|

COMPANY ACCOUNTS |

| << Problems Solving |

| RETURNS ON FINANCIAL SOURCES >> |

Advance

Financial Accounting

(FIN-611)

VU

LESSON

# 23

MORE ABOUT

COMPANY ACCOUNTS

Rights

Issues of Shares

Any

subsequent issue of shares

against consideration is rights

issue. A rights issue

of

shares

is the simples and most

economical way of raising finance. It is

an issue of share

in which

the existing shareholders

have an anticipatory right to subscribe

for the new

shares.

In a rights issue, a warrant is

sent to the existing

shareholders, which entails

them to

take up a specified number of shares at a

specified price. The price

of the

shares

so offered is higher than the

face value but below the

market price to make

the

offer

fascinating.

An

existing share holder who

does not wish to exercise any or all of

the rights is at

liberty

to sell them to third parties who can

purchase such shares at the

same offer

price.

Accounting

entries to record the rights

issue of share is exactly

the same as those we

have

already learned to pass when

share are issued at

premium.

Bank

a/c

Share

Capital a/c

Share

Premium a/c

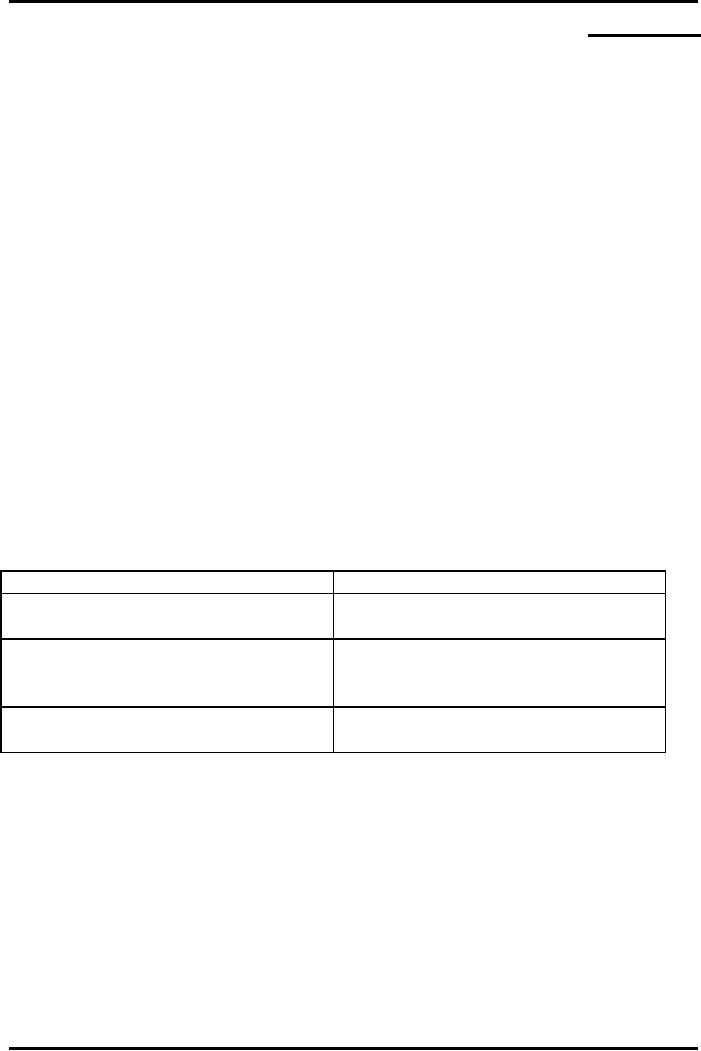

Comparison

between Rights Issue and

Initial Public Offer

(IPO)

Rights

Issue

Initial

Public Offer

1. A

rights issue is made

to

1.

Initial Public Offer is made

to

existing

shareholders

the

public at large

2.

There is no chance of

over

2.

There is a chance of

over

subscription

subscription;

hence

the

floatation

cost is high.

3.

