|

DEPARTMENTAL ACCOUNTS 2 |

| << DEPARTMENTAL ACCOUNTS 1 |

| BRANCH ACCOUNTING SYSTEMS >> |

Advance

Financial Accounting

(FIN-611)

VU

LESSON

# 10

DEPARTMENTAL

ACCOUNTS

Some

times departments prefer to buy

goods from their internal

departments for this

prices

are charged equal to the

normal selling prices or a department may

transfer at it

original

cost price. Since each

department is considered as a separate

profit centre, it is

necessary

to have separate records for

inter-departmental transfer of goods or

even

services.

The

department which transfers the

goods considers its

transfers as equal to sales

and

the

department which receives the

goods considers it as equal to

its purchases and put

it in

the cost of goods sold.

Generally a periodical analysis

sheet is prepared to

record

these

departmental transfers:

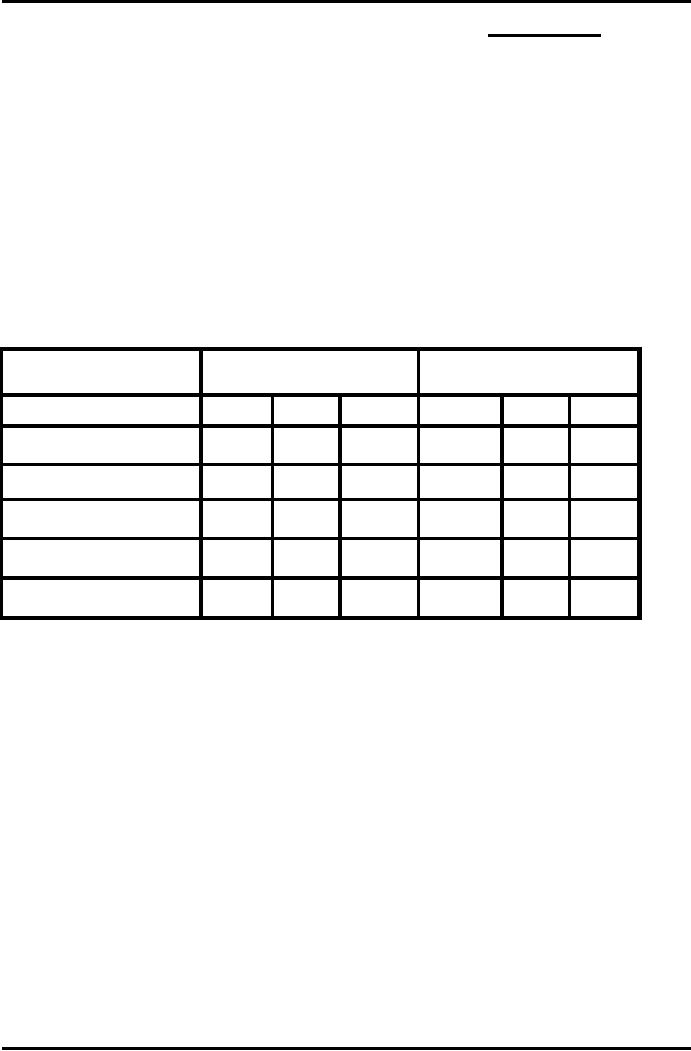

Transferring

Receiving

Departments

Departments

Date

X

(Rs) Y (Rs)

Z

(Rs)

X

(Rs)

Y

(Rs)

Z

(Rs)

April 3 (from X

to Y)

400

----

----

----

400

----

April 10 (from Y

to X)

----

500

----

500

----

----

April 20 (from Z

to Y)

----

----

300

----

300

----

April 30 (from X

to Z)

200

----

----

----

----

200

Total

600

500

300

500

700

200

At

the end of the period

the inter-departmental transfers

are recorded by recording

the

following

accounting entry:

Receiving

Department

Dr.

(at transfer price)

X

500

Y

700

Z

200

Transferring

Department Cr. (at transfer

price)

X

600

Y

500

Z

300

47

Advance

Financial Accounting

(FIN-611)

VU

Solved

Problem:

A firm

has two departments X and Y. Department Y

(manufacturing department)

receives

goods from department X as its raw

material. Department X supplies

the

goods

to Y at cost price. From the

following information prepare a

Departmental

Income

Statement for the year ended

on 31 December 2007:

X

Y

Rupees

Rupees

Opening

Stock (1-1-2007)

250,000

75,000

Purchases

(Outside supplier)

1,000,000

20,000

Sales

(Outside customer )

1,200,000

300,000

Closing

stock (31-12-07)

150,000

50,000

Other

Information:

1.

Depreciation is charged on building @

20% p.a. Cost of building is

Rs. 105,000

and

occupancy ratio is 2/3 and 1/3 for X and Y

respectively.

