|

INDEPENDENT BRANCH |

| << STOCK AND DEBTORS SYSTEM |

| BRANCH ACCOUNTING 1 >> |

Advance

Financial Accounting

(FIN-611)

VU

LESSON#15

INDEPENDENT

BRANCH

Steps

involved in preparing accounts of

independent branch

Reconciliation

Adjustment

Incorporation

Reconciliation

Reconciliation

of the balance of head

office account appearing in

the books of Branch

with

the balance of branch

account appearing in the

books of head office

Reasons

of Difference

The

two balances might be different because

of following reasons:

1.

Cash in transit

2.

Goods in transit

3.

Mistake committed by either

party

NOTE:

Accounting

entry for reconciliation will be passed in

the books of either

party

Accounting

Entries

Cash

in transit

Cash

in transit A/C

Branch

A/C or Head office A/C

Goods

in transit

Goods

in transit A/C

Branch

A/C or Head office A/C

Mistakes

Account

to be rectified

Branch

A/C or Head office A/C

Branch

A/C or Head office A/C

Account

to be rectified

Adjustments

on the books of both

parties

Certain

informations are required to be

adjusted in the books of

both the parties

(head

office

and branch). These

include:

1.

Allocation of head office

expense

2.

Depreciation on branch assets

3. Inter

branch transfers

68

Advance

Financial Accounting

(FIN-611)

VU

Accounting

Entries

Books

of head office

Allocation

of head office

expense

Branch

A/C

Specific

Expense A/C

Depreciation

of branch assets

Branch

A/C

Provision

for depreciation A/C

Inter

branch transfers

Receiving

Branch A/C

Transferring

Branch A/C

Books

of branch

Allocation

of head office

expense

Specific

Expense A/C

Head

office A/C

Depreciation

of branch assets

Depreciation

Expense A/C

Head

office A/C

Inter

branch transfers

Books

of Transferring Branch

Head

office A/C

Goods

returned to head

office

Books

of Receiving Branch

Goods

received from head

office

Head

office A/C

Incorporation

Meanings:

Incorporation

of branch trial balance into

the books of head office.

(Consolidation)

Note:

Accounting entries for incorporation

are passed in the books of

head office only

Accounting

Entries

To

incorporate Branch Cost of

Goods Sold

Cost

of Good Sold A/C

Branch

A/C

To

incorporate Branch Sales

Branch

A/C

Trading

A/C (Sales A/C)

To

incorporate Branch

Expenses

Profit

& Loss A/C (Expenses)

Branch

A/C

To

incorporate Branch other

income

Branch

A/C

Profit

& Loss A/C (income)

69

Advance

Financial Accounting

(FIN-611)

VU

To

incorporate Branch

Assets

All assets

(individually)

Branch

A/C

To

incorporate Branch

Liabilities

Branch

A/C

All

Liabilities (individually)

Note:

After passing the accounting

entries for incorporation the

branch account

Appearing

in the trial balance of head

office will give Nil

Balance.

