|

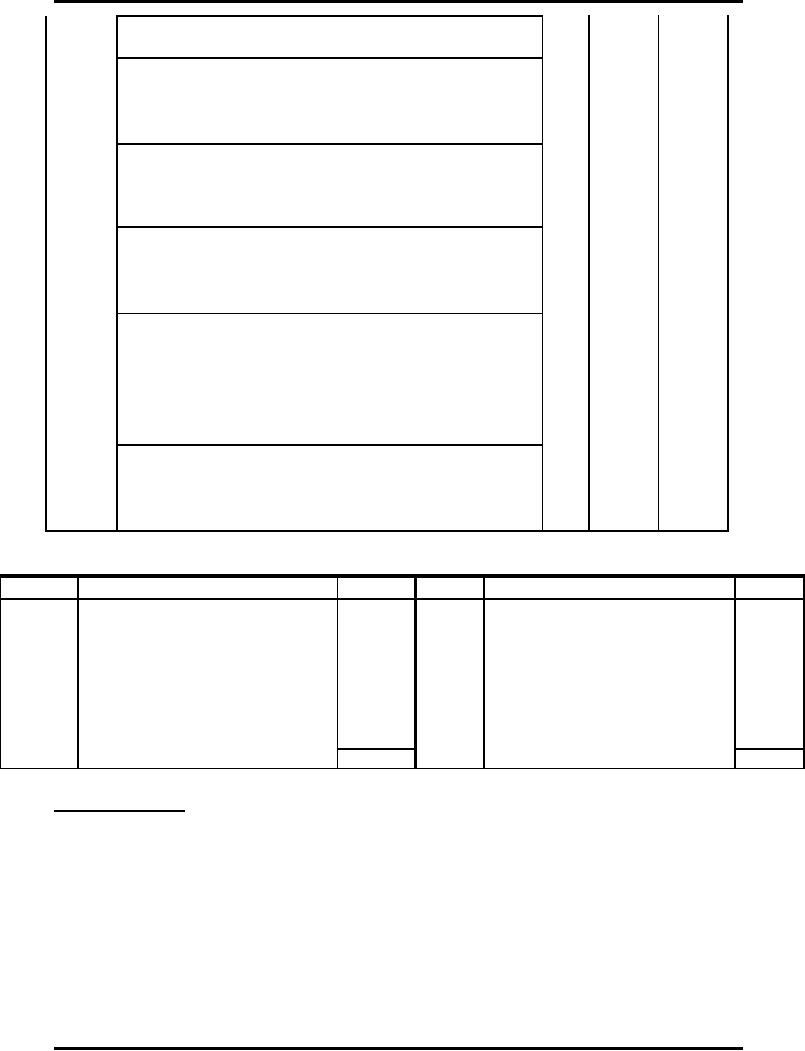

BRANCH ACCOUNTING 1 |

| << INDEPENDENT BRANCH |

| BRANCH ACCOUNTING 2 >> |

Advance

Financial Accounting

(FIN-611)

VU

LESSON

# 16

BRANCH

ACCOUNTING

(Incorporation of

branch)