2. X

department transferred goods

Rs. 250,000 to department Y.

3.

Manufacturing expenses Rs.

10,000.

4.

Selling expenses Rs.

15,000.

5.

General expenses Rs.

58,000.

Solution:

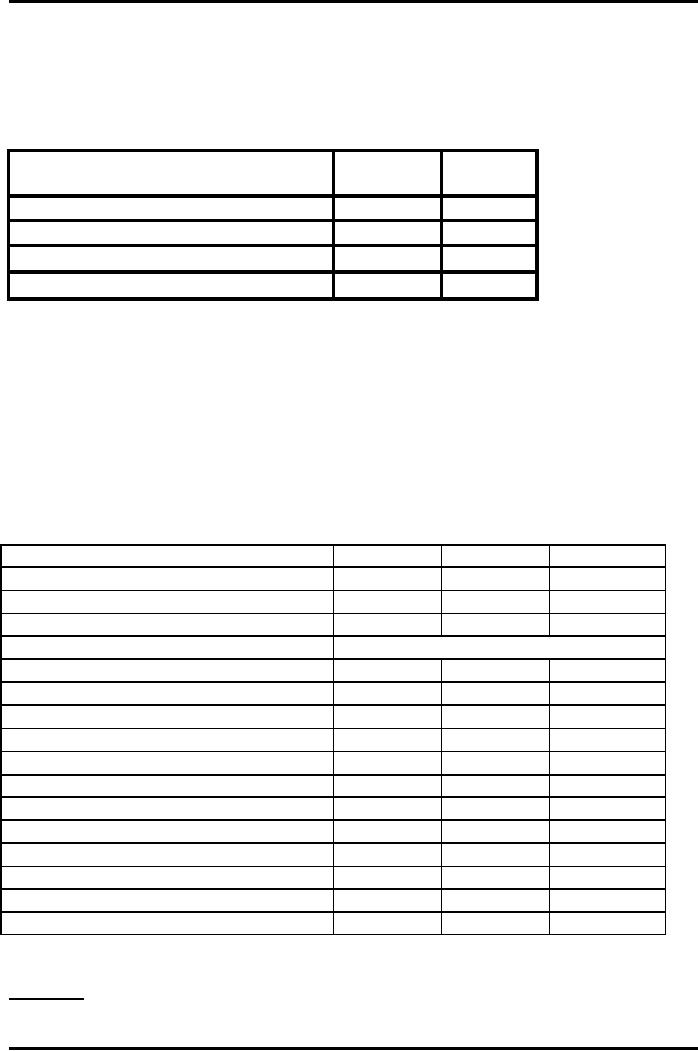

Income

Statement for the year

ended December 31,

2007

Particulars

X

(Rs).

Y

(Rs).

Total

(Rs).

Sales

1,200,000

300,000

1,500,000

Transfer

to Y

250,000

----

250,000

Total

Revenue

1,450,000

300,000

1,750,000

Less

Cost of goods sold

Opening

stock

250,000

75,000

325,000

Add

Purchases

1,000,000

20,000

1,020,000

Less

closing

stock

150,000

50,000

200,000

Transfer

from X

----

250,000

250,000

Manufacturing

expenses

----

10,000

10,000

Total

cost

1,100,000

305,000

1,405,000

Gross

profit

350,000

(5,000)

345,000

Less

Selling expenses

12,000

3,000

15,000

Deprecation

14,000

7,000

21,000

Net

profit

324,000

(15,000)

