|

E-CASH PAYMENT SYSTEM 2 |

| << E-CASH PAYMENT SYSTEM 1 |

| SECURE SOCKET LAYER (SSL) >> |

E-COMMERCE

IT430

VU

Lesson

27

E-CASH

PAYMENT SYSTEM

How

anonymity is ensured in e-cash

payment system?

Anonymity

in e-cash system means that

the identity of the client/buyer is not

disclosed. Note that there

are

two

main stages in this payment

mechanism minting stage

and deposit stage. At minting

stage the serial

no. is

signed by the e-cash bank to provide

third part of a valid e-cash

coin. At this stage the bank knows

as

to who

amongst its different

account holders or clients is

requesting for the bank's

signatures on the serial

no.,

but it does not know the

serial no. it is signing due

to the blinding factor "r". On the

other hand, the

reverse

is true at the deposit stage (when the

coins are sent to e-cash

bank for checking validity).

Now, bank

knows

the serial no. (it had

earlier signed blindly at the

minting stage) but has no

clue about the specific

client

who has sent them for

payment purposes. The bank

may have issued coins to

many of its clients.

It

would

not be known to the bank at the deposit

stage that who amongst them

has done the shopping and is

making the

payment now. Thus, by

scheme, the relationship between the

client and the serial no. is

broken

at the

minting and deposit stage to

ensure anonymity of the client. This

concept may also be illustrated

as

follows:

Minting

Stage

Serial

number (unknown)

Client

(known)

Deposit

Stage

Serial

no. (known)

Client

(unknown)

Withdrawing

Coins

Many

coins of different denominations can be

obtained in a single request to the

bank.

The

request is signed by the client with

his private key and

contains information about the serial

nos. to be

signed.

The request is encrypted

with a symmetric key and

that symmetric key is

encrypted with the

public

key of

the bank, thus creating a secure

envelope. The bank signs

serial nos. in order to mint

coins of

requested

denominations and forward them to the

client/buyer.

E-cash

Purchase

Having

received an order the merchant

sends a payment request to the client in

the following format:

Payreq={currency,amount,timestamp,merchant_bank

ID, merchant_accID, order

description}

Cyber

wallet automatically assembles the correct

payment amount and

pays.

Making

the Payment

Coins

used in the payment are

encrypted with bank's public

key, preventing the merchant to

view them.

Payment

information is forwarded to the bank with

encrypted coins during

merchant's deposit. Only

hash

of the

order description is included in payment

information preventing the bank from

knowing the order

details.

Proving

the Payment

Payer

code is a secret generated by the client.

A hash of it is included in the payment

information so that

client

can later prove the payment if

need be.

118

E-COMMERCE

IT430

VU

Hash

Bluesky

MD

Hash function

and message digest are

sent to the e-cash

bank

Fig.

1

For

instance, the client may

choose the word "Bluesky" as a

code. By applying a hash

function on this code,

a

message digest is obtained. Hash function

and message digest are

sent to the bank. In case a dispute

arises

and

the payer has to prove that

he had made the payment, he

can forward the word/code

"Bluesky" to the

bank

and request it to apply the hash

function on it (which was earlier

sent to the bank). If, on applying

the

hash

function, the message digest

comes to be the same as earlier

available with the bank, it means

that the

person

claiming to be the payer had succeeded in

proving his payment, since

only he was supposed to

know

the

word "Bluesky".

Payment

Deposit

A deposit

request encrypted with

bank's public key

accompanies the payment information.

E-cash bank

maintains

a database of spent coins. On

receipt it checks whether the coin is

valid and whether it

has

already

been spent or not (to

prevent double spending) by

referring to its database. If the

coins are valid the

bank

credits the merchant's account.

Thus, if the client has sent

valid coins worth $10

for payment to the

merchant,

and the merchant already has

$90 in his account then an

amount of $ 10 would be added in

his

account

making it $ 100. Later, the merchant can

request the e-cash bank to transfer this

amount in his

account

with the acquirer bank. This can be done

through ACH and the merchant

can physically

withdraw

the

money form the acquirer

bank.

E-cash

bank plays a backbone role in this

set up and charges a

specified commission for its

services from

the

client and the merchant depending on

its policy.

Lost

Coins

In

case network fails or computer

crashes during payment

transaction, coins might be lost.

All signed

blinded

coins from last 16

withdrawals are sent by the bank to the

client. Client uses the blinding

factor

known

to its wallet to reveal the serial #. It

then sends all serial

nos. to the bank for its

verification whether

or not

the coins have already been

spent. After checking its

database the bank credits the client's

account

with

the value of unspent

coins.