Price of the rights issue is

kept

3.

Initial public offer is

generally

lesser

than the market price

made

on face value

Solved

Problem:

Right

Co Ltd has 80,000 Rs. 10 ordinary

shares in issue. They were

originally issued at

a premium of

Rs. 4 per share. The

current market price of

these shares is Rs. 35

each.

Right

Co Ltd has announced a 1rights

share for every 4 shares held at

Rs. 30 per share.

Required:

1.

Prepare relevant ledger

accounts to record the above

transaction

2.

Prepare extracts of balance

sheet showing share capital

and share premium a/c

3.

Babar owned 3,200 shares in

Right Co Ltd before the

rights issue. How many

numbers

of shares will he own after the

rights issue? What will be his

share of

the

voting right in the Company before and

after the rights

issue?

109

Advance

Financial Accounting

(FIN-611)

VU

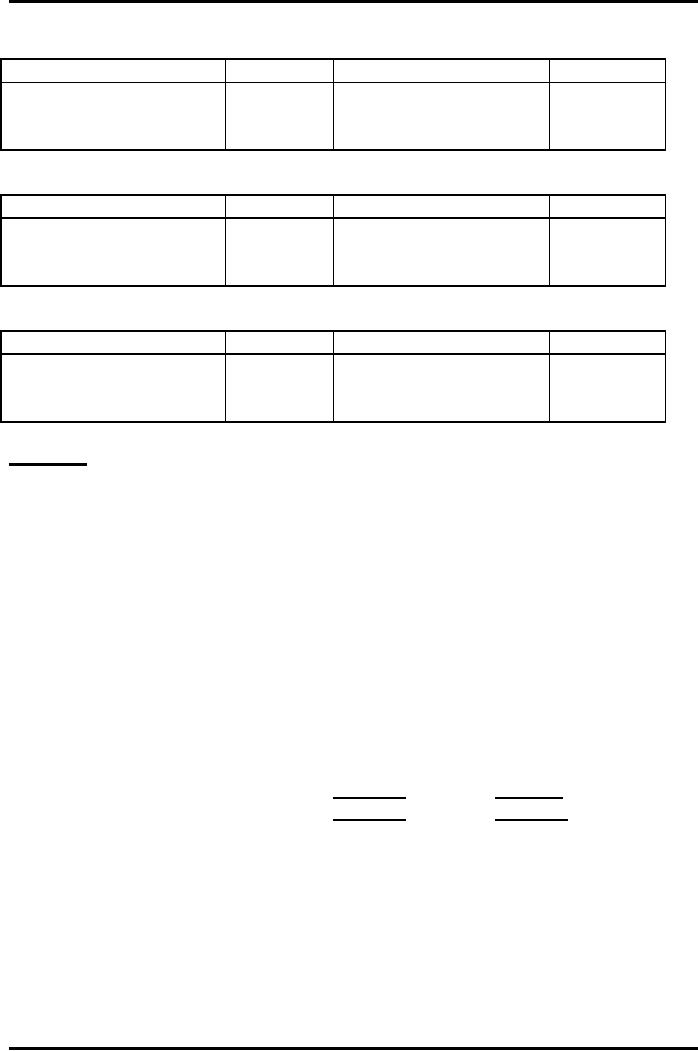

Solution:

Share

Capital a/c

Rupees

Rupees

Opening

balance b/f

800,000

Closing

balance c/f

1,000,000

Bank a/c (rights

issue)

200,000

Share

Premium a/c

Rupees

Rupees

Opening

balance b/f

320,000

Closing

balance c/f

720,000

Bank a/c (rights

issue)

400,000

Bank

a/c

Rupees

Rupees

Share

Capital a/c

200,000

Share

Premium a/c

400,000

Working:

Existing

shares

80,000

Opening

balance of share capital 80,000 x 10 =

800,000

Opening

balance of share premium

80,000 x 4 =

320,000

Rights

shares

80,000 x � =

20,000

Face

value

20,000 x

10= 200,000

Premium

20,000 x

20= 400,000

Balance

Sheet (extracts)

After

Before

Share

Capital

1,000,000

800,000

320,000

Share

Premium

720,000

1,720,000

1,120,000

Before

the rights issue Babar owned

3,200 shares out of a total of

80,000 shares. This

gave

him 4% of the voting rights in the

company. The 1 for 4 rights

issue gives him

another

800 shares and increases his

share holding to 4,000. He now owns

40,000

shares

out of 100,000 shares, which is again

4%.

