those

events that provide evidence

of conditions that existed at

the

balance

sheet date (adjusting events

after the balance sheet

date); and

(b)

Those

events that are indicative

of conditions that arose

after the balance

sheet

date (non-adjusting events

after the balance sheet

date).

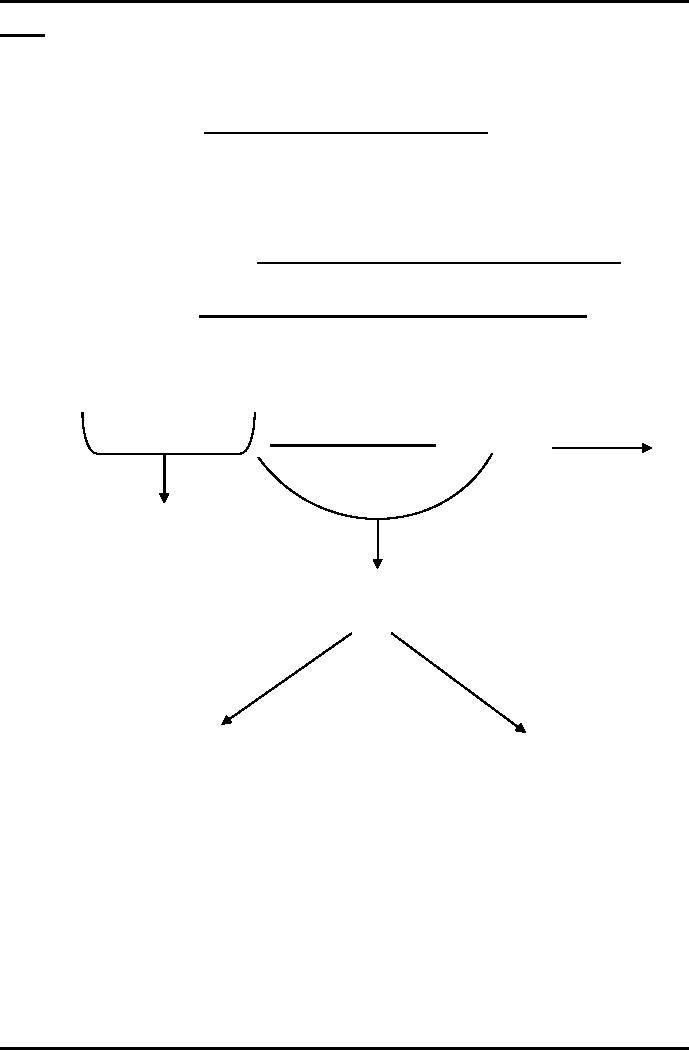

Following

figure will help to under stand

the events after the

balance sheet date;

31 Dec

2008

1 Jan

2008

25 March

2009

Accounting

Period

Events

after the balance

sheet

date.

Adjusting

events

Non-adjusting

events

In

this figure balance sheet

date is December 31, 2008 and

the date of BOD meeting

is

March

25, 2009. So the events

that occur in between these

two dates will be the

events

after

the balance sheet

date.

Explanation:

A

Good Stock costing Rs.

100,000 was written down to NRV of Rs.

97,500 at the

Balance

Sheet date. After the

Balance Sheet date it is

sold for Rs. 96,000.

The

condition of stock at the

balance sheet date has not

changed till sale and the

future

event

provides evidence regarding

the decline in its value.

Thus, it is an adjusting

event

after the balance sheet

date.

134

Advance

Financial Accounting

(FIN-611)

VU

On

the other hand, a Good

Stock costing Rs. 200,000

was written down to NRV of Rs.

197,000 at

the balance sheet date.

After the balance sheet date

the stock was

spoiled

and

sold for only Rs.10, 000 as

scrap.

In

this case the condition of

spoilage did not exist at the

balance sheet date.

This

spoilage

is indicative of condition that

arose after the balance

sheet date. So, this is

a

non-adjusting

event after the balance

sheet date.

Example-1:

Classify

the following events after

the balance sheet date as

adjusting or non-

adjusting:

(a)

Creative

Textile (Private) Limited

decided to takeover Saga

Sports (Private)

Limited

after the balance sheet

date.

(b)

QSA

Surgical announces a plan to discontinue

its Marala Branch after

the

balance

sheet date.

(c)

Sale

of inventory after the

balance sheet date below

its cost and also below

its

NRV (Inventory

was measured at NRV on the

Balance Sheet Date).

(d)

Changes

in tax rates after the

balance sheet date having a

significant effect on

current

and deferred tax assets and

liabilities.

(e)

A doubtful

customer defaults after the

balance sheet date;

provision for such

customer

has been made @

10%.

Asset

purchased on 27th

December

2004, invoice has been

received on 5th

(f)

January

2005. The year ends on

31st December

2004.

(g)

The

discovery of fraud that shows

that the financial

statements are

incorrect.

Solution:

Adjusting

events after the balance

sheet date.

(c),

(e), (f), (g)

Non-adjusting

events after the balance

sheet date.

