|

BRANCH ACCOUNTING |

| << BRANCH ACCOUNTING SYSTEMS |

| BRANCH ACCOUNTING - STOCK AND DEBTOR SYSTEM >> |

Advance

Financial Accounting

(FIN-611)

VU

LESSON

#12

BRANCH

ACCOUNTING

Pro-forma

Invoice Price

Head

office may send goods to

branch either at "cost" or at

"pro-forma invoice

price".

In

previous section of this

chapter we have discussed

accounting treatment for a

dependent

branch to which the goods

are sent to branch at cost

price. In the

forthcoming

section we will discuss the

accounting treatment for the

dependent

branch

to which goods are sent at

pro-forma invoice price. The

treatment is slightly

different

but before discussing the

accounting treatment we must know what

pro-

forma

invoice price is and why head

office prefers to send goods

at pro-forma invoice

price.

Pro-forma

invoice price is higher than

the cost price. Adding a

reasonable profit in

the

cost

makes the price equal to

the pro-forma invoice price.

Here we must know what is

selling

price? Selling price is the

price at which goods are

sold to the customers. So

the

selling

price will be higher than the

pro-forma invoice price in normal

circumstances.

Difference

between cost and pro-forma

invoice price is known as loading and

the

difference

between cost and the selling

price is the profit in real

terms.

Head

office usually sends goods to

its branches at the

pro-forma invoice price to

keep

its

profit margin secret from

the branch managers. Had the

cost been known to

the

branch

manager he would have been in a

position to determine the

exact profits

enjoyed

by the head office, which may

induce the branch manager to

confront the

business

as a competitor. Moreover by sending

goods to the branches at

pro-forma

invoice

price, the head office

can dictate pricing policy

to its branches, as well as

save

work at

the branch because prices

have already been decided.

Sending goods at pro-

forma

invoice price is generally

done where goods are of

standard type,

pre-packed

and unlikely to

fluctuate in price.

Here

it is worth mentioning that "pro-forma

invoice" is name of the

document which

is

sent to branches along with

the goods sent; in this

document description and

quantity

of the goods sent is written

along with the price.

Therefore the price

appearing

on the pro-forma invoice is

named as pro-forma invoice

price.

The

document which is sent to the

customers to evident the

sales of goods to them is

known as

"invoice"; this document

discloses the quantity,

description and selling

price

of the goods sold, along

with the settlement terms.

Technically speaking

"selling

price"

may also be termed as "invoice

price", but "invoice price" and

"pro-forma

invoice

price" are different. It is a

common error that often

people do not care while

using

the terminology and confuse

"invoice price" with the

"pro-forma invoice

price".

The

method of preparing Branch a/c while

goods are sent at pro-forma

invoice price is

the

same with the exception that

the accounting entries

relating to the goods sent

to

and

goods returned from the

branch are recorded at

pro-forma invoice price and

a

reverse

adjustment is required with the amount of

loading (difference between

cost

and

pro-forma invoice

price).

Remember;

the accounting entries for

opening and closing stocks

are recorded at cost

price.

Do not record stocks at pro-forma

invoice price.

Rationale;

an accountant is supposed to record

accounting entries evidenced by

a

source

document. Goods sent to

branch are evidenced through

"pro-forma invoice"

therefore

price mentioned on the

document cannot me ignored while

recording this

56

Advance

Financial Accounting

(FIN-611)

VU

transaction.

Whereas, valuation of opening and

closing stocks is not reported

through

pro-forma

invoice therefore to make it

simple stocks are accounted

for at cost.

Accounting

Entries in the Books of Head

Office

11.

For opening balances of assets at the

branch

Branch

a/c

Branch

assets a/c (individual accounts)

12.

For opening balances of liabilities at

the branch

Branch

liabilities a/c (individual

accounts)

Branch

a/c

13.

For goods sent to the branch

(at pro-forma invoice

price)

Branch

a/c

Goods

sent to branch a/c

14.

For return of goods by the

branch (at pro-forma invoice

price)

Goods

sent to branch a/c

Branch

a/c

15.

