|

SECURE SOCKET LAYER (SSL) |

| << E-CASH PAYMENT SYSTEM 2 |

| E-BUSINESS: DISADVANTAGES OF E-BUSINESS >> |

E-COMMERCE

IT430

VU

Lesson

28

SECURE

SOCKET LAYER (SSL)

SSL is

a protocol developed by Netscape

Communications. SSL is built

into many browsers. It

operates at

the

TCP/IP layer of the OSI model,

and uses a combination of

symmetric and asymmetric cryptography.

If

there

appears the word "https" in a

URL, (e.g, https://www.microsoft.com) it

indicates that the web

server

hosting this

web site is SSL enabled.

So, if a client machine is configured

for SSL then any

exchange of

information

between such a client and the

web server would be in the

encrypted form.

To configure a

client machine for SSL

following steps are

required:

Internet

Explorer:Tools menu->Internet

options->Advanced tab-> Security

(use SSL option can

be

checked)

SSL

Handshake

SSL

supports a variety of encryption

algorithm and authentication methods.

The combination of algorithms

and

methods is called a cipher suite.

When a client connects to an

SSL server, the SSL

handshake begins,

which

means that the two negotiate

a cipher suite selecting the strongest

suite the two have in

common.

Thus,

the handshake establishes the protocols

that will be used during the

communication, selects

cryptographic

algorithms and authenticates the parties

using digital

certificates.

To

start the SSL handshake

process, a client sends a

message to the server, the server

responds and sends

its

digital

certificate that authenticates its

public key. The client

(customer's browser) generates a

secret

symmetric

key for the session. The

client encrypts the secret

key using the public key

that it has just

received

and transmits it to the server.

The server decrypts the

message using its private

key and now

has

the

secret or symmetric key.

Further communication between the

customer's browser and the

merchant's

server

can now be encrypted and

decrypted using the secret

session key.

SSL is

commonly applied in online shopping as the customer

puts in his/her credit/debit

card information

on the

web form for payment

purposes. If the web client

and the server are SSL

enabled, the SSL

handshake

would begin when the client enters the

URL starting with "https". This

handshake can be

accomplished

in seconds. The web form

opens before the client. The

client enters information in the

text

boxes

of the form and on pressing

`submit' all such

information is automatically encrypted

with the agreed

secret

or session key. This secured/encrypted

information travels across the

internet and is retrieved by the

server

side where it is automatically decrypted

with the help of same secret

or session key. Even if

someone

intercepts

the information, he cannot make any

sense out of it because of

encryption.

The

greatest advantage of SSL is

its simplicity. Since SSL is

built into many browsers, no

special encryption

software

is required either on the client or the server

side. However, a drawback of

SSL is that the

merchant

can

store credit/debit card

information after decryption that

can be accessed by unauthorized parties

from

the

merchant's database.

121

E-COMMERCE

IT430

VU

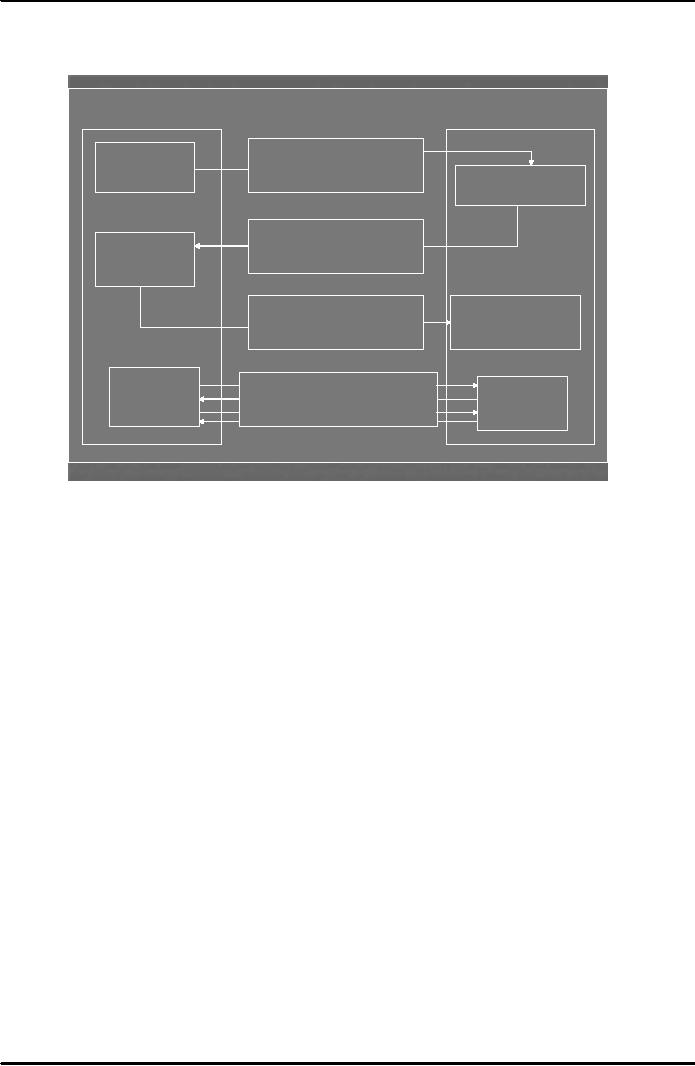

The

process of SSL handshake is

also explained in Fig. 1

below:

