|

BRANCH ACCOUNTING SYSTEMS |

| << DEPARTMENTAL ACCOUNTS 2 |

| BRANCH ACCOUNTING >> |

Advance

Financial Accounting

(FIN-611)

VU

LESSON

# 11

BRANCH

ACCOUNTING SYSTEMS

Accounting

system for Retail Dependent

Branch

There

are three methods to

calculate profits of a retail

dependent branch. Any of

these

can

be used to calculate branch

profits; nevertheless, selection of

method will depend

upon

the nature of operations,

size and level of complexity of

the transaction.

� Debtor

system

� Income

statement system

� Stock

and debtor system

Debtor

System

This

system of accounting is suitable for

the small sized branches. In

this system a

Branch

a/c is opened for each of the

branches in the main ledger of

head office. Each

and

every transaction that is

made in between the head

office and its branches

is

entered

into the specific branch

account. For example there

are two branches of a

business

one in Gujranwala and the

second in Karachi. The head

office will open two

ledger

accounts in its main ledger

one named and titled as

Gujranwala Branch a/c and

the

other as Karachi Branch a/c.

The branch accounts are

maintained in such a way

that

these will give the amount of

profits or losses of the

respective branches.

Lets

have a glance, how does a

Branch a/c look like?

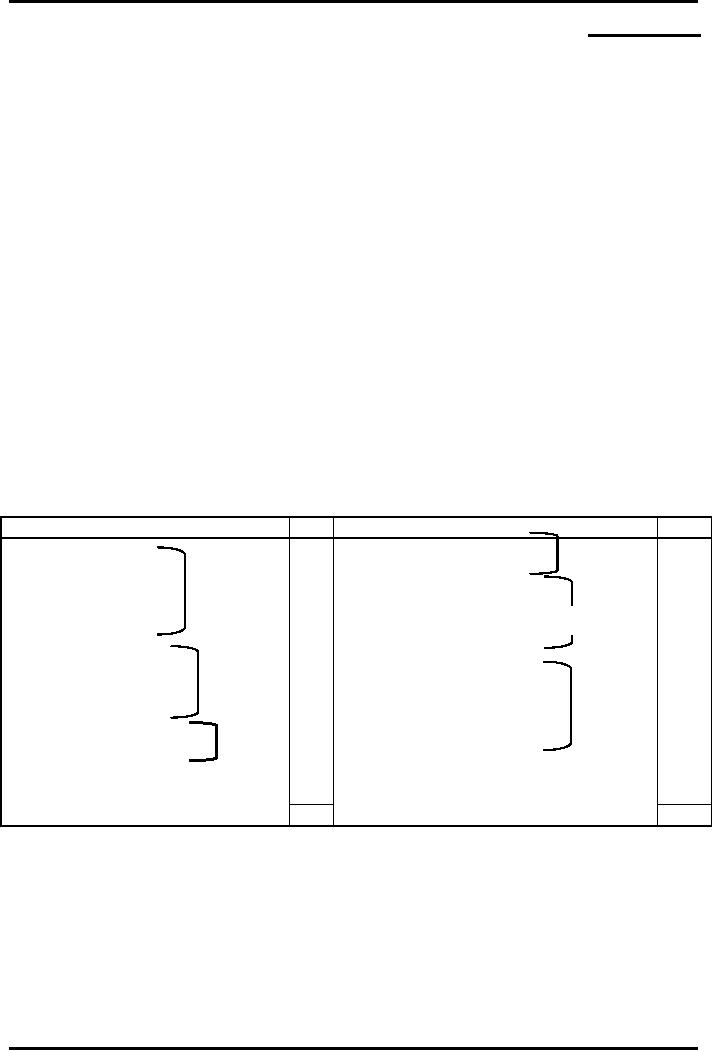

Books

of the Head

Office

Branch

Account

Particulars

Rs.

Particulars

Rs.

Op.

Stock

***

Op. Creditors

***

Opening

Op.

Debtors

***

Op. Outstanding

Expenses

***

Liability

Opening

Op.

Petty Cash

***

Cash received from

branch

Assets

Op.

Furniture

Cash

Sales

***

***

Drawings

Op.

Prepaid Expenses

Collection

from Debtors

***

***

Goods

sent to Branch

***

Goods Returned by

Branch

***

Fresh

Cash

sent to branch

Cl.

Stock

***

Capital

for

branch expenses

***

Cl. Debtors

***

Closing

Assets

for

any other purpose

***

Cl. Petty Cash

***

Cl.

Creditors

***

Cl. Furniture

***

Closing

Liability

Cl.

