|

STOCK AND DEBTORS SYSTEM |

| << BRANCH ACCOUNTING - STOCK AND DEBTOR SYSTEM |

| INDEPENDENT BRANCH >> |

Advance

Financial Accounting

(FIN-611)

VU

LESSON

# 14

STOCK

AND DEBTORS

SYSTEM

Question

On 1st January, 2008 goods costing

Rs. 132,000 were invoiced by Multan

head office to

its

new branch at Lahore and charged at

selling price to produce a

gross profit of 25%

on

the selling price. At the

end of the year, the return

from Lahore Branch showed

that

the

credit sales were Rs.

150,000. Goods invoiced at

Rs. 2,000 to Lahore branch

have

been

returned to Multan head office.

The closing stock at Lahore

branch was Rs.

24,000

at

selling price. Record the

above transactions in the

books of

(i)

Lahore Branch Stock Account;

(ii) Goods Sent to Lahore

Branch Account; (iii)

Lahore

Branch Adjustment Account; and (iv)

Lahore Branch Debtors

Account in the

head

office book and close the

said accounts on 31st December 2008.

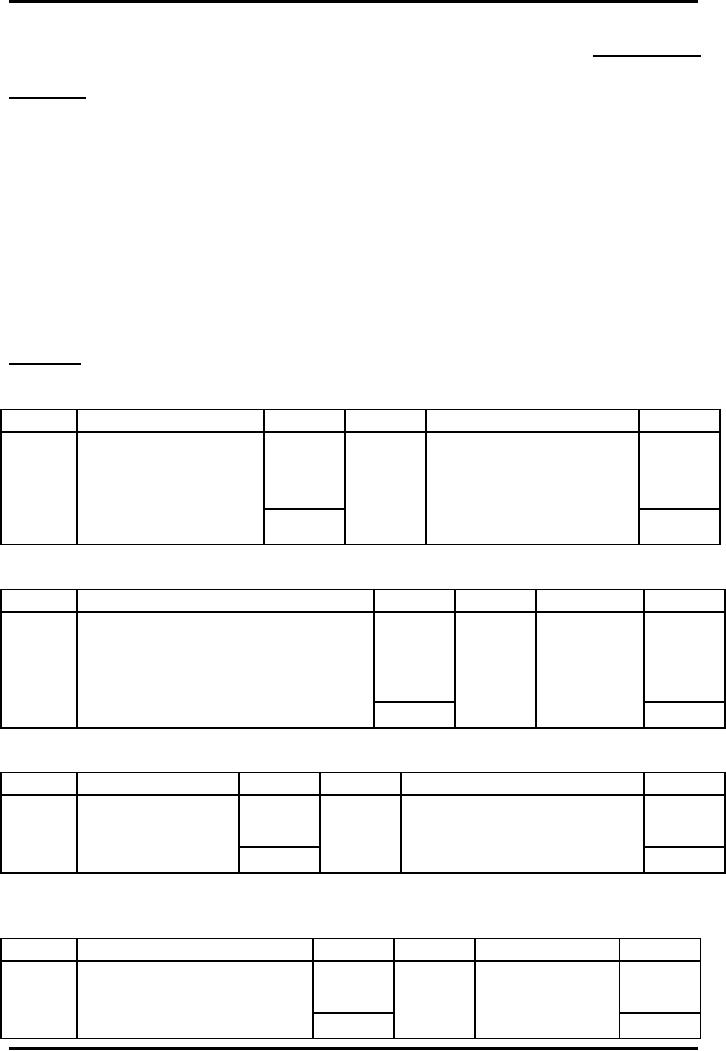

Solution

In

the Books of the Head

Office, Multan

Dr.

Lahore

Branch Stock

Account

Date

Particulars

Rs.

Date

Particulars

Rs.

2008

To

Goods Sent to

176,000

2008

By

Goods Sent to LHR

2,000

Dec.1

LHR

Br. A/c

Dec.31

Br.

A/c (Returns)

150,000

By

Branch Debtor A/c

24,000

(Credit

Sales)

176,000

176,000

By

Balance c/d

Dr.

Goods

Sent to Lahore Branch

Account

Date

Particulars

Rs.

Date

Particulars

Rs.

2008

To

Lahore Branch Stock

A/c

2,000

2008

By

Lahore

176,000

Dec.31

(Returns)

Dec.31

Branch

43,500

To

Lahore Branch Adjustment

A/c

Stock

A/c

To

Purchases A/c (Transferred)

130,500

176,000

176,000

Dr.