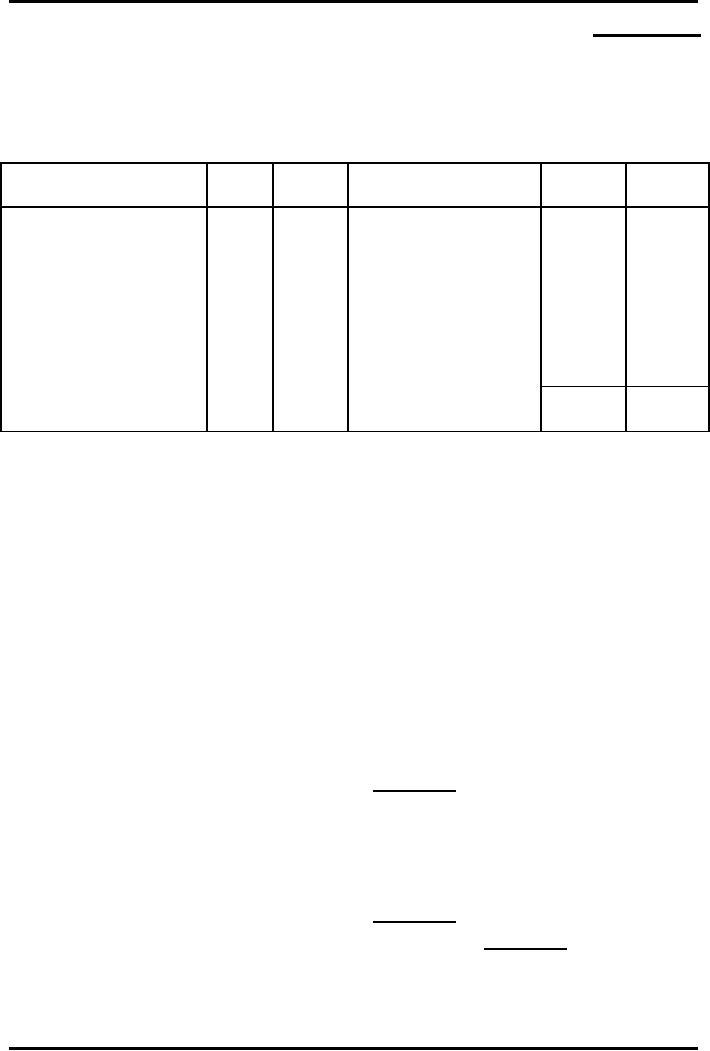

Question

The

following is the Trial Balance of

Murree Branch as on 31st December, 2007.

Dr.

Cr.

Dr.

Cr.

(Rs.)

(Rs.)

(Rs.)

(Rs.)

Lahore

head office

Debtors

3,700

3,240

Stock

1st Jan. 2007

Creditors

6,000

1,850

Purchases

97,800

Rent

1,960

19,000

Sundry

office

1,470

Goods

received from H

138,000

expenses

1,780

O

6,000

Cash at bank

6,000

Sales

Goods

supplied to

Furniture

400

Depreciation

on

4,500

head

office / Sales to H

Furniture

O

145,850

145,850

Salaries

Other

Information:

Stock

at branch on 31st

December 2007

was valued at Rs.

7,700.

Murree

Branch Account in the head

office books on 31st December, 2007 stood at

Rs.

460

(debit balance). On 28th December, 2007 the head

office forwarded goods of

the

value

of Rs. 3,700 to the branch

where they were on 3rd January, 2007.