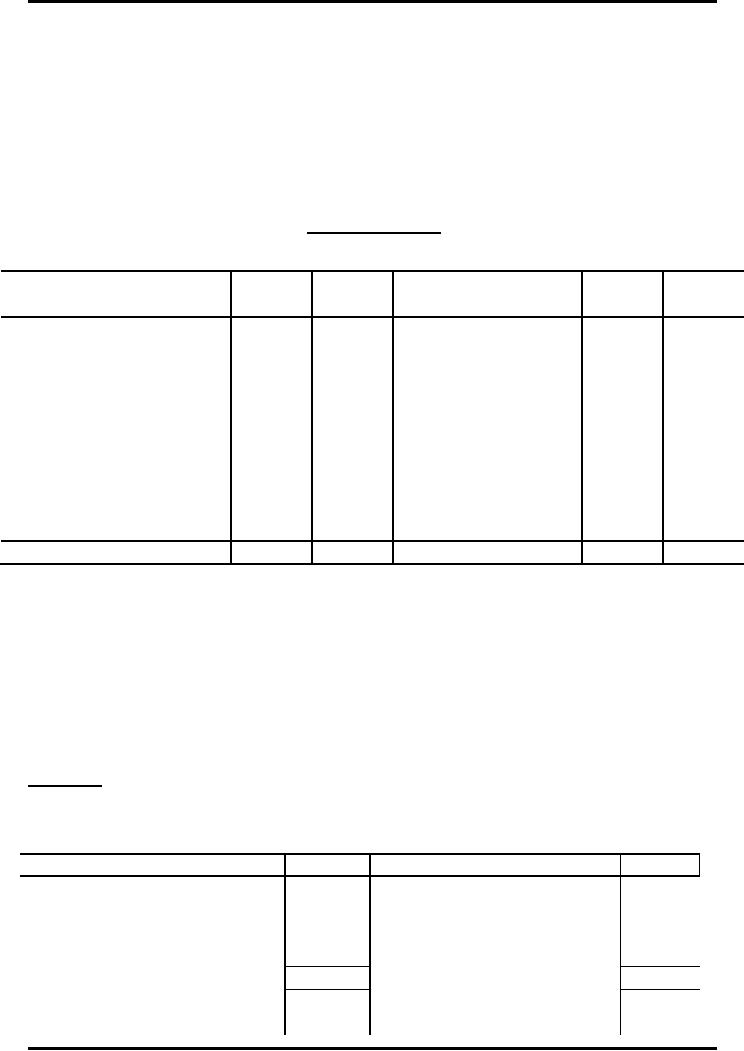

Solved

Question

The

following is the Trial Balance of

Meerut Branch as on 31st December, 2006:

Dr.

Cr.

Dr.

Cr.

(Rs.)

(Rs.)

(Rs.)

(Rs.)

Karachi

head office

3,240

Debtors

3,700

Stock

1st January,

2006

6,000

Creditors

1,850

Purchases

97,800

Rent

1,960

Goods

received from

19,000

Sundry

office

1,470

h/office

expenses

Sales

1,38,000

Cash

at bank

1,780

Goods

supplied to

6,000

Furniture

6,000

h/office

Salaries

4,500

Depreciation

on

400

furniture

Total

1,45,850

1,45,850

Stock

at branch on 31st

December, 2006

was valued at Rs.

7,700.

Meerut

Branch Account in the head

office books on 31st December, 2006 stood at

Rs.

460

(debit balance). On 28th December, 2006 the head

office forwarded goods of

the

value

of Rs. 3,700 to the branch

where they were received on 3rd January, 2007.

Prepare

Memorandum Branch Trading and Profit and

Loss Account and pass

necessary

Journal Entries to incorporate

Meerut branch balances and

prepare Meerut

Branch

Account in the head office

books.

Solution:

Memorandum

Meerut Branch Trading and

Profit and Loss

Account

For

the year ended 31st December, 2006

Particulars

Rs.

Particulars

Rs.

To

opening stock

6,000

By

sales

1,38,000

To

purchases

97,800

By

goods supplied to H/O

6,000

To

goods received from H/O

19,000

By

closing stock

7,700

To

gross profit c/d

28,900

1,51,700

1,51,700

To

salaries

4,500

By

gross profit b/d

28,900

To

rent

1,960

70

Advance

Financial Accounting

(FIN-611)

VU

To sundry

office expenses

1,470

To

depreciation on furniture

400

To

net profit

20570

28,900

28.900

In

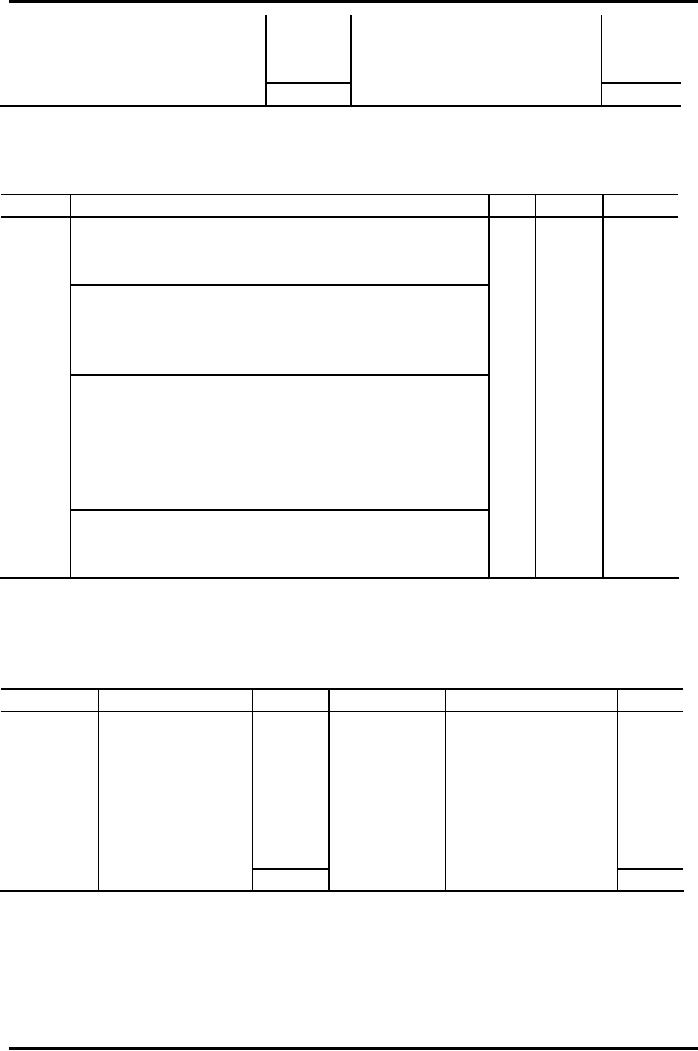

the books of Head

Office

Journal

Dr.

