|

PRACTICING ACCOUNTING FOR INCOMPLETE RECORDS |

| << ACCOUNTING FOR INCOMPLETE RECORDS |

| CONVERSION OF SINGLE ENTRY IN DOUBLE ENTRY ACCOUNTING SYSTEM >> |

Advance

Financial Accounting

(FIN-611)

VU

LESSON

# 2

PRACTICING

ACCOUNTING FOR INCOMPLETE

RECORDS

Following

question illustrates how

adjustments are incorporated in

the closing statement

of

affairs and

what is the difference in a

Balance Sheet and a Statement of

Affairs.

By solving

this question students will

learn that the only

items of Statement of Profit or loss

are

four

i.e., opening balance of owners'

equity, closing balance of owners'

equity, fresh capital

and drawings

the result after adjusting

these items accordingly will be

Net profit for the

year.

Remember one

thing the adjustments like

depreciations, provision for

doubtful debts, accruals

etc are

not accounted for in the

statement of profit or

loss.

Question

Ali and

Bilal are partners in a firm

sharing profits and losses in

the proportion of 3:2.

They

keep

their books on the single

entry system. On 31 December, 2006,

the following Statement

of

Affairs was

extracted from their

books:

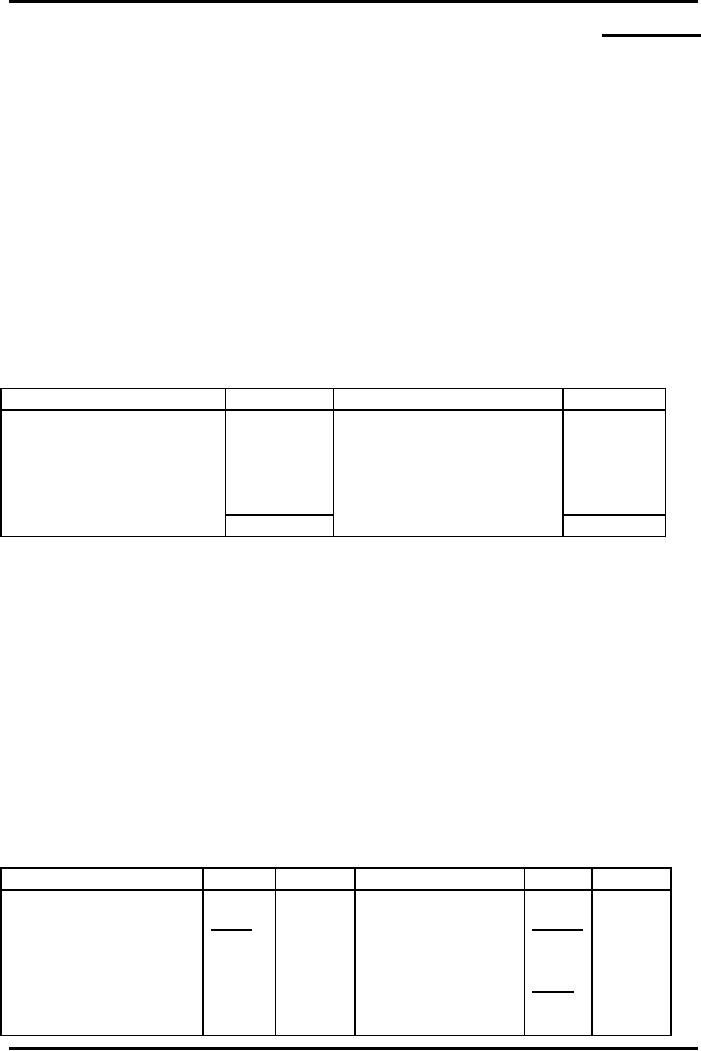

Liabilities

Rs

Assets

Rs

Capital

Accounts

Plant &

Machinery

30,000

Ali

25,000

Stock

20,000

Bilal

20,000

Sundry

Debtors

35,000

Loan-

Bilal

25,000

Cash at

Bank

15,000

Sundry

Creditors

30,000

1,00,000

1,00,000

On 31st December, 2007, their assets

and liabilities were: Sundry

Debtors Rs 40,000;

Sundry

Creditors Rs

25,000 Plant & Machinery Rs

50,000; Stock Rs 30,000;

Bills Receivable Rs

5,000;

Cash at Bank Rs 25,000;

Loan- Bilal Rs

25,000.