119

E-COMMERCE

IT430

VU

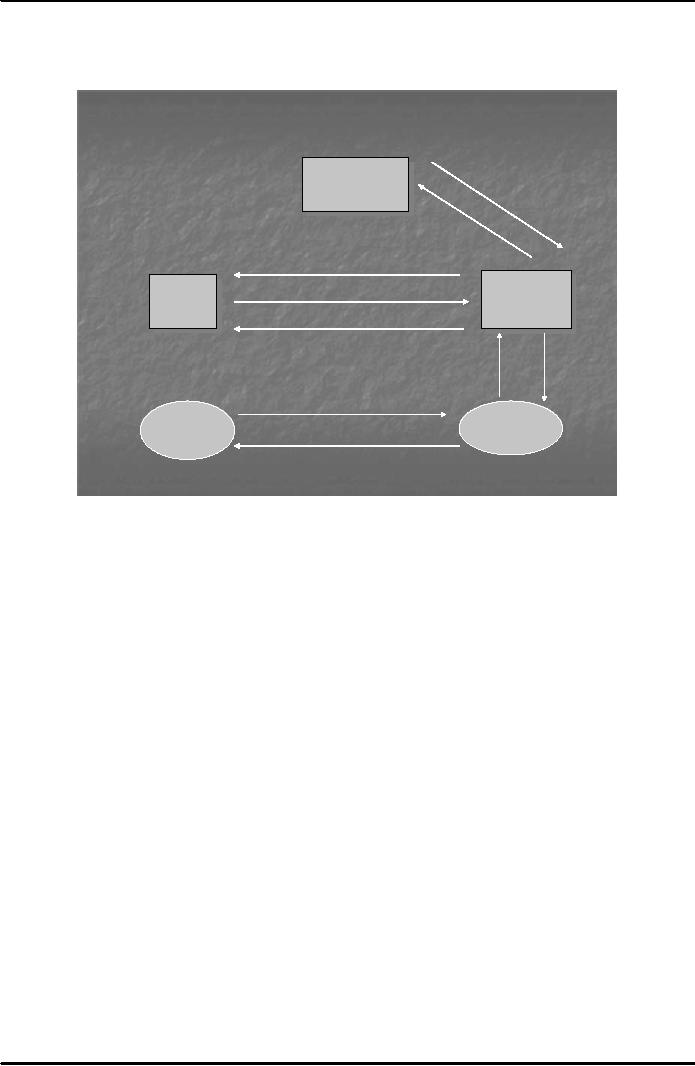

E-Cash

& the Web

Fig.

2 below shows how e-cash

payment system can be applied on

the web:

E-Cash &

the Web

EccashBankk

E ash

Ban

6.

Accepted

5.

Deposit

coins

3. Payment

Request (Order)

Meerchant

M rchant

Clileent

C i nt

4. Payment

(coins,order)

Softwaare

Softw

re

Waalleet

Wl lt

7.

Receipt

2.

Merchant

8.Send

wallet

Starts

goods

1.Select

Order

Web

Web

Server

Browser

9.Goods/Acknowledgement

Fig.

2

Client

wallet and web browser are

installed on the client machine. Web

server software and

merchant

software

are installed on the sever machine. A

client selects an order and

web server starts the

merchant

software/wallet

(steps

1 & 2).

Payment request is made by the

merchant software and the client wallet

pays

through

e-cash coins (steps

3 & 4).

Merchant deposits the coins to

e-cash bank for checking

validity (step

5). If the

coins are valid an

acceptance message is made to the

merchant following which the

receipt of

payment

is sent to the client by the merchant

(steps

6 & 7).

Merchant software intimates the

web server to

send

goods which acknowledges the fact to the

web browser (steps

8 & 9).

120

Table of Contents:

- E-COMMERCE

- WHAT IS A NETWORK

- HOW MANY CLASS A, B, C NETWORKS AND HOSTS ARE POSSIBLE

- NETWORKING DEVICES

- BASICS OF HTML 1

- BASICS OF HTML 2

- TEXT BOXES, CHECK BOXES, RADIO BUTTONS

- FRAMES AND IMAGES IN HTML

- TAG ATTRIBUTES, SOUNDS FILES, ANIMATIONS

- STYLE SHEETS 1

- STYLE SHEETS 2

- SOME USEFUL STYLE SHEETS PROPERTIES

- JAVA SCRIPTING 1

- JAVA SCRIPTING 2

- JAVA SCRIPTING 3

- JAVA SCRIPTING AND XML

- CLIENT AND SERVER SIDE PROCESSING OF DATA

- APPLETS, CGI SCRIPTS

- MAINTAINING STATE IN A STATELESS SYSTEM

- INTEGRATION WITH ERP SYSTEMS

- FIREWALLS

- CRYPTOGRAPHY

- HASH FUNCTION AND MESSAGE DIGEST

- SYMMETRIC KEY ALGORITHMS

- VIRTUAL PIN PAYMENT SYSTEM

- E-CASH PAYMENT SYSTEM 1

- E-CASH PAYMENT SYSTEM 2

- SECURE SOCKET LAYER (SSL)

- E-BUSINESS: DISADVANTAGES OF E-BUSINESS

- E-BUSINESS REVENUE MODELS

- E-MAIL MARKETING

- CUSTOMER RELATIONSHIP MANAGEMENT (CRM)

- META INFORMATION

- DATA MINING

- CONFIDENCE AND SUPPORT

- ELECTRONIC DATA INTERCHANGE (EDI)

- PERSONAL FINANCE ONLINE

- SUPPLY CHAIN

- PORTER’S MODEL OF COMPETITIVE RIVALRY

- BARRIERS TO INTERNATIONAL E-COMMERCE

- ELECTRONIC TRANSACTIONS ORDINANCE, 2002 - 1

- ELECTRONIC TRANSACTIONS ORDINANCE, 2002 - 2

- ELECTRONIC TRANSACTIONS ORDINANCE, 2002 - 3

- GLOBAL LEGAL ISSUES OF E-COMMERCE - 1

- GLOBAL LEGAL ISSUES OF E-COMMERCE - 2