|

COMPANY ACCOUNTS 1 |

| << Partnership Accounts Changes in partnership firm |

| COMPANY ACCOUNTS 2 >> |

Advance

Financial Accounting

(FIN-611)

VU

LESSON

# 20

COMPANY

ACCOUNTS

How a

company differs from other

organizations? This is the

question that will make

able

the students/readers to understand

company accounts. In the

upcoming section

of

this chapter emphasis will be put on

the points of difference form

accounting

perspective.

Company

style of business entity is a

bigger setup comparing with

the sole

proprietorship

and partnership. People with business

ideas join their hands

with

people

having money. Jointly they form a

business in which the investors

(normally)

do no

take interest in the day to day

management affairs.

Salient

Features of Limited Liability

Companies

Following

are the salient features

that make a limited

liability company different

from

other

business entities.

1)

Separate legal

entity

Unlike

sole proprietorship and Partnership

organizations the Company

style of

business

is an incorporated organization that

enjoys a separate legal

entity. It means

that

from the legal point of view

company and owners of the

company are two

different

persons.

This

concept is often confused with

the "Business entity

concept" which is merely an

accounting

concept and is used to record

financial information of an entity.

Whereas,

"Separate

legal entity" signifies that a

company has a legal status

and it can sue and

can

be sued in its own

name.

2)

Limited liabilities

Owners

of a Company style of business

enjoy an advantage that if a

company runs

into

financial difficulties, they cannot be

forced to make further contributions to

the

company.

Even they are not asked to

make good any financial

losses suffered by

the

company.

Liabilities

of the owners of a company

are limited to the amount of

paid up share

capital

(amount contributed by them). Maximum

risk exposed to an owner of a

company

is the loss of contributed

capital money.

3)

Board of directors

Management

affairs of a company are run by a

board of directors that is

elected or

appointed

by the owners. The board of

directors runs the company on

behalf of its

owners,

in a way it can be said that

directors act like

stewards.

Directors

are responsible for decision

making, for running day to day business

affairs,

for

managing financial

issues.

91

Advance

Financial Accounting

(FIN-611)

VU

4)

Sources of finance

Like

other business organizations a

company also gets its

finances from owners and

lenders

but the circle of its owners

and lenders is very large.

5)

Capital from

owners

At

the time of its

incorporation the company

makes an estimate of the

total amount of

capital

that will be required in the

business. This capital is

split into shares and

hence

is known as

share capital. People

(investors) who want to become owner of

the

company

contribute in the share

capital. Contributors of the

share capital are

known

as

share holders or members of

the company. A limited

liability company is jointly

owned by

its members.

6)

Borrowings from

lenders

Large

business projects are

undertaken by the company

style of business which

need

huge

amount of finance. Such financial

requirements are often

cannot be met with the

contributed

share capital alone. For

this purpose a company

borrows finances from

the

financial

institutions (like Banks

etc.) and also a company can

borrow from public in

general

by issuing loan/debenture certificates.

Holders of these certificates

are known

as

debenture holders.

7)

Legal formalities

Company

style of business entity

undertakes huge ventures

that involve contracts

with

suppliers, customers, lender and so many

other concerns. Also it has

large

number of

share holders. This might

create certain difficulties to

the management and

to

the related parties as well.

Therefore incorporation of Limited

Liability Company

requires

certain legal formalities and is

tied up in more tight regulations to run

the

entity,

which are not required to be abided by

the sole proprietorship and

partnership

style

of business entities.

8)

Reporting requirements

As a

limited liabilities company is involved

in transactions with a huge number

of

stake

holders, therefore its

directors are required to

publish and circulate

financial

statements

with regular intervals which may be a

quarter, six months or a

year,

depending

upon the nature of the

company.

Finances

of a Limited Liability

Company

A

company gathers its finances

from two sources:

1. Owned

Equity

2.

Borrowed Equity

92

Advance

Financial Accounting

(FIN-611)

VU

1)

Owned Equity

Owned

equity comprises of:

a)

Equity share capital

(contributed by the

member)

b)

Reserves (realized/unrealized

profits)

i.

Capital

Reserves

Share

premium (unrealized profit)

Revaluation

reserve (unrealized

profit)

Capital

redemption reserve (realized

profit)

ii.

