|

Partnership Accounts Changes in partnership firm |

| << ESSENTIALS OF PARTNERSHIP |

| COMPANY ACCOUNTS 1 >> |

Advance

Financial Accounting

(FIN-611)

VU

Lesson

# 19

Partnership

Accounts

Changes

in partnership firm

Subsequent to

the formation of a partnership

firm, a different accounting

treatment is required

when

any of the following changes

occur in the constitution of

the partnership

(Partnership

deed)

these changes might occur

because of the following

reasons:

� Admission

of a new partner

� Retirement

of an existing partner

� Death

of a partner

Admission of a

new partner

A new

partner may be admitted for

different reasons such as

personal influence, need of

more

capital, or

special skills.

At the

time of admission of a new

partner, certain adjustments

are necessary in the books

of

accounts;

among those calculation of good will is

very important.

Goodwill

Goodwill

may arise from such

attributes of a business as good

reputation, good customer

relationship,

strategic location, skill of

its employees, dynamic

management, durability of

its

products,

effective advertisement, patented

manufacturing process, outstanding

credit rating,

training

program of the employees, and good

relationship with suppliers and

employees, etc.

Goodwill

may be described as the

aggregate of those intangible attributes

of a business that

contribute

to the superior earning

capacity of the business. Goodwill is

the outcome of an

impression

created in the mind of each

customer and related persons.

Valuation

of Goodwill

Methods to

be adopted in valuing goodwill will

depend upon the

circumstances of each

particular

case. At the time of

valuation of goodwill, the

partnership deed should be

examined

and

valuation should be done in uch a

manner as must have been

agreed upon by the

partners.

Goodwill

Calculation methods

1. Average

profit method

2. Super

profit method

3. Market

capitalization method

Average

Profit Method

Under

this method, at first,

average profit is calculated on

the basis of the past

few years'

profits. At

the time of calculating

average profit, precaution

must be taken in respect of

any

abnormal

items of profit or loss which

may affect future profit. It

should be mentioned

that

average

profit is based on simple

average method.

After

calculating average profit, it is

multiplied by a number (times) 3, or 4,

or 5, what ever, as

agreed.

The product will be the

value of the

goodwill.

For

example:

Goodwill is

three times of the average

profit of previous five

years.

Let's

suppose:

Average

profit = 100 / 5 = 20

Goodwill =

20 x 3 = 60

86

Advance

Financial Accounting

(FIN-611)

VU

Solved

Problem No 1:

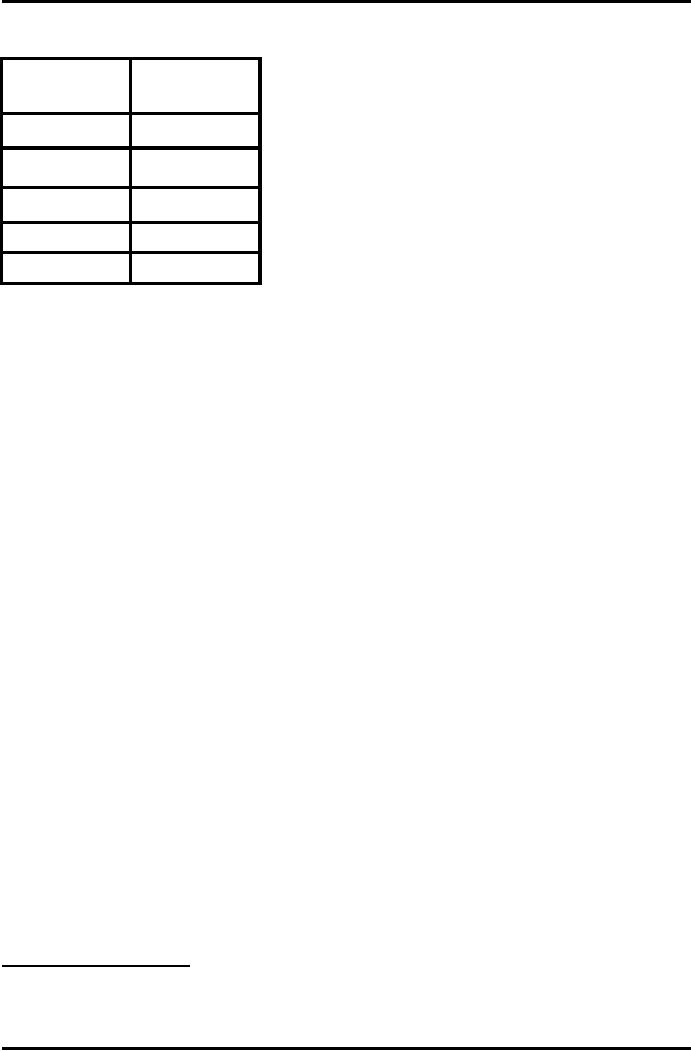

Years

Profit

1st

year

20,000

2nd

year

40,000

3rd

year

50,000

4th

year

70,000

Total

180,000

Goodwill of

the firm is equal to the

three years purchase of the last

four years average

profits:

Average

profit = 180,000 / 4 = Rs. 45,0000

Goodwill =

45,000 x 3 = 135,000

Super

Profit Method

Super profit

is the excess of actual

profit (average profit) over

the normal profit of an

entity. A

common

method of valuation of goodwill is

the super profit method. A

business unit may

possess

some advantages which enable it to make

extra profits over and above

the amount that

would be

earned if the capital of the

business was invested elsewhere

with similar risks.