You are

required to prepare a Profit and Loss

Statement for the year

ended 31st

December,

2007 and a

Statement of Affairs as at that

date after taking into

consideration the

following:

a) Plant and

machinery is to be depreciated by 10%

p.a.

b) Stock is

to be reduced to Rs 25,000.

c) A

provision for bad debts to

be raised at 5% on Sundry

Debtors

d) Interest

on loan is to be allowed at 6%

p.a.

e) During

the period Ali and Bilal

draw Rs 5,000 and Rs 3,000

respectively.

Solution

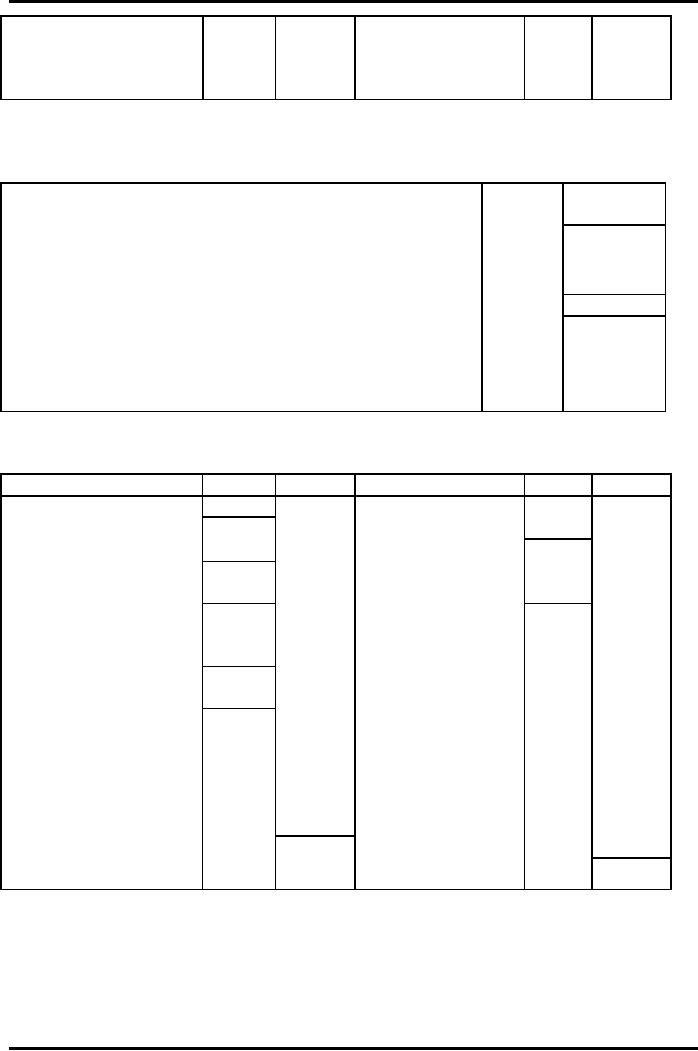

Statement

of Affairs

Ascertainment

of Combined Closing Capital as on

December 31, 2007

Liabilities

Rs

Rs

Assets

Rs

Rs

Loan-

Bilal

25,000

Plant &

Machinery

50,000

Add:

Outstanding

1,500

26,500

Less:

Depreciation

4,000

46,000

Interest

Stock

25,000

40,000

25,000

Sundry

Debtors

Creditors

Less:

Provision for 2,000

Doubtful

debts

38,000

87,500

Bills

Receivable

5,000

5

Advance

Financial Accounting

(FIN-611)

VU

Combined

Capital

Cash at

bank

25,000

(balancing

figure)

1,39,000

1,39,000

Ali

& Bilal

Statement

of Profit and Loss for the

year ended

31.12.2007

Rs

Combined

closing Capital (as

above)

87,500

Add:

Combined Drawings during the

year (Rs 5,000+Rs

3,000)

8,000

95,500

Less:

Combined Opening Capital (Rs

25,000 + Rs 20,000)

45,000

Profit

before adjustments

50,500

Divisible

profit:

Ali-3/5th of Rs. 50,500

30,300

Bilal

2/5th of Rs.