Outstanding Expenses

***

Cl. Prepaid Expenses

***

Profit

& Loss A/c (Profit)

***

Profit

and Loss A/c

(Loss)

***

***

***

In

the above Branch a/c we can

very well observe few facts which are as

under:

1. At

the beginning of the year

the Branch a/c is debited with

the opening

balances

of assets lying with the branch and

credited with the opening

balances

of

the branch liabilities.

Doing this debit and credit

as a result we have

opening

capital

balance at debit side of the

Branch a/c

2. At

the ending of the year

the Branch a/c is credit with

the closing balances

of

assets lying

with the branch and debited with

the closing balances of the

branch

liabilities.

Doing this debit and credit

as a result we have closing

capital balance

at

credit side of the Branch

a/c

51

Advance

Financial Accounting

(FIN-611)

VU

3. During

the year the head

office has sent to branch

goods for selling and cash

for

whatever

purposes. These both are

debited to the Branch a/c.

This can be

considered

as fresh capital (resources)

introduced by head office into

its branch.

4. During

the year the head

office has received goods

(as returned goods)

and

cash

(resources) from its branch,

the source might be any one

e.g. cash sales or

credit

customer or even by selling

branch assets. This receipts

of cash and

return of

goods is credited to the

Branch a/c. This can be

considered as

drawings

made by the head office out

of the branch.

Now

applying the rules studied

in the single entry accounting

system we can get

the

amount of net profit/loss of the

branch.

Accounting

Entries in the Books of Head

Office

1.

For opening balances of assets at

the branch

Branch

a/c

Branch

assets a/c (individual accounts)

2.

For opening balances of

liabilities at the

branch

Branch

liabilities a/c (individual

accounts)

Branch

a/c

3.

For goods sent to the

branch

Branch

a/c

Goods

sent to branch a/c

4.

For return of goods by the

branch

Goods

sent to branch a/c

Branch

a/c

5.

For remittance of cash or

cheque to the branch

Branch

a/c

Cash/Bank

a/c

6.

For cash or cheque received

from the branch

Cash/Bank

a/c

Branch

a/c

7.

For closing balances of assets at

the branch

Branch

asset a/c (individual

accounts)

Branch

a/c

8.

For closing balances of

liabilities at the

branch

Branch

a/c

Branch

liabilities a/c (individual

accounts)

9.

For closing goods sent to

branch account.

Goods

sent to branch a/c

Purchases

a/c

52

Advance

Financial Accounting

(FIN-611)

VU

10.

For closing branch account

into the profit and loss

account

Incase

of profit

Branch

a/c

Profit

& loss a/c

Incase

of loss

Profit

& loss a/c

Branch

a/c

Solved

Problem

Problem

# 1

From

the following information relating to

the Sialkot

Branch for

the year ending 31st

March,

2007, prepare the Branch

Account in the books of head

office.

Rs.

Rs.

Opening

Stock at Branch

37,500

Cheque sent to

Branch

Opening

Debtors in Branch

75,000

Salaries

22,500

Opening

Petty Cash at Branch

750

Rent

& Taxes

3,750

Goods

Sent to Branch

630,000

Petty

Cash

2,750

Cash

Sales

150,000

Closing Stock at

Branch

62,500

Cash

Received from Debtors 525,000

Closing

Debtors at Branch

120,000

Goods

Returned by Branch

5,000

Closing

Petty Cash at Branch

500

Credit

Sales

570,000

Solution:

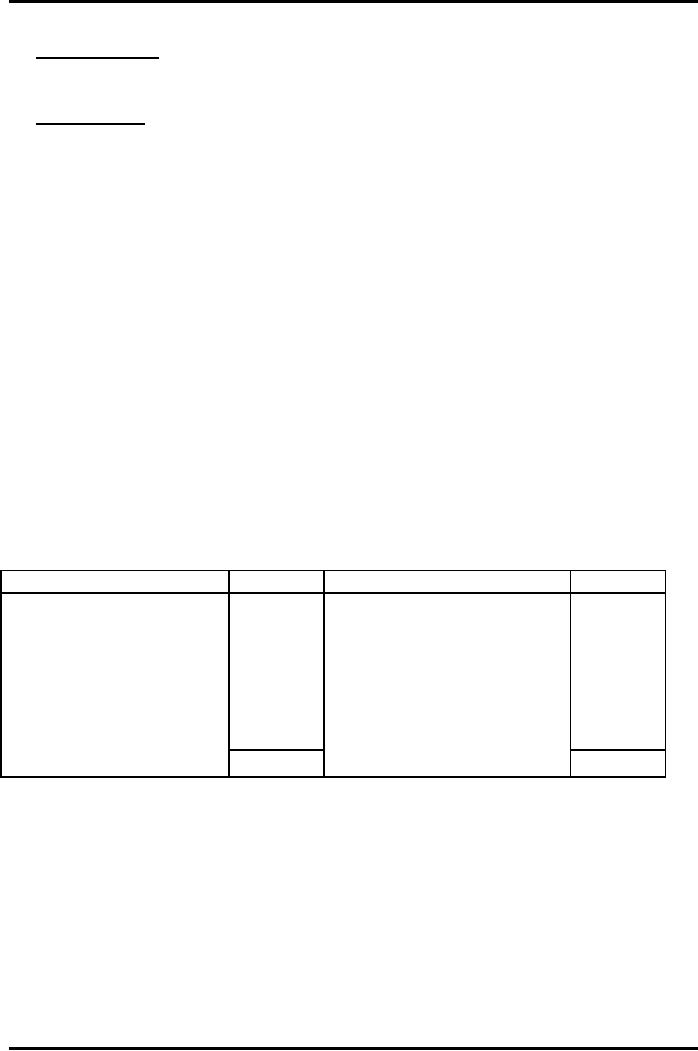

Books

of Head Office

Sialkot

Branch Account

Particulars

Rs.

Particulars

Rs.

Opening

Stock

37,500

Cash

Received from Branch

675,000

Opening

Debtors

75,000

Goods

returned from Branch

5,000

Opening

Petty Cash

750

Closing

Stock

62,500

29,000

120,000

Cash

sent to Branch

Closing

Debtors

Goods

sent to Branch A/c

630,000

Closing

Petty Cash

500

General

Profit & Loss A/c

90,750

(Profit)

863,000

863,000

Problem

# 2

Excellent

Garments of Multan has a branch at

Lahore. Goods are supplied

to the branch

at

cost. The expenses of the

branch are paid from Multan and

the branch keeps a

sales

journal

and the debtors' ledger only.

From the following information

supplied by the

branch,

prepare a Branch Account in

the books of the head

office. (All figures in

rupees)

Opening

Stock

24,000

Closing

Debtors

9,150

Closing

Stock

18,000

Opening

Debtors

?

Goods

received from HO

33,600

Bad

Debt

140

Credit

Sales

41,000

Exp.

paid by Head office

10,400

Cash

Sales

17,500

Cash

received from Debtors

37,900

53

Advance

Financial Accounting

(FIN-611)

VU

Pilferage

of goods by the

employees

(Normal

Loss)

2,000

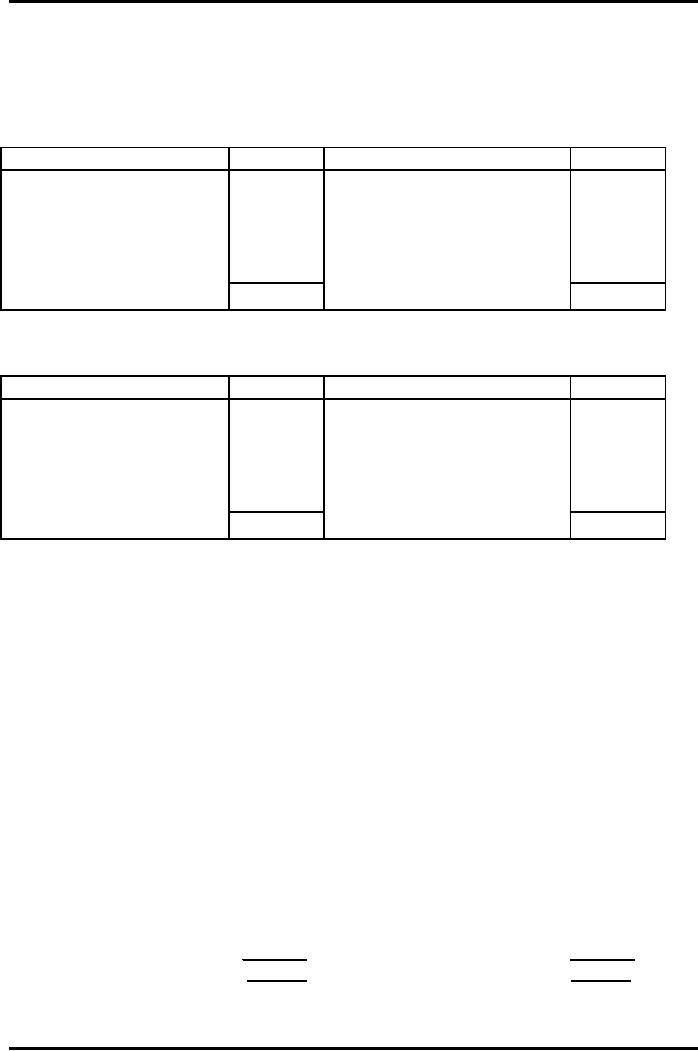

Solution:

In

the books of Head Office

(Multan)

Lahore

Branch Account

Particulars

Rs.