Solution

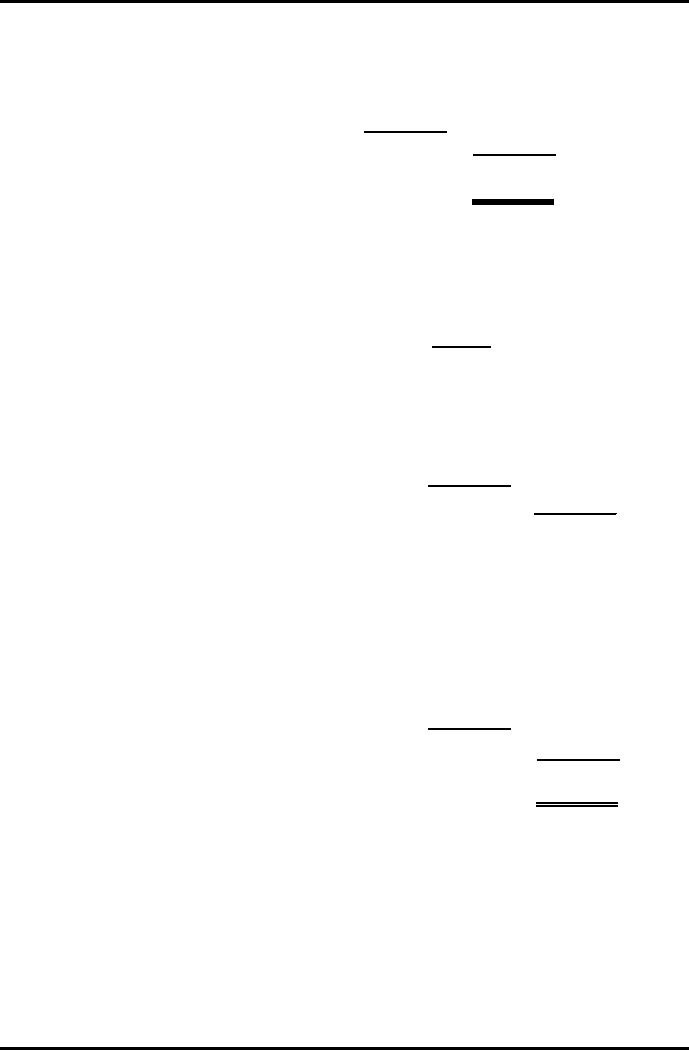

Murree

Income

Statement

For

the year ended 31st December, 2007

Sales

138,000

Goods

supplied to H O

6,000

144,000

Less

CGS

Opening

Stock

6,000

Add

Purchases

97,800

Goods

received from H O 19,000

Less

Closing Stock

7,700

115,100

Gross

Profit

28,900

72

Advance

Financial Accounting

(FIN-611)

VU

Less

operating Expenses

Salaries

4,500

Rent

1,960

Sundry

Office Expenses

1,470

Depreciation

on Furniture

400

8,330

Net

Profit

20,570

Murree

Income

Statement

For

the year ended 31st December, 2007

Sales

138,000

Goods

supplied to H O

6,000

144,000

Less

CGS

Opening

Stock

6,000

Add

Purchases

97,800

Goods

received from H O 19,000

Less

Closing Stock

7,700

115,100

Gross

Profit

28,900

Less

operating Expenses

Salaries

4,500

Rent

1,960

Sundry

Office Expenses

1,470

Depreciation

on Furniture

400

Advertisement

on Equipment 1,000

Depreciation

on Furniture

500

9,830

Net

Profit

19,070

Incorporation

of Branch Trial Balance in

the Head Office

Books

It

has already been stated

that an independent branch

prepares its own Trial

Balance

and

Final Accounts and remits

the copies of these

statements to the head

office.

After

receiving Branch Trial

Balance, head office

proceeds to incorporate it in its

own

books.

This is absolutely necessary

because the branch belongs

to the head office,

and

if

the branch Trial Balance is

not incorporated in the head

office books, the latter

will

not show

correct position.

73

Advance

Financial Accounting

(FIN-611)

VU

The

incorporation of Branch Trial

Balance can be divided into two

parts:

a.

Incorporation of Branch Profit and

Loss

b.

Incorporation of Branch Assets and

Liabilities

Incorporation

of Branch Profit and

Loss

For

the purpose of incorporation of

branch profit and loss, the

head office may follow

any of

the following two methods:

i.

Detailed

Incorporation

ii.

Abridged

Incorporation

Detailed

Incorporation

Under

this method, incorporation is

done with a view to prepare Branch

Trading

and

Profit and Loss Account in

the books of the head

office. Head office opens

a

separate

Branch Trading and Profit and

Loss Account to incorporate all

revenue

transactions

of the branch. This account

is temporary in nature and is prepared

to

ascertain

the real profit or loss of

the branch after making all

adjustments.

In

this connection, we must remember

that head office maintains

only the Branch

Account

and the statements received from

the branch do not form a part of

the

double

entry system. Therefore, all the

Journal Entries should be

passed through

the

Branch Account maintained in

the head office. The

required Journal Entries

are

as

follows:

Journal

Entries

1.