Lahore

Branch Debtors

Account

Date

Particulars

Rs.

Date

Particulars

Rs.

2008

To

Lahore Brach

150,000

2008

By

Balance c/d

150,000

Dec.31

Stock

A/c

Dec.31

150,000

150,000

Dr.

Lahore

Branch Adjustment

Account

Cr.

Date

Particulars

Rs.

Date

Particulars

Rs.

2008

To

Stock Reserve A/c

6,000

2008

By

Goods Sent

43,500

Dec.31

To

General Profit &

Loss

37,500

Dec.31

to

Delhi Branch

A/c

A/c

43,500

43,500

64

Advance

Financial Accounting

(FIN-611)

VU

Question

X Ltd. of

Karachi has a branch at

Lahore. Goods are invoiced

to the branches at

cost

plus

331/3%. The

branch remits all cash

received to the head office

and all expenses are

paid

by the head office. From

the following particulars, prepare

Branch Stock Account,

Branch

Adjustment Account, Branch

Debtors Account and Branch

Profit & Loss

Account

in the books of the head

office. (All figures in

Rs.)

Branch

Debtors on 1.1.2008

6,000

Branch

Stock on 1.1.2008 (invoice

price)

2,400

Sales

Cash

3,000

Credit

60,000

Goods

from head office (invoice

price)

72,000

Cash

received from Debtors

57,600

Discount

allowed to Debtors

1,400

Bad

debts

300

Branch

expenses paid by Head

Office

5,000

Branch

stock on 31.12.2008 (invoice

price)

12,000

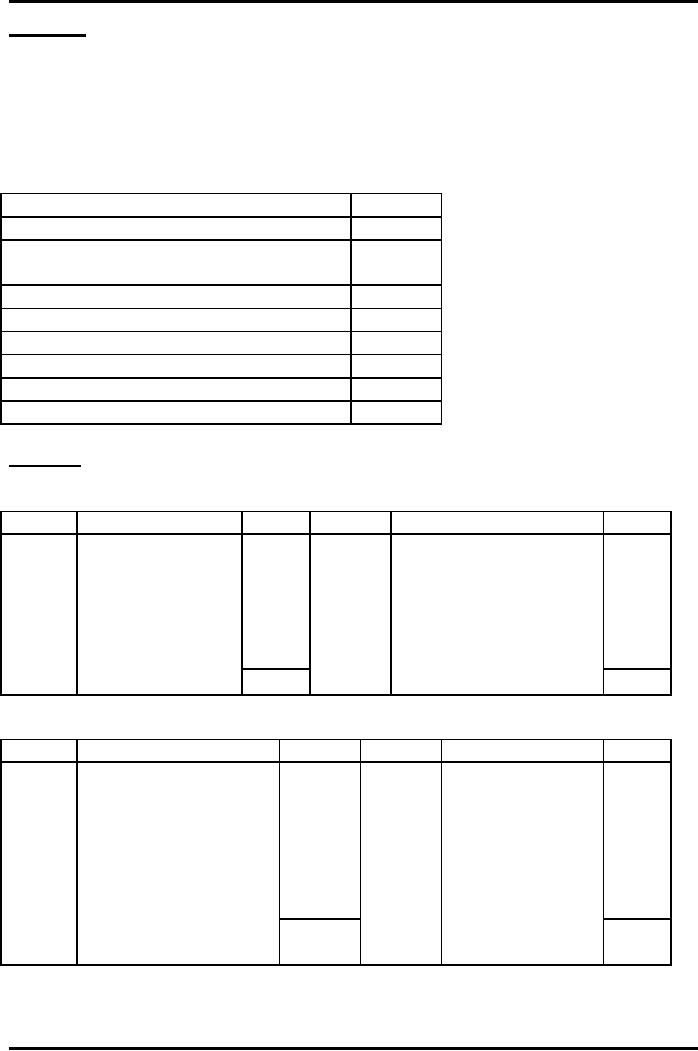

Solution

In

the Books of the Head

Office, Karachi

Dr.

Branch

Stock Account

Date

Particulars

Rs.

Date

Particulars

Rs.

2008

To

Balance b/d

2,400

2008

Jan.1

To

Goods Sent to

Dec.31

By

Bank A/c (Cash

3,000

Dec.31

Branch

A/c

sales)

72,000

60,000

Branch

By

Branch Debtors A/c

12,000

Adjustment

By

Balance c/d

(Surplus)

600

75,000

75,000

Dr.

Branch

Adjustment Account

Date

Particulars

Rs.