For reversal of loading on (net)

goods set to branch (with

the amount of loading)

Goods

sent to branch a/c

Branch

a/c

16.

For remittance of cash or

cheque to the branch

Branch

a/c

Cash/Bank

a/c

17.

For cash or cheque received

from the branch

Cash/Bank

a/c

Branch

a/c

18.

For closing balances of assets at the

branch

Branch

asset a/c (individual

accounts)

Branch

a/c

19.

For closing balances of liabilities at

the branch

Branch

a/c

Branch

liabilities a/c (individual

accounts)

20.

For closing goods sent to branch

account.

Goods

sent to branch a/c

Purchases

a/c

57

Advance

Financial Accounting

(FIN-611)

VU

21.

For closing branch account

into the profit and loss

account

Incase

of profit

Branch

a/c

Profit

& loss a/c

Incase

of loss

Profit

& loss a/c

Branch

a/c

22.

For abnormal loss (should

always be accounted for at

cost)

Abnormal

loss a/c

(at

cost)

Branch

a/c

Insurance

claim a/c (claim

admitted)

Profit

& loss a/c

(balance

if not admitted by the insurance

company)

Abnormal

loss a/c (cost of the

abnormal loss)

Note:

No accounting entry is required for normal

losses.

Solved

Problem # 1

Excellent

Garments of Multan has a branch at

Lahore. Goods are supplied

to the

branch

at cost. The expenses of the

branch are paid from Multan and

the branch keeps

a

sales journal and the

debtors' ledger only. From

the following information

supplied

by

the branch, prepare a Branch

Account in the books of the

head office. Goods

are

sent

to branch at pro-forma invoice

price which is cost plus 20%. (All

figures in

rupees)

Opening

Stock (at Pro-forma invoice)

28,800 Closing Debtors

9,150

Closing

Stock (at Pro-forma

invoice)

21,600

Opening Debtors

?

Goods

received from HO (at Pro-forma

invoice)

40,320

Bad

Debt

140

Credit

Sales

41,000

Expenses

paid by Head office

10,400

Cash

Sales

17,500

Cash

received from Debtors

37,900

Pilferage

of goods by the employees (Normal

Loss) 2,000

Solution:

(Debtors System)

In

the books of Head Office

(Multan)

Lahore

Branch Account

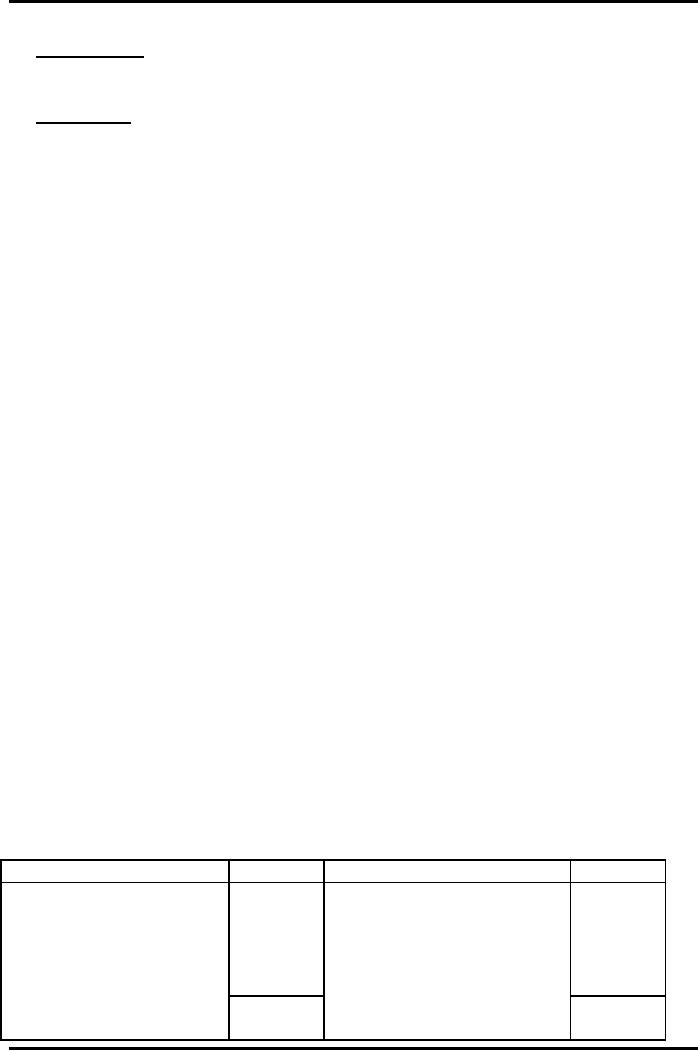

Particulars

Rs.