SSL

Client (browser)

SSL

Server

Send

encryption algorithms

Client

sends

and

key length

"hello"

message

Server

responds

With

"hello" message

Send

server certificate

Client

sends

containing

server's public key

response

Server

receives client

Send

client certificate

and

response

and

encrypted

private session key

initiates

session

Send

data between client

and

Session

Session

server

using private shared

key

Fig.

1

Secure

Electronic Transaction (SET)

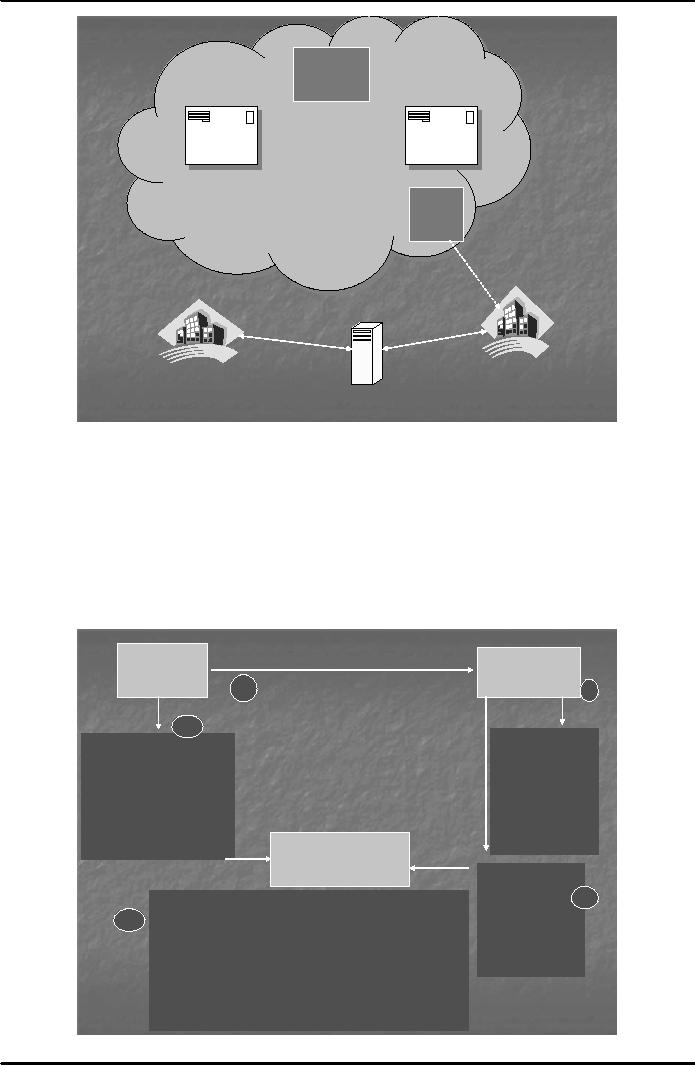

The

drawback in SSL that the credit

card/debit card information

remains with the merchant led to

the

development of a

more sophisticated protocol

called SET. It was developed in

1997 jointly by Visa,

MasterCard,

Netscape and Microsoft. There

are four entities involved in a SET

transaction cardholder,

merchant,

and certification authority

and payment gateway. The

role of payment gateway is to

connect

entities on the

internet with those which

are not on the internet such

as the electronic network of banks

(see

fig. 2

below). Payment gateway provides the

security of data transmission

to/from the acquirer bank.

Merchants

must have special SET

software to process transactions.

Customers must have digital

wallet

software

that stores certificates and

card information.

122

E-COMMERCE

IT430

VU

Certification

Authority

Payer

Payee

Internet

Debit

Card

Debit

Card

Debit

Card

Debit

Card

Payment

Gateway

Payer's

Acquirer

Bank

Automated

Clearing

Bank

House

Fig.

2

Dual

Signature in SET

SET

hides customer's credit card

information from merchants

and hides order information

from banks to

protect

privacy. This scheme is called

Dual Signature.

A dual

signature is created by combining

two message digests and

creating a new digest called

Dual

Signature

Message Digest (DSMD). Fig. 3 below

explains how the scheme of dual

signatures is

implemented in

SET.