Date

Particulars

Rs.

2008

To

Stock Reserve A/c

3,000

2008

By

Stock Reserve

600

Dec.31

(12,000

x �)

Dec.31

A/c

(2,400 x

To

Gross c/d

33.33/133.33)

16,200

(Transferred

to Branch

By

Goods sent to

18,000

PLS

A/c)

Branch

A/c

Branch

Stock

(Surplus)

600

19,200

19,200

65

Advance

Financial Accounting

(FIN-611)

VU

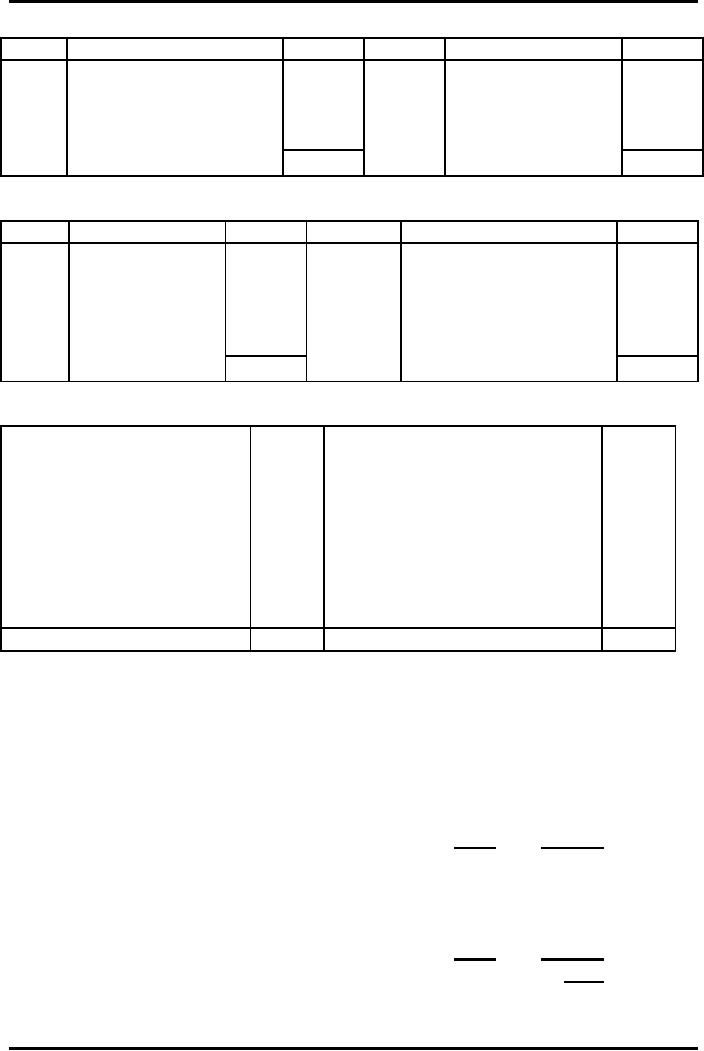

Dr.

Branch

Profit & Loss

Accountr.

Date

Particulars

Rs.

Date

Particulars

Rs.

2008

To

Branch Expenses A/c

2008

By

Gross Profit b/d

16,200

Dec.3

Discount

Allowed

1,400

Dec.31

By

General Profit &

500

300

1

Bad

debts

Loss

A/c (Loss)

15,000

Cash

Expenses

16,700

16,700

Dr.

Branch

Debtors Account

Date

Particulars

Rs.

Date

Particulars

Rs.

Jan.1

To

Balance b/d

6,000

2008

By

Bank A/c

57,600

2008

Dec.31

By

Branch Expenses A/c

1,400

Discount

Allowed

Bad

debts

300

To

B

Dec31

60,000

By

Balance c/d

6,700

ranch

Stock A/c

66,000

66,000

Branch

Account

Rupees

Rupees

6,000

Cash Received

60,600

Opening

Debtors

1,800

Goods Returned

0

Opening

Stock (at cost)

72,000

Goods sent to branch

(loading)

18,000

Goods

sent to branch (at

15,000

Closing Debtors

6,700

Inv.)