For items on the debit

side of the Branch Trading

Account

Branch

Trading Account

To

Branch Account

[The

above entry is passed for

the total amount of items

like opening stock, purchases,

carriage

inwards,

wages, processing cost, goods

received from head office,

sales returns, etc.]

2.

For items on the credit

side of the Branch Trading

Account

Branch

Account

To

Branch Trading

Account

[The

above entry is passed for

the total amount of items

like sales, goods sent to

head office,

closing

stock, purchases returns,

abnormal loss of stock,

etc.]

3.

For items on the debit

side of the Branch Profit

and Loss Account

Branch

Profit and Loss

Account

To

Branch Account

[The

above entry is passed for

the total amount of items

like salaries, rent, depreciation,

bad

debts,

repairs, discount allowed,

etc.]

4.

For items on the credit

side of the Branch Profit

and Loss Account

Branch

Account

74

Advance

Financial Accounting

(FIN-611)

VU

To

Branch Profit and Loss

Account

[The

above entry is passed for

the total amount of items

like discount received,

miscellaneous

income,

etc.]

Abridged

Incorporation

Under

this method, a Memorandum Trading and

Profit and Loss Account

is

prepared

for ascertaining branch profit. Only

one entry is passed for

incorporating

branch

net profit/loss.

Branch

Account

To

General Profit and Loss

Account

[In

case of loss the above entry

shall be reversed.]

Incorporation

of Branch Assets and

Liabilities

This

part of the incorporation is

done with a view to include branch assets

and

liabilities

in the annual Balance Sheet

of the whole business. At the

beginning of the

new

financial year, assets and liabilities

are sent back to the

books of the branch

by

means

of reverse entries.

For

the purpose of incorporation,

the following entries are

passed:

Journal

Entries

1.

For Branch Assets

Branch

Assets Accounts

Dr.

[Individually]

To

Branch Account

2.

For Branch

Liabilities

Branch

Account

Dr.

[Individually]