(a),

(b), (d)

The

process involved in authorizing the

financial statements for issue will

vary

depending

upon the management structure,

statutory requirements and

procedures

followed

in preparing and finalizing the

financial statements.

In

some cases, an entity is

required to submit its

financial statements to

its

shareholders

for approval after the

financial statements have

been issued. In such

cases,

the financial statements are

authorized for issue on the

date of issue, not

the

date

when shareholders approve the

financial statements.

135

Advance

Financial Accounting

(FIN-611)

VU

Example-2:

The

management of an entity completes

draft financial statements for

the year to 31st

December

2005 on 28th January 2006. On

18th February 2006,

the board of

directors

reviews

the financial statements and

authorizes them for issue. The

entity announces

its

profit and selected other

financial information on 19th February 2006. The

financial

statements

are made available to

shareholders and others on 1st March 2006. The

shareholders

approve the financial

statements at their annual

meeting on 15th

April

2006 and

the approved financial

statements are then filed with a

regulatory body on

17th April 2006.

The

financial statements are authorized

for issue on 18th February 2006 (date of

board

authorization

for issue).

In

some cases, the management

of an entity is required to issue

its financial

statements

to a

supervisory board (made up

solely of non-executives) for approval.

In such cases,

the

financial statements are

authorized for issue when the

management authorizes

them for

issue to the supervisory

board.

Example-3:

On

18th February 2002,

the management of an entity

authorizes financial

statements

for

issue to its supervisory

board. The supervisory board

is made up solely of non-

executives

and may include representatives of

employees and other outside

interests.

The

supervisory board approves

the financial statements on

26th February 2002.

The

financial

statements are made

available to shareholders and others on

1st March 2002.

The

shareholders approve the

financial statements at their

annual meeting on 15th

April 2002 and

the financial statements are

then filed with a regulatory body on

17th

April

2002.

The

financial statements are authorized

for issue on 18th February 2002 (date of

management

authorization

for issue to the supervisory

board).

RECOGNITION

AND MEASUREMENT:

Adjusting

Events after the Balance

Sheet Date:

An

entity shall adjust the

amounts recognized in its

financial statements to

reflect

adjusting

events after the balance

sheet date.

Example-4:

A

customer was considered doubtful at

the balance sheet date. A

provision for such

customer

was made @ 50%. After the

balance sheet date, customer

was declared as

insolvent

based on his financial

position on year end.

Required:

What will be

the accounting

treatment?

Solution:

136

Advance

Financial Accounting

(FIN-611)

VU

This

is an adjusting event after

the balance sheet date and

should be recognized in

the

financial

statements. At the balance

sheet date, 100% provision

shall be made against

that

debtor i.e. provision is to be

increased by further 50%.

Example-5:

A

customer was doubtful at the

balance sheet date. A

provision for such customer

was

made

@ 5%. After the balance

sheet date, customer paid

85% of the total

amount.

Required:

What will be

the accounting

treatment?

Solution:

This

is an adjusting event. This

event shall be recognized in

the financial

statements.

At

the balance sheet, provision

shall be made @ 15% i.e.

Additional 10%

provision

shall

also be recorded.

Non-adjusting

Events after the Balance

Sheet Date:

An

entity shall not adjust the

amounts recognized in its

financial statements to

reflect

Non-adjusting

events after the balance

sheet date.

Example-6

An

asset, whose book value is

Rs. 89,000, was destroyed by

fire after the balance

sheet

date.

Required:

(i)

Identify

event type

(ii)

What will be

accounting treatment?

Solution:

(i)

This

is non-adjusting event as the

condition arose after the

balance sheet date.

(ii)

An

entity shall not recognize

such event in the financial

statement. It shall only

be

disclosed.

Examples

are:

a)

Decline

in market value of investments

between the balance sheet

date and the

date

when the financial statements

are authorized for

issue.

b)

Loss

of stock after the date of

financial statements.

The

following are the examples of

non-adjusting events after

the balance sheet

date

that

would generally result in

disclosure:

137

Advance

Financial Accounting

(FIN-611)

VU

(a)

A

major business takeover

after the balance sheet

date or disposing of a

major

subsidiary;

(b)

Announcing

a plan to discontinue an

operation;

(c)

Major

purchases of assets, classification of

assets as held for sale, other

disposals

of assets, or expropriation of major

assets by government;

(d)

The

destruction of a major production plant

by a fire after the balance

sheet

date;

(e)

Announcing,

or commencing the implementation

of, a major

restructuring;

(f)

Abnormally

large changes after the

balance sheet date in asset

prices or foreign

exchange

rates;

(g)

changes

in tax rates or tax laws

enacted or announced after

the balance sheet

date

that have a significant

effect on current and deferred

tax assets and liabilities;

(h)

Entering

into significant commitments or

contingent liabilities, for example,

by

issuing

significant guarantees; and

(i)

Commencing

major litigation arising,

solely out of events that occurred

after

the

balance sheet date.