9,000

Cash

sent to branch

Closing

Stock (at cost)

500

Income

Statement (loss)

94,800

94,800

Branch

Income

Statement

Rupees

Sales

63,000

Cost

of goods sold

Opening

stock (at cost)

1,800

Goods

received from head office

(at cost)

54,000

(46,800)

Closing

stock (at cost)

9,000

Gross

profit

16,200

Operating

expenses

Cash

expenses

15,000

Bad

debts

300

Discount

allowed

1,400

(16,700)

Loss

transferred to head office

Income Statement

(500)

Whole

Sale Branch

66

Advance

Financial Accounting

(FIN-611)

VU

Sometimes,

the head office

(specifically dealing the

manufacturing activities)

sells

goods

to actual consumers through its

retail shops. In this case,

the head office

sends

goods

to the branches at wholesale

prices which cost plus a percentage of

profit. The

branch

is likely to sell those

goods at retail prices which is

more than the

wholesale

prices.

The real profit earned by

the branch is the difference

between the retail

selling

price

and the wholesale price. For

example the cost price of an

article is Rs. 100,

the

wholesale

price, Rs. 160 and the

retail selling price, Rs.

180. Where an article is

sold by

the

branch, the actual profit is

Rs. 180 100 = Rs. 80 but the

branch's profit is Rs. 180

160 =

Rs. 20.

This

system of accounting is followed for

dependent branches where

these are treated

as

profit centre only. The real

cost of the branch is the

whole sale price of the

goods

sent.

But, we must remember that

wholesale prices are fixed

above cost. Therefore,

if

all

the goods that have

been sent to branch are

sold no problem arises. The

real

problem

arises when a part of stock

remains unsold at the

branch, which includes an

element

of profit that could not be

realized by the head office.

Such unrealized profit

is

reversed

in the books of head office

by recording this accounting

entry:

Income

Statement a/c

Dr.

(Wholesale

price less cost

price)

Stock

Reserve a/c Cr.

In

the balance sheet the

branch stock is shown at cost

i.e. after deducting

stock

reserves.

67

Table of Contents:

- ACCOUNTING FOR INCOMPLETE RECORDS

- PRACTICING ACCOUNTING FOR INCOMPLETE RECORDS

- CONVERSION OF SINGLE ENTRY IN DOUBLE ENTRY ACCOUNTING SYSTEM

- SINGLE ENTRY CALCULATION OF MISSING INFORMATION

- SINGLE ENTRY CALCULATION OF MARKUP AND MARGIN

- ACCOUNTING SYSTEM IN NON-PROFIT ORGANIZATIONS

- NON-PROFIT ORGANIZATIONS

- PREPARATION OF FINANCIAL STATEMENTS OF NON-PROFIT ORGANIZATIONS FROM INCOMPLETE RECORDS

- DEPARTMENTAL ACCOUNTS 1

- DEPARTMENTAL ACCOUNTS 2

- BRANCH ACCOUNTING SYSTEMS

- BRANCH ACCOUNTING

- BRANCH ACCOUNTING - STOCK AND DEBTOR SYSTEM

- STOCK AND DEBTORS SYSTEM

- INDEPENDENT BRANCH

- BRANCH ACCOUNTING 1

- BRANCH ACCOUNTING 2

- ESSENTIALS OF PARTNERSHIP

- Partnership Accounts Changes in partnership firm

- COMPANY ACCOUNTS 1

- COMPANY ACCOUNTS 2

- Problems Solving

- COMPANY ACCOUNTS

- RETURNS ON FINANCIAL SOURCES

- IASB’S FRAMEWORK

- ELEMENTS OF FINANCIAL STATEMENTS

- EVENTS AFTER THE BALANCE SHEET DATE

- PROVISIONS, CONTINGENT LIABILITIES AND CONTINGENT ASSETS

- ACCOUNTING POLICIES, CHANGES IN ACCOUNTING ESTIMATES AND ERRORS 1

- ACCOUNTING POLICIES, CHANGES IN ACCOUNTING ESTIMATES AND ERRORS 2

- BORROWING COST

- EXCESS OF THE CARRYING AMOUNT OF THE QUALIFYING ASSET OVER RECOVERABLE AMOUNT

- EARNINGS PER SHARE

- Earnings per Share

- DILUTED EARNINGS PER SHARE

- GROUP ACCOUNTS

- Pre-acquisition Reserves

- GROUP ACCOUNTS: Minority Interest

- GROUP ACCOUNTS: Inter Company Trading (P to S)

- GROUP ACCOUNTS: Fair Value Adjustments

- GROUP ACCOUNTS: Pre-acquistion Profits, Dividends

- GROUP ACCOUNTS: Profit & Loss

- GROUP ACCOUNTS: Minority Interest, Inter Co.

- GROUP ACCOUNTS: Inter Co. Trading (when there is unrealized profit)

- Comprehensive Workings in Group Accounts Consolidated Balance Sheet