Offer

for Items

Merchant

Buyer/Bidder

or Auction

house

�Encrypted

message includes

1b

2

amount

offered on the item,

but no

account information

1a

�MD1

encrypted with

Bidder's

�Decrypt

message

private

key

�Encrypted

message authorizing

with

auction house

payment to

the auction

private

key

house if

offer is

�Decrypt

MD1 with

accepted,

but no details

bidder's

public key

about

what item is bought

�Determine

�MD2

and DSMD

whether

to

encrypted

with

accept

bid

Bidder's

private key

Acquirer

Bank

�Encrypted

message

that

offer is

accepted 3

�Decrypt

account information with

acquirer private key

from

bidder

�Decrypt

offer acceptance message

with acquirer private

4

�MD1

encrypted

key

4

with

auction

�Decrypt

MD2 and DSMD with

bidder's public key

house's

private

�Decrypt

MD1 from step no. 3

with auction house's

public

key

key

�Concatenate

MD1 and MD2

�Recompute

dual signature and verify

against DSMD sent

by bidder

Fig.

3

123

E-COMMERCE

IT430

VU

SET

software on the customer side

splits the order information

from the account information. MDI is

the

message

digest obtained by applying hash

function on the order information. MD2 is

the message digest

obtained by

applying hash function on the

account information. Both,

MD1 and MD2 are concatenated

and

a

third message digest, DSMD,

is obtained by again applying the hash

function on the concatenated

message

digests. The order

information or the offer for

items is forwarded to the

merchant/auction house

in an

encrypted form along with

its message digest (MD1)

signed with the private key

of the buyer/bidder

(step

1b). The

merchant/auction house decrypts the

order information/offer and verifies the

signatures of

the

buyer/bidder through his/her

digital certificate (step

2). If the

order/offer is acceptable to the

merchant

then the merchant signs the

received MD1 with merchant's

private key and sends it to

the

acquirer

bank along with an encrypted letter of

acceptance to the offer (step3). On the

other hand, the

buyer

sends the text based account

information (credit card details) to the

acquirer in an encrypted

form.

The

buyer also sends MD2

(message digest related to

account information) and

DSMD to the acquirer bank

signed

with his/her private key

(step

1a). The

acquirer bank decrypts this information.

Mainly, the acquirer

bank

receives four pieces of

information as follows (step

4):

MD1

from merchant/auction house

related to order

information

Account

information in encrypted form

from the buyer

MD2

related to account information

from the buyer

DSMD

from the buyer

Acquirer

bank concatenates MD1 and

MD2 and applies the hash

function to compute a message

digest.

Note

that if this message digest is the

same as the DSMD received by the

acquirer, it ensures that

a

particular

order information or offer is

related to particular account

information. At the same time, we

have

achieved

our purpose that the order

information should not reach the bank

and the account

information

(credit

card no. etc.) should not

reach the merchant/auction

house.

SETCo.

SETCo.

is a company formed to lead the

implementation and promotion of

SET specifications It

ensures

that

the vendors of SET software comply with

the requirements laid down by

its originators. A merchant

holds certificate

from card brand indicating

that the merchant is authorized to accept

credit card payment.