Dividends

If an

entity declares dividends to

holders of equity instruments

after the balance

sheet

date,

the entity shall not

recognize those dividends as a

liability at the balance

sheet

date.

If

dividends are declared (i.e.

the dividends are

appropriately authorized and no

longer

at the discretion of the

entity) after the balance

sheet date but before

the

financial

statements are authorized for

issue, the dividends are not

recognized as a

liability

at the balance sheet date

because they do not meet the

criteria of a present

obligation

in

IAS-37.

Such dividends are disclosed

in the notes in accordance

with

IAS-1

Presentation of Financial

Statements.

Example-7:

Mobitel

Private Limited announces

dividend to its shareholders

amounting to

Rs.1,500,000

after the Balance Sheet

Date. The closing balance of

Retained Earnings is

Rs.

7,000,000 including above

dividend.

Required:

Effect

of the above on Financial

Statements.

Solution:

It

shall be disclosed in the

notes to the accounts as

follows:

Proposed

Dividend

Dividend

proposed for the year is

Rs.1,500,000.

138

Advance

Financial Accounting

(FIN-611)

VU

Going

Concern

An

entity shall not prepare its

financial statements on a going

concern basis if

management

determines after the balance

sheet date either that it

intends to liquidate

the

entity or to cease trading, or

that it has no realistic

alternative but to do so.

Deterioration

in operating results and financial

position after the balance

sheet date

may

indicate a need to consider

whether the going concern

assumption is still

appropriate.

If the going concern

assumption is no longer appropriate,

the effect is so

pervasive

that this Standard requires

a fundamental change in the

basis of accounting,

rather

than an adjustment to the amounts

recognized within the original

basis of

accounting.

Example-8:

Elahi

(Private) Limited is in the

course of finalizing its

financial statements for the

year

ended

30th June

2004.

Due to

market competition and loss of

customers, company intends to

cease its

business

and liquidate the

company.

Should

the company prepare

financial statement on a going

concern basis or not?

Solution:

The

company should not prepare

the financial statement on a

going concern basis.

It

must

also disclose the fact

that financial statements

are not prepared on a

going

concern

basis. The amounts appearing

in Financial Statements would also be

adjusted

appropriately

according to new basis of accounting

i.e. current market

values.

139

Table of Contents:

- ACCOUNTING FOR INCOMPLETE RECORDS

- PRACTICING ACCOUNTING FOR INCOMPLETE RECORDS

- CONVERSION OF SINGLE ENTRY IN DOUBLE ENTRY ACCOUNTING SYSTEM

- SINGLE ENTRY CALCULATION OF MISSING INFORMATION

- SINGLE ENTRY CALCULATION OF MARKUP AND MARGIN

- ACCOUNTING SYSTEM IN NON-PROFIT ORGANIZATIONS

- NON-PROFIT ORGANIZATIONS

- PREPARATION OF FINANCIAL STATEMENTS OF NON-PROFIT ORGANIZATIONS FROM INCOMPLETE RECORDS

- DEPARTMENTAL ACCOUNTS 1

- DEPARTMENTAL ACCOUNTS 2

- BRANCH ACCOUNTING SYSTEMS

- BRANCH ACCOUNTING

- BRANCH ACCOUNTING - STOCK AND DEBTOR SYSTEM

- STOCK AND DEBTORS SYSTEM

- INDEPENDENT BRANCH

- BRANCH ACCOUNTING 1

- BRANCH ACCOUNTING 2

- ESSENTIALS OF PARTNERSHIP

- Partnership Accounts Changes in partnership firm

- COMPANY ACCOUNTS 1

- COMPANY ACCOUNTS 2

- Problems Solving

- COMPANY ACCOUNTS

- RETURNS ON FINANCIAL SOURCES

- IASB’S FRAMEWORK

- ELEMENTS OF FINANCIAL STATEMENTS

- EVENTS AFTER THE BALANCE SHEET DATE

- PROVISIONS, CONTINGENT LIABILITIES AND CONTINGENT ASSETS

- ACCOUNTING POLICIES, CHANGES IN ACCOUNTING ESTIMATES AND ERRORS 1

- ACCOUNTING POLICIES, CHANGES IN ACCOUNTING ESTIMATES AND ERRORS 2

- BORROWING COST

- EXCESS OF THE CARRYING AMOUNT OF THE QUALIFYING ASSET OVER RECOVERABLE AMOUNT

- EARNINGS PER SHARE

- Earnings per Share

- DILUTED EARNINGS PER SHARE

- GROUP ACCOUNTS

- Pre-acquisition Reserves

- GROUP ACCOUNTS: Minority Interest

- GROUP ACCOUNTS: Inter Company Trading (P to S)

- GROUP ACCOUNTS: Fair Value Adjustments

- GROUP ACCOUNTS: Pre-acquistion Profits, Dividends

- GROUP ACCOUNTS: Profit & Loss

- GROUP ACCOUNTS: Minority Interest, Inter Co.

- GROUP ACCOUNTS: Inter Co. Trading (when there is unrealized profit)

- Comprehensive Workings in Group Accounts Consolidated Balance Sheet