To

Branch Liabilities

Account

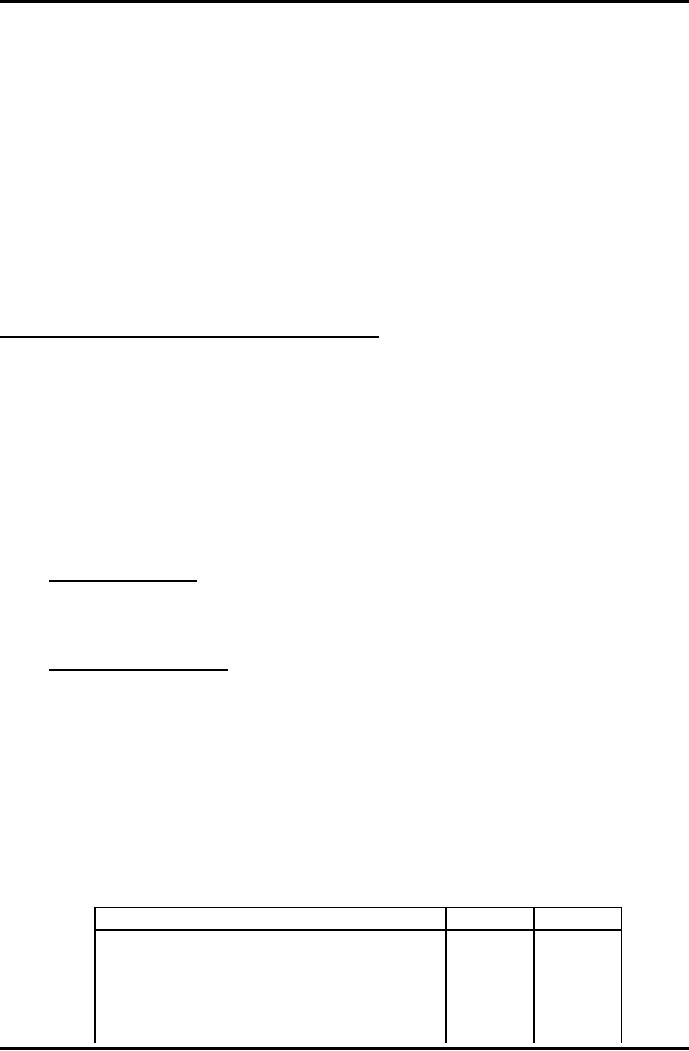

Question

Babar

Co. Ltd. of Islamabad had a branch in

Sahiwal which maintained its

accounts

independently.

Accounts relating to fixed assets in

the Sahiwal branch were,

however,

kept

in the books of accounts of

the head office. On 31st December, 2006 the

Sahiwal

branch

extracted the following Trial

Balance from its own books of

accounts and

forwarded

the same to the head

office.

Particulars

Dr.

(Rs)

Cr.

(Rs)

Stock

in Trade (01.01.2006)

20,000

Purchases

50,000

Carriage

and Freight Inward

2,500

Goods

Received from head

office

15,000

Transit

insurance on goods

received

1,000

75

Advance

Financial Accounting

(FIN-611)

VU

Salaries

10,000

Rents

rates and taxes

3,800

General

office expenses

9,000

Sundry

debtors

7,200

Cash

in hand and at bank

2,500

Sales

75,900

Sundry

creditors

5,000

Miscellaneous

receipts

500

Purchases

returns

800

Sales

returns

500

Bills

receivable

1,500

Discount

allowed

200

Head

office account

41,000

Total

1,23,200

1,23,200

The

closing stock (as at

31.12.2006) at Sahiwal branch

was Rs. 16,000. Depreciation

was

to be

allowed @ 15% p.a. on Branch

Plant and Machinery of Rs. 25,000 and @

20% p.a.

on

Branch Furniture and Fittings of

Rs. 6,000. Outstanding rent

in respect of the

year

2006

amounted to Rs. 500. Sahiwal

Branch account, in the head

office books, showed

a

debit

balance of Rs. 46,000 and it

was revealed that the

difference in the

balances

shown by

Head Office Account and

Sahiwal Branch Account was

on the account of

cash-in-transit.

You

are to show Journal Entries

required to incorporate the

above Trial Balance

and

other

particulars in the books of

the head office and also

the Sahiwal Branch

Account.