309,000

Less

General expenses

58,000

Net

profit of business

251,000

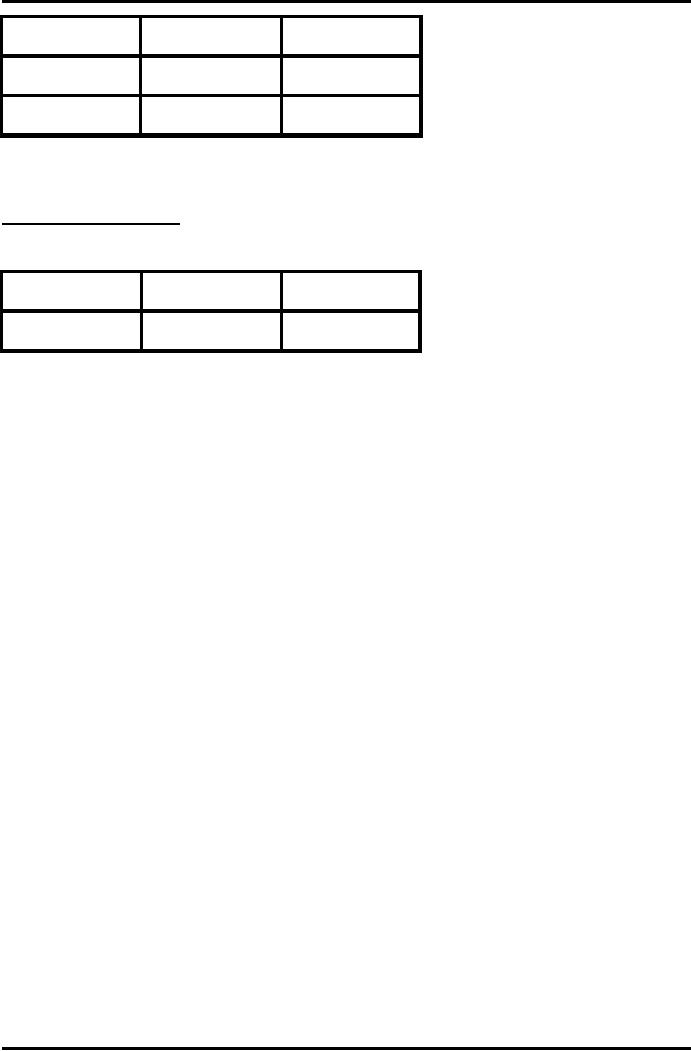

Working:

Selling

expense Rs. 15,000

48

Advance

Financial Accounting

(FIN-611)

VU

X

(Rs)

Y

(Rs)

Sales

1,200,000

300,000

Sales

ratio

12

3

X

=15,000 X 12/15 = 12,000

Y

=15,000 X 3/15 = 3,000

Depreciation

expense

Building

105,000 X 20/100 = Rs. 21,000

X

(Rs)

Y

(Rs)

Deprecation

2/3

1/3

X

=21,000 X 2/3 = 14,000

Y

=21,000 X 1/3 = 7,000

BRANCH

ACCOUNTING

Introduction

Large

business entities open up

branches in diversified geographic

segments such as

towns and

cities and even in different

countries. Segmenting their

business

geographically

facilitate the business to

market its products/services

over a large

territory

and thus increase its profits.

Here we must make this

distinction that

departments

are business segments

whereas, branches are

geographic segments.

A

branch may be defined as a segment of an

enterprise that is

geographically

separated

from the rest of the entity,

controlled by a head office, and

generally

carrying

on the same or substantially

same activities as of the

entity.

For

example in our daily life we observe

branches of banks, bakeries,

shoes stores,

schools,

hotels and restaurants

etc.

It is worth

mentioning here that a

branch is not a separate legal

entity, it is simply a

segment

of an entity. From accounting

perspective, a branch is identified as a

profit

centre

and if it is an independent branch then it

becomes an investment

centre.

To

have clear picture of the

performance, profits of each

branches are

calculated

separately

and then are consolidated in the

accounts of the head office.

Depending

upon

the size of the branch

the decision is taken

regarding the accounting

system to be

implemented

there. Had the branch size

is small there would have

been single entry

system.

Where the branch size is

considerable large and it can

afford a complete

accounts

department there we will follow the

double entry accounting system,

such

are

often independent

branches.