These

extra

profits, generally expressed as super

profits, can be valued, and goodwill is

the value of

the

few years' purchase of super

profit.

In this

method, super profits are

taken as the basis for

calculating goodwill in place of

average

profit.

Certain

steps are followed in

calculating goodwill under super

profit method, these are

as

under:

1. Calculate

Capital of the firm

2. Calculate

normal profit by multiplying

firm's capital with normal

rate of return

3. Calculate

average profit of the

firm

4. Calculate

super profit by subtracting normal

profit from the average

profit

5. Multiply

the super profit by the

number of year's purchase (number of

times)

6. The

product will be called

goodwill.

Let's

suppose:

Normal

profit = 200,000 x 18% =

36,000

Super profit

= Average profit Normal

profit

= 45,000

36,000 = 9,000

Goodwill

= 9,000 x 3

= 27,000

Market

Capitalization Method

Under

this method the value of

the firm is first determined

based on the market

capitalization

rate using

the following

formula:

Average

profit of the firm x

100

% of market

rate of return

87

Advance

Financial Accounting

(FIN-611)

VU

The above

formula will give an estimate of the

firm's value in the market.

By subtracting the

book

value of the net assets

(owners' equity/capital) of the

firm from the above

calculated

value we

shall get the amount of

goodwill.

Suppose

average profit of the firm

is Rs. 45,000 and the market

rate of return is 18% and

the

capital

(net assets) of the firm is

Rs. 200,000.

Then

the good will of the firm will be

calculated as under:

Goodwill

= 45,000 /

18 x 100 = 250,000

= 250,000

-200,000

=

50,000

Accounting

treatment of goodwill

Since the

goodwill of a partnership firm

belongs to the old partners

and no one else, it is

apparent

that some adjustments must

be made to the Capital

accounts of the old partners

upon

the

admission of a new partner so

that the incoming partner

will not take a share of

the

goodwill

belonging to old partners

without payment. The amount

that the incoming

partner

pays for

goodwill is known as premium

for goodwill. This goodwill

can be treated in the books

of account

in any of the following

manner:

Goodwill

Raised

Scenario-1

When

the incoming partner cannot

bring cash as premium for

goodwill

Here,

the capital accounts of the

old partners are

artificially inflated towards

the right of the

goodwill,

without any cash

contribution. The idea is

that if the business were

sold immediately

after

the admission of the new

partner and the goodwill and

other assets realized their

book

value,

the old partners would

automatically receive cash

for their share of the

goodwill since

the

amounts attributable to them in

respects of the goodwill are

now included in their

respective

capital

accounts.

In this

case, goodwill account is to be

raised in the books of account at

its full value by

debiting

the

goodwill account and crediting

the old partners' capital

accounts in old

ratio.

Journal

Entry

Goodwill

A/c 135,000

A's

capital A/c

81,000

B's

capital A/c

45,000

Working

A's

share = 135,000 x 3/5 =

81,000

B's

share = 135,000 x 2/5 =

54,000

Important

Note

Following

should be taken in to account

when doing the above

treatment for

goodwill:

1. If

goodwill already appears in

the Balance Sheet which is

equal to full value of

goodwill so

calculated, then no entry is

required to be passed.

2. if

goodwill already appears in

the Balance Sheet which is

less than the full value

of

goodwill

then goodwill is to be raised

for the balance (full value

of goodwill calculated

less

goodwill already appearing in the

Balance sheet)

88

Advance

Financial Accounting

(FIN-611)

VU

3. if

goodwill already appears in

the Balance sheet which is

more than the full value

of

goodwill,

then excess goodwill is to be

written off. The journal

entry will be as under:

Old

partners' capital

accounts

Dr

Goodwill

accounts

Cr

(Being

the value of the goodwill

written down to its

calculated value)

Goodwill

Raised & Written-Off

Scenario-2

When

the incoming partner cannot

bring anything as premium for

goodwill but no goodwill

is

to

appear in the books:

Since the

value of the goodwill

constantly changes and partners

may not wish that an

account

should

remain in the books,

goodwill is raised in the books

first and, thereafter it is

written off.