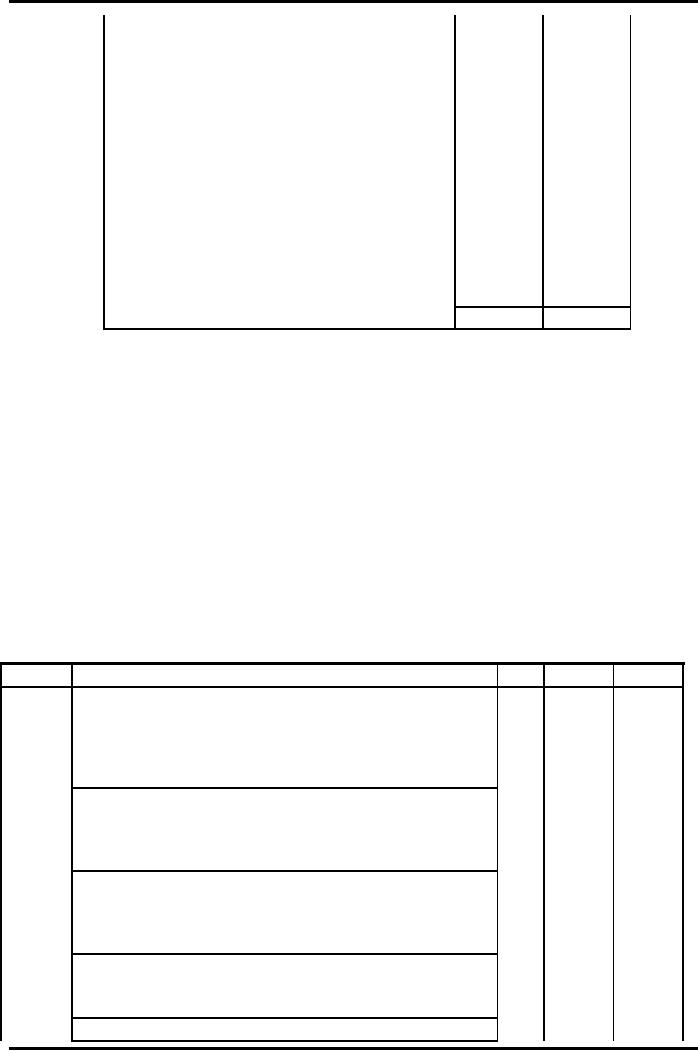

In

the books of Babar Co.

Ltd. (H.O.)

Journal

Dr.

Cr.

Date

Particulars

L.F.

Rs.

Rs.

89,000

2006

Sahiwal

Branch Trading A/c

Dec,

To

Sahiwal Branch A/c (Note

1)

89,000

[Being

the incorporation of opening

stock, purchases,

31

carriage

and freight inward, goods

received from head

office,

transit

insurance, sales returns

etc]

92,700

Sahiwal

Branch A/c

To

Sahiwal Branch Trading A/c

(Note 2)

92,700

[Being

the incorporation of closing

stock, sales and

purchase

returns]

Sahiwal

Branch Trading A/c

3,700

To

Sahiwal Branch Profit &

Loss A/c

3,700

[Being

the gross profit transferred to

Branch Profit & Loss

Account]

Sahiwal

Branch Profit & Loss

A/c

28,450

To

Sahiwal Branch A/c (Note

3)

28,450

[Being

the incorporation of branch

expenses]

Sahiwal

Branch A/c

500

76

Advance

Financial Accounting

(FIN-611)

VU

To

Sahiwal Branch Profit &

Loss A/c

500

[Being

the incorporation of branch

miscellaneous income]

General

Profit and Loss A/c

24,250

Dr.

24,250

To

Sahiwal Branch Profit &

Loss A/c

[Being

the incorporation of branch

net loss]

5,000

Cash

in Transit

To

Sahiwal Branch A/c

5,000

[Being

cash remitted by Sahiwal

Branch not yet received

by

the

H.O.]

4,950

Sahiwal

Branch A/c

To

Branch Plant & Machinery

A/c

3,750

1,200

To

Branch Furniture & Fittings

A/c

[Being

the depreciation charges on branch

assets]

Sahiwal

Branch Closing Stock

A/c

16,000

Sahiwal

Branch Debtors A/c

Dr.

7,200

Sahiwal

Branch Bills Receivable

A/c

1,500

Sahiwal

Branch Cash in hand A/c

2,500

To

Sahiwal Branch A/c

27,200

[Being

the incorporation of branch

assets]

Sahiwal

Branch A/c

5,500

To

Sahiwal Branch Creditors

A/c

5,000

To

Outstanding Rent A/c

500

[Being

the incorporation of branch

liabilities]

In

the books of the Babar

Co. Ltd. (H.O.)

Sahiwal

Branch Account

Date

Particulars

Rs.

Date

Particulars

Rs.

46,000

89,000

31.12.06

To Balance

b/d

31.12.06

By

Sahiwal Branch Trading

A/c

To

Sahiwal Branch Trading

A/c

(Note

1)

92,700

(Note

2)

By

Sahiwal Branch Profit &

Loss

28,450

To

Sahiwal Branch Trading

A/c

A/c

500

To

Branch Plant & Machinery

A/c

By Cash in

Transit A/c

3,750

5,000

To

Branch Furniture & Fittings

A/c

By

Sahiwal Branch Assets

A/c

1,200

27,200

To

Sahiwal Branch Creditors

A/c

5,000

To

Outstanding Rent A/c

500

1,49,650

1,49,650

Working

Notes:

1.