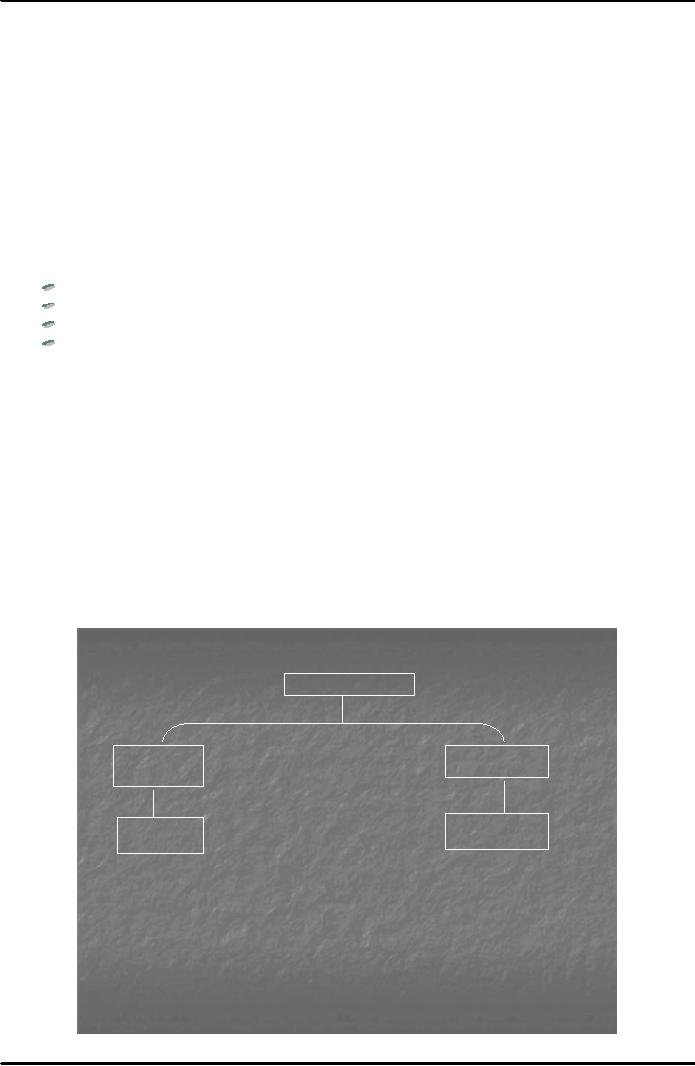

The

customer holds certificate from the card

issuing bank. SETCo acts as a root

certification authority in

the

certification hierarchy (see Fig. 4

below)

SETCo

Card

Issuer Bank

Card

Brand

Customer

Merchant

Fig.

4

124

E-COMMERCE

IT430

VU

SSL

vs. SET

SSL

only handles secured

transmission of credit card no.

but SET is designed to handle the

whole

transaction

in a secured manner using dual

signatures.

SSL is

a general purpose protocol

built into the browser,

whereas SET requires software

on, both,

the client

and the merchant

side.

SET

uses a hierarchy of certificates

for authentication.

SET is complex

and distribution of certificates is

sometimes not stable.

SET

increases transaction

cost.

SET

transactions are slower than

SSL.

SET

uses a payment gateway for

secured transmission of

information.

E-Business

An

e-business is defined as a company/entity

that has an online presence.

E-businesses that have the

ability

to

sell, trade, barter or transact

over the web can be

considered as e-commerce businesses. An

e-business

model is

defined by a company's policy,

operations, technology and

ideology.

Advantages

of E-business

Some

of the major advantages of an e-business as

compared to a traditional business

are as under:

Personalized

service

High-quality

customer service

No

inventory cost

Worldwide

reach of the business

Electronic

catalogues (convenient and quick

transaction)

Bulk

transactions

Improved

supply chain

management

125

Table of Contents:

- E-COMMERCE

- WHAT IS A NETWORK

- HOW MANY CLASS A, B, C NETWORKS AND HOSTS ARE POSSIBLE

- NETWORKING DEVICES

- BASICS OF HTML 1

- BASICS OF HTML 2

- TEXT BOXES, CHECK BOXES, RADIO BUTTONS

- FRAMES AND IMAGES IN HTML

- TAG ATTRIBUTES, SOUNDS FILES, ANIMATIONS

- STYLE SHEETS 1

- STYLE SHEETS 2

- SOME USEFUL STYLE SHEETS PROPERTIES

- JAVA SCRIPTING 1

- JAVA SCRIPTING 2

- JAVA SCRIPTING 3

- JAVA SCRIPTING AND XML

- CLIENT AND SERVER SIDE PROCESSING OF DATA

- APPLETS, CGI SCRIPTS

- MAINTAINING STATE IN A STATELESS SYSTEM

- INTEGRATION WITH ERP SYSTEMS

- FIREWALLS

- CRYPTOGRAPHY

- HASH FUNCTION AND MESSAGE DIGEST

- SYMMETRIC KEY ALGORITHMS

- VIRTUAL PIN PAYMENT SYSTEM

- E-CASH PAYMENT SYSTEM 1

- E-CASH PAYMENT SYSTEM 2

- SECURE SOCKET LAYER (SSL)

- E-BUSINESS: DISADVANTAGES OF E-BUSINESS

- E-BUSINESS REVENUE MODELS

- E-MAIL MARKETING

- CUSTOMER RELATIONSHIP MANAGEMENT (CRM)

- META INFORMATION

- DATA MINING

- CONFIDENCE AND SUPPORT

- ELECTRONIC DATA INTERCHANGE (EDI)

- PERSONAL FINANCE ONLINE

- SUPPLY CHAIN

- PORTER’S MODEL OF COMPETITIVE RIVALRY

- BARRIERS TO INTERNATIONAL E-COMMERCE

- ELECTRONIC TRANSACTIONS ORDINANCE, 2002 - 1

- ELECTRONIC TRANSACTIONS ORDINANCE, 2002 - 2

- ELECTRONIC TRANSACTIONS ORDINANCE, 2002 - 3

- GLOBAL LEGAL ISSUES OF E-COMMERCE - 1

- GLOBAL LEGAL ISSUES OF E-COMMERCE - 2