Revenue

Reserves

Retained/Accumulated

profits (realized

profits)

General

reserves (realized

profits)

Named/Specific

reserves (realized

profits)

o Plant

replacement reserve

o Dividend

equalization reserve

All of

the categories mentioned

above will be discussed in details

along with

accounting

entries in the forthcoming

part of this chapter.

Following table will help

in

understanding

the difference between

equities of different entities and how

owners

are

differently identified.

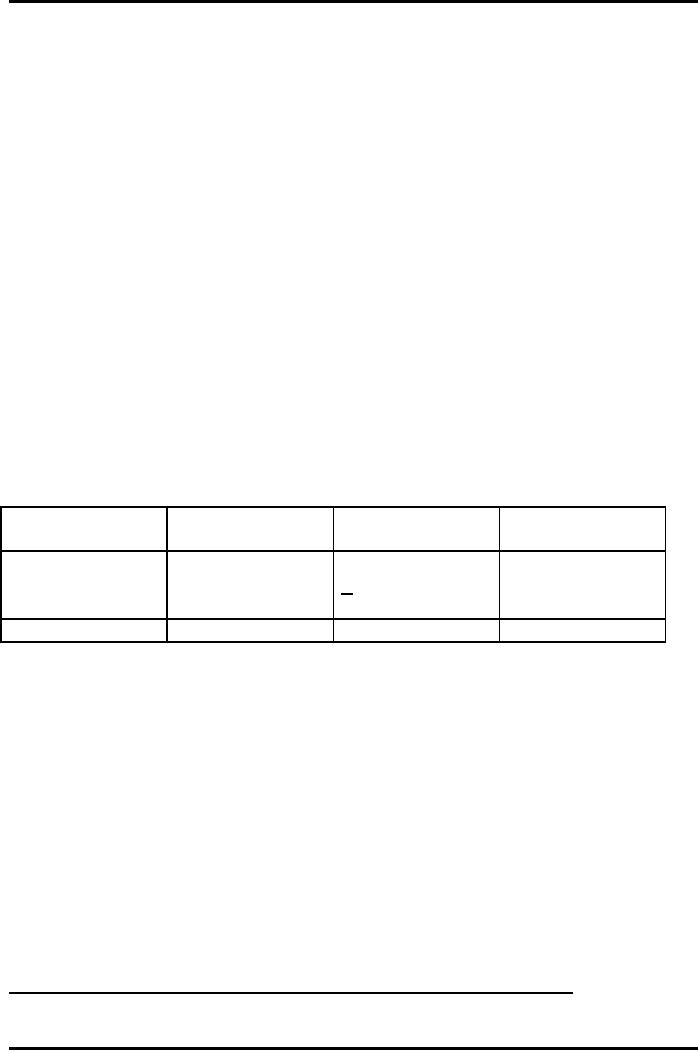

Sole

Partnership

Company

proprietorship

Owners'

Equity

Capital

Capital

Account Share

Capital

+ Net

profit

+

Current Account

Reserves

-

Drawings

Proprietor

Partner

Member

Owners

2)

Borrowed Equity

Borrowed

equity comprises of:

a)

Borrowings as Loan from the

financial institutions

b)

Borrowings as Debt certificates

issued to the

financers/lenders

Accounting

for Share Capital and

Reserves

Keeping

in view the rules of Dr and Cr for the

items of owners' equity,

(increase Cr.

and

decrease Dr.) the accounting

entries for the transactions

relating to the

movement

in

owners' equity are as

under:

Accounting

for issue of Share

Capital

For

issue of share capital at

nominal value (at par)

against cash

consideration:

Bank

a/c

Share

Capital a/c

93

Advance

Financial Accounting

(FIN-611)

VU

For

issue of share capital at

nominal value (at par)

against non cash

consideration:

Assets

a/c

(like

fixed assets or stock)

Share

Capital a/c

For

issue of share capital at a

premium

Bank

a/c

Share

Capital a/c

Share

Premium a/c

Share

premium

Companies

having strong background

often issue their shares at

a price that is more

than

the nominal (face) value.

Excess of the issue price

over the nominal value

is

known as

share premium.

Note:

Remember

one very important tip;

share capital a/c always

credits with its

nominal

(face) value only, any excess

received as resources will be credited to

the

share

premium a/c.