Journal

Entry (Goodwill

raised)

Goodwill

A/c 135,000

A's

capital A/c

81,000

B's

capital A/c

45,000

Journal

Entry (Goodwill raised & written

off )

A's

capital A/c

67,500

B's

capital A/c

45,000

C's

capital A/c

22,500

Goodwill

A/c

135,000

A's

benefit

Old

ratio (Cr) 81,000

New

ratio (Dr)67,500

(Cr)

13,500

B's

benefit

Old

ratio (Cr) 54,000

New

ratio (Dr)45,000

(Cr)

9,000

A's

benefit + B's benefit

13,500 +

9,000 = 22,500

C's

share = 22,500

C's

share = 135,000 x 1/6 =

22,500

Goodwill

Brought in Cash

Scenario-3

When

the required amount of premium for

goodwill is brought in by the incoming

partner and

the

money is retained in the business to

increase the cash resources:

In this

situation, premium for

goodwill is to be shared by the

old partners in the

sacrificing

ratio.

The sacrificing ratio is to be

calculated by deducting the

new ratio from the

old ratio for

each

partner. It should be noted

that when the profit

sharing ratio between the

old partners does

not change

as between themselves, this

old profit sharing ratio is

their sacrificing

ratio.

Goodwill

brought in cash

89

Advance

Financial Accounting

(FIN-611)

VU

Bank

A/c 22,500

C's

premium for goodwill A/c

22,500

Distribution

of goodwill (sacrifice ratio)

C's

premium for goodwill A/c

22,500

A's

capital A/c

13,500

B's

capital A/c

9,000

A's

share = 22,500 x 3/5 =

13,500

B's

share = 22,500 x 2/5 =

9,000

Goodwill

Brought in Cash &

Withdrawn

Scenario-4

When

the required amount of premium for

goodwill is brought in by the new

partners and this

amount is

immediately withdrawn by the old

partners:

Goodwill

brought in cash

Bank

A/c 22,500

C's

premium for goodwill A/c

22,500

Distribution

of goodwill (sacrifice ratio)

C's

premium for goodwill A/c

22,500

A's

capital A/c

13,500

B's

capital A/c

9,000

Goodwill

withdrawn

A's

capital A/c 13,500

B's

capital A/c 9,000

Bank

A/c

22,500

90

Table of Contents:

- ACCOUNTING FOR INCOMPLETE RECORDS

- PRACTICING ACCOUNTING FOR INCOMPLETE RECORDS

- CONVERSION OF SINGLE ENTRY IN DOUBLE ENTRY ACCOUNTING SYSTEM

- SINGLE ENTRY CALCULATION OF MISSING INFORMATION

- SINGLE ENTRY CALCULATION OF MARKUP AND MARGIN

- ACCOUNTING SYSTEM IN NON-PROFIT ORGANIZATIONS

- NON-PROFIT ORGANIZATIONS

- PREPARATION OF FINANCIAL STATEMENTS OF NON-PROFIT ORGANIZATIONS FROM INCOMPLETE RECORDS

- DEPARTMENTAL ACCOUNTS 1

- DEPARTMENTAL ACCOUNTS 2

- BRANCH ACCOUNTING SYSTEMS

- BRANCH ACCOUNTING

- BRANCH ACCOUNTING - STOCK AND DEBTOR SYSTEM

- STOCK AND DEBTORS SYSTEM

- INDEPENDENT BRANCH

- BRANCH ACCOUNTING 1

- BRANCH ACCOUNTING 2

- ESSENTIALS OF PARTNERSHIP

- Partnership Accounts Changes in partnership firm

- COMPANY ACCOUNTS 1

- COMPANY ACCOUNTS 2

- Problems Solving

- COMPANY ACCOUNTS

- RETURNS ON FINANCIAL SOURCES

- IASB’S FRAMEWORK

- ELEMENTS OF FINANCIAL STATEMENTS

- EVENTS AFTER THE BALANCE SHEET DATE

- PROVISIONS, CONTINGENT LIABILITIES AND CONTINGENT ASSETS

- ACCOUNTING POLICIES, CHANGES IN ACCOUNTING ESTIMATES AND ERRORS 1

- ACCOUNTING POLICIES, CHANGES IN ACCOUNTING ESTIMATES AND ERRORS 2

- BORROWING COST

- EXCESS OF THE CARRYING AMOUNT OF THE QUALIFYING ASSET OVER RECOVERABLE AMOUNT

- EARNINGS PER SHARE

- Earnings per Share

- DILUTED EARNINGS PER SHARE

- GROUP ACCOUNTS

- Pre-acquisition Reserves

- GROUP ACCOUNTS: Minority Interest

- GROUP ACCOUNTS: Inter Company Trading (P to S)

- GROUP ACCOUNTS: Fair Value Adjustments

- GROUP ACCOUNTS: Pre-acquistion Profits, Dividends

- GROUP ACCOUNTS: Profit & Loss

- GROUP ACCOUNTS: Minority Interest, Inter Co.

- GROUP ACCOUNTS: Inter Co. Trading (when there is unrealized profit)

- Comprehensive Workings in Group Accounts Consolidated Balance Sheet