Particulars

Rs.

Opening

Stock

24,000

Cash

Received from Branch

17,500

Opening

Debtors

6,200

Cash

Received from Debtors

37,900

Cash

sent to Branch

10,400

Goods

sent to Branch

6,720

Goods

sent to Branch a/c 40,320

(loading)

18,000

General

Profit & Loss a/c 8,360

Closing

Stock

9,160

(Profit)

Closing

Debtors

89,280

89,280

58

Advance

Financial Accounting

(FIN-611)

VU

Working:

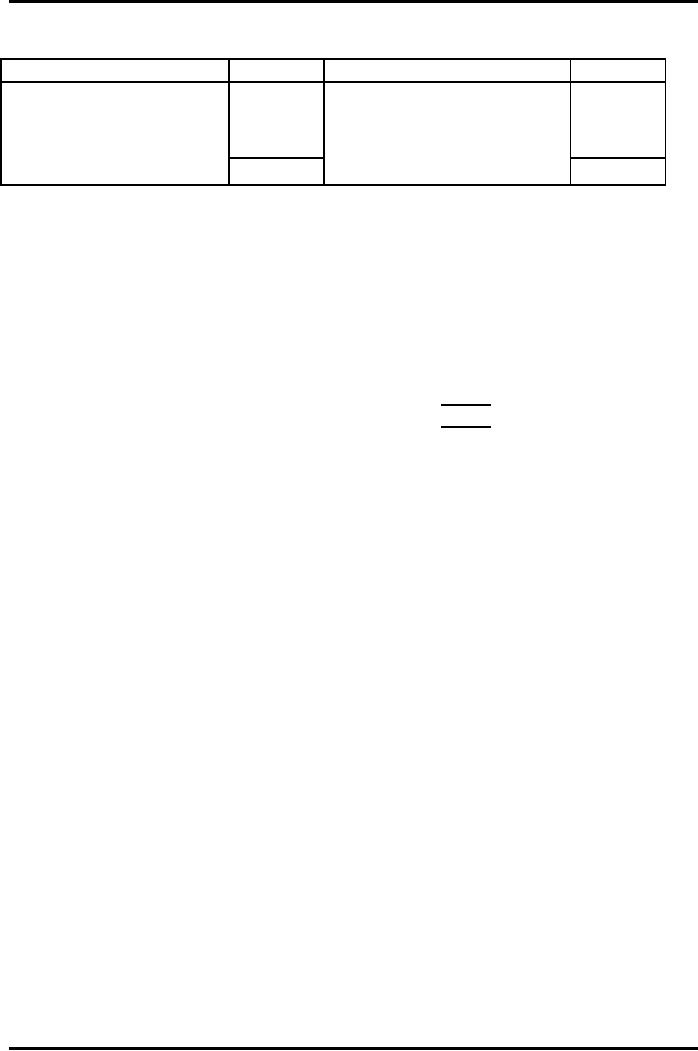

Debtors

Account

Particulars

Rs.

Particulars

Rs.

Op.

Debtors (Balancing

6,200

Cash

Received from Debtors

37,900

fig)

41,000

Bad

Debts

140

Sales

(credit)

Cl.