Solved

problem:

Rafi

Ltd Co issues 100,000 ordinary share

capital @ Rs 10 each with a premium @ Rs

7

per

share.

Record

the above transaction in the

books of accounts.

Working:

RS.

100,000 @

Rs. 10

1,000,000

100,000 @

Rs. 7

700,000

1,700,000

Accounting

Entry:

Bank

a/c

1,700,000

Share

Capital a/c

1,000,000

Share

Premium a/c

700,000

Ledger

Accounts:

Share

Capital a/c

Rupees

Rupees

Bank

a/c

1,000,000

94

Advance

Financial Accounting

(FIN-611)

VU

Share

Premium a/c

Rupees

Rupees

Bank

a/c

700,000

Bank

a/c

Rupees

Rupees

Share

Capital a/c

1,000,000

Share

Premium a/c

700,000

Accounting

for movements in

Reserves

Reserves

are profits that are

retained in the company (not

distributed to its

shareholders).

To understand the accounting

entries for movement in

Reserves

following

details will be very much helpful.

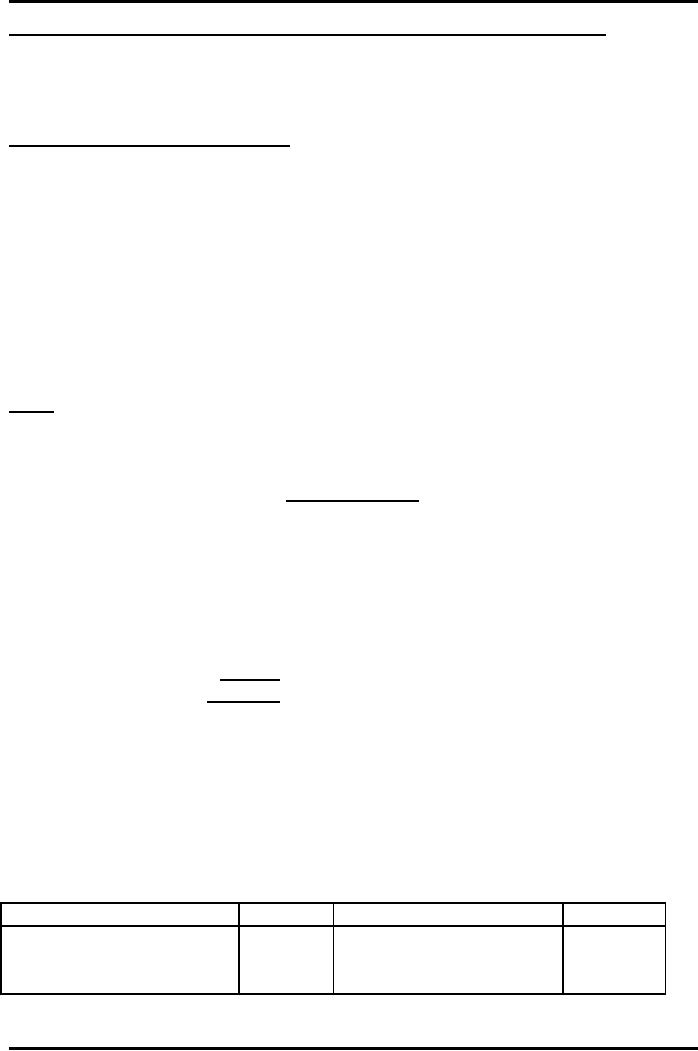

Reserves

Capital

Reserves

Revenue

Reserves

Those

profits which are not distributed

Those which are distributable to

share-

To

the share holders as cash

dividend

holders

as cash dividend.

Share

Capital

General

Retained

Premium

Redemption

Reserve

Profits

Reserve

Revaluation

Named/Specific

Reserve

Reserve

Plant

Dividend

Replacement

Equalization

Reserve

Reserve

Profits

Un-Realized

Profits

Realized

Profits

�

Share

Premium

Profit

after tax

�

Revaluation

Reserve

95

Advance

Financial Accounting

(FIN-611)