Opening

stock Rs. 20,000 + Purchases

Rs. 50,000 + Carriage and Freight

Rs.

2,500

+ Goods from head office Rs.

15,000 + Transit insurance Rs.

1,000 + Sales

Return

Rs. 500 = Rs. 89,000.

2.

Sales

Rs. 75,900 + Closing Stock

Rs. 16,000 + Purchase Returns

Rs. 800 = Rs.

92,700.

3.

Salaries

Rs. 10,000 + Rent rates

(including outstanding) Rs.

4,300 + General

office

expenses Rs. 9,000 +

Discount allowed Rs. 200 +

Depreciation on Plant

and

Machinery Rs. 3,750 +

Depreciation on Furniture and Fittings

Rs. 1,200 =

Rs.

28,450.

77

Table of Contents:

- ACCOUNTING FOR INCOMPLETE RECORDS

- PRACTICING ACCOUNTING FOR INCOMPLETE RECORDS

- CONVERSION OF SINGLE ENTRY IN DOUBLE ENTRY ACCOUNTING SYSTEM

- SINGLE ENTRY CALCULATION OF MISSING INFORMATION

- SINGLE ENTRY CALCULATION OF MARKUP AND MARGIN

- ACCOUNTING SYSTEM IN NON-PROFIT ORGANIZATIONS

- NON-PROFIT ORGANIZATIONS

- PREPARATION OF FINANCIAL STATEMENTS OF NON-PROFIT ORGANIZATIONS FROM INCOMPLETE RECORDS

- DEPARTMENTAL ACCOUNTS 1

- DEPARTMENTAL ACCOUNTS 2

- BRANCH ACCOUNTING SYSTEMS

- BRANCH ACCOUNTING

- BRANCH ACCOUNTING - STOCK AND DEBTOR SYSTEM

- STOCK AND DEBTORS SYSTEM

- INDEPENDENT BRANCH

- BRANCH ACCOUNTING 1

- BRANCH ACCOUNTING 2

- ESSENTIALS OF PARTNERSHIP

- Partnership Accounts Changes in partnership firm

- COMPANY ACCOUNTS 1

- COMPANY ACCOUNTS 2

- Problems Solving

- COMPANY ACCOUNTS

- RETURNS ON FINANCIAL SOURCES

- IASB’S FRAMEWORK

- ELEMENTS OF FINANCIAL STATEMENTS

- EVENTS AFTER THE BALANCE SHEET DATE

- PROVISIONS, CONTINGENT LIABILITIES AND CONTINGENT ASSETS

- ACCOUNTING POLICIES, CHANGES IN ACCOUNTING ESTIMATES AND ERRORS 1

- ACCOUNTING POLICIES, CHANGES IN ACCOUNTING ESTIMATES AND ERRORS 2

- BORROWING COST

- EXCESS OF THE CARRYING AMOUNT OF THE QUALIFYING ASSET OVER RECOVERABLE AMOUNT

- EARNINGS PER SHARE

- Earnings per Share

- DILUTED EARNINGS PER SHARE

- GROUP ACCOUNTS

- Pre-acquisition Reserves

- GROUP ACCOUNTS: Minority Interest

- GROUP ACCOUNTS: Inter Company Trading (P to S)

- GROUP ACCOUNTS: Fair Value Adjustments

- GROUP ACCOUNTS: Pre-acquistion Profits, Dividends

- GROUP ACCOUNTS: Profit & Loss

- GROUP ACCOUNTS: Minority Interest, Inter Co.

- GROUP ACCOUNTS: Inter Co. Trading (when there is unrealized profit)

- Comprehensive Workings in Group Accounts Consolidated Balance Sheet