Bonus

Issue of Shares

Bonus

issue of shares is made when

the company has build up

substantial reserves.

Issue

of bonus share is made to

the existing shareholders without

receiving any

110

Advance

Financial Accounting

(FIN-611)

VU

consideration.

In bonus issue of share a

part of company's reserves

are reclassified as

share

capital. This is also known as

capitalization of reserves or scrip

issue.

There

are a number of reasons for issue of

bonus shares.

1.

Increasing the number of shares in

issue will make it easier to

divide the shares

between

a larger numbers of shareholders.

This is useful when a

company

wants

to bring in news

shareholder.

2.

Increasing the value of the

company's share capital will

strengthen the

balance

sheet.

This is useful if a company

has grown rapidly, and the

share capital is

out of

proportion to the net assets of

the entity.

3.

The market price of each

share will fall. This makes

the shares more

affordable,

and

encourages more people to buy

shares. This is the most

common reason for

publicly

quoted company to make a

bonus issue.

Solved

Problem:

Bonus

Co Ltd has 50,000 Ordinary Shares in

issue for Rs. 10 each. It

decides to issue

bonus

shares 2 for every 5 shares

held. Share premium will be utilized for

the issue.

Balance

sheet of Bonus Co Ltd immediately

before the bonus issue is as

follows:

Rupees

Ordinary

Share Capital

500,000

Share

Premium

380,000

Retained

profits

570,000

1,450,000

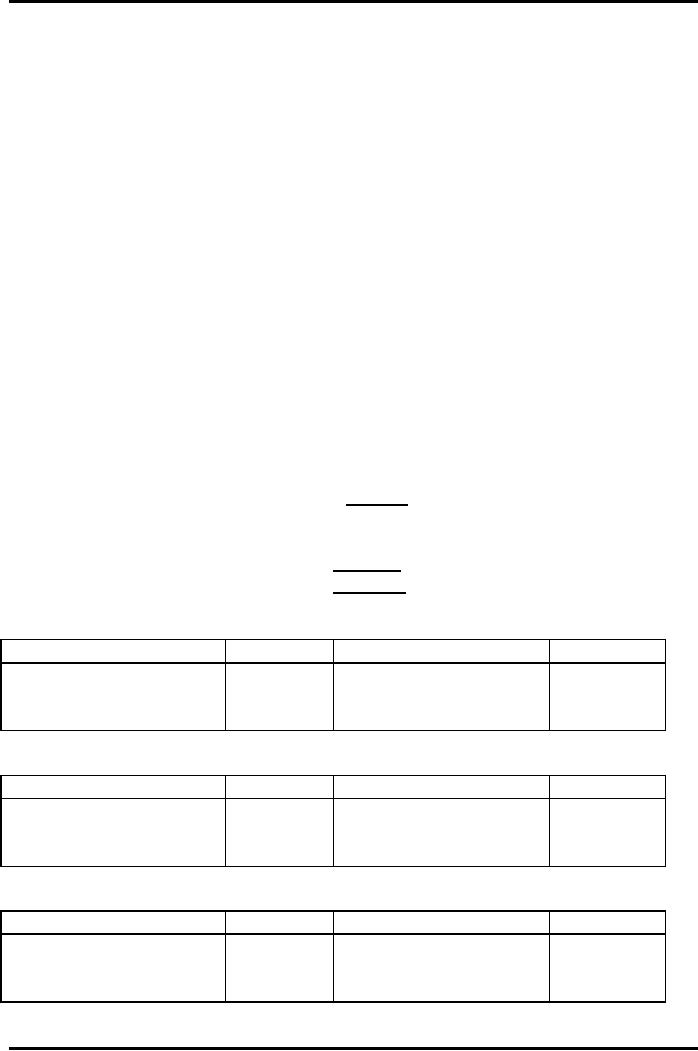

Share

Capital a/c

Rupees

Rupees

Opening

balance b/f

500,000

Closing

balance c/f

700,000

Share premium a/c

200,000

Share

Premium a/c

Rupees

Rupees

Share

Capital a/c

200,000

Opening balance b/f

380,000

Closing

balance c/f

180,000

Retained

profits a/c

Rupees

Rupees

Opening

balance b/v

570,000

Share

Premium a/c

570,000

111

Advance

Financial Accounting

(FIN-611)

VU

Balance

sheet of Bonus Co Ltd immediately

after the bonus issue is as

follows:

Rupees

Ordinary

Share Capital

700,000

Share

Premium

180,000

Retained

profits

570,000

1,450,000

112

Table of Contents:

- ACCOUNTING FOR INCOMPLETE RECORDS

- PRACTICING ACCOUNTING FOR INCOMPLETE RECORDS

- CONVERSION OF SINGLE ENTRY IN DOUBLE ENTRY ACCOUNTING SYSTEM

- SINGLE ENTRY CALCULATION OF MISSING INFORMATION

- SINGLE ENTRY CALCULATION OF MARKUP AND MARGIN

- ACCOUNTING SYSTEM IN NON-PROFIT ORGANIZATIONS

- NON-PROFIT ORGANIZATIONS

- PREPARATION OF FINANCIAL STATEMENTS OF NON-PROFIT ORGANIZATIONS FROM INCOMPLETE RECORDS

- DEPARTMENTAL ACCOUNTS 1

- DEPARTMENTAL ACCOUNTS 2

- BRANCH ACCOUNTING SYSTEMS

- BRANCH ACCOUNTING

- BRANCH ACCOUNTING - STOCK AND DEBTOR SYSTEM

- STOCK AND DEBTORS SYSTEM

- INDEPENDENT BRANCH

- BRANCH ACCOUNTING 1

- BRANCH ACCOUNTING 2

- ESSENTIALS OF PARTNERSHIP

- Partnership Accounts Changes in partnership firm

- COMPANY ACCOUNTS 1

- COMPANY ACCOUNTS 2

- Problems Solving

- COMPANY ACCOUNTS

- RETURNS ON FINANCIAL SOURCES

- IASB’S FRAMEWORK

- ELEMENTS OF FINANCIAL STATEMENTS

- EVENTS AFTER THE BALANCE SHEET DATE

- PROVISIONS, CONTINGENT LIABILITIES AND CONTINGENT ASSETS

- ACCOUNTING POLICIES, CHANGES IN ACCOUNTING ESTIMATES AND ERRORS 1

- ACCOUNTING POLICIES, CHANGES IN ACCOUNTING ESTIMATES AND ERRORS 2

- BORROWING COST

- EXCESS OF THE CARRYING AMOUNT OF THE QUALIFYING ASSET OVER RECOVERABLE AMOUNT

- EARNINGS PER SHARE

- Earnings per Share

- DILUTED EARNINGS PER SHARE

- GROUP ACCOUNTS

- Pre-acquisition Reserves

- GROUP ACCOUNTS: Minority Interest

- GROUP ACCOUNTS: Inter Company Trading (P to S)

- GROUP ACCOUNTS: Fair Value Adjustments

- GROUP ACCOUNTS: Pre-acquistion Profits, Dividends

- GROUP ACCOUNTS: Profit & Loss

- GROUP ACCOUNTS: Minority Interest, Inter Co.

- GROUP ACCOUNTS: Inter Co. Trading (when there is unrealized profit)

- Comprehensive Workings in Group Accounts Consolidated Balance Sheet