50,500

20,200

50,500

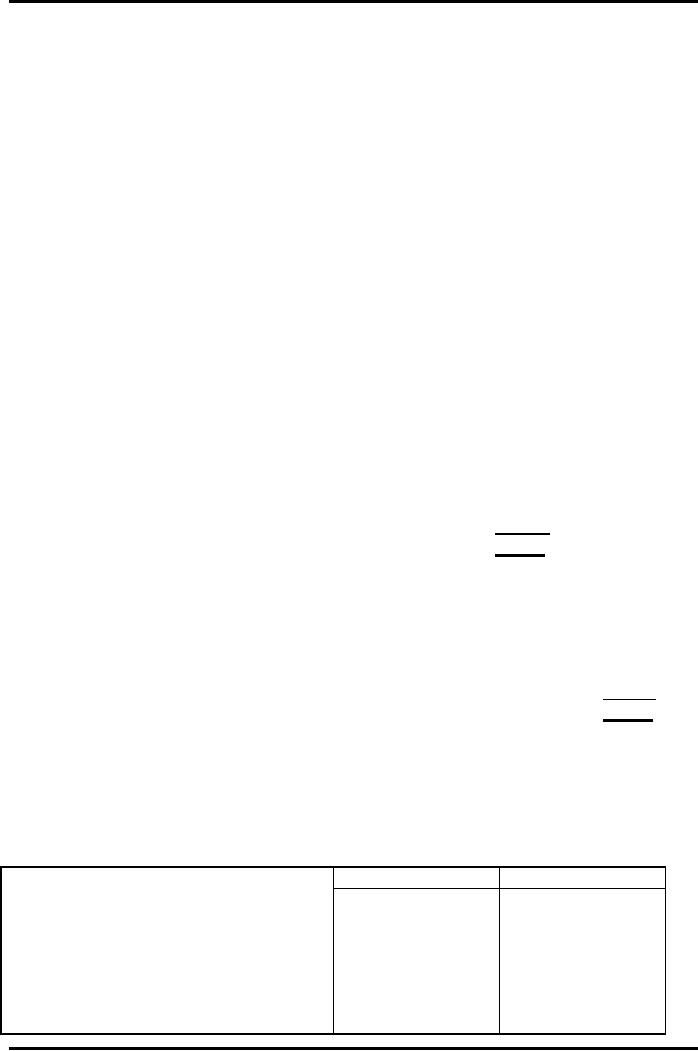

Ali

& Bilal

Balance

Sheet as at 31.12.2007

Liabilities

Rs

Rs

Assets

Rs

Rs

Plant &

Machinery

50,000

CapitalAli

Opening

balance

Less:

Depreciation

4,000

46,000

25,000

Add:

Profit

25,000

Stock

30,000

Sundry

Debtors

40,000

55,300

Less:

Drawings

5,000

50,300

Less:

Provision for

2,000

Doubtful

debts

38,000

Capital-

Bilal

Opening

Balance

Bills

Receivable

5,000

20,000

Add:

Profit

Cash at

bank

25,000

20,200

40,200

Less:

Drawing

3,000

37,200

Loan-

Bilal

25,000

Outstanding

Interest

1,500

Sundry

Creditors

25,000

1,39,000

1,39,000

Following

question illustrates how

changes in the balances of

assets and liabilities affect

the in

crease or

decrease in the balances of

owner's equity.

Important

tips:

� Increase

in the balance of asset will cause an

increase in the owner's

equity

� Increase

in the balance of liabilities will cause

a decrease in the owner's

equity

� Decrease

in the balance of asset will cause a

decrease in the owner's

equity

6

Advance

Financial Accounting

(FIN-611)

VU

�

Decrease in

the balance of liabilities will cause an

increase in the owner's

equity

�

Increase in

balance means that closing balance is

greater than the opening balance

and

vice

versa.

Question

Calculate

net profit for the

year ending on December 31, 2007

from the information

regarding

changes

occurred at the end of the

year in following balances:

Rupees

Increase in

Machinery

14,000

Increase in

Stocks

6,000

Decrease in

Debtors

2,000

Decrease in

Cash

1,000

Increase in

Creditors

1,500

Decrease in

Accrued expenses

300

Drawings

during the year 2007

10,000

Fresh

capital introduced during

the year 2007

4,000

Solution

Working:

Rupees

Increase/decrease

in owner's equity (net

assets)

Increase in

Machinery

14,000

Increase in

Stocks

6,000

Decrease in

Debtors

(2,000)

Decrease in

Cash

(1,000)

Increase in

Creditors

(1,500)

Decrease in

Accrued expenses

300

15,800

Statement

of Profit or Loss

For the

year ended December 31,

2007

Rupees

Increase in

owner's equity

15,800

Add

Drawings

10,000

Less Fresh

Capital

(4,000)

Net

Profit

21,800

Problem

questions

Q.