Debtors c/f

9,160

47,200

47,200

Opening

stock at cost

28,800 x

100/120 = 24,000

(pro-forma

invoice x

% of

cost by

% of

pro-forma invoice)

Closing

stock at cost

21,600 x

100/120 = 18,000

(pro-forma

invoice x

% of

cost by

% of

pro-forma invoice)

Loading

on goods sent to branch

(net)

Rupees

Goods

sent to branch (at pro-forma

invoice)

40,320

Less

Goods returned by branch (at

pro-forma invoice)

0

Net

goods sent

(at

pro-forma invoice)

40,320

40,320 x

20/120 = 6,720

(pro-forma

invoice x

% of

loading by

% of

pro-forma invoice)

Income

Statement System

The

head office may also prepare

an Income Statement to find out the

profits of

branch.

Such Income Statement is

merely a memorandum; the only

reason for

preparing

the statement is to have full

information of all transactions which

are

ignored

in Debtor System (already

discussed in the previous

section). While preparing

the

Income Statement of the

branch we shall be using all

those skills which we

have

learned

in the single entry system of

accounting during conversion of single

entry into

double

entry.

We know very

well that in Income Statement

incomes and expenses are

measured on

the

basis of accrual concept and

the profits are measured

according to the

matching

concept.

So the cost of goods sold

will be determined keeping in view that

the goods

sent

to branch are equivalent to

purchases of the branch and

should be included at

cost.

Obviously the opening and

closing stocks can not be

measured at a value that

is

above

its cost.

Above

problem can be solved through

Income Statement System as well.

Following is

the

solution.

59

Table of Contents:

- ACCOUNTING FOR INCOMPLETE RECORDS

- PRACTICING ACCOUNTING FOR INCOMPLETE RECORDS

- CONVERSION OF SINGLE ENTRY IN DOUBLE ENTRY ACCOUNTING SYSTEM

- SINGLE ENTRY CALCULATION OF MISSING INFORMATION

- SINGLE ENTRY CALCULATION OF MARKUP AND MARGIN

- ACCOUNTING SYSTEM IN NON-PROFIT ORGANIZATIONS

- NON-PROFIT ORGANIZATIONS

- PREPARATION OF FINANCIAL STATEMENTS OF NON-PROFIT ORGANIZATIONS FROM INCOMPLETE RECORDS

- DEPARTMENTAL ACCOUNTS 1

- DEPARTMENTAL ACCOUNTS 2

- BRANCH ACCOUNTING SYSTEMS

- BRANCH ACCOUNTING

- BRANCH ACCOUNTING - STOCK AND DEBTOR SYSTEM

- STOCK AND DEBTORS SYSTEM

- INDEPENDENT BRANCH

- BRANCH ACCOUNTING 1

- BRANCH ACCOUNTING 2

- ESSENTIALS OF PARTNERSHIP

- Partnership Accounts Changes in partnership firm

- COMPANY ACCOUNTS 1

- COMPANY ACCOUNTS 2

- Problems Solving

- COMPANY ACCOUNTS

- RETURNS ON FINANCIAL SOURCES

- IASB’S FRAMEWORK

- ELEMENTS OF FINANCIAL STATEMENTS

- EVENTS AFTER THE BALANCE SHEET DATE

- PROVISIONS, CONTINGENT LIABILITIES AND CONTINGENT ASSETS

- ACCOUNTING POLICIES, CHANGES IN ACCOUNTING ESTIMATES AND ERRORS 1

- ACCOUNTING POLICIES, CHANGES IN ACCOUNTING ESTIMATES AND ERRORS 2

- BORROWING COST

- EXCESS OF THE CARRYING AMOUNT OF THE QUALIFYING ASSET OVER RECOVERABLE AMOUNT

- EARNINGS PER SHARE

- Earnings per Share

- DILUTED EARNINGS PER SHARE

- GROUP ACCOUNTS

- Pre-acquisition Reserves

- GROUP ACCOUNTS: Minority Interest

- GROUP ACCOUNTS: Inter Company Trading (P to S)

- GROUP ACCOUNTS: Fair Value Adjustments

- GROUP ACCOUNTS: Pre-acquistion Profits, Dividends

- GROUP ACCOUNTS: Profit & Loss

- GROUP ACCOUNTS: Minority Interest, Inter Co.

- GROUP ACCOUNTS: Inter Co. Trading (when there is unrealized profit)

- Comprehensive Workings in Group Accounts Consolidated Balance Sheet