Particulars

Rs.

Opening

Stock

24,000

Cash Received from

Branch

17,500

6,200

Cash Received from

Debtors

Opening

Debtors

37,900

10,400

Closing Stock

Cash

sent to Branch

18,000

33,600

Closing Debtors

Goods

sent to Branch a/c

9,160

General

Profit & Loss a/c

8360

(Profit)

82,560

82,560

Working:

Debtors

Account

Particulars

Rs.

Particulars

Rs.

Op.

Debtors (Balancing

6,200

Cash Received from

Debtors

37,900

41,000

Bad Debts

fig)

140

Sales

(credit)

Cl.

Debtors c/f

9,160

47,200

47,200

Problem

# 3

From

the following particulars of a dependent

branch. Prepare Branch a/c

showing

the

profit or loss of the branch

for the year ended

31-12-2007: (all figures are

in Rs.)

Opening

stock

30,000

Goods

sent to branch

90,000

Cash

sent by head office

Cash

sales

120,000

for

salaries

10,000

for

other expenses

4,000

Closing

stock could not be ascertained but it is

know that the branch usually

sells

at

cost plus 20% of the

cost.

Solution:

Branch

Account

Rupees

Rupees

Opening

stock

30,000

Cash received from branch

120,000

Goods

sent to branch

90,000

closing

stock

20,000

Cash

sent to branch

14,000

Profit

& loss a/c

6,000

140,000

140,000

54

Advance

Financial Accounting

(FIN-611)

VU

Working:

Calculation

for Closing

Stock

Sales

at

120%

120,000

Cost

of sales at

100%

120,000

x100/120 = 100,000

Opening

stock + Goods sent

Closing stock = Cost of

sales

30,000

+ 90,000 X = 100,000

X

(closing stock) = 120,000

100,000

X

(closing stock) =

20,000

55

Table of Contents:

- ACCOUNTING FOR INCOMPLETE RECORDS

- PRACTICING ACCOUNTING FOR INCOMPLETE RECORDS

- CONVERSION OF SINGLE ENTRY IN DOUBLE ENTRY ACCOUNTING SYSTEM

- SINGLE ENTRY CALCULATION OF MISSING INFORMATION

- SINGLE ENTRY CALCULATION OF MARKUP AND MARGIN

- ACCOUNTING SYSTEM IN NON-PROFIT ORGANIZATIONS

- NON-PROFIT ORGANIZATIONS

- PREPARATION OF FINANCIAL STATEMENTS OF NON-PROFIT ORGANIZATIONS FROM INCOMPLETE RECORDS

- DEPARTMENTAL ACCOUNTS 1

- DEPARTMENTAL ACCOUNTS 2

- BRANCH ACCOUNTING SYSTEMS

- BRANCH ACCOUNTING

- BRANCH ACCOUNTING - STOCK AND DEBTOR SYSTEM

- STOCK AND DEBTORS SYSTEM

- INDEPENDENT BRANCH

- BRANCH ACCOUNTING 1

- BRANCH ACCOUNTING 2

- ESSENTIALS OF PARTNERSHIP

- Partnership Accounts Changes in partnership firm

- COMPANY ACCOUNTS 1

- COMPANY ACCOUNTS 2

- Problems Solving

- COMPANY ACCOUNTS

- RETURNS ON FINANCIAL SOURCES

- IASB’S FRAMEWORK

- ELEMENTS OF FINANCIAL STATEMENTS

- EVENTS AFTER THE BALANCE SHEET DATE

- PROVISIONS, CONTINGENT LIABILITIES AND CONTINGENT ASSETS

- ACCOUNTING POLICIES, CHANGES IN ACCOUNTING ESTIMATES AND ERRORS 1

- ACCOUNTING POLICIES, CHANGES IN ACCOUNTING ESTIMATES AND ERRORS 2

- BORROWING COST

- EXCESS OF THE CARRYING AMOUNT OF THE QUALIFYING ASSET OVER RECOVERABLE AMOUNT

- EARNINGS PER SHARE

- Earnings per Share

- DILUTED EARNINGS PER SHARE

- GROUP ACCOUNTS

- Pre-acquisition Reserves

- GROUP ACCOUNTS: Minority Interest

- GROUP ACCOUNTS: Inter Company Trading (P to S)

- GROUP ACCOUNTS: Fair Value Adjustments

- GROUP ACCOUNTS: Pre-acquistion Profits, Dividends

- GROUP ACCOUNTS: Profit & Loss

- GROUP ACCOUNTS: Minority Interest, Inter Co.

- GROUP ACCOUNTS: Inter Co. Trading (when there is unrealized profit)

- Comprehensive Workings in Group Accounts Consolidated Balance Sheet