1

A and B are

carrying on business in partnership

sharing profits and losses

equally. They were

unable to

maintain full and complete records. From

the following available

information,

compute

the profits of the firm and

prepare a Balance Sheet:

1.1.2007

(Rs)

31.12.2007

(Rs)

Land and

Building (Cost)

50,000

50,000

Machinery

(Cost)

60,000

75,000

Furniture

(Cost)

20,000

25,000

Stock

12,000

30,000

Debtors

17,000

22,000

Bank

4,900

5,000

Cash

1,100

5,000

7

Advance

Financial Accounting

(FIN-611)

VU

Prepaid

Insurance Premium

5,000

-

Bills

Receivable

-

8,000

Creditors

60,000

50,000

Bills

Payable

10,000

-

At the

beginning of the year, the

capitals of the partners

were equal. During the

year, A brought

in Rs.

15,000 and B has withdrawn

Rs. 5,000. An insurance

policy matured during the

year for

Rs.

10,000. A sum of Rs. 4,000

has become bad out of

debtors. Provision has to be made

for

depreciation

@ 10% on Land and Building,

Machinery and Furniture.

Q.

2

From

the following information

calculate net profit for

the year ending on December

31, 2007

by preparing

statement of profit or

loss:

Rupees

Increase in

Furniture

78,000

Decrease in

Stocks

25,000

Decrease in

Debtors

11,000

Increase in

prepaid rent

2,000

Increase in

Bank

7,000

Increase in

Creditors

10,000

Decrease in

Accrued expenses

3,000

Drawings

during the year 2007

35,000

Fresh

capital introduced during

the year 2007

50,000

8

Table of Contents:

- ACCOUNTING FOR INCOMPLETE RECORDS

- PRACTICING ACCOUNTING FOR INCOMPLETE RECORDS

- CONVERSION OF SINGLE ENTRY IN DOUBLE ENTRY ACCOUNTING SYSTEM

- SINGLE ENTRY CALCULATION OF MISSING INFORMATION

- SINGLE ENTRY CALCULATION OF MARKUP AND MARGIN

- ACCOUNTING SYSTEM IN NON-PROFIT ORGANIZATIONS

- NON-PROFIT ORGANIZATIONS

- PREPARATION OF FINANCIAL STATEMENTS OF NON-PROFIT ORGANIZATIONS FROM INCOMPLETE RECORDS

- DEPARTMENTAL ACCOUNTS 1

- DEPARTMENTAL ACCOUNTS 2

- BRANCH ACCOUNTING SYSTEMS

- BRANCH ACCOUNTING

- BRANCH ACCOUNTING - STOCK AND DEBTOR SYSTEM

- STOCK AND DEBTORS SYSTEM

- INDEPENDENT BRANCH

- BRANCH ACCOUNTING 1

- BRANCH ACCOUNTING 2

- ESSENTIALS OF PARTNERSHIP

- Partnership Accounts Changes in partnership firm

- COMPANY ACCOUNTS 1

- COMPANY ACCOUNTS 2

- Problems Solving

- COMPANY ACCOUNTS

- RETURNS ON FINANCIAL SOURCES

- IASB’S FRAMEWORK

- ELEMENTS OF FINANCIAL STATEMENTS

- EVENTS AFTER THE BALANCE SHEET DATE

- PROVISIONS, CONTINGENT LIABILITIES AND CONTINGENT ASSETS

- ACCOUNTING POLICIES, CHANGES IN ACCOUNTING ESTIMATES AND ERRORS 1

- ACCOUNTING POLICIES, CHANGES IN ACCOUNTING ESTIMATES AND ERRORS 2

- BORROWING COST

- EXCESS OF THE CARRYING AMOUNT OF THE QUALIFYING ASSET OVER RECOVERABLE AMOUNT

- EARNINGS PER SHARE

- Earnings per Share

- DILUTED EARNINGS PER SHARE

- GROUP ACCOUNTS

- Pre-acquisition Reserves

- GROUP ACCOUNTS: Minority Interest

- GROUP ACCOUNTS: Inter Company Trading (P to S)

- GROUP ACCOUNTS: Fair Value Adjustments

- GROUP ACCOUNTS: Pre-acquistion Profits, Dividends

- GROUP ACCOUNTS: Profit & Loss

- GROUP ACCOUNTS: Minority Interest, Inter Co.

- GROUP ACCOUNTS: Inter Co. Trading (when there is unrealized profit)

- Comprehensive Workings in Group Accounts Consolidated Balance Sheet