Cr.

Date

Particulars

L.F.

Rs.

Rs.

2006

Meerut

Branch A/c

20,570

Dec.31

To

General Profit & Loss

A/c

20,570

(being

the incorporation of branch

net profit)

Goods

in Transit A/c

3,700

To

Meerut Branch A/c

3,700

(Being

goods sent to branch on 28th December,

received

on 3rd January,

2007)

Meerut

Branch Furniture A/c

6,000

Meerut

Branch Debtors A/c

3,700

Meerut

Branch Stock A/c

7,700

Meerut

Branch Cash A/c

1,780

To

Meerut Branch A/c

19,180

(Being

the incorporation of branch

assets)

Meerut

Branch A/c

1,850

To

Meerut Branch Creditors

A/c

1,850

(Being

the incorporation of branch

liability)

In

the books of the Head

Office

Meerut

Branch Account

Dr.

Cr.

Date

Particulars

Rs.

Date

Particulars

Rs.

31.12.2006

To balance c/d

460

31.12.2006

By goods in Transit

3,700

A/c

To

Meerut

1,850

By

Meerut Branch

19,180

Branch

Creditors

Assets

A/c

A/c

To

general Profit

20,570

&

Loss

22,800

22,800

71

Table of Contents:

- ACCOUNTING FOR INCOMPLETE RECORDS

- PRACTICING ACCOUNTING FOR INCOMPLETE RECORDS

- CONVERSION OF SINGLE ENTRY IN DOUBLE ENTRY ACCOUNTING SYSTEM

- SINGLE ENTRY CALCULATION OF MISSING INFORMATION

- SINGLE ENTRY CALCULATION OF MARKUP AND MARGIN

- ACCOUNTING SYSTEM IN NON-PROFIT ORGANIZATIONS

- NON-PROFIT ORGANIZATIONS

- PREPARATION OF FINANCIAL STATEMENTS OF NON-PROFIT ORGANIZATIONS FROM INCOMPLETE RECORDS

- DEPARTMENTAL ACCOUNTS 1

- DEPARTMENTAL ACCOUNTS 2

- BRANCH ACCOUNTING SYSTEMS

- BRANCH ACCOUNTING

- BRANCH ACCOUNTING - STOCK AND DEBTOR SYSTEM

- STOCK AND DEBTORS SYSTEM

- INDEPENDENT BRANCH

- BRANCH ACCOUNTING 1

- BRANCH ACCOUNTING 2

- ESSENTIALS OF PARTNERSHIP

- Partnership Accounts Changes in partnership firm

- COMPANY ACCOUNTS 1

- COMPANY ACCOUNTS 2

- Problems Solving

- COMPANY ACCOUNTS

- RETURNS ON FINANCIAL SOURCES

- IASB’S FRAMEWORK

- ELEMENTS OF FINANCIAL STATEMENTS

- EVENTS AFTER THE BALANCE SHEET DATE

- PROVISIONS, CONTINGENT LIABILITIES AND CONTINGENT ASSETS

- ACCOUNTING POLICIES, CHANGES IN ACCOUNTING ESTIMATES AND ERRORS 1

- ACCOUNTING POLICIES, CHANGES IN ACCOUNTING ESTIMATES AND ERRORS 2

- BORROWING COST

- EXCESS OF THE CARRYING AMOUNT OF THE QUALIFYING ASSET OVER RECOVERABLE AMOUNT

- EARNINGS PER SHARE

- Earnings per Share

- DILUTED EARNINGS PER SHARE

- GROUP ACCOUNTS

- Pre-acquisition Reserves

- GROUP ACCOUNTS: Minority Interest

- GROUP ACCOUNTS: Inter Company Trading (P to S)

- GROUP ACCOUNTS: Fair Value Adjustments

- GROUP ACCOUNTS: Pre-acquistion Profits, Dividends

- GROUP ACCOUNTS: Profit & Loss

- GROUP ACCOUNTS: Minority Interest, Inter Co.

- GROUP ACCOUNTS: Inter Co. Trading (when there is unrealized profit)

- Comprehensive Workings in Group Accounts Consolidated Balance Sheet