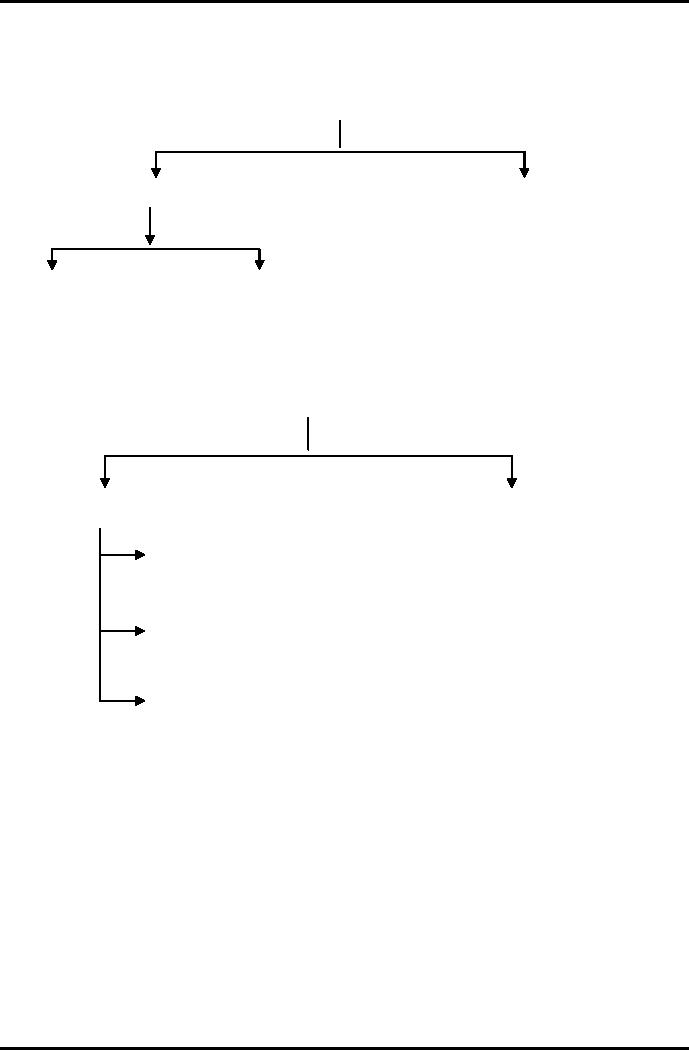

Classification

of Branches

For

accounting purposes branches

are classified as

under:

1.

Foreign Branch (not

part of our

syllabus)

2.

Domestic Branch

a.

Independent branch (investment

centre)

49

Advance

Financial Accounting

(FIN-611)

VU

b.

Dependent branch (profit

centre)

i.

Whole-sale branch

ii.

Retail branch

Classification

Domestic

branch

Foreign

branch

Independent

Dependent

Dependent

Branch

Retail

sale branch

Whole

sale branch

Debtors

system

Income

statement system / Final

account system

Stock &

Debtors system

Independent

Branch

This

is the type of branch which

maintains its own set of

books. The method of

accounting

is the double entry book

keeping.

Branch

manager of such a branch is

given certain powers for

decision making

regarding

procurement, selling, advertising,

staffing, pricing, and even for

purchasing

of

fixed assets. These branches

are taken as an investment

centre.

Dependent

Branch

This

is the type of branch which does not

maintain its own set of

books. All records

are

maintained

by the head office, which is

concerned with the branch

profits only.

Branch

manager of such a branch is not

given decision making

powers, the manager

acts

according to the instruction and

policies directed by the

head office.

50

Table of Contents:

- ACCOUNTING FOR INCOMPLETE RECORDS

- PRACTICING ACCOUNTING FOR INCOMPLETE RECORDS

- CONVERSION OF SINGLE ENTRY IN DOUBLE ENTRY ACCOUNTING SYSTEM

- SINGLE ENTRY CALCULATION OF MISSING INFORMATION

- SINGLE ENTRY CALCULATION OF MARKUP AND MARGIN

- ACCOUNTING SYSTEM IN NON-PROFIT ORGANIZATIONS

- NON-PROFIT ORGANIZATIONS

- PREPARATION OF FINANCIAL STATEMENTS OF NON-PROFIT ORGANIZATIONS FROM INCOMPLETE RECORDS

- DEPARTMENTAL ACCOUNTS 1

- DEPARTMENTAL ACCOUNTS 2

- BRANCH ACCOUNTING SYSTEMS

- BRANCH ACCOUNTING

- BRANCH ACCOUNTING - STOCK AND DEBTOR SYSTEM

- STOCK AND DEBTORS SYSTEM

- INDEPENDENT BRANCH

- BRANCH ACCOUNTING 1

- BRANCH ACCOUNTING 2

- ESSENTIALS OF PARTNERSHIP

- Partnership Accounts Changes in partnership firm

- COMPANY ACCOUNTS 1

- COMPANY ACCOUNTS 2

- Problems Solving

- COMPANY ACCOUNTS

- RETURNS ON FINANCIAL SOURCES

- IASB’S FRAMEWORK

- ELEMENTS OF FINANCIAL STATEMENTS

- EVENTS AFTER THE BALANCE SHEET DATE

- PROVISIONS, CONTINGENT LIABILITIES AND CONTINGENT ASSETS

- ACCOUNTING POLICIES, CHANGES IN ACCOUNTING ESTIMATES AND ERRORS 1

- ACCOUNTING POLICIES, CHANGES IN ACCOUNTING ESTIMATES AND ERRORS 2

- BORROWING COST

- EXCESS OF THE CARRYING AMOUNT OF THE QUALIFYING ASSET OVER RECOVERABLE AMOUNT

- EARNINGS PER SHARE

- Earnings per Share

- DILUTED EARNINGS PER SHARE

- GROUP ACCOUNTS

- Pre-acquisition Reserves

- GROUP ACCOUNTS: Minority Interest

- GROUP ACCOUNTS: Inter Company Trading (P to S)

- GROUP ACCOUNTS: Fair Value Adjustments

- GROUP ACCOUNTS: Pre-acquistion Profits, Dividends

- GROUP ACCOUNTS: Profit & Loss

- GROUP ACCOUNTS: Minority Interest, Inter Co.

- GROUP ACCOUNTS: Inter Co. Trading (when there is unrealized profit)

- Comprehensive Workings in Group Accounts Consolidated Balance Sheet