VU

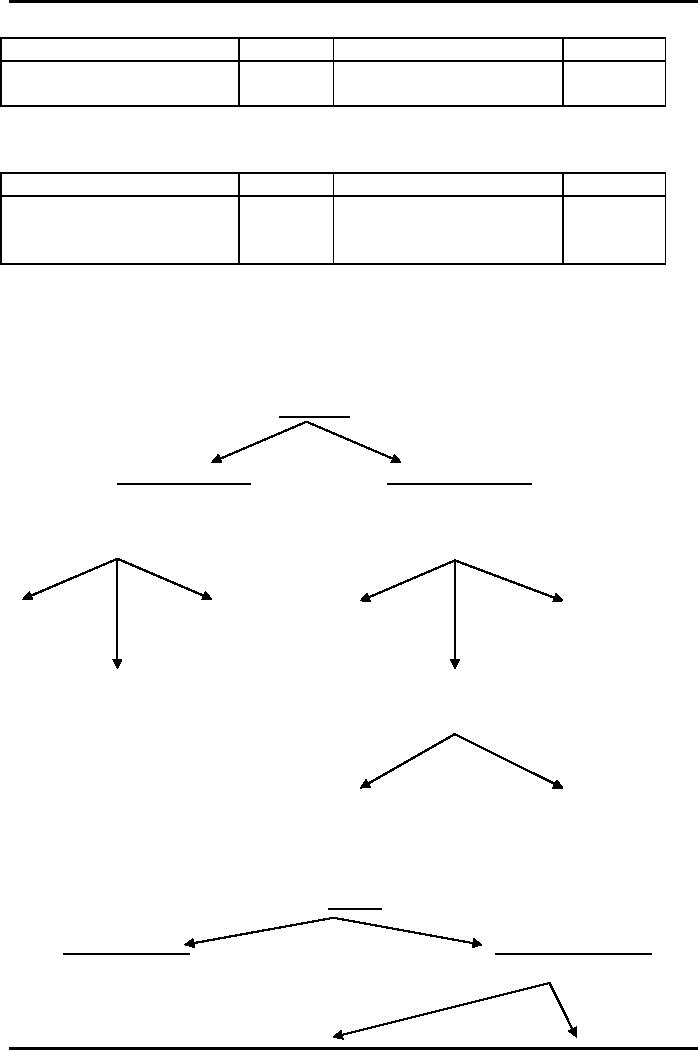

Transfer

of profits

Part

of profit paid to

as

Reserves

share

holder

as

cash dividend

Capital

Redemption General

Named

Retained

Reserve

Reserve

Reserve

Profits

Above

diagram clearly shows that

all reserves except share premium and

revaluation

reserves

are created out of the

profits realized during the

year. We may say that

reserves

are the profits set

aside for some specific

purpose or otherwise.

Accounting

entry for

such setting aside of

profits is:

Profit

& loss a/c

Dr

Reserves

a/c Cr

A

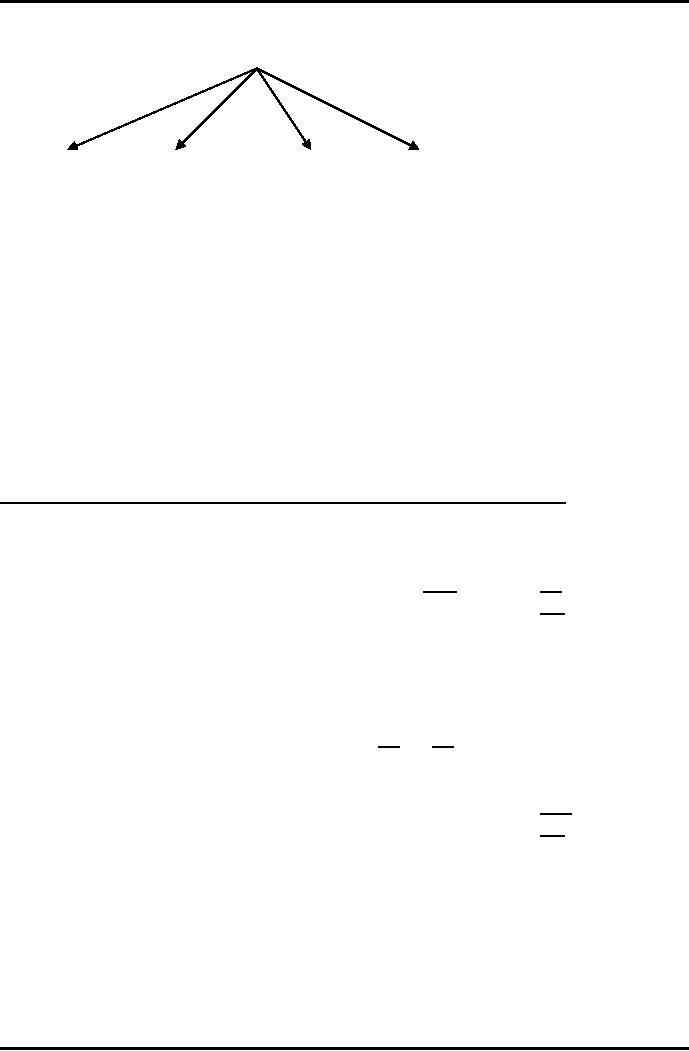

standard format of balance

sheet of a company looks

like some what as

under:

Limited

Liability Company

Balance

Sheet

As on

December 31, 2009

Rs.

Rs.

Assets

Non

Current Assets

***

Current

Assets

***

Current

Liabilities

(***)

***

***

Financed

By (sources of finance)

Owners'

Equity

Ordinary

Share Capital

***

Reserves

Capital

Reserves

***

***

***

Revenue

Reserves

***

Non

Current Liabilities

Loan

from financial institutions

***

Loan

Stocks/Term Finance

Certificates

***

.

***

Balance

sheet shows financial

position of and entity. Upper

part of the balance sheet

shows

resources

of an entity. Lower part of the

balance sheet clearly shows

the sources of finance.

96

Table of Contents:

- ACCOUNTING FOR INCOMPLETE RECORDS

- PRACTICING ACCOUNTING FOR INCOMPLETE RECORDS

- CONVERSION OF SINGLE ENTRY IN DOUBLE ENTRY ACCOUNTING SYSTEM

- SINGLE ENTRY CALCULATION OF MISSING INFORMATION

- SINGLE ENTRY CALCULATION OF MARKUP AND MARGIN

- ACCOUNTING SYSTEM IN NON-PROFIT ORGANIZATIONS

- NON-PROFIT ORGANIZATIONS

- PREPARATION OF FINANCIAL STATEMENTS OF NON-PROFIT ORGANIZATIONS FROM INCOMPLETE RECORDS

- DEPARTMENTAL ACCOUNTS 1

- DEPARTMENTAL ACCOUNTS 2

- BRANCH ACCOUNTING SYSTEMS

- BRANCH ACCOUNTING

- BRANCH ACCOUNTING - STOCK AND DEBTOR SYSTEM

- STOCK AND DEBTORS SYSTEM

- INDEPENDENT BRANCH

- BRANCH ACCOUNTING 1

- BRANCH ACCOUNTING 2

- ESSENTIALS OF PARTNERSHIP

- Partnership Accounts Changes in partnership firm

- COMPANY ACCOUNTS 1

- COMPANY ACCOUNTS 2

- Problems Solving

- COMPANY ACCOUNTS

- RETURNS ON FINANCIAL SOURCES

- IASB’S FRAMEWORK

- ELEMENTS OF FINANCIAL STATEMENTS

- EVENTS AFTER THE BALANCE SHEET DATE

- PROVISIONS, CONTINGENT LIABILITIES AND CONTINGENT ASSETS

- ACCOUNTING POLICIES, CHANGES IN ACCOUNTING ESTIMATES AND ERRORS 1

- ACCOUNTING POLICIES, CHANGES IN ACCOUNTING ESTIMATES AND ERRORS 2

- BORROWING COST

- EXCESS OF THE CARRYING AMOUNT OF THE QUALIFYING ASSET OVER RECOVERABLE AMOUNT

- EARNINGS PER SHARE

- Earnings per Share

- DILUTED EARNINGS PER SHARE

- GROUP ACCOUNTS

- Pre-acquisition Reserves

- GROUP ACCOUNTS: Minority Interest

- GROUP ACCOUNTS: Inter Company Trading (P to S)

- GROUP ACCOUNTS: Fair Value Adjustments

- GROUP ACCOUNTS: Pre-acquistion Profits, Dividends

- GROUP ACCOUNTS: Profit & Loss

- GROUP ACCOUNTS: Minority Interest, Inter Co.

- GROUP ACCOUNTS: Inter Co. Trading (when there is unrealized profit)

- Comprehensive Workings in Group Accounts Consolidated Balance Sheet